Invoice Automation Software

Invoice Automation Software– Make invoicing fast and fully automated. Simplify billing, reduce errors, and improve cash flow with ease!

Key Features of Vyapar’s Invoice Automation Software Built For SMBs in India

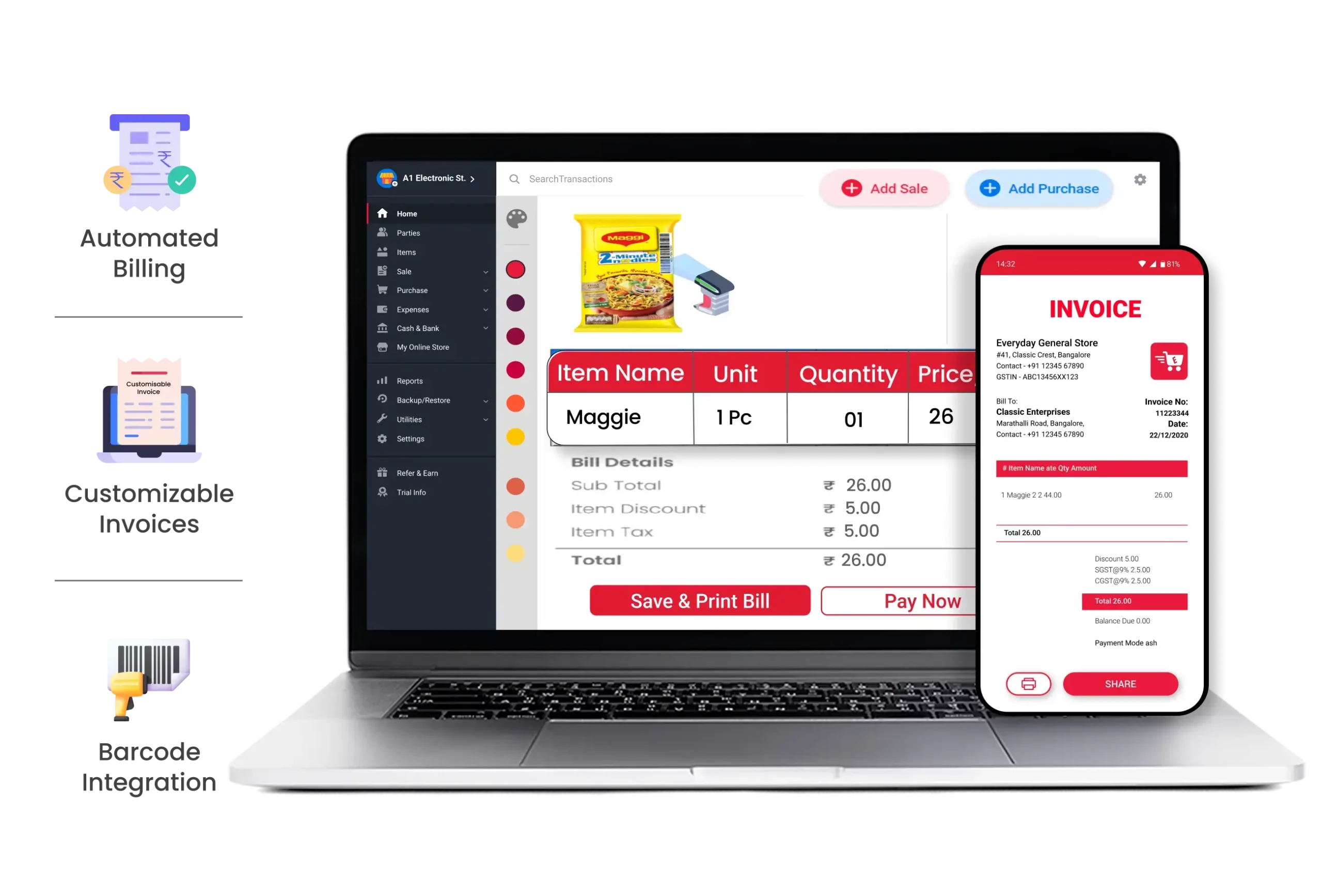

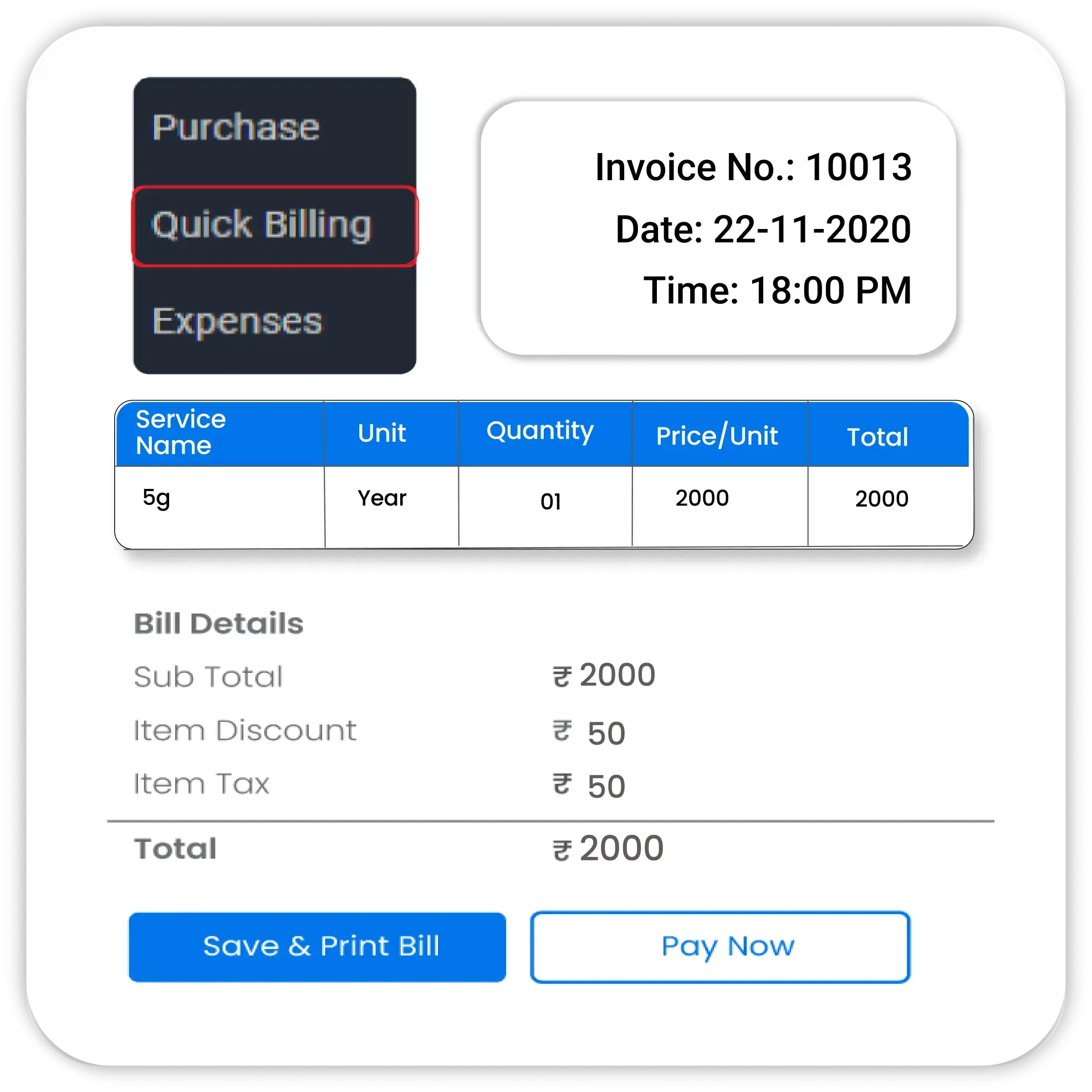

Automated Billing and Invoicing

Vyapar’s ISP billing software automates the billing process, ensuring error-free and efficient invoicing for every customer.

- Quick Billing: Speed up your billing process with a few clicks, reducing time spent on invoicing.

- Error-Free Calculations: Ensure accuracy in every invoice with automated calculations, eliminating manual errors.

