Assets and Liabilities Format in PDF, Excel

Vyapar automates error-free assets & liabilities. Get real-time insights in seconds.

⚡️ Eliminate errors with pre-defined formulas

⚡ Simplify calculations and save time

⚡️ Generate accurate balance sheets in minutes

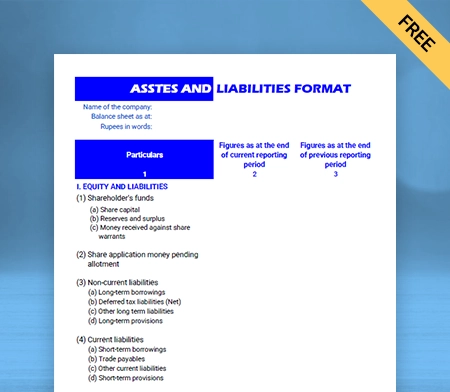

Download Free Assets and Liabilities Format

Download free Assets and Liabilities Format pdf, excel, and make customization according to your requirements at zero cost.

Customize Invoice

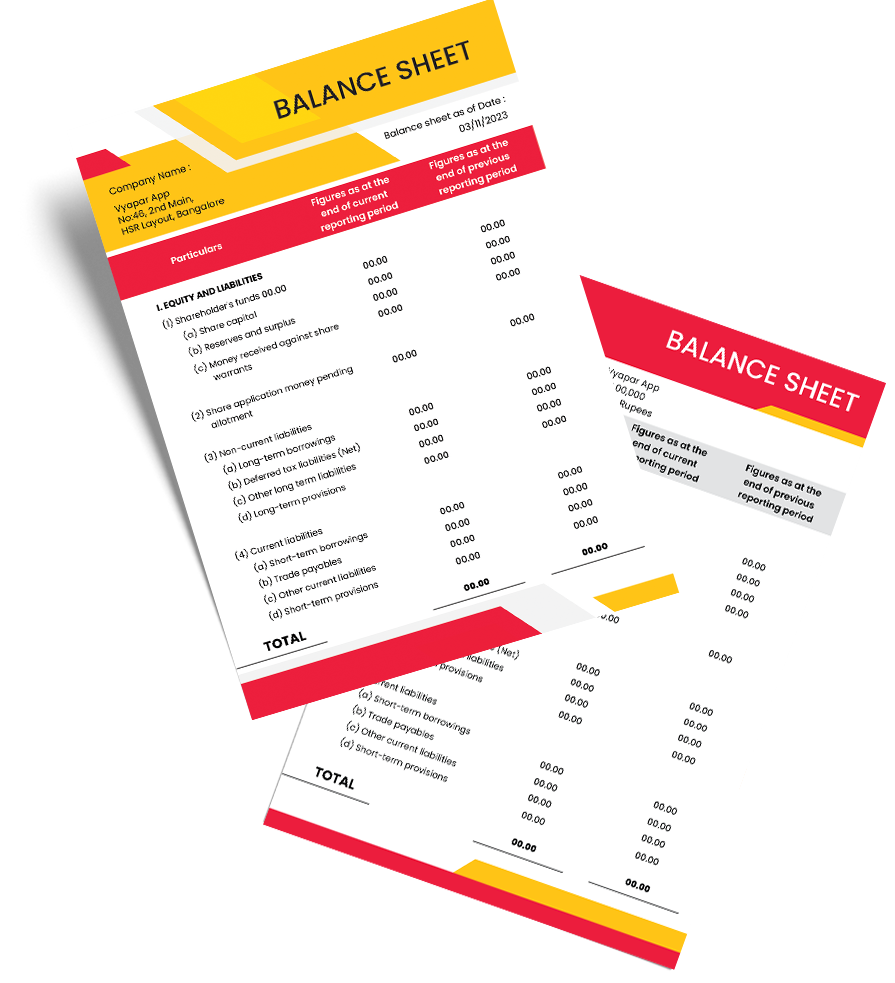

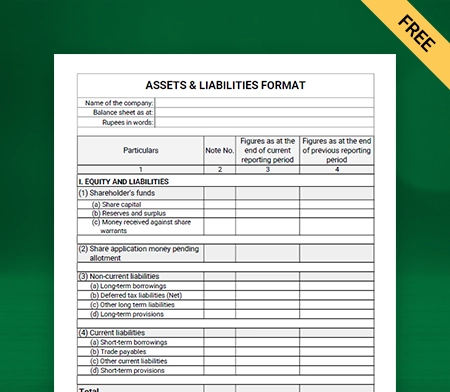

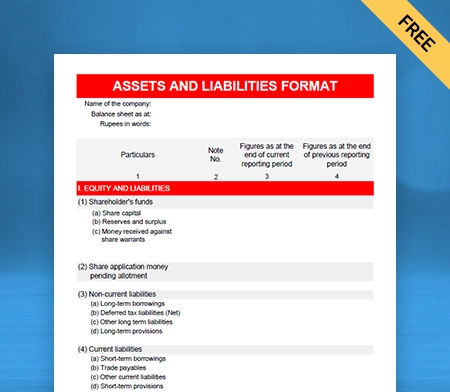

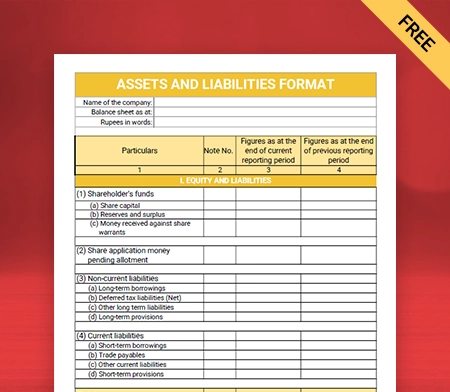

Assets and Liabilities Format – I

Assets and Liabilities Format – II

Assets and Liabilities Format – III

Assets and Liabilities Format – IV

Generate Invoice Online

Highlights of Balance Sheet Liabilities and Assets Formats

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal and grand total amounts

Consistently formatted

What are Assets and Liabilities?

An asset represents any resource owned/controlled by the business. It holds an economic value and is expected to give future benefits. Assets represent the value of ownership that you can convert into cash. However, cash itself is also an asset.

Every company has debts, which appear on the balance sheet as liabilities. Liabilities are things you owe or have borrowed. Liabilities are settled by transferring economic benefits over time. It can be in the form of cash, goods, or services.

Types of Assets

Tangible Assets

An asset with a finite monetary value and physical form is known as a tangible asset. Tangible assets have two categories: Current Assets and Fixed Assets.

Current Assets:

Current Assets are a company’s short-term assets and are also known as current accounts. They are sold, consumed, used, or exhausted through business operations Within one year.

Current assets include cash, cash equivalent, debtors, stock, and other liquid assets. Current accounts are essential to fund regular business activities.

Fixed Assets:

Fixed assets are long-lived, tangible property that a company cannot quickly convert into cash. They are also Non-Current Assets because they take a long time to liquidate. The company can use them to obtain credit and attract investors because they have long-term value.

Fixed assets are investments that show stakeholders that the company has growth potential. Further, they are of two types: Freehold and Leasehold Assets. Freehold assets are purchased with legal ownership and use rights. The owner uses leasehold assets without the legal right to do so for a set time.

Every company has debts, which appear on the balance sheet as liabilities. Liabilities are things you owe or have borrowed. Liabilities are settled by transferring economic benefits over time. It can be in the form of cash, goods, or services.

Intangible Assets

An intangible asset is not present in a physical form. Some examples include goodwill, brand recognition, and intellectual rights of property. They can be created or acquired by businesses.

Types of Liabilities:

Current Liabilities:

The company’s current liabilities are its short-term financial obligations. They must get settled in cash within the operating cycle of the company. Current liabilities have a life cycle of one year. Within that calendar year, the user can pay them with current assets.

Long-term Liabilities:

Long-term liabilities are based on the long-term financial obligations of a business. They are due over a calendar year and do not require immediate clearance.

Contingent Liabilities:

Contingent liabilities may or may not arise due to a particular event. Thus, contingent liabilities are potential liabilities.

How to prepare an assets and liabilities Balance Sheet?

Every balance sheet has three main components and follows the same equation: Assets = Liabilities + Shareholder’s equity. Here’s how you can prepare an assets and liabilities statement:

Determine the Reporting Date and Period:

The balance sheet depicts the company’s financial position on a specific date. The reporting date can be the end of a month, quarter, or year.

If a company can use the traditional calendar year of 12 months, the reporting date is December 31. Most companies prepare their financial statements as per the financial year. The reporting date, in that case, is March 31.

Public companies need to present their reports quarterly. When this is the case, the reporting date is usually the last day of the quarter. March 31, June 30, September 30, and December 31 are the end dates of each quarter.

