NPO Balance Sheet Format

Manage NPO finances collaboratively. Vyapar automates tasks, tracks progress & lets your team work together seamlessly. Download App for Desktop & ditch error-prone formats!

⚡️ Eliminate errors with pre-defined formulas

⚡ Simplify calculations and save time

⚡️ Generate accurate balance sheets in minutes

Download Free NPO Balance Sheet Format

Download free NPO Balance Sheet Formats, and make customization according to your requirements at zero cost.

Customize Invoices

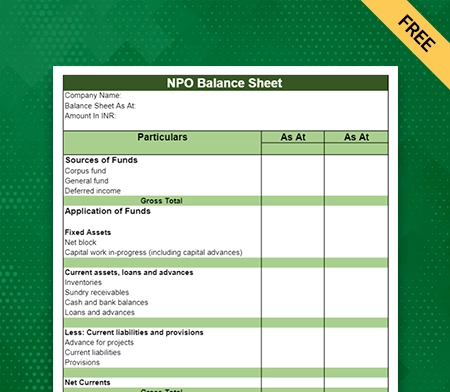

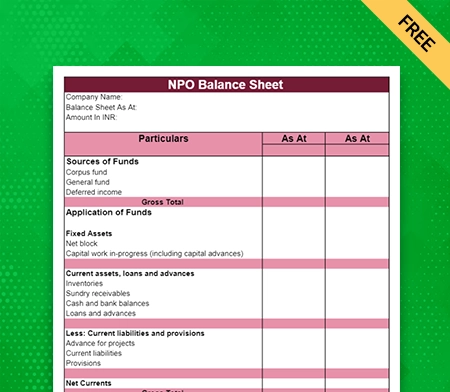

NPO Balance Sheet Format Type I

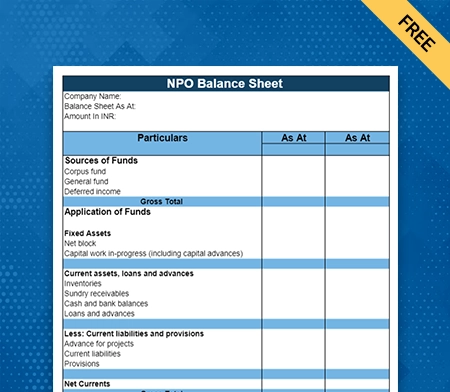

NPO Balance Sheet Format Type II

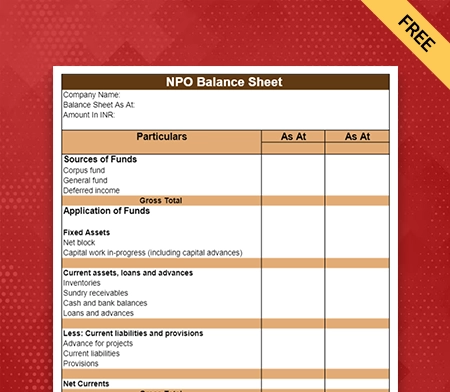

NPO Balance Sheet Format Type III

NPO Balance Sheet Format Type IV

Generate Invoice Online

What is the NPO Balance Sheet Format?

The NPO balance sheet format is a financial statement that shows how well a non-profit group is performing financially. It usually has three parts: assets, bills, and net assets, also called equity. The asset side of the NPO balance sheet usually has investments, total money, and property of the organisation. On the other hand, Debts with responsibilities are listed in the liabilities section.

In the net asset section, the difference between “assets a liabilities” is shown. This difference shows the organisation’s financial situation or “equity” and makes it easier to understand total liabilities at any given point. Non-profit groups use this format to figure out how stable they are financially and what resources they have.

Components Of NPO Balance Sheet Format

Here are the following components of the Non Profit Organisation Balance Sheet Format:

1: Cash And Cash Equivalents

Cash and cash equivalents are the fundamental components of the NPO balance sheet format. This category includes the organisation’s readily available cash, such as capital funds in bank accounts, outstanding balances, and any short-term investments that can be easily converted into cash.

