Delivery Challan Format | Excel, Word, PDF

Create compliant, professional Delivery Challans instantly with our free, ready-to-use templates.

- ⚡️ Stay 100% GST-Compliant for Job Work, Stock Transfers & Goods Movement

- ⚡ Download Ready-to-Use Challan Formats in Word, Excel & PDF Instantly

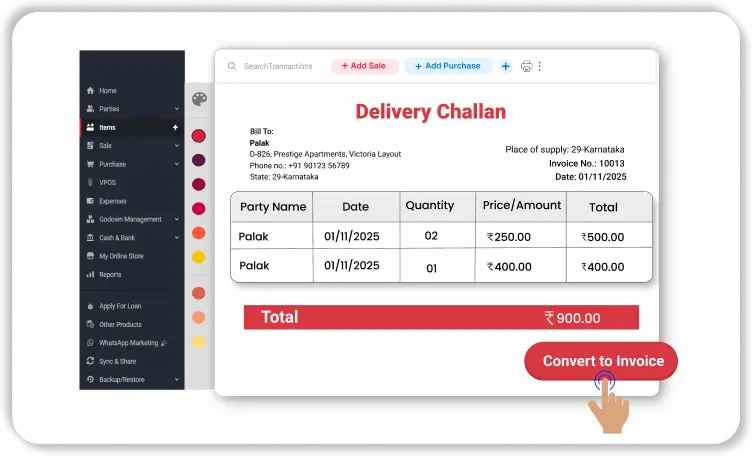

- ⚡️ Speed Up Billing: Convert Any Challan into a Final Invoice in One Click

What is a Delivery Challan?

A Delivery Challan (DC) is a formal document used by a business to track and confirm the movement of goods. It is a crucial tool for businesses that need to transport inventory for reasons other than a final sale.

Unlike a tax invoice, a Delivery Challan does not record the sale price or tax amount. Its primary purpose is to serve as proof of dispatch and transport. It is legally mandatory under GST Rule 55 for specific activities, such as sending goods for job work, stock transfers between branches, or delivering items on a trial basis. It provides a transparent audit trail for physical inventory movement.

