Provisional Balance Sheet Format in Excel, Pdf

Vyapar simplifies provisional balance sheets. Run different scenarios & make informed decisions about your finances.

⚡️ Eliminate errors with pre-defined formulas

⚡ Simplify calculations and save time

⚡️ Generate accurate balance sheets in minutes

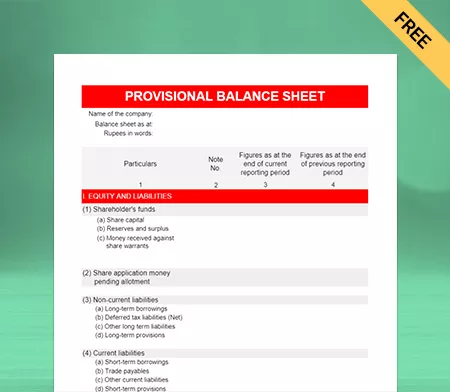

Download Free Provisional Balance Sheet Format

Download the provisional balance sheet format in excel, pdf and customize it according to your requirements at zero cost.

Template – I

Template – II

Template – III

Template – IV

Generate Invoice Online

Highlights of Provisional Balance Sheet Format

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built from scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

What is a Provisional Balance Sheet?

A provisional balance sheet meaning shows the unaudited changes to a company’s financial status, including assets, all existing liabilities, completed investments, external debt, and financing for equity. It includes almost accurate values and helps your business manage your assets for better results in future. A provisional balance sheet is also known as an unaudited balance sheet.

The asset side contains all current and non-current assets in a provisional balance sheet format. It includes long-term investments like land, office, machines, and vehicles. Further, the current asset comprises cash in the bank, monthly receivables, and short-term stocks.

The liability side of the unaudited balance sheet format contains non-current and current liabilities. The non-current liabilities consist of long-term term loans, and current liabilities include short-term loans, like an existing loan and account payables.

Most Useful Features of The Vyapar App

Generate Reports

The data collected in the Vyapar provisional balance sheet maker app can help you create reports such as transaction reports, bank statements, GST reports, custom reports, etc., to analyze different metrics. Our app allows detailed analysis of accurate company details like the inventory report can help you identify the product demand, and a tax report helps in filing taxes quickly.

Data Safety and Security

Vyapar app allows you to take a backup of all data, and your data stays safe in an encrypted format. The auto backup and updates features in the provisional balance sheet maker app will let your employees continue their work from where they left off. You can also make your backup by saving data in an Excel Spreadsheet or PDF format.

Tax and Discounts

Vyapar app provides item-wise and transaction-wise tax and discount options that you can add for your customers in the invoices. The item price can be inclusive or exclusive of taxes per your business accounting methods. Using the provisional balance sheet maker app, you can add or modify your invoice’s tax rate and group. You can use it to claim input tax credits to the extent. By recording the expenses, your business can optimize the expenditure and save time filing taxes.

Multiple Payment Type

Vyapar app is compatible with multiple payment options. You can accept payments via cash, cheque, QR, UPI, NEFT, IMPS, debit/credit card, etc. You can also print QR code, UPI ID, Bank account details, and other payment-related options on the invoice. Using the app, you can generate bills for your customers anytime.

Bank Accounts

Your business can easily add, manage, and track all payments by using the free accounting and billing features offered by our provisional balance sheet maker app. Vyapar supports multiple modes of payments, so you can quickly enter the data whether your revenue is from banks or e-wallets. It is an efficient way to manage your business accounts. Also, you can access the data anytime using the internet.

Dashboard Management

The dashboard of the Vyapar app helps you check all important elements of your business in one place. Using the provisional balance sheet maker app feature, you can track your business data and information across all areas. The dashboard is user-friendly, which makes it easy to use. You can find out about cash-in-hand, bank balance, stock, and other crucial information about your entity’s financial health in one place.

Benefits of Using Provisional Balance Sheet Format by Vyapar

Eliminate Errors:

The free Vyapar software uses tools that automatically update your transactions’ data as they happen. Thus it decreases the chances of errors and mistakes. It also gives you information about what has been sold and what you need to restock. Manual data entry is inclined to error and can harm your business, and Vyapar is an easy way to get accurate and real-time information.

Save Time:

The manual accounting process is time-consuming and increases the chance of calculation errors and mistakes. You can avoid this issue by opting for the provisional balance sheet format by the Vyapar App, which automatically performs all calculations correctly and lays out estimated plans. You can save time with the easy bookkeeping app to manage your trust.

Work Offline:

Most accounting software relies on internet connectivity, making it difficult to use in remote areas. With the best accounting app, you don’t have to worry about internet access or connectivity as it is an offline application, and you can easily use it anywhere. Also, the offline feature ensures that timely backups are created, and no data is lost. It helps businesses with poor connectivity operate the app without hassle, making it the best choice for small business owners.

Create your first invoice with our free Invoice Generator

Frequently Asked Questions (FAQs’)

Provisional financial statement formats will show a summary-level income statement and balance sheet. Using Vyapar’s professional provisional balance sheet formats can create them seamlessly.

Using a provisional balance sheet formats can help you in multiple ways. It saves time by eliminating duplicative entries and keeping all your accounting details in one place. The app seamlessly accepts online digital payments and creates personalized invoices with business logos, fonts, and themes.

Provisional financial statements incorporate the sales details in a financial year without audit reports to arrive at an economic picture of that business. The unaudited balance sheets are an early indicator of business health, and they can help make the right decisions for the next financial year before the audit takes place.

Yes. By enabling the “Auto-Sync” option in Vyapar App, you can use the Vyapar app on multiple devices simultaneously. You will need separate licenses for both Android and Windows devices.

Provisional financial statements are interim statements prepared temporarily, often during audits or pending transactions, providing estimated financial data until final figures are available.

To create a provisional balance sheet:

1. Gather financial data.

2. Estimate missing figures based on available information.

3. Use Vyapar or a spreadsheet to organize data into a balance sheet format.

4. Label the balance sheet as provisional.

5. Regularly review and adjust as more accurate data becomes available.

In most cases, a provisional balance sheet does not require a Chartered Accountant (CA) signature as it is based on estimated figures and subject to change. However, for formal purposes like audits or regulatory reporting, a CA signature may be necessary.

The difference between a provisional and final balance sheet is that a provisional one is based on estimated or projected figures, providing an initial view that may change. In contrast, a final balance sheet reflects the actual financial position with accurate and complete data.

The provisional, projected, and estimated balance sheet format in Excel includes anticipated figures for assets, liabilities, and equity based on future predictions or forecasts, providing a snapshot of the expected financial position of a company.