Projected Balance Sheet Format In Excel

Vyapar makes projected balance sheets easy. Collaborate with ease, track progress & stay on top of your goals.

⚡️ Eliminate errors with pre-defined formulas

⚡ Simplify calculations and save time

⚡️ Generate accurate balance sheets in minutes

Download Free Projected Balance Sheet Format

Download Free Projected Balance Sheet Format in Excel, Pdf, Word, and make customization according to your requirements at zero cost.

Customize Invoices

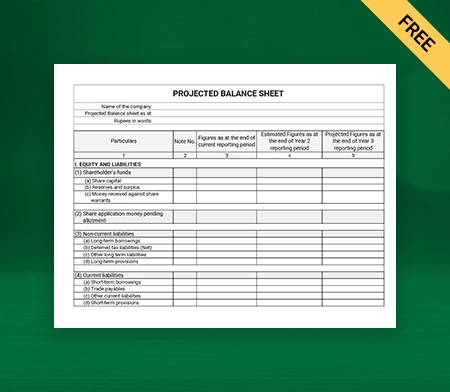

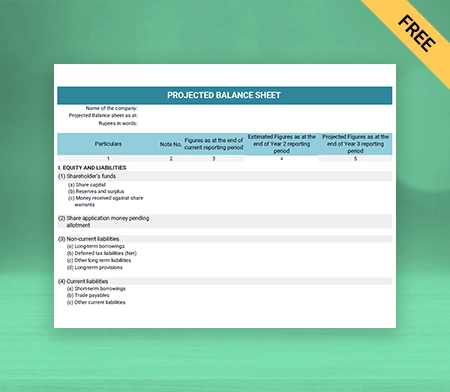

Projected Balance Sheet Format Type I

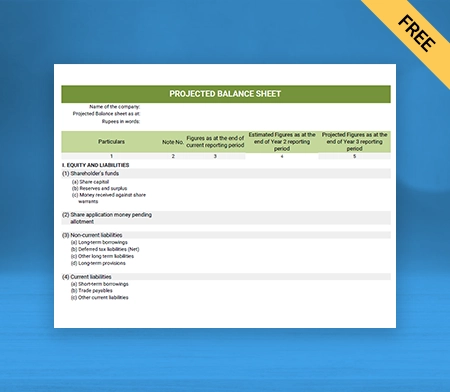

Projected Balance Sheet Format Type II

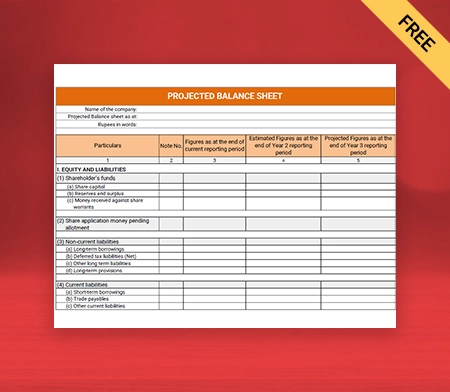

Projected Balance Sheet Format Type III

Projected Balance Sheet Format Type IV

Generate Invoice Online

Highlights of Projected Balance Sheet Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal and grand total amounts

Consistently formatted

What is Projected Balance Sheet?

A projected balance sheet shows the estimated changes to a company’s financial status, including assets, liabilities, investments, and financing for equity. It is a tabulation of future projections and helps your business manage your assets for better results in future. A free projected balance sheet india is also known as a pro forma balance sheet.

The asset side contains current and non-current assets in a projected balance sheet format. The long-term investments include land, building, machinery, and vehicles. Further, the current asset comprises cash in hand/bank, receivables, and short-term stocks.

On the liability side of the pro forma balance sheet format, there are non-current and current liabilities. The non-current liabilities consist of a term loan, and current liabilities include short-term loans, like a working capital loan and account payables.

How to Prepare a Projected Balance Sheet?

Create a Format for the Projected Balance Sheet:

Projected Balance Sheets are used to project balances for a specified time so that you can create them many times. You can make a balance sheet before any acquisition or merger to ensure the next few months of your business plans. With a formatted projected balance sheet, you can easily adjust the assets, liabilities, and equity for the time you’re working within without spending the time and effort recreating one each time.

Gather Past Financial Statements:

You should obtain all the necessary information and records of your company. Accountants and experts use the previous financial statements to make predictions about the company’s economic future. They analyze trends and review ongoing assets and liabilities in the current balance sheets to draw predictions. It would be best to gather at least two years of financial data so the projections are as accurate as possible.

Review your Past and Ongoing Assets and Liabilities:

Reviewing these items can further help you prepare a projected balance sheet. You will be more aware of the assets you have had, your current assets, and your prior and present liabilities. With the help of the past data, you will determine if you want to include those assets and liabilities on the free projected balance sheet you are creating.

Project your Fixed Assets

A fixed asset is a tangible and long-term investment for the business because it is an asset the company regularly uses, such as production machinery or company vehicles. Any projected balance sheet should include fixed assets, but remember to account for depreciation. It refers to the reduction in value that an asset experiences the more it is used, especially if there is some wear and tear.

Estimate the company’s debt

In the projected balance sheet, you should be able to estimate the level of debt the company will have during the period you cover. You should review your current obligations, including the amounts, the payments you will need to make over the coming months, and when to pay off the debt. This information will help you determine which debts to include and in what amounts on the projected financial statements.

Forecast your equity

Forecast your equity by reviewing your previous equity, calculating last year’s net income, including dividends, and adding any changes to equity. When you can forecast equity accurately, you are estimating the earnings for the business that you can pass along to the stakeholders. In addition, the information is essential for investors who wish to know that they will get a positive return on their investment.

