Donation Receipt Format | App

Download the donation receipt format for trusts and NGOs. Or use the Vyapar App to create donation receipts, track payment history, manage outstanding easily and grow your business faster! Get started with a free trial for 7 days!

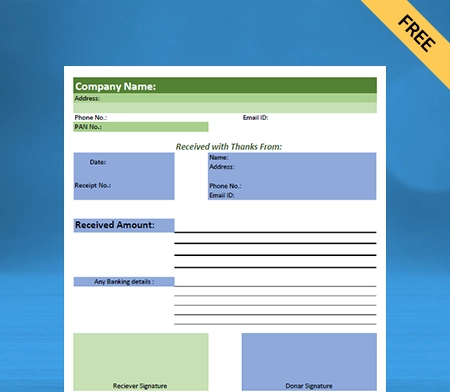

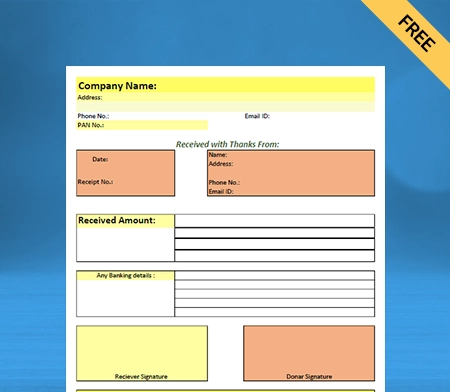

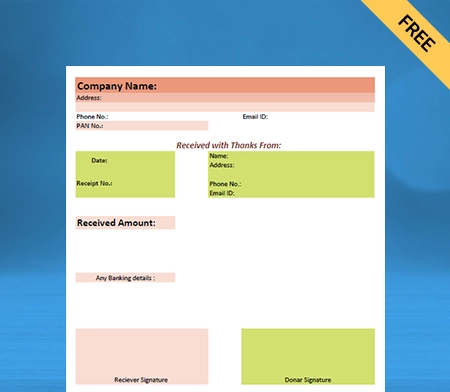

Download the Free Donation Receipt in Excel, Word, and PDF Format

Highlights of Donation Receipt Format

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print-friendly

Built from scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

What is a Donation Receipt?

A charitable donation receipt is a written acknowledgement that the non-profit entity received a donor’s gift. Charitable donation receipts include information about the gift (donor name, organisation name, amount, and type). The contribution can be monetary or non-monetary.

Donation receipts have numerous advantages for donors and the organisations that issue them. Donors commonly use them when filing taxes, as specific charitable contributions can help reduce income taxes. A donation receipt is proof of the contribution and helps donors claim a tax deduction.

What are the Benefits of Making a Donation?

When you choose to donate, you may not realise that it will provide you with many personal benefits in addition to helping your favourite cause. Here are some benefits of making donations:

- Contributing joy to others is always a good idea. Your enthusiastic contributions can make a massive difference in other people’s lives. Further, you can inspire your family, friends, and others to support charities.

- Children who witness their parents giving to charity are more likely to be generous. You must encourage your children to help others in need. Sharing the experience of donating to charity with your children teaches them early on that they can make a difference in the world.

- Children naturally want to help others, so nurturing their natural generosity is likely to result in them growing up with a greater appreciation for what they have and continuing to support charity in the future.

- The knowledge that you’re helping others is hugely empowering. The act of giving to others makes you feel content. Cash donation receipts, church donation receipts, or any other religious organisation donation receipts can provide you with tax benefits.

- To many people, having the ability to improve the lives of others is a privilege that comes with a sense of obligation. We can reinforce our ethical beliefs by living per these feelings of responsibility.

- When you give money to charity, you open the door to meeting new people who believe in your exact causes. It can give your everyday life more meaning. Life is hectic, and it’s easy to forget to express gratitude for all you’ve been given. Charity is an excellent way to express gratitude.

Contents of a Donation Receipt And Charitable Trust

Here are the essentials of a deduction donation receipt:

- The full name of the donor

- The name of the non-profit organisation

- Address and contact details of the donee

- The donation ID is unique.

- The date of the donation

- Receipt number

- Type of donation

- The amount or number of gifts in goods or services received.

- Signing authorities’ signatures

Tax Benefits of Donation Under Section 80g

The Income Tax Act allows deductions for contributions to certain relief funds and charitable organisations under section 80G. Any taxpayer, such as individuals, companies, firms, or anyone else, can claim this deduction. Donation receipt format in Word by Vyapar help highlight those tax benefits in the receipt to help your donors claim them when they file taxes.

Mode of Donation Eligible For Deduction Under Section 80g

- Tax deductions are only available for cash or cheque donations. On the other hand, cash donations do not qualify for a tax deduction above Rs. 10,000.

- Donations in kind, i.e., other than monetary contribution, do not qualify for a tax deduction.

- Donations in cash exceeding Rs 2000 are no longer eligible for tax deduction since 2017-18. Donations exceeding Rs 2000 should be made in any mode other than cash to qualify for a deduction under section 80G.

However, not all donations are eligible for a full tax deduction. Some are limited to 50% of the amount contributed. Others, however, are eligible for the same deduction, but only up to 10% of the taxpayer’s adjusted gross income. Section 80G of the Income Tax Act provides the prescribed list of such institutions.

You must submit the following details with your income tax return to claim such a deduction:

- Name of the donee (the institution receiving the donation)

- Address of donee

- PAN of the donee

- Amount donated

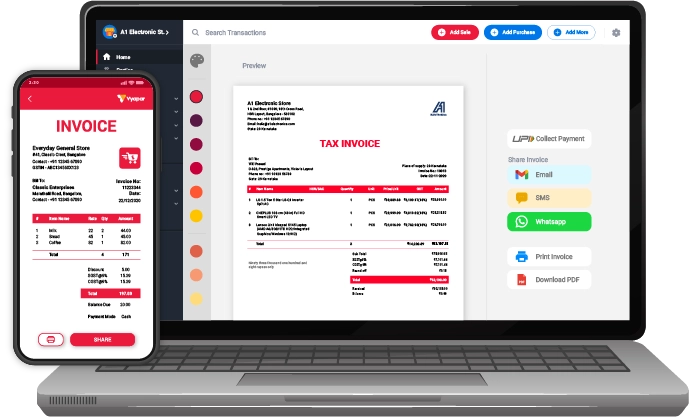

Why Vyapar App is a Better Alternative to a Donation Receipt Format?

Flexible And Saves Time: Non-profit organisations require automated, user-friendly software to accept any contribution efficiently and correctly. Automated payment processing software handles all back-end processes when a donation or transaction is made.

Vyapar donation receipt maker app is an automated software that includes all of the necessary calculation tools. It saves the company countless hours of manual labour. It also ensures your records are constantly updated correctly.

Instead of worrying about accounting, the organisation can concentrate on managing its initiatives. Payment processing requires flexibility as well. Transactions are processed quickly and easily by our accounting software Vyapar.

Easy Business Management: You can manage all of your charitable donation receipts in one place with the Vyapar app. It can assist you in keeping track of outstanding invoices and sending reminders to clients. It can assist you in tracking all active orders and ensuring they are delivered on time.

Using the Vyapar printing bill maker app, you can establish your brand image and create a professional sales invoice for your customers. Maintain all your client information in one place to quickly generate a monthly invoice for them.

Using a professional billing app can help you gain your customers’ trust. Furthermore, because you can access all essential features in one app via the business dashboard, the app enables you to manage your projects in a streamlined manner.

Various Payment Options: Accept all digital payments and make it easy for current and new customers to pay online using their preferred payment method. Additionally, the Vyapar app allows you to send charitable donation receipts to customers via email and WhatsApp.

Including a single QR code that accepts all payment methods is possible. Payment methods accepted include cash, credit card, debit card, UPI, NEFT, RTGS, QR codes, e-wallets, pay later, and others.

People value convenience, and the ability to pay you according to their preferences is the essential convenience you can provide. You can generate high-quality invoices with multiple payment options using the Vyapar printing sales invoicing app.

Build A Positive Image: Providing professional quotation format and sending donation receipts to donors helps develop a positive brand image. To build trust, you can also provide complete disclosure about the transaction.

Vyapar GST printing bill generator app can help you build a professional brand. A custom tax-deductible donation receipt that has been professionally designed can help you stand out from the crowd and establish yourself as a professional seller.

Buyers trust the custom-built quote because it contains all the information needed to close a deal. Product/service descriptions, discounts, taxes, and terms of sale may all be included in the printed quote data.

Life-Long Free Basic Usage: Our business accounting application’s essential features are free. Android users can use the free services to use the donation receipt formats available in the app. Our goal of bringing millions of small business owners into the digital economy includes providing free access.

You can use the accounting software for free if you register and obtain a free copy from the Play Store. On the other hand, a business can use a subscription to access the deluxe functions and desktop programs.

After each transaction, you and your client will receive a free SMS containing transaction details such as credit and debit values. It keeps both parties on the same page and transparent.

Customisable Formats: You can customise Vyapar donation receipts entirely. To perfectly present your brand’s identity, you can include our company logo, style, font, and brand colours in your invoice. You can also generate the donation receipts in word format, excel format, or any other format.

Having everything on the receipt is essential so the donor knows how their money is used. GST billing software makes you appear professional when printing bills and provides detailed information about your customers’ purchases.

Your organisation can stand out from the crowd with fully customised GST-compliant printing invoices. Create editable printing bill templates to help you include all of your company’s needs when creating a professional invoice.

Useful Features of Using the Vyapar App for Donation Receipt

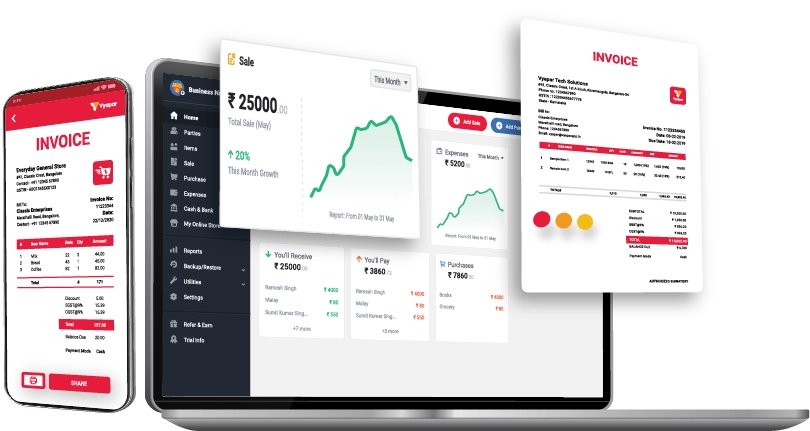

Generate Reports: Donations to a non-profit organisation can take several forms. They necessitate specialised tracking, documentation, and management across multiple platforms, projects, and fiscal periods. Use the 40+ report outline created with our free billing software for all your business needs.

To assess the effectiveness of a donation, your organisation requires adaptable, dynamic non-profit accounting software that can track these various types of contributions. Using the Vyapar donation receipt maker app extensively improves the operational efficiency of your organisation.

You can easily export the reports to PDF or Excel. The Vyapar free stock maintain app allows users to manage these transactions and generate real-time reports. Users can instantly view and analyse data with the free GST Invoicing & Accounting Software.

Using the donation receipt maker app, you can generate graphical reports for tracking sales and expenses. This free software analyses accurate business details, accounts, and many more; it is also an efficient way to quickly analyse the business’s profit.

Cash Flow Management: Accounting software that meets your entity’s accounting needs is required. Vyapar allows you to keep track of your donation receipt sample. Your company’s cash flow ensures you have enough budget to manage the organisation effectively.

The dashboard can assist you in determining whether or not you can easily sustain current expenses without falling behind. You can send donation invoices to donors with a thank you note using the Vyapar app. It helps to improve your professional image.

You can use donation receipt data stored in a database to record transactions. It aids in payment tracking. Cash flow management is widely used in billing, accounting, and other business functions.

The Vyapar cash receipt software automates the management process. Keeping accounting records accurate prevents errors. Using this free billing software, you can efficiently manage your company’s cash flow. With this all-in-one software, you can manage cash transactions.

Online and Offline Billing: Our software does not require you to stop billing operations due to poor internet connectivity. Even if you are not connected to the internet, you can generate invoices for your donors using the Vyapar app.

You can generate bills offline and online using our cash receipt format in Excel, PDF, and Word formats. The donation receipt generator app by Vyapar will validate and update transactions when you connect your database to the internet.

Using our GST donation receipt format, you can generate donation receipts for your doughnuts as soon as they send you a donation. The online invoicing and offline features of Vyapar are beneficial in rural areas with poor connectivity and network issues.

The app’s features benefit clients because they no longer have to wait for their invoices. The billing process is further simplified because everything is recorded immediately after the occurrence, so there is no need for additional effort.

Bank Accounts: Our software can quickly add, manage, and track online and offline payments. The tasks become more manageable when they use an easy-to-use free note from the GST donation receipt maker app for mobile. Whether your revenue comes from banks or e-wallets, you can quickly enter data into the free billing software.

