Credit Note Format in GST

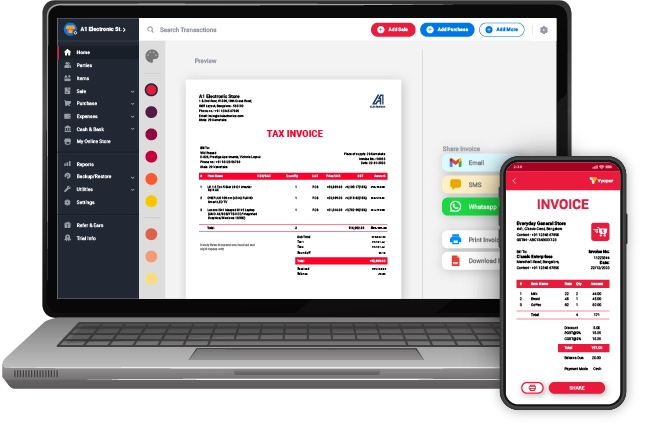

Vyapar can help you manage and issue credit notes in GST seamlessly. The Vyapar app is excellent for issuing bills, managing accounts, and creating credit notes. The best part is that using the credit notes in GST by Vyapar requires no external staff training.

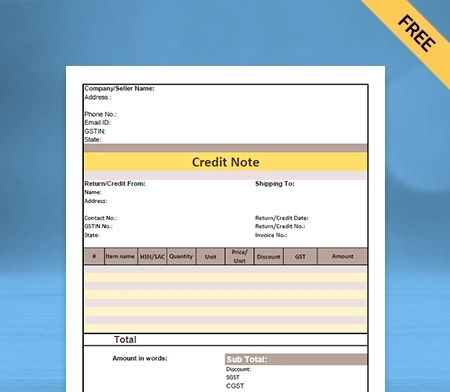

Highlights of Credit Note Format in GST

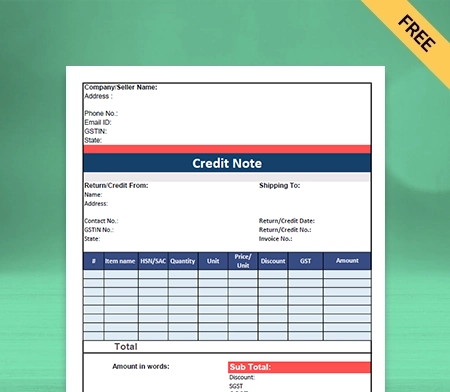

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built from scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