- Automatic Invoice Details: Generate unique invoice numbers, date, time, and other transaction specific details automatically, keeping all invoices organized and easy to track.

Professional & Customizable Invoices

Automated invoicing software gives your business control over the look and feel of their invoices with templates and customization options that match their branding.

- Multiple Templates: In invoice automation software you can choose from a variety of professional invoice templates to match your brand style, giving each invoice a polished, professional look.

- Quick Personalization: in auto invoice software you can modify invoice fields, add terms, and change layouts to suit your business needs effortlessly.

- Add Branding Elements: Integrate your logo, brand colors, and other custom details for a polished, professional touch on every invoice.

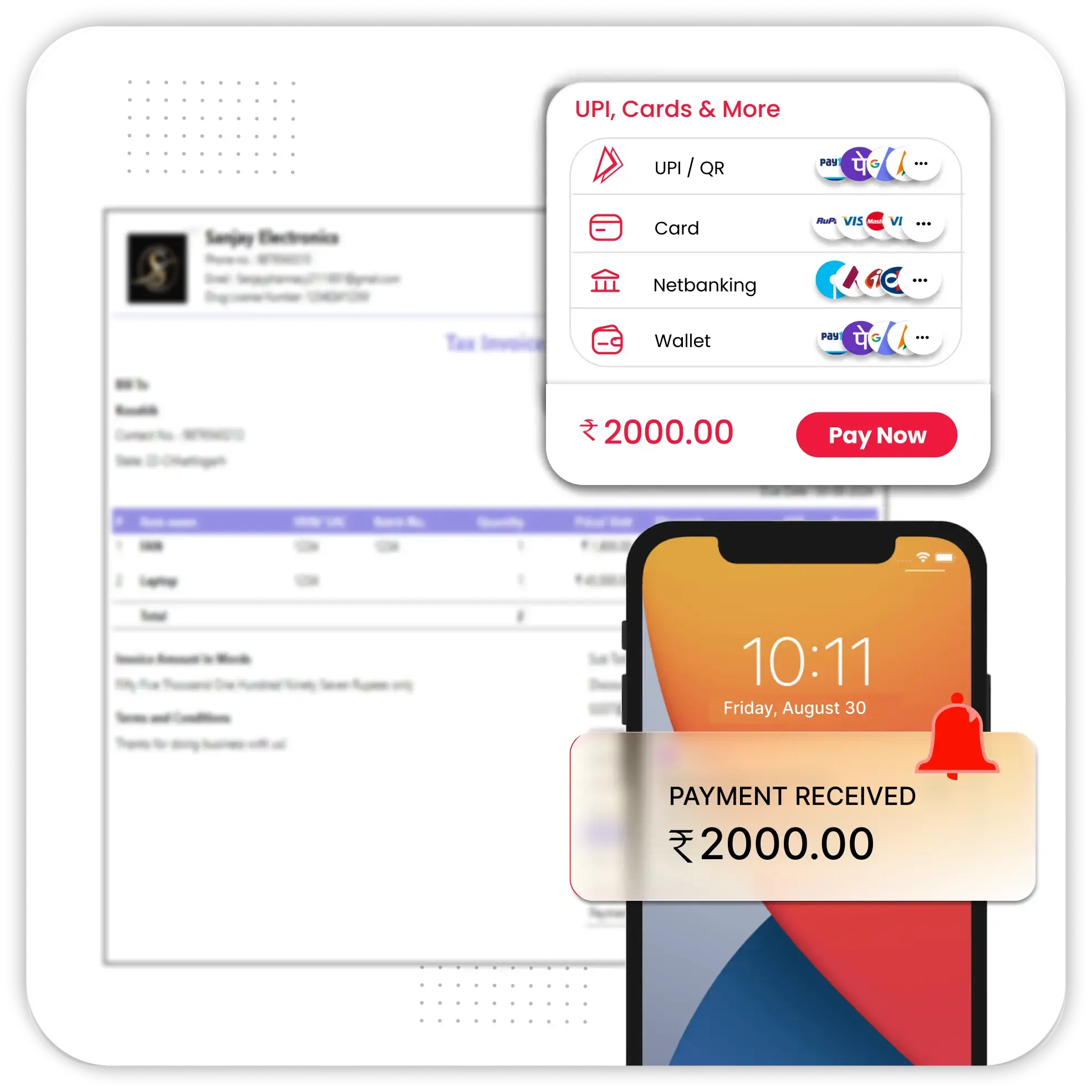

Flexible Payment Options

Invoice automation software supports various payment methods to give customers choice and ensure timely payments.

- Multiple Payment Modes: Offer UPI, cards, bank transfers, and cash to simplify payments for clients.

- Automated Payment Reminders: Set reminders to prompt clients as their invoice due date nears.

- Digital Payment Links: Send direct payment links within invoices for seamless client payment experiences.

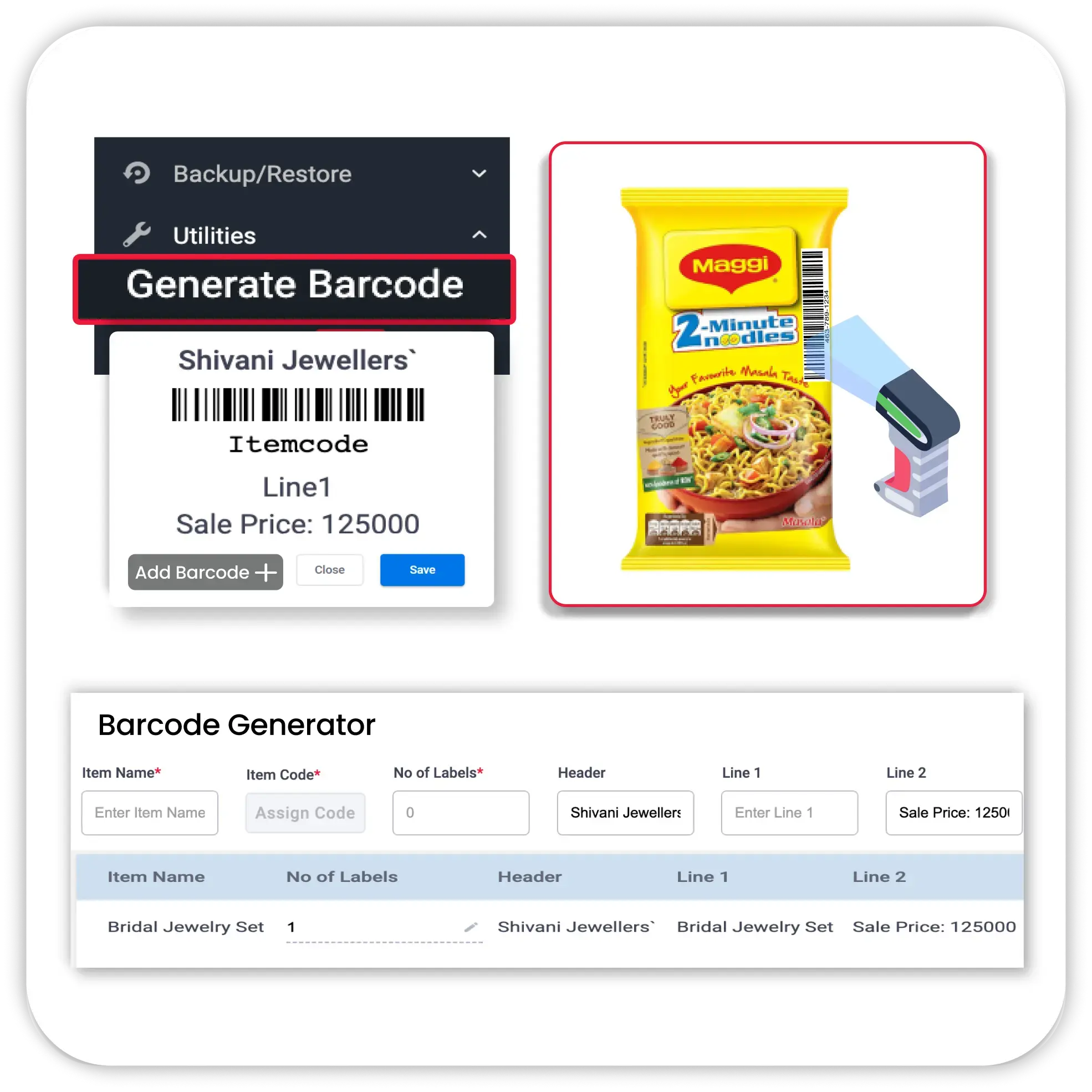

Smart Barcode Management

Invoice automation software streamlines inventory tracking with barcode generation and management directly linked to invoices.

