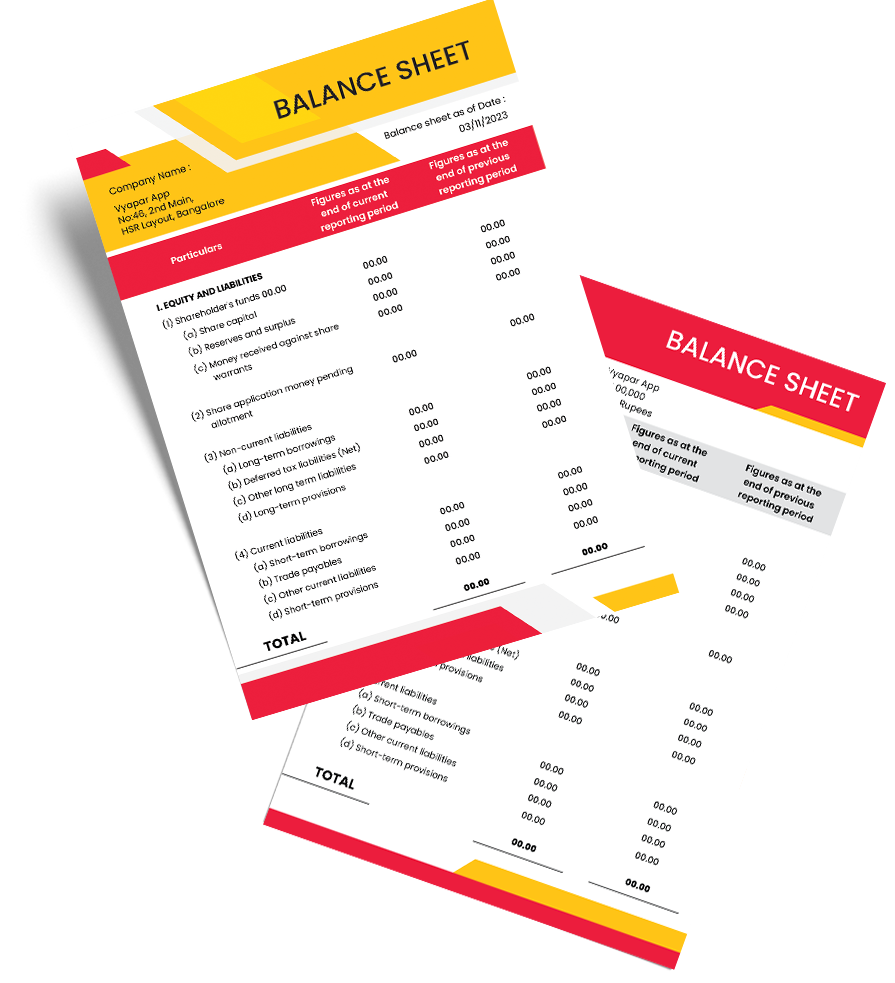

Balance Sheet Format in Final Accounts

Take control of your final accounts! Vyapar automates balance sheets & generates all the reports you need. Streamline workflows, collaborate & stay organized.

⚡️ Eliminate errors with pre-defined formulas

⚡ Simplify calculations and save time

⚡️ Generate accurate balance sheets in minutes

Highlights of Balance Sheet Assets and Liabilities Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal and grand total amounts

