Delivery Challan Format in Word, Excel, PDF

Download free editable delivery challan formats in Excel, Word, and PDF. For automated challan creation, inventory updates, and GST-ready documents, try the Vyapar App for free today.

- ⚡️ Vyapar offers over 50+ templates to create challans

- ⚡ Easily convert to sales with Vyapar

- ⚡️ Accepts payments with UPI

Download Free Delivery Challan Format in Word, Excel, PDF

Explore delivery challan templates, and make customization according to your requirements at zero cost.

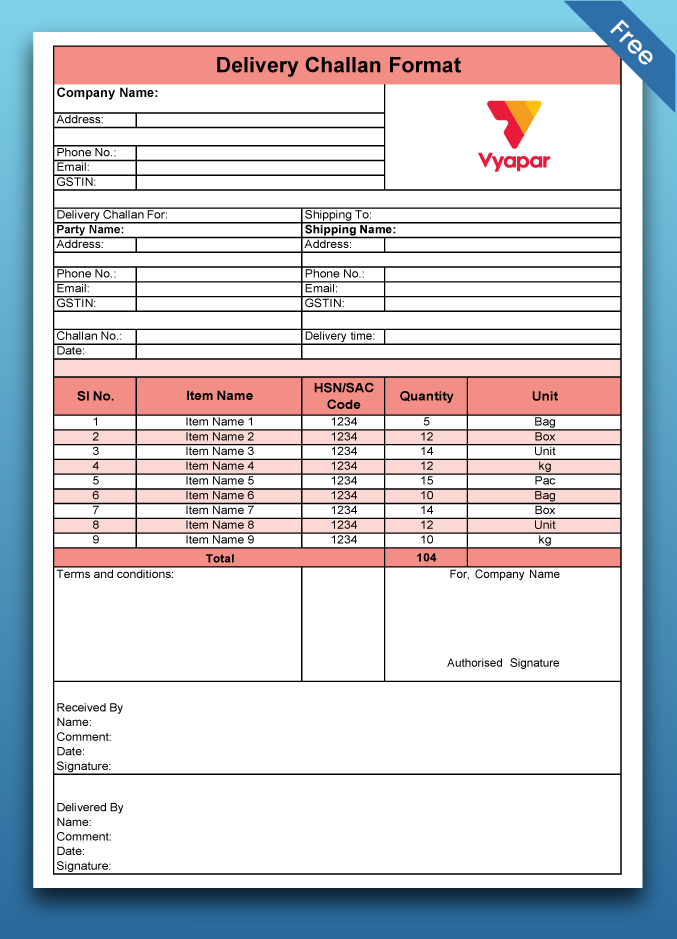

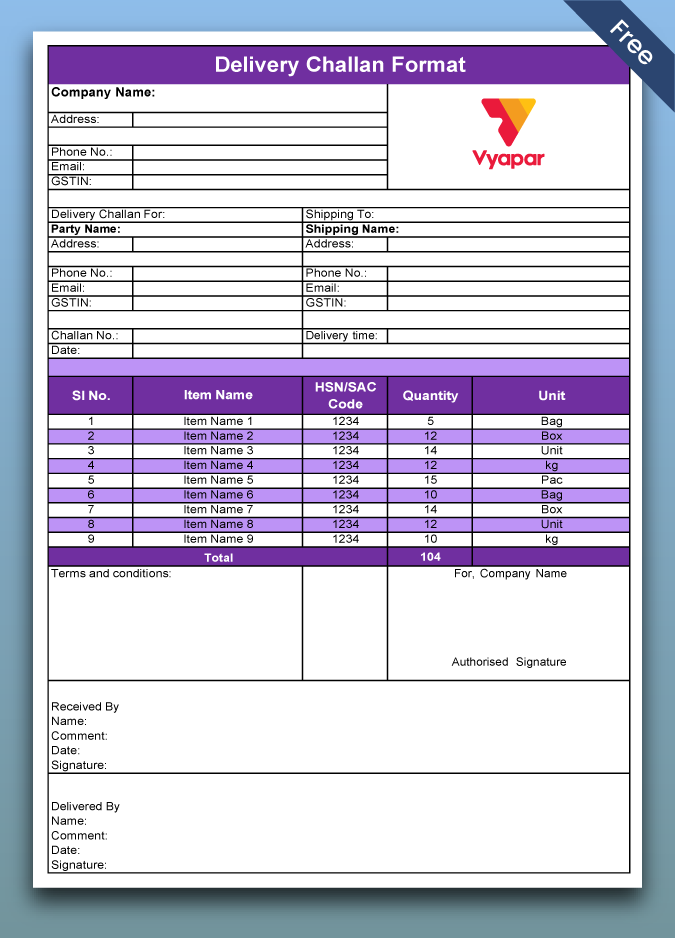

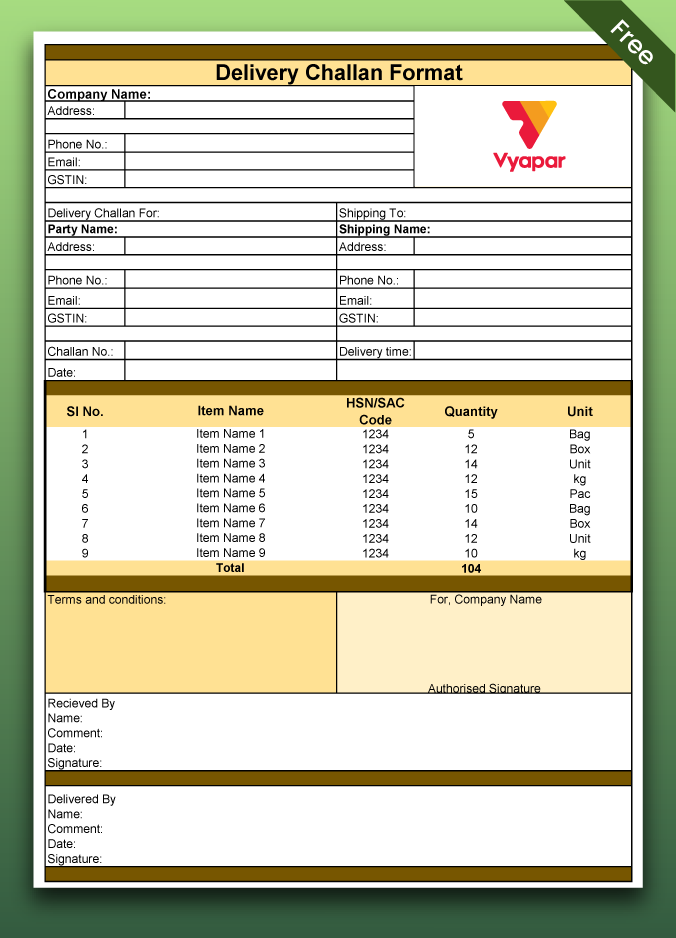

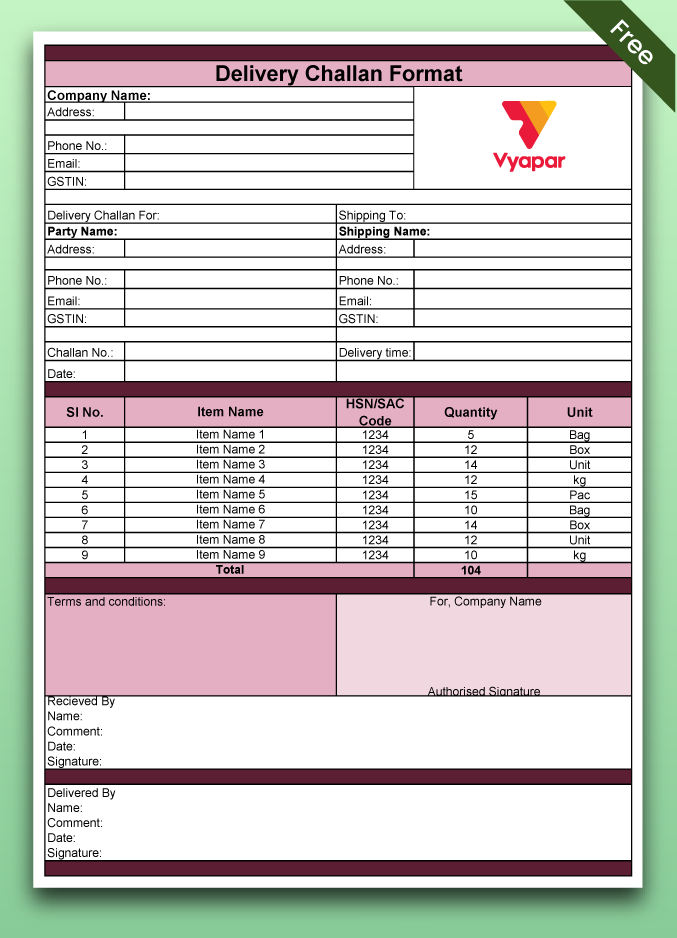

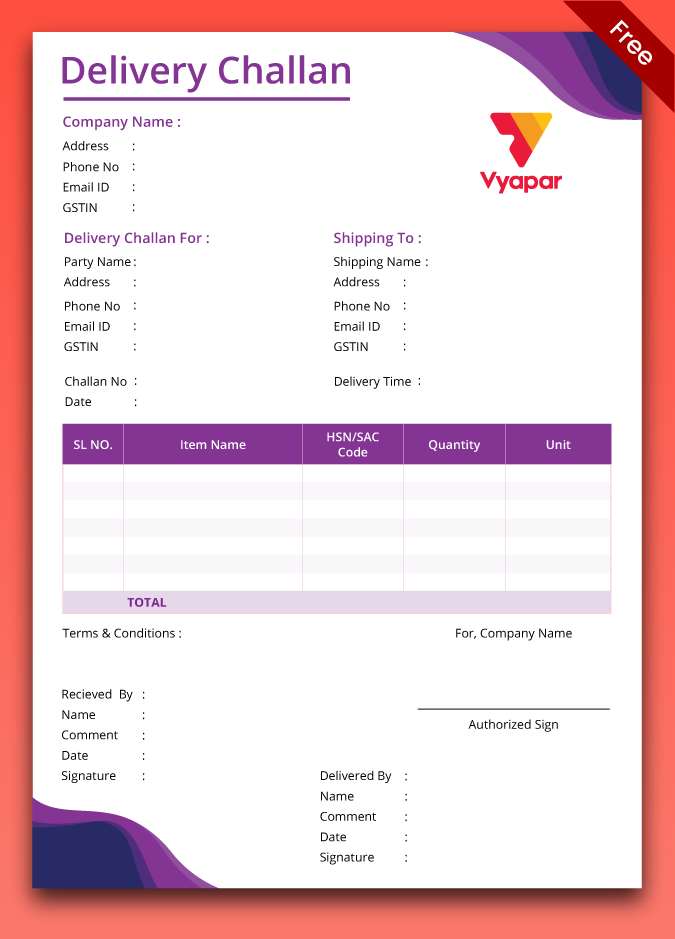

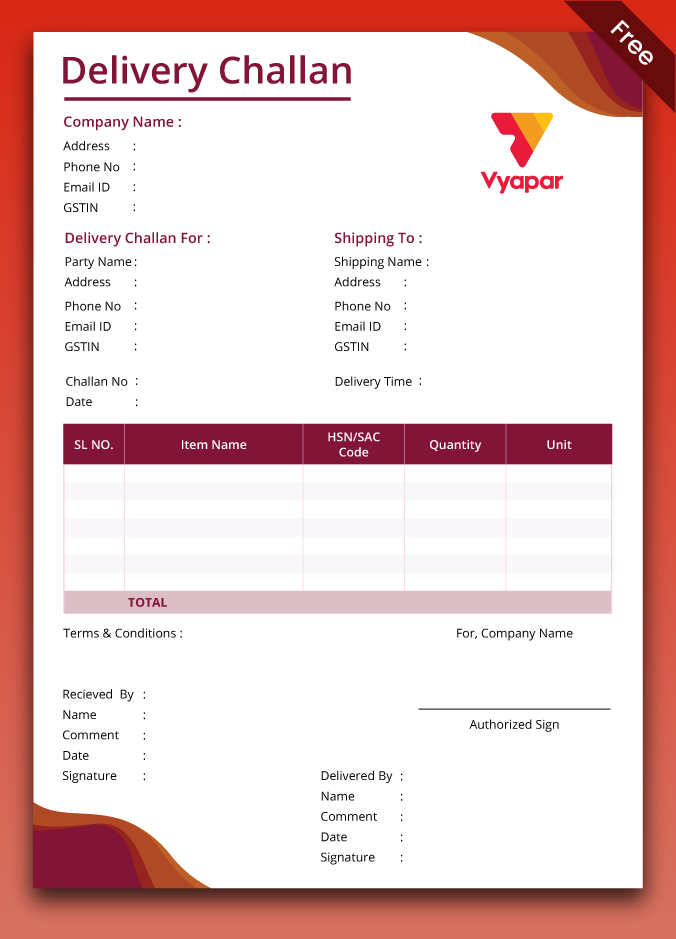

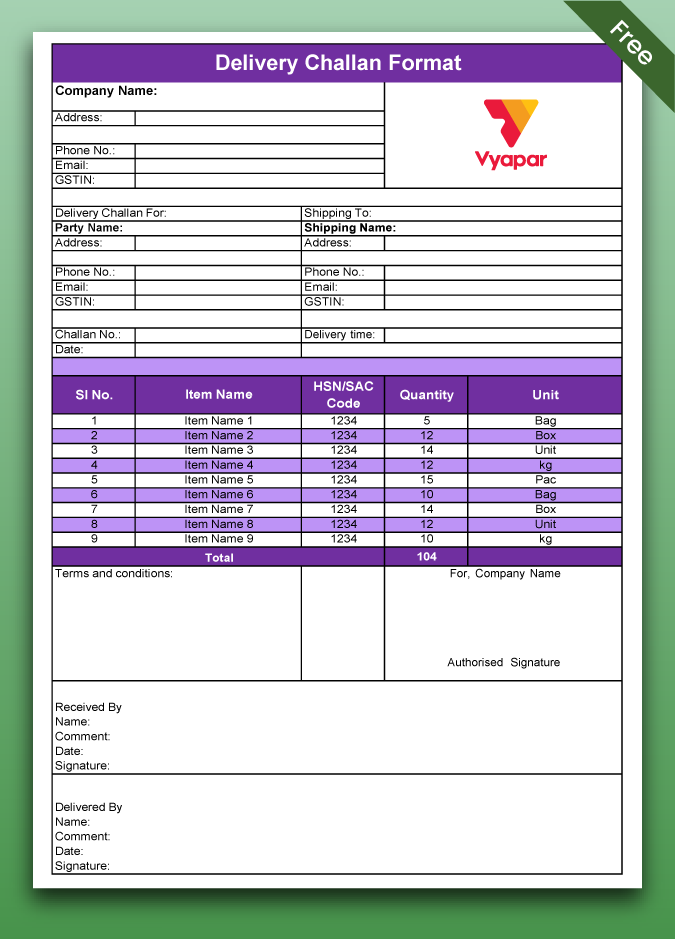

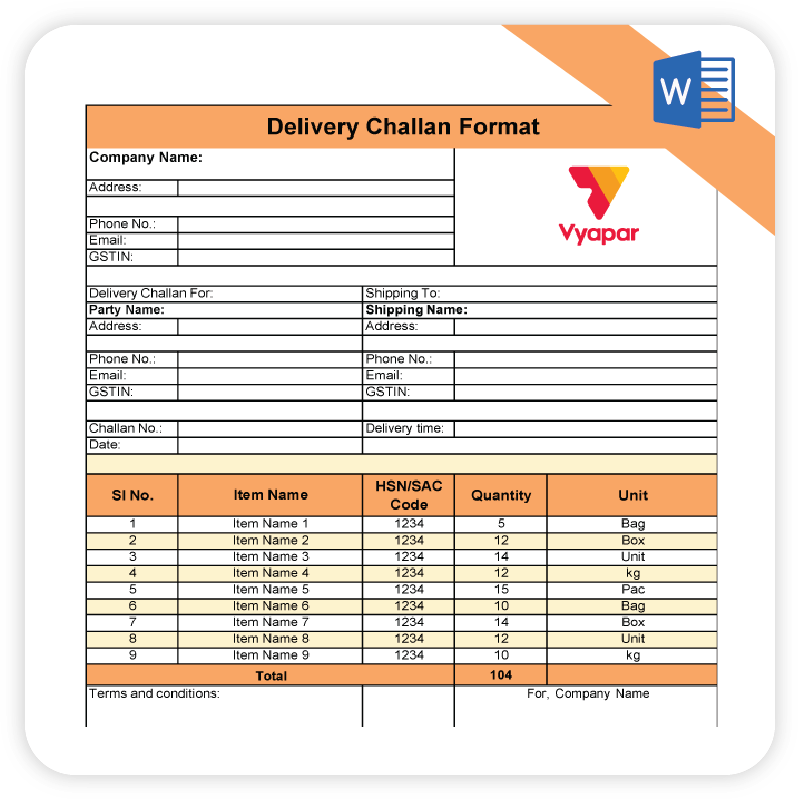

Word Delivery Challan Format

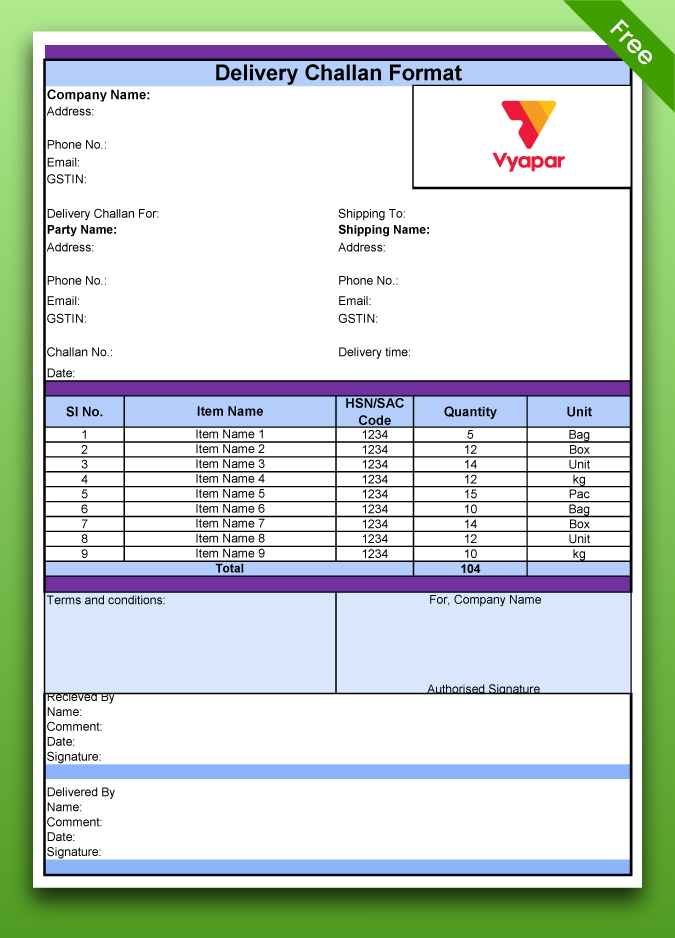

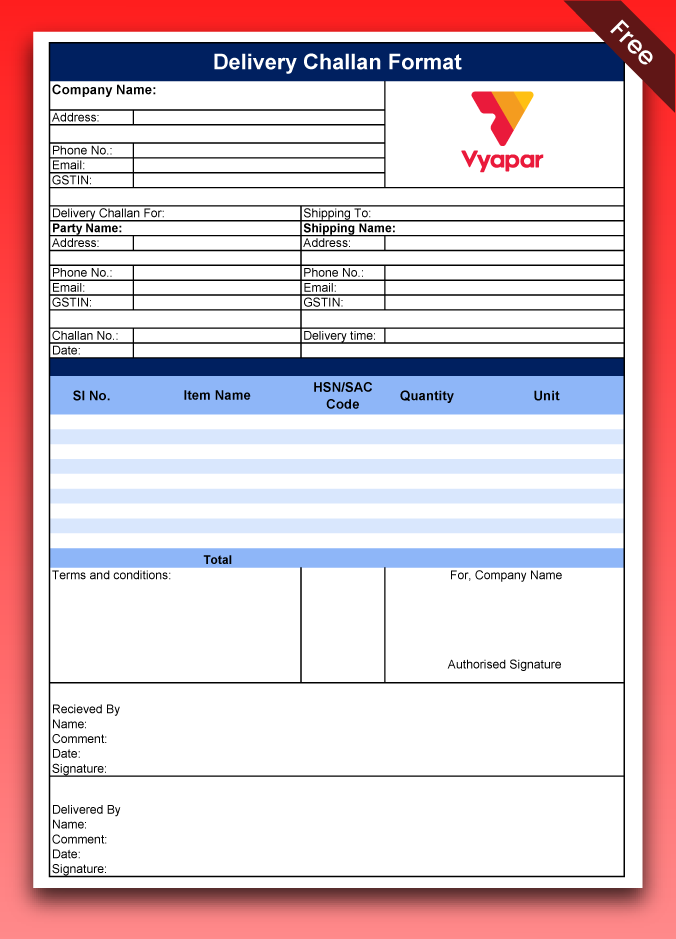

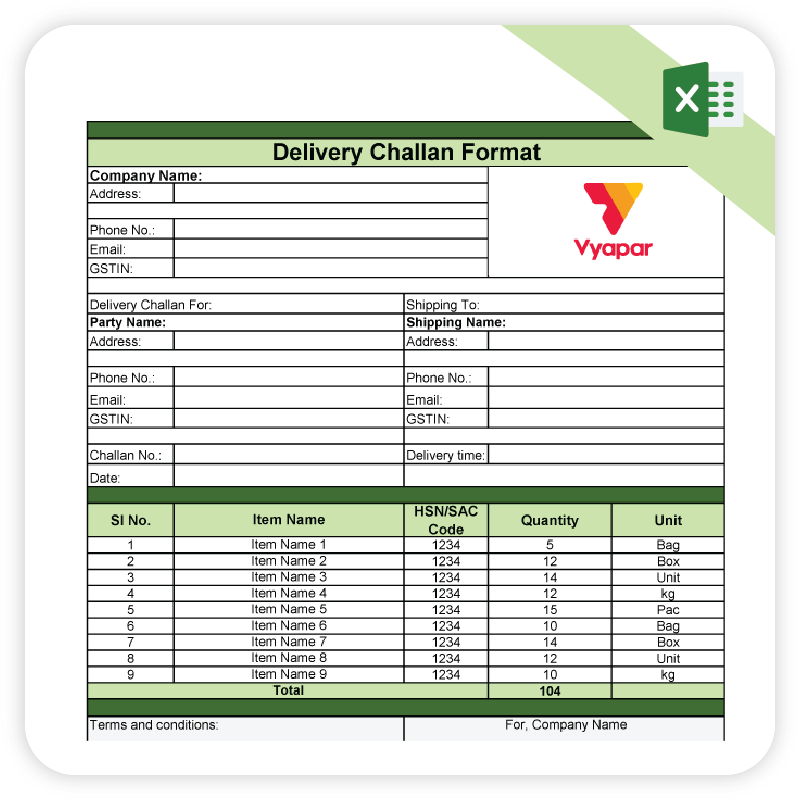

Excel Delivery Challan Format

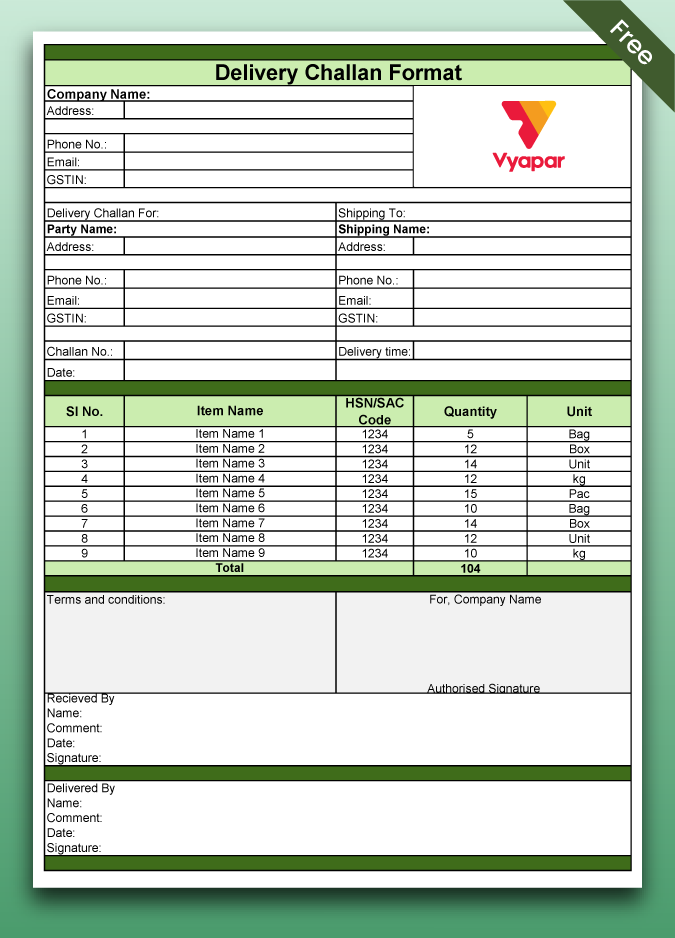

