Credit Note Format

Looking for the perfect credit note format? Download our easy-to-use credit note formats in Word, PDF and others for quick and accurate billing. But why just credit note formats when Vyapar does more? Start your free trial now!

Credit Note Format Vs Vyapar App

Features

Credit Note Format

No Daily Template Edits

Auto Credit Note Creation

Syncs with Billing & Inventory

Auto-Save Customer Data

Share Via WhatsApp/Email

Auto Sync Across Devices

Data Backup And Security

Works Offline

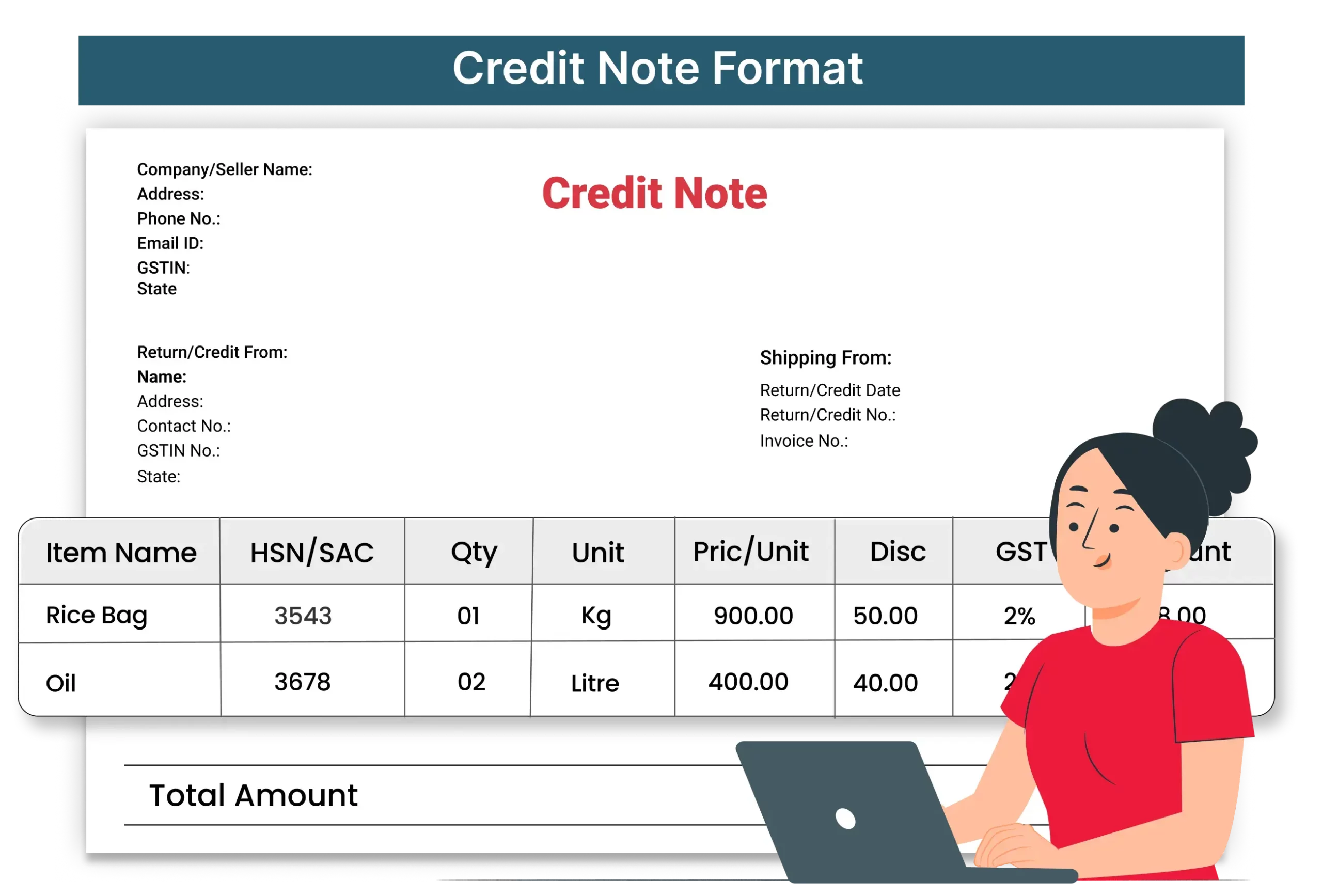

Download Free & Easy-to-Use Credit Note Format in Word, PDF, and more

Whether you need a credit note format in Word or credit note PDF format, Vyapar offers simple and customizable templates for your business needs.

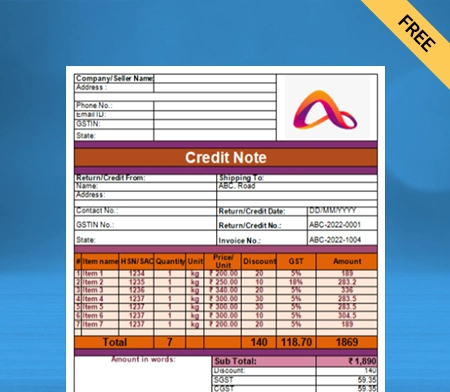

Credit Note Format in Word – 1

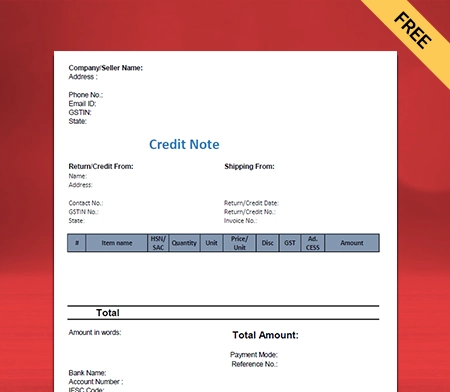

Credit Note Format in Word – 2

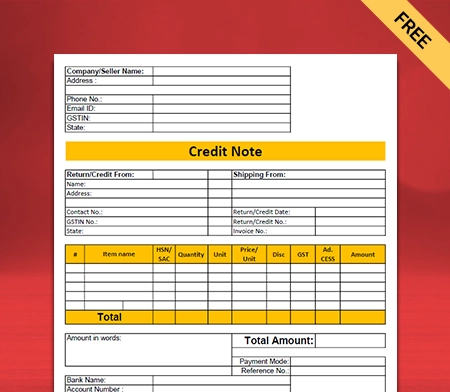

Credit Note Format in Word – 3

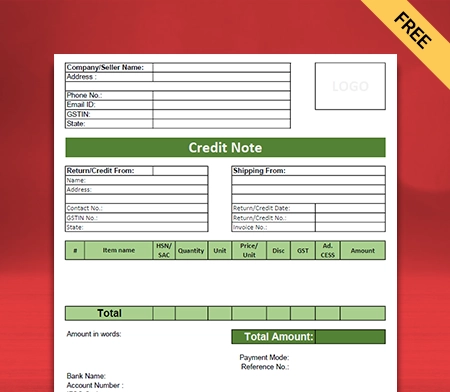

Credit Note Format in Word – 4

Credit Note PDF Format – 1

Credit Note PDF Format – 2

Credit Note PDF Format – 3

Credit Note Format in GST

Credit Note Format in Excel

Automate Credit Notes With Vyapar.

What is a Credit Note?

A credit note is a document issued by a seller to reduce the amount a buyer owes, usually due to returned goods, overpayments, or billing errors. It serves as an official adjustment to an invoice, ensuring accurate financial records and customer satisfaction. Typically, a credit note format in Word or PDF includes details like the reason for the credit, the amount being credited, and the original invoice number.

This document acts as a correction to an already issued invoice and ensures that both parties maintain accurate and transparent financial records. It is a vital part of the accounting process and helps in reconciling accounts without altering the original invoice.

Key Components of a Credit Note

Credit Note VS Debit Note

From Format to Full Control — Explore Vyapar Now

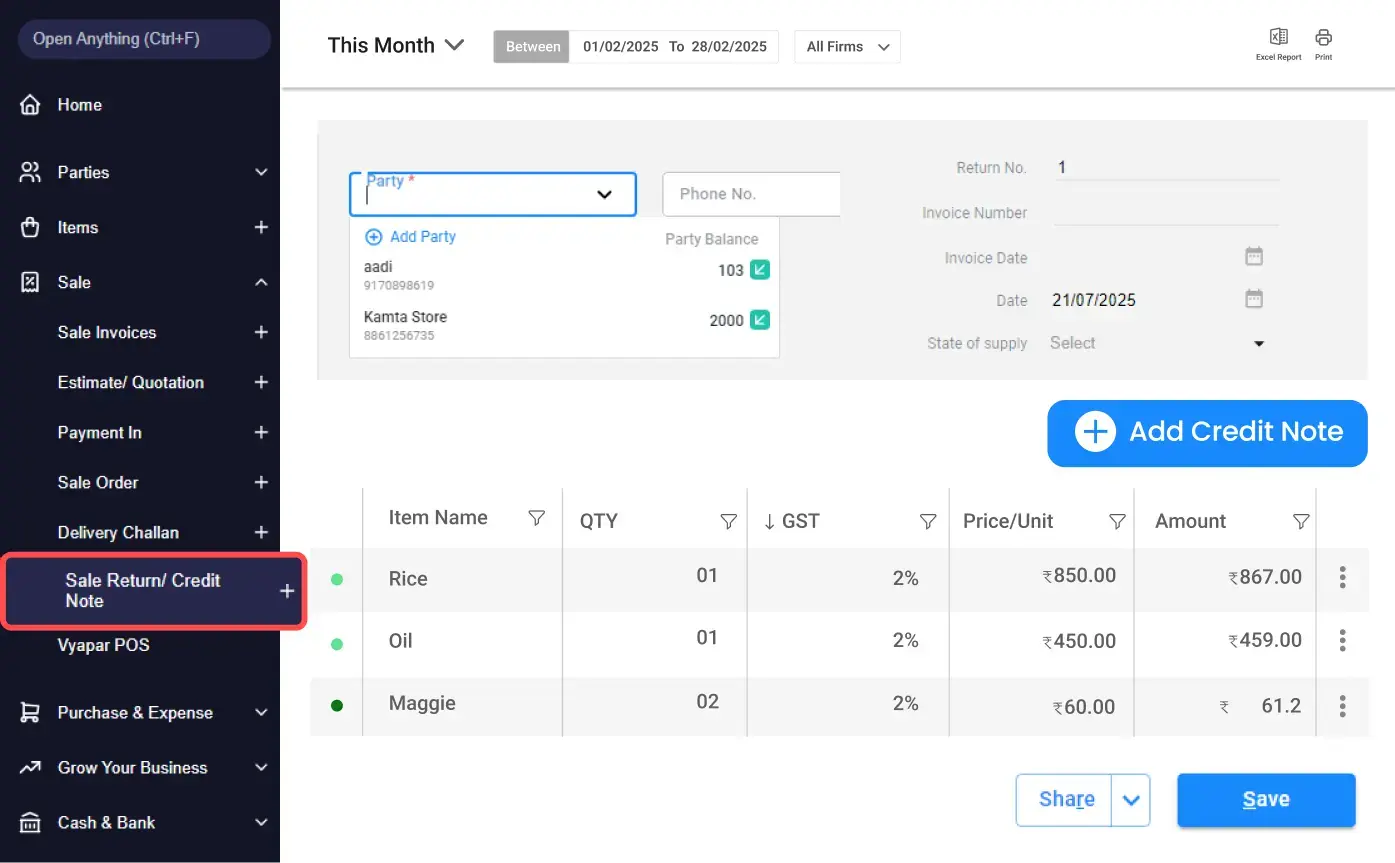

How to Create a Credit Note in Vyapar

- Open the Vyapar Desktop App.

- Click on “Sales” from the left-hand menu.

- Then click on the “Credit Note.”

- Fill in the customer name, item details, and GST info.

- Optionally, add the reason for issuing the credit note.

- Click “Save” to complete the process.

- You can now share or download the credit note format in PDF or Word.

Why Vyapar is the #1 Solution to Manage Credit Notes

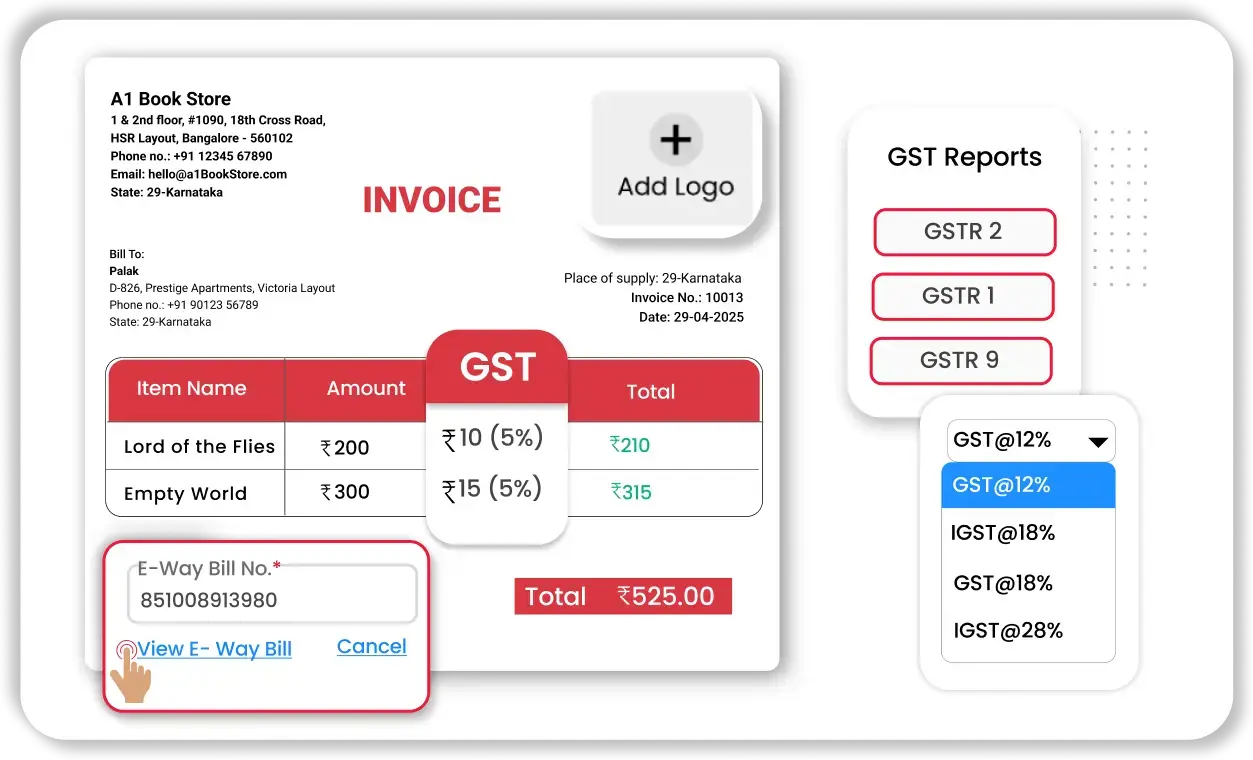

GST Filing & Compliance

Vyapar simplifies the entire GST filing process by auto-generating GST-compliant invoices and helping you file GST returns with ease. The software ensures your business stays up-to-date with the latest GST laws by automatically calculating GSTIN, Input Tax Credit (ITC), and GST Output Tax.

Vyapar allows you to easily create and manage credit notes and debit notes, ensuring any returns or adjustments are accurately reflected in your accounts.

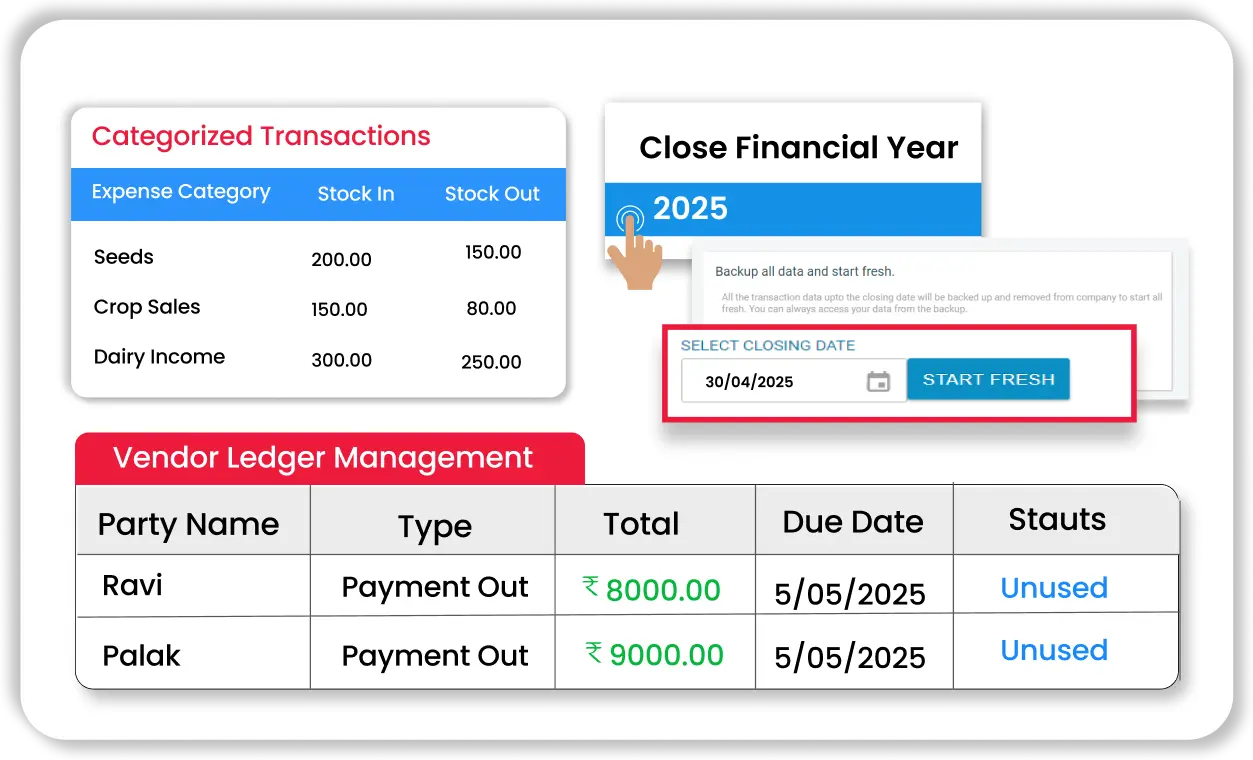

Inventory Management

Vyapar offers robust inventory management features that allow business owners to track their stock levels in real time. Key features like stock alerts, inventory tracking, and inventory reconciliation ensure that you never run out of essential products or overstock. You can also manage low stock, dead stock, and inventory aging to optimize stock levels and reduce storage costs.

Accounting & Bookkeeping

Vyapar makes accounting effortless by providing tools to manage your accounts payable and accounts receivable. The software supports double-entry accounting and allows businesses to track their expenses, sales, and profits with ease. You can generate essential financial reports such as balance sheets, cash flow statements, and income statements to gain valuable insights into your business’s financial health.

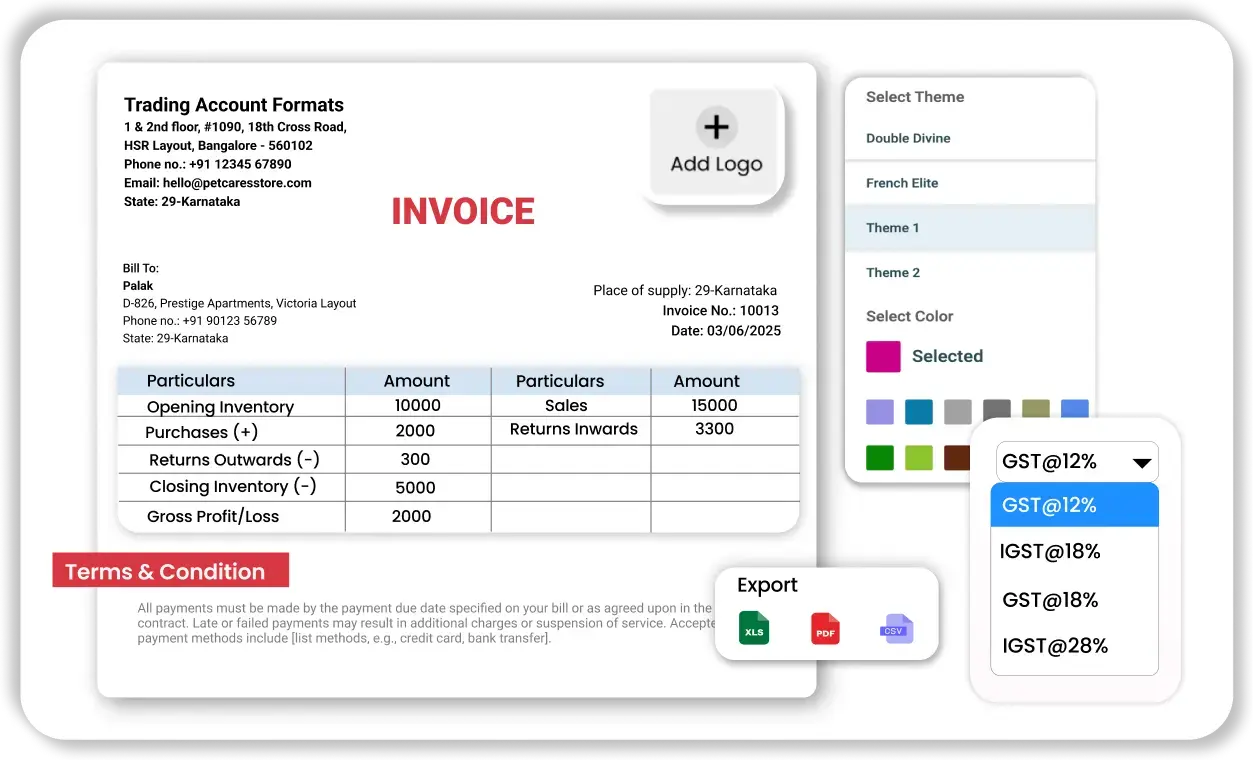

Invoicing & Billing

Vyapar streamlines the invoicing process with customizable invoices that can be generated for every sale or purchase. The software supports GST invoicing, recurring billing, and discount management, making it easy for you to create professional invoices quickly. Vyapar also enables tracking of outstanding invoices and payment reminders, ensuring you get paid on time.

Business Reports

Vyapar provides detailed and actionable business reports to help you make informed decisions. Whether it’s tracking profit and loss, sales reports, or inventory performance, you can access real-time data that allows you to stay on top of your business operations.

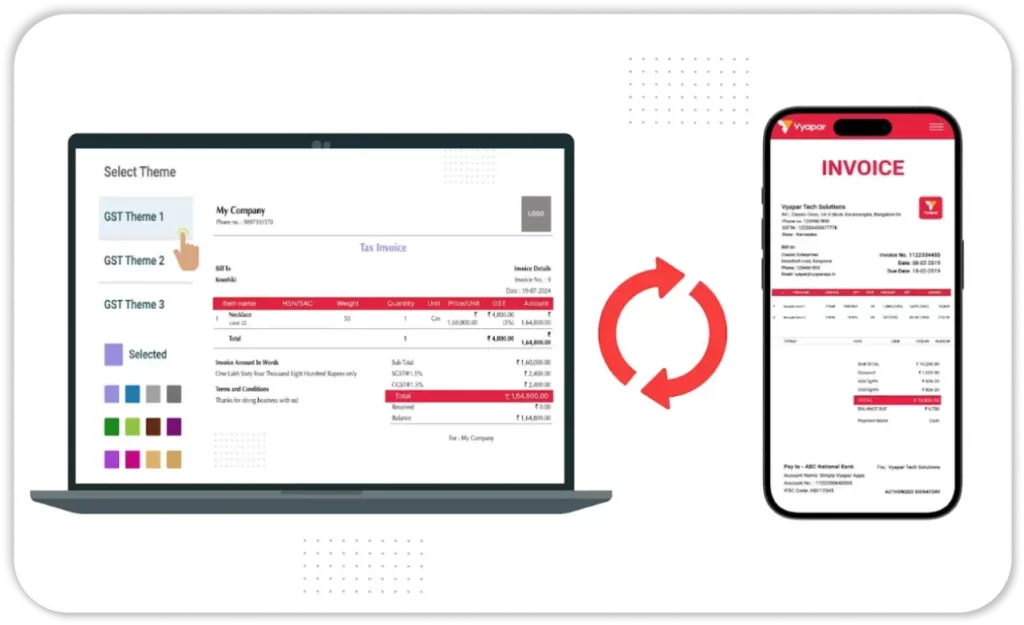

Multi-Device Sync

Vyapar is available as both a mobile app and a desktop version, which means you can manage your business from anywhere. Whether you’re in the office or on the go, Vyapar ensures real-time sync across all devices, allowing you to access your data instantly. This flexibility helps business owners stay productive and maintain control over their operations no matter where they are.

Frequently Asked Questions (FAQ’s)

What is a credit note?

What information should be included in a credit note format?

How is a credit note different from an invoice?

Can a credit note be used for partial refunds?

How do I create a credit note format?

What is the purpose of a credit note in accounting?

Can I download a credit note template?

Is there a limit to how many credit notes I can issue?

Can Vyapar help me create credit notes automatically?

How do credit notes affect my inventory management?

Why Prefer Credit Note Format in Word?

What are credit note in PDF format

How does a credit note PDF format help in maintaining professionalism?

Is credit note PDF format suitable for compliance and audits?