Consistently formatted

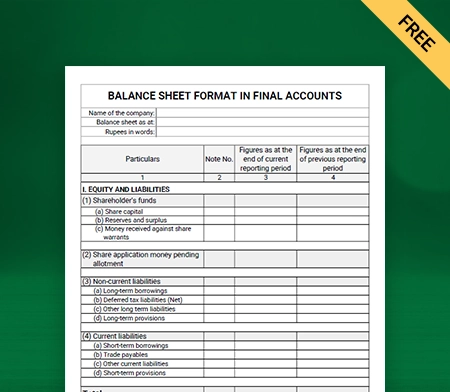

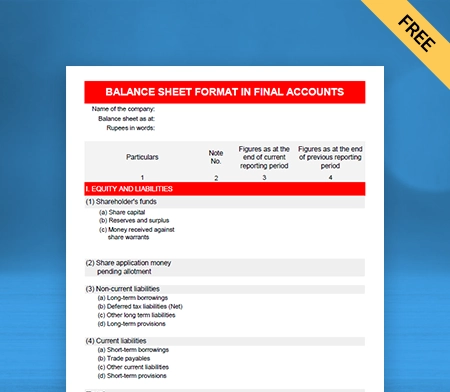

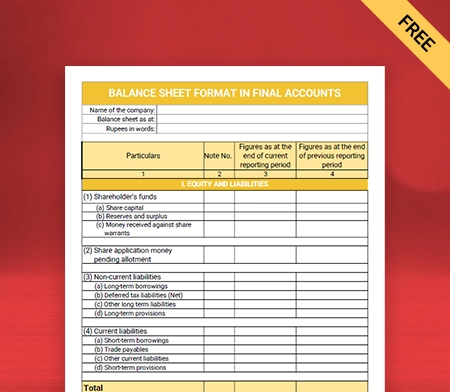

Download Free in Final Account Format

Download free final account Balance Sheet Formats, and make customization according to your requirements at zero cost.

Customize Invoice

Type I

Type II

Type III

Type IV

Generate Invoice Online

What is a Balance Sheet?

A balance sheet provides information regarding the financial position of a company. It provides the basic details of the assets and liabilities owned by a company. The balance sheet is one of the three fundamental financial statements.

It shows the financial stability of a business at the end of an accounting period. A balance sheet depicts a fair picture of the financial position of any business. It showcases a company’s total assets, liabilities, and shareholders’ equity.

A balance sheet is a statement that shows the Application of Funds. It is like an income statement that depicts the Sources of Funds. Thus, a balance sheet is a financial statement that shows a company’s assets, liabilities, and shareholders’ equity. It is done at a specific point in time.

What is the Significance of a Balance Sheet?

The balance sheet of a company helps in the analysis of its financial stability and health. It provides the financial position of a business in a given period of time. It is usually done at the end of a financial year.

The following points mentioned below highlight the significance of a balance sheet:-

- A balance sheet is crucial for a business as it shows its financial position.

- Comparing of balance sheet year-to-year shows the growth of the company.

- The bank requires an essential tool when applying for a business loan.

- The balance sheet enables the owners to decide the organisation’s expansion.

- A balance sheet is significant as it identifies the application of funds present in the business.

- It helps stakeholders to understand the liquidity position and business performance and growth.

- A balance sheet helps view the business’s ability to tackle unforeseen expenses.

- A balance sheet also helps in identifying the source of funds.

Why Do You Need a Balance Sheet?

A balance sheet is an essential fundamental financial statement. It provides detailed insights to both internal as well as external stakeholders.

It helps a company in making important financial decisions. You make good decisions when you know your business’s financial position on a specific date.

It allows the banks to understand how financially stable you are to avail loans. It also helps in identifying the latest trends in the listed items.

The working capital is also identified as it determines the financial position. Thus, it is a need to maintain a balance sheet.

How Do You Prepare a Balance Sheet?

The balance sheet showcases the assets, liabilities, and shareholder’s equity on a particular date. It is essential to prepare a balance sheet as it shows a company’s financial position.

The steps mentioned below determine how to prepare a balance sheet:

- You need to determine the frequency of preparing the balance sheet. It is usually done on an annual basis.

- Next, you need to identify the assets and liabilities of your company.

- Estimate the identified assets and liabilities.

- Determine and calculate the shareholder’s equity.

- List out the liabilities and owner’s equity on the left-hand side. Record the assets on the right-hand side of the T-account.

- Thus, the assets will equal the liabilities and owner’s equity.

It is how a balance sheet is prepared in the final accounts by using the Vyapar App.

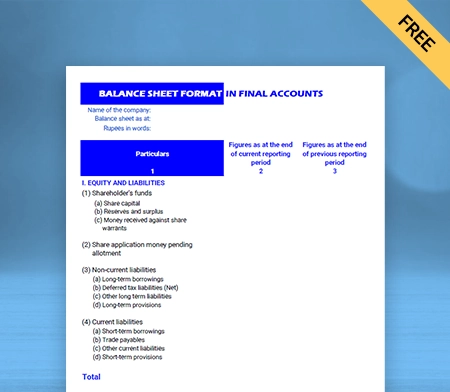

What Are The Components of a Balance Sheet?