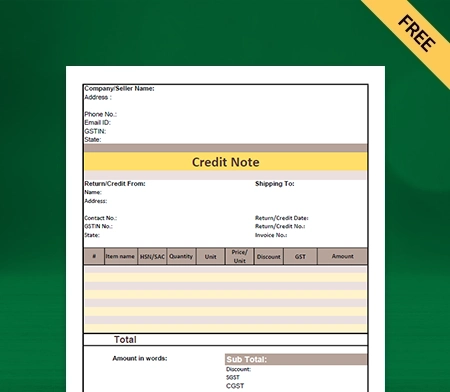

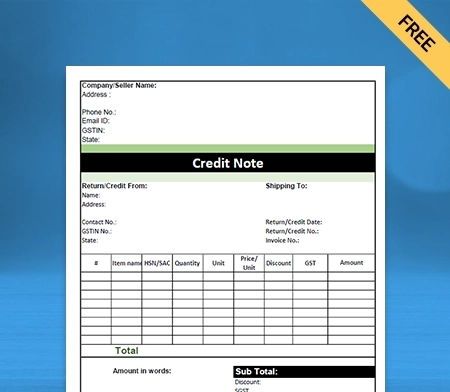

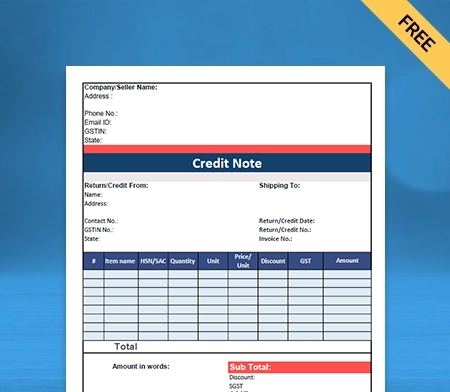

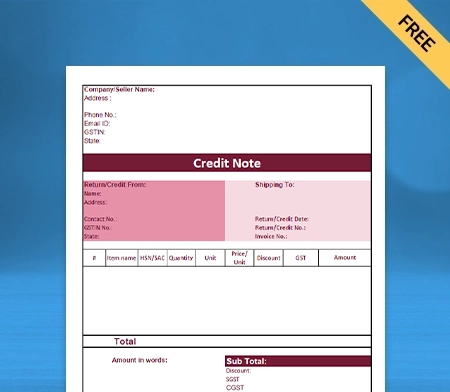

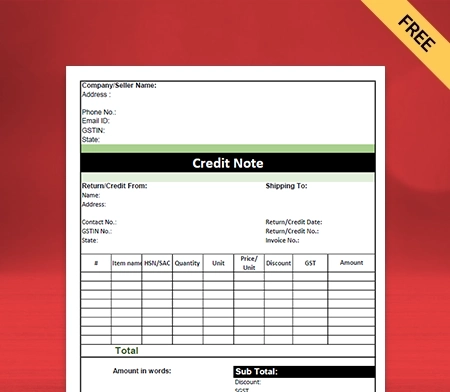

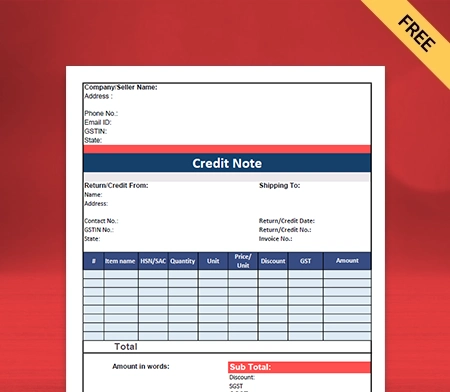

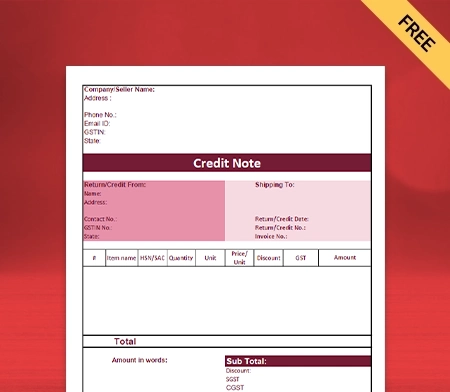

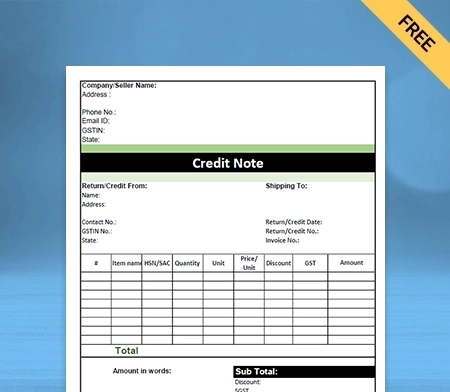

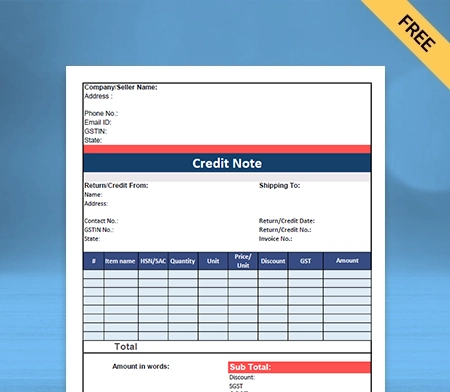

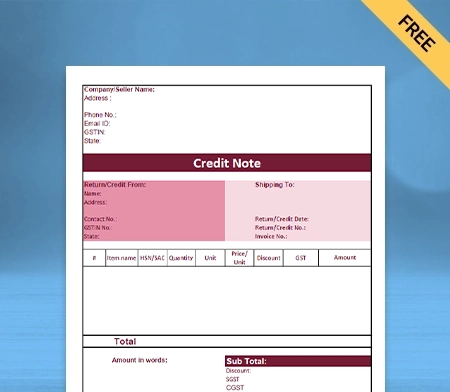

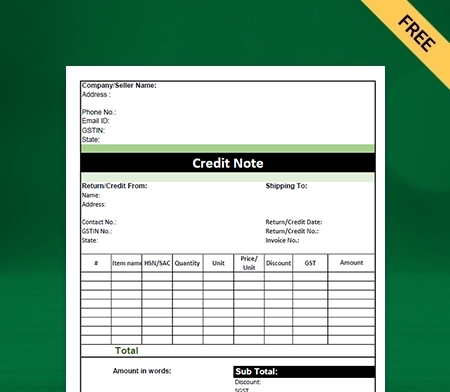

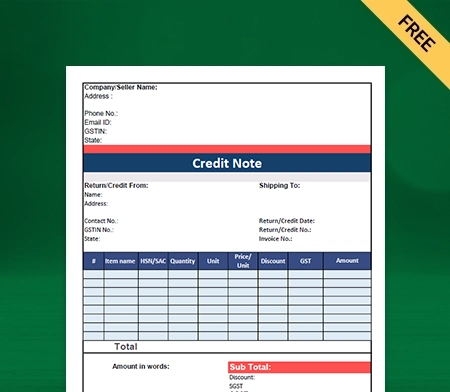

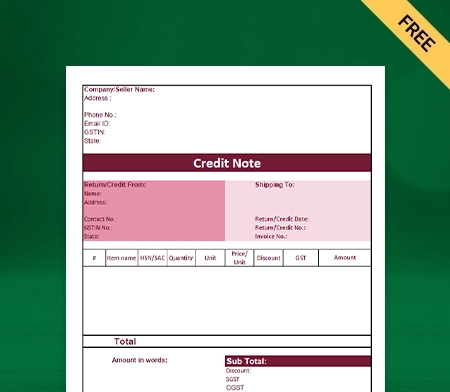

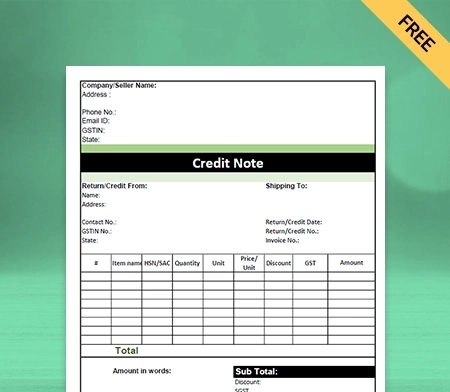

Download Credit Note Format in GST

Download the credit note format in GST, and customize according to your requirements at zero cost.

What is a Credit Note Format in GST?

Credit note format in GST is described under section 34(1) of the CGST act. A credit note in GST is part of the purchasing process, along with other documents such as quotes and invoices. They are generally used when something goes wrong during the purchasing process.

In these circumstances, the supplier has to offer a discount or refund to the customer. It is often called credit. Things that go wrong might be:

- The Goods provided by a buyer to a seller are faulty and damaged.

- Services provided by a seller to the buyer are not up to standard.

- The goods and services provided are acceptable. However, the seller has charged the customer the wrong price on the invoice.

- An agreed discount is not applied to the invoice.

- A discount has been agreed upon after an invoice has been sent to the buyer.

- When the buyer accidentally overpaid in the invoice.

Whatever the reason, When the mistakes like these happen, the seller needs to provide credit notes in GST to their customers.

What Are The Benefits Of Using Credit Note Format In GST?

Here are the following benefits given down below of using the credit note format in GST:

Credit Note Are Orderly In Terms Of Administration

Another function of the credit note in GST is an effort to be orderly in terms of administration. All operations in a business will be more orderly and funneled in the right direction in case there are written notes or documents.

To function in credit note format, you do not need to operate it manually, mainly because of the possibility of human error. To overcome these circumstances, you can use a document management system. The credit note in GST is helpful to make it easier if you need the document to view transactions that have occurred one day.

Credit notes in GST or memos are one form that can help business people to be administratively orderly and follow accounting standards for a financial year.

Credit Note Help You In Knowing Errors In The Financial Statement

Credit notes in GST help you to know about the errors often occurring in business operations, especially in the finance department. The memorandum should accommodate records of all transactions, which is one of the important reasons why this credit memo is needed. By recording all dealings and errors simultaneously, business people can evaluate so that they do not happen again in the future.