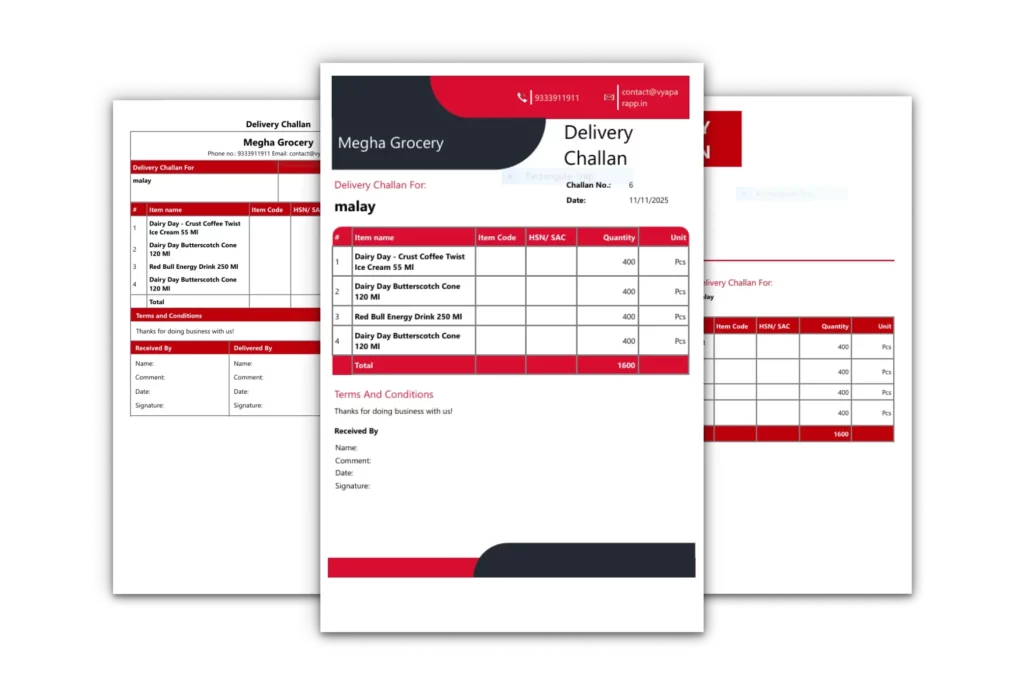

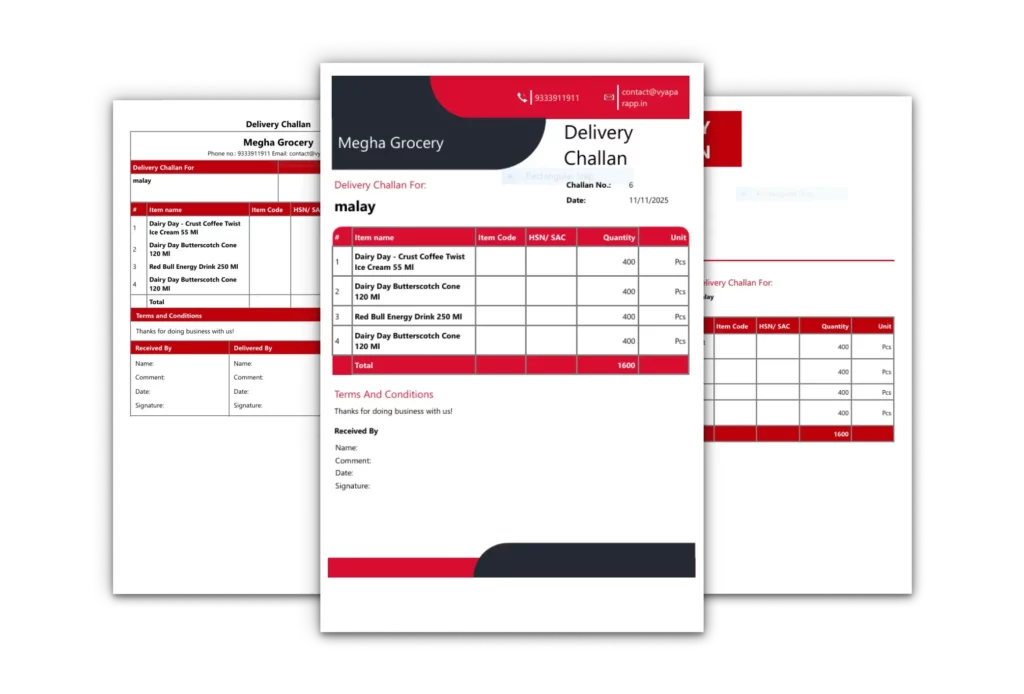

Ready for a Seamless Stock Workflow? Explore Our Premium Delivery Challan Themes

Our free formats are a great start, but the Vyapar App offers a superior, automated solution. These modern designs are exclusively available inside the Vyapar App, where you can instantly convert your delivered Challan into a final GST Invoice while saving time and eliminating manual data entry.