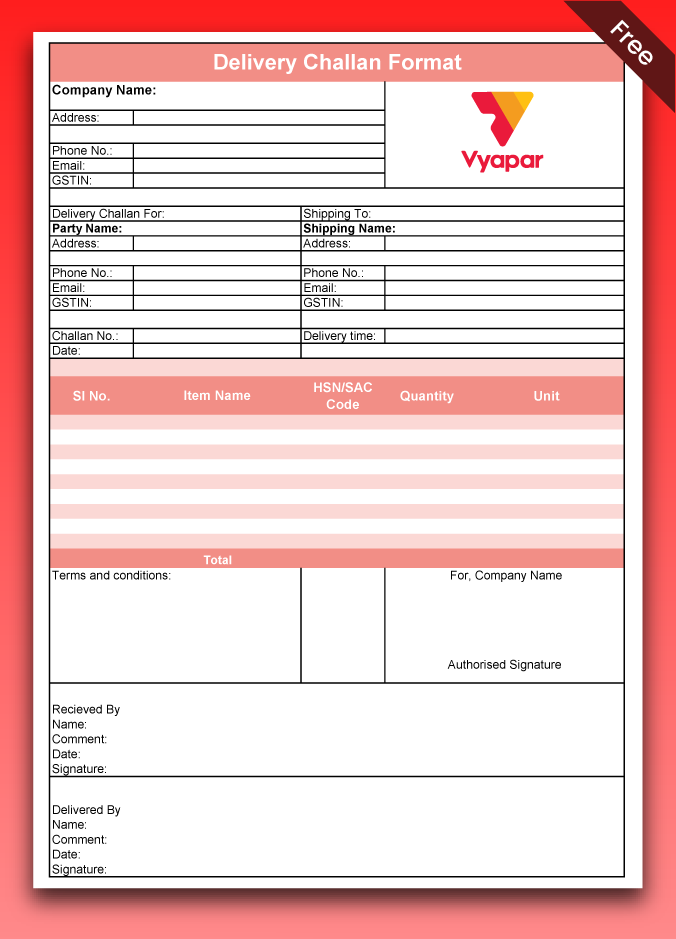

PDF Delivery Challan Format

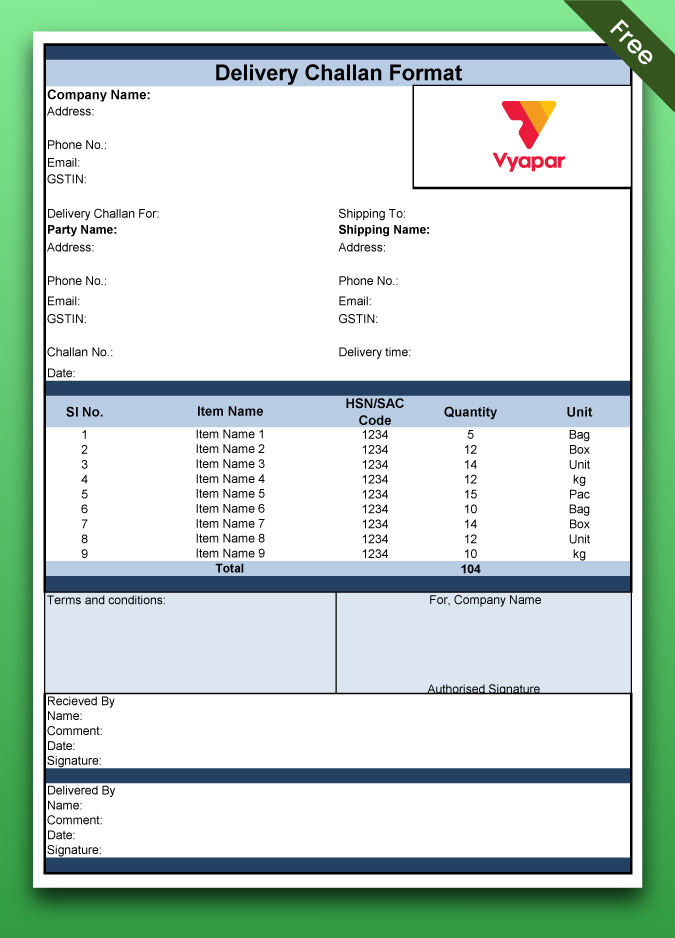

Delivery Challan in Google Sheets

Delivery Challan in Google Docs

Challan Formats

Create Your First Delivery Challan with Vyapar App

What is a Delivery Challan?

A delivery challan is a document that lets you officially record the movement of goods when no invoice is created. It helps track items being transported between locations—whether for approval, job work, or internal transfers—without indicating a sale.

