What is an Asset in Accounting? A Simple Explanation

Estimated reading time: 11 minutes

In accounting, an asset is anything valuable a business owns or controls, expected to bring future economic benefit. These include cash, property, machinery, inventory, and even rights like patents and trademarks, often known as intellectual property. These resources are critical in business operations, helping generate income and support day-to-day functions. The more assets a company has, its financial position or net worth is likely to be stronger.

The balance sheet lists the resources. It categorizes them based on their nature, such as short-term or long-term. This helps show the company’s financial health clearly.

This classification helps business owners and investors see what the company owns. It shows how these resources can support growth and stability.

Key Takeaways of Assets in Accounting

- A business’s Assets are valuable resources, such as cash, inventory, and property.

- These resources support income generation and operational needs.

- They are crucial for evaluating a business’s financial strength.

Understanding Assets in Accounting

An asset is something a business owns that it uses to produce goods, provide services, or generate income. For example, if a company purchases a machine for production, that machine becomes an asset. People generally categorize them into current (short-term) and non-current (long-term) assets. This classification helps clarify each asset’s role in the business.

Having various resources signals a company’s financial health and stability, supporting daily operations and enabling growth. Resources help businesses get bank loans and attract investors. They show that the company can repay debts and fund projects.

Types of Assets in Accounting

1. Current Assets

Current assets represent short-term resources that businesses can convert into cash within a year. They are essential for covering daily expenses and meeting immediate financial needs. Common examples include:

- Cash and Cash Equivalents: Money held in a business’s bank account and highly liquid resources.

- Accounts Receivable: Money owed by customers who purchased goods on credit.

- Inventory: Products or materials available for sale.

- Prepaid Expenses: Payments made in advance for future services, like rent or insurance.

2. Non-Current Assets

Non-current assets, or long-term items, represent resources that companies expect to hold for over a year. These resources support income generation over time and play a crucial role in business operations. Examples include:

- Property, Plant, and Equipment (PP&E): Land, buildings, machinery, and equipment used in production.

- Intangible Assets: Non-physical resources like patents, trademarks, and copyrights.

- Long-Term Investments: Resources for holding over extended periods, such as stocks or bonds.

Importance of Assets in Accounting

Assets are important for a business’s financial health and growth. They help a company invest, expand, and run daily operations.

1. Business Growth and Expansion

This enables business expansion by providing the necessary resources to increase production or open new locations. Machinery and technology, for example, are critical resources that support operations.

2. Cash Flow Management

Current assets, like cash and accounts receivable, play a vital role in managing cash flow and working capital. With enough cash and liquid resources, a business can meet its financial obligations, pay suppliers, and cover unexpected costs.

3. Financial Security and Borrowing

Resources on the balance sheet indicate a business’s financial strength. Companies with a robust resource base can secure bank loans more easily, as lenders consider these resources as security. For example, a business with property can use it as collateral for a loan.

How Assets are Used in Accounting

In the field of accounting, financial reports enumerate assets. This helps show the business’s financial health clearly.

The balance sheet is the main document for recording resources. We divide these resources into current and non-current categories. The list includes them by their value.

1. Balance Sheet and Asset Classification

The balance sheet groups this by type and value. The report details present resources initially, followed by enduring assets. This setup gives stakeholders a clear view of the company’s resources. It shows how these can help grow the business and address debts.

2. Financial Ratios Using Assets

Financial ratios help evaluate a company’s resource management. For example, you can find the current ratio by dividing current assets by current liabilities. This ratio shows if the business has enough resources to pay short-term debts. Ratios like these provide insight into how well a company manages its assets and liabilities.

3. Asset Depreciation

For non-current items like equipment or buildings, accounting uses depreciation to gradually expense their cost over time. Depreciation reflects wear and tear on assets, showing a gradual decrease in value each year. This process helps companies track the remaining value of their long-term resources.

Examples of Assets in a Business

Here are a few examples to better understand assets in accounting:

Example 1: Cash as an Asset

If a business has ₹50,000 in its bank account, this cash is a current asset. Cash is essential for paying bills, purchasing supplies, and covering payroll. Having cash readily available allows the business to handle immediate expenses without borrowing.

Example 2: Inventory as an Asset

Imagine a clothing store that has ₹20,000 worth of clothes for sale.. This inventory is a current resource because the store can sell these items to quickly generate cash. Inventory is crucial for businesses that sell physical goods, directly impacting their income.

Example 3: Equipment as a Non-Current Asset

If a bakery owns an oven worth ₹30,000, this oven is a long-term resource expected to last several years and generate income. The balance sheet records the oven’s cost, and the value decreases over time through depreciation.

Different Categories of Assets

1. Tangible vs. Intangible Assets

Assets can be tangible (physical items like buildings) or intangible (non-physical items like patents). Tangible resources are easier to value because they are physical items. Intangible resources, like intellectual property, add value through legal rights or branding.

2. Operating vs. Non-Operating Assets

Businesses actively use operating assets, such as machinery for production. People do not use non-operating assets, like vacant land, actively. However, they can provide future economic benefits or generate cash through sales.

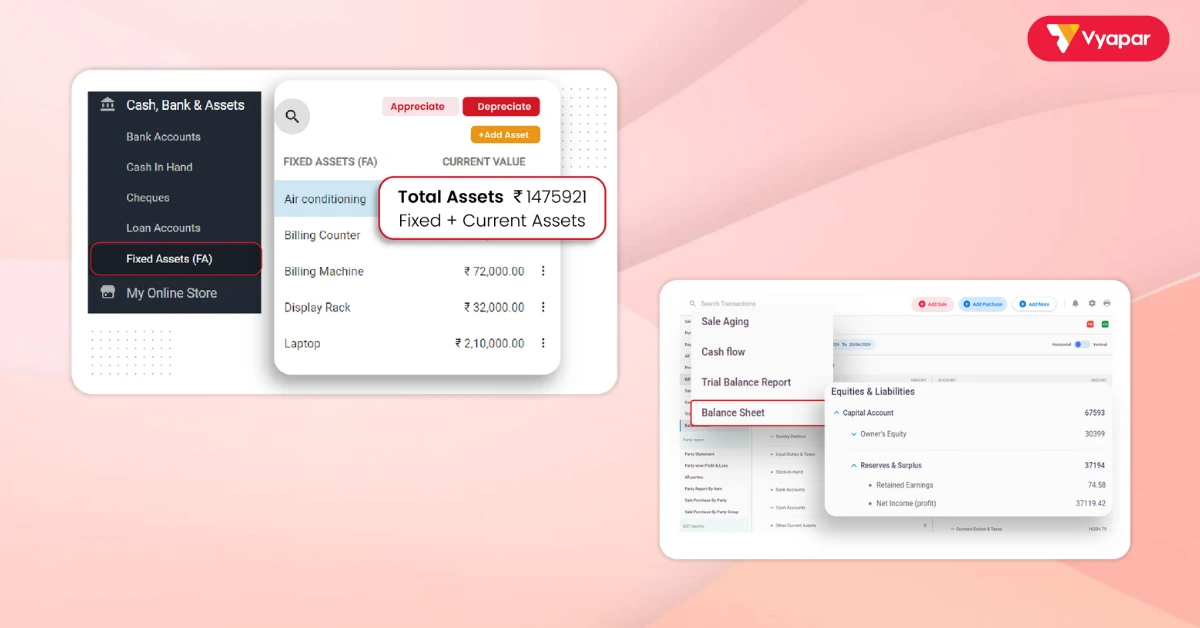

How Vyapar App Can Help Manage Assets

The Vyapar app is accounting software for small businesses. It helps users manage purchases, sales, and the value of resources. The app organizes financial information efficiently, enabling clear asset management without requiring extensive accounting knowledge.

1. Recording Asset Purchases and Sales

Vyapar allows business owners to record both purchases and sales of equipment, property, or inventory. The app prompts users to enter details like the item, cost, and date, ensuring a complete record of all assets.

2. Managing Depreciation and Appreciation

Vyapar helps track depreciation for long-term items. This allows owners to record how the value of items, like machinery or vehicles, decreases over time. If an asset increases in value, Vyapar helps record it accurately. This provides a clear picture of a company’s net worth.

3. Generating Financial Reports

Vyapar organizes recorded data into financial reports, such as balance sheets and income statements, based on the resources added. These reports give a clear view of the business’s financial health. They demonstrate how effectively assets generate income.

4. Real-Time Tracking of Cash and Inventory

Vyapar allows businesses to monitor cash levels and inventory in real time. Knowing exact cash and stock levels helps businesses manage cash flow and make informed spending decisions.

5. Tax-Ready Asset Reports

Vyapar generates tax-ready reports that include details on assets, depreciation, and appreciation, simplifying tax filing for small businesses. This feature is valuable for businesses needing accurate records for compliance.

With Vyapar, small business owners can track assets, understand their net worth, and create financial reports easily.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free!

Try our Android App (FREE for lifetime)

FAQ’s

An asset is something valuable that a business owns or controls. This includes cash, inventory, and equipment. Assets help the business make money and provide future benefits.

Assets are essential for business growth, covering expenses, and showing a company’s financial strength.

Companies use fixed assets, such as buildings, machinery, and equipment, for several years. They are vital for business operations and are recorded on the balance sheet.

You can turn current assets into cash within a year. Examples include cash and inventory. Non-current assets last more than a year. Examples are buildings and equipment.

Intangible assets are non-physical items like patents, trademarks, and copyrights that add value through legal rights or branding.

Depreciation slowly lowers the value of long-term assets over time. This helps businesses show a more accurate value for these items.

The balance sheet lists assets, starting with current resources, followed by long-term resources, and groups them by type and usage.

The Vyapar app helps you track purchases and manage asset value. It creates financial reports and monitors cash and inventory in real-time. This makes asset management easier for small businesses.

Related Posts: