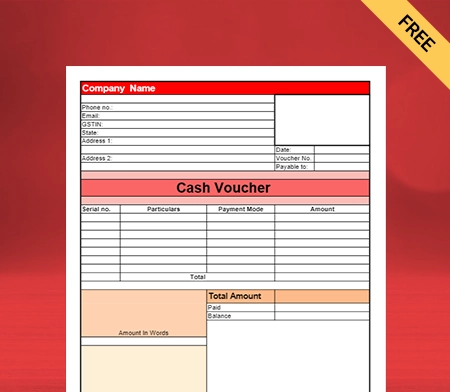

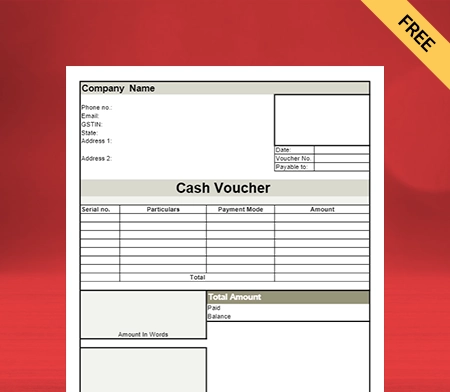

Cash Voucher Format PDF

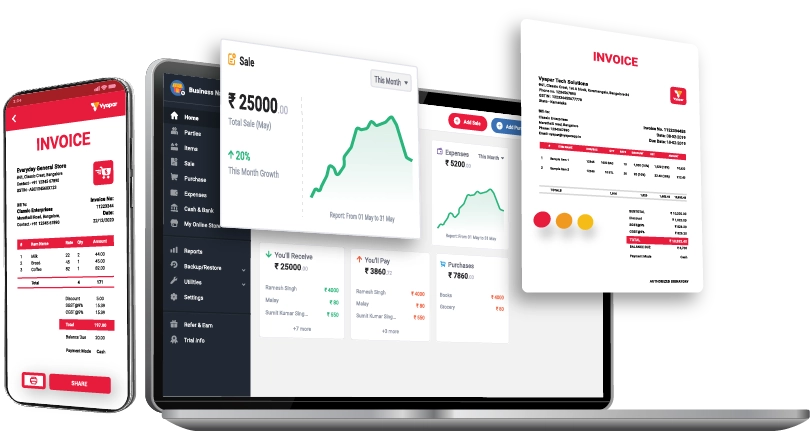

Download the cash voucher format in PDF to boost sales for your business. Or use the Vyapar app for billing and accounting easily and grow your business faster. Unlock a week-long trial, absolutely free!

What is a Cash Voucher?

A company needs to take care of far too many aspects of finance. Vyapar cash voucher format PDF has made this task slightly easier for you. You can now ensure that all possible transactions are correctly recorded and maintained.

Here’s when you can use cash vouchers in your company:

- If you need to make a cash transaction through a petty cash fund, you must take out a cash voucher format PDF.

- Petty cash is a small amount of money available for meeting receipts up to Rs 20,000 or 30,000. It varies in different organisations. Therefore, you can accordingly create the cash voucher PDF formats.

- Corporates usually use petty cash voucher formats to keep some liquidity available immediately.

- This is for the convenience of the employees to get reimbursements on incidental or minor expenditures done via cash transactions.

How Do You Need to Fill Out a Form For a Cash Voucher?

You need to follow the below-mentioned procedure for filing out the cash vouchers format PDF with the Vyapar app. Follow the steps one by one:

- You need to fill out a form for a cash voucher.

- The petty cash voucher needs to be submitted to the employee in charge of your department

- The reason for the withdrawal of the petty cash fund needs to be stated.

- If a formal receipt for cash has been submitted, payment details of the expenditure already made need to be submitted along with it.

Reasons For Using a Cash Voucher in PDF:

There are several reasons why professional GST formats for cash vouchers by Vyapar are generally used for cash vouchers. Some of them are listed here:

- All cash transactions carried out by the company employee at their own expense are recorded by the company through cash vouchers.

- All the receipts for the payments done in the company’s name are with the internal auditor or the finance department.