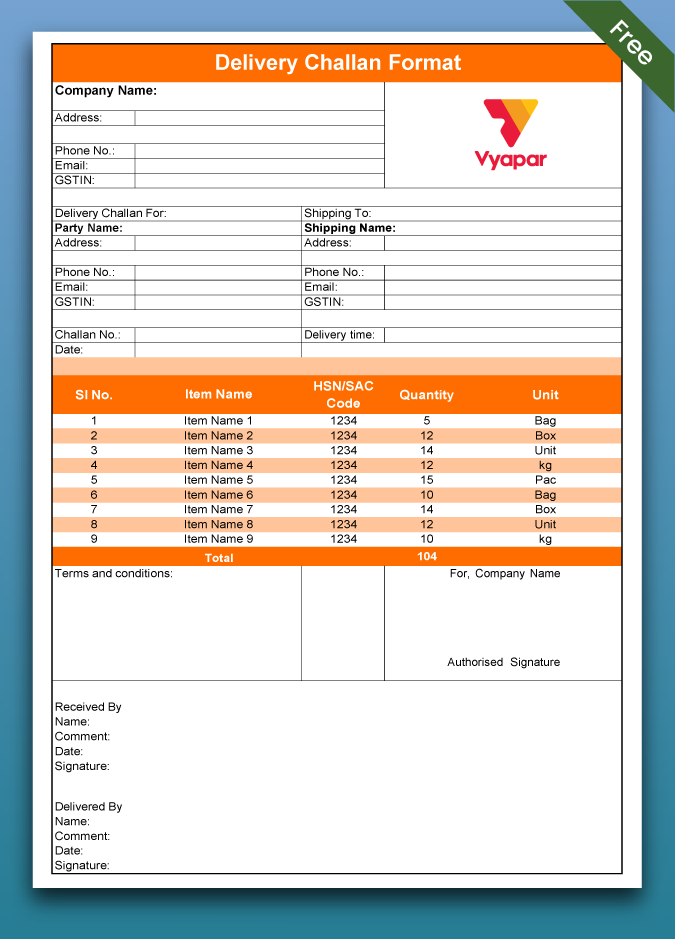

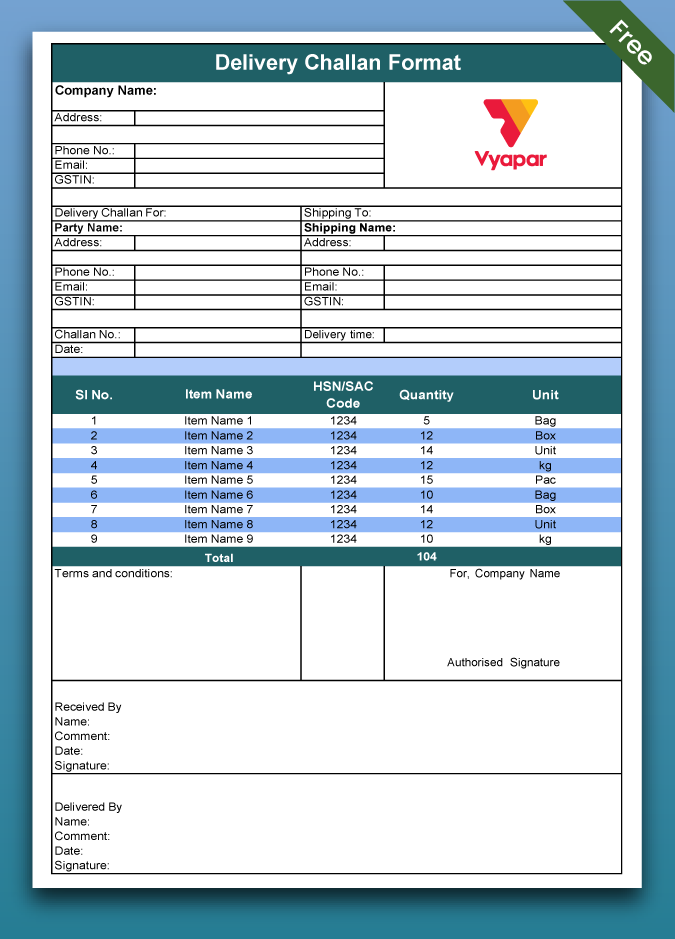

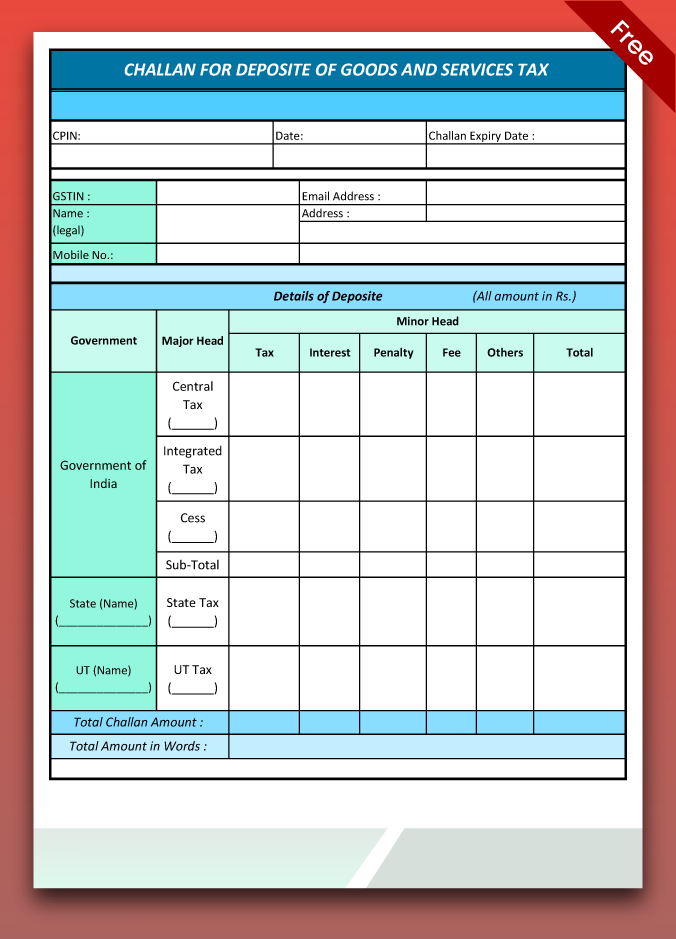

Key Components of GST Delivery Challan

Challan Number & Date

A unique serial number and the issue date of the challan.

Name, Address, and GSTIN

Details of both the sender and the receiver, including GSTINs if registered.

Description of Goods

Clear details of the items being delivered (name, quantity, unit).

HSN Code

HSN for each product that helps categorize them for tax purposes, making sure they are taxed correctly.

Quantity & Unit

Number of goods and their measurement units (e.g., kg, pcs).

Tax Rate

GST rate applicable (IGST, CGST, SGST)—only if tax is charged.

Place of Supply

Especially important for inter-state movement of goods.

Signature of the Supplier

Signature of the authorized person issuing the challan.

How to Use These Delivery Challan Templates?

Follow these simple steps to fill out your delivery challan after downloading:

- ✅Add Sender and Receiver Details

- ✅Fill in Item Description, Quantity, and Unit

- ✅Mention the Dispatch Date and Transport Info

- ✅Include Signature & Company Stamp

Customization Tips:

- ✅Add your business logo

- ✅Use a serial number for tracking

- ✅Print or share digitally

When Should You Use a Delivery Challan?

Delivery challans are used in various situations, including:

- ✅ Sending goods for approval or demonstration

- ✅ Stock transfers between company branches

- ✅ Job work and temporary outsourcing

- ✅ Movement of consignment stock

- ✅ Transportation of goods without an immediate sale

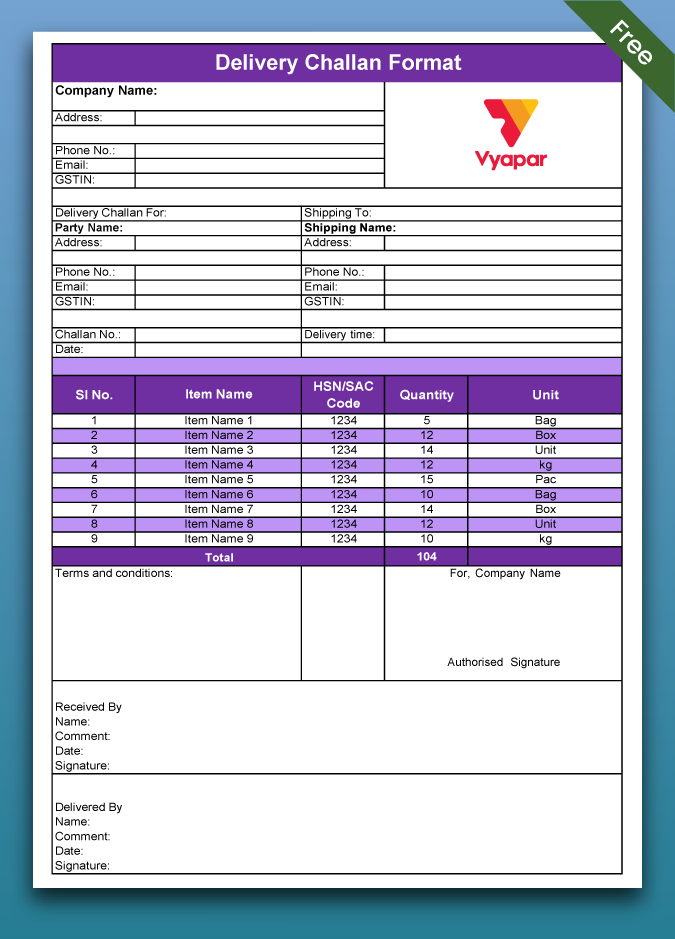

Easily Create a Challan in Your Preferred Format

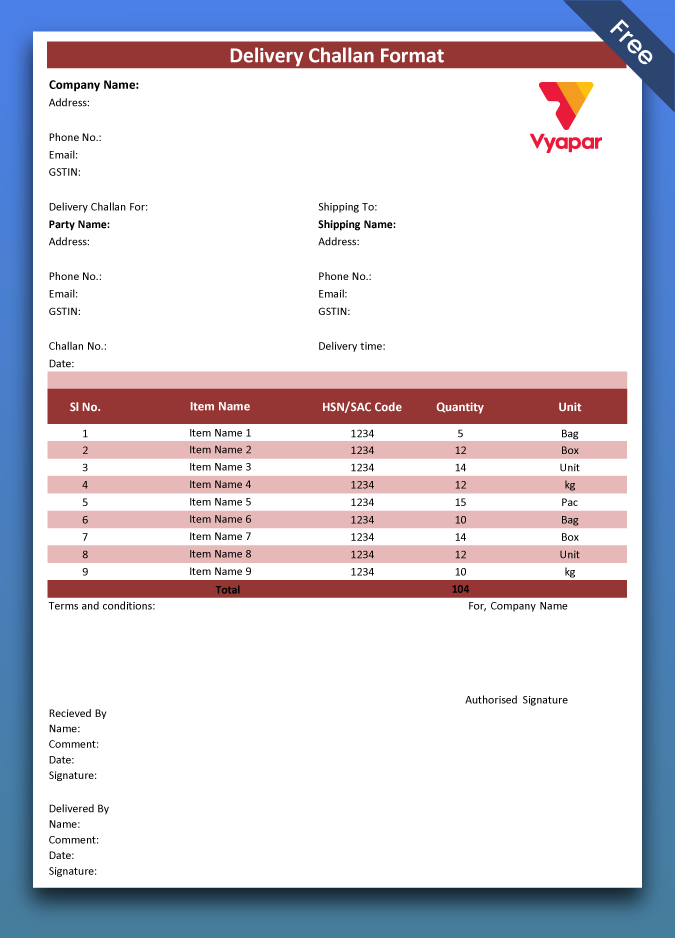

Delivery Challan Format in Word

Use the templates to make your DC format in Word.

- Find your favourite challan application format by browsing the available options.

- Make the necessary changes based on your shipment needs.

- Change the business name, goods description, client information, challan date and number, overall cost, and contact details.

- Change your Challan’s fonts, logos, and colours to suit your needs.

