Balance Sheet Format for Trust

Eliminate trust balance sheet errors. Vyapar automates them flawlessly. Save time, ensure accuracy & gain valuable insights easily.

⚡️ Eliminate errors with pre-defined formulas

⚡ Simplify calculations and save time

⚡️ Generate accurate balance sheets in minutes

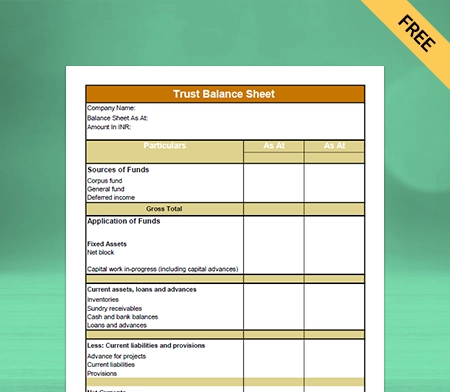

Download Free Trust Balance Sheet Format

Download free Trust Balance Sheet Formats, and make customization according to your requirements at zero cost.

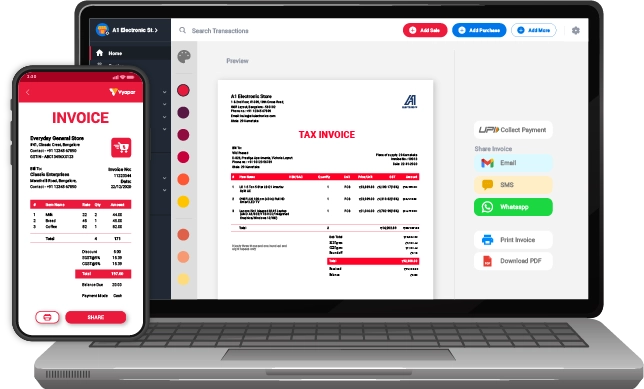

Customize Invoices

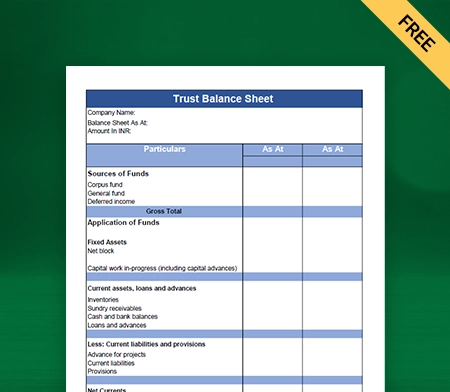

Trust Balance Sheet Format Type I

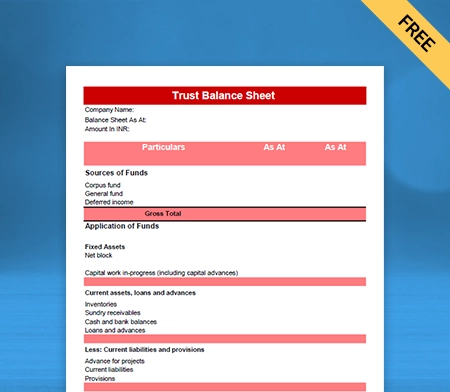

Trust Balance Sheet Format Type II

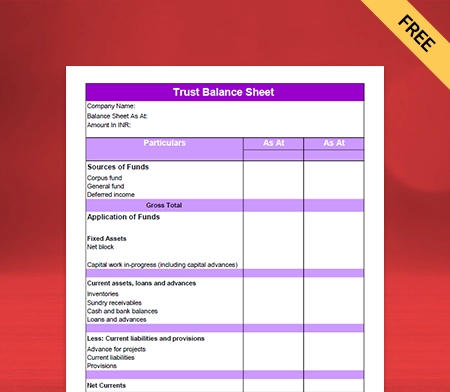

Trust Balance Sheet Format Type III

Trust Balance Sheet Format Type IV

Generate Invoice Online

Highlights of Trust Balance Sheet Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal and grand total amounts

Consistently formatted

What is Trust?