Cash and cash equivalents play a crucial role in an organisation’s liquidity and meeting with the organisation’s short-term financial obligations. It indicates the financial stability of the organisation as well as the resources available for day-to-day operations or emergency needs.

2: Investment And Endowments

Investments and endowments are another critical component of the NPO balance sheet format. Non-profits commonly hold long-term investments such as stocks, bonds, and other financial instruments to generate money and maintain their activities. These investments are often managed to preserve money while providing profits.

Furthermore, non-profits may have funds set aside specifically as endowments, which are invested to provide a constant stream of revenue for the organisation’s long-term sustainability. Investments and endowments are financial assets held by the NPO that contribute to its financial stability and future growth.

3: Property And Equipment

Property and equipment are a vital part of the format of balance sheet of non profit organisation. Most non-profits accommodate land, buildings, cars, machinery, and other fixed assets. The organisation put a lot of money into buying these real assets.

Property and equipment are critical to the NPO’s ability to do its work and support its goal. They are typically listed on the balance sheet at their historical cost or fair market value. They may be subject to depreciation or impairment, which shows the organisation’s physical resources.

4: Accounts Payable

Accounts payable is another crucial part of the NPO balance sheet format; it shows how much NPO owes but has yet to pay. Some of these unpaid total liabilities are invoices, bills, or expenses due to suppliers, vendors, and creditors.

Accounts payable shows the organisation’s short-term financial responsibilities and how well it can meet them. Non-profits must manage their accounts payable well to maintain good relationships with their partners, run smoothly, and adhere to payment terms and deadlines.

5: Loans And Debts

When an organisation has taken money for different reasons, its outstanding loans and debts are mentioned in its balance sheet. NPOs can receive money through long-term loans, lines of credit, or other ways to help with growth or program funding.

This part shows how much the organisation owes to lenders or financial institutions and how much it must repay. The NPO needs to keep track of and handle these loans and debts to plan its finances well, manage its cash flow, and meet its repayment terms and obligations. It helps the NPO’s finances stay stable and strong.

6: Accrued Expenses

Accrued Expenses refer to the amount the organisation owes for services or products they have received but still need to be invoiced or paid. Non-profit organisations may also accommodate the incurred expenses such as professional services, salaries and utilities over an accounting period.

On the balance statement, accrued expenses are a liability for the organisation’s outstanding expenses. It gives an Accurate position of the organisation. It offers financial representation through reporting and presentation of the organisation’s financial position that requires accrued expenses to be properly recorded and recognised.

7: Unrestricted Net Assets

The NPO balance sheet format relies heavily on unrestricted net assets. They reflect the portion of an organisation’s net assets that donors do not restrict. This donation can be utilised for general operations, programs, or other operational needs at the discretion of the NPO’s administration.

Unrestricted net assets indicate the organisation’s financial flexibility and resources, allowing it to respond to changing requirements, invest in strategic initiatives, and preserve financial stability. They measure the organisation’s overall financial health and ability to pursue its mission effectively.

8: Restricted Net Assets

Restricted net assets comprise a sizable portion of the NPO balance sheet format. These funds are donations or grants with certain constraints on their use. NPOs must allocate and use these assets with the purposes or time frames indicated by the donors or granting organisations.

Restricted net assets are further classified into two types: temporarily restricted net assets with restrictions that will soon expire and permanently restricted net assets with limitations that must be held for eternity. These components emphasise the organisation’s fiduciary responsibility and dedication to upholding donors’ wishes.

Benefits Of Using The NPO Balance Sheet Format

Here are the following benefits of using the NPO balance sheet format:

1: Provides Transparency

The NPO balance sheet format encourages transparency by giving a clear and concise overview of an organisation’s finances. It makes it easy for donors, board members, and the public to understand the organisation’s total liabilities and net assets.