- The vouchers can easily be stored with the accounts or finance department.

- Cash can be withdrawn from the cash fund using these same vouchers to meet immediate yet small expenses.

- The cash available in the cash fund needs to be utilised for specific purposes only as pre-determined by the company. It allows more clarity for reimbursements and other such policies.

- Allows you to pre-determine cash funds for the next quarter or financial year.

- You will have a fixed amount of funds for food, stationery, refreshments, etc.

- The exact reason for these withdrawals is clearly stated in all cash vouchers.

- Simplifies the process of reimbursement and disbursement.

What is a Petty Cash Voucher?

There are so many cash transactions that a company needs to take care of. Keeping proper records of all these transactions is essential to clarify all payment details.

However, it is impossible to keep handing out checks or demand drafts for the bank every time an expense has been incurred. It is where petty cash vouchers come into the picture:

- Petty cash vouchers help maintain a cash reserve of a lower and higher end. The available cash reserve companies opt for ranges from Rs 5,000 to Rs 30,000.

- Petty cash vouchers are great for cash transactions on office supplies, stationeries, team lunches, and reimbursements for any other expenditure done for the company by an employee.

- Petty cash vouchers are serially numbered not just to maintain a proper record but also because these voucher numbers are then used in audits conducted later in the year.

Reasons For Using a Petty Cash Voucher in PDF:

- You will have an overview of all extra expenditures that the company may not necessarily incur otherwise.

- All cash transactions carried out do not always have a receipt for all the goods and services an employee has availed for the company.

- This fund is used for expenses where using a check is entirely unreasonable and unnecessary.

- Not all forms of payment do not have to be accepted at every establishment. Cash payments become the mode of payment thereon.

- It authenticates the expenditure incurred by an employee in the company’s name.

- It ensures the employee is appropriate and timely reimbursement for the cash transaction they incurred.

- Allows the company to check on all expenses it admits, other than the expenses it directly meets.

- Assists internal and external auditors to see how efficiently you have maintained your records of all possible expenses, especially in the case of these smaller transactions.

- Maintains transparency for the company. Even without an audit, a company has to keep stock of the expenditure they incur.

- The exact reason for these withdrawals is clearly stated in all petty cash vouchers.

What Makes PDF Cash Vouchers by Vyapar Perfect for Businesses?

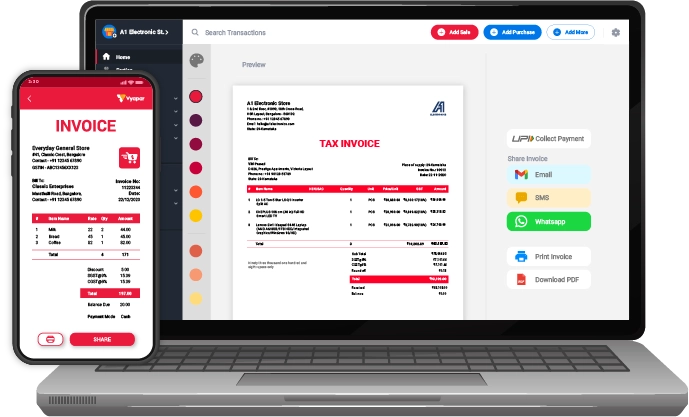

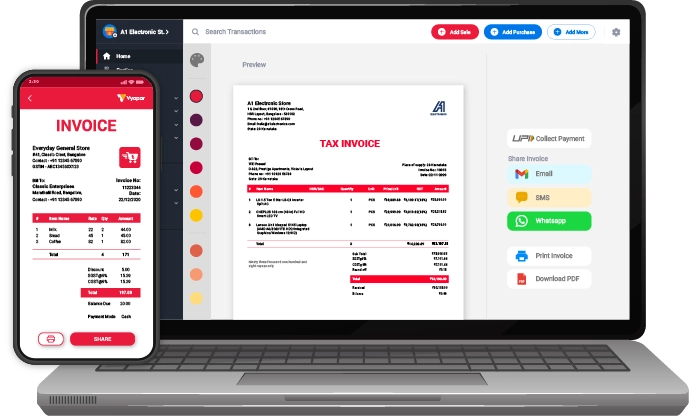

You can create free PDF cash vouchers with the Vyapar app on Android and Windows devices. Vyapar PDF cash vouchers help you in many ways. Some of them are as follows:

Ease of use:

You can download the cash voucher PDF format for free. Additionally, you can download the Vyapar app on your Android smartphone or Windows desktop. Access to all the tools makes it seamless to create and manage cash vouchers in one place.