Credit Note Format In GST Helps You In Avoiding Financial Data Mistakes

Every small business must conduct a financial audit and report at least once a year. At the time of inspection, there are often transactions with unclear origins, which can harm your business when these transactions occur. These mistakes can often happen because of the lack of concern from the business owner towards the following transactions and notes or evidence in the company. To minimize the following errors, business owners can make notes or notes for every transaction, one of which is a note or credit memo.

Small Business Avoid The Possible Of Conflicts

Conflicts can occur anytime for various reasons, including between business actors and customers. Many things lead to this conflict. One of them is a misunderstanding between the Business owner and customer.

With a credit note in GST, this misunderstanding will not occur because there is already a written agreement. With it, your small business will avoid possible conflicts.

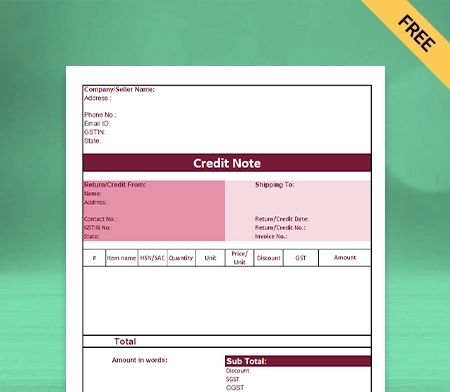

What Is The Format Used In The Credit Note Format in GST?

There is no prescribed format, but a credit note in GST issued by a supplier should contain the following particulars given down below:

- It should have the name, address, Goods, and Services Tax Identification Number of the supplier and the nature of the document.

- Contains consecutive serial numbers not above sixteen characters, in one or multiple series, containing alphabets or numerals or special characters hyphen or dash and slash symbolized as “-” and “/” respectively, and any combination thereof, unique for a financial year.

- It should have the date of issue.

- It should have the recipient’s name, address and Goods and Services Tax Identification Number or Unique Identity Number if registered.

- It must have a name, address of the recipient and address of delivery, along with the name of the State and its code if such recipient is unregistered.

- It should have the serial number and date of the corresponding tax invoice or, as the case may be, the bill of supply.

- It should have a value of the taxable supply of goods or services, the rate of tax and the amount of the tax credit to the recipient. Further, it should have the supplier’s signature (physical or digital). In the case of an authorized representative, the representative’s signature is required.

How To Create A Credit Note Format In GST By Using The Vyapar App?

Here are the steps to create a credit note in GST given down below:

There are two options available in Vyapar to generate a credit note in gst.

- Go to the homepage, and click on add more options. You will get the sale return option there. Click on that option. (You can also use the shortcut key (Alt+ R) to open the sales form).

- You will see the credit note window. You have to fill in the customer name, details, and invoice number, which generally asks for an invoice you might have created while selling goods to your customers. Fill in the invoice number so that your return can be adjusted against that invoice, and you can track it in the future.

- Fill in the details of the returned products, and fill in the amount paid. If you are returning the amount to your customer, and if you are not, then it is better to leave it blank. And now you can save it.

This method of creating a credit note in GST might be time-consuming for a lot of customers. You can use the alternate method below when you want to adjust the credit note along with its sale invoice.

- Go to the left menu sale section, and click on the sale invoices, where you can see all the invoices. Now, you have to search the sale invoice whose products are being returned, and this can search by party name, invoice number, date, amount, and invoice balance.

- After searching for your invoice with the respective options, you can click on the three dots and then click on the convert to return option. Your credit note is automatically ready, with all the required details like the customer’s name, invoice number and the items.

You can use the delete icon if you want to delete a few things in an item list. Only items in this list should remain to create a credit note. Then you can save it. - You can check these transactions by going into the report section, party statement option.

Your credit note in GST format is ready. As you know, this format comes in all three formats ( PDF, Word and Excel). You can share the GST credit note with your customers via email or WhatsApp.

Additional Benefits Of Using The Vyapar App

GST Billing With Tax Filing And Reporting:

Invoices are inseparable from any business as they directly impact your brand identity. Vyapar allows you to create GST and Non-GST opportunities simultaneously, and this professional platform helps you make the GST bills and credit notes under the GST laws of the Government of India.

