Fixed Asset Management Software

Effortlessly track, manage, and optimize your business assets with Vyapar’s Fixed Asset Management Software. Simplify depreciation calculations, reduce losses, and ensure compliance—all in one place. Start managing your assets smarter today!

Best Fixed Asset Management Features of Vyapar Tailored for Your Business

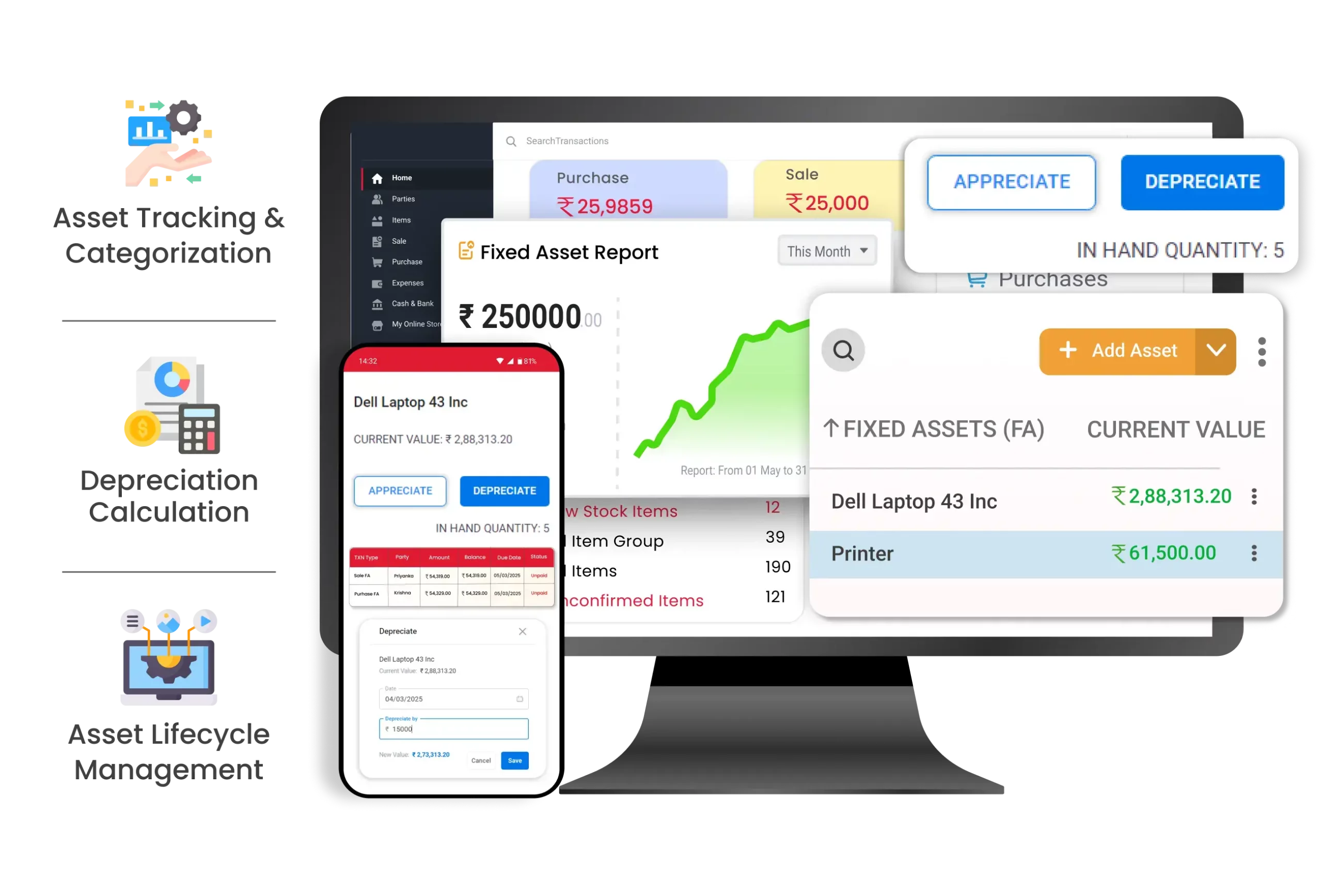

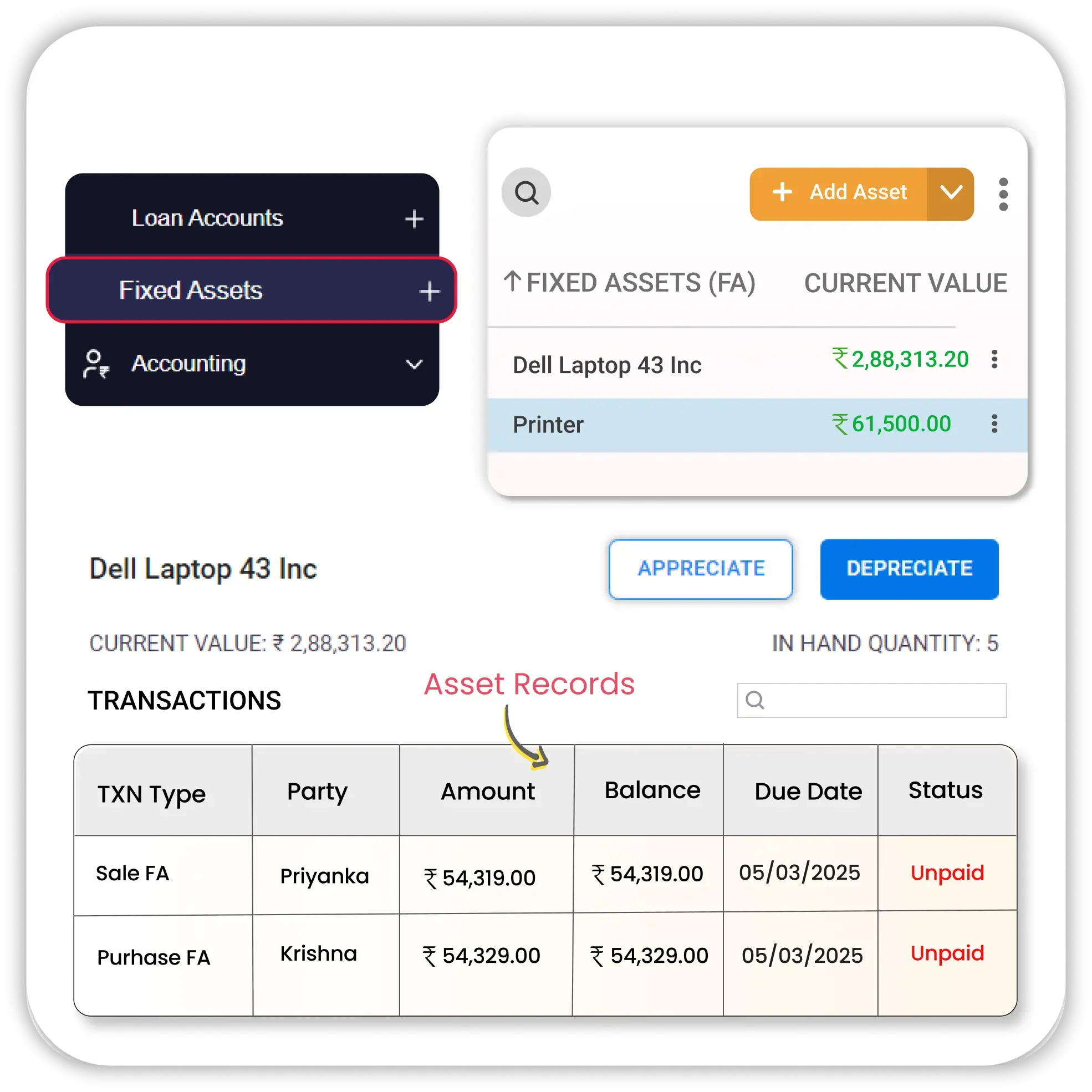

Asset Tracking

Efficient asset tracking ensures businesses can monitor fixed assets, and maintain clear records. Vyapar fixed asset management software enables seamless asset tracking with easy-to-use categorization tools for better organization and financial management.