Transferring funds from one bank to another and sending and receiving funds from bank accounts can help you manage your cash flow. As a result, it’s ideal for companies that use the Vyapar invoicing app for all cash-ins and cash-outs.

Before using the app’s bank accounts feature, you must first connect a business account in your bank to the GST cash billing software. It also lets you quickly withdraw or deposit funds from your bank accounts.

The Vyapar donation receipt generator app supports open cheques, allowing users to deposit or withdraw funds and quickly close them. in addition to the many other payment options available in the app, we allow you to track cheque payments.

Data Safety and Security: Data security is now the number one priority for every organisation. You can safeguard your app data by configuring an automatic data backup with our donation receipt software in India. For added security, you can also create a local backup.

It would aid in securing data stored on a personal device, such as a pen drive or hard drive. You can ensure your company’s security by using the free billing app to set up automatic backups or make secure backups regularly.

Following a review of the business reports generated by the Vyapar app, the accounting features of the Vyapar donation receipt maker app will ensure that you can analyse your sales data and create a business strategy whenever necessary.

Vyapar donation receipt software in India allows you to configure an automatic data backup, which ensures the safety of the data stored in the app. You can also use your sales data to generate reports and analyse sales data for potential future growth.

Choose Themes: Maintaining and sharing professional invoices with donors can help improve the identity of your charity organisation. The GST donation receipt maker app includes two invoice themes for thermal printers. It also comes with twelve invoice templates for standard printers.

With this GST invoice software, you can quickly improve the appearance of your invoice. The available customisation options are simple to use. Using Vyapar’s printing bill formats, you can create a professional printing invoice for your client. Printing invoices can help you impress a client.

The GST donation receipt maker app is the best and is simple. Choose from the best GST invoice formats to meet the needs of your business. Most businesses use our free billing software to present a professional image.

It has a wide range of themes for both thermal and standard printers. You can completely customise all of the themes. Any religious organisation or charitable organisation can use the app to make donation receipts.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

A donation receipt format is written documentation of contributions made by a donor. It serves as an acknowledgement to a donor that their donation was well-received. Donation receipts help donors to keep track of their finances and file taxes, as donations can reduce income tax liability.

A donation receipt format must include the donor’s name, address and contact number, date, name of the organisation, amount, reason for payment, receipt number, and name of the receiver.

Select any format that suits your needs. Customise the receipts and save them. There will be an option to download it in PDF, Excel, or other formats.

Donation receipts notify the donor that their contribution has been received and allow the non-profit to express their gratitude. Donation receipts also provide donors with important tax information.

Donation receipts are also called donation invoices or non-profit receipts.

Here’s how you can get a receipt for donations online:

-> Select form 10BD in the Login of the Trust or Society.

-> Continue after selecting the year.

-> Give specifics for each section.

-> Download the CSV file, fill in the required information, and save the file in CSV format.

-> After completing all details, proceed to preview and submit it after e-verification.

-> After completing Form 10 BD, you can download the Certification of Donation (Form 10 BE) within 24 hours.

If you have filed your application on or before 01/07/2021, you can download the certificate from a view-filled form. Go to the e-file and then the Income Tax forms. You will see an option to view filled forms, select form 10A and click on the download PDF button.

A donation receipt format contains all essential fields to collect and mention details regarding a charitable donation. To create a professional donation receipt, make sure that the receipt of the donation includes all vital details, including:

1. Name and contact details of the donor.

2. Name of the non-profit organisation.

3. Receipt number and donation date.

4. Donation type, amount, and purpose.

5. Signature of entities involved.

Using a professional donation receipt format, you can include all essential details in the final donation receipt. Vyapar provides the best donation receipt formats for all non-profit organisations to make the accounting process effortless.

A donation receipt is an official document highlighting the details of a gift made by the donor to any non-profit organisation. If a donor wishes the funds to be used up for a specific purpose or cause, they can mention it in the details, and the donation is used accordingly.

Using the Vyapar app, any non-profit organisation can create charitable donation receipts highlighting all the details regarding the donation. You can mention the purpose of funds to ensure they are accounted for accordingly. You can reassure the donor regarding using funds by saying it in the donation receipt.

A proof of donation form helps provide evidence that the donor donates. Any non-profit organisation can issue proof of donation to their donors. It is done to ensure the proper accounting of funds received.

Vyapar app can help a charitable organisation create proof of donation as a donation receipt with proper data accounting. Every donation receipt you start using the app is visible in the app. It helps make the accounting tasks effortless.