Personal Accounting Software

Are you looking for the best Accounting Software for personal use? Use the Vyapar App to track expenses, income, and payments all with one accounting solution platform. Try it for Free and grow your home business faster!

Accounting Software Features Designed for Personal Use

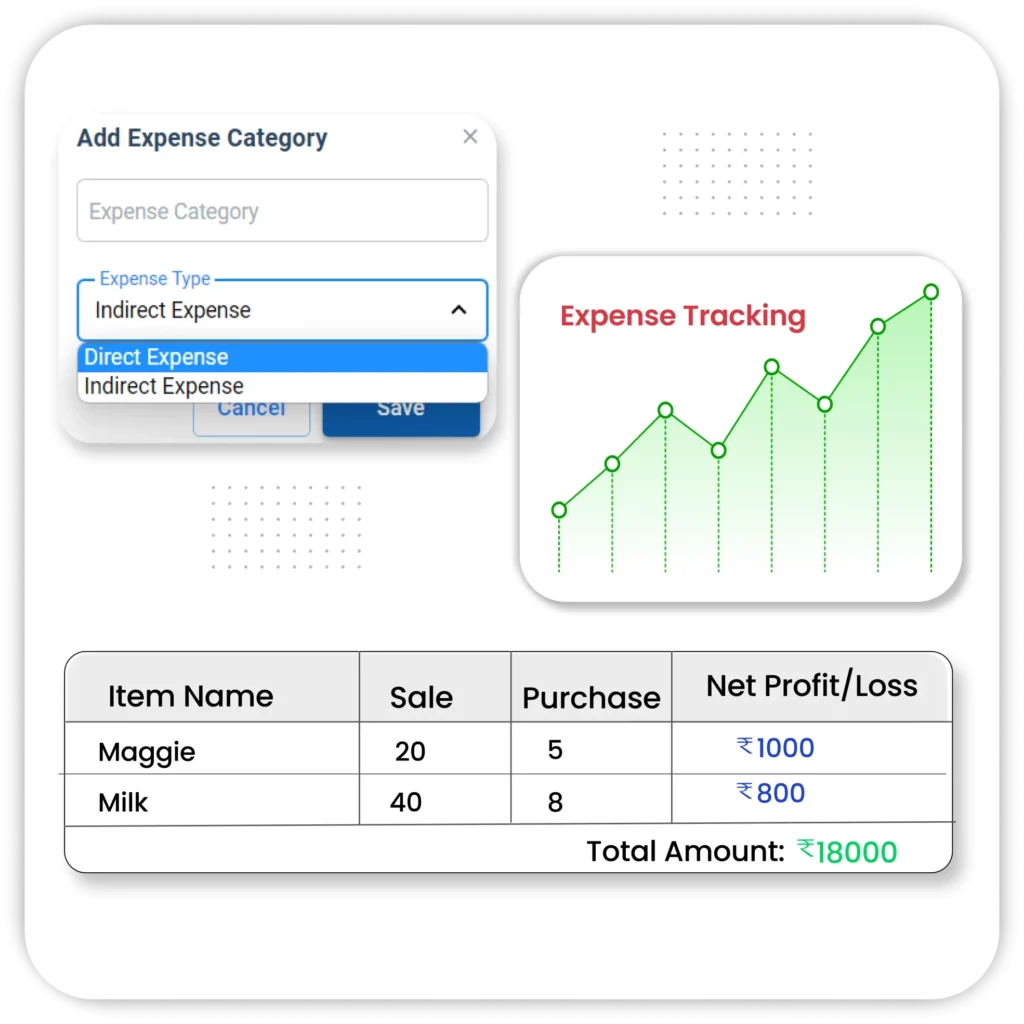

Expense Tracking

Vyapar’s expense tracking feature allows you to monitor and manage your spending across various personal and household categories.

- Automatic Expense Entry: Vyapar’s personal accounting software lets you record expenses instantly by selecting from predefined or custom categories, ensuring consistent documentation of costs like groceries, travel, and medical bills.

- Category-Based Insights: Track spending across categories with color-coded charts, making it easy to identify where your money goes and optimize your personal budget accordingly.

- Attach Bills or Receipts: You can attach scanned bills, photos, or receipts to each expense entry in Vyapar, providing proof and helping with tax planning or future reference.