- Real-Time Asset Monitoring: Monitor asset availability, purchase dates, and conditions in Vyapar to ensure complete visibility of your fixed assets at all times.

- Search & Filter Assets Easily: Vyapar allows users to search and filter assets by purchase date, or vendor, making it easier to retrieve and manage asset records.

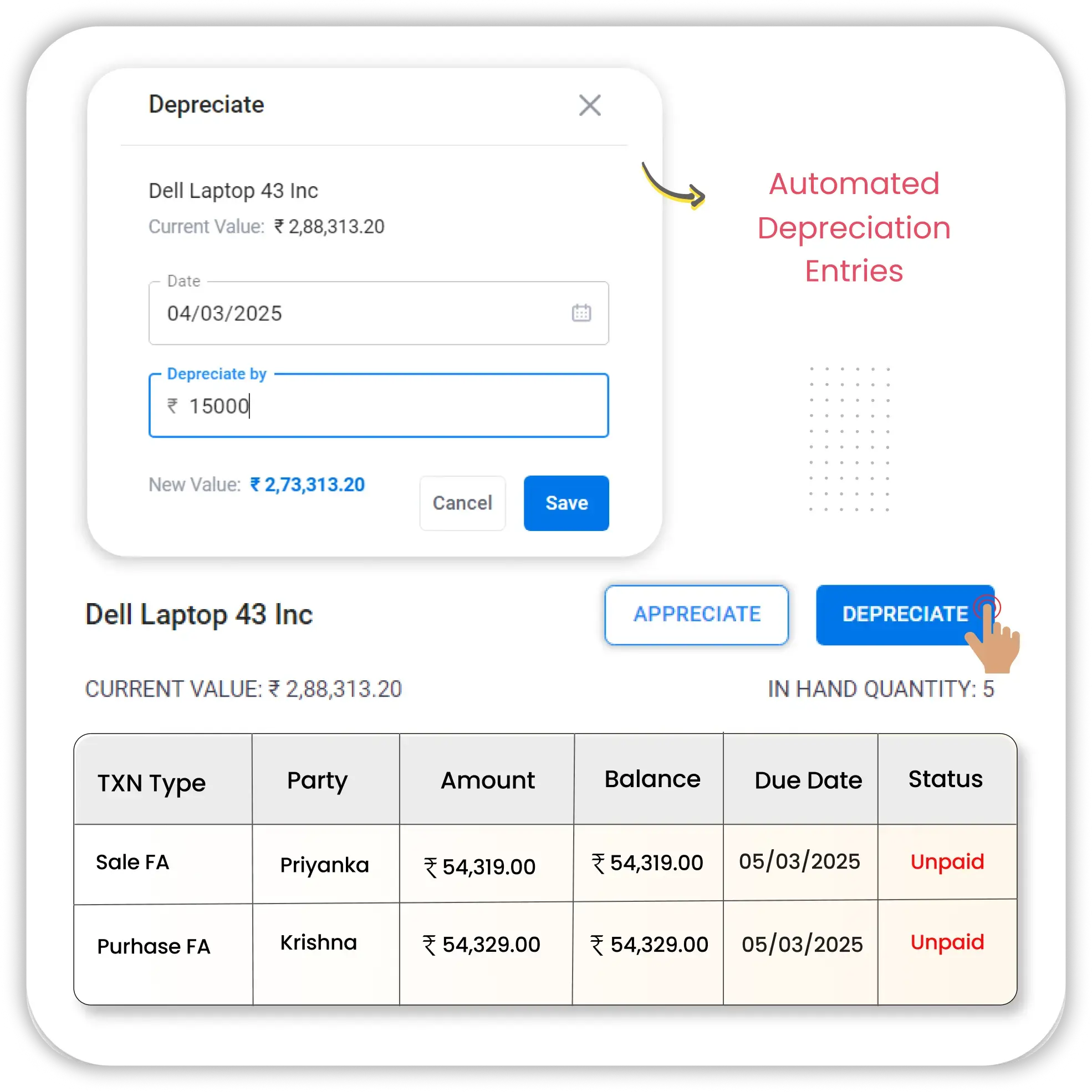

Depreciation Calculation

Accurate depreciation tracking helps businesses estimate asset value over time for better tax calculations and financial reporting. Vyapar fixed asset software automates depreciation calculations to simplify accounting for fixed assets.

- Multiple Depreciation Methods: Vyapar supports Straight-Line and Reducing Balance methods, allowing businesses to choose how they want to depreciate fixed assets for accurate financial reporting.

- Depreciation Reports for Tax Filing: Generate detailed depreciation reports in Vyapar, making it easier to track asset value reduction and stay compliant with tax regulations.

