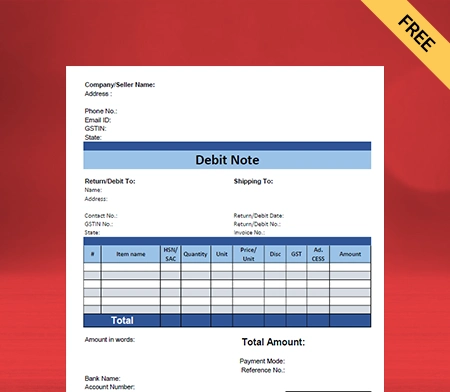

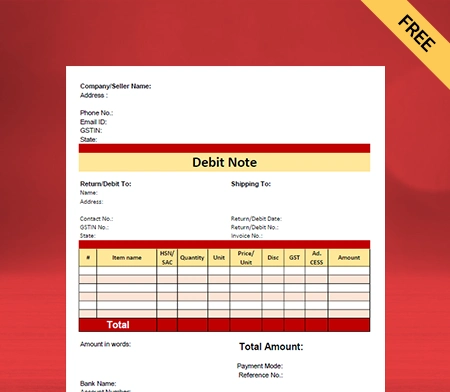

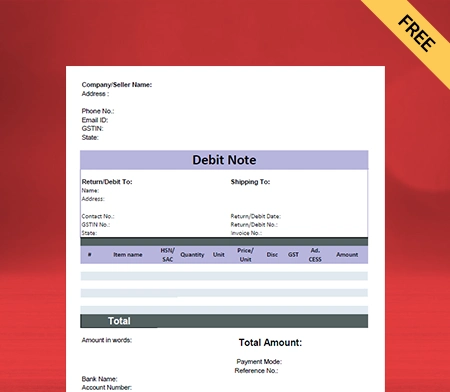

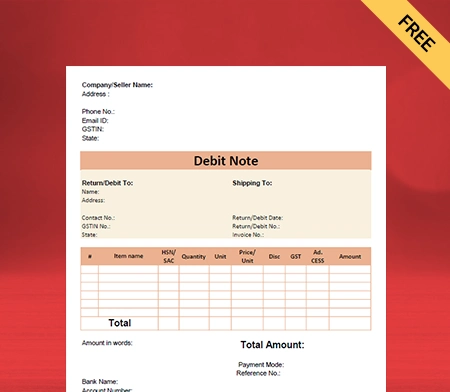

Debit Note Format in PDF

In case you are in the retailer business, you frequently come across the debit note, which you may have to issue to the supplier of your goods and services to call attention to their current obligations for the factual mistake or damaged goods.

Highlights of Debit Note Format PDF

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built from scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

What is a Debit Note Format PDF?

A debit note format pdf, also acknowledged by the name of the debit memo, is issued from a buyer to their supplier to request a return of funds due to incorrect or damaged goods, purchase cancellation or other specified circumstances.

A debit note may seem companion to a credit note, except it’s issued from the buyer’s side. Therefore, debit notes are issued before the sellers can create a credit note for their goods and services.

A debit note acts as a beneficiary’s formal request for a credit note from the supplier. The document serves as an attestation to support a purchase return in the accounting books of a client.

What is the Benefit of Using the Debit Note Format PDF?

Given down below are some advantages of issuing a debit note format PDF:

A Quick Way to Security:

Like many, industries and businesses have shifted to PDF files primarily because they can be password protected. As a beneficiary, in case you worry that your sensitive and important data needs to be kept secure from hackers and unauthorized personnel, PDF files give you the option to do so.

You don’t need to worry, as the best debit notes maker app ensures every possible way to keep your data intact. You may easily Secure your data which you may use while issuing the debit note to your supplier.

Moreover, a few important documents do not need further editing, so here can also give limited access to users, i.e., users can only view files but not make any changes to the content.

The Ultimate Deal on Format:

No matter who you share your debit memo with and on which device, the Format remains the same. It is easy to view and share your debit note, and it will not distort the components of your document. It makes your debit memo a professional note.

It is a major problem you may face while issuing the debit note in Word files where the Format goes awry if you open the file on a different version or device than it was created. But it is much more convenient to use in PDF format.

You can also customise your debit note format PDF as per your requirement. It enhances the quality of your business and services. It makes your business platform much more lucrative for other buyers and sellers.

The Ultimate Strategy is to be Multidimensional:

PDFs allow you to integrate different kinds of content, including your debit note memo, i.e., images, videos, graphics, animations, 3D models, etc., without ruining the document’s Format. It enhances the quality of your paperwork and makes it easier and smoother to perform your activities.