French Elite

Double Divine

Professional

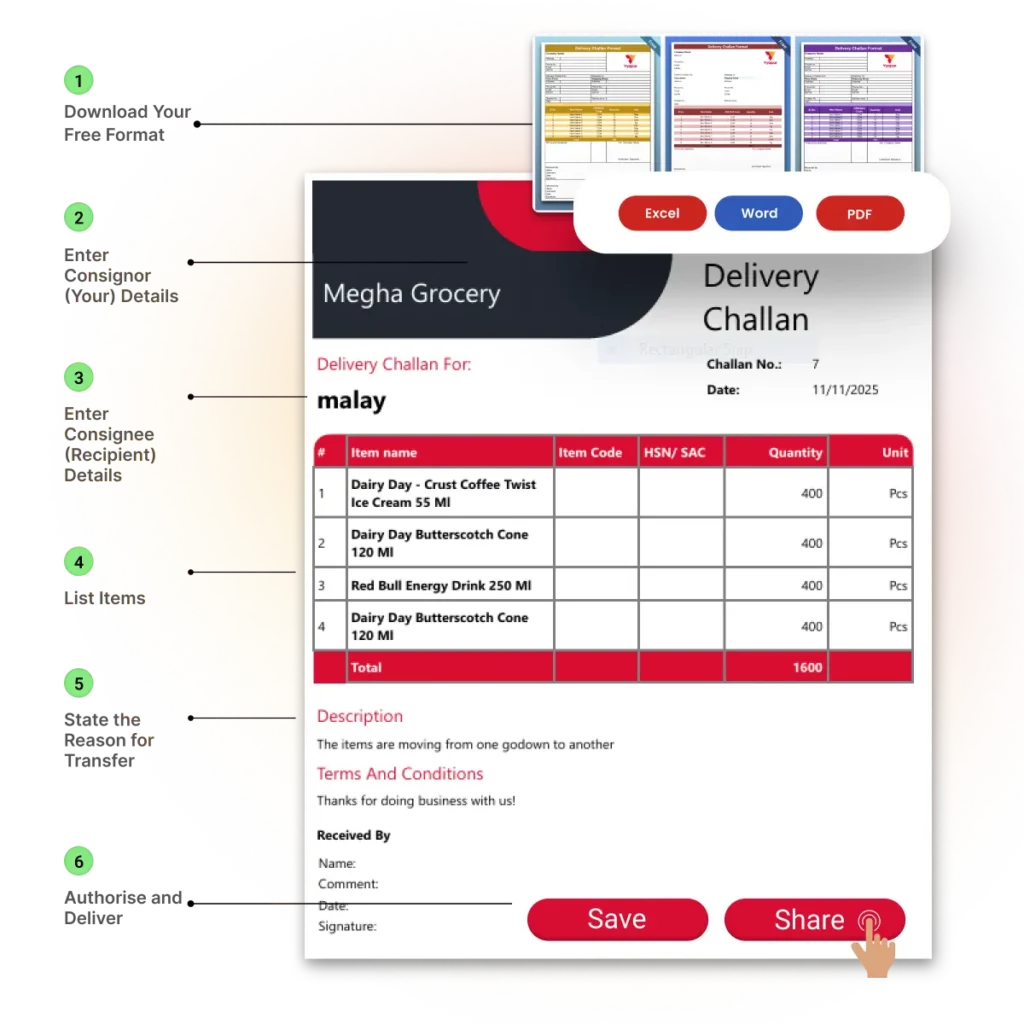

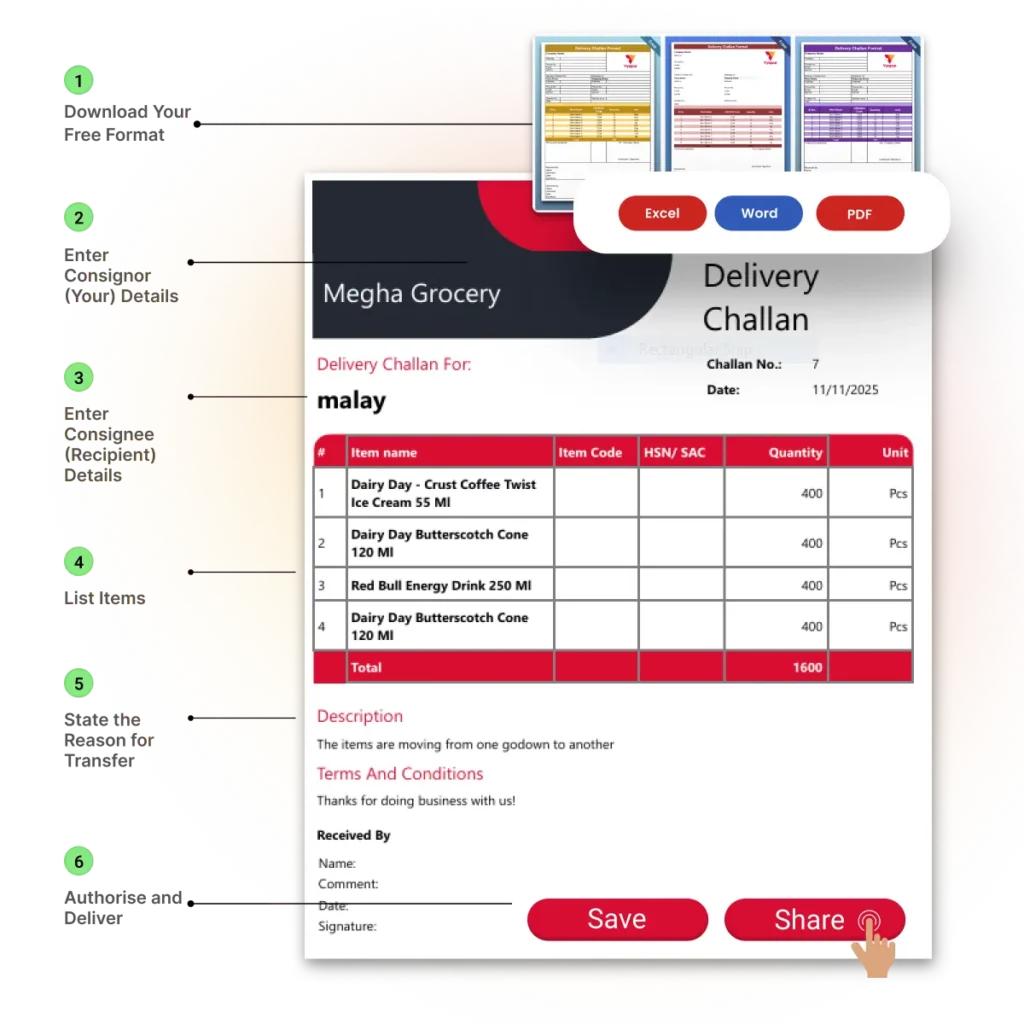

How to Use a Free Delivery Challan Format

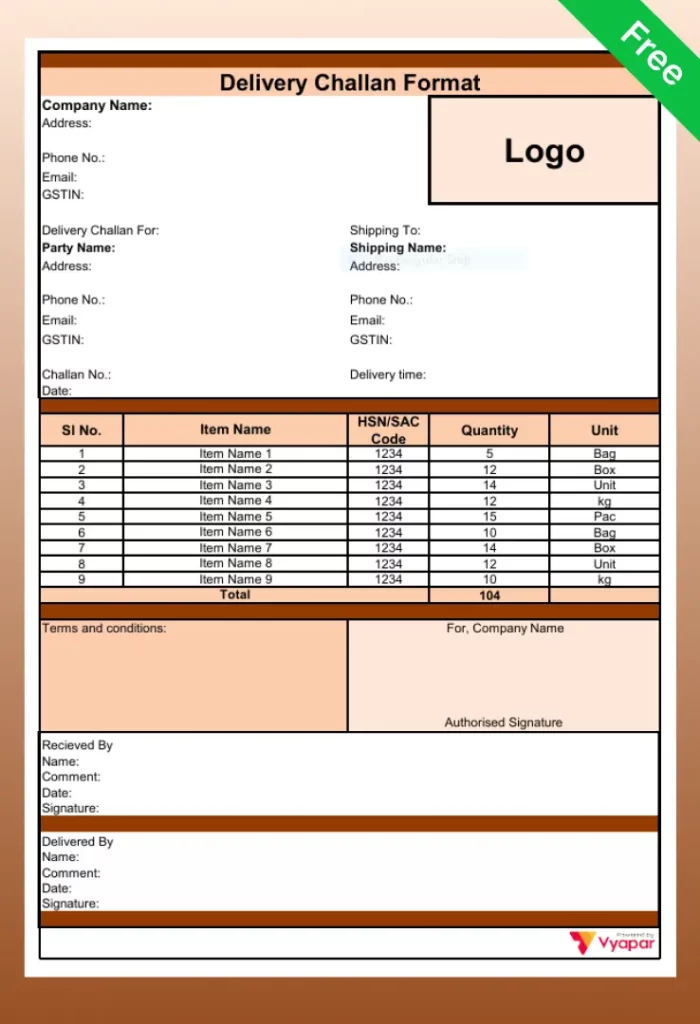

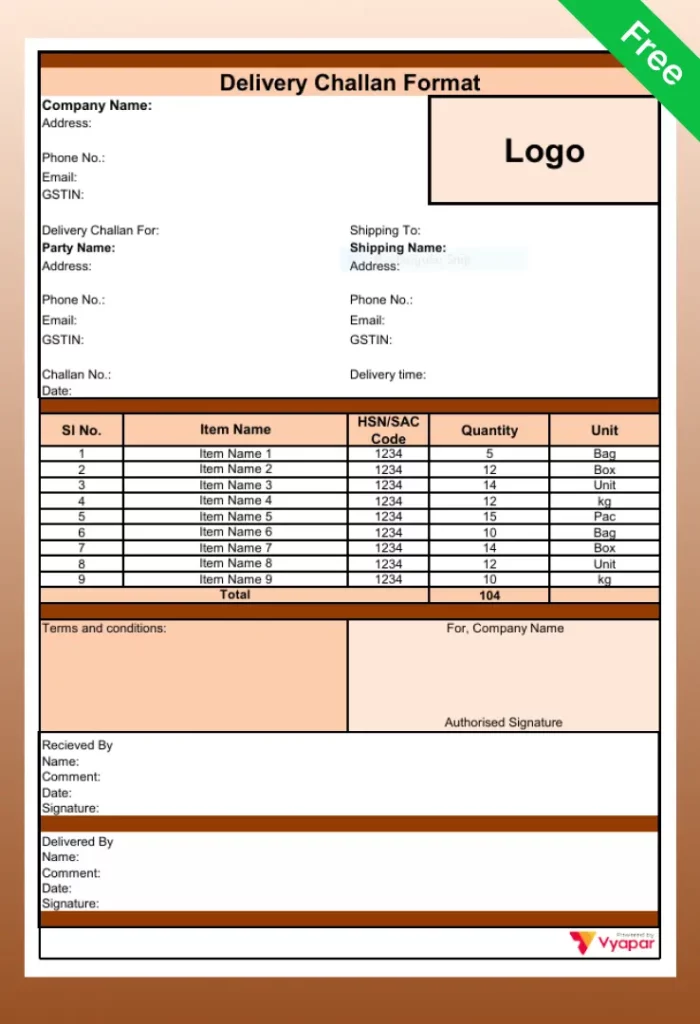

✅ Step 1: Download Your Free Format: Choose the Delivery Challan template that best suits your needs (Word, Excel, or PDF). Our templates are compliant, customizable, and ready to use.

✅ Step 2: Enter Your (Consignor) Details: Fill in your business name, logo, address, contact information, and GSTIN (as the sender/consignor). This identifies the goods’ origin.

✅ Step 3: Enter Recipient (Consignee) Details: Include the recipient’s name, address, and GSTIN (whether they are a job worker, branch office, or customer).

✅ Step 4: State the Reason for Transfer: Crucially, specify the Reason for Transfer (e.g., “Supply for Job Work,” “Stock Transfer to Branch”). This is the most important legal requirement for the document.

✅ Step 5: List Items: Add a detailed list of goods, including the HSN/SAC Code and Quantity. Do NOT include the final price or tax amount.

✅ Step 6: Authorise and Deliver: Have the dispatcher sign the document. Print multiple copies for the sender, transporter, and receiver to ensure a legal and transparent transport process.

When to Issue a Delivery Challan under GST?

Under GST, you must normally issue a tax invoice when you move goods. However, Rule 55 outlines specific situations where you can move goods without an invoice, using only a delivery challan instead.

These situations include:

- Job Work: Sending goods to a job worker for processing, and receiving them back.

- Goods for Approval: Sending goods to a customer on a “sale or return” basis. The invoice is only raised later if the customer decides to keep the goods.

- Transporting in Batches: When goods are moved in multiple shipments (in a semi-knocked-down condition). You issue one main invoice and a separate delivery challan for each subsequent truck/shipment.

- Other Reasons: Any transport of goods that is not for an immediate sale (e.g., moving stock from one warehouse to another).

The triplicate copy rule (Rule 55(2)) ensures that all three parties involved in the movement (sender, transporter, and receiver) have a valid document for the goods.

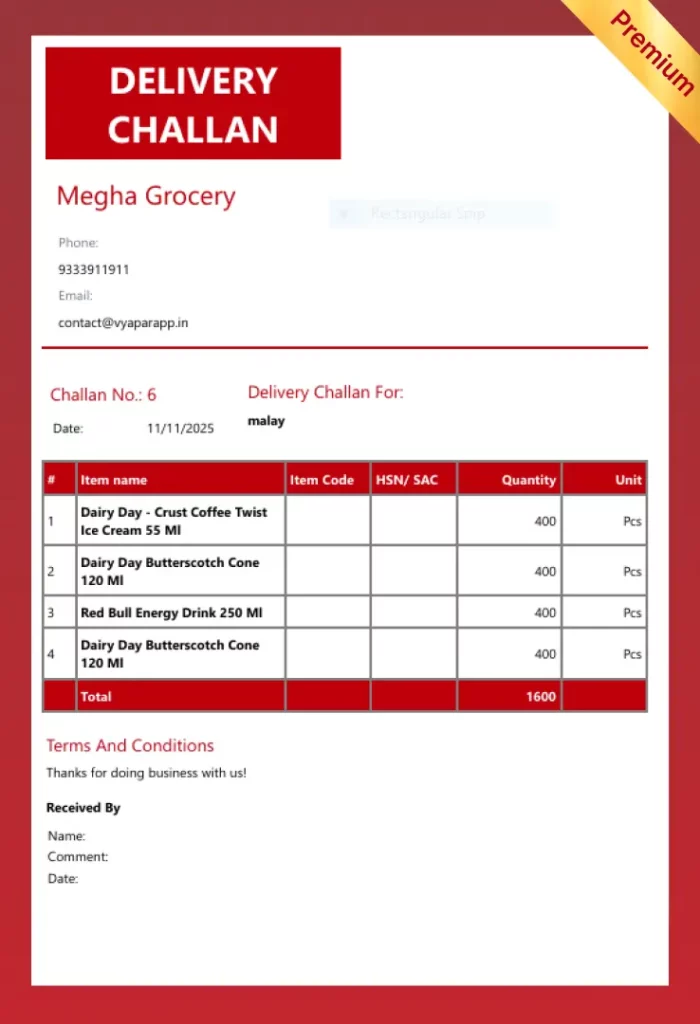

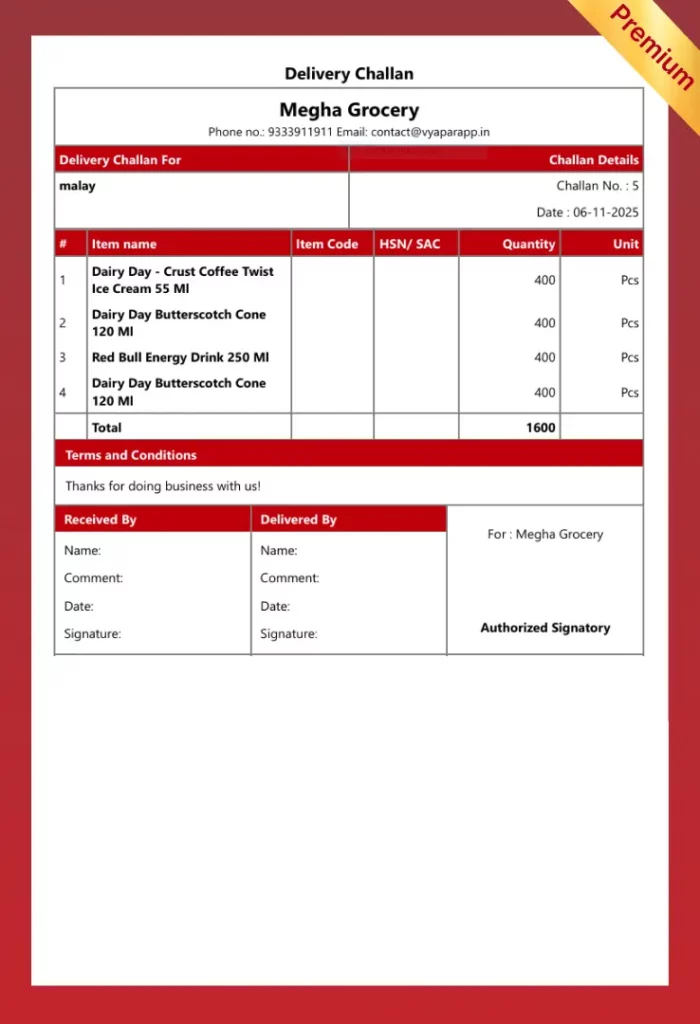

Key Components of a Professional Delivery Challan

A legally compliant Delivery Challan must be clear, detailed, and include these six essential elements:

1. Document Title and Number

The document must clearly be titled “Delivery Challan”. Include a unique, sequential DC Number for tracking and the Date Issued.