Companies use the same reporting periods to compare the current financial performance and financial position with those of the previous years.

Identify Your Assets:

After you’ve decided on a date, the next step is to list your assets in separate line items. It would help if you separated the assets in the order of liquidity.

Liquid assets, such as cash and receivables, go first, followed by less liquid assets like inventory. This way, shareholders can understand the financial strength of the business.

After you’ve listed your current assets, you’ll need to include your long-term ones. Add all the assets once you categorize them. The final tallied amount will get termed as Total Assets. Ensure that all the data surrounding assets is correct.

Identify Your Liabilities:

You need to identify the liabilities and arrange them separately. Current liabilities are amounts you owe to creditors within the next twelve months. It includes accounts payable, short-term loans, and accrued liabilities.

Non-current liabilities are amounts that you will not pay within the year. It includes long-term loans, bonds payable, pension plans, and mortgages. Add both subtotals to find your total liabilities.

Calculate Shareholders’ Equity:

Next, you need to calculate Shareholder’s equity. You can do it by determining retained earnings and share capital. Retained earnings are profits set aside by a company for reinvestment. This amount can not get distributed as dividends.

If there is one owner, then the Shareholders’ equity is easy to calculate. The computation becomes complicated when public companies are involved.

Add “Total Liabilities” to “Total Shareholders’ Equity” and Compare it to Assets.

You must compare total assets to total liabilities plus equity to ensure that the balance sheet is balanced. If the balance sheet does not tally, there is most likely an issue with some of the accounting data.

You’ve performed the balance correctly if your liabilities + equity = assets. Check to ensure that all of your entries are correct and accurate. You may have missed or repeated assets, liabilities, or equity due to errors. Correct them.

Affidavit of Assets and Liabilities:

Assets and Liabilities must be disclosed in an affidavit by the parties before they claim maintenance.

I (your name), d/o or s/o (father’s name), aged about (your age) years, resident of (your resident), do hereby solemnly affirm and declare as under:

A) Personal Information

B) Details of Legal Proceedings and Maintenance being paid

C) Details of dependent family members

D) Medical details, if any, of the Deponent and dependent family members

E) Details of Children of the parties

You need to disclose all the details correctly.

Additional benefits of using the asset and liabilities management app by Vyapar:

Using an asset and liabilities manager app can help you in managing multiple business requirements. You can save time by keeping your accounting details in one place. Also, Vyapar lets you create personalized invoices with business logos, fonts, and themes.

Easy and Accurate Accounting:

You can generate financial reports, balance sheets and tables of accounts using the Vyapar app. Our accounting software creates accurate estimates and bills automatically.

You can download assets and liabilities statements as a PDF report. You can use the reports for tax filing and save money. There is no need to hire an accountant or auditor.

Multiple Payment Type:

The Vyapar app supports multiple payment methods so your customers can seamlessly send you payment. You can accept cash or bank payments using NEFT, IMPS, and RTGS.

It also allows the customer to scan a QR code from image and UPI ID on the invoice to make payment. You can have a POS device in your store to collect payment using a debit/credit card too.

Manage inventory:

The Vyapar app has a highly effective inventory management system that helps track the items. Inventory management is easy as the app displays the current status of customer transactions.

With this app, a single employee can manage the entire inventory. You can check the current status of your list at any time and set up alerts for new orders.

Helps in Decision making:

It is challenging to manage the business finances and everything else. The Vyapar app can generate detailed reports on your company’s assets and liabilities.

Users can always see a clear picture of costs and revenue. When you edit a deal or price, the data is automatically updated so you can take action and make informed decisions.

Automated Invoicing:

Our app’s multiple invoice themes enable you to create customized invoices. It makes you appear professional to your clients. You can obtain updated customer payment reports.

Also, receive payments directly to your bank account. It helps send automated payment reminders with a few clicks to your customers. So, you can manage payments and avoid dues.

Save time and ensure fast growth:

The Vyapar App can help you with a seamless accounting process. Any team member can use it and ensure no mistakes are made.

You can secure your business accounts using our accounting software. With the help of previous data, you can plan for the future. It will help you take the time to examine other aspects of your business.

Data backup and security:

Our free GST billing software in India allows you to set up automatic data backups. It helps secure the information stored in the app. It also facilitates quick access, file search, and retrieval.

