Balance Sheet Maker App | Generator

Vyapar creates them in seconds, for free! Impress clients with professional balance sheets & get faster approvals. Share them easily!

⚡️ Eliminate errors with pre-defined formulas

⚡ Simplify calculations and save time

⚡️ Generate accurate balance sheets in minutes

Features of Vyapar Balance Sheet Maker App

Vyapar delivers you much more than a simple balance sheet app. You can add assets and liabilities for a business outlook and customize it to enter other valuable attributes like cash flow, working capital, income-generating assets, accounts receivables, and further inventory details. It allows you to track equity regularly, and all the available balance sheet templates come with pre-set formulas for determining accurate results.

Business Performance Dashboard

With your dashboard, you can quickly view your business performance by tracking sales, purchases, cash in hand, stock value, expenses, open checks, and loan amounts. The Vyapar app includes all the convenient features for your business requirements. The app enables you to access this data anywhere through live status tracking.

Inventory Control

One of the most challenging operations for every business is to manage inventory. Using the Vyapar accounting balance sheet maker app, you can keep track of the items, products, or equipment you need to sell your services. Doing this will avoid the threat of inventory shortages halting operations. Additionally, it will let you know about surplus inventory to avoid making unnecessary purchases. Along with this, Vyapar App’s inventory management software allows you to get alerts of upcoming expiry items and makes you take further action.

Easy Invoicing

You can simplify invoicing for your business by creating custom invoices. You can download and use multiple balance sheet formats and modify them to suit your business requirements. You only need to add the items, and your invoice will get generated with a few clicks. It will simplify the process and help you avoid mathematical errors in manual billing.

Sale/Purchase Orders

You can manage purchase and sale orders separately using the Vyapar App, as it provides a separate section for both. You can control the bills of your customers and suppliers efficiently and track the payments and make outstanding payments from the app itself.

Send Payment Reminders

The Vyapar app can generate automated reminders that you can send to customers directly through the app and remind them of delayed payments. You can get paid directly to your bank account through UPI, and thus, you can get paid faster and tackle outstanding payment issues.

Create Estimates and Quotes

If you have a potential client asking for a quotation, you can send a detailed estimate of the overall bill to promote your sales. You can give them accurate information and send them the total amount of the service and what you will deliver at that price.

Get the Free Balance Sheet Maker App. Try Vyapar for FREE!

What is a Balance Sheet Maker App?

The Balance Sheet Maker is a tool or app designed to assist individuals or businesses in creating balance sheets. It streamlines the process of compiling financial data and formatting it into a structured balance sheet, aiding in financial analysis and decision-making.

What is the Purpose of the Balance Sheet Maker App?

The purpose of the Balance Sheet Maker App or software is to simplify the process of creating balance sheets for businesses. It offers templates that streamline the compilation of financial data & allowing users to prepare accurate professional balance sheets easily. Vyapar’s easy to use accounting app enables businesses to assess their financial health, monitor assets and liabilities, and make informed decisions based on the presented financial information. Overall, Balance Sheet Maker software like Vyapar aims to enhance your financial management for all sizes of businesses.

How Does Vyapar’s Balance Sheet Maker Work?

Vyapar App for Balance Sheet Maker simplifies the process of creating comprehensive balance sheets for businesses. Users can access the app and input their financial data, including assets, liabilities, and equity. The app then automatically organizes this information into a structured format, generating a detailed with the best balance sheet software. With Vyapar’s intuitive interface and customizable features, users can tailor their balance sheets to suit their specific needs. Whether it’s tracking financial performance, assessing liquidity, or presenting financial statements to stakeholders, Vyapar’s Balance Sheet Maker free streamlines the entire process, saving time and ensuring accuracy in financial reporting.

Importance of Using a Balance Sheet Maker App

The importance of using a balance sheet maker app lies in its ability to streamline the process of creating accurate and detailed financial statements for businesses. When you compare Vyapar with other apps, it stands out by enabling you to efficiently organize financial data, track assets, liabilities, and equity, and generate detailed balance sheets that offer deeper insights into your business’s financial health and performance.. Additionally, a balance sheet maker app helps users adhere to accounting standards, maintain compliance, and make informed decisions based on real-time financial information. Overall, leveraging a balance sheet maker app can significantly enhance financial management practices and contribute to the success and growth of a business.