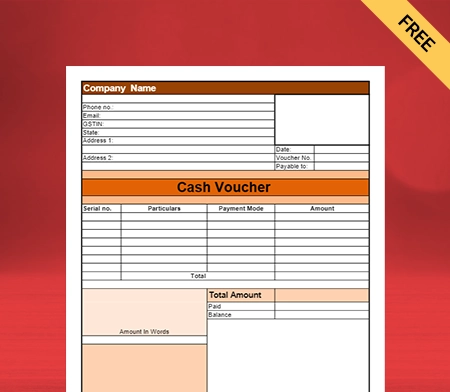

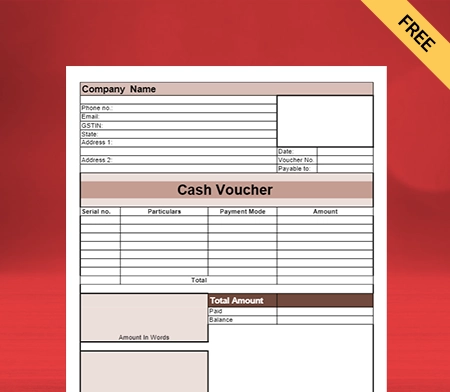

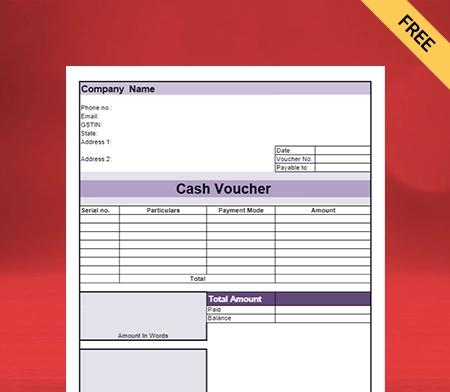

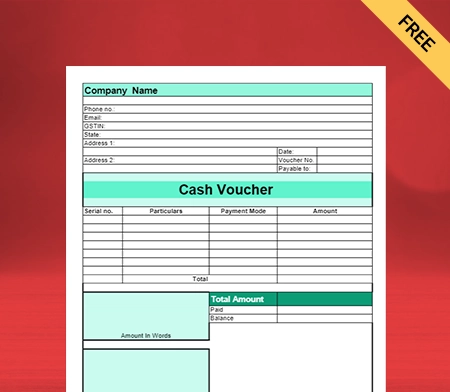

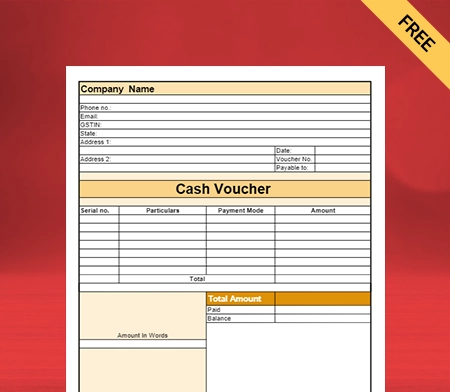

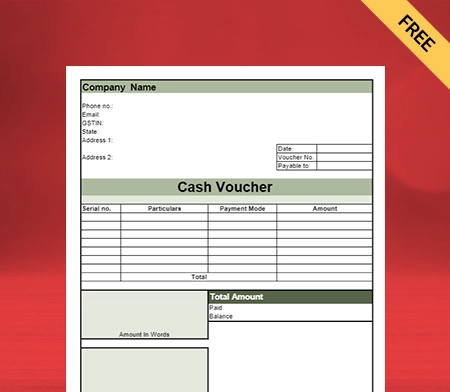

Customisation:

You can customise the PDF Cash Voucher using Vyapar as per your suitability. You can choose the format and fonts of your choice. Using custom-designed formats for vouchers, you can include all the details and fields you need to manage them seamlessly.