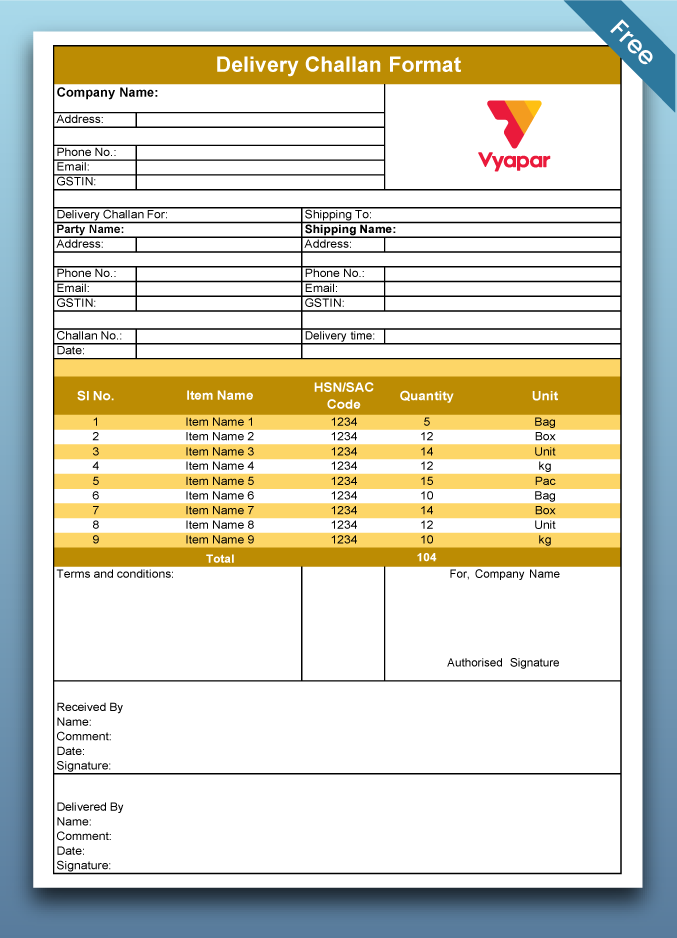

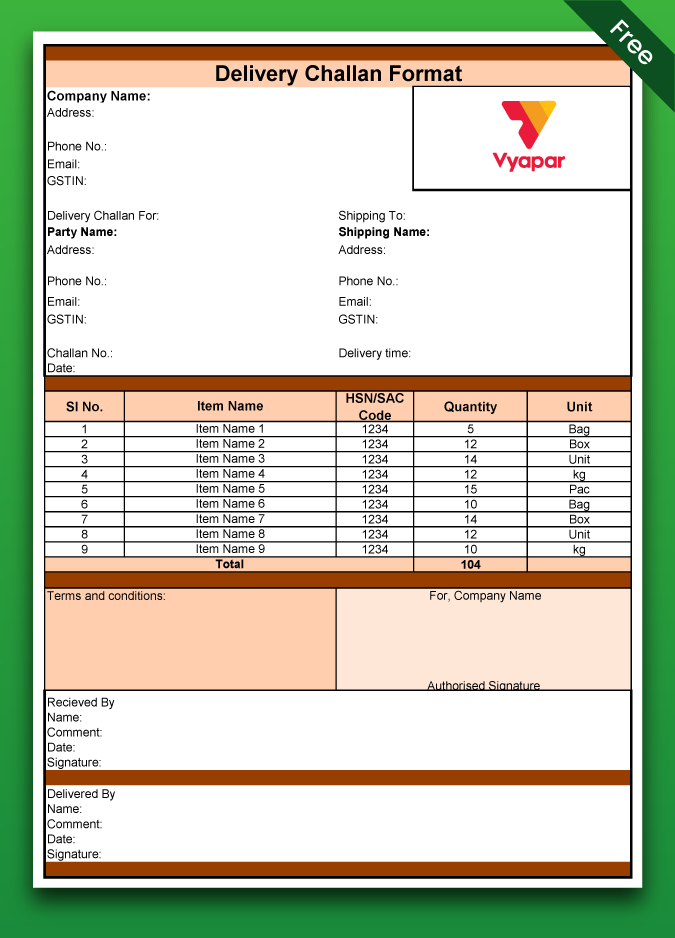

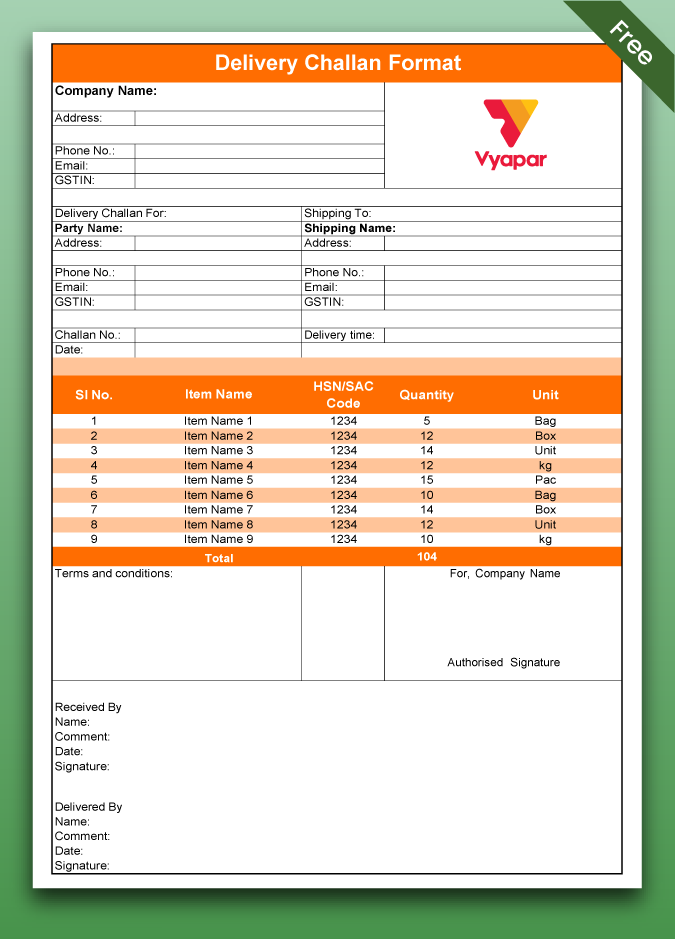

Delivery Challan Format in PDF

The PDF format is ideal when you need a finalized, non-editable version of your delivery challan. It’s most suitable in these cases:

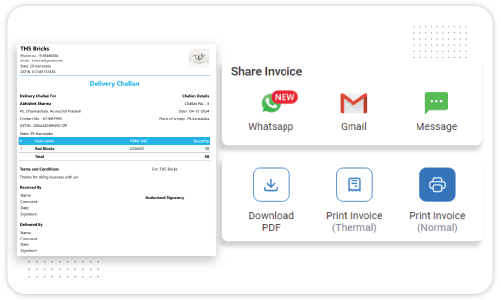

- Sharing digitally through WhatsApp, email, or messaging apps

- Printing a neat, professional copy for your delivery team or customers

- Avoiding edits—great for record-keeping or signed confirmations

- Ensuring format consistency across all devices and operating systems

Because PDF files keep your layout intact and are easy to view anywhere, they’re a reliable choice for smooth and professional delivery operations.

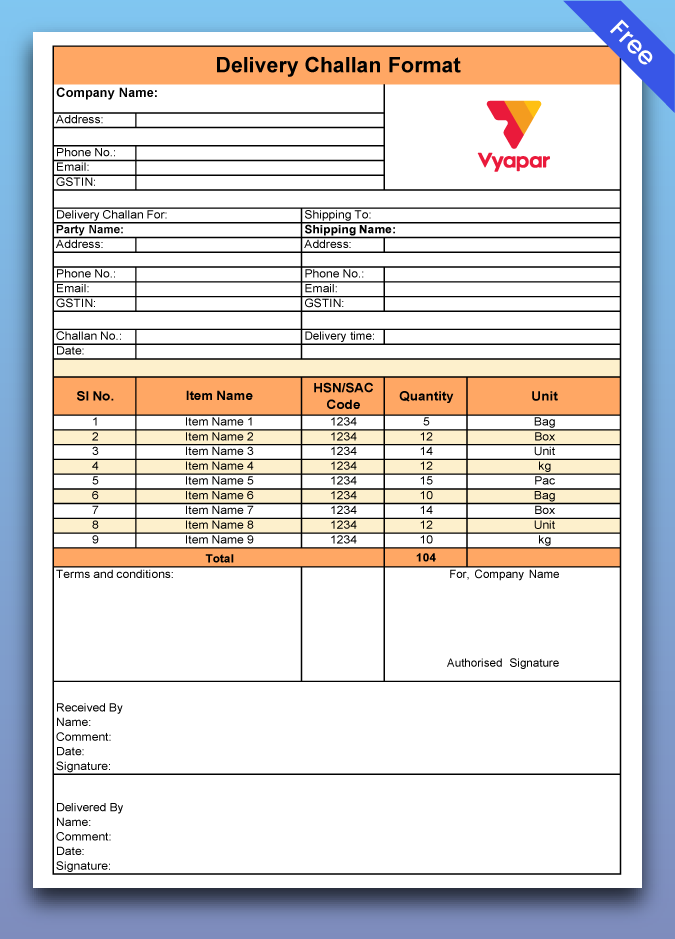

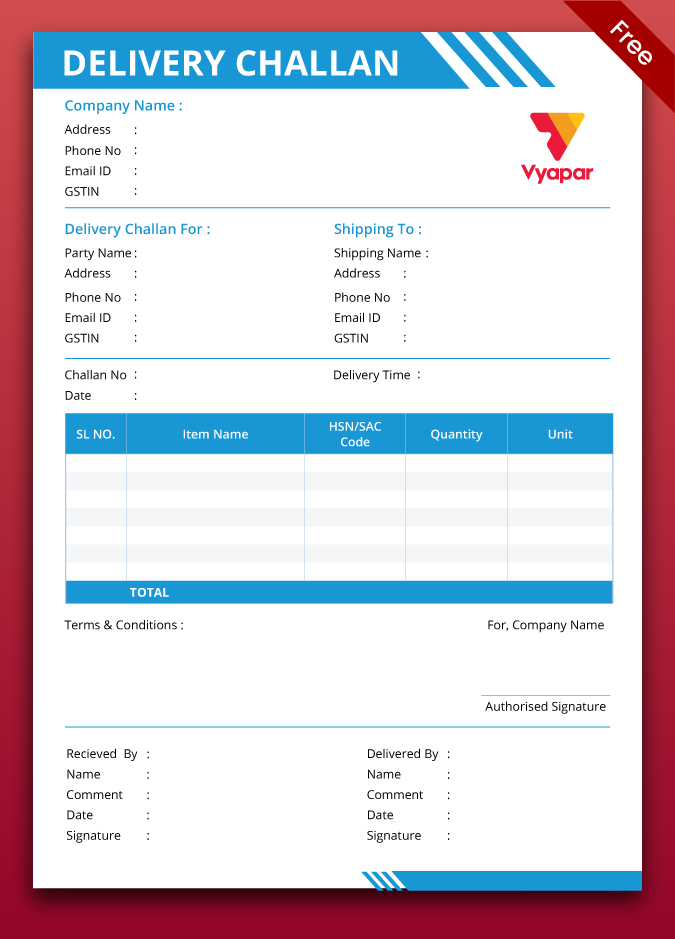

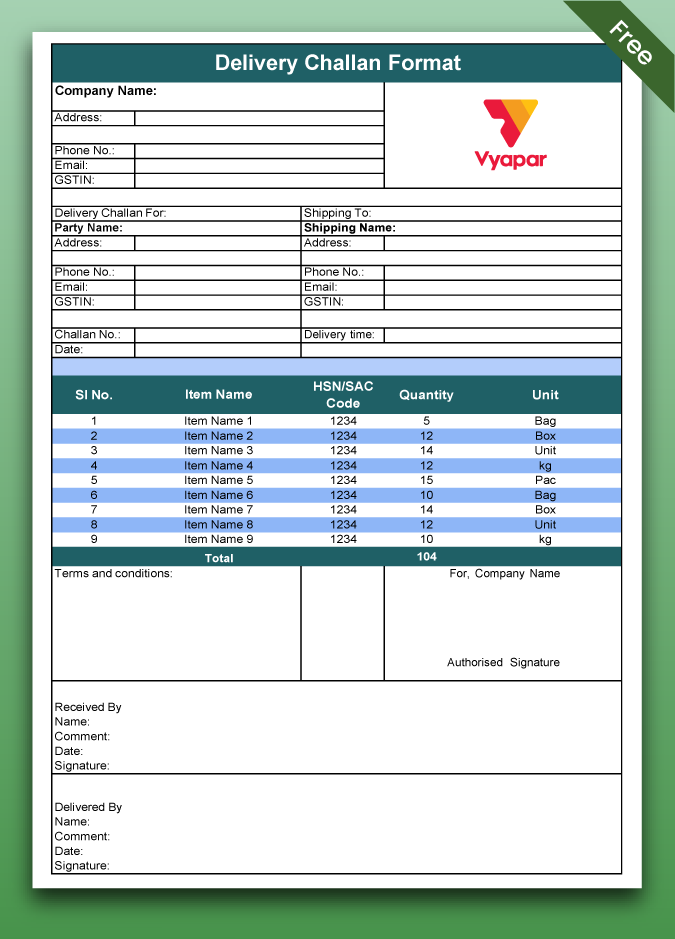

Delivery Challan Format in Excel

The Excel DC format is ideal when you want a fully editable and customizable delivery challan. It’s best for:

- Quickly entering or updating product details

- Creating multiple challans using formulas or bulk editing

- Auto-calculating totals, quantities, or taxes

- Keeping detailed internal records in a spreadsheet format

If you prefer flexibility and control while working offline, Excel is a practical choice.

