Debit Note Format in Word

Vyapar can help you manage and issue debit notes seamlessly. Over 10 million small business owners trust Vyapar in India. Businesses can use the app to create debit notes using free debit note formats. The best part is that using the word debit notes by Vyapar requires no technical knowledge. Start your free 7-day trial now!

Highlights of Debit Note Format Word

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built from scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

What is a Debit note format in word?

A debit note is a commercial note evidencing that a debit has been made to the account of the party named in the debit note. A debit note is generally issued to the sellers. However, a seller can issue a debit note too.

The debit note is a commercial note used as a source document for recording the purchase return in accounting books. The debit note in word format can help businesses professionally present data in a debit note.

Why is a debit note format in word used?

A debit note is permitted by section 36 of the CGST Act. The buyer issues the word debit note to the seller as a means to request a credit note. A seller can issue the debit note to the buyer when they wish to adjust the invoice amount upwards. It is done when the earlier invoice is recorded in the wrong value.

We came across these debit notes in business to business transactions. The use of debit notes is as follows:

Issued by the seller:

- When the amount stated in the invoice is not correct.

- Receipt of damaged and defective goods.

- When there is an overstatement of the value of the invoice.

- On the cancellation of the purchase of products/services.

- When goods received are not up to the buyers expected standards.

Issued by the buyer:

- When the payable amount to the seller increases significantly.

- When the value is understated in the invoice.

- When the addition is made to the order of product/service.

When should a debit note in word format be issued?

A debit note is a commercial document issued by the supplier under section 34(3) of the CGST Act when there might be a GST charge invoice or a need for an increase in taxable value. As per the act, a supplier can give a credit note on or before 30th September. Or before the date of filing of the annual return, whichever is earlier.

The debit note is issued by the seller/business when the tax invoice is issued, and the taxable value given in that invoice is less than the actual taxable value.

The debit note is also issued when the taxable amount or GST charged is lower than what is applicable for such goods and services.

When goods issued to the buyer are damaged, expired, or unfit for use/ sale to the end customer or when goods delivered are not in proper condition.

A debit note is also issued when incorrect billing/miscalculation cancellation of products and services purchase.

Debit Note Vs Credit Note

Significant differences between credit and debit notes are as listed below:

A Debit note or debit memo is a document that reflects that a debit is made to the other party’s account. On the other hand, a credit note is an instrument used to inform the other party’s account is credited in the party books.

A Debit note represents the positive amount while a Credit note represents the negative amount, which means a debit note lowers account receivables. In contrast, a credit note lowers the account payables.

In the case of a debit note, the purchase book is updated. Meanwhile, the sales return book is updated in the case of credit notes.

The customer generally issues a debit note to the supplier (seller of the goods). On the other hand, the credit note is issued by the supplier (the seller of the goods) to the customer (the buyer of the goods).

A debit note is issued during the credit purchase. In contrast, the credit note is issued during the event of credit sales.

A debit note is another form of purchase return of the product. However, the credit note is another form of sales return.

A debit note is issued in exchange for credit notes. Meanwhile, credit notes are issued in exchange for debit notes.

As a standard practice, a debit note is prepared in blue ink, while a credit note is written in red ink.

Why do you need a Debit Note format?

Let’s understand why the debit note is required through the example:

The buyer issues the debit note or debit memo to initiate a purchase return for the goods procured on credit. It is done when the supplier fails to deliver goods or services on time or when they are overbilled.

Further, a debit note is issued when there might be a calculation error or when a buyer isn’t interested and no longer wants to make a purchase. When higher taxes are applied on goods and services, or when goods offered to the buyer are damaged, defective or inappropriate in shape, size, or quantity.

The sellers can also issue the debit note when the seller wants an adjustment in the invoice, when the seller changes or increases the billing account, when the buyer suddenly increases the order quality, or to remind the buyer about their current debt obligations.