With the Vyapar app for online and offline features, small businesses can seamlessly share the GST bills with their clients for goods and services. The Vyapar app has more than 10 GST bill formats.

When it comes to GST reporting, by using the Vyapar app, you can create different sorts of GST reports. For example, GSTR1: provides the summary of the month’s sales, and GSTR2: provides an overview of all the purchases for the month. There are many more GSTR reports on the Vyapar platform for small businesses financial year transactions.

Vyapar’s Payments Recovery System:

Vyapar billing software provides a route map for efficient receipt payment. Vyapar’s Payment GST app tracks unpaid bills and taxes charged on your invoices allowing you to collect balances and increase your financial cash flow.

Vyapar will send payment reminders to customers along with addresses and the GSTIN number to ensure you have a higher and faster collection rate. You can also maximize its simple payment recovery system to minimize your outstanding collections on the returns of your goods.

Multiple Payment Methods:

Vyapar app gears you with multiple payment options. You don’t have to waste time with your customers, as it provides different payment options so that they can pay you for your goods and services, tax and amount without difficulty and hesitation according to their comfort.

It makes your small business look more professional and reduces the acute angle and unwanted friction between you and your clients upon the payment options. Using the Vyapar billing software, you can receive your tax and amount by cheque and cash and even with a card payment system like debit and credit card at the same time.

Business Accounting Software like vyapar also allows you online transaction modes like net banking, IMPS/RTGS/E-Wallet etc. Even with other modern ways of payment, such as the QR code and the Barcode. It makes your transaction very smooth and quick at the same time.

Vyapar Provides You With The Business Dashboard:

Vyapar credit note maker app provides you with a business dashboard. With the Vyapar dashboard’s help, you can check your real-time business status. You can find the cash-in-hand, bank balance and other critical details of your business’s financial health in one place.

The app helps keep your work portfolio very smooth, and you can easily focus on the essentials of your small business. With such information, using the Vyapar app, you can make informed decisions for the financial year for your business.

Credit Note Vs Debit Note

The credit note is issued when the seller receives goods(returned) from the buyer showing that the money for the related goods is being returned in the form of a credit note. Meanwhile, a debit note is issued when the buyer returns goods to the seller.

The seller generally sends a credit note in GST if the goods are found incomplete, damaged or incorrect. On the other hand, the debit note is often used to return goods on credit.

Credit notes in GST often show a negative amount. Meanwhile, a debit note is generally prepared like a regular invoice and shows a positive amount.

The credit note in GST is sent to inform about the credit made in the buyer’s account and the reasons mentioned. On the other hand, a debit note is sent to inform about the debit made in the seller’s account and the reason mentioned.

Journal entry to record a credit note in GST in the buyer’s books; on the other hand, journal entry to register a credit note in the buyer’s books.

The sales book return book is updated based on the credit note in GST. Meanwhile, the purchase book is updated based on debit notes.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Download Free Customizable Credit Note Format In GST

GST Credit Note Format in Word

GST Credit Note Format in PDF

GST Credit Note Format in Google Docs

GST Credit Note Format in Excel

GST Credit Note Format in Google Sheet

Frequently Asked Questions (FAQs’)

Credit Note format in GST is defined as which made such supply or the date of furnishing the relevant annual return, whichever is earlier.

In other words, it is known that output tax liability cannot be reduced in cases where credit notes have been issued after September. The output tax for input tax credit liability of the supplier decreases once.

Use the credit note format in GST and other essential details such as the supplier’s name, address, and GSTIN. It must also define the nature of the document (Credit note, in this case), unique serial number (containing only letters and numbers), and date of issue.

GST credit notes include the name and address of the recipient. If the recipient is registered for GST, the note must consist of their GSTIN/UIN in that respective document.

GST is applicable on credit notes, just like debit notes. A taxable person must issue credit notes when there is a supply shortage of goods and services. So, the purchaser is no longer liable to make that payment.

Since the amount received in the form of credit note in GST is a discount and not a supply by the applicant to the supplier for goods and services.

Hence, no GST is levied on the receiver on cash discount/incentive/schemes offered by the supplier to the applicant through credit note against supply without adjustment of GST.

The GST law of the Government of India mentions the maximum time limit for declaring the same in GST returns on goods and services it pertains to a particular financial year. It should be reported on 30th September of the following financial year of supply..