- Barcode Generation: Create unique barcodes for your products, allowing for quick and easy identification.

- Efficient Billing: Connect barcode scanner directly with invoicing to instantly adjust inventory counts and automatically update inventory details while billing.

- Improved Accuracy: Automatic stock data updates minimizes manual errors in billing and makes it a more reliable and accurate process.

Transform Your Business with Powerful Features of Vyapar’s Invoice Automation Software

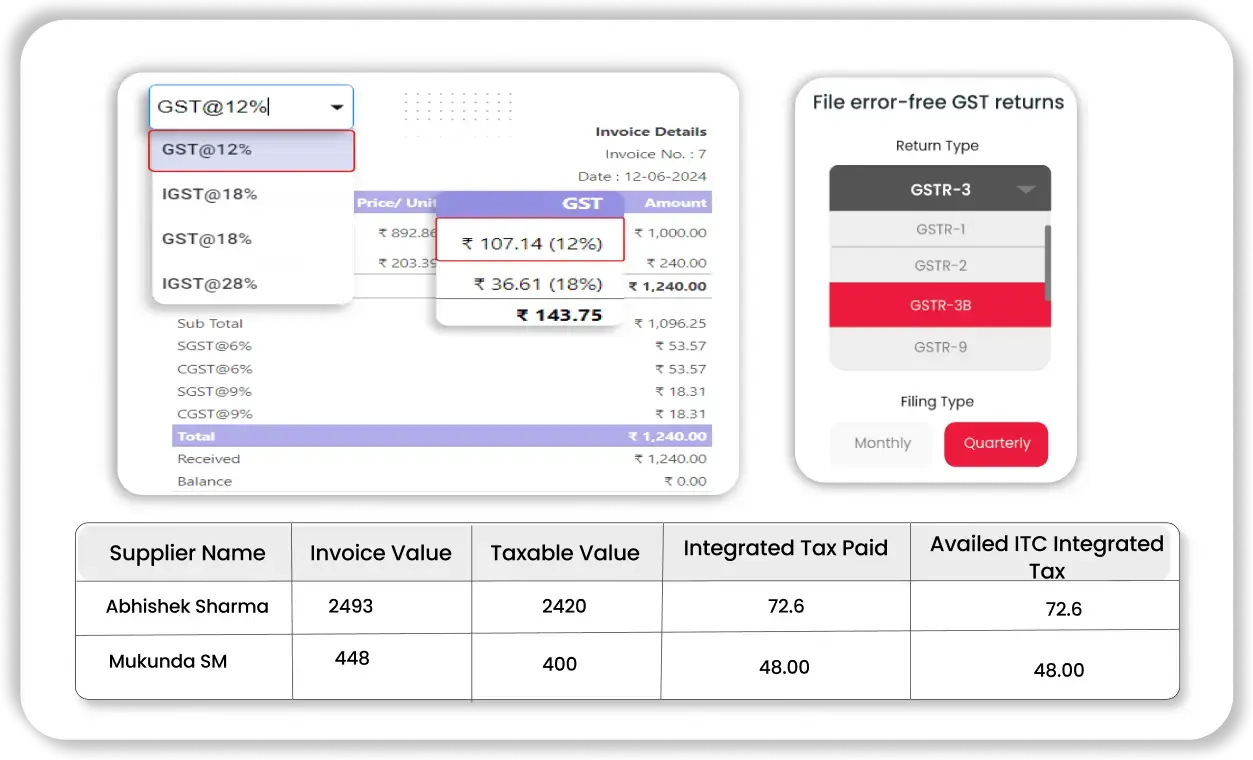

GST Compliance

Customizable Invoice Templates

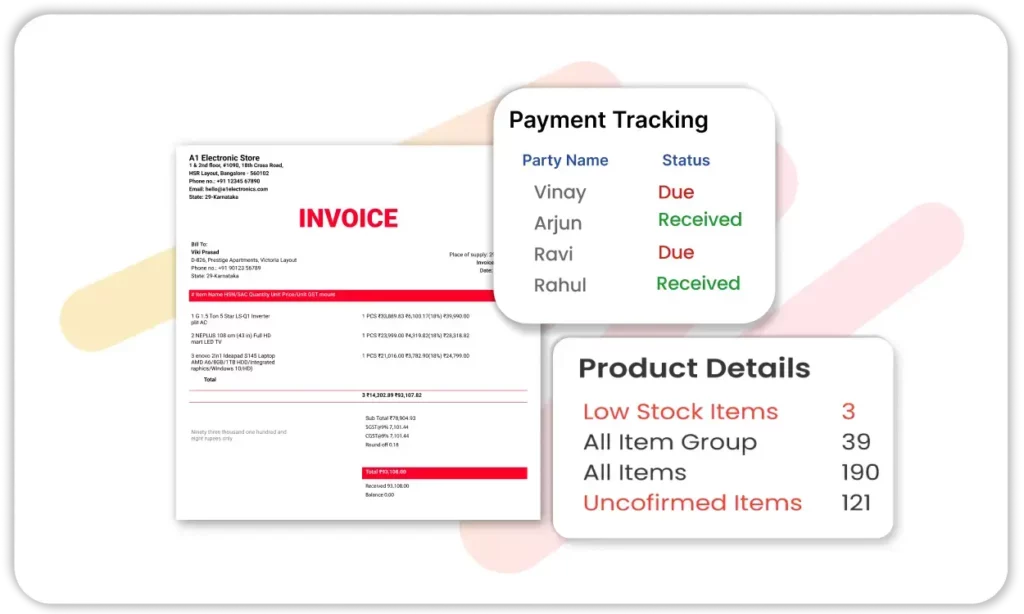