But if you need ready-made formats, inventory auto-updates, and one-click PDF sharing, try the Vyapar Delivery Challan Maker. It helps you go beyond manual templates with smarter, faster, and GST-compliant options—right from your phone or PC.

How Do You Create a Delivery Challan in Vyapar App?

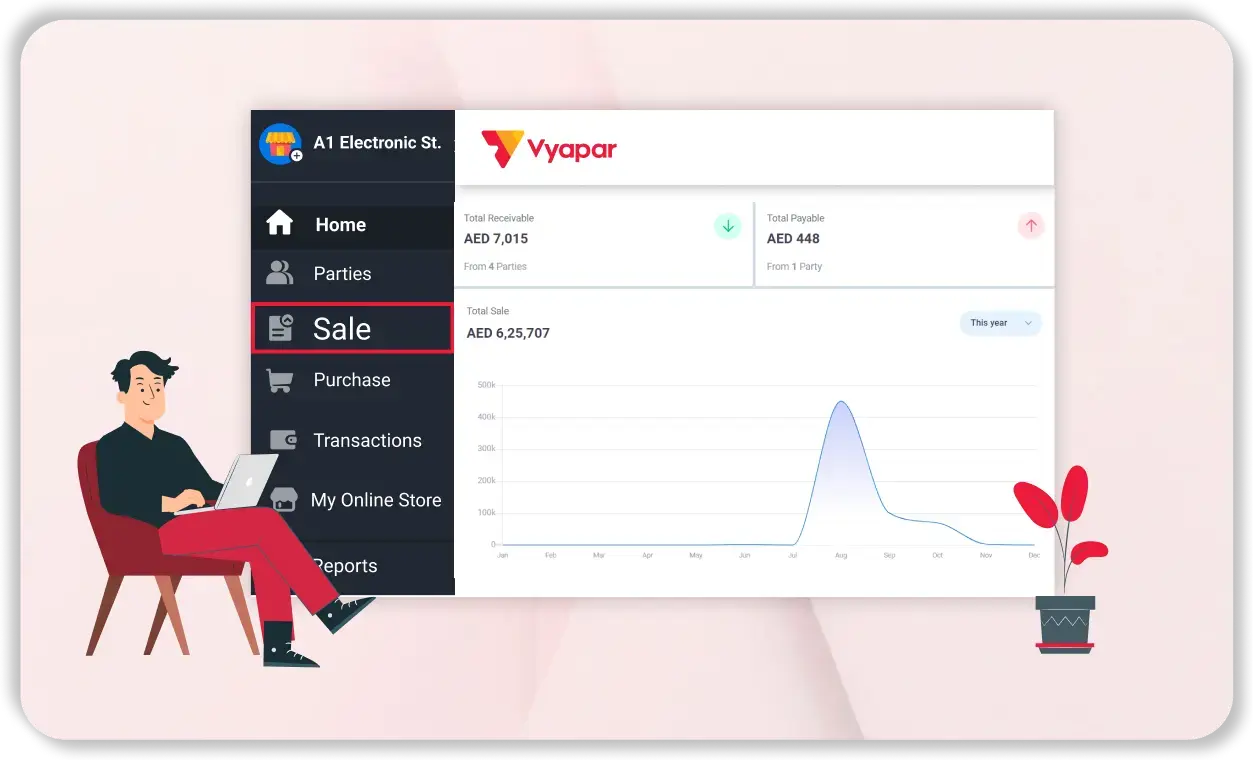

1. Open Vyapar App Dashboard

- Open the Vyapar app on your device. Access the main dashboard where you manage business transactions, and click on the “Sales” menu for more options.

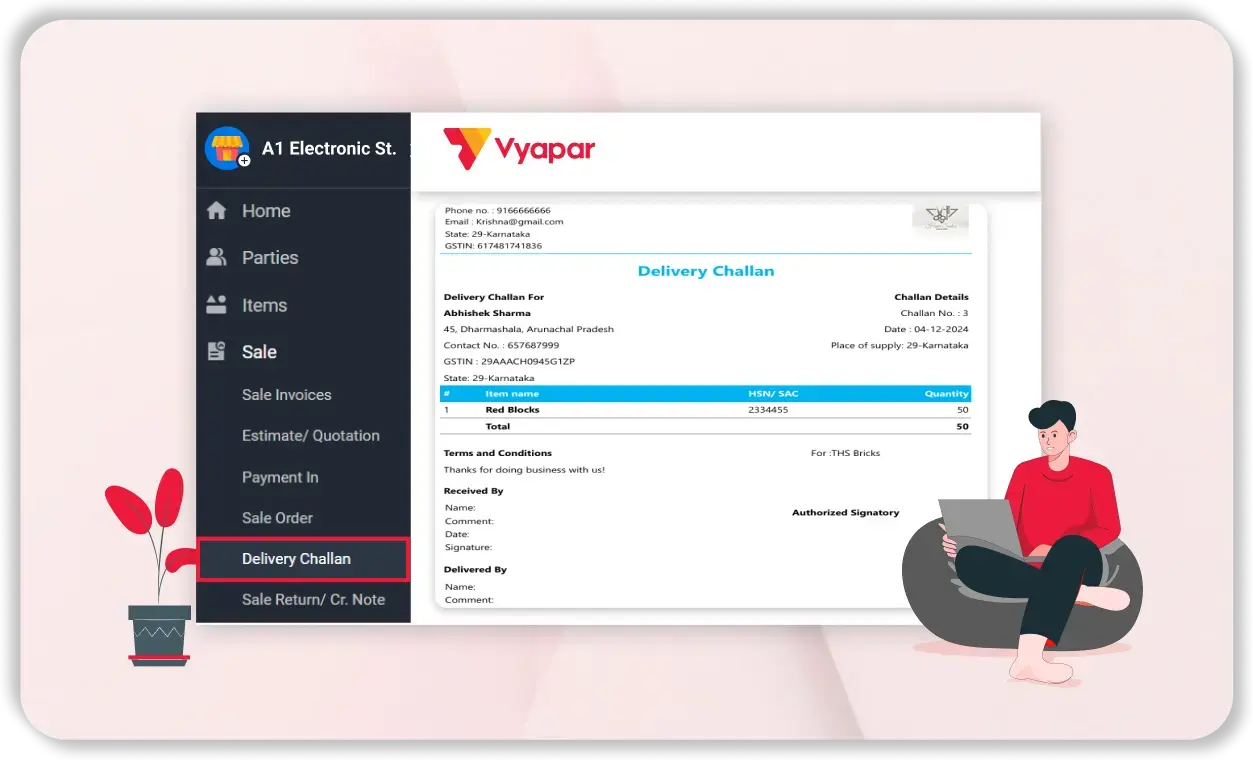

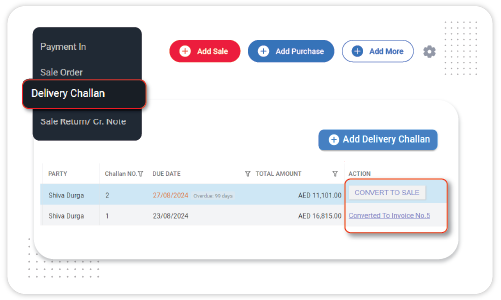

2. Choose Delivery Challan

- From the available transaction types in the “Transactions” menu, select “Delivery Challan” to start creating a document for transferring goods without billing them immediately.

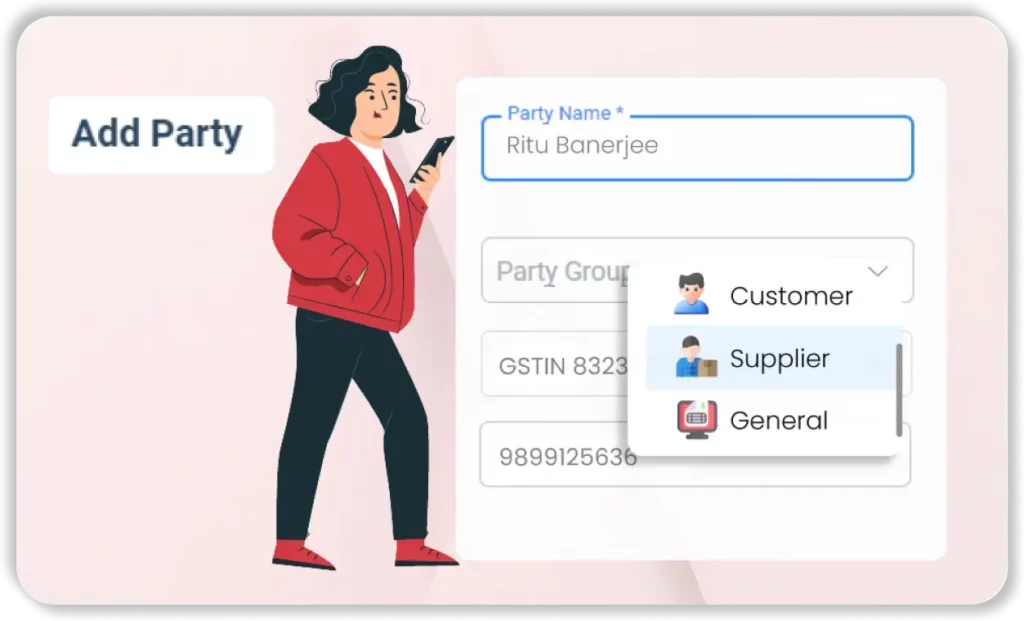

3. Enter Party Details

- Add the recipient’s details by selecting an existing party or creating a new one.

- Include the party’s GST information, if applicable.