2. Consignor Details (Your Business)

Clearly display your Business Name, Logo, Address, Phone Number, and GSTIN. This identifies the sender of the goods.

3. Consignee Details (Recipient)

Include the recipient’s Name, Address, and GSTIN (whether a customer, job worker, or branch office). This ensures legal compliance for stock transfer.

4. Itemised List of Goods

A detailed table listing the goods. Include the Description, HSN/SAC Code, Quantity, and the Taxable Value of the goods. Note: Tax amount/Final Price is NOT included.

5. Reason for Transfer

Crucially, state the specific Reason for the transfer (e.g., “Supply for Job Work,” “Stock Transfer to Branch,” or “Sale on Approval”). This dictates the GST rules that apply.

6. Terms, Conditions, and Authorisation

Include necessary Terms regarding the transfer and delivery. Crucially, space for the Signature of the person receiving the goods and the Authorisation Signature of the dispatcher.

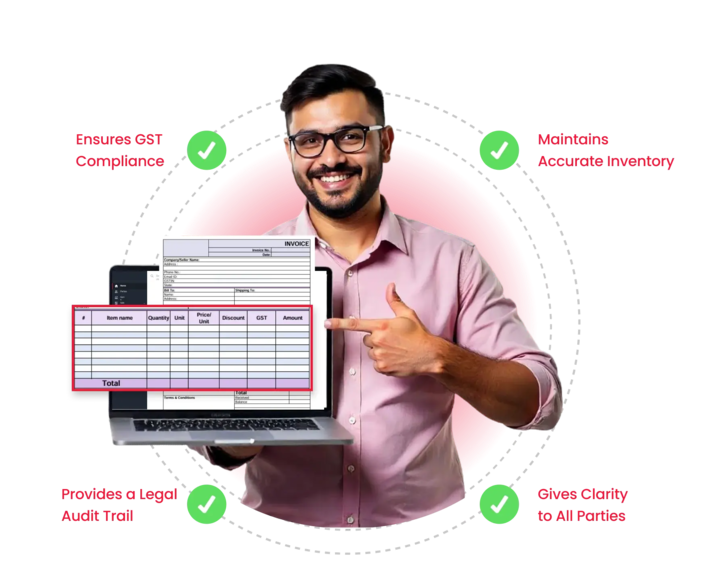

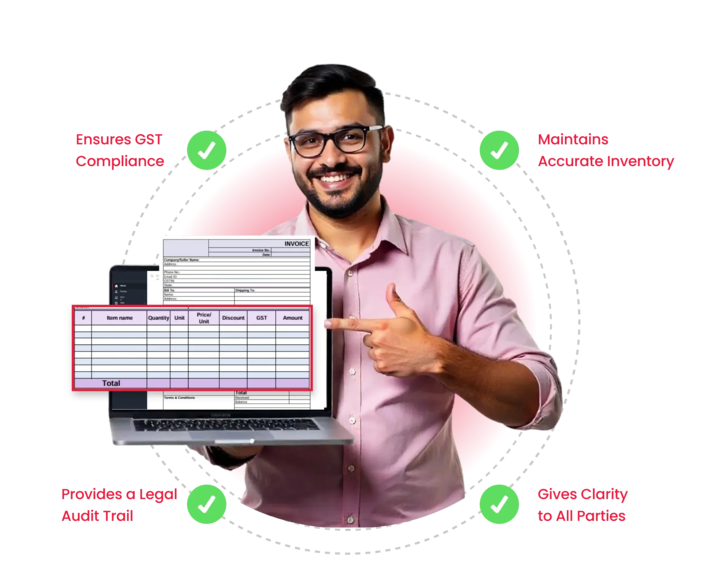

Advantages of Using a Professional Delivery Challan Format

Using a dedicated Delivery Challan Format is not just a suggestion, it’s a critical legal and operational requirement that ensures compliance and protects your inventory.

- Ensures GST Compliance: A Delivery Challan is the legally mandatory document (under GST Rule 55) for moving goods without a tax invoice. Using it correctly for job work, stock transfers, or goods on approval keeps you safe from tax penalties.

- Maintains Accurate Inventory: It creates a formal record of all goods leaving your warehouse that are not for sale. This ensures your stock counts remain 100% accurate, as you can track items out for job work or at other branches.