Payment Tracking

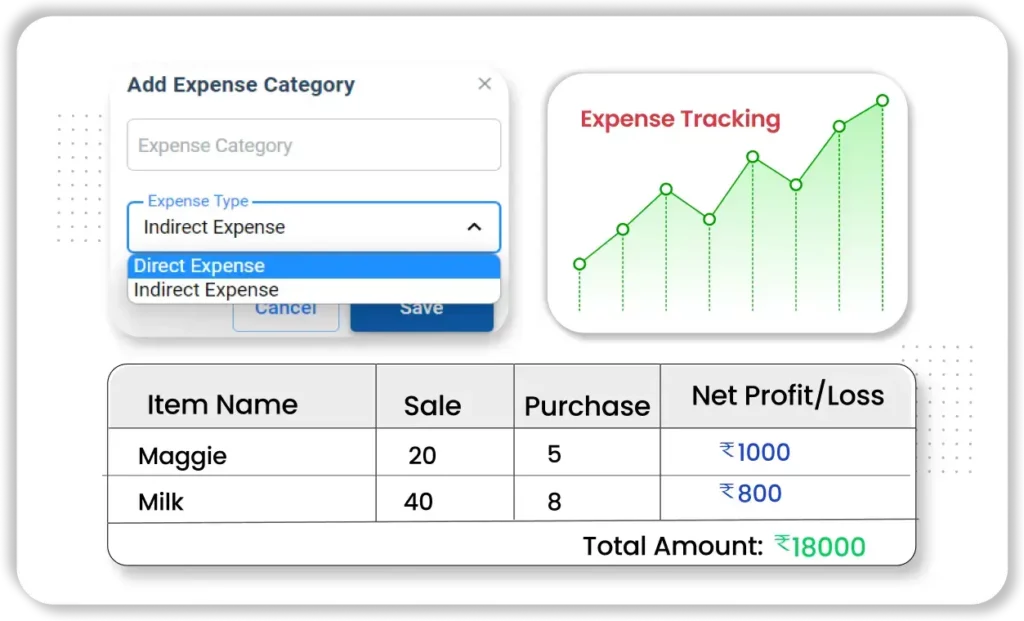

Expense Tracking

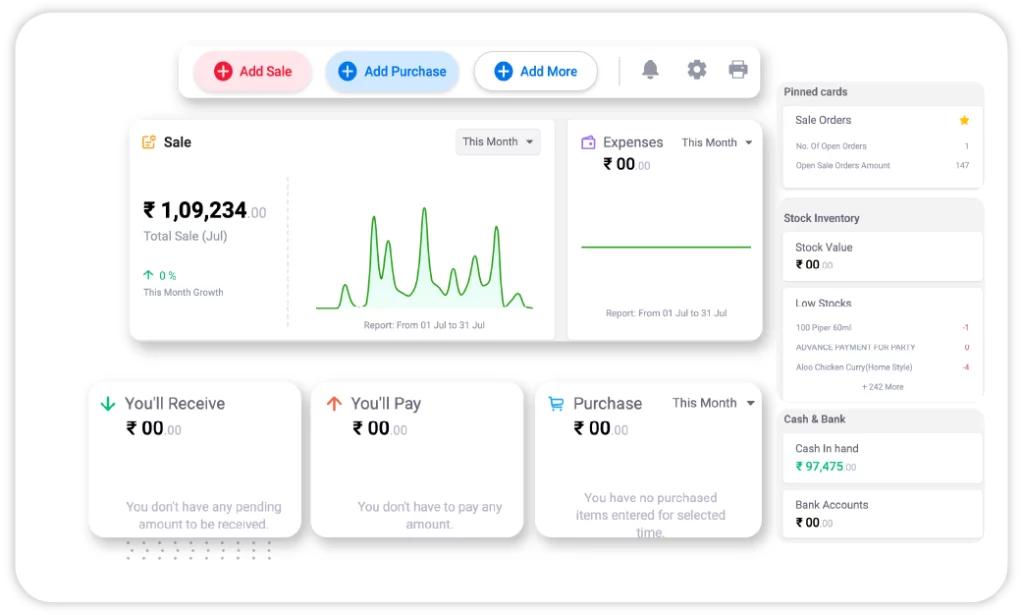

Business Dashboard

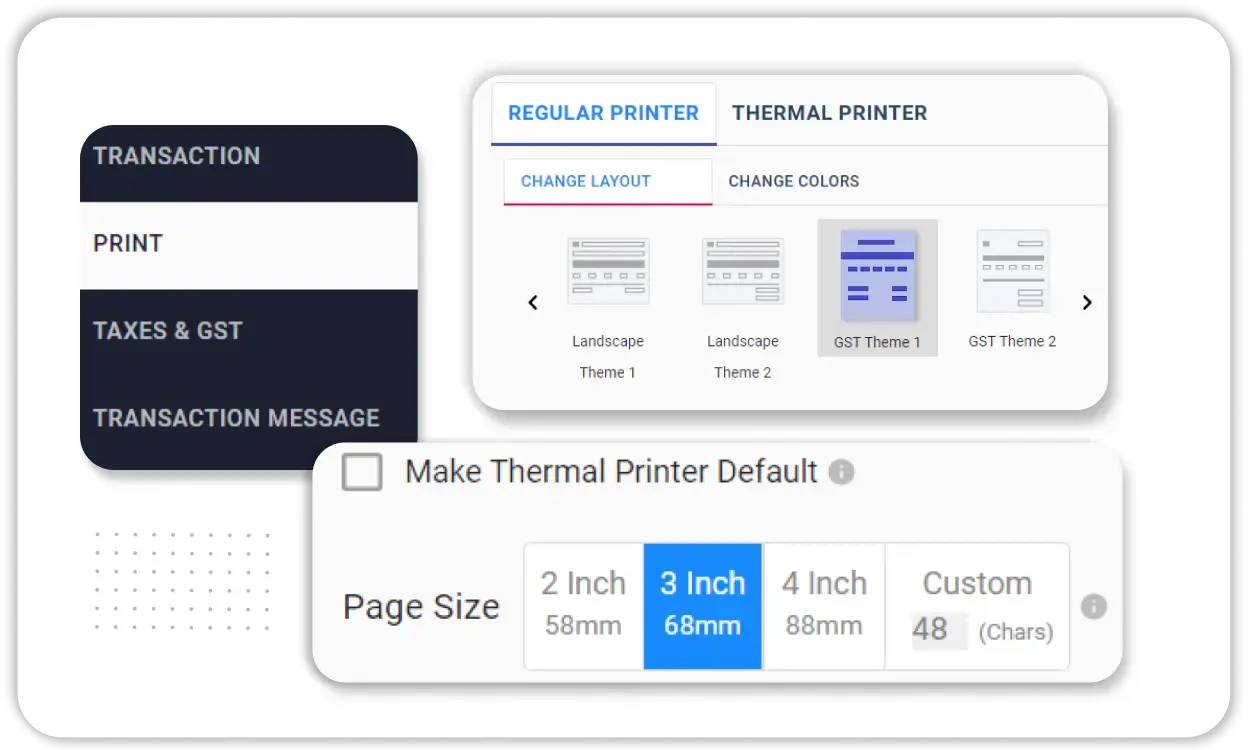

Multi-Printer Support

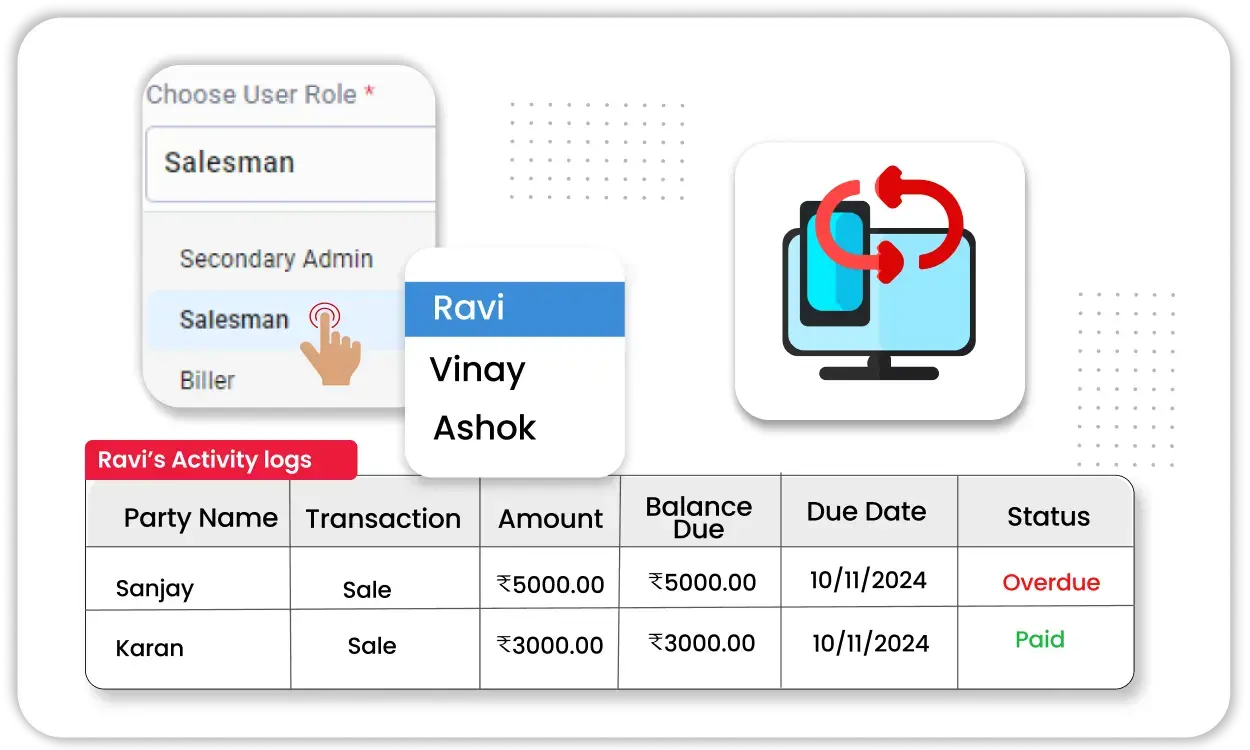

Multi-Device Sync

Native Currency Support

Smart Inventory Management

Party Management

Real-Time Reporting

Mobile App Accessibility

Vyapar’s Next-Gen Invoice Automation Software Made for You

Comprehensive GST Compliance

Vyapar invoice automation software helps businesses stay GST-compliant by automating tax calculations and generating GST invoices.