Trackable:

You can easily maintain track of your cash vouchers with the Vyapar app. Using the app, you can track their expiry dates and plan your discounts and offers accordingly.

Helps Strategize Sales:

Vyapar is a strategic tool that goes beyond collecting data. In a matter of minutes, you can analyse your sales strategy by compiling your data into business reports.

Makes Vouchers Attractive:

With different formats, fonts, and designs available – you can modify the cash voucher format PDF and make it more attractive. Attractive vouchers will make it more appealing to people using them and help you build a positive brand image.

Online/Offline Availability:

You can access the cash vouchers on the Vyapar application in any mode – online and offline. You can open the cash voucher format PDF and create them anytime with the Vyapar app.

Printable:

You can also give the command for printing the cash vouchers format PDF simultaneously from the app, saving you a lot of time. The app works with thermal and regular printers, so you can use it with any printer available in your store.

How Many Types of Cash Vouchers are There?

Various cash voucher format PDFs are commonly used across corporations and other organisations. There are two that are commonly used:

Credit Vouchers:

When cash funds for making a future expense need to be disbursed, you must fill out a credit voucher. So, a credit voucher can be revoked if goods, assets, and investments are sold.

Debit Vouchers:

Once the payment has been made, it can be made any time after, and reimbursement is required. It can be made to any department internally and must not be submitted to the finance department.

What are the Elements of a Credit Voucher?

When applying, get some cash before making an expenditure for the company. It needs to have certain things beforehand. These are as follows:

- The name of the cash recipient needs to be clearly stated in a legible manner

- The amount of cash disbursed has to be stated

- The date of application needs to be at the top of the credit voucher

- Reason for the disbursement of cash

- Account code to which the disbursement has been charged

- General ledger account to be charged

- The credit voucher number already needs to be pre-generated by the company.

- An authorised signature of the Department Heads

With easy-to-use accounting software Vyapar, you don’t need to worry about missing any entry because it will remind you when you have missed something. You can create free PDF cash vouchers with Vyapar.

What are the Elements of a Debit Voucher?

When you apply for funds after an employee has made a cash payment to the company. It needs to have certain elements beforehand. It is as follows:

- The name of the purchaser needs to be stated clearly.

- The amount of cash to be reimbursed has to be stated

- The date of application needs to be after the payment has been received by the relevant party

- Reason for the reimbursement of cash

- Account code to which the reimbursement has been charged

- The documentation of the payment is made

- The debit voucher number already needs to be pre-generated by the company.

- An authorised signature of the Department Heads

When you use the free billing app Vyapar, you won’t be worried about missing any entries since it sends you a reminder if there is anything you’ve missed. All the things are relevant to the format for cash vouchers in PDF.

What Does it Mean to Replenish the Petty Cash Fund?

It simply implies that the employee in charge of petty cash has to request and receive a fixed amount of petty cash funds from the company’s regular checking account. It is not usually the case that extra funds are allotted for the petty cash fund before the financial cycle or quarter is over.

If there are any overhead charges, they are usually allotted through petty cash funds only, as these are not significant expenses. They are also quite irregular. Therefore, it is not a daily occurrence as well.

The finance department or an internal auditor controls the petty cash funds.

How Can Sequentially Numbered Cash Vouchers Help Your Business?

It is simply not the case that cash vouchers are just a formality. Some bounds and protocols have been fixed for the corporate world to follow.

This implies that certain principles monitor something as small as cash vouchers. These principles allow parity to come about in industries. Employees and auditors do not have to clamour to get a detailed account of all the expenditures.

Sequentially numbered cash vouchers can be attained quickly and are very common. The management must ensure that all cash vouchers are adequately sequenced as they need to be submitted to an auditor on request. It is all ensured with the GST formats for cash vouchers by invoicing software Vyapar.

You can efficiently do it with the help of the Vyapar app and see the results on your own – how effective it will be.

What is the Best Way to Maintain Cash Vouchers?

Creating free PDF cash vouchers is also an art. You can make the cash voucher format PDF easily with the Vyapar accounting software. Follow the below-mentioned skills to do it more efficiently.

- Break Into Smaller Tasks: It is quite possible to get lost in these small tasks, especially when you have to present them all to an auditor whenever they ask. This is precisely why every organisation has a system of cash vouchers to ensure that all their transactions and cash payments are recorded from the beginning. It is almost a matter of habit.

- Journaling: It will not be possible for anyone to use petty cash funds without submitting a cash voucher. The best way to maintain your cash voucher records is through a journal. Most of these cash vouchers are requested through physical printed copies because of their form format. This is why a journal is a perfect solution to this problem.

- Pre-Sequenced Cash Vouchers: Sequencing the cash vouchers makes sense now because you will have a written record to check all the transactions against. This journal and the other relevant documents will need to be submitted at the end of a financial quarter or year.

- Keep One Person-In-Charge: You do not need an entire department working on a tiny task. It is enough to have one person look after its operations and report to the rest of the finance or accounts department. The financial custodian in charge of all the cash vouchers can only make these financial records. It ensures that there is no tampering with the records. You will also be able to have accountability for these petty cash vouchers as well.

- Control: This custodian will also be responsible for replenishing the petty cash funds whenever needed. Their signature is ultimately required before the general ledger account meets any payments.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Download Cash Voucher Format PDF

Frequently Asked Questions (FAQs’)

There needs to be a pre-numbered and pre-sequenced sheet, either digital or printed, for the cash voucher. It needs to state the name of the recipient of the cash funds, the date of disbursement, the amount of cash disbursed, and why.

There needs to be an account code to which the disbursement has been charged, along with the formal receipts attached to the form. Without the signatures of the relevant Heads of the Department and the custodian of cash vouchers, the payment will not follow through.

It is a generic sum of money that an organisation sets aside to meet unexpected and infrequent daily expenses. Some of these expenses may be incurred by the employees of the company. This amount will be reimbursed with the help of these cash vouchers alone.

Every such cash transaction is recorded with the help of petty cash vouchers. It helps the company maintain transparency across different levels of the organisation.

In general, the officer in charge of the finance department can ask for the replenishment of petty cash funds. It must be communicated in a written format and taken from the company’s general account. This ensures transparency throughout the organisation.

There are two types of cash vouchers: credit and debit cash vouchers. The functions of both these vouchers are different. It is the responsibility of the management to ensure that you have access to these primary forms of the protocol.

Generally, creating free PDF cash vouchers is done in average size. The available paper size for cash vouchers is 12.7 x 20.3cm. However, you can choose any size of your choice.

The general medium of print is an uncoated service-sized paper. However, these forms are usually available online and can be downloaded before you submit them.

A petty cash voucher is generally written after the expenditure has been made. It is done to get a reimbursement for the cash payments that the employee has already made.

It is possible to use petty cash funds in cases where it is not always possible to get a formal receipt. However, these are incurred for small and random expenses. These do not occur regularly.

You need to give in all the details like a cash voucher format PDF. However, it is not always possible to provide a payment receipt in cases of petty cash vouchers. However, you still need to provide a good list of expenditures.

It allows corporations and other organisations to check on all the unexpected expenses in the company. These vouchers will need to be presented to an internal or external auditor whenever asked for it.

Cash vouchers help a company maintain transparency at all levels. Proper organisation of finances is the foundation of any business.

The management must ensure that the format for cash vouchers in PDF is maintained and used in sequential order. It ensures that there is no gap in information coming and going.

Even though this is a tiny part of the expenditure that a company takes on. It is still essential to maintain them properly, as they will be submitted whenever there is an audit.

There will be many withdrawals of this form from time to time. As an organisation, you must ensure you have all the proper records. The easiest way to maintain your cash vouchers is to maintain a journal entry of the office’s financial transactions via petty cash vouchers.