Asset Lifecycle Management

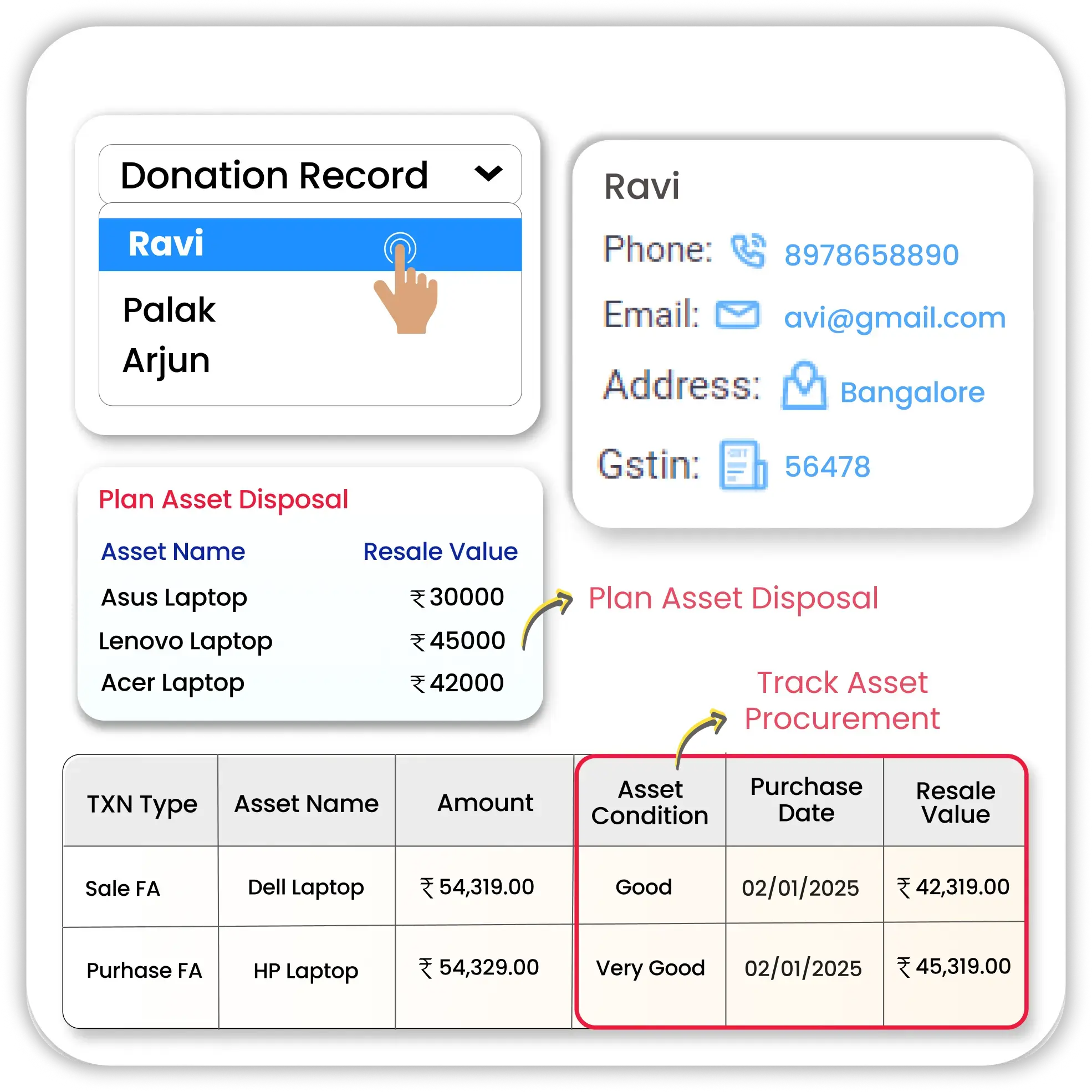

Managing an asset’s full lifecycle, from acquisition to disposal, is crucial for financial planning. Vyapar fixed asset accounting software helps businesses track asset movement, usage, and end-of-life status efficiently.

- Track Asset Procurement: Maintain records of asset purchases, vendor details, and costs in Vyapar to ensure seamless asset lifecycle management from the beginning.

- Monitor Usage & Condition: Regularly update asset conditions, usage history, and maintenance logs in Vyapar to optimize asset utilization and prevent unexpected failures.

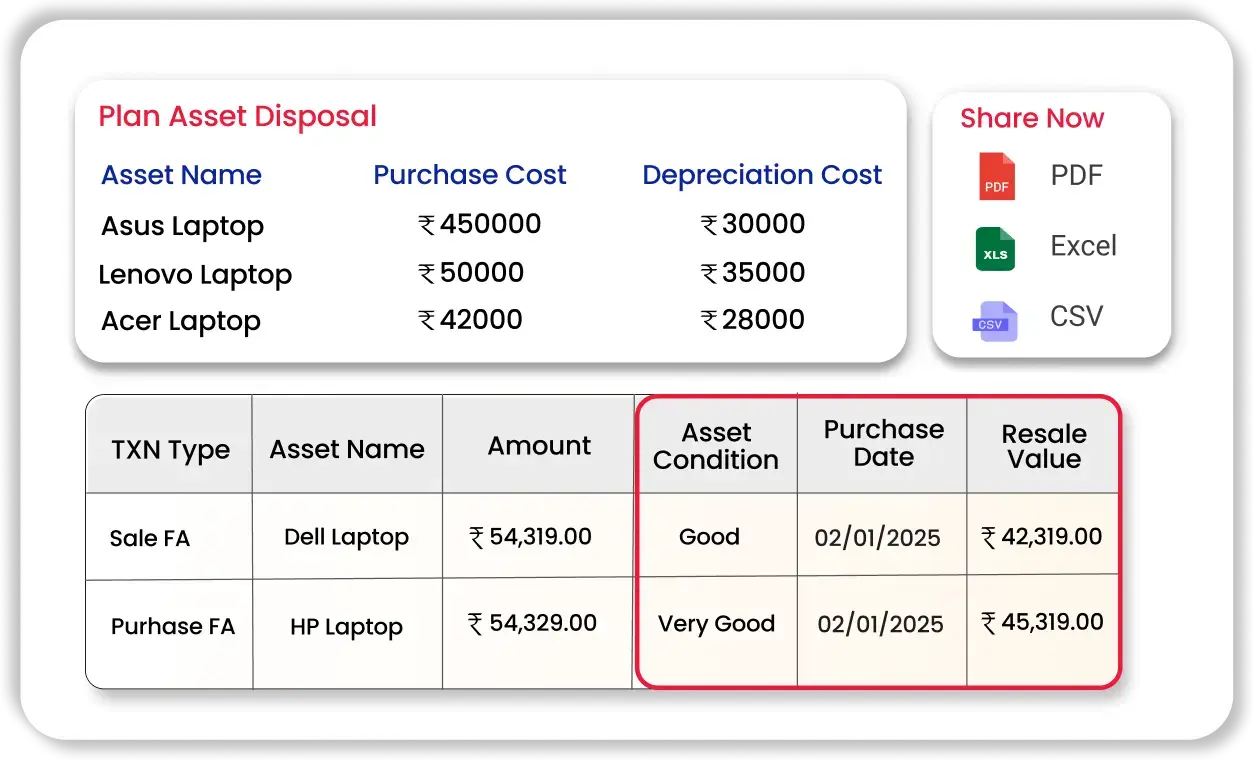

- Plan Asset Disposal: Vyapar allows businesses to track asset retirement, resale, or scrapping, ensuring assets are properly accounted for at the end of their lifecycle.

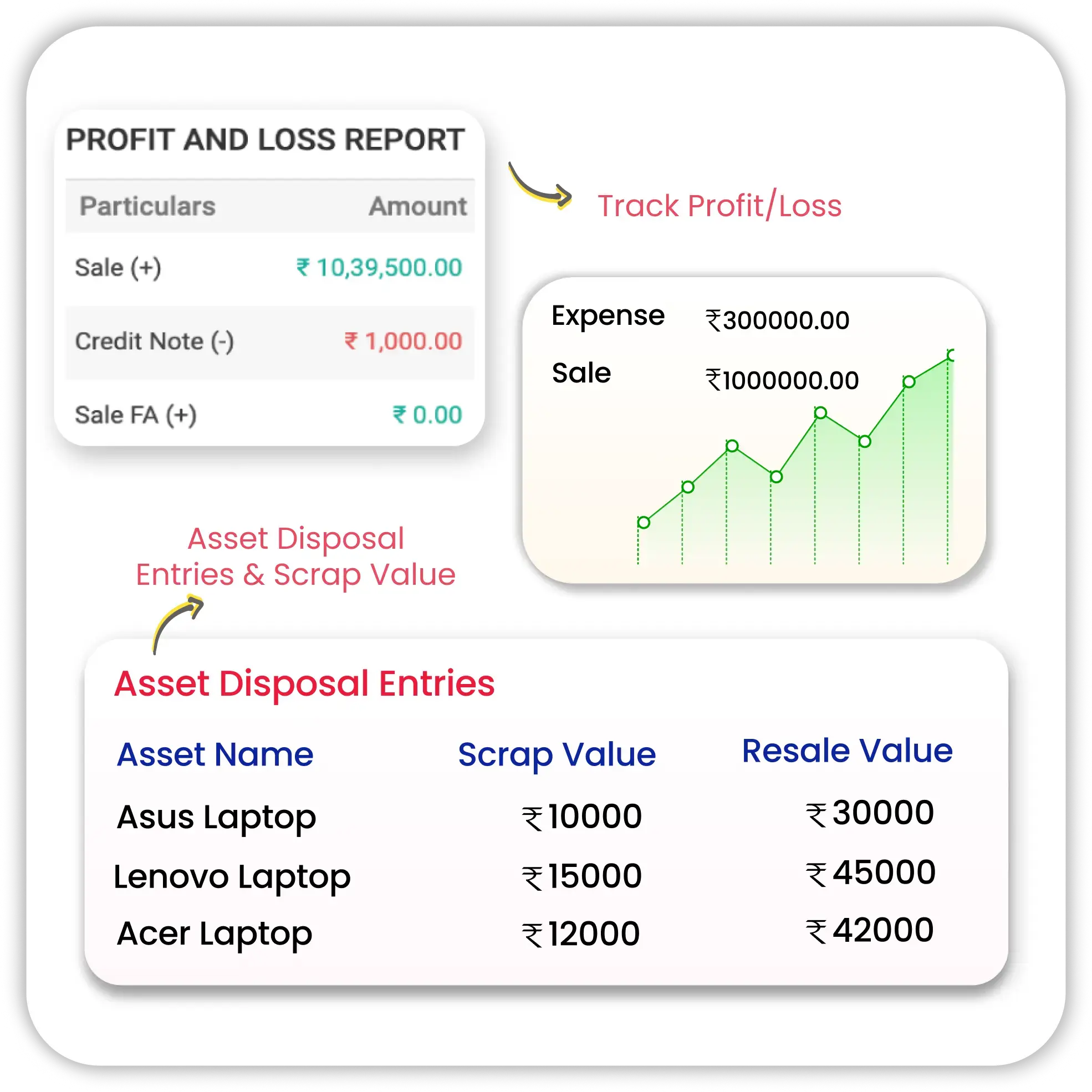

Asset Disposal & Retirement Management

Disposing of assets efficiently prevents financial losses and maintains compliance. Vyapar fixed asset tracking software helps track asset sales, scrap values, and write-offs for accurate financial reporting.

- Asset Disposal Entries: Record disposed or retired assets in Vyapar to keep financial records up to date and track the impact on business finances.

- Calculate Scrap Value: Vyapar enables businesses to determine scrap value or resale price of assets, ensuring correct financial projections before disposal.

- Track Profit/Loss on Disposal: Businesses can analyze financial gain or loss from asset disposal in Vyapar, ensuring transparency and informed decision-making.

Add-On Features of Fixed Asset Management Software

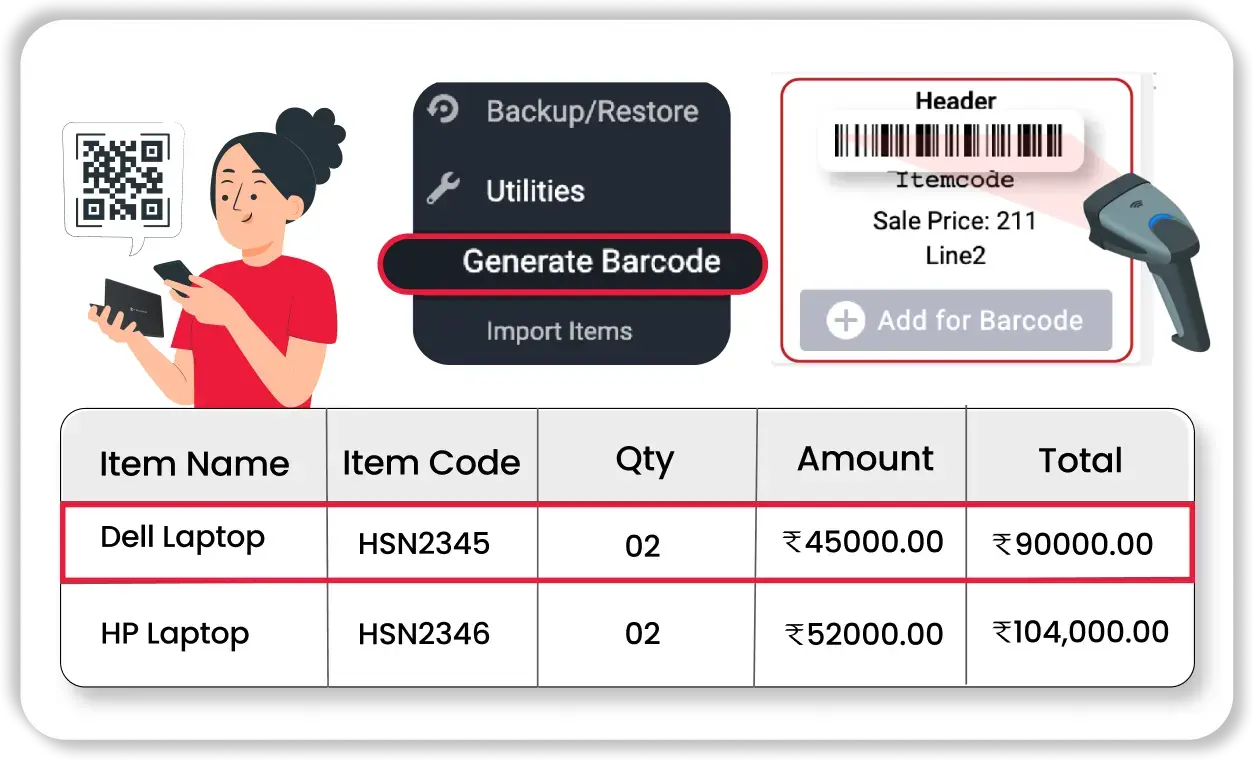

Barcode & QR Code Integration

Automated Asset Audits

Asset Maintenance & Service Tracking

Expense Management

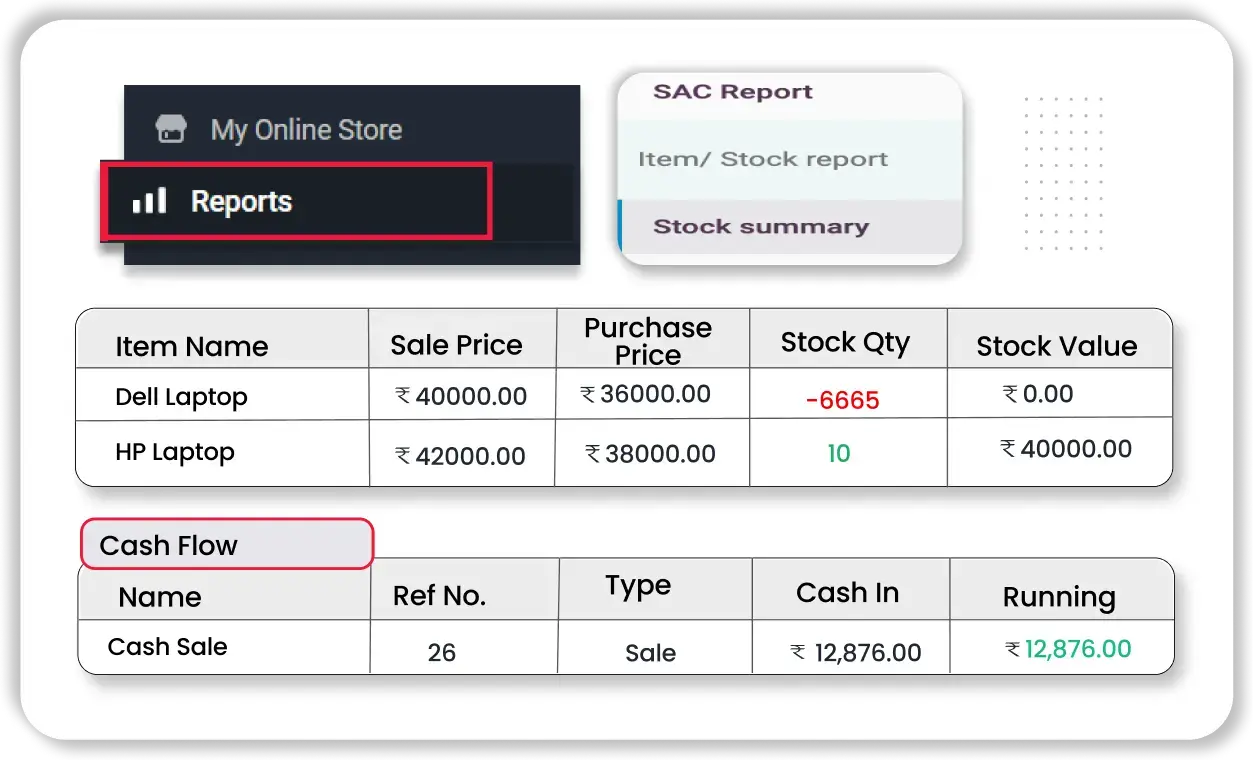

Custom Reports & Analytics

Integration with Accounting Software

GST & Tax Compliance

Regulatory Compliance Management

Multi-User Access

Cloud-Based & Mobile Access

Maximize Asset Efficiency with Vyapar’s Fixed Asset Software

Barcode & QR Code Integration Capability

Assigning unique barcodes or QR codes simplifies asset tracking and retrieval. Vyapar asset accounting software allows businesses to scan and manage assets efficiently with in-app barcode and QR code features.

- Generate Unique Codes: Easily assign barcodes or QR codes to assets in Vyapar, ensuring each fixed asset is uniquely identifiable for quick retrieval.

- Scan & Update Asset Status: Use Vyapar’s scanning feature to update asset records instantly, reducing manual data entry and improving accuracy.

- Efficient Inventory & Asset Control: Businesses can categorize, transfer, and manage assets efficiently by scanning barcodes and keeping records in real-time.

Automated Asset Audits

Conducting periodic audits ensures asset accuracy and prevents mismanagement. Vyapar asset management accounting software simplifies asset audits by maintaining structured records and generating reports for verification.

- Track Asset Availability: Ensure assets are accounted for with Vyapar’s audit-friendly reports, helping businesses detect missing or unaccounted-for assets.

- Compare Records with Physical Assets: Vyapar allows businesses to cross-check system records with actual physical assets, reducing discrepancies and improving audit accuracy.

- Generate Audit Reports: Get detailed asset audit reports in Vyapar for financial transparency and compliance with company policies.

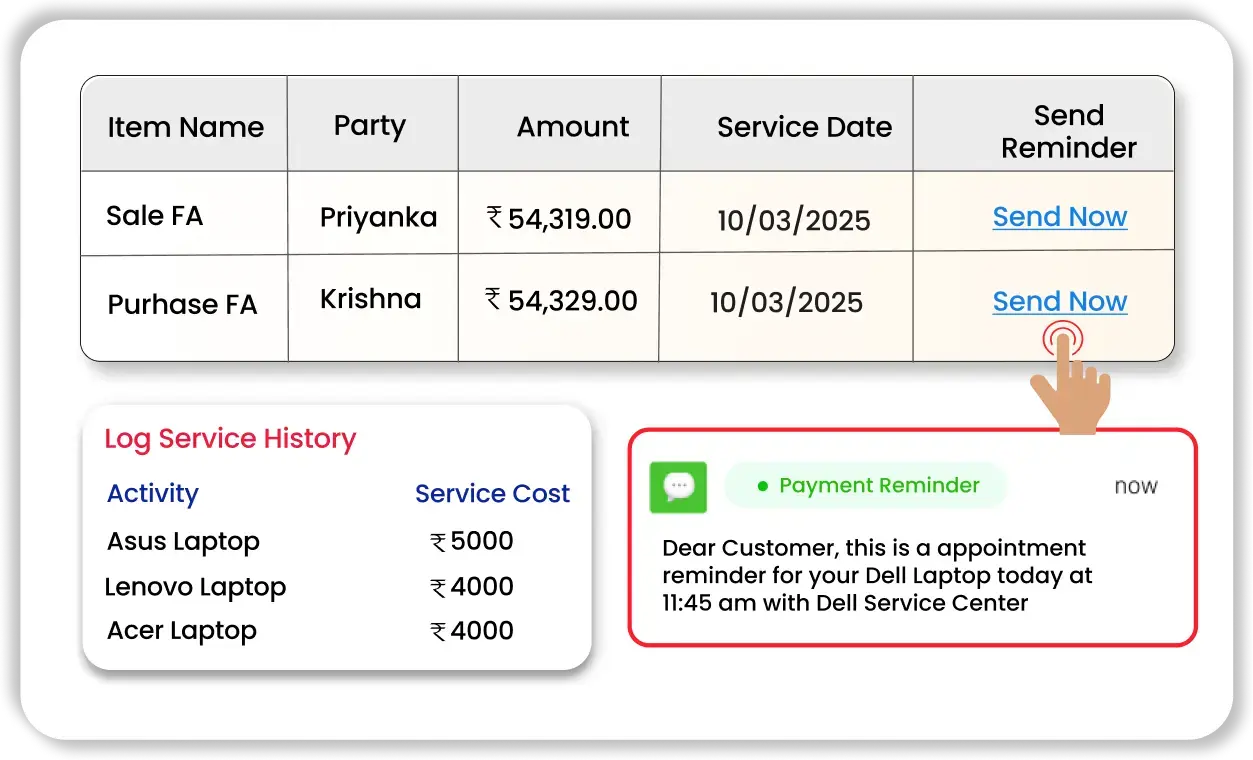

Easy Asset Maintenance & Service Tracking

Regular maintenance increases asset lifespan and performance. Vyapar fixed asset tracking software helps businesses track service schedules, record maintenance expenses, and set reminders.

- Schedule Maintenance Activities: Set maintenance schedules in Vyapar to ensure timely servicing of fixed assets, preventing unexpected breakdowns.

- Log Service History: Record each maintenance activity, repair, or service cost to track asset performance over time.

- Set Maintenance Alerts: Vyapar allows businesses to set reminders for upcoming service dates, ensuring proper upkeep of assets.

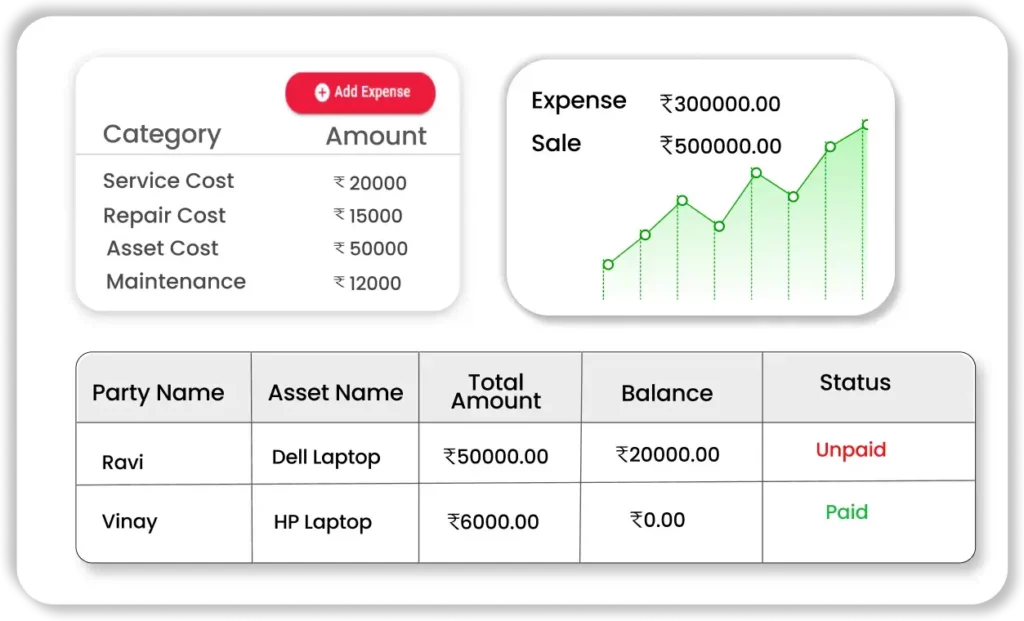

Expense Management for Asset Maintenance

Tracking maintenance costs ensures businesses control expenses and avoid overspending. Vyapar fixed asset management software allows businesses to log, categorize, and analyze all expenses related to fixed asset maintenance and repairs.

- Log Maintenance Expenses: Businesses can enter maintenance expenses in Vyapar by specifying the asset, date, vendor, and amount, ensuring complete records of servicing costs for each fixed asset.

- Categorize Service Costs: Vyapar lets users create specific expense categories like “Repairs,” “Annual Maintenance,” or “Spare Parts,” making it easy to track where asset-related costs are incurred.

- Generate Expense Reports: Businesses can generate reports showing total maintenance costs for each asset, helping them analyze trends and optimize budgeting for asset servicing.

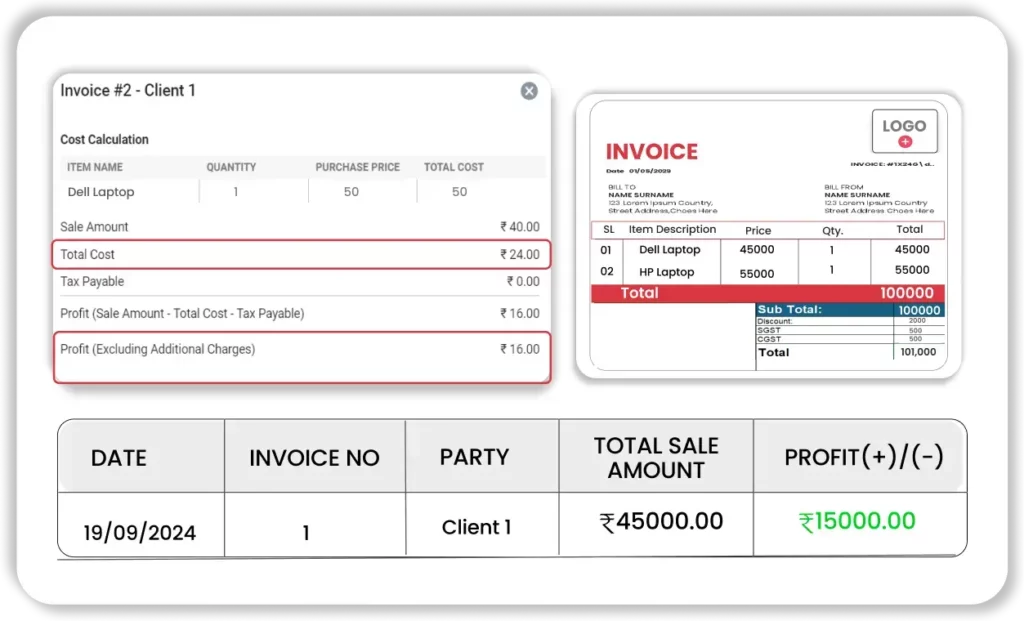

Efficient Custom Reports and Analytics

Vyapar fixed asset software provides detailed reports on fixed asset valuation, depreciation, and expenses. These reports help businesses analyze asset performance and make data-driven financial decisions.

- Generate Asset Valuation Reports: Users can check the current worth of an asset based on its purchase cost and depreciation over time, helping with financial planning and audits.

- Analyze Depreciation Trends: Vyapar offers reports on depreciation deductions per month or year, allowing businesses to track how asset value decreases over time for better financial forecasting.

- Export & Share Reports: Businesses can export reports in PDF or Excel formats directly from Vyapar, making it easy to share insights with accountants, investors, or internal teams.

Integration with Accounting Software

For businesses using Vyapar to manage fixed assets, seamless accounting integration ensures that all asset-related financial transactions are recorded properly in balance sheets and tax filings.

- Record Asset Purchases Automatically: When an asset is added in Vyapar accounting application, its cost is automatically recorded under expenses, ensuring accurate bookkeeping without manual data entry.

- Sync with GST Invoices: If an asset is purchased from a GST-registered supplier, Vyapar fixed asset accounting software captures GST details and applies them to tax reports, ensuring compliance with Indian tax laws.

- Maintain Asset Liabilities: If a fixed asset is purchased on credit, Vyapar allows businesses to record pending liabilities, helping in tracking payments and financial obligations.

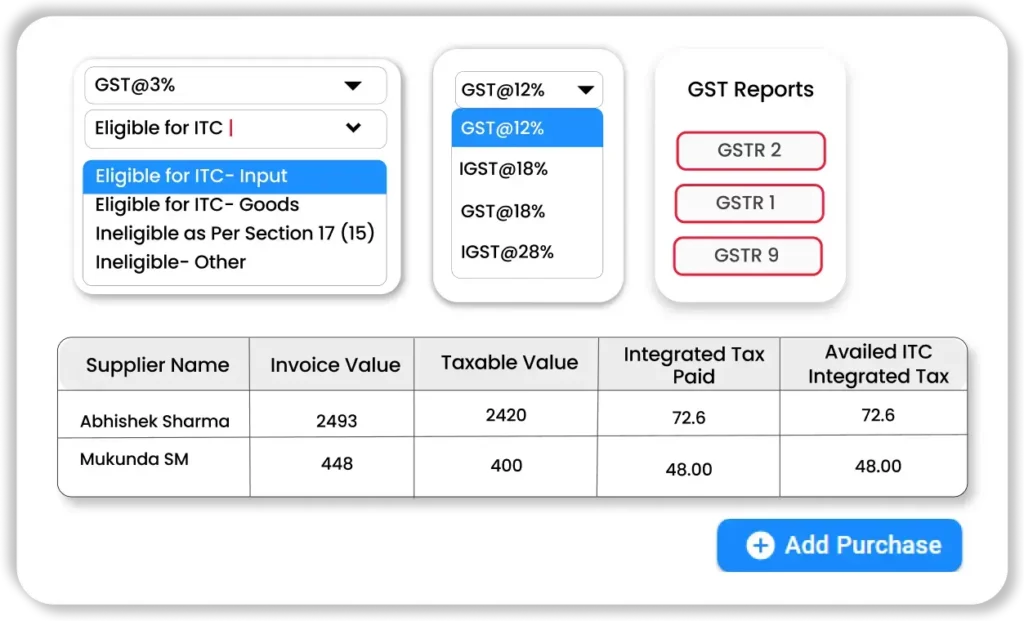

GST and Tax Compliance

Managing tax compliance for fixed assets is crucial, especially for businesses that claim input tax credit (ITC). Vyapar’s free fixed asset management software simplifies tax tracking for asset purchases and ensures GST compliance.

- Track ITC on Fixed Assets: Vyapar automatically calculates how much GST can be claimed as input tax credit on capital purchases, reducing overall tax liability.

- Generate Tax Reports: Businesses can generate GST-compliant reports, showing all asset purchases, tax paid, and ITC eligibility, simplifying tax return filing.

- Simplify Tax Compliance: Vyapar ensures all asset-related transactions are recorded correctly so businesses don’t miss tax deductions and stay compliant with government regulations.

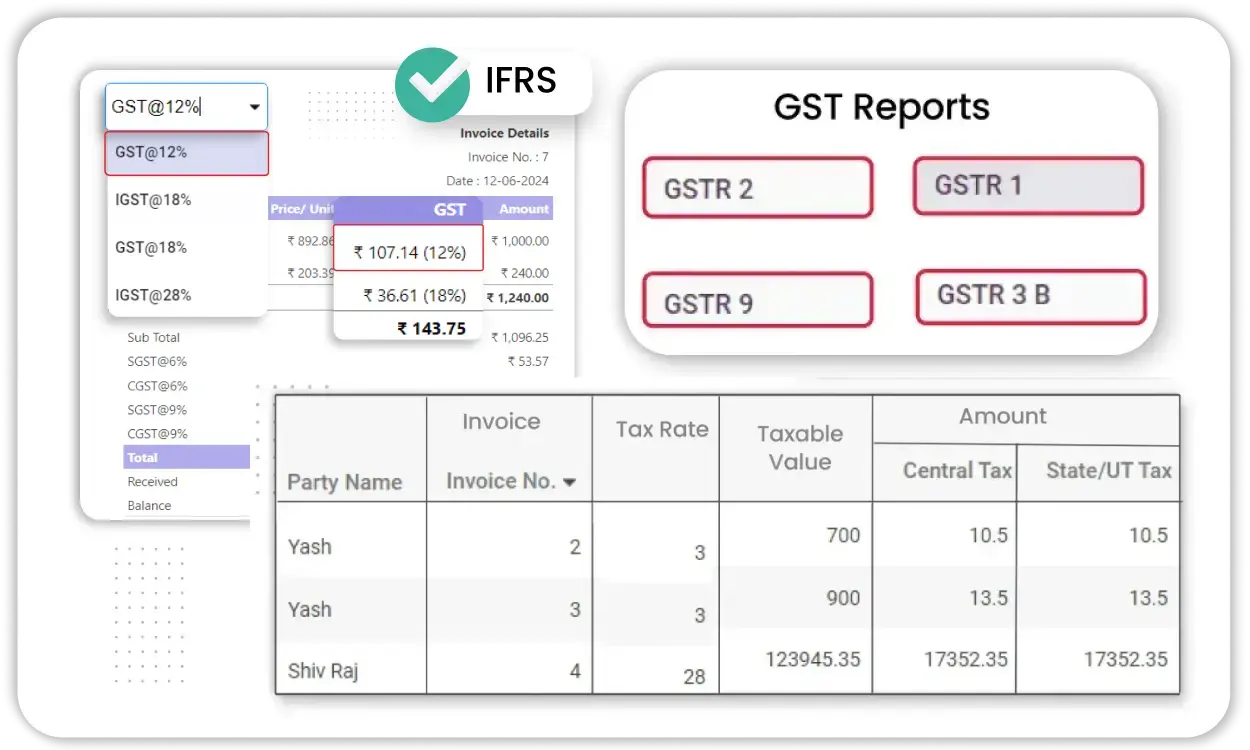

Regulatory Compliance Management

Vyapar fixed asset accounting software helps businesses follow financial and tax regulations related to asset management. Proper compliance prevents legal issues and ensures financial transparency.

- Follow IFRS & Accounting Standards: Vyapar supports accounting principles such as Straight-Line and Reducing Balance depreciation methods, ensuring compliance with standard financial reporting practices.

- Audit-Ready Documentation: Businesses can store invoices, receipts, and maintenance records in Vyapar, making it easier to provide documentation during tax audits or financial inspections.

- Stay Updated with Regulations: Vyapar regularly updates features to comply with Indian tax laws and accounting standards, ensuring businesses always have the latest regulatory support.

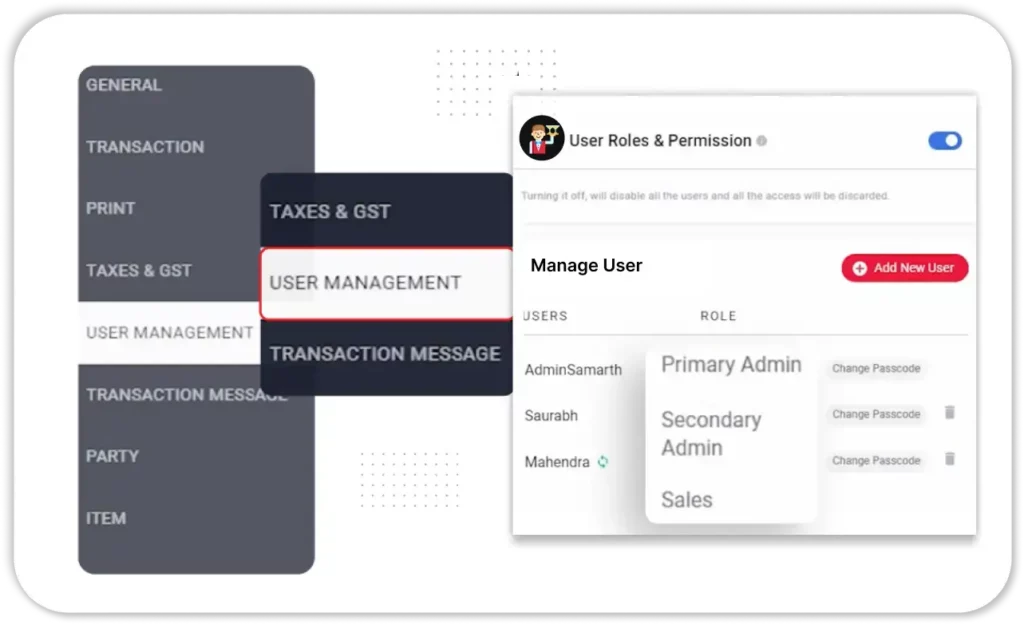

Multi-User Access with Role-Based Permissions

In businesses where multiple team members handle asset records, Vyapar fixed asset software ensures secure access control by allowing different roles with specific permissions.