This transparency builds trust and confidence among donors about your organisation, making decisions based on facts easier and encouraging accountability. By putting financial information in a standard format, the NPO balance sheet makes communicating easier and helps people understand how healthy and stable the non-profit’s finances are.

2: Helps With Compliance

Non-profits must follow specific rules for reports that come from laws and rules. The Non Profit Organisation Balance Sheet Format is critical to meeting these standards, like following the Generally Accepted Accounting Principles (GAAP) for non-profits.

By following the rules and using the NPO balance sheet format, groups can show their financial information is correct. It makes the organisation’s financial reports more transparent, accountable, and reliable, which helps it meet its legal obligations and follow the rules.

3: Accurate Financial Assessment

The NPO balance sheet format is helpful in assessing non-profit organisations’ financial health and stability. It provides a clear overview of the organisation’s assets, liabilities, and net assets at a particular accounting period. This data allows stakeholders to evaluate the organisation’s financial health, liquidity, and long-term viability.

By comprehending the composition of assets and liabilities, income and expenditure accounts, decision-makers can make informed decisions regarding resource allocation, fundraising efforts, and financial planning. The NPO balance sheet format of a non-profit organisation facilitates improved financial decision-making by providing a clear and accurate depiction of financial standing through financial reports.

4: Long-Term Planning

The NPO balance sheet format is a key part of planning and budgeting for non-profit organisations in the long run. It gives useful knowledge about the organisation’s assets and liabilities, which are its financial resources. By looking at the balance sheet, charities can figure out where they stand financially, see their resources, and plan for future projects or initiatives.

It allows them to see where there might be gaps in funds and take steps to get the money they need. The format of the balance sheet is the basis for strategic financial planning. It ensures that charities can use their resources well and reach their long-term goals.

5: Helps With Financial Accountability

The Non Profit Organisation Balance Sheet Format enables non-profits to demonstrate their financial responsibility to stakeholders. The balance sheet demonstrates its responsible resource management by providing a comprehensive overview of the organisation’s assets, liabilities, and net assets.

This transparency fosters trust and confidence among stakeholders, including donors, board members, and the general public, as it demonstrates the non-profit’s dedication to effectively achieving its mission. The balance sheet format of a non-profit organisation functions as a tangible demonstration of financial stewardship, bolstering its credibility and commitment to achieving its goals and objectives.

6: Provides Better Comparability

The NPO balance sheet format gives non-profit groups a standard way to report their finances, making it easy to compare financial information. By looking at the balance sheets of different charities, stakeholders can compare and judge how well they are doing financially, how they are set up, and how efficient they are.

This comparison helps determine how well resources are being used, how stable the finances are, and how healthy the company is. It allows stakeholders to make well-informed choices, find best practices, and learn from successful financial management strategies used by similar organisations. It encourages the non-profit sector to keep getting better and growing.

7: Helps In Fund Tracking

Non-profits manage several funds or restricted resources, and the NPO balance sheet format makes it easier to maintain and report on these funds separately. Non-profits may properly identify and communicate financial information about each fund using this format.

The NPO balance sheet format fosters accountability by allowing organisations to demonstrate responsible management to stakeholders and regulatory authorities by offering transparent visibility into the financial state and utilisation of various finances. It improves their ability to manage and allocate resources effectively, ensuring that assets are used in compliance with donor wishes and legal obligations.

8: Provides Board Oversight

Non-profit boards can use the NPO balance sheet format to acquire a clear and simple knowledge of the organisation’s financial status. The format allows the board to monitor the organisation’s financial health by presenting critical financial information such as assets, liabilities, and net assets systematically.

It promotes informed decision-making by giving the data required to assess financial stability, resource allocation, and budgeting. The framework also assists the board in exerting effective monitoring and guaranteeing the financial viability and accountability of the organisation.