Income Management

Using personal accounting software like Vyapar allows users to seamlessly manage all income streams. Whether you have multiple income sources or additional income streams, our tool will help you track every rupee.

- Real-Time Updates: Receive immediate insights into your cash flow as the system automatically records transactions.

- Reports and Forecasts: Generate monthly or annual income reports to make better financial decisions.

- Budgeting Made Easy: Allocate funds efficiently and track how your income aligns with your financial goals.

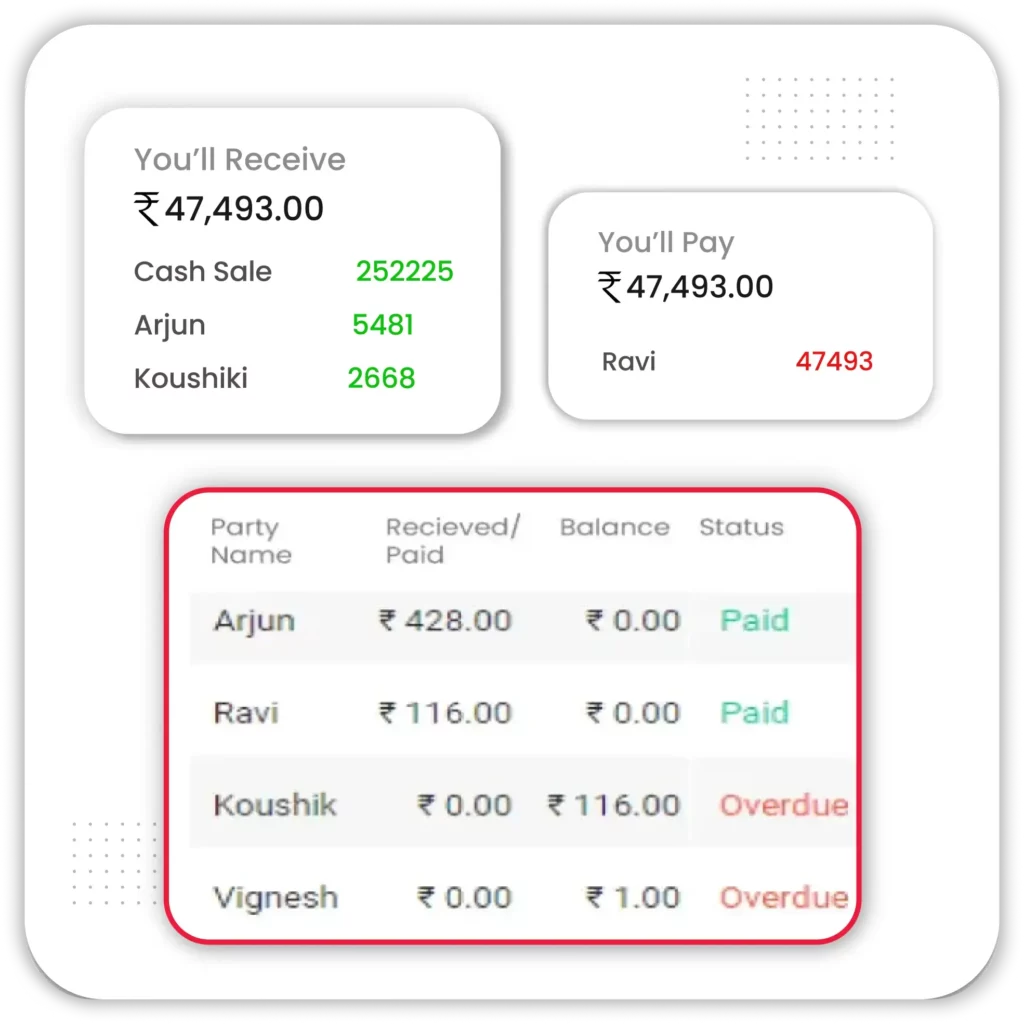

Track Receivables and Payables

Managing cash flow is crucial. Free personal accounting software helps you avoid missing payments or forgetting invoices. Features include:

- Invoice Management: Track all outstanding payments and generate professional invoices.

- Payment Alerts: Receive reminders for due dates, ensuring no missed payments.

- Easy Reconciliation: Match payments with invoices in just a few clicks.