- Automated GST Calculation: The software calculates GST amounts automatically, ensuring accuracy and saving time.

- Easy Filing Process: Vyapar automates GST report generation, providing detailed reports that simplify filing and make tax season hassle-free.

- ITC Tracking: Efficiently track Input Tax Credit to maximize tax benefits with precise and accurate monitoring.

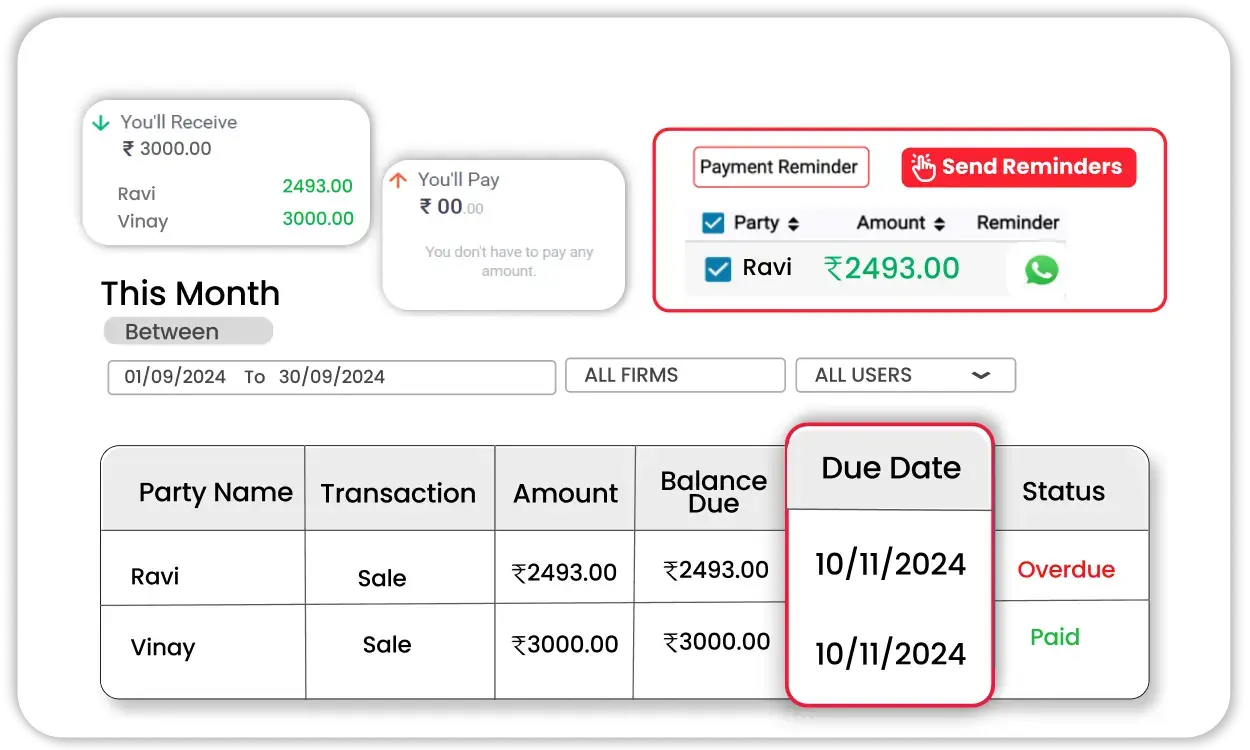

Easy Payment Tracking

Vyapar Invoice automation software monitors incoming payments and outstanding dues to improve cash flow and ensure timely collections.

- Real-Time Payment Updates: Track payment statuses for each invoice in real-time, keeping you informed of pending and received payments.

- Due Payment Alerts: Send and receive auto alerts for overdue invoice payments, helping to minimize outstanding dues.

- Payment Reconciliation: Vyapar automated invoicing software automatically matches payments with invoices, making it easy to reconcile transactions and maintain accurate financial records, reducing the risk of discrepancies.

Expense Tracking Integration

Integrate expense tracking directly within the invoicing system for a complete financial overview.

- Expense Categories: Organize expenses into categories like rent, utilities, and supplies for streamlined management.

- Expense Reports: Generate detailed reports to track spending patterns and make informed financial decisions.

- Track Paid / Unpaid Expenses: Keep a thorough record of all paid and unpaid expenses, ensuring accurate tracking and easy access for audits.

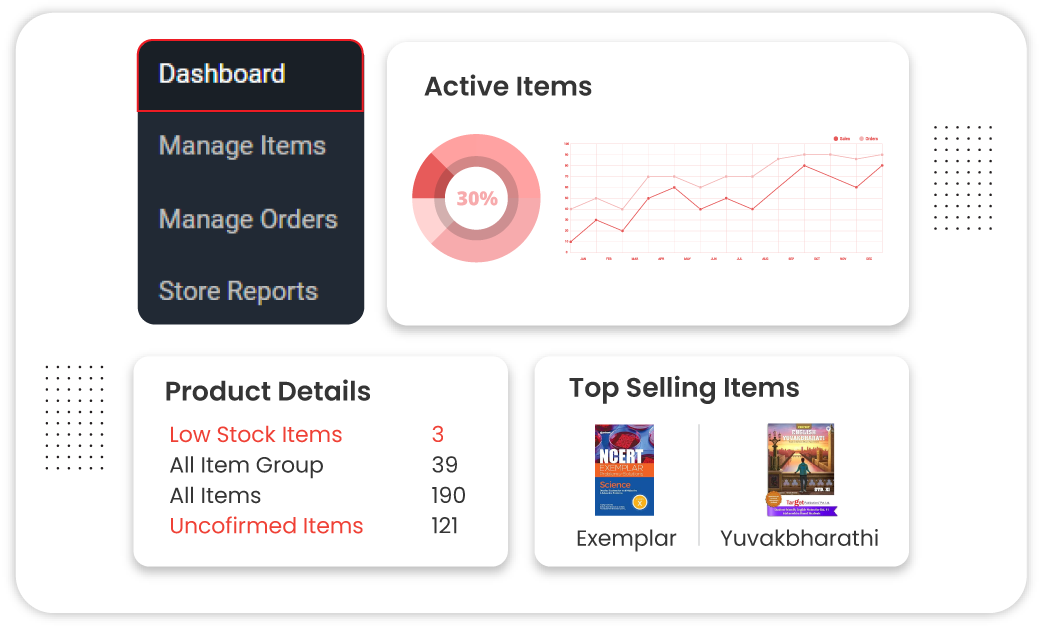

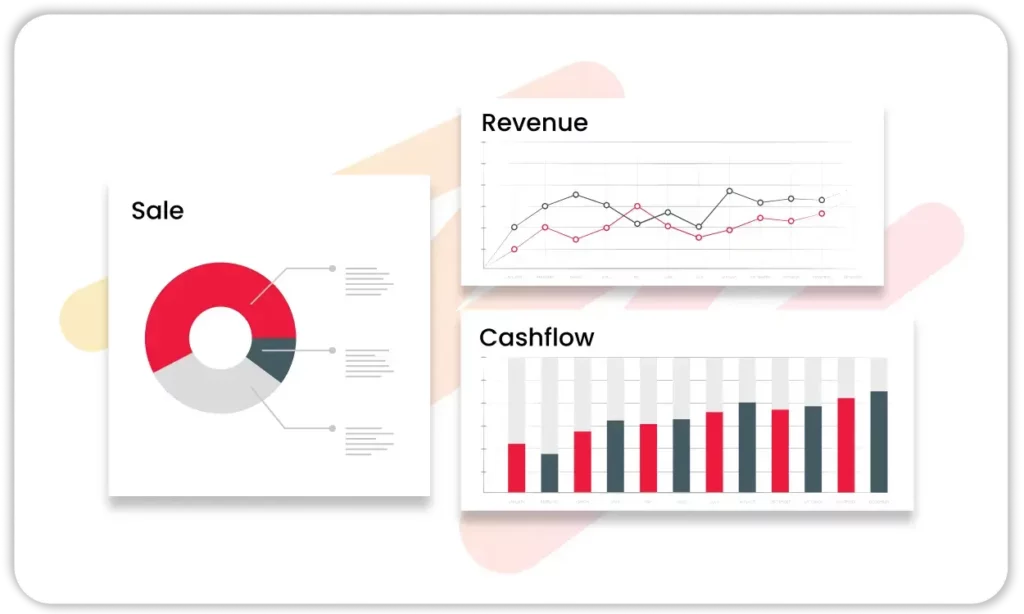

Business Dashboard

Gain comprehensive insights into your business’s performance with Vyapar automated invoicing software’s real-time dashboard.