A trust is a legal and fiduciary relationship where the grantor (holder of rights) assigns the right to hold title to assets and property to the trustee (beneficiary) for their benefit. It provides legal protection to the donor’s assets while ensuring that the distribution is done according to their wishes.

Anyone can create a trust for many purposes, like providing for the well-being of a minor, for religious or charitable purposes, and providing medical aid to the author. However, The Indian Trusts Act 1882 specifically states that a person cannot create a trust for an unlawful purpose.

Types of Trusts

Although there are various types of trusts, each fits into one or more of the following classifications:

Living or Testamentary:

A Living or sometimes known as Inter Vivos Trust, is a written legal document in which an individual’s assets are placed into a trust for their use and benefit during their lifetime. Later, these assets get transferred to the beneficiaries in the event of that individual’s death.

A testamentary trust, otherwise known as a will trust, is a trust which arises upon the death of the testator and specifies the instructions about how the trustee will designate the assets after the testator’s death.

Revocable or Irrevocable:

A revocable trust is a testament that can be changed or terminated while the grantor is still alive. It is a legal document that places the trustor’s assets and property into the trust during their lifetime and distributes them to the heirs or beneficiaries after their death.

As the name indicates, an irrevocable trust is one that the grantor cannot change, alter, modify, or terminate once the trust deed is signed and established. Once transferred to the trust, the trustor cannot exercise control over assets or property.

Funded or Unfunded:

A funded trust has different assets, including stocks, cash, bonds, and properties put into it by the grantor during its lifetime. The three parties of the trust deed are the grantor, the beneficiary, and the trustee.

An unfunded trust is merely a trust agreement with no funding, and it can become funded after the trustor’s death; otherwise, they remain unfunded. An unfunded trust exposes assets and property to risks that trust can avoid; thus, proper funding is essential.

Benefits of Trust Balance Sheet Format by Vyapar

Overall Performance:

With the automated trust bookkeeping feature of the Vyapar App, you gain instant access to your trust’s financial health. You can track results by setting standards and comparing them with actual results. Thus, you will get a better picture of your trust’s overall performance, which will help in decision-making.

Easier Financial Calculations:

It is challenging and frustrating to manage accounts on a spreadsheet. Trust Balance Sheet Format by Vyapar makes trust accounting and reconciliations painless and straightforward. The automated accounting software helps with complex calculations and issues.

Better Management of Cash Flow:

The Vyapar trust balance sheet maker app provides you with real-time insights and better control over the trust’s cash flow. Cash flow is an essential part of accounting as it helps you plan small and large expenses and ensures that you have enough funds to maintain ongoing trust requirements.

Saves Time and Efforts:

The manual process is time-consuming and increases the likelihood of errors and mistakes in calculations. You can bypass this issue by opting for the trust balance sheet format by the Vyapar app, and it automatically performs all calculations correctly. With the easy bookkeeping app to manage the trust, you can save time.

Automate your balance sheet creation with Vyapar

Principles of Trust Accounting:

Preserve the Client’s Property Belongings:

Deposit checks and cash in the bank punctually. If you cannot get them deposited in your bank, lock up deposits that you receive at the end of the day. Ensure that you employ up-to-date virus protection and use two-factor authentication or a unique, robust password for online banking.

Delegate, Never Abdicate Responsibility:

Split the duties between your staff members according to their caliber so that one staff member is responsible for handling deposits and another staff member is accountable for handling distributions. With the involvement of all the staff members, users can easily balance the accounts at the month-end.

No Commingling or Mixing Funds:

You need to set up an individual bank account for each client to hold their money. You can not integrate personal or professional funds with trust accounts, and your accounting program will allow you to create an account that is a sub-account of the trust for each client with trust account money.

The Funds in the Trust Account are not Yours:

You should adequately characterize the funds in your client’s trust account as they are not an asset but “other current liability” of the firm. When your client asks for their trust account balance refunds, you must pay them immediately. It would be best to create deposit and withdrawal protocols into your trust account procedures.

