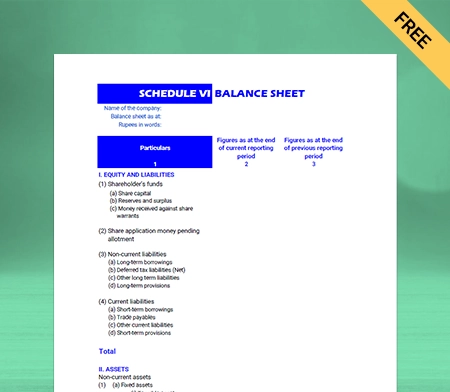

Schedule 6 Balance Sheet Format

Save time on Schedule-6 balance sheets with Vyapar. Generate them in seconds & use the data for future financial planning. Download the App Now & get insights faster!

⚡️ Eliminate errors with pre-defined formulas

⚡ Simplify calculations and save time

⚡️ Generate accurate balance sheets in minutes

Highlights of Schedule 6 Balance Sheet Simple Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal and grand total amounts

Consistently formatted

Download Free Schedule 6 Balance Sheet Format

Download free Schedule 6 Balance Sheet Formats, and make customization according to your requirements at zero cost.

Customize Invoices

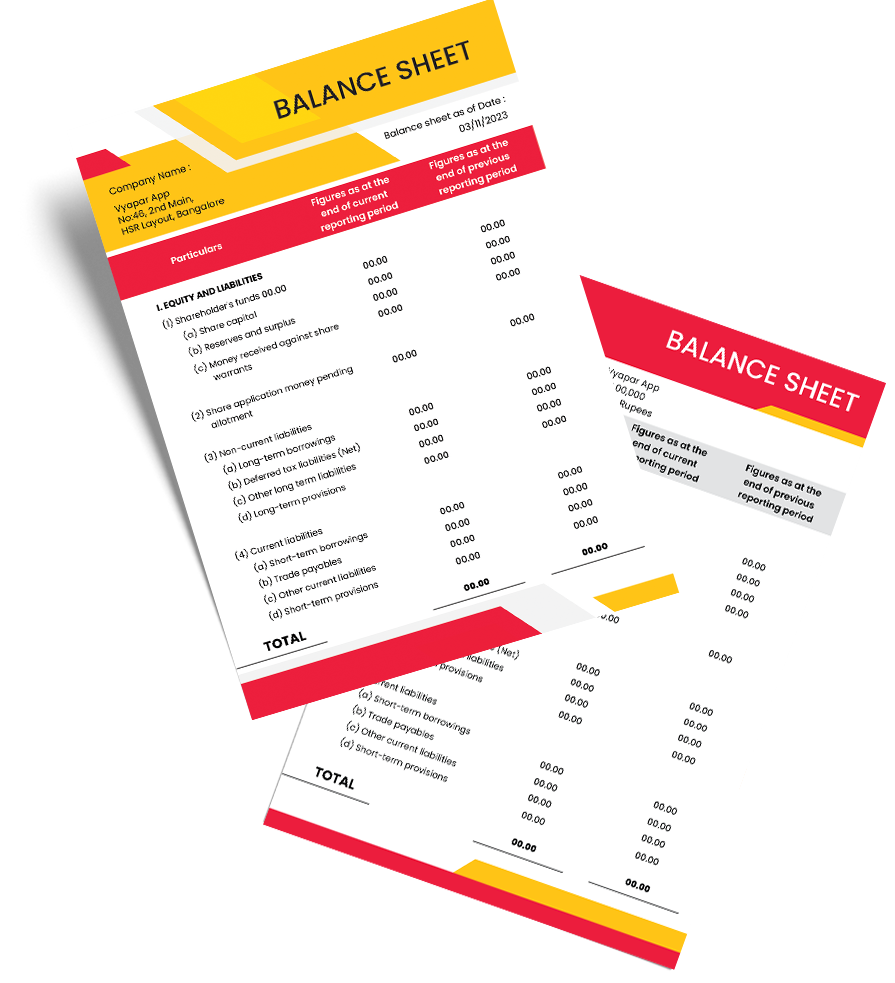

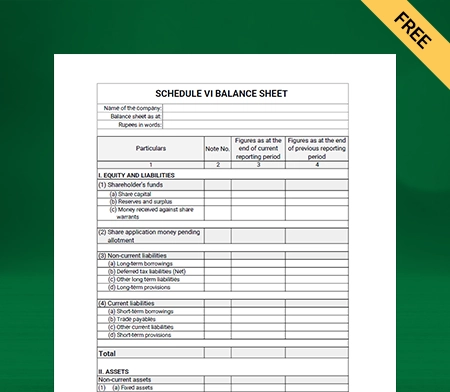

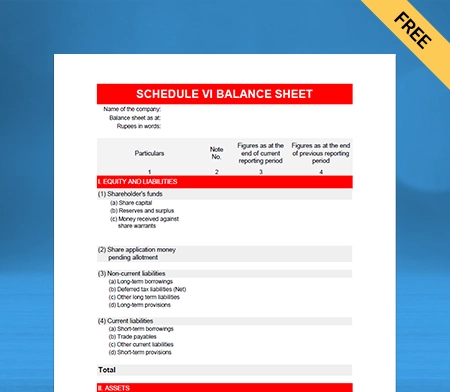

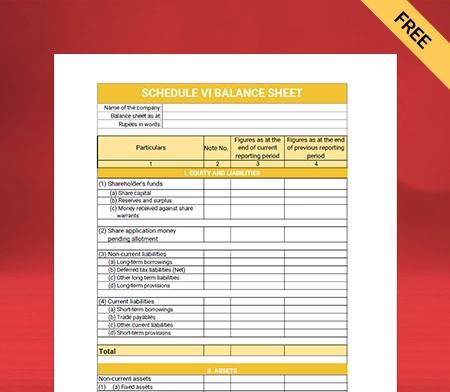

Schedule 6 Balance Sheet Format Type I

Schedule 6 Balance Sheet Format Type II

Schedule 6 Balance Sheet Format Type III

Schedule 6 Balance Sheet Format Type IV

Generate Invoice Online

What is Schedule 6 of the Balance Sheet?

Schedule 6 to the Companies Act, 1956 deals with how every company registered under the act shall prepare a Balance Sheet, Profit & Loss Statements, and notes. Schedule 6 applies to all the companies registered under the Companies Act, 1956, to prepare financial statements of a financial year commencing on or after April 1, 2011.

Various economic and regulatory reforms have taken place for companies over the years. On February 28, 2011, the Ministry of Corporate Affairs issued a revised form of Schedule 6 to enhance the disclosure requirements under the old Schedule and harmonize them with the notified Accounting Standards.

Benefits Of Using Schedule 6 Balance Sheet Format by Vyapar:

Seamless user experience:

Bookkeeping is a time-consuming task when done manually. But with online accounting software, you can easily maintain all your accounts up to date. The Vyapar schedule 6 balance sheet generator has a user-friendly interface which makes it simple and easy for every business owner. You don’t need special training or accounting knowledge to operate the app.

Increased automation of tasks:

The free schedule 6 balance sheet maker app enables seamless business accounting and operational efficiency of your business. It automatically records the data and transactions into the respective accounts, and it can also automatically generate invoices and payment reminders. Automation helps you save time and focus on other essential tasks.

Real-time overview of your business:

