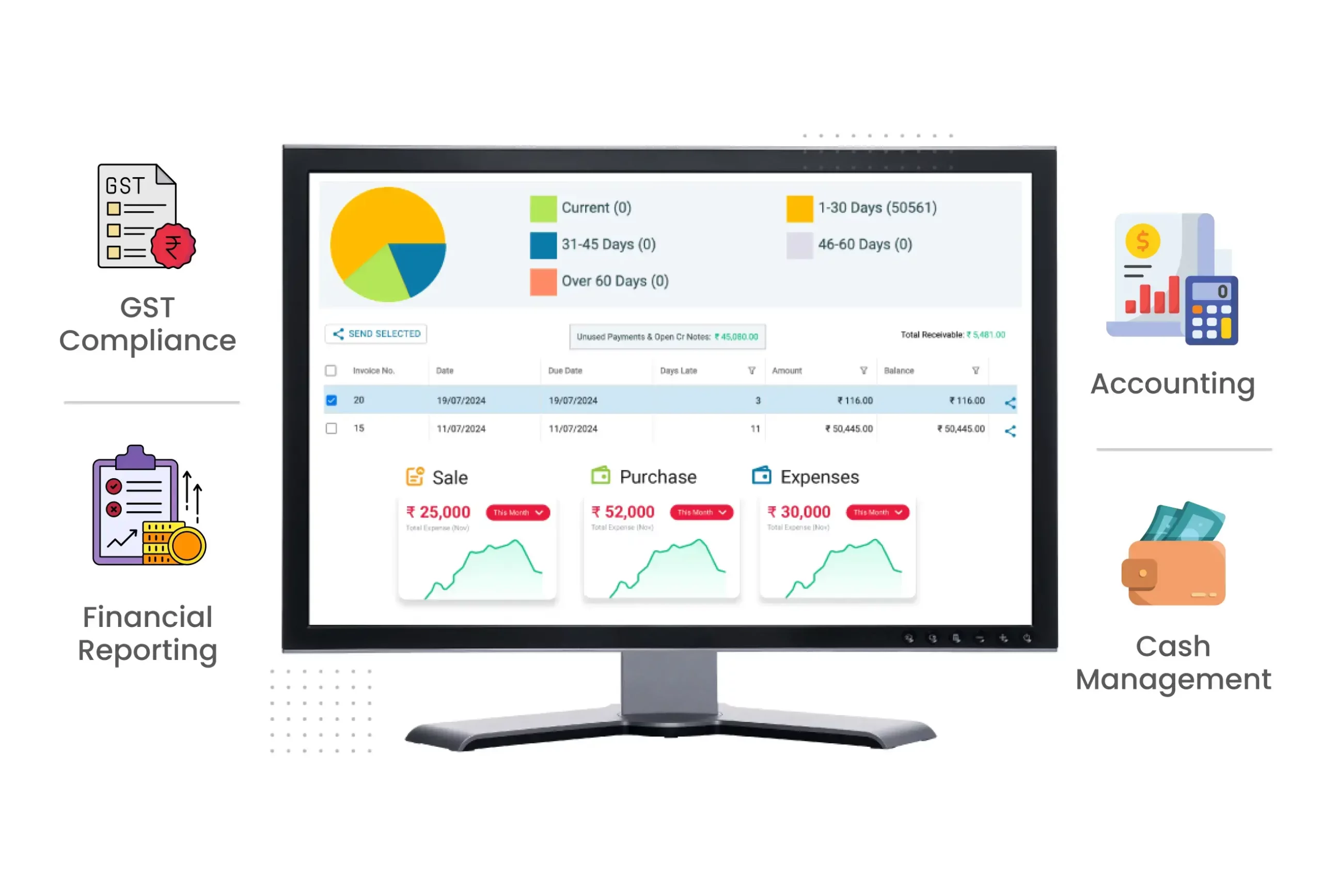

Accounting and Financial Software

Our powerful accounting and finance software is an all-in-one financial solution. Manage your accounting, track expenses, and generate reports effortlessly. Try it for free today!