Moreover, using the PDF format also lets you make presentations, reports, and portfolios, so you don’t have to rely on different software for different tasks. You can use Vyapar billing software to perform your debit note operation seamlessly.

You can also make your debit memo documents more aesthetically pleasing by adding visuals without any trouble. It may attract your client’s attention and loyalty to your business.

Extremely Convenient to Use:

PDFs work masterfully on all operating systems as the Format is easy to view and share on any online digital platform. Most android devices even come with built-in apps to view PDF files.

Using a tool like Vyapar can help make it convenient. Using the Vyapar app, you can send the debit note in PDF seamlessly. Vyapar is free software that works very well and can make it easy for you to create PDF debit notes.

Makes your Format Compact:

The best thing about the debit note format PDF is how you can compress complete information into a file size that is easy to share or receive without compromising quality. You don’t have to store information separately; you can only do it in a single format.

Debit note format PDF does not take up too much space in your hard drive, and they can be shared quickly and easily. It is great for industries and companies that have to manage an influx of data daily to perform their business operation.

You can issue the debit memo in PDF seamlessly by using the professional platforms of Vyapar, which already comes with all the essential details needed to create the debit note. It comes at very affordable prices, and there are many features for which you don’t have to pay an extra dime.

What are the Features of Using the Debit Bill in PDF Format?

The certain features for using the debit note format PDF are given down below:

Drag and Drop in Samurai Way:

Using the debit note format PDF requires no technical knowledge. You can use the drag-and-drop element you want to see in your debit note in PDF documents. It is very simple to use, and you can easily create and customise the Vyapar billing software.

It is very convenient and is one of the best modes for older people with little knowledge about technical things. Vyapar ensures every possible way to help you easily generate a debit note format PDF to your supplier.

Customize your Credit Note That’s What Professionals do:

YIn case you are using the debit note in a PDF document. You can easily customize your debit note in PDF to match your name by selecting a background colour or image, adding a logo, or changing fonts and colours.

Using such tools, you can make your business platform more lucrative and professional. With Vyapar, you can customize your credit note in PDF format per your requirement.

Vyapar gears you with all the essential tools and techniques to perform your business without facing difficulties in your platform, like accounting, reports, etc.

No Stress Guaranteed by Sharing Your Debit Note in PDF:

Your debit note is in a PDF document. Once it is created, you can easily share it on various Online platforms with your supplier. You may not have difficulty with it as it is convenient to share and requires no technical skill or knowledge.

People with limited knowledge can also share it easily on WhatsApp and can be emailed to suppliers and customers in just a few easy and simple steps.

You can easily use the professional platforms of Vyapar to create, customise and send your debit note in PDF format to your supplier seamlessly.

Customize the Format as you Wish:

When you download your debit note in a PDF document, you can give it a custom format and name to make it easy to save and search for your business operation in the future.

You can easily search and send it to your supplier per your requirement. It makes your work a lot easier, and you don’t have to spend extra hours searching the files. It is very easy to customize your file, especially when using the professional Vyapar platform.

It gears you with all sorts of tools and techniques to easily and quickly perform your operation. Vyapar comes at very affordable prices in comparison to other platforms.

Facing Difficulty with Electronic Signatures: Here is a Simple Solution:

While using the Portable Format Document, you can easily accept electronic signatures whenever someone fills out your online form. You can also get your supplier’s signature over your debit note format PDF per your terms and conditions.

It already has all the automated details in the debit note in the PDF document. Vyapar offers several signature widgets, so you can pick one that best meets your needs.

You can also insert the blank space into your debit note in PDF if your supplier wants to leave any additional comments on anything. You may easily customize your debit note format PDF as per your requirement by using the Vyapar billing software.

Why Vyapar App is a Better Alternative to Debit Note Format?

GST Billing and Reporting:

Issuing the bills and invoices to your customers is essential as they impact the brand’s identity. Vyapar billing simultaneously creates professional GST bills that comply with the GST law in India.

You can generate multiple invoice formats and bills per your requirement using a professional Vyapar billing platform. Vyapar has online and offline features, and small and medium business owners can easily share their GST invoices and bills with customers.

You require no technical skill or knowledge to perform your operation. It can be created easily in a few simple steps as it comes with all the automated details. Regarding reporting, you can generate all types of GST reports printable that are essential as per your business platform in different sizes.

With this Vyapar app accounting software, you can generate multiple invoices and bills in simple steps. You can also customise your bills and invoices as per your requirement on Vyapar.

