Credit Note Format in Excel

Vyapar can help you manage your business and issue Excel credit notes within minutes. Over more than 5 million small business owners trust the Vyapar app for many business requirements. It is effortless to use the app for creating credit notes using free credit note formats in Excel by Vyapar.

Highlights of Excel Credit Note Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

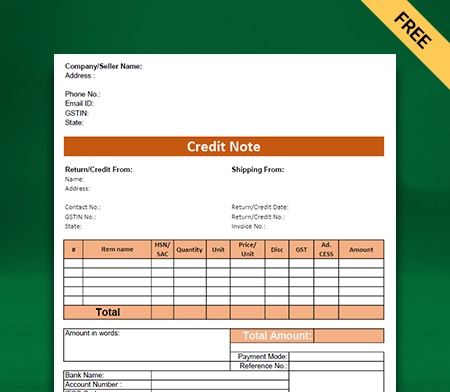

Download a Free Excel Credit Note Formats

Download professional free excel credit note formats, and make customization according to your requirements at zero cost.

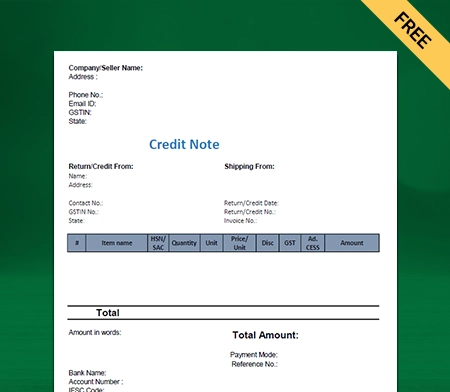

Excel Credit Note Format – 1

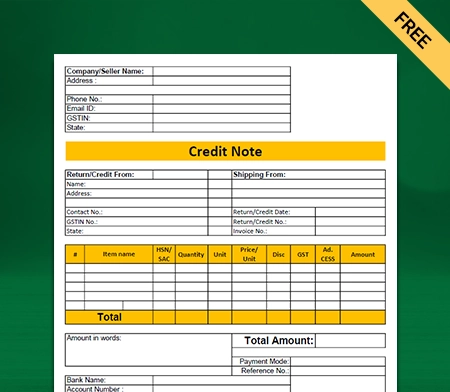

Excel Credit Note Format – 2

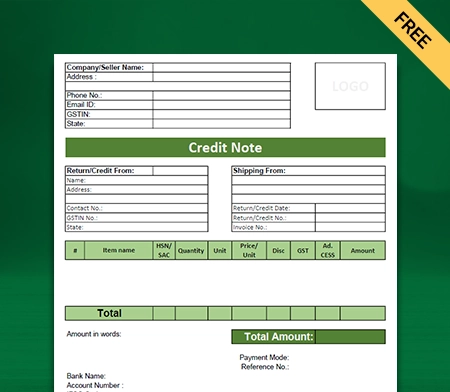

Excel Credit Note Format – 3

Excel Credit Note Format – 4

Generate Invoice Online

What Is a Credit Note?

A credit note is a document acknowledging sales returns that the seller issues to the buyer. The customer can use it in the future to offset future purchases. A credit memo is also referred to as a credit memorandum. You can download the GST credit note format in Excel and use it to create GST-compliant credit notes for your customers.

The credit note represents an acknowledgment of the debit note raised by the buyer. It helps imply that a buyer owes a seller less than their previous invoice. You can create and send credit notes for free to your customers using a professional credit note format in Excel. It serves as the basis for the sales return journal.

A supplier can issue a credit note to inform the buyer if there is a reduction in the taxable value of the goods supplied. Although it is not a refund, it is a way for customers to buy products later that represent the same value without paying twice.

Why Is a Credit Note in Excel Used?

Issuing a credit note using Excel format is permitted by Section 34(1) of the CGST Act. It is used when an issued tax invoice needs amendment. Making changes helps reduce tax liability by eliminating the chances of double taxation. The uses of credit notes are as follows:

- As and when the buyer returns a sale due to any possible quality issues, service rejection, or damaged goods.

- Suppose the seller has collected a higher price by mistake. Or the buyer has paid more than the invoiced price due to an error.

- Sellers may issue credit notes as post-sale discounts instead of a refund. It can help increase sales.

- When the customer gets less quantity of goods or lower quality service than stated in the tax invoice.

In any similar situation, the buyer can exchange his purchase for other items or services the seller offers. The primary reason to issue a credit note is to keep records straight for accounting purposes. After all, you can not delete or edit an invoice once it is issued. But, the credit notes let you modify the invoice amount without deleting the original invoice.

When Should Excel Credit Notes Get Issued?

Section 34(2) of the CGST Act, 2017, states the time limit to issue credit notes to customers. As per the act, a supplier can give a credit note:

(i) On or before 30th September.

(ii) On or before the date of filing of the annual return, whichever is earlier.