- Sales & Revenue Overview: Quickly access metrics such as total sales, outstanding payments, and net income to stay on top of your business’s financial health.

- Performance Tracking: Monitor daily, weekly, or monthly performance trends with visual graphs and charts that offer clear insights.

- Quick Access to Key Metrics: In this automated invoicing software’s dashboard you can instantly view essential data points like top-selling products, cash flow, expense and much more, helping you make informed business decisions.

Multi-Printer Support

Increases flexibility in printing invoices across various devices.

- Device Compatibility: Support a range of printers to print invoices on demand.

- Print from Any Device: Integrate with multiple devices—mobiles, desktops, or tablets—for efficient printing.

- Customizable Print Layouts: Set default layouts and formats for consistent printed invoices.

Multi-Device Sync

Vyapar automated invoicing software allows seamless data synchronization across devices, ensuring you always have access to the latest information.

- Automatic Syncing: Sync data between devices automatically, ensuring information consistency.

- Multi-User Support: Enable access for multiple users with permissions, ideal for teams needing shared access.

- User Logs: Track user activity with detailed logs, providing transparency and accountability across team members.

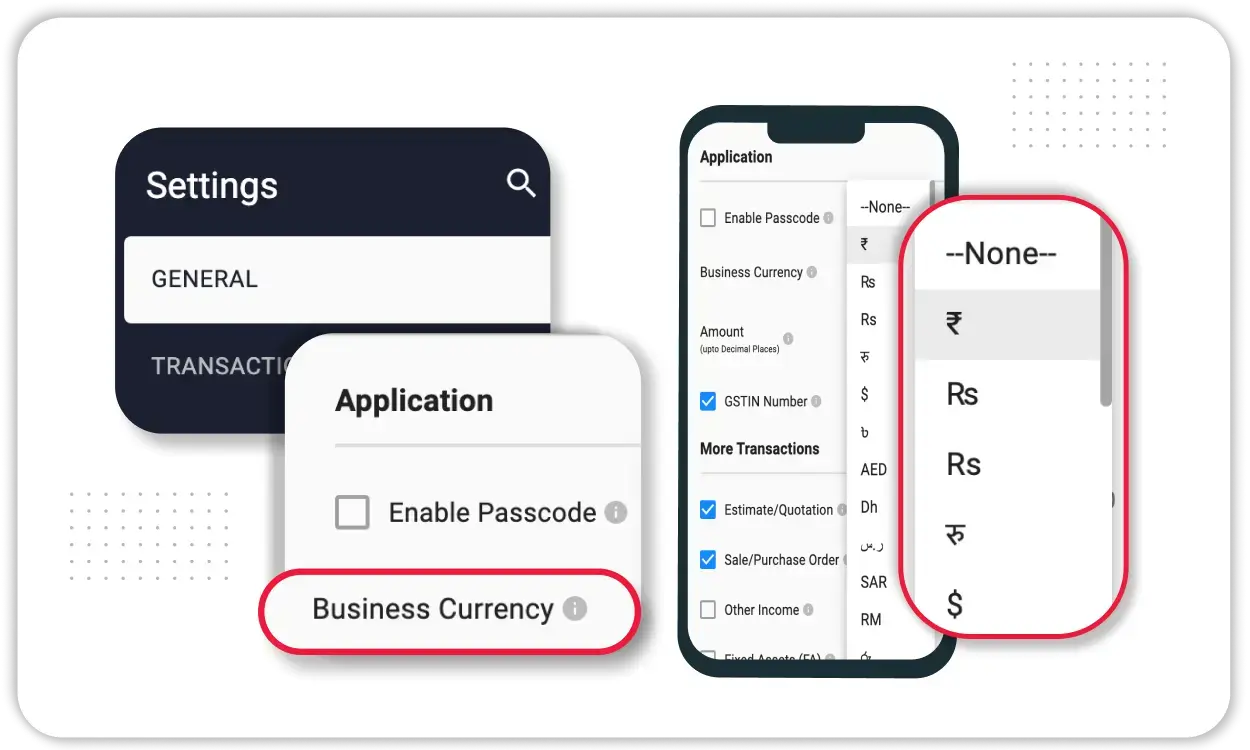

Native Currency Support

Create invoices in your native currency or select a currency of your choice to ease transactions.

- Flexible Payment Options: Accept payments in multiple currencies, offering a seamless experience for international clients.

- Automatic Currency Selection: Vyapar automated invoicing software automatically selects the native currency based on the client’s location, simplifying the invoicing process.

Smart Inventory Management

Manage stock levels efficiently with inventory adjustments linked directly to invoices.

- Automatic Stock Adjustment: Each invoice adjusts the stock levels in real-time, ensuring accurate inventory.

- Inventory Alerts: Get notified when stock levels are low or items are nearing expiration, ensuring timely reordering and inventory management.

- Comprehensive Inventory Reports: Access reports on stock movement and valuation for informed purchasing decisions.

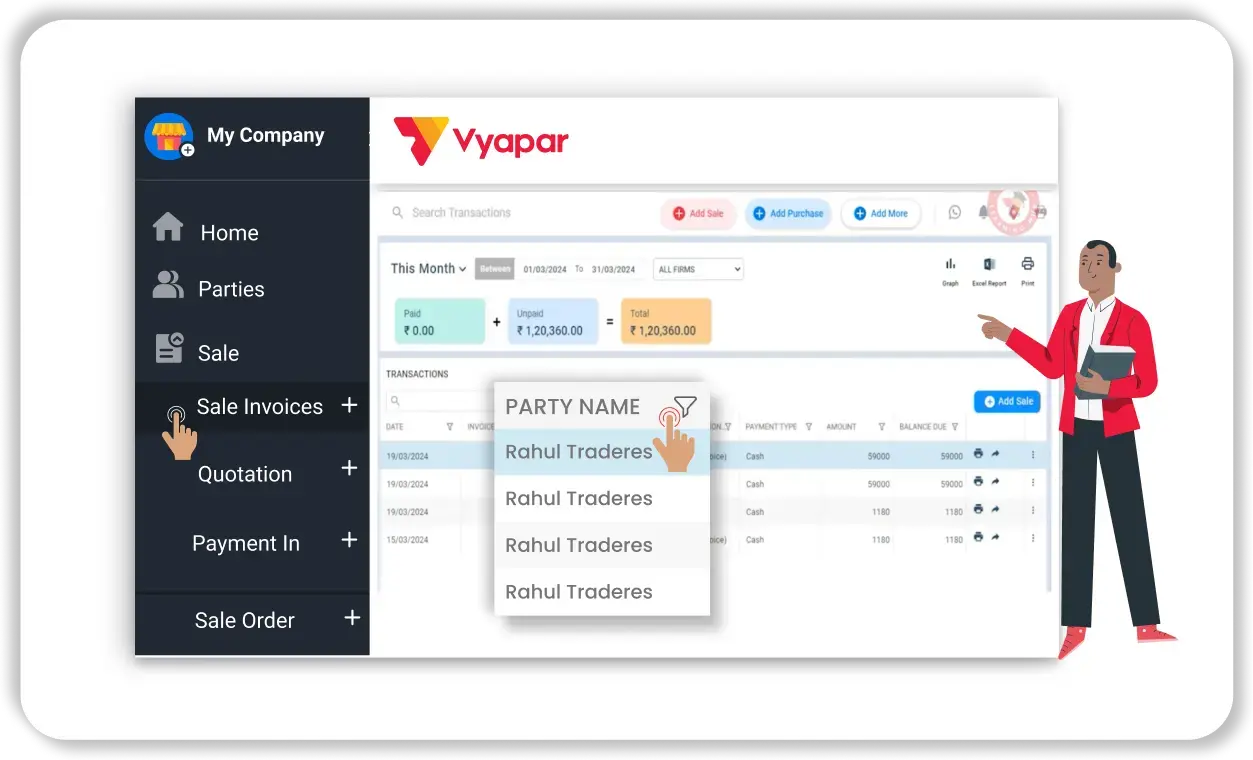

Party Management

Organize client and vendor information within Vyapar for seamless transaction tracking and relationship management.