A balance sheet provides detailed insights regarding the financial position of the company. They do this by correctly listing all the items in their respective accounts of the final account.

The three components of a balance sheet in final accounts are:-

- Assets

- Liabilities

- Owner’s Equity

Each of the components gets further subdivided into specific categories. Let’s discuss and understand each one of the components.

Assets:

Assets are the resources owned by your business that provides benefits in the long run. Assets are classified into current assets and fixed assets.

Current assets are the assets that can be easily converted into cash within a year. It includes inventories, cash, accounts receivables, marketable securities, and prepaid expenses.

Fixed assets are assets that cannot be easily converted into cash in the ordinary course of business. These assets are long-term assets, also known as non-current assets.

Fixed assets are further subdivided into tangible and intangible non-current assets. Tangible non-current assets include plant and machinery, long-term investments, etc. Intangible non-current assets include goodwill, patents, copyrights, etc.

Liabilities:

Liabilities refer to the money a company owes to its creditors and lenders. Liabilities are classified into current liabilities and non-current liabilities.

Current liabilities are the liabilities needed to get paid off within the ordinary course of business. It should get paid off in the normal course of business or within one year, whichever is longer. It includes accrued expenses, deferred revenues, accounts payable, etc.

Non-current liabilities are the liabilities that are due for payment for more than a year. It includes the long-term provision, long-term liabilities, deferred tax payments, etc.

Owner’s Equity:

It is also known as capital. Owner’s equity is the amount invested by the owner in the business.

Owner’s Equity = Paid-In Capital + Retained Earnings

The increase in business earnings will also increase the owner’s equity.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

What is the Role of Balance Sheet in Financial Statements?

The Financial Accounting Standards Board (FASB) has formulated widely accepted standards for companies to report accounting information. These rules are called Generally Accepted Accounting Principles (GAAP). Business entities use it to prepare and report accounting information.

According to GAAP, every business entity is required to prepare a balance sheet. It should be designed at the end of an accounting period. A balance sheet provides detailed information regarding the financial health and position of the business.

Thus, a balance sheet gives an unbiased view of the company’s financial position. It is the role of the balance sheet in financial statements.

How to create a balance sheet format in final accounts using Vyapar?

Follow the given steps to create a balance sheet format using the Vyapar App:-

- Firstly, download the Vyapar App

- Open the Vyapar App and complete the required login process

- Now fill out all the necessary details regarding your company

- Once the login process is done, then go to “Reports” from the top left menu option

- Once you open reports, check for “Balance Sheet” in the transaction section

- Now, when you click on the “Balance Sheet” option, you get an option to generate a balance sheet seamlessly.

- The balance sheet is generated from the “from and to date” on the top.

- This date can be changed according to your requirements.

Using the above method, you can generate a balance sheet using the balance sheet maker app by Vyapar.

Benefits of Using Vyapar for Balance Sheet Requirements

Provides Both Online and Offline Software:

Using the best balance sheet maker app gives you absolute freedom to run your business operations offline and online.

You need not stop working when you have low network connectivity. In such situations, all you need to do is use the Vyapar software. Use the balance sheet format in the Vyapar app to create and generate the balance sheet format.

Further, you can also analyse the financial position of your business with the help of the generated balance sheet.

Optimise Time Management:

When performing the manual process, you have to spend a ton of time. It is to ensure everything is done right. However, business accounting software like Vyapar app avoids mismanagement of time.

The software does all the calculations instantly and gets the estimates in real time. It records all the items correctly on the assets and liabilities side and ensures no mistakes happen. Hence, the billing and accounting software saves a lot of time for its users.

Eliminates Human Errors:

Humans tend to make errors while recording accounting information, but a computer does not. A mistake can cause a lot of damage. So, choosing and generating the correct balance sheet format is necessary. Vyapar app ensures that all the trial balance items are recorded correctly.

The items should be recorded in the respective accounts, and the amounts should be entered without errors. Errors are fatal, and so the Vyapar app ensures that it provides a user-friendly interface.

Efficient Analysis of financial issues:

The Vyapar app generates your company’s balance sheet with the help of its software. It ensures that the generated balance sheet is correct with no mistakes.

Thus, the balance sheet generated helps its users in the efficient analysis of the financial position of their business. It helps them understand the business’s financial stability and growth aspect.

Additional Valuable Features of the Vyapar App

Tracks Your Business Activities

Keeping track of your business activities is necessary. It is also essential to manage your business activities efficiently. The Vyapar App ensures that you track all your business activities.

It includes payment updates, cash flow statements, bank accounts, inventory management, and order status. The Vyapar App helps you to list your expenses and income separately. The dashboard section on the app ensures that your process of keeping track of business activities is run smoothly.

Generates Financial Reports

You can generate the financial reports of your business. You can create a balance sheet in various formats. They are mentioned below:-

- PDF Format

- MS Word Format

- MS Excel Format

- Google Sheets Format

- Google Docs Format

The balance sheet generated helps you analyse your business’s financial health. It allows you to evaluate your growth reach along with your liquidity position.

The software analyses all sorts of business reports and financial statements. It is an effective way to look into the financial information of the business entity.

GST Billing/Invoicing

The Vyapar billing software allows you to create GST bills. These bills comply with India’s GST laws. Having a professional invoice depicts the identity of your business entity. Vyapar generates GST invoices in 20 seconds and prints them.

Sharing the invoices with your clients is an easy process in the Vyapar App. The automatic software for your billing requirements makes it a smooth process.

The barcode scanner speeds up the billing process, which saves a lot of time. Other shortcut keys enable its users to complete the billing process faster.

Send Quotations

The Vyapar App allows you to generate quotations and estimates and send them to customers. The quotes can be printed out and sent to customers, or they can be sent via SMS, email, or WhatsApp.

You can include the raw material and finished goods separately and make the estimates and quotations error-free. The advanced software helps you manage your business with accurate quotes and estimates.

keep track of Bank Accounts

The Vyapar App allows you to track and manage payments easily. The user interface software quickly transfers data into the billing software of the app.

To use the bank accounts feature in the app, you must link your business account with the bank. It allows you to send and receive money. It helps you deposit and withdraw funds from your bank quickly.

Data Security

The software of the Vyapar app is 100% safe and secure. It protects the privacy of its users. The free GST billing software in India also ensures that automatic data backups are enabled. All of it is done in the interest of its users.

You can also enable a local backup for your data for more precautions and security. The secured database facilitates its users with quick data retrieval and file research.

Vyapar does not share the factual data of its users with anyone. Your data is secured by advanced encryption software. The financial stability of your company that is generated from the balance sheet remains confidential.

Frequently Asked Questions (FAQs’)

A final account which includes a balance sheet, is calculated by the following steps:-

* List the items of the trial balance along with their adjustments in the trading account.

* Calculate the gross profit or gross loss from a trading account.

* Record the debit items on the expense side of the P&L account.

* Record the credit items on the income side of the trading P&L account.

* Calculate the net profit or net loss from the profit and loss account.

* Record all the debit items on the asset side of the balance sheet.

* Record all the credit items on the liabilities side of the balance sheet.

* Add net profit or loss obtained to the capital on the liabilities side of the balance sheet.

* Make a total of the balance sheet, where assets will be equal to liabilities.

That’s how you do the final account and balance sheet.

Preparation of the final account is the last stage in the accounting cycle. The final account includes a trading account, profit and loss account, and balance sheet. Thus, a balance sheet is a part of the final accounts and not the final account itself.

A final account is prepared by a joint-stock company at the end of a fiscal year. It depicts a clear picture of the financial position of a company. This is useful for the owners, management, and other users of such accounting information.

Another name for the final account is three accounts. The three accounts include trading accounts, profit and loss accounts, and balance sheets.

A final account is an account that is prepared at the final stage in the accounting cycle. It depicts the profit or loss and the financial position of the business entity. A few examples of a final account include a trading account and a balance sheet.

In final accounts, the balance sheet account summarizes a company’s financial position by listing its assets, liabilities, and owner’s equity at a specific point in time. Vyapar simplifies this process with its intuitive accounting tools, aiding businesses in generating accurate and insightful balance sheets effortlessly.

The final account format includes the Income Statement, showing revenues and expenses, and the Balance Sheet, detailing assets, liabilities, and owner’s equity.

To make a final balance sheet, list all assets, liabilities, and owner’s equity, categorize them, calculate totals, and ensure assets equal liabilities plus owner’s equity. Present the information in the standard balance sheet format.