You can also make a local backup for added security. Your data is synced and protected by advanced encryption in the Vyapar system.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Other useful features of the Vyapar asset and liability generator app:

Custom Invoicing and Billing

Using Vyapar, you can create estimates on the spot and add contact information, item details, and prices. Our app gives you complete control over how your templates look.

Invoices can be generated in 20 seconds, printed, and shared with clients via WhatsApp or email. You can use the barcode scanner and shortcut keys to speed up the billing process.

“Bill wise payment” is an important feature of the Vyapar App. It makes it simple to link payments to sales invoices. The free GST Mobile App allows multiple parties to manage each client separately easily.

This feature allows you to easily track all challan due dates and old challans at any time. The Vyapar App enables any business to identify any overdue payments quickly.

Recover Dues with reminders

Our accounting and billing software helps maintain cash flow and ensure timely payments. Using the app’s reminder feature, you can send repayment reminders to your customers. It will use WhatsApp and email to remind them of the total amount owed and the due date.

Reminders ensure that the customer does not forget to make a payment. Vyapar’s best billing software includes various payment options to help your customers pay on time. It accepts cash, credit cards, debit cards, e-wallets, NEFT, RTGS, UPI, QR codes, and other payment methods.

It ensures that your customers can pay using the way that is most convenient for them. With the payment reminder feature, many small and medium business owners reduced payment delays. You can create reports to adjust your business plans based on available cash flow.

Challan for Delivery

Vyapar’s “Delivery Invoice” serves as delivery confirmation. Users can create delivery challans and attach them to their consignment using the app. It ensures that your goods arrive safely at their destination.

The app makes it simple to track your shipment and provides instructions if it goes missing. This ultimate free GST invoicing software assists the consignor in efficiently managing the consignee details.

To ensure clarity, you can state the order’s terms and conditions ahead of time. It allows the business to run smoothly and ensures that consignments reach customers safely. Converting delivery invoices into bills is also a very efficient way to help adjust auto stock.

When the shipment arrives at the customer, you can convert your delivery challan into an invoice. All you need is to create it using Vyapar’s free billing app. It will allow you to receive payments in various ways, avoiding late fees.

Automatic data backup

The Vyapar app is entirely secure, and you can store your data accurately. Our free app allows you to create local, external, or online Google Drive backups to keep your data safe.

Furthermore, the software makes data recovery simple. For added security, the data is encrypted. If you use the offline version, you must enable the auto-backup feature to receive backups to your registered email address.

Vyapar’s “auto-backup” feature simplifies backups. When you enable this mode in the Vyapar app, a daily backup is created automatically. They provide backup options, including Local Drive, Google Drive, and email.

The app has an encryption system that ensures the data is only accessible to the owner. You can use the app to create customized data backups and help ensure the security of your data. Your data cannot be accessed by any third party or even our team.

Frequently Asked Questions (FAQs’)

The balance sheet shows the assets, liabilities, and Shareholder’s equity of the business in real-time.

The law mandates public officials or employees to declare all assets and liabilities formats.

A company’s assets are what it owns, and its liabilities are what it owes. Both are listed on a company’s balance sheet.

Assets are what a company owns, and liabilities are what it owes. Assets minus liabilities equal an owner’s equity.

Before claiming maintenance, all parties must file an Affidavit of Liabilities. If there is any misrepresentation, the wrongdoer will be held liable for contempt of court.

* Determine the Reporting Date.

* Identify Your Assets.

* Identify Your Liabilities.

* Calculate Shareholders’ Equity.

* Add Total Liabilities and Total Shareholders’ Equity.

* Tally both sides.

* Decide on the title of your affidavit.

* Put the person’s name and personal background information in the first paragraph.

* The opening sentence must be in the first person tense.

* Outline the information given or state the facts of the case.

Assets are what a company owns, while liabilities are what it owes.

The formula is: Assets = Liabilities + Owner’s Equity

For efficient management, try Vyapar. It’s accounting software that helps businesses track and manage assets and liabilities, making financial decisions easier.

To declare assets and liabilities, compile a list of everything the business owns (assets) and everything it owes (liabilities), then organize them according to their respective categories.

The balance sheet format separates assets and liabilities into two main sections. Assets are divided into current (cash, inventory) and non-current (property, equipment), while liabilities are categorized as current (accounts payable) and non-current (long-term loans).

To balance assets and liabilities on a balance sheet, ensure that the total assets equal the total liabilities and owner’s equity. This is achieved by organizing assets and liabilities into their respective categories and adjusting entries to maintain equilibrium.