Create your first invoice with our free Invoice Generator

Benefits Of Using Projected Balance Sheet Format By Vyapar:

Saves Time and Efforts:

The manual accounting process is time-consuming and increases the chance of errors and mistakes in calculations. You can avoid this issue by opting for the projected balance sheet template Excel, Pdf, Word by the Vyapar App, and it automatically performs all calculations correctly and lays out estimated plans. With the easy bookkeeping app to manage the trust, you can save time.

Reduces Errors:

The free Vyapar billing software uses tools that automatically update your transactions’ data as they happen. Thus it decreases the chances of errors and mistakes. It also gives you information about what has been sold and what you need to restock. Manual data entry is inclined to error and can harm your business, and Vyapar is an easy way to get accurate and real-time information.

Offline Access:

Most accounting software relies on internet connectivity, making it difficult to use them in remote areas. With the best accounting app, you don’t have to worry about internet access or offline feature connectivity as it is an offline application, and you can easily use it anywhere. Also, the ensures the safety of your data, which keeps it accessible only to the user,and third parties and even Vyapar can not access it.

Most Useful Features of The Vyapar App:

Data Safety and Security:

The app allows you to take a backup of all your data, and your data stays safe in an encrypted format on your device. The auto backup and updates features in the projected balance sheet maker will let you continue your work from where you left off, and you can also make your backup by saving data in an Excel Spreadsheet or PDF format.

Tax and Discounts:

The app provides item-wise and transaction-wise tax and discount options. The item price can be inclusive or exclusive of taxes as per your company’s accounting methods. You can also add or modify your invoice’s tax rate and group. It helps claim input tax credits to the extent. By recording the app’s expenses, the company could optimize the expenditure and save time filing taxes.

Multiple Payment Type:

Vyapar app is compatible with multiple payment options. You can accept payments via cash, cheque, QR, UPI, NEFT, IMPS, debit/credit card, etc. You can also print QR code, UPI ID, Bank account details, and other payment-related options on the invoice. It helps you generate bills for your customers without requiring you to stay online.

Generating Reports:

The data collected in the Vyapar App can help you create reports such as transaction reports, bank statements, GST reports, custom reports, etc., to analyze different metrics. This app allows detailed analysis of accurate company details like the inventory report can help you identify the product demand, and a tax report helps in filing taxes quickly.

Dashboard Management:

The Dashboard of the Vyapar software helps you check your business status, and you can easily track your business data and information across all areas of the entity. The Dashboard is user-friendly, which makes it easy to use. You can find out about cash-in-hand, bank balance, stock, and other crucial information about your entity’s financial health in one place.

Bank Accounts:

Companies can easily add, manage, and track the payments more quickly by using the free accounting and billing software of Vyapar. Vyapar supports multiple modes of payments, so you can quickly enter the data whether your revenue is from banks or e-wallets. It is an efficient way to manage the accounts, but you must add your bank with the Vyapar software. Also, you can access the data from anywhere with internet connectivity.

Frequently Asked Questions (FAQs’)

It would be best to calculate cash in hand and money at the bank, fixed assets, the value of financial instruments, profits, liabilities, and business capital.

Projected financial statements incorporate current trends and expectations to arrive at an economic picture that management believes it can attain as of a future date.

Projected financial statements will show a summary-level income statement and balance sheet. Using Vyapar’s projected balance sheet formats can make the process of creating them seamless.

Using a projected balance sheet format in Excel, Pdf, Word can help you in multiple ways. It saves time by eliminating duplicative entries and keeping all your accounting details in one place. The app seamlessly accepts online digital payments and creates personalized invoices with business logos, fonts, and themes.

Yes. By enabling the “Auto-Sync” option in Vyapar App, you can use the Vyapar app on multiple devices. You will need separate licenses for both Android and Windows devices.

The difference lies in their timing and purpose. A provisional balance sheet format presents current financial data, while a projected balance sheet format forecasts future financial conditions.

A balance sheet projection format in Excel allows forecasting future financial positions based on expected income, expenses, and other financial data.

To make a projected balance sheet:

1. Gather financial data and forecasts.

2. Estimate revenue, expenses, assets, and liabilities.

3. Calculate equity.

4. Organize data into the balance sheet format.

5. Review and adjust for accuracy.

6. Document assumptions and methodologies.

A projected balance sheet and profit and loss (P&L) statement format are financial projections that estimate a company’s future financial position and performance. The projected balance sheet includes assets, liabilities, and equity, while the projected P&L statement includes revenue, expenses, and net income. These formats are essential for financial planning and decision-making.

The balance sheet projection model is a financial tool that forecasts a company’s future balance sheet by estimating values for assets, liabilities, and equity based on projected financial data, assumptions, and sensitivity analysis. It helps businesses plan for future financial needs, assess risks and opportunities, and communicate financial expectations to stakeholders.

A projected balance sheet is necessary for financial planning, strategic decision-making, forecasting performance, risk management, investor communication, and compliance purposes. It helps businesses plan effectively, assess risks, and communicate financial expectations to stakeholders.

To prepare a projected income statement and balance sheet:

1. Gather historical financial data, sales forecasts, and expense projections.

2. Estimate revenue and expenses for each period.

3. Calculate net income by subtracting expenses from revenue.

4. Project assets and liabilities based on business plans and growth expectations.

5. Determine equity by subtracting liabilities from assets.

6. Organize data into standard formats for income statement and balance sheet.

7. Review, adjust, and document assumptions for transparency.

To create a projected balance sheet for a credit card limit:

1. Gather financial data and credit card usage information.

2. Estimate future credit card expenditures and payments.

3. Project assets and liabilities based on credit card usage and payments.

4. Determine equity by subtracting liabilities from assets.

5. Organize data into the balance sheet format.

6. Review, adjust, and document assumptions for transparency.