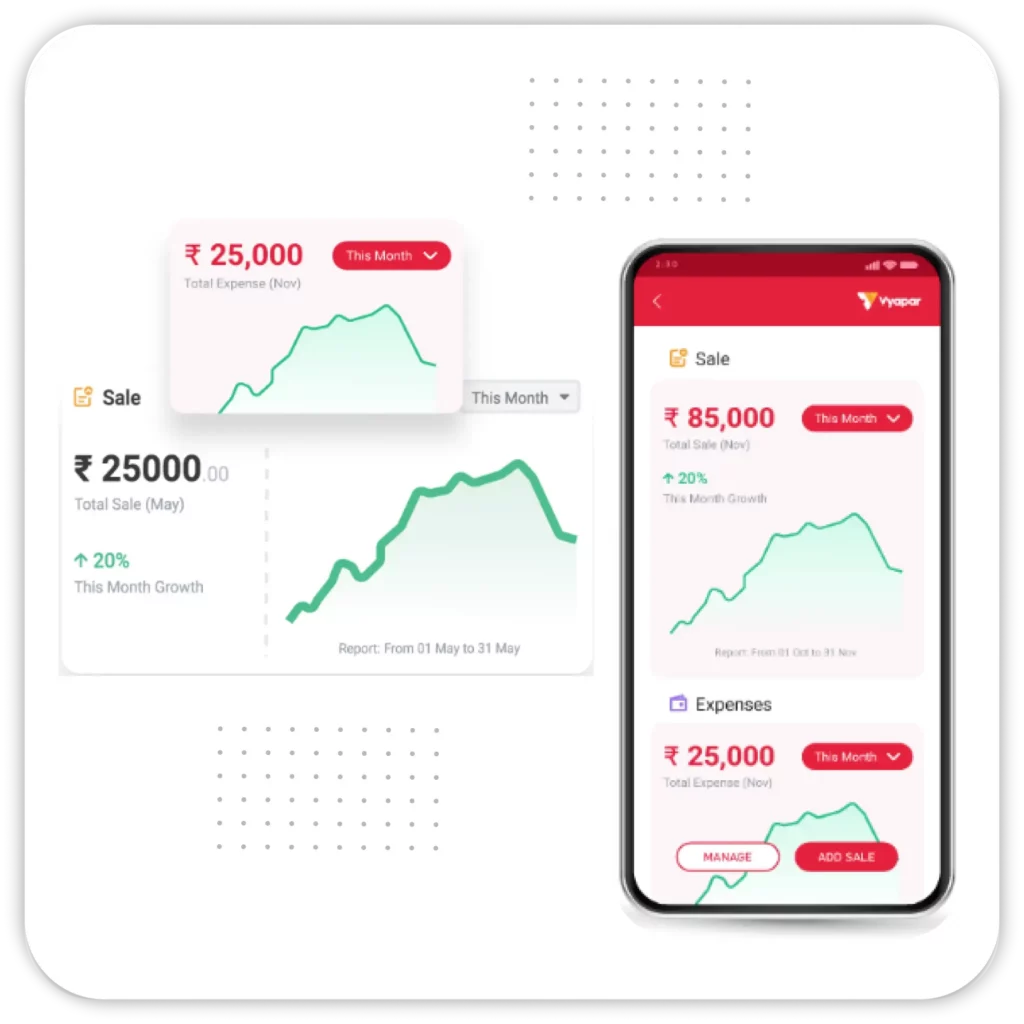

Mobile App Accessibility

Accessibility of your business anywhere and anytime is crucial. Vyapar’s personal accounting app allows you to manage your finances wherever you are.

- Cross-Platform Compatibility: Available on Android, iOS, and desktop platforms.

- Cloud Sync: Your data syncs automatically, ensuring your information is always up-to-date, no matter the device.