Top 4 Game-Changing Features of Accounting & Financial Software

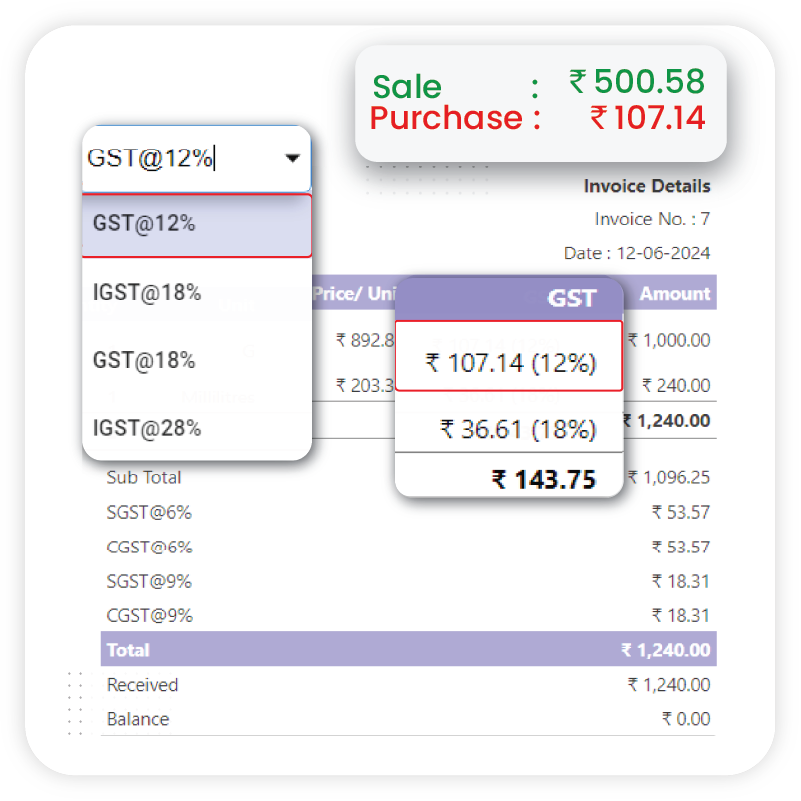

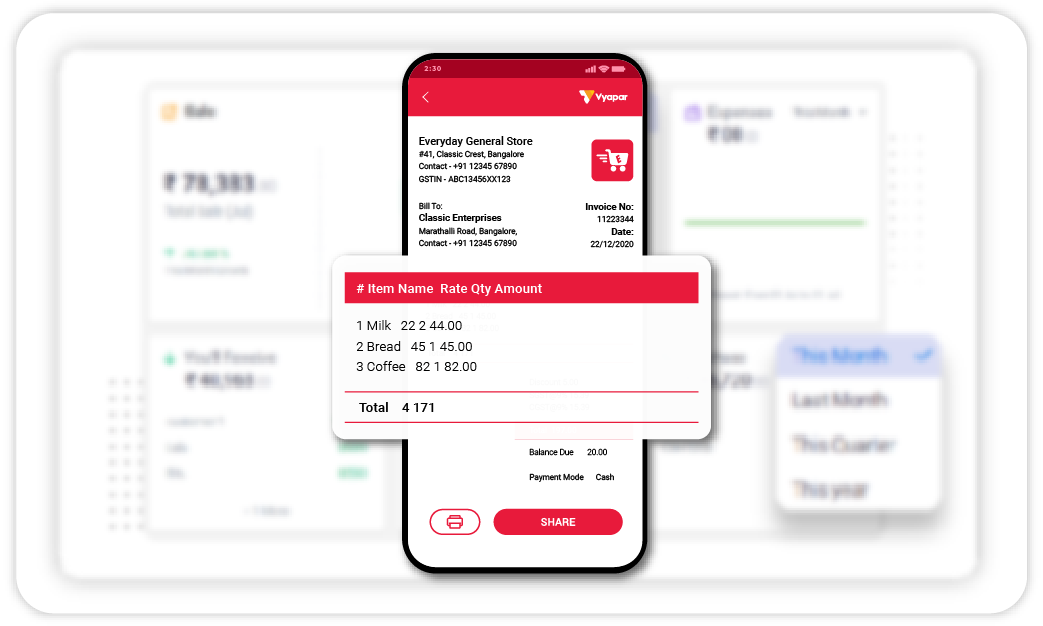

GST Invoicing & Billing

Creating and managing GST-compliant invoices has never been easier with Vyapar’s accounting and financial software. Automate the entire process and track all transactions effortlessly.

- Quick GST Invoices: Generate invoices that comply with GST regulations instantly.

- Automatic Calculations: Let the system handle tax calculations to ensure accuracy.

- Track Sales & Purchases: Monitor your sales and purchase history in real time.

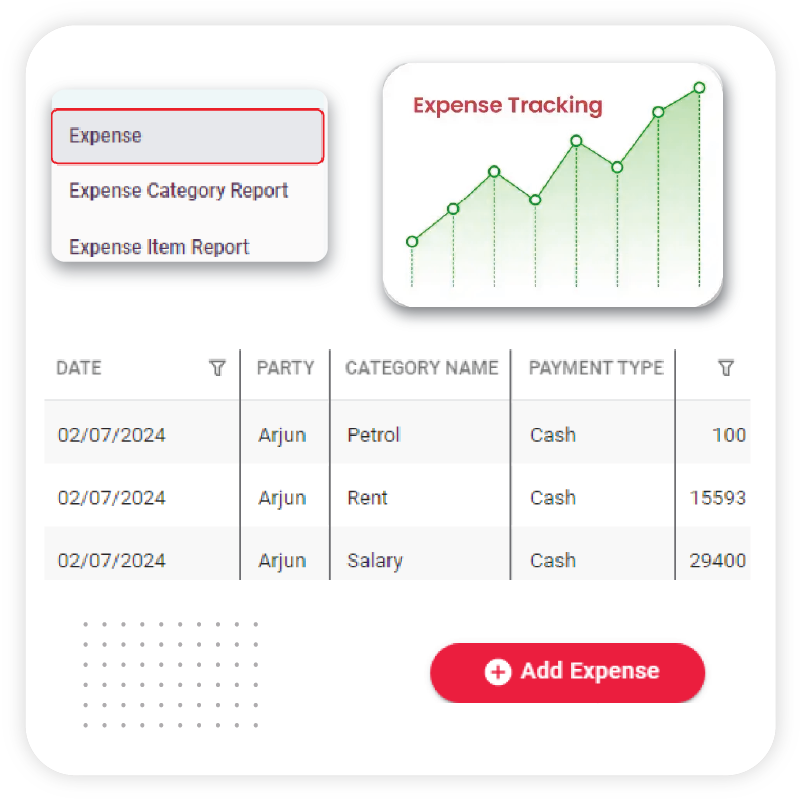

Expense Management

Simplify the way you manage and categorize business expenses with Vyapar financial accounting tools expense management feature. Gain better control over your spending and avoid manual tracking errors.

- Automated Expense Tracking: Capture and categorize expenses in real-time.

- Custom Expense Categories: Set up personalized categories to suit your business needs.

- Expense Reports: Generate detailed reports to get a clear picture of your spending.

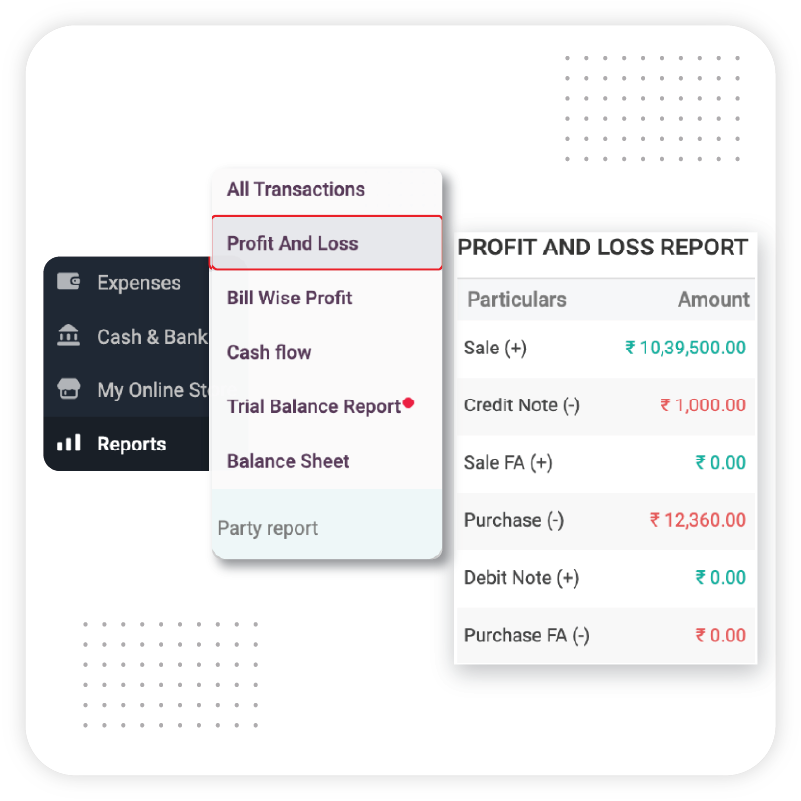

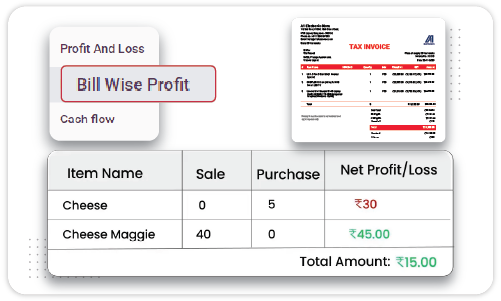

Financial Reports

Generate comprehensive financial reports such as profit & loss statements and balance sheets using financial accounting software. These reports provide an insightful view of your business’s financial health.

- Detailed Reports: Automatically generate accurate profit & loss statements, balance sheets, and cash flow reports.

- Historical Data Analysis: Compare past and current data to identify trends and areas for improvement.

- Customizable Views: Tailor reports based on specific needs to present clear insights.

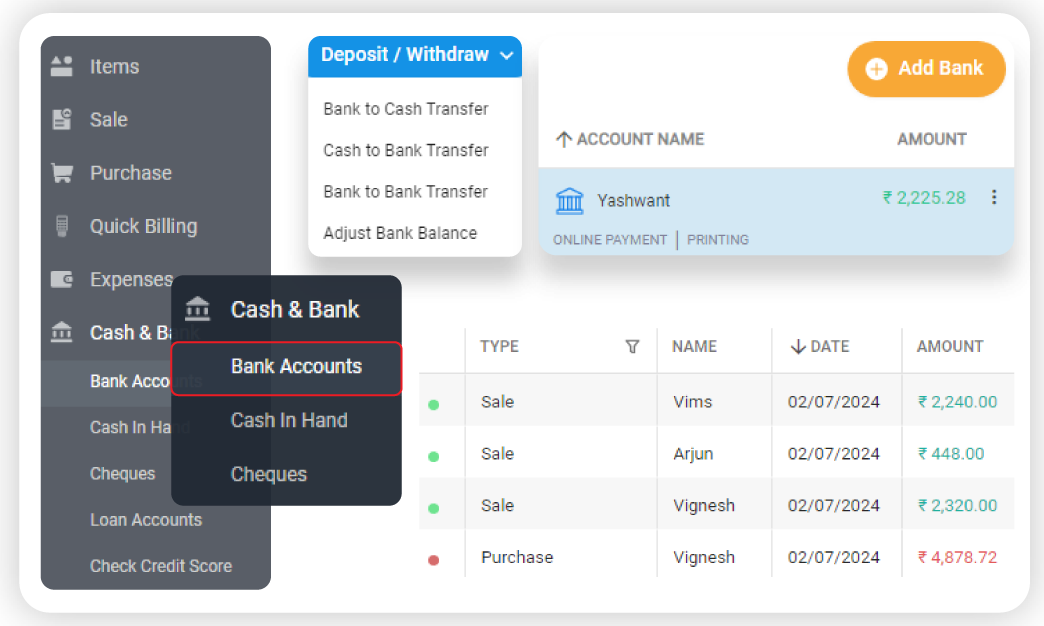

Cash Flow Management

Ensure business stability by staying on top of your cash flow with real-time cash flow management tools within Vyapar’s software. This feature helps you make informed decisions to maintain liquidity.

- Real-Time Monitoring: Keep track of cash inflows and outflows for better financial control.

- Periodic Cash Flow Reports: You can check daily, weekly and monthly basis cash flow trends in the software.

- Cash Flow Adjustment: Adjust your cash balance as or when needed.