- Client Profiles: Store detailed information, including contact details and transaction history, for each client.

- Credit Management: Set credit limits and track credit usage for each party, helping manage risk.

- Transaction History: Access a full record of past transactions with each client or vendor for better relationship management.

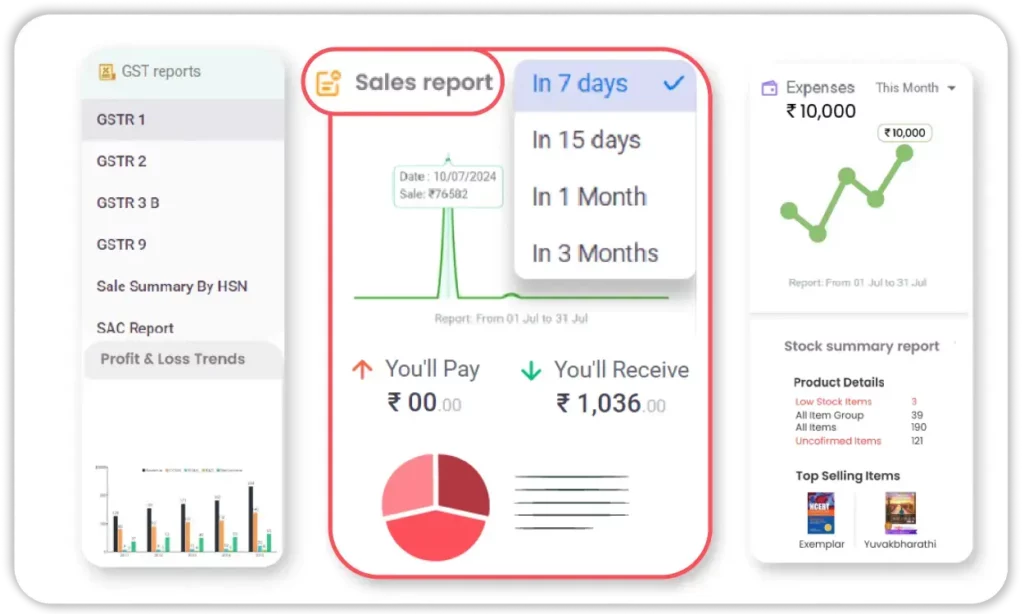

Real-Time Reporting and Analytics

Vyapar auto invoice software offers a range of reports and analytics to track financial health and improve business insights.

- Sales and Expense Reports: Generate reports on sales and expenses to understand business trends.

- Profitability Analysis: Track profits and losses over time to assess business health.

- Customizable Reports: Filter and customize reports to focus on the data that matters most to your business.

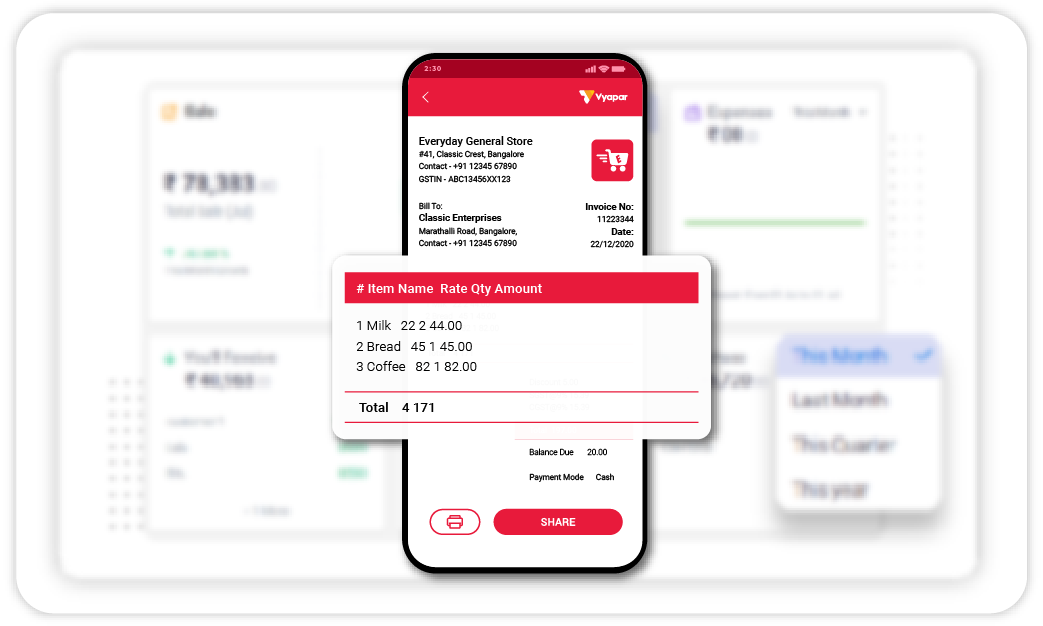

Mobile App Accessibility

Manage invoices, payments, and inventory on the go with this invoice automation software’s mobile-friendly app.

- Access Anytime, Anywhere: Manage invoicing, inventory, and payments from any location using the mobile app.

- Instant Notifications: Receive real-time updates on payments, due dates, and stock levels directly to your mobile.

- User-Friendly Interface: The app’s intuitive design makes it easy to perform key business tasks from your phone.

Effortless Invoicing for Businesses – Start with Vyapar Today!

Choosing the Right Invoice Automation Software for Your Business

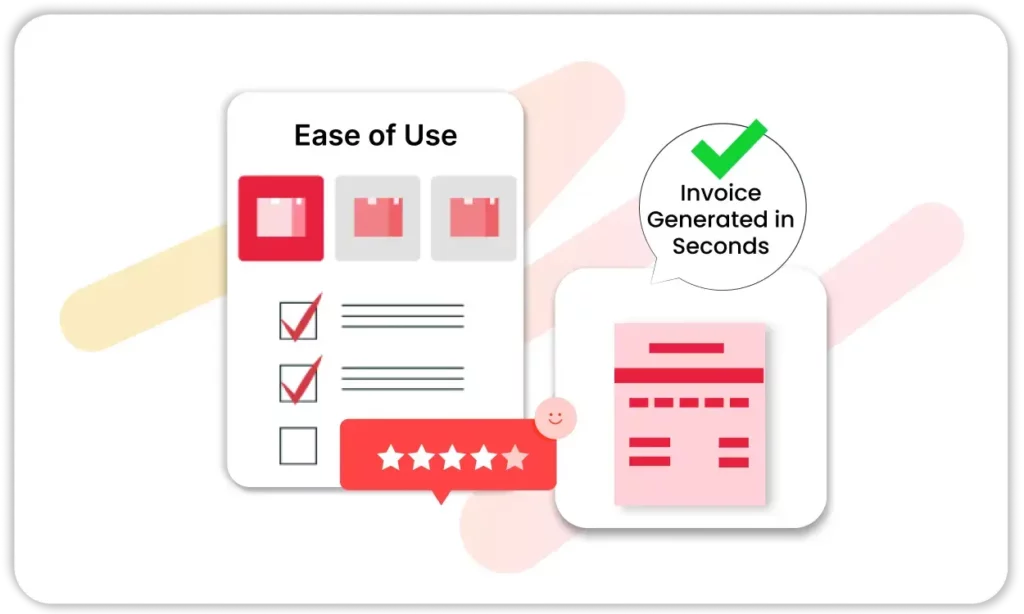

Ease of Use for All

Choose invoice automation software that’s intuitive and accessible, allowing your team to handle invoicing and payment tracking with ease. A user-friendly system ensures quick onboarding and saves time on daily tasks.