Steps To Choose The Best Software To Create NPO Balance Sheet Format

Here are the following steps to choose the best billing software for your Non-profit organisation to create the professional looking balance sheet format:

Step 1: Identify Needs And Priorities

It is essential to evaluate the demands and requirements of your non-profit organisation before selecting the appropriate software. Identify areas where software could improve efficiency and productivity, such as fundraising, donor administration, volunteer coordination, and programme tracking.

Prioritise features and functionalities that correlate with the objectives and workflows of your organisation, such as robust reporting, system integration, automation capabilities, and user-friendly interfaces. By identifying your organisation’s specific requirements and focusing on key areas for improvement, you can better grasp your requirements.

Step 2: Evaluate Feature And Integration

When choosing free inventory management software to create an NPO balance sheet format, it’s essential to look at the functions and how well they can work together. Look for tools that make it easy to enter and organise financial data, determine your assets and debts, and make accurate balance sheets.

Integration with accounting or financial management systems already in place can speed up data sharing and make sure that everything is the same. Also, ensure the file types are compatible to make sharing and working together easy. By looking at these things, you can ensure that the software gives you the tools you need to create and manage NPO balance sheets effectively and efficiently.

Step 3: Define Budget And Resources

When choosing software to make a balance sheet for an NPO, it’s important to consider your organisation’s funds and resources. Check the price of the program, including licensing, subscription, and any possible customisation fees, to ensure it fits your budget.

Also, determine if your organisation has the technical tools and skills to handle software installation and ongoing management. By matching the tools you choose to your budget and resources, you can ensure you have a long-lasting and effective way to make NPO balance sheets.

Step 4: Request For Free Demos Or Trial

It is essential to request demonstrations or trials from potential vendors before deciding on the NPO balance sheet creation software for your non-profit organisation. Request hands-on experience with the software, concentrating on balance sheet creation-related features. Evaluate how the software handles asset and liability tracking duties and membership fee management.

This trial period permits you to evaluate the software’s usability, functionality, and compatibility with the requirements of your organisation. It is an opportunity to ensure that the selected software accurately manages membership fees and generates comprehensive balance sheets for non-profit organisations.

Feature Of Vyapar App That Makes It Best To Create NPO Balance Sheets

Provides 7 days Free Trial:

Vyapar’s accounting software for the non-profit organisation allows businesses to use NPOs for free for 7 days before deciding to buy them. You can thoroughly review its features and functions and see if it suits your non-profit organisation. During these 7 days, you don’t have to pay monthly fees for using our premium tool.

Non-profit organisations do not have to pay anything to use Vyapar on Android phones. You can do a lot of tasks in Vyapar, which makes your accounting more correct and efficient and helps to save a significant amount of money. One crore small companies use Vyapar because it is highly efficient and easy for their users.

If you want to use Vyapar software for a non-profit organisation’s Windows computer, you have to pay a small subscription fee after 7 days. After the end of the trial period, you can go for a full-time subscription to our best online accounting software. It is value-for-money accounting software for the non-profit organisation.

Cash And Bank Management:

Vyapar is a comprehensive solution for non-profit organisations for cash and bank management. With Vyapar, you can easily manage cash-to-bank and bank-to-cash transfers, enabling a swift transfer of funds between your cash register and bank accounts. Additionally, the platform simplifies inter-account transactions by enabling bank-to-bank funds transfers for your donors.

Moreover, Vyapar enables the modification of cash and bank balances, thereby facilitating the accurate monitoring and reconciliation of your financial records. Vyapar streamlines cheque administration by facilitating the recording and tracking of cheque transactions. You can efficiently manage deposits and withdrawals and verify the clearing status within the system.

In addition, the platform simplifies loan account management by providing tools for documenting loan information, monitoring payments, and generating loan statements for streamlined financial tracking. Vyapar offers businesses comprehensive cash and bank administration capabilities, an intuitive interface, and a variety of features that optimise financial operations.