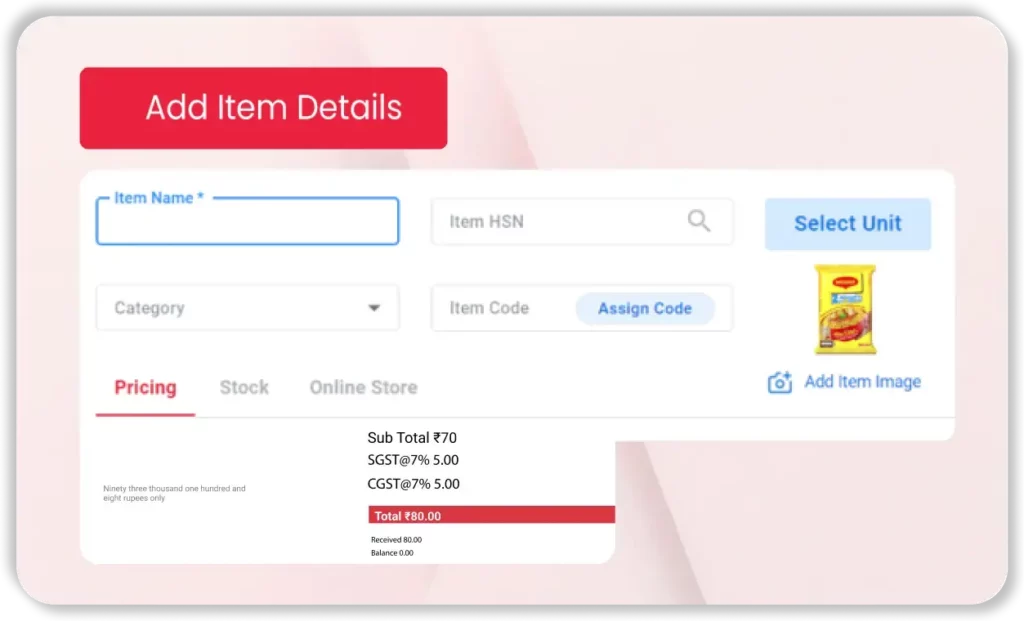

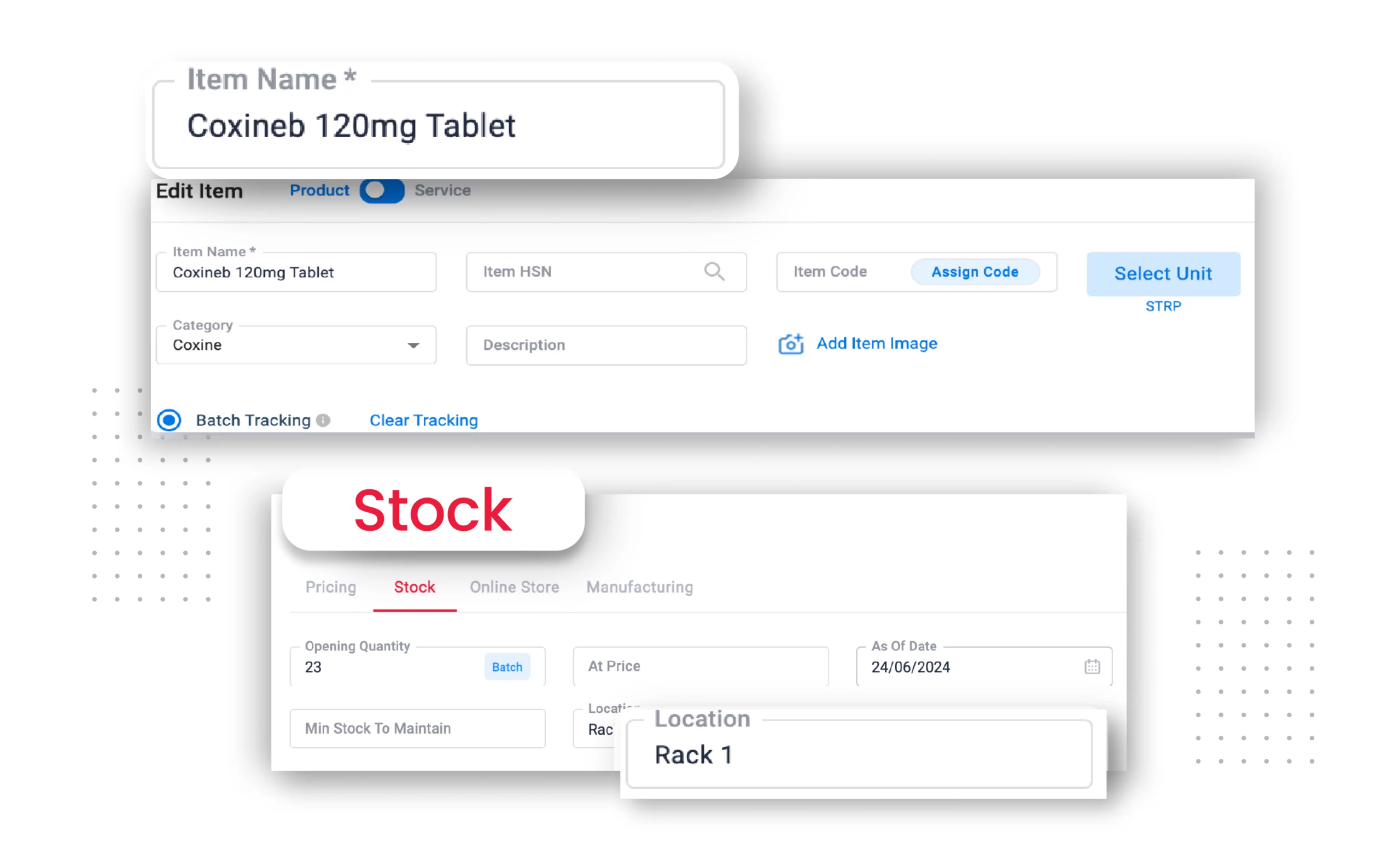

4. Add Items

- Click “Add Item” and enter the product or service details.

- Include item quantity, price, and any necessary attributes like batch number or serial number.

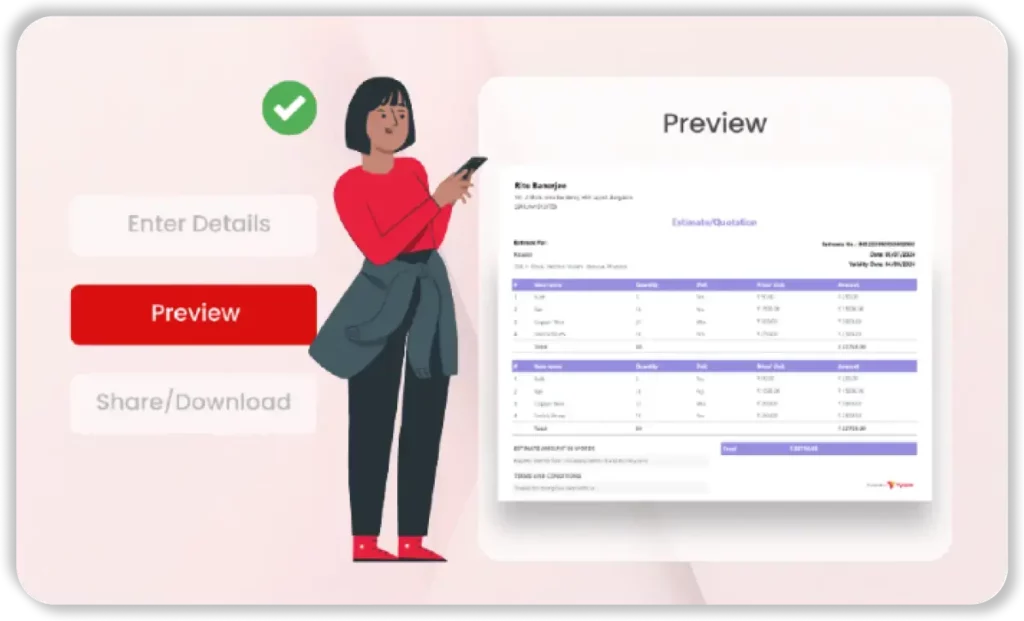

5. Preview and Save

- Review the challan for accuracy and click “Save”.

- You can print or share the challan via email, WhatsApp, or other channels directly from the app.

Get a Free Demo

Valuable Features of the Vyapar Delivery Challan Generator

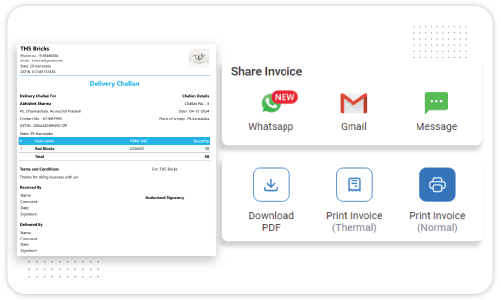

Create and Send Delivery Challans in 1 Click

Quickly generate professional delivery challans and share them via WhatsApp, email, or print—saving valuable time and effort.

- Instant challan creation with minimal input

- Share digitally or print on the go

- Reduces paperwork and processing delays

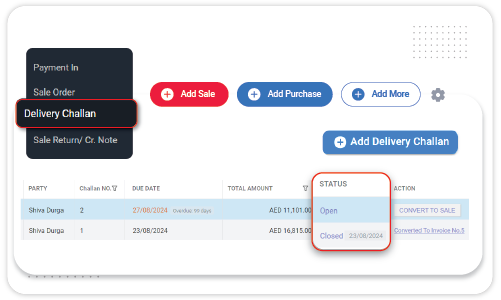

Link Challans Directly With Invoices

Convert delivery challans into GST-compliant invoices on Vyapar challan book app to simplify billing and ensure a smooth flow from delivery to payment.

- One-click conversion from challan to invoice

- GST compliance for seamless documentation

- Avoid duplicate entries and errors

Adjust Stock Levels in Real Time

Every challan updates your inventory automatically, helping you track item movement and avoid stock mismatches or shortages.

- Auto-update stock after each delivery

- Accurate real-time inventory tracking

- Prevents stock-outs or overstocking

Use GST-compliant Templates

Send delivery challans in formats that meet Indian GST standards, keeping your records accurate and legally valid.

- Pre-set GST-compliant challan formats

- Easy to customize with branding

- Ensures audit-ready documentation

Track Delivery Challan Status

Monitor the status of delivery challans in real-time for better visibility into your operations. Keep everything organized and ensure timely conversion without missing important updates.

- Track challans as pending, completed, or invoiced.

- Real-time updates for effective management.

- Ensure timely conversion of delivery challans.

Benefits of Creating a Delivery Challan in the Vyapar App

Builds a Positive Brand Image

Using the Vyapar delivery challan software, you can provide customised professional quotes to your clients, which builds a positive brand image. Your delivery challan can include our company’s logo, style, font, and brand colours.

Track Business Status

Manage your company’s payments, open orders, inventory status, and cash flow all in one place. Using Vyapar’s business dashboard, you can streamline your whole management process.