Add-On Features of Free Accounting & Financial Software for Small Businesses

Item-Wise Profit Calculation

Receivables & Payables Management

TCS Management

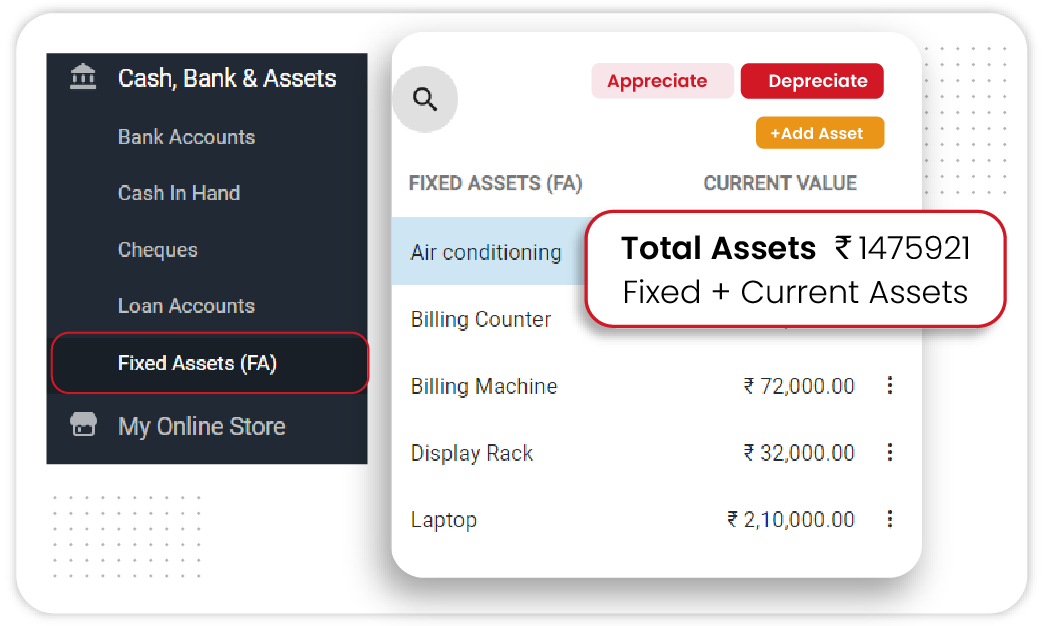

Asset Management

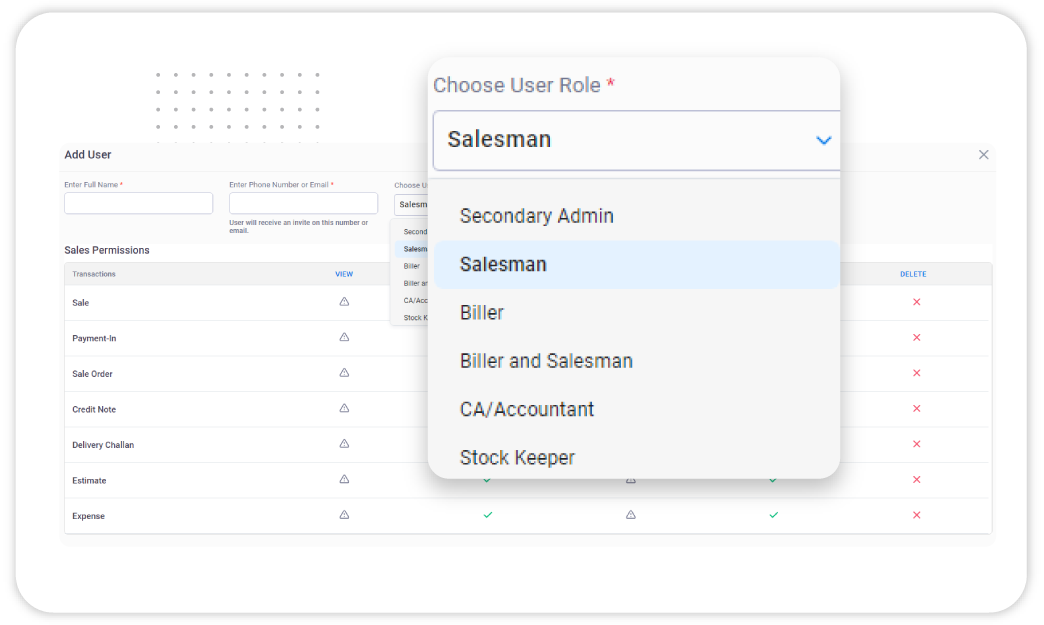

Multi-User Access

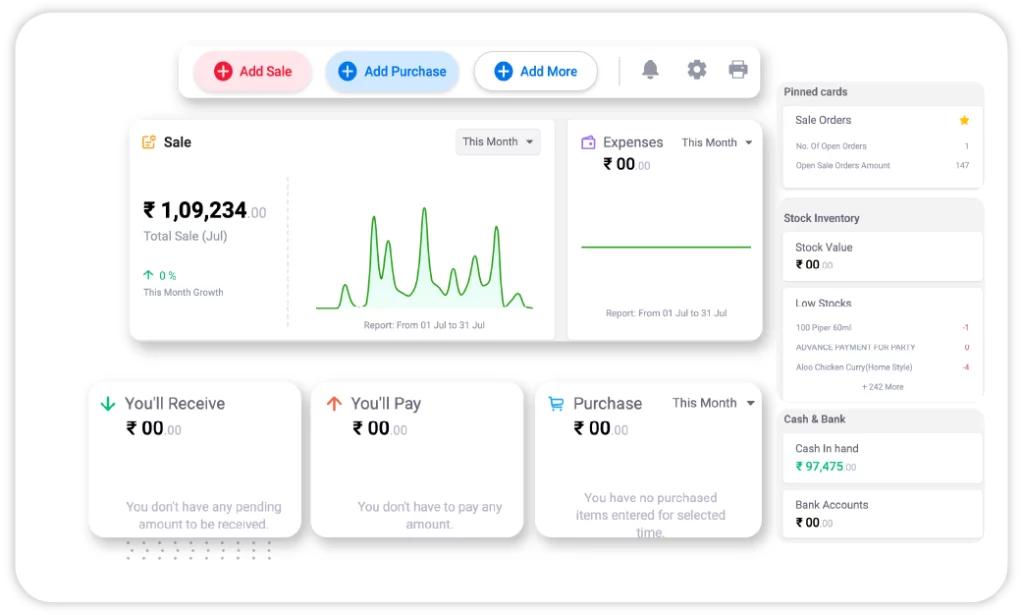

Customizable Business Dashboard

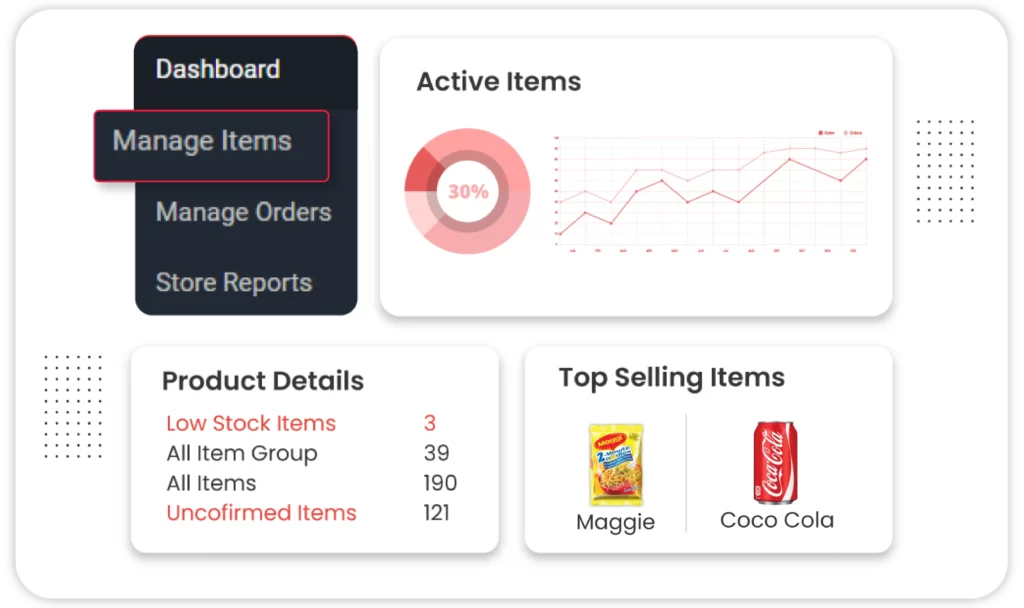

Seamless Inventory Tracking

Mobile App Access

Bill-Wise Tracking

Cash and Bank Management

Party Management

Reminder and Alerts

Payment Reminders

Purchase Order Management

Data Security

Simplify All Your Financial Challenges with Vyapar’s Free Accounting and Finance Software

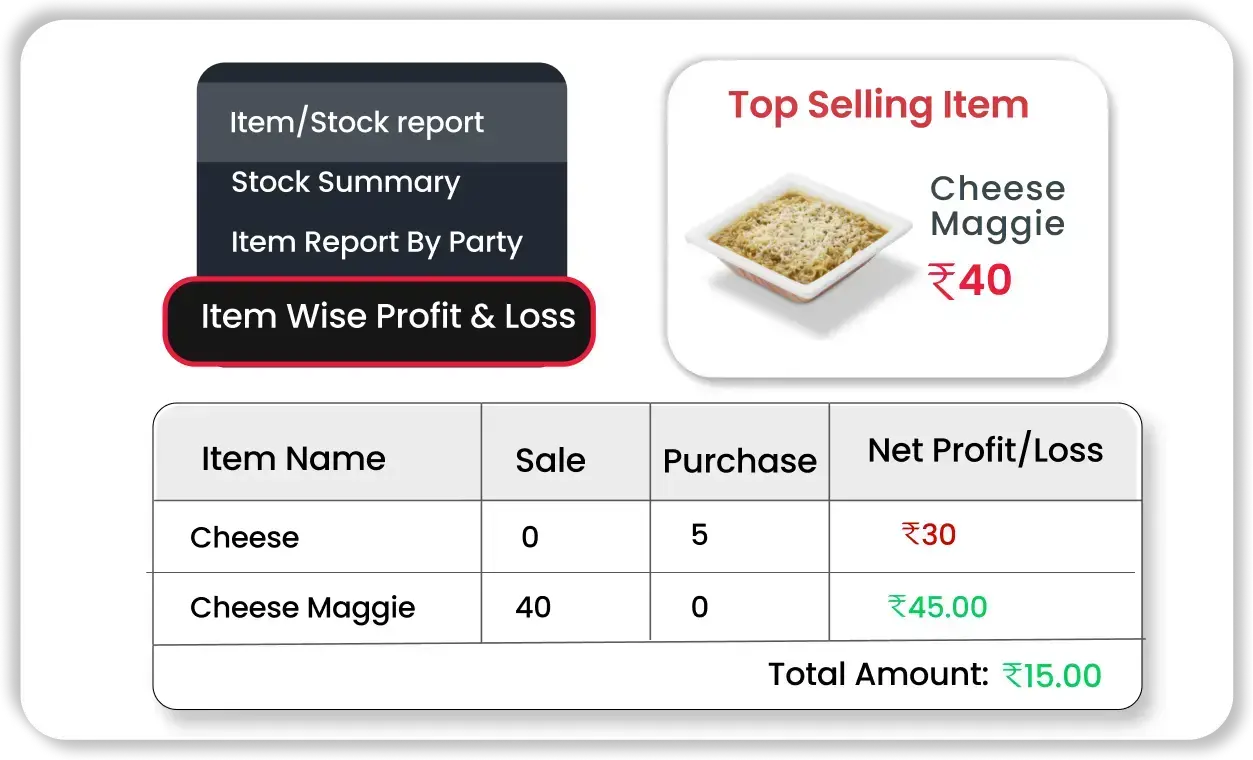

Item-Wise Profit Calculation

Gain insight into how each product or service contributes to your bottom line. Vyapar financial software‘s item-wise profit calculation allows you to make more informed business decisions.

- Detailed Profit Tracking: Analyze the profitability of individual items.

- Data-Driven Pricing: Adjust pricing strategies based on product profitability.

- Identify Top Performers: Determine which products contribute the most to your profits.

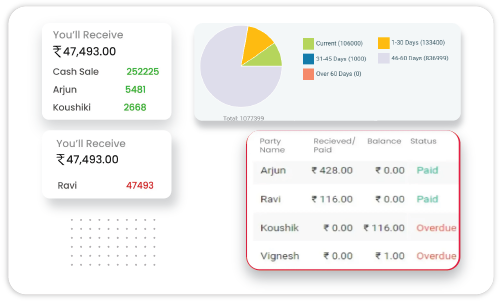

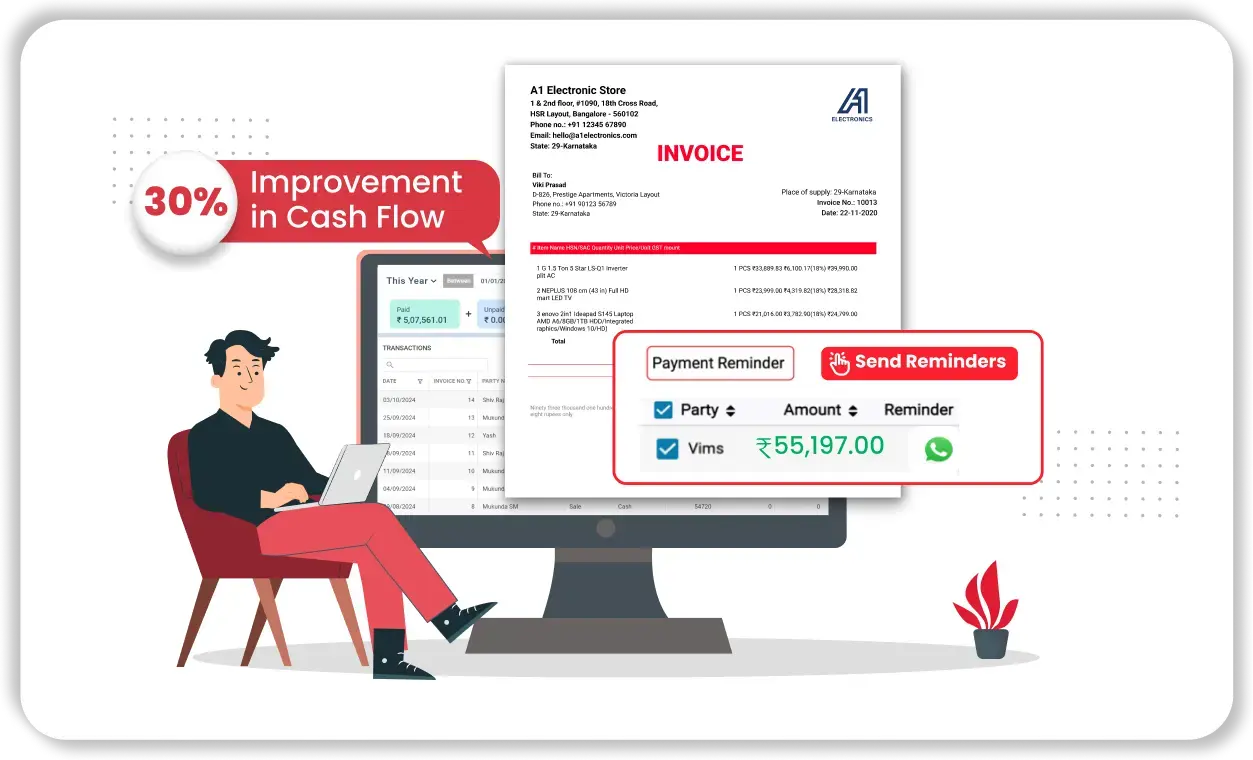

Receivables & Payables Management

Ensure timely payments and maintain a healthy cash flow by managing receivables and payables efficiently with Vyapar’s financial accounting software.

- Track Payables & Receivables: Monitor what’s due to you and what you owe.

- Automated Reminders: Set reminders for overdue payments to ensure collections.

- Aging Analysis: Generate reports to view aging of receivables and payables.

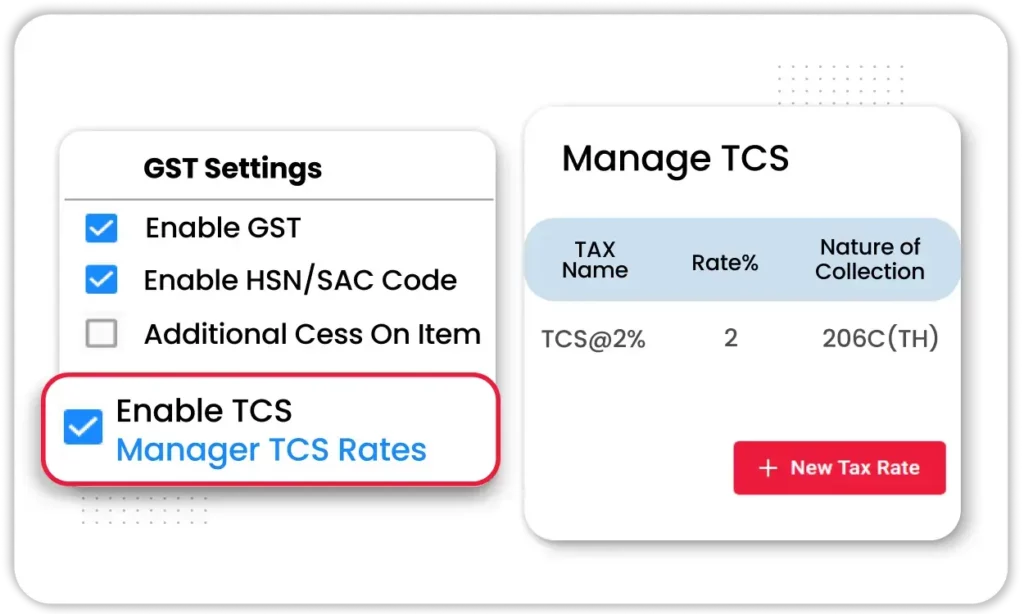

TCS Management

Stay compliant with TCS regulations by automating the tax collected at source (TCS) management with Vyapar’s accounting and finance software.

- Automated TCS Calculation: The system automatically calculates TCS based on transactions.

- Tax Filing Made Simple: Generate accurate reports for tax submissions.

- Stay Compliant: Avoid fines and audits by ensuring timely tax payments.

Asset Management

Track your business assets, including their value and depreciation, with financial accounting software’s asset management tools. Keep your assets in optimal condition and ensure proper utilization.

- Asset Tracking: Manage all physical and intangible assets in one system.

- Monitor Depreciation: Automatically calculate asset depreciation over time.

- Optimize Asset Usage: Maximize the lifecycle of your assets by scheduling maintenance.

Multi-User Access

Collaborate efficiently with your team by providing multi-user access to Vyapar’s accounting software.

- User Permissions: Control who has access to specific features of the software.

- Team Collaboration: Work together on financial tasks in real-time.

- Track User Activity: Monitor who is making changes for transparency and accountability.

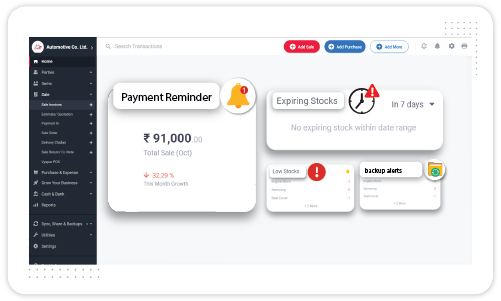

Customizable Business Dashboard

Get a holistic view of your business performance with Vyapar financial accounting software’s customizable business dashboard. Tailor it to display the most important metrics.

- Real-Time Data: Access key metrics like sales, expenses, and cash flow at a glance.

- Personalized Widgets: Customize your financial accounting tool dashboard with the metrics that matter most to your business.

- Immediate Insights: Use real-time updates to make quick, informed decisions.

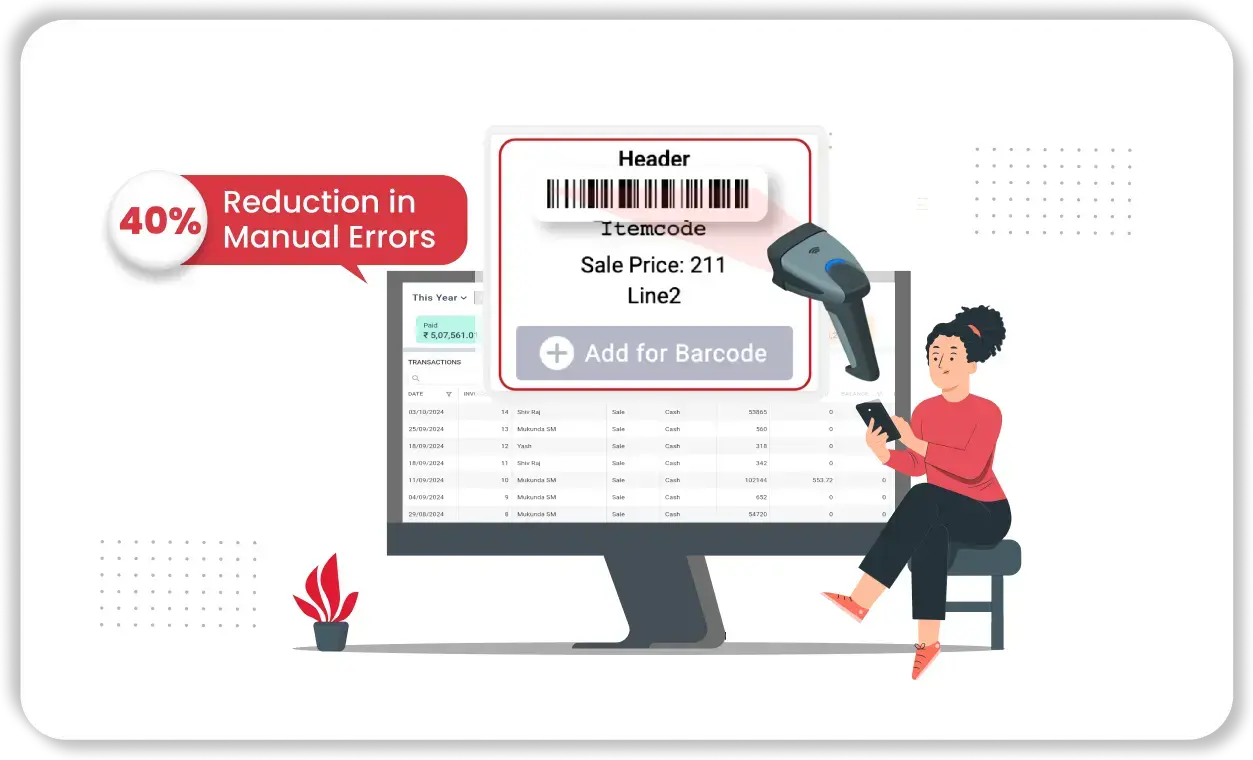

Seamless Inventory Tracking

Managing inventory becomes a breeze with Vyapar’s seamless inventory tracking feature. Maintain optimal stock levels with ease.

- Track Stock Levels: Monitor your stock in real-time to avoid overstocking or shortages.

- Automatic Reorder Alerts: Receive alerts when inventory levels reach a critical point.

- Inventory Reports: Generate detailed reports to identify slow-moving or fast-moving items.

Mobile App Access

Stay connected to your business wherever you are with Vyapar’s mobile app.

- Manage Finances On the Go: Access your accounting & finance software from your smartphone.

- Instant Notifications: Get alerts and updates on your financial activities.

- Mobile-Friendly Interface: A user-friendly mobile app designed for easy navigation.

Bill-Wise Tracking

Manage both your profits and payments efficiently with bill-wise tracking. This feature offers detailed tracking for better financial control.

- Profit by Bill: Understand the profitability of each invoice.

- Payment Tracking: Monitor payments collected for individual bills.

- Transparent Transactions: Maintain clarity in all your billing activities.

Cash and Bank Management

Effortlessly manage your cash flow and bank accounts using Vyapar’s cash and bank management tools.

- Contra Entry: Cash withdrawal and deposits entry management.

- Cash Flow Insights: Stay on top of your liquidity by monitoring deposits and withdrawals.

- Track Multiple Accounts: Manage various bank accounts and cash sources in one place.

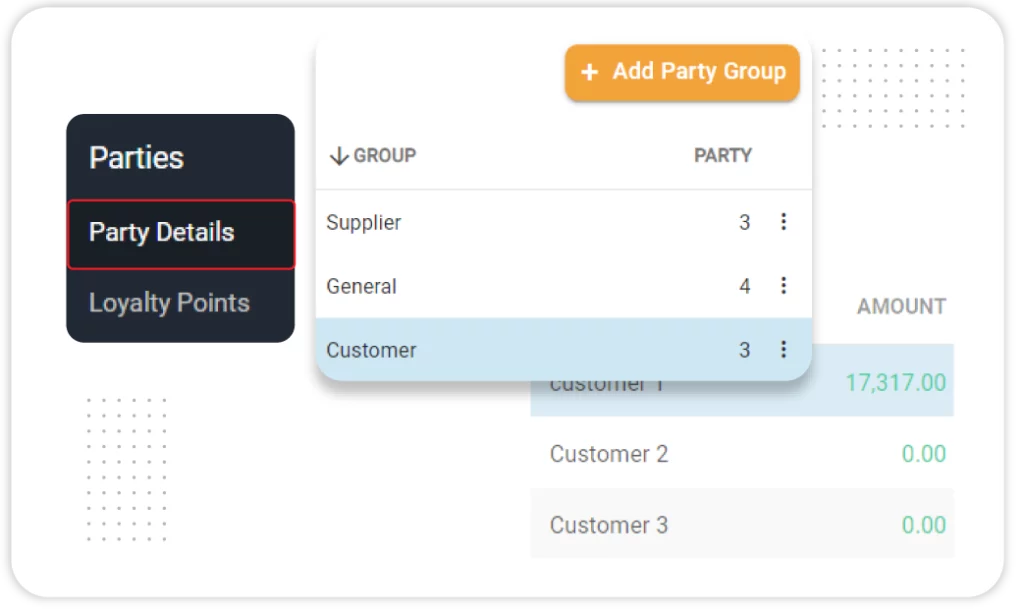

Customer and Vendor Management

Build and maintain strong relationships with your customers and vendors using Vyapar’s customer and vendor management tools.

- Party Contact Details: Keep all vendor and customer information in one place.

- Track Payment History: View payment histories for easy reference.

- Streamlined Communication: Send invoices, reminders, and updates directly from the software.

Reminder and Alerts

Never miss a deadline with Vyapar’s reminder and alert system. Ensure you’re always aware of upcoming payments or tasks.

- Payment Due Alerts: Receive notifications for payments you need to make or collect.

- Stock Alerts: Get timely reminders for both low stock and expiring stocks for seamless inventory management.

- Data Backup Alerts: Set up periodic reminders based on your specific needs.

Vyapar’s Powerful Accounting and Finance Software. Try it Free Today!

Why Vyapar is the Ideal Software Choice for Free Accounting and Finance Management

Choosing the right free accounting and finance software is essential for small businesses looking to streamline their operations without a hefty price tag.

Vyapar financial accounting tool offers all the features you need to manage your business finances effectively, from GST invoicing to expense tracking and cash flow management. Vyapar’s free financial software is designed with user-friendliness in mind, allowing businesses to handle their finances with ease, even without a strong accounting background.

Comprehensive Financial Tools

Vyapar offers a complete suite of accounting and finance software tools, including invoicing, expense tracking, and cash flow management, providing a one-stop solution for businesses to manage their finances efficiently.

Offline Functionality

Vyapar’s accounting & finance software works offline, allowing businesses to manage their finances without internet access. Once reconnected, data is synced automatically, ensuring you never miss any crucial updates.

Security and Data Backup

With Vyapar, your financial data is securely encrypted and automatically backed up. This ensures that your sensitive information is protected, providing peace of mind with this free financial management software.

Exceptional Customer Support

Vyapar offers reliable customer support through multiple channels, ensuring that users of its free accounting and finance software get prompt assistance whenever they encounter issues or need help using features.

Mobile Accessibility

Manage your business finances anytime, anywhere, with Vyapar’s mobile app. This free accounting and finance software keeps you connected to your financial data on the go.

Cost-Effective for Small Businesses

Vyapar provides powerful free financial software solutions without hidden costs, making it perfect for small businesses looking to manage their finances efficiently without breaking the bank.

Enhanced Cash Flow Management

Vyapar’s accounting and finance software helps you monitor cash inflows and outflows in real-time, enabling better liquidity management and financial planning for your business.

All-In-One Solution

Vyapar accounting and finance software integrates multiple business operations into one platform. You don’t need different tools for accounting, billing, inventory, and expense tracking. Vyapar does it all, making your work easier and cheaper.

Achieve 100% Success: Proven Accounting and Financial software

1.30% Cash Flow Improvement

By automating invoicing, expense tracking, and payment reminders, businesses have experienced a significant improvement in their cash flow management.

2. 40% Reduction in Manual Errors

Automated processes eliminate human errors, ensuring accurate financial reporting and invoicing.

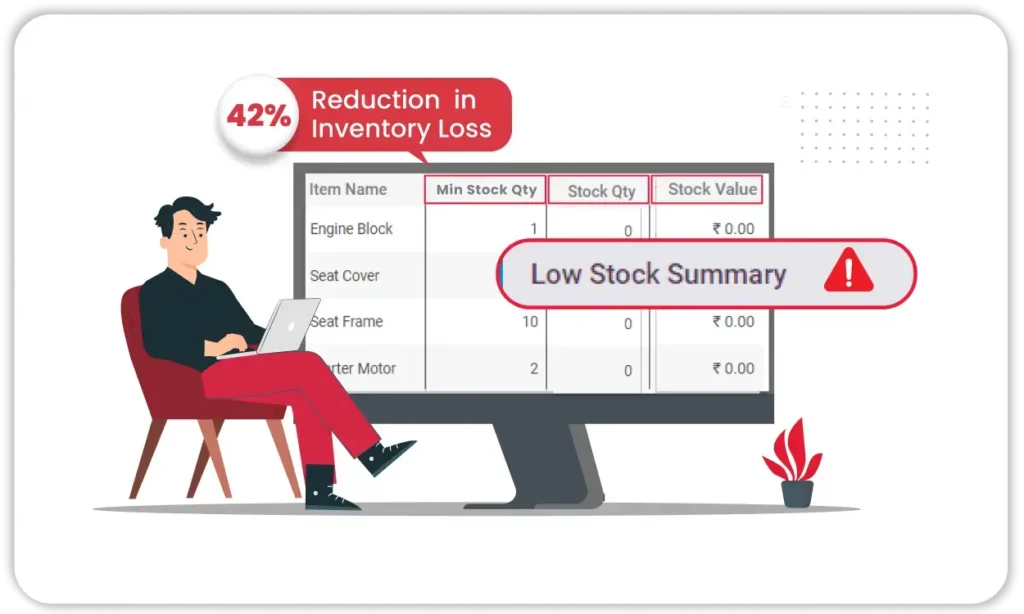

3. 42% Reduction in Inventory Loss

Real-time inventory tracking helps businesses optimize stock levels, reducing the chances of loss due to overstocking or stockouts.

4. 50% Improvement in Operational Efficiency

The streamlined processes allow businesses to manage finances more efficiently, reducing time spent on manual tasks.

5. 10x Faster Billing Process

Automated billing tool or invoice generator ensures faster invoice generation, improving cash flow and reducing payment delays.

Get a Free Demo

Ease Your Day-to-Day Accounting!

Take Your Business to the Next Level with Vyapar! Try FREE

Frequently Asked Questions (FAQs’)

Financial software helps businesses manage their financial operations, including invoicing, expense tracking, and financial reporting. It automates many accounting tasks, reducing the risk of manual errors and improving overall efficiency.

Accounting and finance software streamlines financial tasks such as invoicing, expense management, and cash flow monitoring. It provides real-time insights into a business’s financial health, helping owners make informed decisions.

Yes, Vyapar offers free financial software for small businesses, providing essential tools for managing finances without the high costs associated with traditional accounting software.

Absolutely! Vyapar allows businesses to generate detailed financial reports such as profit & loss statements, balance sheets, and cash flow reports, providing a clear view of your business’s financial health.

Yes, Vyapar offers a mobile app that allows users to manage their finances on the go. This feature ensures that business owners can access their financial data from anywhere at any time.

Vyapar’s cash flow management tools allow businesses to monitor their inflows and outflows in real-time, ensuring that they maintain healthy liquidity and make informed financial decisions.

Finance & accounting software is a digital tool that helps businesses manage their financial operations, including tracking income, expenses, invoices, payroll, and generating financial reports. It simplifies bookkeeping, ensures accuracy, and helps in maintaining tax compliance.

Finance and accounting systems are software tools designed to manage and automate a business’s financial operations, such as tracking income, expenses, invoicing, payroll, and financial reporting. These systems are important because they improve accuracy, save time, and provide real-time insights into a company’s financial health, helping businesses make informed decisions and stay compliant with tax laws.

Yes, Vyapar financial accounting software india is tailored for small and medium-sized businesses. It’s user-friendly and affordable, offering essential tools for managing finances, tracking income and expenses, and ensuring GST compliance. It’s designed to be intuitive, even for those without a financial background.

Vyapar is widely recognized as one of the best app for financial accounting, especially for Indian businesses. It offers a range of features tailored to meet the unique needs of small to medium-sized businesses, including GST compliance, expense tracking, and multi-device synchronization, making it an ideal choice for efficient financial management.

Computerized financial accounting software automates accounting processes, allowing businesses to manage finances, track expenses, and generate reports digitally.

Vyapar is a comprehensive computerized financial accounting software designed to simplify accounting for small to medium-sized businesses, particularly in India.

Vyapar stands out as a highly effective financial accounting program designed for small and medium-sized businesses. It offers essential tools like GST-compliant invoicing, expense tracking, inventory management, and real-time financial reporting, making it an all-in-one solution that simplifies financial management.

Financial accounting packages are software solutions designed to manage a business’s financial transactions, including bookkeeping, invoicing, payroll, and tax preparation. These accounting software financial packages help businesses automate accounting tasks, reduce errors, track income and expenses, and generate financial reports, making it easier to manage finances efficiently and stay compliant with tax regulations.