- Provides a Legal Audit Trail: A DC is your formal proof of dispatch and receipt. The “triplicate copy” system (for sender, transporter, and receiver) prevents disputes about what was sent, when, and why.

- Gives Clarity to All Parties: A challan clearly states the reason for transport. This prevents confusion for your transporter and informs the recipient (e.g., a job worker) exactly what they are receiving and what is expected.

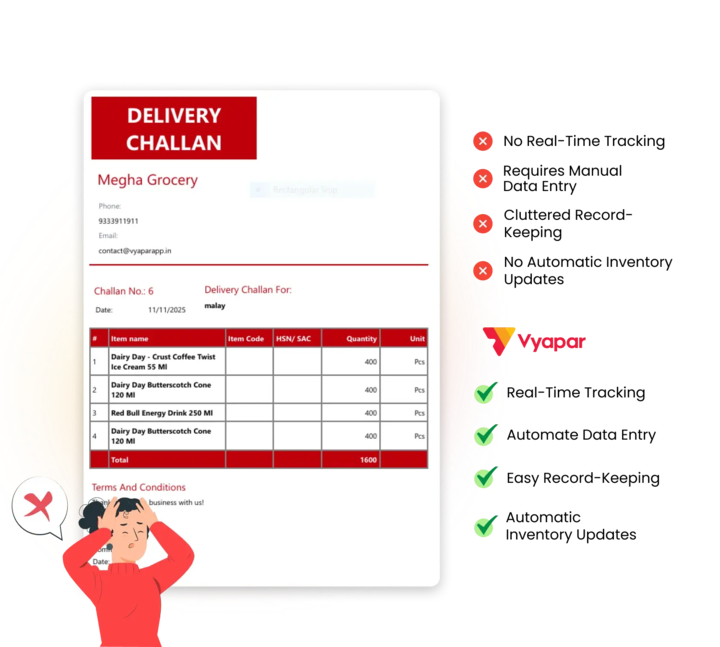

Limitations & Challenges of Using Static DC Templates

While a free delivery challan template in Excel or Word is a start, it creates significant manual work, compliance risks, and inventory errors.

- No Real-Time Tracking: A static DC format is an offline file. You have no way to track the delivery status, confirm receipt, or get a glance which items are still outstanding with your job workers.

- Requires Manual Data Entry & Conversion: This is the biggest bottleneck. When you’re ready to create the final tax invoice, you must manually retype every single item detail from the challan into a new invoice. This doubles the work and is a major source of errors.

- No Automatic Inventory Updates: The template doesn’t connect to your stock levels. You must remember to manually deduct the goods from your inventory when you send the challan, and you might forget to add them back if they are returned.

- Cluttered Record-Keeping: Your entire transport history becomes a messy folder of files (e.g., DC-001.pdf, JobWork-DC-002.docx). You can’t run a report to see all outstanding challans or your complete history with a specific job worker.

Benefits of Switching to Vyapar for Delivery Challans

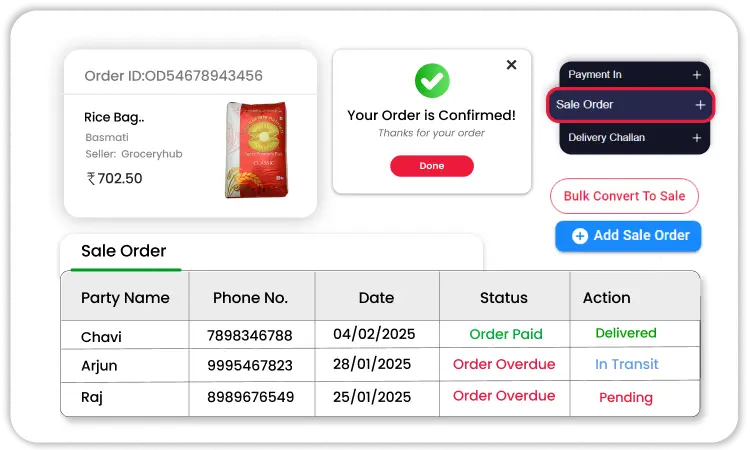

Create Compliant Challans Instantly

Generate GST-compliant delivery challans (for job work, stock transfers, etc.) from your phone or desktop.

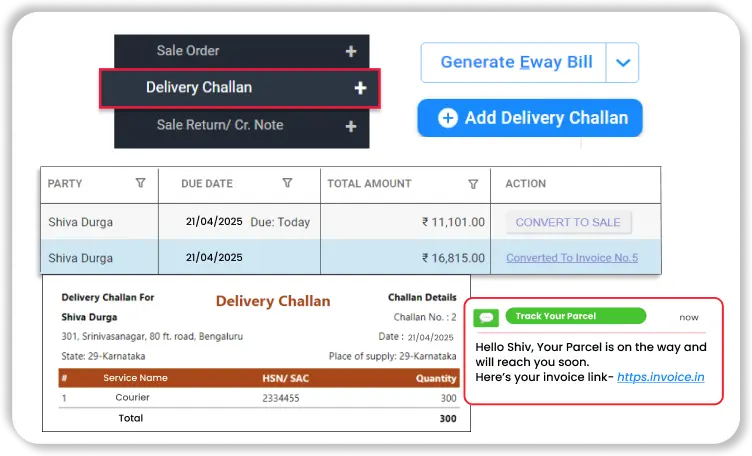

Convert Challans to Invoices in 1-Click

When your order arrives, instantly convert the PO into a purchase bill. No more manual data entry.