Provide Multiple Payment Options

With the Vyapar invoicing app, create invoices offering multiple payment options, including bank transfers and UPI. You can also generate QR code and add to make customer payments quicker and more convenient.

Online/Offline Billing

Keep your business running offline with Vyapar’s delivery challan maker. Accept payments without internet, and once reconnected, all transactions auto-update in your accounting records seamlessly.

Simple and Time-Saving

There is no need for specialised accounting knowledge to use the Vyapar software. The app’s user-friendly interface makes it simpler for users to use different challan formats.

Access Features for Free

For Android & iOS users, the Vyapar app’s basic plan is free. You don’t have to pay to use the necessary features and accounting tools.

Vyapar’s Growing Community

Take Your Business to the Next Level with Vyapar! Try it for Free!

Frequently Asked Questions (FAQs’)

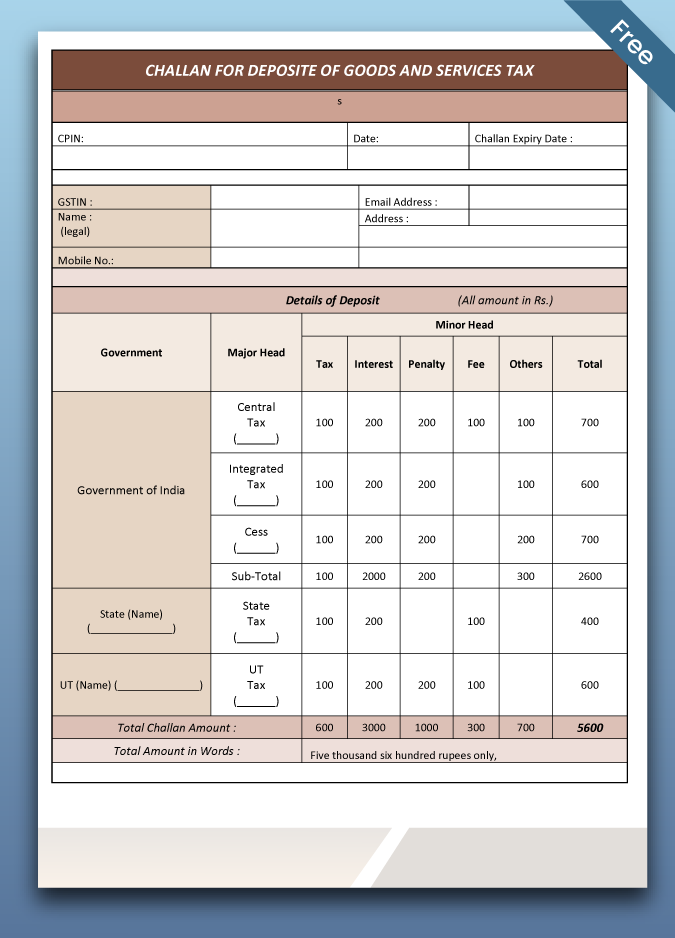

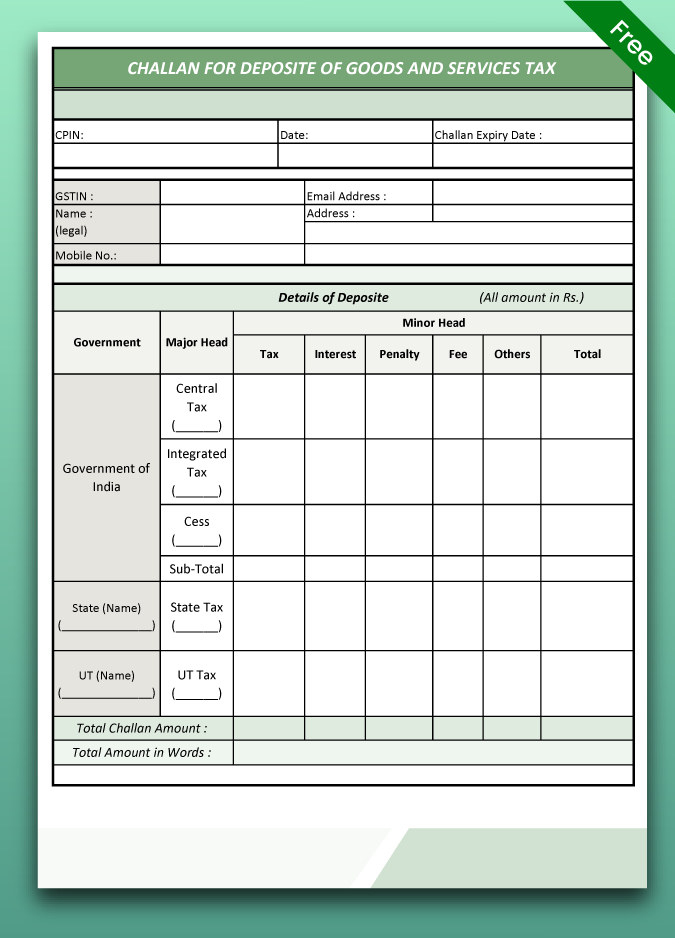

A Challan is a document used in many professional requirements with a wide range of use cases. This document represents a form of an important document involved in various financial transactions.

In simple words, a Challan can be defined as an essential document, a receipt of an acknowledgment, a document of proof, necessary paperwork, etc., which is used to fulfill part of various financial transactions.

You can create a Challan Format in PDF, Word, and Excel and customize it. You can use Vyapar to generate GST challans and download the best copy of the challan for your customers.

The format includes the supplier and the supplier’s name and address. Mention the GSTIN if registered. HSN code for the goods. The product’s HSN code.

You must make three copies of the delivery challan per rule 55(2) of the CGST Act.

Original copy – For the Buyer

Duplicate copy – For the Transporter

Triplicate copy – For the Seller

A delivery challan is generated when you must send goods or capital goods; however, GST does not apply in this situation. Therefore, a delivery challan records the number of goods delivered and serves as proof when payment is not made at the time of supply.

The movement of goods up to a distance of 20 km does not require an e-Way bill. After implementing GST, sending the e-Way bill with the Delivery Challan is necessary.

A tax invoice carries legal obligations and serves as proof of ownership. Contrarily, a delivery challan has no legal obligations and offers no evidence of ownership.

Yes, the delivery Challan will work as an e-Way Bill. Any registered taxpayer or transporter may generate an e-way bill on the delivery challan using the GST portal.

When delivering goods, a seller gives the buyer a delivery challan. A sale may or may not arise out of these goods.

A delivery challan is a document that contains details of the goods being transported from one place to another, which may or may not result in a sale. A delivery challan usually includes the following information:

– Date and challan number.

– Name, address and GSTIN of the consignor and the consignee.

– HSN code, description, quantity and rate of the goods.

– Taxable amount, GST rate and other taxes, if applicable.

– Place of supply for inter-state transport.

– Signature of the supplier or authorised person.

Yes. A delivery challan is a legal document that can sometimes be used for transporting goods without an invoice. Delivery challan is issued as per the provisions of Section 31 of the CGST Act and Rule 55 of the CGST Rules.

Delivery challan should contain the details of the goods, the consignor and the consignee, and the tax amount, if applicable. To ensure compliance, refer to the delivery challan format by the Vyapar app and customise it to meet your business-specific needs.

A delivery challan is sometimes issued when the supply of goods is not specific or complete, such as when the goods are sent for job work, exhibition, approval, or export promotion. Sometimes, a delivery challan is issued for transporting goods without an invoice.

Some common examples are listed below:

– Supply of liquid gas where the quantity is unknown at the time of removal.

– Transportation of goods for job work or reasons other than supply.

– Goods are sent on an approval basis or for exhibition or export promotion.

– Goods supplied where the invoice cannot be issued at the time of removal.

A delivery note and a delivery challan are documents used for transporting goods, but they differ. Here is a list of the main differences:

1. A delivery note accompanies a shipment of goods and provides a list of the products with quantity included in the delivery. A delivery challan contains details of the products in that particular shipment, which may or may not result in a sale.

2. The seller usually issues a delivery note to the buyer as proof of delivery and has no tax implications. The supplier issues a delivery challan to the recipient per the GST rules, which may have tax implications in some cases.

3. A delivery note does not affect the inventory levels of the seller or the buyer, as it is just a record of the goods delivered. A delivery challan affects the supplier’s inventory levels, decreasing the inventory stock when the goods are transported.

You can convert a delivery challan into a sales invoice once the shipment is delivered and the sale is finalised. All you need to do is make changes to the delivery challan details as finalised to create the final invoice for the customer.

To make the entire process faster, you can opt for the Vyapar app, which helps record the details of all delivery challans. You can make the necessary changes within minutes using the invoicing tools. Once done, you can share the sales invoice and collect payments.

As per the law, the taxpayer must raise a proper tax invoice for the taxable products, whereas he is free to issue a delivery challan for the transportation of non-taxable goods.

Yes, you can make an Excel delivery challan online using platforms with ready-made templates. Websites like Vyapar App offer different templates for download and personalize to fit your business.

Many businesses require invoices to include Excel capabilities for easy calculation and time savings. A delivery challan format is simple to create in Microsoft Excel. Select and customise the template that suits your requirements the most. You can create an outstanding challan for your customers in minutes using Vyapar’s free Excel DC templates.

A delivery challan is a legal document. It is required with the transportation of goods from one place to another.

In this situation, under the GST law, the transaction is not treated as a supply. It is issued only when you send goods. The GST does not apply to such transactions.

A seller usually issues a delivery challan in Word format to the buyer while the goods are delivered. These goods being transferred may or may not result in a sale.

According to the GST law, a tax invoice must be generated when any taxable material is taken out. The taxable material here denotes the material produced using the company’s raw material.

One crucial criterion of such taxable material is that there should have been some input tax credit on the raw material. Hence, it is under the law that the supplier generates a tax invoice. After that, the supplier collectively pays the tax mentioned in these invoices. However, certain situations exist when the material supplied is not meant for sale. In such cases, a tax invoice can not be generated. So, in these cases, the supplier can issue a delivery challan in place of a GST invoice.

A Returnable Delivery Challan is a document used when you send goods that are not meant to be sold but will come back later. It’s used for things like tools, samples, or equipment that are temporarily moved.

You use a Returnable Delivery Challan when sending items that need to come back, such as tools for repairs, items for testing, or equipment for demo purposes.

A Returnable Delivery Challan should have details like the sender and receiver names, description of items, quantity, purpose of sending, and the expected return date. It should also state that the goods are returnable.

No, a GST invoice isn’t needed for a Returnable Delivery Challan because the goods aren’t being sold. But GST details may be added if taxes apply to the transportation of those items.

Yes, with Vyapar you can easily create and manage Returnable Delivery Challans. It helps you add all the needed information, making the process smooth and well-documented.

A delivery challan is crucial in keeping track of items. The businesses that need PDF Challans are :

– Companies are involved in the trading of goods

– In cases where a single company transports items across various warehouses

– A supplier of goods and commodities

– A wholesaler

– A manufacturer