Tax Reporting and Invoice Payment

Look for invoice automation software with automated tax reporting and real-time invoice payment tracking. These features simplify tax compliance and make it easy to monitor payment status, helping you avoid missed payments and stay organized.

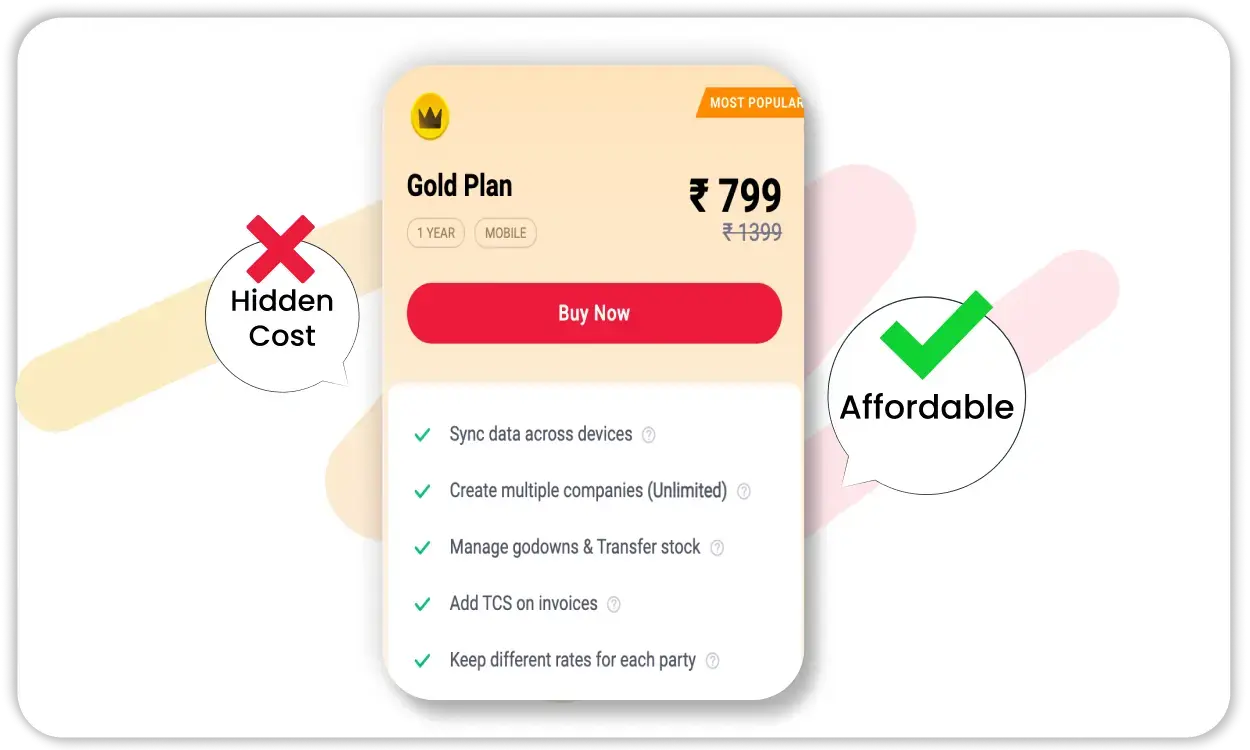

Value for Money

Select invoice automation software that offers essential features at a reasonable cost. Good value means accessing powerful tools without overspending, ensuring your business achieves maximum efficiency and growth.

Why Vyapar’s Invoice Automation Software is the Smart Choice for Your Business

Affordable Pricing

Vyapar invoice automation software offers a cost-effective solution tailored for small and medium-sized businesses. With transparent pricing, users can access a range of powerful features without hidden fees.

The free trial option in this automated invoice management software also allows businesses to explore and experience Vyapar’s benefits before committing, ensuring they find the right fit for their needs.

Ease of Use

Vyapar invoice automation software’s intuitive design makes it easy for anyone to use, even without technical expertise.

The platform offers a clean, organized interface with helpful in-app guides, enabling users to quickly understand and navigate its tools for invoicing, inventory, and payment management.

Enhanced Productivity

Vyapar invoice automation software automates time-consuming tasks like invoicing, payment tracking, and inventory updates, freeing up business owners to focus on core activities.

This automation reduces errors and improves efficiency, helping businesses manage operations more effectively and save valuable time.

Real-Time Insights with Business Dashboard

With this automatic invoicing software’s real-time dashboard, users get a quick overview of sales, revenue, and other key metrics.

This visual insight enables business owners to track performance trends, understand cash flow, and make informed decisions based on current data.

365 Days Customer Support

Vyapar offers the best round-the-clock support to ensure users can get help whenever they need it.

The dedicated support team is available to assist with troubleshooting, questions, and guidance, making Vyapar a reliable choice for businesses that prioritize ongoing support

Frequently Asked Questions (FAQs’)

Automated invoicing software is a modern-day business tool that generates, sends, and manages bills. It is a digital alternative to the less secure and less professional practices of using paper and spreadsheets to create invoices. It allows small and medium size businesses to automate their business operations.

Here are the following benefits of using the automated invoicing software:

1. Time and cost savings

2. Increased accuracy and reduced errors

3. Improved cash flow management

4. Enhanced professional image

5. Streamlined record-keeping

6. Multiple payment options for customers

Many automated invoicing software options integrate with well-known accounting and CRM platforms. These interfaces seamlessly synchronize data, ensuring immediate updates of your invoicing information across platforms. They eliminate the need for manual data entry and enhance overall efficiency in managing your finances and customer relationships.

Yes, it is possible to customise the look and layout of invoices. You can easily customise invoices using our professional tool for your business platform. You can add a business logo, change colour, design and theme per your business requirement. Your business can do various operations such as billing, invoicing, estimate and quotation, tracking expenses etc.

Yes, most modern automated invoicing software handles various currencies and tax requirements effectively. Further, you can modify the templates to make your bill compatible with multiple currencies.

Many automated invoicing software typically have built-in currency conversion features that allow you to bill customers in their preferred currency. It provides precise billing and facilitates international operations within the framework of local tax legislation.

Yes, you can use the Vyapar software, which allows you to send your clients an automated reminder of their due date through WhatsApp, e-mail and chat. It also provides your clients various options to pay for your goods and services, such as the QR, UPI, IMPS, NEFT, E-wallet credit and debit cards. If your internet is connected, you can easily use Vyapar to send and receive payment.

Automated invoicing software must have robust data security measures in place. Strong security measures, like encryption, encrypted data transmission, and regular backups, are top priorities for reputable service providers. We protect sensitive data by implementing user access controls, utilizing multi-factor authentication, and enforcing stringent data access policies.

You can check on the development of your invoices thanks to the tracking tools offered by automated invoicing software programmes like Vyapar. These functions notify you instantly about the status of your invoices, informing you whether they have been opened, paid, or are past due.

Using Vyapar you can auto generate invoices, reduce manual work and ensure timely payments with reminders and instant invoicing.

Yes, Vyapar offers auto generated invoice with fully customizable templates, enabling users to add branding elements like logos, color schemes, and personalized fields.

Vyapar supports various payment methods, including UPI, credit cards, bank transfers, and cash, offering flexibility for clients.

Absolutely! Vyapar is GST-compliant and automates GST calculations, simplifying tax filing and ensuring accurate records.

Yes, Vyapar automated invoice capture software offers a mobile app that lets you manage invoices, track payments, and check inventory on the go.

In Vyapar, generating an auto invoice without a signature is simple. Vyapar’s invoice automation software allows you to set up billing details, and the software will automatically create invoices with a message like “This is an auto generated invoice, no signature required.” This feature streamlines the billing process, ensuring professional and efficient invoicing without needing manual signatures.

Yes, Vyapar provides an efficient auto invoice program designed to automate the invoicing process. With Vyapar, you can set up billing details once, and the software will automatically generate invoices as needed. This feature not only saves time but also ensures accurate, professional invoices without the need for manual intervention, making billing seamless for your business.