- Assign User Roles: Business owners can create different user roles (e.g., Admin, Accountant, or Employee) to control who can view or edit asset records.

- Secure Financial Data: Only authorized users can access critical asset data like purchase costs, depreciation, and disposal values, reducing risks of data misuse.

- Multi-Device Access: Team members can log into Vyapar from different devices while maintaining real-time data sync, ensuring smooth collaboration on asset management.

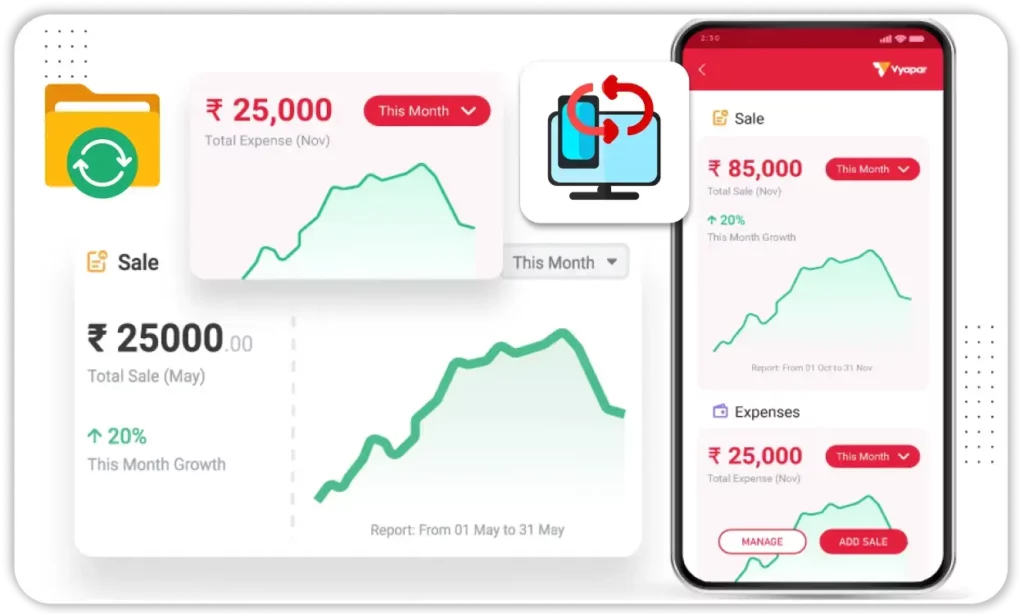

Cloud-Based and Mobile Access

Managing fixed assets anytime, anywhere is essential for businesses. Vyapar’s cloud backup and mobile app support enable users to track and update asset records remotely.

- Manage Assets on Mobile: Vyapar’s Android and desktop apps allow users to add, edit, or check asset details on the go, improving accessibility and efficiency.

- Cloud Backup for Security: All asset-related data is securely backed up in the cloud, ensuring that information is not lost due to device failure or accidental deletion.

- Sync Across Devices: Whether using Vyapar on mobile, tablet, or PC, all asset records stay updated in real-time, allowing seamless asset management across different locations.

How to Add Fixed Assets on Vyapar Accounting App

Track, Depreciate, Optimize – Smart Fixed Asset Management Starts Here!

Take Control of Your Assets with Vyapar’s All-in-One Fixed Asset Management Solution

Vyapar’s Fixed Asset Management Software eliminates these risks by providing a real-time view of asset lifecycle, from purchase to disposal. Whether you run a retail store, a manufacturing unit, or a service business, tracking assets manually can result in errors and missed depreciation calculations. Vyapar automates these processes, ensuring accuracy and saving valuable time.

Beyond tracking, Vyapar empowers businesses to optimize asset utilization and reduce costs. Imagine never losing track of essential equipment or missing scheduled maintenance—preventing breakdowns and downtime. With seamless reports, tax compliance support, and an intuitive dashboard, Vyapar makes asset management effortless, helping businesses stay in control and maximize profitability.

Unlock Business Growth with These Key Benefits of Vyapar Fixed Asset Software

Prevent Asset Mismanagement

Avoid financial losses by keeping track of all fixed assets, ensuring nothing goes missing or underutilized in your business.

Accurate Depreciation Planning

Automate depreciation calculations, helping you make informed financial decisions and optimize tax benefits without manual errors.

Minimized Downtime & Maintenance Costs

Schedule asset maintenance to prevent unexpected breakdowns, ensuring smooth business operations and reducing repair expenses.

Better Financial Forecasting

Gain real-time insights into asset value, allowing you to plan budgets and investments confidently.

Improved Compliance & Audit Readiness

Maintain detailed asset records, ensuring you meet regulatory requirements and are always audit-ready without last-minute hassles.

Higher ROI on Assets

Maximize the lifespan and efficiency of your assets, helping you extract the most value from every investment.

Vyapar’s Growing Community

Take Your Business to the Next Level with Vyapar App! Try Free!

Frequently Asked Questions (FAQs’)

Fixed asset management software helps businesses track, maintain, and optimize their physical assets throughout their lifecycle. It ensures accurate depreciation, improves asset utilization, reduces losses, and helps in compliance with financial regulations.

Vyapar’s Fixed Asset Software simplifies asset tracking, automates depreciation calculations, schedules maintenance, and provides real-time reports. It helps businesses reduce losses, improve financial planning, and maintain accurate records for tax and compliance purposes.

A good fixed asset software should include asset tracking, depreciation management, audit-ready reports, maintenance scheduling, barcode/RFID integration, cloud backup, and multi-user access to streamline operations.

Currently, Vyapar is a desktop and mobile-based software, allowing offline access to asset data. However, you can back up data to cloud storage for added security and remote access.

Fixed asset accounting software focuses on depreciation calculations, financial reporting, and tax compliance. Fixed asset tracking software helps monitor asset location, usage, and maintenance schedules to prevent loss or theft. Vyapar offers a blend of both functionalities.

Asset accounting software automates depreciation calculations, generates financial reports, and helps businesses comply with tax regulations. It eliminates manual errors, ensuring precise asset valuation and improved financial forecasting.

Yes, Vyapar provides asset management accounting software features that generate tax-ready depreciation reports, ensuring compliance with GST, income tax, and audit requirements.

A cloud-based fixed asset software allows businesses to access asset data from anywhere, collaborate with multiple users, and secure information with automatic backups, reducing the risk of data loss.

Vyapar provides secure local and cloud backup options to prevent data loss. It also offers role-based access control, ensuring only authorized personnel can modify or view asset records.

Absolutely! Vyapar’s fixed asset management software is designed for SMBs, offering an affordable, easy-to-use solution that helps businesses streamline asset tracking, accounting, and compliance without any technical expertise.