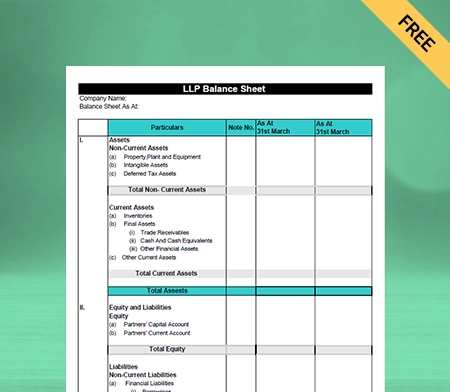

LLP Balance Sheet Format

Skip error-prone LLP balance sheet formats! Vyapar automates them flawlessly. Save time, ensure accuracy & gain valuable insights for your business.

⚡️ Eliminate errors with pre-defined formulas

⚡ Simplify calculations and save time

⚡️ Generate accurate balance sheets in minutes

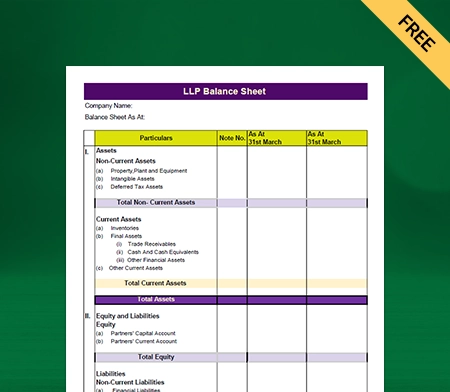

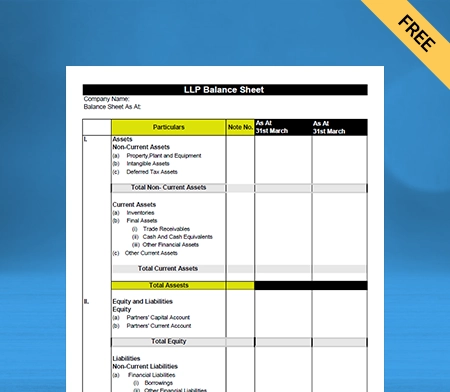

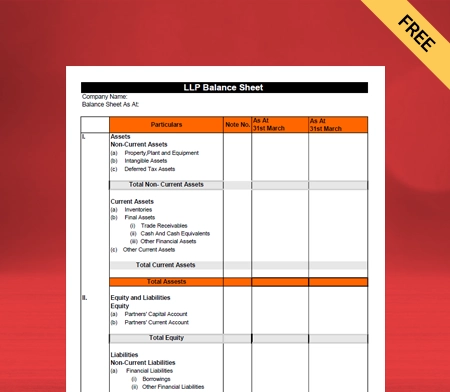

Download Free LLP Balance Sheet Format

Download Free LLP Balance Sheet Formats, and make customization according to your requirements at zero cost.

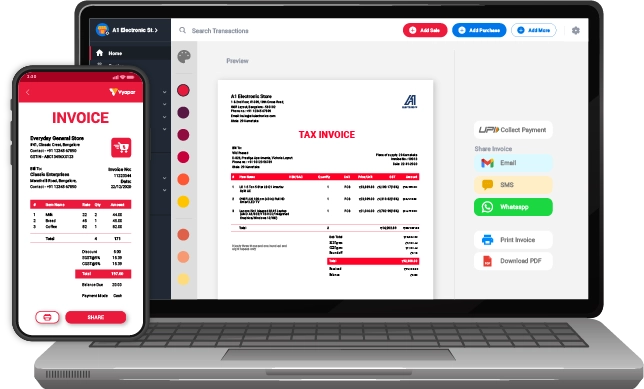

Customize Invoices

Theme – I

Theme – II

Theme – III

Theme – IV

Generate Invoice Online

Highlights of LLP Balance Sheet Simple Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal and grand total amounts

Consistently formatted

What is LLP?

A limited liability partnership (LLP) combines aspects of both a partnership and a corporation, offering limited liability to the partners. It combines the advantages of a company with the flexibility of a partnership. Individuals, Indian private or public companies, foreign companies, or other LLPs registered in or outside India can be partners in an LLP. With the business app, you can choose from different balance sheet formats that suit your business needs.

Benefits of LLP Balance Sheet Format by Vyapar

Instantly Generate Reports:

LLP balance sheet formats help businesses make informed decisions by making it easier to analyze the sales data. You can use the data collected in the Vyapar app to create 37+ reports and explore different metrics. Vyapar app allows detailed analysis of accurate company details like the inventory report can help you identify the product demand, and a tax report helps in filing taxes quickly.

Multiple Payment Type:

The best LLP balance sheet maker app by Vyapar provides your customers with the convenience of multiple payment options. So, when you turn your quote into an invoice, the customers can send you the payment seamlessly. You can accept payments via cash, cheque, QR, UPI, NEFT, IMPS, debit/credit card, etc. It also lets you print QR code, UPI ID, Bank account details, and other payment-related options on the invoice.

Saves Time:

The manual process of recording data can take up a lot of time, and you might need to hire many accountants in your LLP to do it. But, the Vyapar app can help you with a seamless accounting process using professional LLP balance sheet formats. Any employee on your team can operate it and ensure that there are no mistakes.

Ease of Business:

Vyapar helps businesses create GST compliant LLP balance sheet formats and makes the accounting process seamless. You can make and share invoices on WhatsApp, manage inventory, and make estimated bills using the app. You can also generate GSTR reports, track unpaid invoices, send payment reminders and collect payments directly online using UPI payments.

LLP Balance Sheet Format: Key Components to Include

To accurately portray the financial status of a limited liability partnership, several essential details must be incorporated into the LLP balance sheet format. These vital components include:

- LLP name and the date of the balance sheet.

- Assets, such as cash, investments, property, and equipment.

- Liabilities, including loans, accounts payable, and taxes owed.

- Partners’ capital accounts, indicating contributions and draws.

- Totals for each category and the overall balance sheet.

- Comparisons with previous periods to illustrate trends and changes.

These elements are crucial for ensuring that an LLP balance sheet format provides a comprehensive overview of the partnership’s financial health and facilitates effective financial analysis and decision-making.

Characteristics of LLP

- The Limited Liability Partnership Act of 2008 governs LLPs, rendering the provisions of the Indian Partnership Act of 1932 inapplicable to them.

- An LLP is a body corporate holding a separate legal entity and perpetual succession.

- Every Limited Liability Partnership shall use the phrases “Limited Liability Partnership” or “LLP” as the last word of its name.

- There is no minimum requirement for capital contribution while forming LLP, and the compliance requirements are minimal.

- LLP Act 2008 states that there must be two designated partners in every LLP, one of whom shall be resident in India.

- Every LLP shall maintain annual accounts and solvency statements and file them with the Registrar.

- Audits are not compulsory for LLPs unless their contribution exceeds ₹25 lacs or if the maximum annual turnover of the business is more than ₹40 lacs.

Create your first invoice with our free Invoice Generator

Process of Incorporation of an LLP

Obtain DSC:

Before initiating the incorporation process, it’s essential to apply for the digital signature of the designated partners of the LLP. All required LLP documents are filed online and must be digitally signed. Therefore, designated partners must obtain their Digital Signature Certificate (DSC) from certified government agencies.

Apply for DIN:

You need to apply for the DIN (Digital Identification Number) of all the designated partners of the LLP. DIN is an 8-digit unique identification number that lasts a lifetime. Any person intending to become a director shall have to make an application in eForm DIR-3 for the allotment of DIN. You must affix the scanned copy of the required documents, including the Aadhar Card and PAN card. The form must be signed by a full-time company secretary or by the managing director of the existing company where the applicant is appointed.

Reservation of Name:

Visit the MCA website and select RUN-LLP to reserve the name of the proposed LLP. It is recommended to use the free name search facility on the MCA portal before quoting the name on the form. Fees should accompany the state as per Annexure A. The portal will offer you a list of closely resembling names and help you choose names that are not similar to other companies. The Registrar will approve the name if it is not disfavored in the central government’s view and does not resemble any existing firm or corporation.

Application for Incorporation:

A copy of the incorporation document should be filed with the Registrar, who has jurisdiction over the state where the proposed LLP’s registered office is located, in the form FiLLiP. A maximum of two partners shall apply for the DPIN number in the form FiLLiP. You must accompany the form with fees as per Annexure A.

Drafting and Filing LLP Agreement:

As per section 2(1)(O) of the LLP Act, 2008, Limited Liability Partnership Agreements mean any written agreement between the members of the LLP or between the LLP and its partners which specifies the mutual rights and duties of the partners. It is mandatory to make and execute an LLP agreement within 30 days of the incorporation, and it must be printed on stamp paper and filed online in form 3 on the MCA portal.

How to prepare an LLP Agreement?

Prepare the agreement and print it on Stamp paper of the required value. The value of a non-judicial stamp paper varies depending on the state where the LLP is registered. All LLP partners must sign the agreement at the bottom of each page, and two witnesses must sign at the contract’s conclusion. Each partner should receive a copy of the LLP agreement.

Features of the Vyapar LLP balance sheet maker app

LLP Management:

You can manage your LLP accounts easily using this free software. It allows you to create quotations, estimates, and accurate GST invoices and share them with potential customers online. The Vyapar LLP balance sheet formats come with GST billing and accounting features, allowing you to create GST and non-GST transactions and track the sale or purchase orders. The user can access the data on different devices at their convenience.

Data Saftey and Security:

The app allows you to take a backup of all your data. Your data stays safe in an encrypted format on your device, and the records of your LLP will remain safe as the app itself cannot use without the user’s permission. The auto backup and updates will let you continue your work from where you left off, and you can also make your backup by saving data in an Excel Spreadsheet or PDF format.

Cash and Bank Management:

The user can easily do cash to the bank or bank to cash transfers. The LLP balance sheet format also allows you to adjust cash and bank amount and helps in the overall management of the LLP. An LLP can easily manage all the accounts and analyze the financial statements and reports.

Tax and Discounts:

The authorized GST Billing software makes it smooth to file taxes for LLP. Our LLP balance sheet maker app provides item-wise and transaction-wise tax and discount options. The item price can be inclusive or exclusive of taxes as per your company’s accounting practices. You can also add or modify your invoice’s tax rate and group. Further, it helps claim input tax credits and allows you to include discounts and offers for individual services/products to speed up the billing and accounting process.

Frequently Asked Questions (FAQs’)

A balance sheet helps describe an organization’s financial health insightfully and professionally. It reveals the liabilities and assets of LLP to the interested parties giving them an idea of all partners’ contributions. Using an LLP balance sheet format makes getting the details in the desired format easier.

The time taken for LLP filings can range from 14 to 20 working days. It varies because government authorities take time to respond to applications, approve names, and review document submissions.

Yes. Our team at Vyapar provides you with multiple LLP balance sheet formats for free. You can use the one that suits your business requirements the best and even customize them to meet your unique business requirements.

There is no minimum requirement for the partner contribution in LLP registration, and a partner can contribute both tangible and intangible assets to the LLP partnership.

A minimum of 2 individuals are needed to do an LLP registration in India, but there is no limitation to the number of partners that can start an LLP formation.

Vyapar provides access to LLP balance sheet formats for free. You can use the premium features of the Vyapar app using a monthly subscription plan. The app is affordable, and you can choose the package that suits your requirements the best.

The LLP balance sheet is a financial statement that summarizes the assets, liabilities, and partners’ equity of a Limited Liability Partnership (LLP). It provides a snapshot of the LLP’s financial position at a specific time, similar to a company’s balance sheet.

Yes, a balance sheet is compulsory for LLPs (Limited Liability Partnerships). LLPs are required to prepare and maintain financial statements, including a balance sheet, as part of their statutory obligations and compliance with accounting standards. The balance sheet provides a summary of the LLP’s financial position, including its assets, liabilities, and partners’ equity, which is essential for transparency, financial reporting, decision-making, and regulatory compliance.

In accounting, LLP stands for Limited Liability Partnership. It’s a business structure that offers partners limited liability protection. LLP accounting involves maintaining financial records, preparing statements, managing taxes, and ensuring compliance with accounting standards and regulations.

Yes, audit of an LLP is mandatory if its annual turnover exceeds INR 40 lakhs or its contribution exceeds INR 25 lakhs in any financial year. However, LLPs can also opt for a voluntary audit even if they do not meet these thresholds.

Yes, there is a specific format for an LLP (Limited Liability Partnership) balance sheet. It includes sections for assets (current and non-current), liabilities (current and non-current), and partners’ equity. This format ensures a clear representation of the LLP’s financial position.

To prepare a balance sheet for a limited company:

1. Gather financial statements and details of assets, liabilities, and equity.

2. List current and non-current assets, including cash, inventory, and property.

3. List current and non-current liabilities, such as accounts payable and long-term debt.

4. Calculate shareholders’ equity by subtracting liabilities from assets.

5. Organize data into the standard balance sheet format.

6. Review and adjust for accuracy and compliance.

7. Include explanatory notes and finalize the balance sheet for presentation to stakeholders.