Automated accounting of the business makes it possible for individuals to record transactions in real-time and better understand finances. The software syncs all the data from all your transactions, and you don’t have to enter each detail manually. You can check out the details anytime using business dashboard within the app.

Making Tax GST-compliant:

It is essential for tax planning and preparation to keep accurate business records. The best GST billing and invoicing software with its built-in tax report program make your work easy. You will be able to file your return and calculate your tax credits more easily with standardised financial statements and accurate, categorised data.

Key Features of Revised Schedule 6 Balance Sheet

- The revised Schedule contains general instructions that lay down the broad principles and guidelines for preparing and presenting Financial Statements.

- The Revised Schedule 6 advises only the vertical format for presenting Financial Statements, so a company will now not have an alternative to using a horizontal format.

- The Revised Schedule 6 has eliminated the concept of ‘schedule,’ Such information is now to be furnished in the notes to accounts.

- One must segregate Current and Non-Current assets and liabilities into their portions in the revised balance sheet format.

- Shareholders holding shares of more than 5% in the company need to disclose the number of shares they hold.

- Information regarding an aggregate number of shares and classes allotted for consideration other than cash, bonus shares, and shares bought back will be required for five years immediately before the Balance Sheet date.

- In the Statement of Profit and Loss, any debit balance will fall under “Reserves and surplus.”

- Non- Refundable Share application money not exceeding the issued capital will be shown separately in the Schedule VI Balance Sheet format.

- “Trade receivables” will be used instead of “sundry debtors.” The dues arising from goods sold or services provided in the normal course of business are known as Trade Receivables.

- Trade receivables outstanding for more than six months require separate disclosure from the date the bill is due for payment.

- “Capital advances” must be presented separately under the head “Loans & Advances” and not anywhere else.

- You must disclose only capital commitments in the old Schedule, but you must also disclose other commitments under the new Schedule.

- All the defaults in repayments of loans and interest need a disclosure in the revised Schedule VI Balance Sheet.

- Nevertheless, disclosures concerning defaults in repayment of dues to a financial institution, bank, and debenture holders continue in the report under the Companies (Auditor’s Report) Order, 2003 (CARO).

Create your first invoice with our free Invoice Generator

Features Of The Vyapar Schedule 6 Balance Sheet Maker App:

Data Safety and Security:

Vyapar app handles data and ensures that it is safe with the help of Login Security, Data Encryption, and Continuous backup, making it the best online accounting software. The Vyapar schedule 6 compatible formats comes with many useful features that allows businesses to store information the app collects and create backups to keep it safe and secure.

You can choose the data you want to use for import, and you can take a backup of the data in your google drive by enabling Auto Backup. The software is bound to protect user privacy so no one can access the user’s data without permission, not even Vyapar itself.

Tax and Discounts

Calculation and filing of taxes is a lot of work, but this authorised GST Billing features in the balance sheet maker app makes it smooth. The app enables you to add tax in different transactions like sales, purchases, and more, as per your requirements.

The item price can be inclusive or exclusive of taxes as per your company’s accounting methods. The app also provides item-wise discount options, and you can round off the transaction based on your preference. You can also add or modify your invoice’s tax rate and group. It helps claim input tax credits to the extent.

Track all transactions

The Balance Sheet Format maker enables you to share the invoices via multiple methods like emails, WhatsApp and SMS. It facilitates the businesses to enter a discount during the payments. You can also track paid and unpaid invoices by linking sales against payment, credit notes, etc.

The app lets you set due dates and payment terms, and you can see the preview of your invoice during its creation. A seller can add extra charges like shipping, packaging, on tier invoices, and it allows you to check profit while making a new sale invoice. All of these features make is seamless for you to track all business transactions seamlessly.

Generate business reports

After creating invoices, you can use the collected data to create a balance sheet compatible with schedule sheet using pre-generated formats by Vyapar app. It will help generate sales or purchase reports quickly to analyse different metrics of the growth of your business.

You can create various reports like inventory reports to identify product demand and focus on keeping stock of them in-store. A tax statement can help you in filing taxes and GST seamlessly. Also, you can eliminate lots of manual work and save time for your employees. You don’t need to hire employees, eliminating extra costs.

Invoice and Printing

You can simplify invoicing for your business by creating custom invoices. The free invoicing app compatible with schedule 6 balance sheet formats enables you to choose a fixed format with themes and colors to make every business transaction professional.

You can download and use multiple balance sheet formats and modify them to suit your business requirements. You only need to add the items, and your invoice will get generated automatically. The app lets you select the printer you use for your business and set the text size and page size you want to use for printing your transaction PDFs.

Frequently Asked Questions (FAQs’)

When combined with other financial statements, the balance sheet is an important document to know liquidity, leverage, efficiency, and rates of return.

Schedule VI Balance Sheet represents the company’s financial position at any point in time in the Schedule VI format of the Companies Act.

The schedule 6 balance sheet formats saves time and keeps all your accounting details in one place while keeping compatibility of schedule 6 in check. The app facilitates online digital payments and comes with multiple useful features.

Not yet! We will implement this feature very soon, but you can export data to Tally directly from Vyapar.

Yes. Vyapar works well offline, so you don’t have to worry about a lack of internet access or connectivity. You can backup data once you have internet connectivity or use local backups if you have no network access.

The Vyapar Mobile App (basic version) is completely free of cost, and the premium version comes with a yearly subscription plan. Vyapar Desktop App is not free but has a 7-day free trial can help you explore the app before you start your subscription.

Schedule III and Schedule VI are different formats for preparing balance sheets under the Companies Act in India.

1. Applicability: Schedule III applies to companies following Indian Accounting Standards (Ind AS) or Indian GAAP, while Schedule VI is for companies following the old Indian GAAP.

2. Format: Schedule III uses a vertical format, while Schedule VI uses a horizontal format.

3. Classification: Schedule III has detailed asset, liability, and equity classifications, while Schedule VI has specific formats based on the company’s industry.

4. Disclosure: Schedule III has more comprehensive disclosure requirements than Schedule VI.

5. Regulatory Compliance: Companies transitioning to Schedule III must comply with updated standards and regulations.

The Revised Schedule VI, introduced in 2011, replaced the old Schedule VI under the Companies Act, 1956. It standardized the format for financial statements, focusing on transparency and comparability. Key features include a vertical format, detailed asset-liability classification, comprehensive disclosure requirements, notes to accounts, and provisions for comparative information. The Revised Schedule VI aimed to align Indian accounting practices with international standards and improve financial reporting quality.

A balance sheet typically consists of two schedules: Schedule III and Schedule VI. Schedule III is applicable to companies following Indian Accounting Standards (Ind AS) or Indian Generally Accepted Accounting Principles (GAAP), while Schedule VI is applicable to companies following the old Indian GAAP. These schedules provide guidelines and formats for preparing the balance sheet and other financial statements as per the Companies Act in India.