Efficiency:

A balance sheet maker app streamlines the process of creating financial statements, saving time and effort.

Organization:

Users can easily organize financial data, including assets, liabilities, and equity, in one place.

Accuracy:

The app ensures accuracy in financial reporting by automating calculations and reducing manual errors.

Insights:

Users gain valuable insights into their business’s financial health and performance through detailed balance sheets.

Decision-Making:

Access to real-time financial information enables informed decision-making and strategic planning.

Fast Growth:

You can secure your business accounts using the balance sheet software. It will help you make plans for the future by using previous data and giving you enough time to check other aspects of your business. You can expand your business and grow your brand.

Create your first invoice with our free Invoice Generator

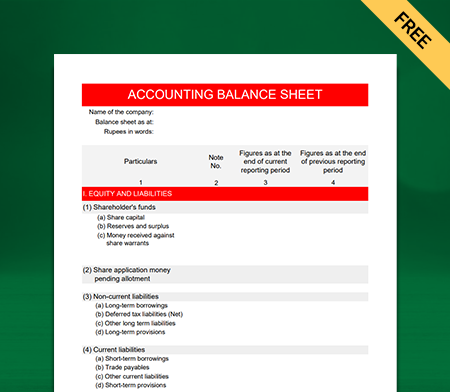

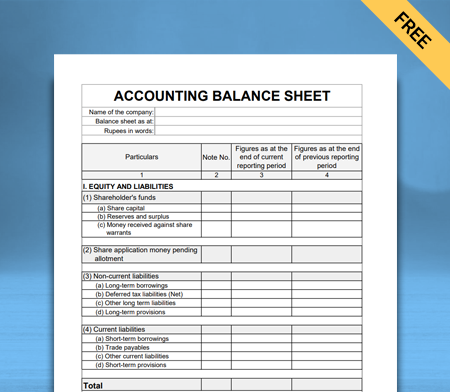

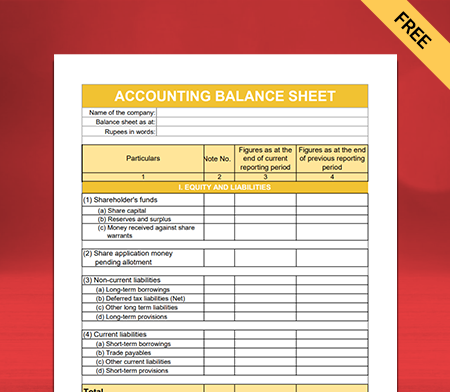

Free Professional Accounting Balance Sheet Formats

Download professional free accounting balance sheet formats, and make customization according to your requirements at zero cost.

Template – 1

Template – 2

Template – 3

Frequently Asked Questions (FAQs’)

Yes, the Vyapar free balance sheet maker app is user-friendly, with simple interfaces and step-by-step guidance to assist users in creating their balance sheets efficiently.

Vyapar’s free balance sheet app for Android, iOS, and Desktop is available to provide flexibility and accessibility to users.

The balance sheet maker app is important because it simplifies financial reporting, saves time, reduces errors, and provides valuable insights for decision-making.

Yes, using Vyapar on your Android smartphone and desktop, you can easily access real-time information about your company. Follow these steps to check your balance sheet: Open the Vyapar App on your Android/desktop computer, go to the Left Main Menu, then select Reports and choose Balance-sheet.

The app will create a backup of your previous year’s data on your device or Google Drive when closing the book. Restore that file to your Vyapar App to see your last year’s data.

Vyapar App automatically sends you a notification when a new update is released, clicking on which your app gets updated. You can also opt for the “check for updates” option in the app to do the same or download the latest version of the Vyapar App from www.vyaparapp.in. The newly downloaded file overrides the old version of the app.

The balance sheet format in accounting arranges assets on the left, followed by liabilities and equity on the right. Vyapar excels as a balance sheet maker app with its user-friendly design and robust features, making financial reporting easy and professional.