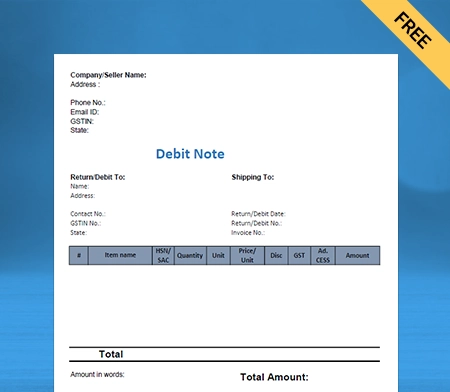

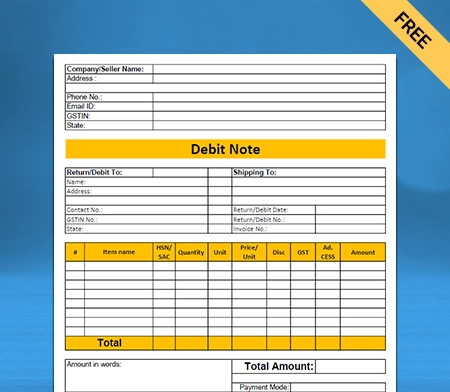

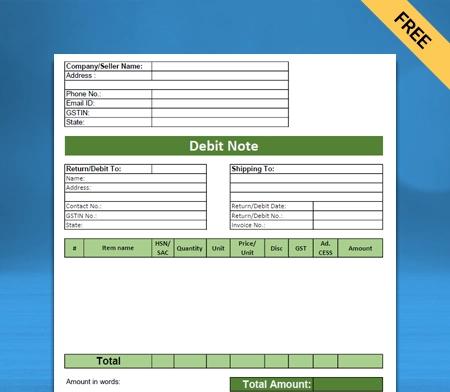

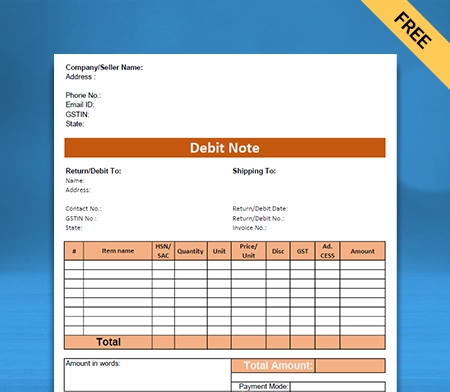

Content on the Debit Note Format in Word:

Debit Memo usually includes:

- A serial number.

- Date of the note.

- A brief description of the prior business to business transaction.

- Details of the item return.

- The signature of an appropriate company authority.

A Debit Note invoice can include the following information:

- The name of the company or issuer.

- Zip code, issuer’s address, web address, and phone number.

- Date of creating a debit note.

- Date of placing the order.

- Order number for which it is issued.

- Order terms and conditions.

- Company’s name (buyer).

- Customer Id-as stated in the invoice.

- Zip code, buyer’s address, email id, and phone number.

- Name of the contact person (buyer).

- Invoice details- item name (goods and services), the reason for debit, item description, quantity, price, and the total amount.

How to create a Debit Note format in word using the Vyapar app?

You can create a debit note using the Vyapar app. To make one, open the Vyapar app. There are two options available to log the entry of debit notes.

1. Click on add more (+) button.

- There you will find a purchase return. Click on it, and there is also a shortcut key(Alt+L).

- Enter customer number, name, and invoice number. It can be adjusted against that invoice so that you can track it in the future.

- Put the details that must be included and the amount in the received amount. If you take your money back, then fill that box, or if you don’t, leave it.

- Save the debit note and share it.

The main drawback of this method is that it is time-consuming for the customers. So Vyapar app offers you a simple and clear-cut method. It is generally used when Debit Note is adjusted with its particular purchase invoice.

2. Go to the left menu.

- There will be a purchase section. Click on it.

- Find whose products are being returned here.

- You can search according to date, invoice number, amount, or invoice balance, through any following method.

- The invoice will appear on your screen. Click on three dots.

- Then click on the convert to return option.

- Debit Note is ready with Vendor’s name, invoice number, and other essential details.

- Then in the item list, you can delete the other products by using the delete icon, and you will go with only those products whose Debit Note you have to make.

- Then save this invoice after altering the necessary changes.

You can check the following transaction in the party statement.

Additional benefits of using the Vyapar app for Debit Note requirements:

Convenient Data Entry:

As we all know, manual bookkeeping requires data entry. You will spend most of your time filling cash registers and spreadsheets as a bookkeeper. Luckily, here Vyapar app automates these time-consuming tasks to focus on what matters to you.

Using the debit note maker app, you can modify your bill amounts seamlessly and track the changes. Further, you can create and manage invoices and debit notes and seamlessly maintain accounts.

Speed And Accuracy:

Faster billing is essential for running any business. Generating GST-compliment invoices, setting bill payments, and estimates on the go is something we need to do. Vyapar app for desktop here lets you do it all seamlessly.

Thus with the help of the Vyapar app, you can add pace to your business operations and achieve your goals. Further, automation will eliminate the possibility of making errors while creating debit notes.

Efficient inventory management:

With the help of the Vyapar app, you can effectively track and manage inventory. Its dashboard will provide you with real-time insights into your stock inventory level. Vyapar will let you determine which items are about to run out of stock.

The data adjusts with the entry of invoices, expenses, and debit and credit notes automatically. So, you can place an advance order with your suppliers before you run out of them in your store.

Cost-Effective solutions:

A vast number of SMEs spend at least more than INR 50000 a year on accounting and administrative costs. Vyapar app will eliminate all the extra costs so you can use your money for business growth.

Further, it will eliminate manual work and automate various business processes. You can access the premium features in the Vyapar app to create personalized debit and credit notes at a small subscription cost.

Online/Offline Software:

Vyapar app helps you perform your business transaction both online and offline. You don’t have to worry about having an active internet connection to create debit notes.

The Vyapar app helps you to use the free debit note format to create and send debit notes. Further, you can also generate invoices, record expenses, and manage your cash book.

Customisation options:

Vyapar app also offers a lot of themes to change your debit note format at your own will. You can make the changes according to meet your unique business requirements. Vyapar also offers professional invoice formats that will let you send well-designed invoices.

Using the app, you can manage the bills and keep track of debit and credit notes to manage payments effectively. Personalized debit notes can help build a positive brand outlook. It can help showcase your professionalism.

Bank account management:

We all know that managing multiple bank accounts and payment options is not an easy task. But the Vyapar app or PC makes adding and managing multiple bank accounts much easier. It supports POS devices and QR codes.

It can help you get payments through credit cards, debit cards, UPI, and e-wallets to ensure efficient payments. You can also use the Vyapar dashboard to tally your bank statements and monitor your cash flow.

Other valuable features of the Vyapar app

GST Billing and invoicing:

These days creating GST-compliant accurate invoices is essential to run your Business throughout India. Vyapar supports various types of mixed, credit, and proforma invoices. It helps create debit and credit notes too.

With the help of Vyapar billing software, you can create GST bills that comply with India’s GST laws. It automates your billing requirements which is a great help in running your respective businesses. The Vyapar assists small and medium businesses to save more time in accounting.

Here, you can create a GST bill in both online and offline modes in a few simple and easy steps, which will help you keep your account updated. Vyapar app makes sharing your invoice with other business owners and customers easy.

High-Grade Security:

Vyapar software offers outstanding security features that ensure data security and provide safe authorized access. It comes with auto backup to Google-drive and manual backup to Google-drive, email, and local drive.

Using Vyapar ensures that your data is safely updated to servers. Further, you can create debit notes for your customers and share them with them.

Receivables and Payables:

Vyapar app also helps you to segregate the accounts receivables and payables. The free debit note format maker app lets you stay on top of your finances and quickly determine the amount of money you have to “receive” or “pay” to someone. Moreover, Vyapar also helps you to identify the defaulters who have delayed your payments.

Vyapar software users can keep all the transaction details safe and secure and issue debit and credit notes seamlessly. Vyapar helps to save time by sending payment reminders to all your customers using the current payment reminder feature.

Online service Catalogue:

Here Vyapar software/app helps you to set up your beautiful products/services catalog for your customers, and it means helping you to receive online orders from your customers. It gives you more business through online business.

Vyapar also lets you list all items’ details and help your customers place orders online. So, your customers do not have to reach out to your store, and you can deliver the items to their doorstep for convenience.

Debit Note Format in Word

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

Yes, you can make a debit note using the Vyapar app. Vyapar app provides free access to the debit note formats for all businesses. The free format can help you to save time and effort in creating professional credit note formats.

Using word formats for debit and credit notes by Vyapar, you can perform debit and credit. It will help you manage the invoice changes professionally and keep track of them in one place.

Issuing a debit note further increases the tax liability. As far as tax payments and tax returns are concerned, a debit note is treated the same as a tax invoice.

The details of a debit note are generally declared by the supplier while filing returns for a month it was issued, either by September after the financial year in which the transaction took place or by the annual return file date, which comes first.

There is no deadline for issuing the debit note, but once it is issued, the supplier must declare it in their respective monthly returns no later than the following month.

All data and records related to the debit note must be preserved. They must be kept accessible for both digital and physical use until their expiry. It is 72 months from the date of providing the relevant annual returns.

A debit note is not eligible for input tax credits in the following circumstances;

-> Any incorrect refunds, short-paid taxes, unpaid taxes, fraudulent ITC utilization, intentional provision of fake details, or omission of dates. (SECTION 74)

-> When penalties have been levied on goods and taxes. (SECTION 130)

-> When the goods and vehicles are seized at transit points. (SECTION 129)

In these following circumstances, the document must state ‘INPUT TAX CREDIT IS NOT ADMISSIBLE’.