Online/Offline Software:

Vyapar debit note maker app helps you manage your business-to-business transaction online and offline. You may run your business from the hilly regions or densely forested areas where you frequently face the problem of poor internet and network connection problems.

You may travel across places for business purposes, so performing your day-to-day tasks becomes very difficult. Using the Vyapar debit note maker app helps eliminate business management issues in network-prone areas as it works online and offline.

Further, you will get multiple features without paying an extra dime. Vyapar comes at very affordable prices. You don’t have to worry about having an active internet connection to create debit notes in PDF.

You can customize your debit note format PDF using the Vyapar billing software per your requirement. You can issue invoices and bills which comply with the laws of the Government of India to your clients seamlessly.

Speed and Accuracy:

Speed is an essential part of the modern era for online business as you can reach thousands of people in a few clicks. Businesses are polishing their delivery speed to be more profitable and advantageous over their competitors.

So, you know the importance of speed and accuracy in today’s business environment. Here comes the Vyapar debit note maker app in play as it helps sharpen your business activities in your day-to-day operations. It will make your business meet modern-era speed and accuracy in your business tasks.

Thus, with the help of the Vyapar app, you can add pace to your business operations and achieve your goals and issue the debit note in PDF format to your suppliers seamlessly. Further, automation will eliminate the possibility of making errors while creating debit notes in PDF format.

Create Various Transactions:

Using the Vyapar app, you can make purchase and sale transactions seamlessly. It is very easy to use and requires no technical knowledge to perform your business activities.

Our free billing and accounting app is suitable for use by people of all generations. A businessperson can easily acclimate to the function and features of our debit note maker app.

You can also issue other important transactions such as the expense, sale-purchase return, sale and purchase order, estimate and quotation, payment in-out, Credit and debit note, delivery challan, e-way bill, etc. You can issue these transactions seamlessly by using the Vyapar app.

Vyapar billing software is trusted by more than one million small business owners in India for many business activities. You can use bills and invoices per your requirement using the Vyapar debit note generator for free.

Tax and Discounts:

Vyapar gears you with item, transaction-wise tax, and discounts on your goods and services. Item price can be inclusive and exclusive of taxes. You can add or modify the tax rate and tax group.

Any employee in your team can learn to share these transactions in your bill or invoices with your clients. They can share it on SMS, WhatsApp, and Gmail. You can perform discount management on the Vyapar app using your android device and PC.

You can receive your payment via Quick Response codes and UPI payments. Vyapar is a professional platform that is a panacea for many problems with accounting or poor network connection.

Vyapar gears you with all sorts of tools and techniques to perform your business operation seamlessly. You can enjoy its features and tools to make your business more accessible and reachable to your clients. You can customize the debit note in PDF format per your requirement using Vyapar.

Parties: Registered Unregistered-Regular & Registered Composition

You can manage party Email, phone, registered-address shipping address, shipping address, GST number, etc. You can manage Party additional fields to manage PAN/registration/DoB etc. You can add and assign tasks per your requirement in a party group.

You can manage the party by opening the balance after that and the payables balance. You can set up reminders to receivable parties. You can easily transfer the party-to-party balance transfer, and Vyapar billing software comes at very affordable prices for your business operation.

You can perform multiple tasks by using the billing features in our debit note maker app. You can track your payments through offline substitutes such as cash and cheque. Online substitutes include UPI, IMPS/RTGS, E-Wallet, Net banking, etc. It makes your business more professional and helps to build customer trust and loyalty.

Create your first invoice with our free Invoice Generator

Debit Note Format in PDF

Frequently Asked Questions (FAQs’)

A debit note, also acknowledged by the name of the debit memo, is issued from a buyer to their supplier to request a return of funds due to incorrect or damaged goods, purchase cancellation or other specified circumstances.

You can use the Vyapar billing platform to create a debit note in PDF format, as it comes with automated data required to make a debit note. Later you can choose any format available (PDF, Word, and Excel) in Vyapar best billing software.

You can use the Vyapar billing software to create the debit and credit format. Later you can choose PDF format, among other options, to create your debit and credit notes. Creating and sharing debit and credit notes is easy using the Vyapar billing software.

A debit note or debit receipt is associated with an invoice. The main difference between invoices and debit is that invoices always show a sale, whereas debit notes and receipts reflect adjustments or returns on transactions that have already taken place.

Recipients can issue debit notes in PDF without GST. In any condition, the recipient does not accept the value shown in the supplier’s invoice.

The seller does not issue a credit note in PDF, and the recipient has only the option to issue a debit note in PDF without GST; otherwise, it will inflate the purchases.