When a supplier/business has to cancel an invoice issued earlier, they can issue a credit note. Companies can create professional and unique credit notes for customers. All they need is the Vyapar Excel credit note format.

At times, one can wonder why they can’t simply delete invoices instead of issuing credit notes. The simple answer is that it is illegal to do so.

According to the law, you can not delete an invoice once it gets issued. The authorities monitor and regulate these actions very strictly. It is done to protect the interests of the consumer and eliminate fraud.

However, there are situations where it is necessary to cancel an invoice due for a genuine reason. In such cases, you can cancel the invoice, but it requires the issuance of a credit memo.

A credit memo allows customers to use their funds as they deem fit. You do not have to link the credit notes to invoices. You can issue them to your customers separately.

Create your first credit note with Vyapar App

Difference Between a Credit Note and a Debit Note

The main differences between credit and debit notes are listed below:

A debit note or debit memo is a formal request produced by the buyer. It conveys their request to the supplier to issue a credit note. Similarly, a credit note the seller sends to the buyer informs the customer about the credit made to their account.

For identification purposes, the debit note is prepared in blue ink, and the credit note is in red ink. Also, the supplier issues a credit note to the buyer in exchange for a debit note issued by them.

The debit note implies a reduction in account receivables. Meanwhile, a credit note implies a decrease in account payables. So, a debit note represents a positive amount, and a credit note represents a negative amount.

A debit note reduces purchase accounts, whereas a credit note reduces sales accounts. So, a credit note is a basis for the entries in the sales return book. Meanwhile, a debit note is a basis in the purchase return book.

Debit notes are issued by the buyer when they return the goods/services offered by the seller. In return, the credit notes are given by the seller to acknowledge the change in the transaction.

Why Do You Need a Credit Note?

Let’s go through an example to understand the importance of a credit note.

A seller creates an invoice for the goods or services sold to a customer. The customer pays for them. As the customer observes some quality issues later, he can cancel/modify the purchase.

The customer will return the goods. Now, the buyer returns the goods and sends a debit note. Now, the supplier can accept and prepare a credit note using a free credit note format in Excel.

It is done to acknowledge the buyer’s requests. To prepare a credit note professionally, the supplier can use the Excel format by Vyapar.

Contents of Credit Note

A professionally created credit note includes the products, quantities, and prices for products or services the buyer returns. You can use Vyapar credit note format in Excel to make one for your business requirements.

The supplier can issue a credit note in case of defective goods, errors, or allowances. Under any law, there is no prescribed credit note format in Excel. However, the supplier can include the following information to make it look professional.

1. Name and address of the business.

2. Unique serial number not exceeding 16 characters.

3. Document type.

4. Date of issue.

5. The total taxable value of supply, rate, tax, and tax credit.

6. GSTIN of the supplier.

7. Authorised representative’s signature.

Using a credit memo will reduce the buyer’s obligation to pay the previously issued invoice. The credit memo usually refers to the original invoice and states the issue.

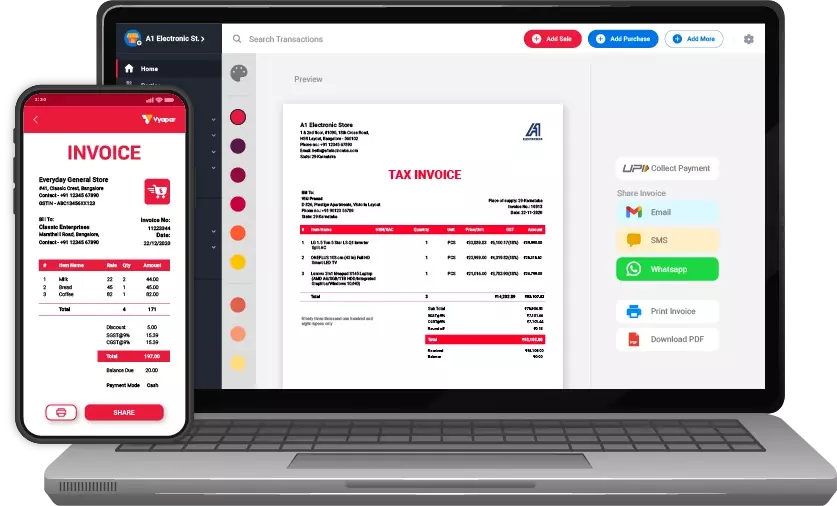

How to Create a Credit Note Using the Vyapar App?

Open the Vyapar App on your device and you can choose from one of the two options available to log the entry of credit notes within the Vyapar app.

1. Click on add more (+) button:

- You will find a sale return. Click on it.

- Enter the customer’s details. Including name and address.

- If inventory is involved then enter the product details or else you can issue the credit note by just mentioning the credit amount too.

- Save the invoice.

Creating a credit or debit note manually can take a lot of time. You can go with the easy option with Vyapar. You can use the app when you want to adjust a credit note to its specific invoice.

2. Go to the left menu:

- There is a sale section in the menu. Click on it.

- Click on the sale invoice. You will see the list of all invoices.

- In the search bar, find the invoice with the returned product.

- You can perform the search using many filters. You can use party name-wise, invoice number-wise, date-wise, amounts-wise, or invoice balance.

- The invoice will appear on your screen. Click on the three dots and then the return option.

- You will see that the credit note is already ready with all the required details.

- You can customise the credit note to add any additional detail. You can modify it to meet your needs.

- Make the required changes and save it.

You can check the credit note in the party transaction under the Report section.

Additional Benefits of Using the Vyapar App for Credit Notes

Free Billing and Accounting

You can access credit note format in Excel for free using the Vyapar billing software. You can create invoices, maintain inventory, and use many other features for free on Android devices. Additionally, any business can get a free trial for 7 days with the desktop versions.

Provide All Payment Options

The Vyapar billing solutions help accept a wide range of payment methods. Cash alternatives include UPI, NEFT, and IMPS. You can provide a QR code to collect eWallet and UPI payments.

Further, you can use a POS machine to collect credit/debit card payments. Customers are less likely to default when provided with multiple convenient payment options.

Track Business Status

Vyapar helps you keep tabs on business cash flow, inventory status, orders, and payment updates. It is essential to track and manage business activities.

The business dashboard in the Vyapar app makes the process simple. The dashboard will provide a clear picture of your business transactions.

Manage Cash Flow

Managing cash flow is considered vital for short-term business planning. It monitors cash flow which helps avoid business risks. You can track your payments using the billing software.

Our GST accounting software lets the users record all business transactions. The automatic management features help prevent mistakes in accounting.

Optimise Operations

Work smartly and keep up with the competition using the latest features in the Vyapar app. You can eliminate manual calculations and keep your books updated. It speeds up your accounting process and helps you optimise your business operations. With Vyapar, you can manage everything on a single app.

Online/Offline Software

You don’t have to stop your business activities because of a weak internet connection. You can use the credit note format in Excel available in the app to create and send credit notes to your customers. Further, you can generate new invoices, manage your cash book, and record expenses.

Data Backup and Security

Our free GST billing software in India allows you to set up automatic data backups. It helps secure the information stored in the app. It also facilitates quick access, file search, and retrieval.

You can also make a local backup for added security. Your data is synced and protected by advanced encryption in the Vyapar system.

Other Valuable Features of the Vyapar App

Multiple Themes

You can enhance your brand identity by using professional themes. The Vyapar thermal printer billing software has two thermal invoice themes and twelve regular printer invoice themes. Further, all themes are fully customisable to meet unique business requirements.

There are multiple theme options for thermal and regular printers. They are available for free, so all businesses can access them. GST Invoicing Software is suitable for all retailers, shopkeepers, freelancers, contractors, and other companies. The app allows you to customise and improve the look of your invoice.

Account Receivable and Payable

Vyapar allows you to keep individual records of account receivables and payables for all customers. Users can send payment reminders to any party via WhatsApp, SMS, or email. Further, in the Vyapar billing software, you can track the money you are ‘yet to receive’ and ‘have to pay’.

Users can keep all the transaction details secure and issue credit or debit notes seamlessly. You can set up payment reminders to ensure your customers pay on time. You can save time by sending payment reminders to all of your customers using the payment reminder feature. Having this data ensures you can manage the business cash flow.

Online Store

Using Vyapar GST billing solutions, you can take your offline store online. You can list all of the services/products you sell to your customers. The app will assist you in presenting a catalogue of all the services/products to customers. Furthermore, Vyapar billing software does not charge fees for using online store features.

A grocery store owner can list all groceries and receive orders in the locality. Once packed, you can deliver it to them, making it easier to compete with other local vendors around you. It will help you increase your online sales seamlessly. These features help assist you in taking your business online for free.

GST Billing Solutions

A professional invoice represents the identity of a company. You can create a GST bill online and offline in a few steps and keep your accounts updated. It automates your billing requirements which is a great help for businesses. The Vyapar app effectively assists medium and small businesses to save more time in accounting.

You can create and send invoices to your customers within minutes. Sharing your invoices with other business owners and customers is easy using the Vyapar billing app. Unlike other billing software, it will allow you to send GST invoices. You can create GST bills that comply with India’s GST law by using Vyapar billing software.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

You can easily use a credit note format in Excel. Open your payment credit note, and under Credit Note Options, select Edit. Make the changes and click Update or Save.

Vyapar provides free access to credit note format in Excel for all businesses. The free Excel credit note format in excel can help you save the time and effort required to create professional credit notes.

The credit note can include the listed details:

1. Order reference number.

2. Contact details of both parties.

3. Details of the credit provided by the supplier.

4. Reason for issuing a credit note.

5. Terms and conditions of the payment.

A credit note indicates the return of funds to the buyer. An invoice error, a damaged or incorrect item, or other circumstances can be the reason. The buyer can use this credit to get other goods or services from the supplier.