Keep Adequate Records of each Client Transaction:

As a fiduciary, you must provide the correct accounting details to your clients. Collect all the details like date, amount, source, and purpose of every deposit. Ensure the appropriate client’s name is on every trust account cheque. It will reduce the odds that you’ll overspend in one account while acting on behalf of another client.

Verify Trust Accounts:

You ought to ensure that you have correctly set up each client’s trust account, and for that, you will want to complete a three-way reconciliation each month. Check the bank balance against the balance in the accounting records, allocate and distribute the deposits according to the balance shown on the statement. Do not skip the step of verification ever.

Don’t Spend What you don’t have:

Your client’s trust account funds are not yours, so they should never move without paperwork and an appropriate reason. You should ensure adequate funds in the trust account for the client on whose behalf you are about to issue a disbursement.

Follow State Bars and Government Regulations:

The rules and regulations of trusts are set, managed, and enforced by the state bar. Most jurisdictions direct you to preserve trust account records for five years after the client matter is closed. The state bar or other government body may randomly audit a group of firms and their trust accounts.

Features of Vyapar’s Trust Balance Sheet Format:

Trust Management

With the help of Vyapar billing software,you can maintain single and multiple trusts using the best trust balance sheet software by Vyapar. The user can access the data on different devices at their convenience, and they get the option to create GST and Non-GST transactions. The app’s dashboard is organized and caters to all your accounting needs.

Data Safety and Security

The app allows you to take a backup of all your data, and your data stays safe in an encrypted format on your device. The auto backup and updates features in the trust balance sheet maker app will let you continue your work from where you left off, and you can also make your backup by saving data in an Excel Spreadsheet or PDF format.

Cash and Bank Management

The user can easily do cash to the bank or bank to cash transfers. The trust balance sheet format also allows you to adjust cash and bank amount and helps in cheque management. Trust can easily manage all the accounts and analyze the profit and loss statements.

Tax and Discounts

As per Section 11, income derived from property held under trust for charitable or religious purposes is exempted subject to certain conditions. In other cases, any Trust with a total gross income of more than the basic exemption limit must file income tax returns mandatorily. The free balance sheet format for trust helps understand the basics of tax applicable to trust.

Frequently Asked Questions (FAQs’)

The balance sheet shows the trust’s financial position at the end of the accounting period but is usually, by convention, included on the first page of the accounts. It shows the total value of the funds held on behalf of beneficiaries and represented by: total assets less total liabilities.

The trust balance sheet format by Vyapar provides you with a snapshot of a business’s financial position and helps determine risks and returns.

Yes, the charitable donation is eligible for tax deduction under Section 80G of the Income Tax Act 1961.

To obtain the tax benefit of making donations, you must submit the name, address, PAN of the donee, Form 16, the stamped receipt, among other requirements.

A trust balance sheet helps describe a trust’s financial health insightfully and professionally. It reveals the liabilities and assets to the interested parties, making it easier for anyone to analyse the data at any point in time.

Yes, a balance sheet is mandatory for trusts. Trusts, like other legal entities, are required to maintain proper financial records and prepare financial statements, including a balance sheet. The balance sheet provides a snapshot of the trust’s financial position, including its assets, liabilities, and equity, at a specific point in time. This information is important for transparency, accountability, and compliance with regulatory requirements. Trusts typically prepare balance sheets as part of their annual financial reporting obligations.

To balance a trust account:

1. Record all transactions in the trust ledger.

2. Compare ledger transactions with bank statements.

3. Identify and correct any discrepancies or errors.

4. Adjust the ledger to reconcile differences.

5. Verify that the ending balance matches the bank statement.

6. Document the reconciliation process for auditing purposes.

A trust account can be viewed as both an asset and a liability. It’s an asset for the owner or beneficiary and a liability for the trustee responsible for managing the funds.

The financial statements for trusts include the balance sheet (showing assets, liabilities, and equity), income statement (revenues, expenses, net income), statement of changes in equity, statement of cash flows, and notes to the financial statements. These statements provide a comprehensive view of the trust’s financial position, performance, and cash flows.