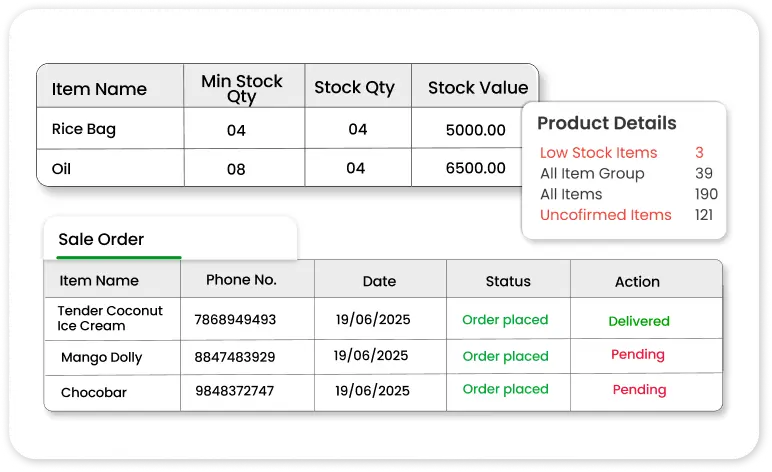

Manage Your Stock Automatically

Vyapar tracks all “out for delivery” items and adjusts your stock levels, keeping your inventory 100% accurate.

Track Your Delivery Status

Know the real-time status of your goods in transit and get confirmation when they’ve been received.

Explore Our More Business-Related Pages

Download free delivery order templates in Word, Excel, and PDF, perfect for delivery services, logistics companies, and shipment tracking workflows.

Explore Vyapar’s salesman tracking software solution, track field sales team locations, monitor visits, measure productivity, and generate reports seamlessly.

Download professional CCTV installation quotation formats in PDF, Word, and Excel for security service providers.

Frequently Asked Questions (FAQs)

A delivery note is a simple document that accompanies a delivery, listing the products and quantities. A delivery challan is a more formal, GST-compliant document (under Rule 55) that is legally required for moving goods without a tax invoice, such as for job work or stock transfers.

A delivery challan is used to document the movement of goods when no sale has occurred. A bill of supply is a billing document (like an invoice), but is issued for goods or services that are exempt from GST.

Yes, an e-Way Bill is mandatory if the total value of the goods on the delivery challan is over ₹50,000. The delivery challan and the e-Way Bill are two separate documents that must accompany the goods during transport.

You must prepare three copies (triplicate) of the delivery challan:

a. Original: For the consignee (the receiver).

b. Duplicate: For the transporter (the driver).

c. Triplicate: For the consignor (you, the sender).

A returnable delivery challan is used when you send goods to a location temporarily, with the full intention of having them returned (e.g., sending tools to a job site, goods for demo, or items for repair). It serves as a record that the goods are expected back.

Yes. When a customer returns goods to you (a sales return), a delivery challan can be issued by them to accompany the goods. This acts as a formal record of the items being sent back to your warehouse.

It’s a critical tool. A delivery challan formally records goods leaving your inventory (even without a sale), such as for stock transfers or job work. This ensures your inventory count remains accurate and provides a clear audit trail for all stock movements.

This can cause inventory and legal disputes. The recipient should not accept the delivery until the discrepancy is noted on the challan. The sender may need to issue a revised delivery challan or a credit/debit note to correct the inventory and value records.

Yes. A delivery challan is a legal document under GST Rule 55. It is the official document required for the movement of goods in specific cases where a tax invoice cannot be issued.

This is a specific delivery challan format in Excel that includes all the mandatory GST fields, such as your GSTIN, the recipient’s GSTIN, HSN/SAC codes, and the taxable value of the goods. Our free Excel templates are designed to be GST-compliant.

Businesses often prefer a delivery challan format in Word when they need to add detailed descriptions, specific terms, or a cover letter to the document. It offers more flexibility for text and formatting than an Excel file.

The best way to create a delivery challan online is to use an online delivery challan maker like the Vyapar app. While templates are a good start, an app automates the process by saving your items and customers, ensuring GST compliance, and letting you create and send challans from your phone.

Manually, you must copy all the details from the challan to a new invoice. The easiest way is with software like Vyapar, which allows you to convert any “delivered” challan into a final GST invoice with a single click, saving time and preventing errors.

Yes. The Vyapar app allows you to create and manage both standard and returnable delivery challans. You can track which items are out for job work or demo and mark them as “returned” when they come back to your inventory.

Did not find what you were looking for?