Enable Multiple Payment Options:

Using our advanced payment tool, you can offer various online and online modes of payment to your non-profit organisation donors. Vyapar is a highly efficient tool for managing the cash flow in your non-profit organisation. You can receive your donation on Vyapar and offer receipt and payment account information through SMS, WhatsApp and Gmail.

If you are running your non-profit organisation from remote areas, you may frequently face network and internet connectivity issues; using Vyapar, you can easily receive your donation through offline payment options such as cash, cheque and QR to continue your philanthropic work. Vyapar is also an offline and online software that allows you leverage to run your NPO from anywhere across India.

You can also receive your donation through Vyapar online mode of transaction into your organisation’s bank account such as net banking, IMPS/RTGS/E-Wallet, credit and debit card etc. By using Vyapar, you can have a real-time view of opening and closing balances through our Vyapar business dashboard.

Choose Theme For NPO Balance Sheet Format:

Maintaining a professional NPO balance sheet for your non-profit organisation and sharing it with your clients can positively impact your organisation. The accounting App includes two thermal printer invoice templates. In addition, there are twelve invoice and balance sheet templates for standard printers.

This accounting software can rapidly enhance your NPO balance sheet appearance. You can prepare your non-profit organisation balance sheet for your donors precisely and as your preferred details. Generated business balance sheets are more likely to impress a prospect.

Vyapar Accounting App is optimal for managing your organisation’s cash flow. Performing various functions, such as maintaining assets and liabilities with our business overview dashboards, is straightforward. Choose the most appropriate balance sheet for your non-profit organisation’s needs. It is an ideal method for constructing a favourable image among your stakeholders, board members and donors.

Create Multiple Reports For Non-Profit Organisations:

Vyapar accounting software provides a variety of transaction reports to facilitate financial management. The “Day Book” comprehensively records all transactions during a specified time frame. The “Sales Aging Report” outlines unpaid sales invoices, thereby facilitating the monitoring of customer payments.

The Balance Sheet generally refers to the financial position of a company, highlighting its assets, liabilities side, and equity over a financial period. The Profit and Loss statement details revenues, prepaid expenses, and net profit or loss. The Expenses report categorises expenditures to facilitate cost analysis.

Lastly, the Tax Report facilitates tax compliance by summarising taxable transactions. With Vyapar, businesses can efficiently access and use these reports for making informed decisions and preserving financial transparency. You can also create your reports in various formats such as docs, PDF, Excel and Word.

Frequently Asked Questions (FAQs’)

No balance sheet format is the way that financial information for non-profit groups is organised and shown. It usually has three main parts: the assets, the liabilities, and the net assets. The net assets part breaks down further into funds that are not restricted, temporarily restricted, and permanently restricted. It gives a full picture of an NPO’s financial resources and obligations.

The NPO balance sheet format is meant to give a clear and concise picture of the organisation’s finances. It helps people interested in the group, like donors, board members, and regulators, figure out its assets, liabilities, and net assets. The balance sheet helps people make good decisions, shows who is responsible for the money, and helps figure out if a group can do what it says it will do.

The NPO balance sheet differs from a for-profit business’s balance sheet because it doesn’t have a section for the owner’s stock. Instead, it has a section for “net assets.” Non-profit groups don’t have owners. It is divided into three sections: funds with no restrictions, funds with temporary restrictions, and funds with permanent restrictions.

A format of balance sheet of non profit organisation demonstrates its financial stability by evaluating its net assets. Significant unrestricted funds indicate a solid financial position and the ability to cover expenses for a non-profit organisation. In addition, a healthy asset-liability ratio demonstrates stability and the ability to meet financial obligations.

Typically, non-profits prepare balance statements at the conclusion of their fiscal year. Depending on the organization’s demands and reporting requirements, interim balance sheets may be prepared regularly throughout the year to monitor financial performance and provide stakeholders with timely information.

Related Posts: