Receipt And Payment Account Format

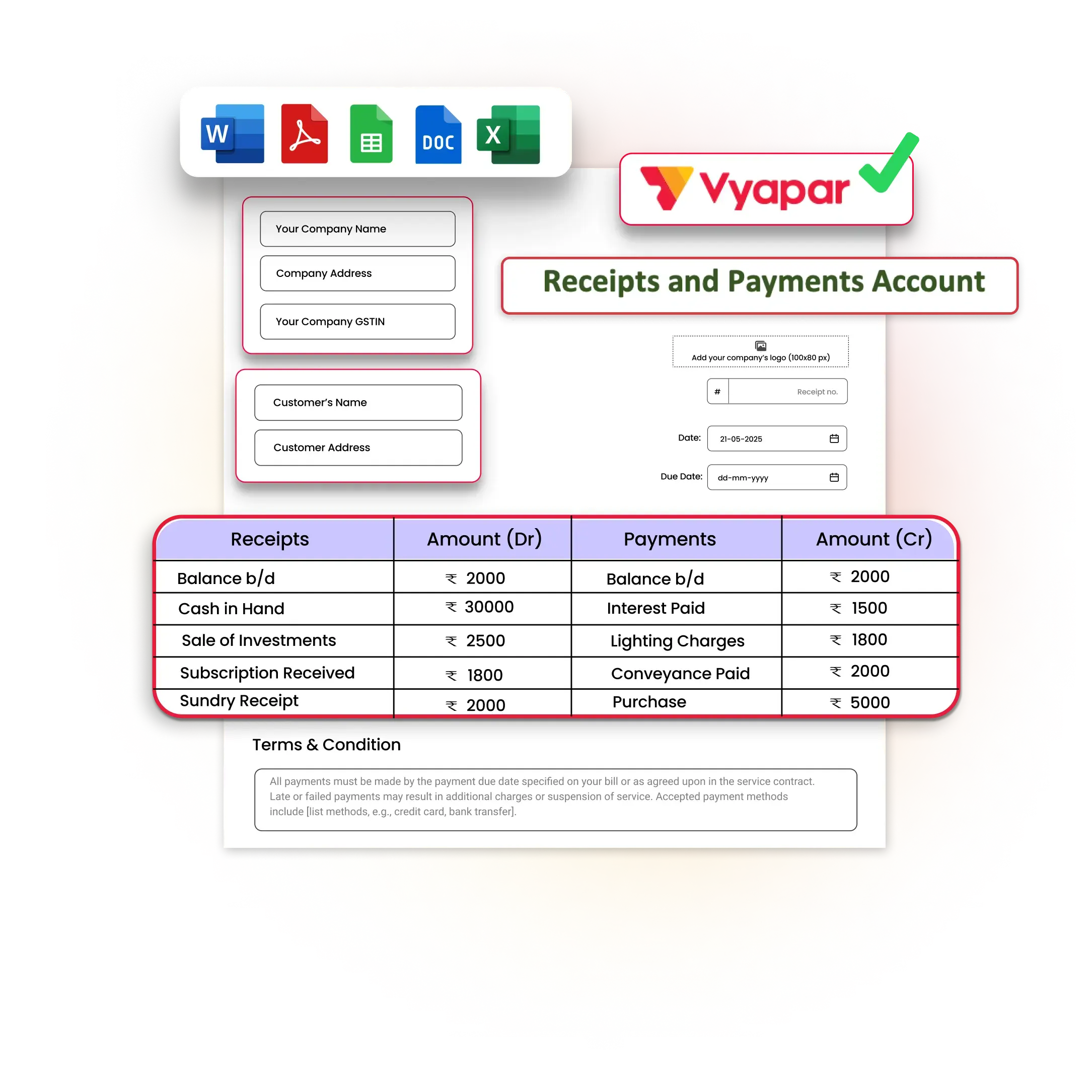

Looking for an easy way to track all your receipts and payments in one place? Download the ready-to-use Receipt and Payment Account Format by Vyapar. It’s perfect for small businesses, accountants, and freelancers who want to maintain clear records.

Free Receipt And Payment Account Format vs Vyapar App

Receipt And Payment Account Format

Billing Software

Price

Free

Free

200+ Professional Themes

Quick Billing

Unlimited Receipts

Auto Calculation

Error-Free Transactions

Data Backup

UPI Payments

Payment Reminders

Business Status Reports

Download Receipt And Payment Account Format in Excel, Word, and PDF

Use 100+ Receipts Template to Create Receipts. Try Vyapar for FREE!

What Is A Receipt And Payment Account?

A Receipt and Payment Account is a simple summary of all the cash transactions made by an organization during a specific accounting period. It shows where the money came from (receipts) and where it was spent (payments).

This account is mostly used by non-profit organizations, clubs, and societies that deal mainly in cash. Unlike profit and loss accounts, it doesn’t separate capital and revenue transactions — it includes all cash and bank entries, whether big or small.

It does not include non-cash transactions like depreciation. This makes it a straightforward way to track your actual cash flow.

Typical cash receipts can include:

- Membership fees

- Donations or grants

- Subscriptions

- Other income received in cash

And payments can include:

- Salaries

- Rent and utilities

- Office supplies

- Any cash-based expenses

With Vyapar, you can download a ready-to-use Receipt and Payment Account Format in Excel or PDF and manage all these entries with ease — no accounting degree needed!

Importance of Receipts and Payments Account

1. Tracks Real-Time Cash Flow

Offers a complete view of cash inflows and outflows. It helps businesses manage liquidity and make timely financial decisions.

2. Simplifies Financial Reporting

Compiles all receipts and payments in a single report, making it easier for small organisations to present their financials clearly.

3. Ensures Transparency

Every transaction is documented, improving transparency for audits, donors, and stakeholders—ideal for NGOs and trusts.

4. Helps with Budgeting

Analysing past receipts and payments helps you make informed budgets, control spending, and plan better for future financial needs.

5. Supports Reconciliation and Audit

Helps reconcile bank statements with internal records. This simplifies audits and ensures accuracy in financial reporting.

6. Aids in Compliance and Record-Keeping

Provides a reliable and structured financial history that supports compliance with statutory requirements and internal policies.

Main Features of a Receipt and Payment Account

The Receipt and Payment Account offers a clear, cash-based view of your organisation’s financial movements over a period. Here’s what makes it essential:

- Based on Cash Accounting

Unlike accrual-based methods, this account records transactions only when money is actually received or paid. That means no adjustments for outstanding payments or prepaid expenses—it’s all real-time cash flow. - Tracks All Cash Receipts

Whether it’s sales, donations, grants, or membership fees, this account gives a neat summary of every rupee coming in. Each source is listed clearly so you can see where your money is coming from. - Captures All Cash Payments

Expenses such as salaries, rent, electricity bills, office supplies, or loan repayments—everything that goes out is tracked. You’ll get a complete picture of your spending habits. - Shows Opening & Closing Balances

It begins with the cash and bank balance at the start of the period and ends with the closing balance. This helps reconcile your financial position and keeps your cash tracking tight. - Ignores Non-Cash Items

You won’t find capital receipts, depreciation, or outstanding bills here. This format is strictly for actual cash inflows and outflows—making it clean and straightforward. - Acts as a Cash Flow Control Tool

By reviewing income vs. expenses, organisations can spot patterns, manage liquidity, and plan better. It’s a great tool for small entities to stay financially aware.

Contents To Include In Professional Receipt And Payment Account Formats

Benefits Of Using Receipt And Payment Account Formats With Vyapar

So What are you waiting for?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

What is the Receipt and Payment Account Format?

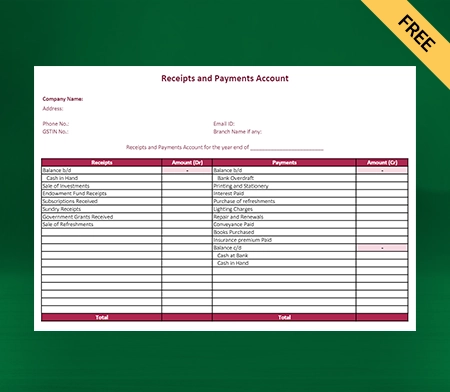

What is the Format of a Receipt and Payment Account?

Receipts Side (Left/Debit Side):

– Opening balance of cash and bank

– Cash received from various sources

– Bank receipts

– Any other sources of cash inflow

Payments Side (Right/Credit Side):

– Payments for various expenses

– Payments made through the bank

– Any other cash outflows

At the end, you calculate the totals of both sides. The difference is carried over as the closing balance.

What Details Are Included in the Receipt and Payment Account?

– Date of the transaction

– Particulars or descriptions (e.g., source of receipt, purpose of payment)

– The amount received or paid

– Mode of the transaction (cash or bank)

– Opening balance

– Closing balance

Is a Receipt and Payment Account Prepared for a Specific Period?

What is the Purpose of Preparing a Receipt and Payment Account?