Features that Make Vyapar the Best Free Personal Accounting App

Online/Offline Compatibility

Tax Compliance

Custom Invoicing

Multi-Payment Options

Print and Share

WhatsApp Marketing

Financial Reports

Cloud Backup and Data Security

Alerts and Notifications

Inventory Management

Export to Excel or PDF

Home Based Accounting Software for Individuals Simplifies Financial Management

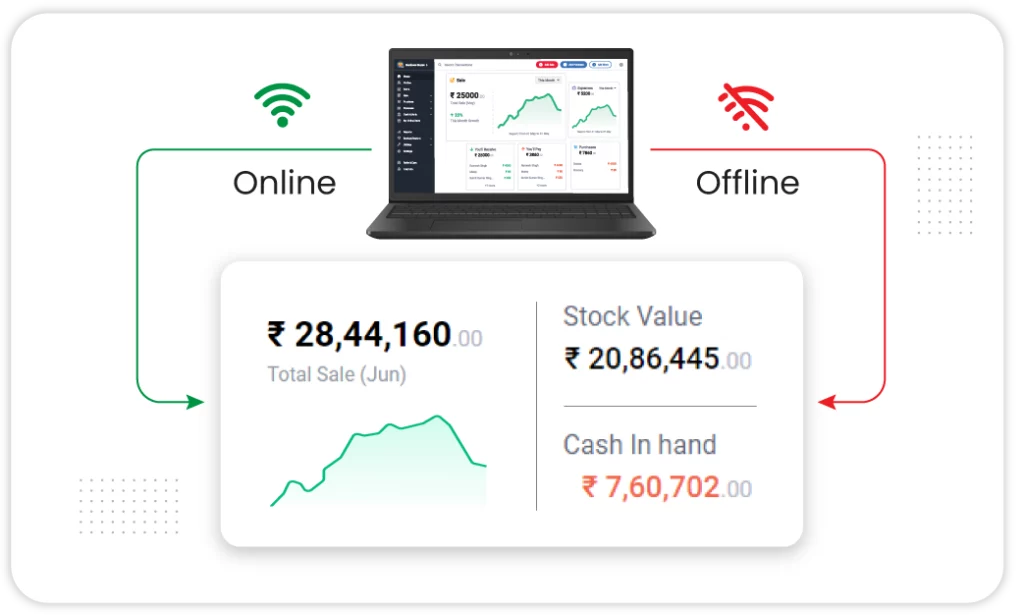

Online/Offline Compatibility

Vyapar’s personal accounting software ensures smooth financial management even without an internet connection. Whether you’re using the app at home or on the go, you can manage your accounts seamlessly.

- Work Without Interruptions: Use the software offline for key tasks like expense tracking and invoicing.

- Seamless Sync: Once you go online, the system syncs all your changes to the cloud, maintaining up-to-date records.

- Flexibility for All Situations: This feature makes Vyapar the top personal accounting app. Users can access their data anytime and anywhere.

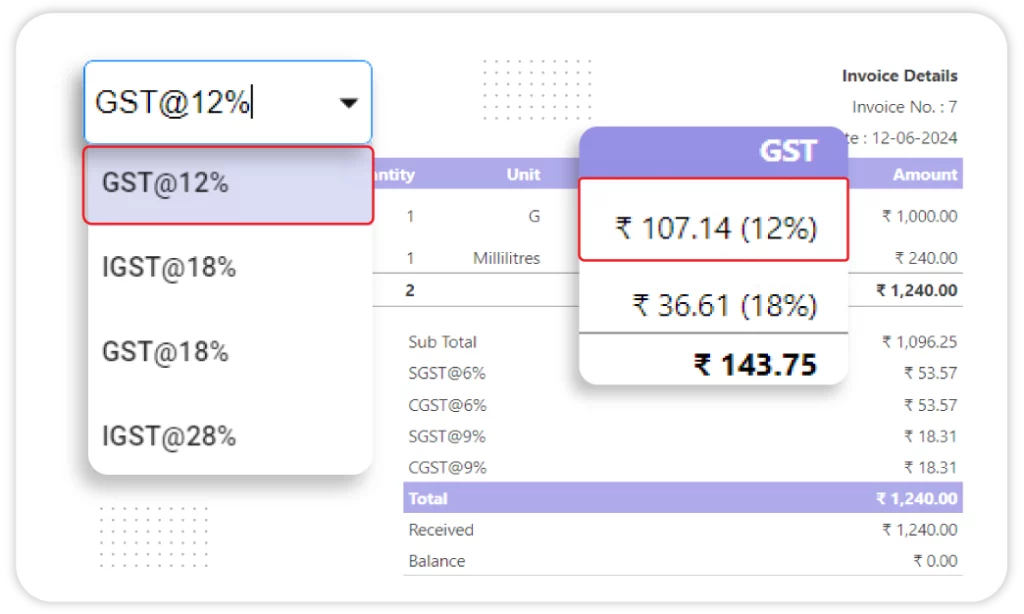

Tax Compliance

Vyapar helps you stay compliant with tax laws. This makes it one of the best personal accounting software options in India for managing taxes. The software automatically calculates and applies the necessary taxes, including GST.

- GST Ready: Automatically calculate Goods and Services Tax (GST) for every invoice. This feature is important for personal accounting software in India.

- Tax Reports: Generate detailed reports for easy tax filing.

- Simplify Tax Season: With everything tracked in one place, filing your taxes becomes hassle-free, and you avoid penalties.

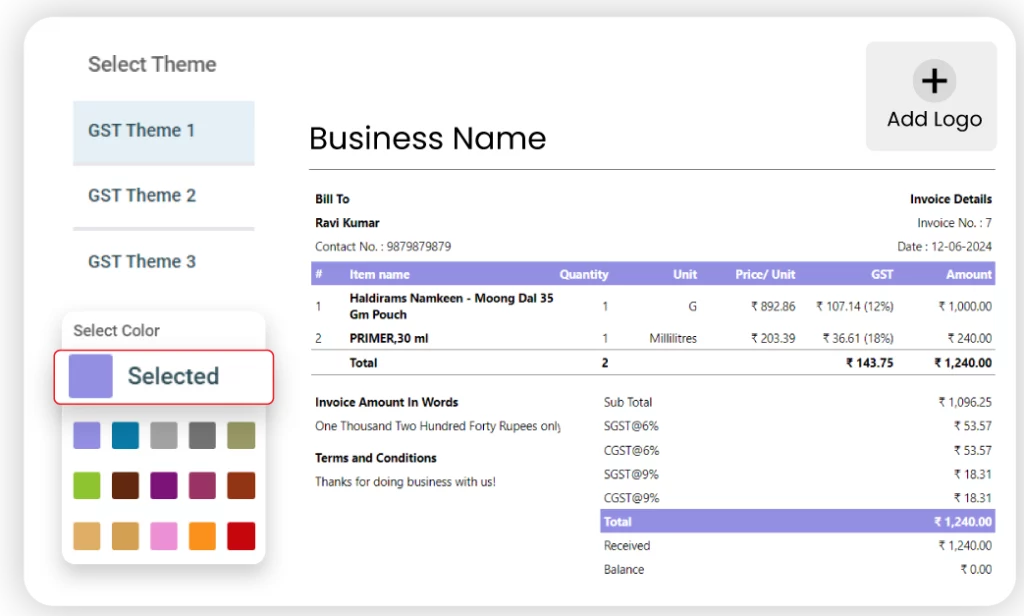

Custom Invoicing

Customize your invoices to suit your personal or business needs with our invoicing system. This feature sets Vyapar apart as one of the best personal accounting apps for invoicing.

- Personalization Options: Add your logo, select colors, and choose formats to align with your brand.

- Professional-Looking Invoices: Generate polished invoices that leave a lasting impression on clients.

- Save Templates: Quickly create invoices using saved invoice templates, making billing efficient and tailored.

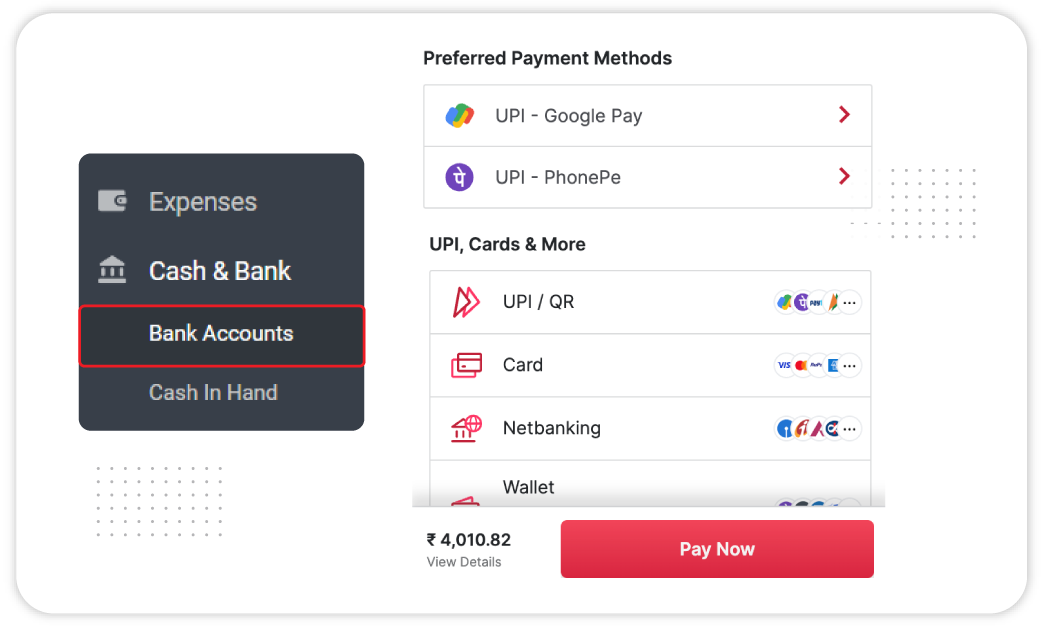

Multi-Payment Options

Allow your customers to pay in different ways. This is an essential feature of personal accounting software for both home businesses and individuals.

- Diverse Payment Methods: Accept payments using credit and debit cards, UPI, and net banking. This makes it one of the best accounting programs for flexibility.

- Instant Payment Tracking: Track payments in real-time, so you always know the status of your receivables.

- Faster Collections: With more payment options, you can collect payments faster, improving your cash flow.

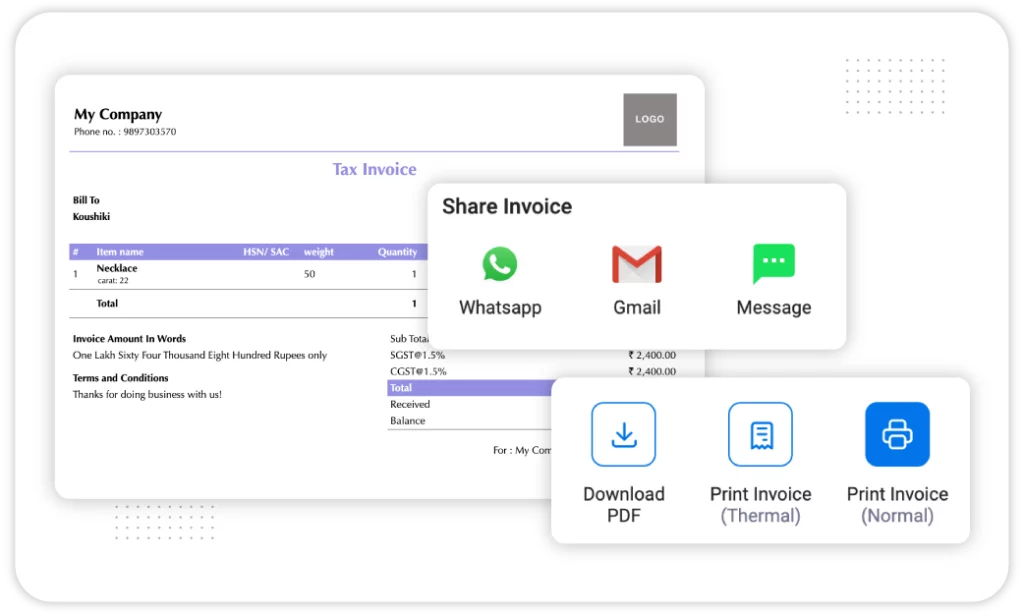

Print and Share

Quickly print or share invoices, reports, and financial documents directly from Vyapar’s free personal accounting software.

- Easy Printing: Print invoices, reports, and statements with just a few clicks.

- Share Via Multiple Platforms: Share files via WhatsApp, email, or other platforms, making a good user experience.

- Time-Saving Features: Streamline communication by sharing financial documents directly with your accountant or clients.

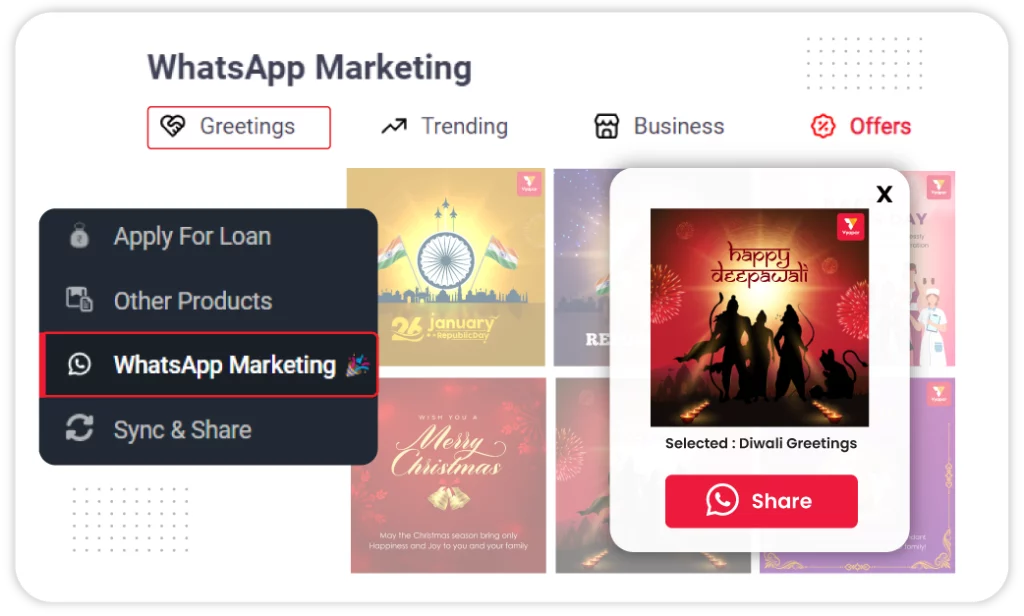

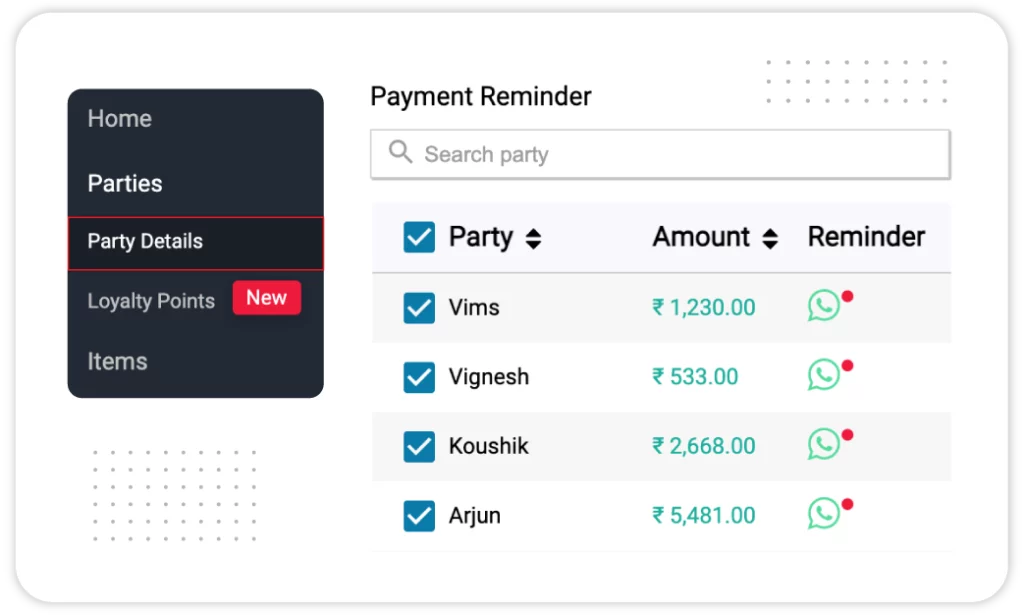

WhatsApp Marketing for Home Businesses

For home business users, Vyapar enables direct WhatsApp messaging to clients—send offers, reminders, and greetings to boost engagement and collections.

- Send Greetings: Share festive or seasonal messages to build better customer relationships.

- Promote Offers: Quickly notify customers about new products, discounts, or deals.

- Remind for Payments: Auto-send polite payment reminders via WhatsApp for timely follow-ups.

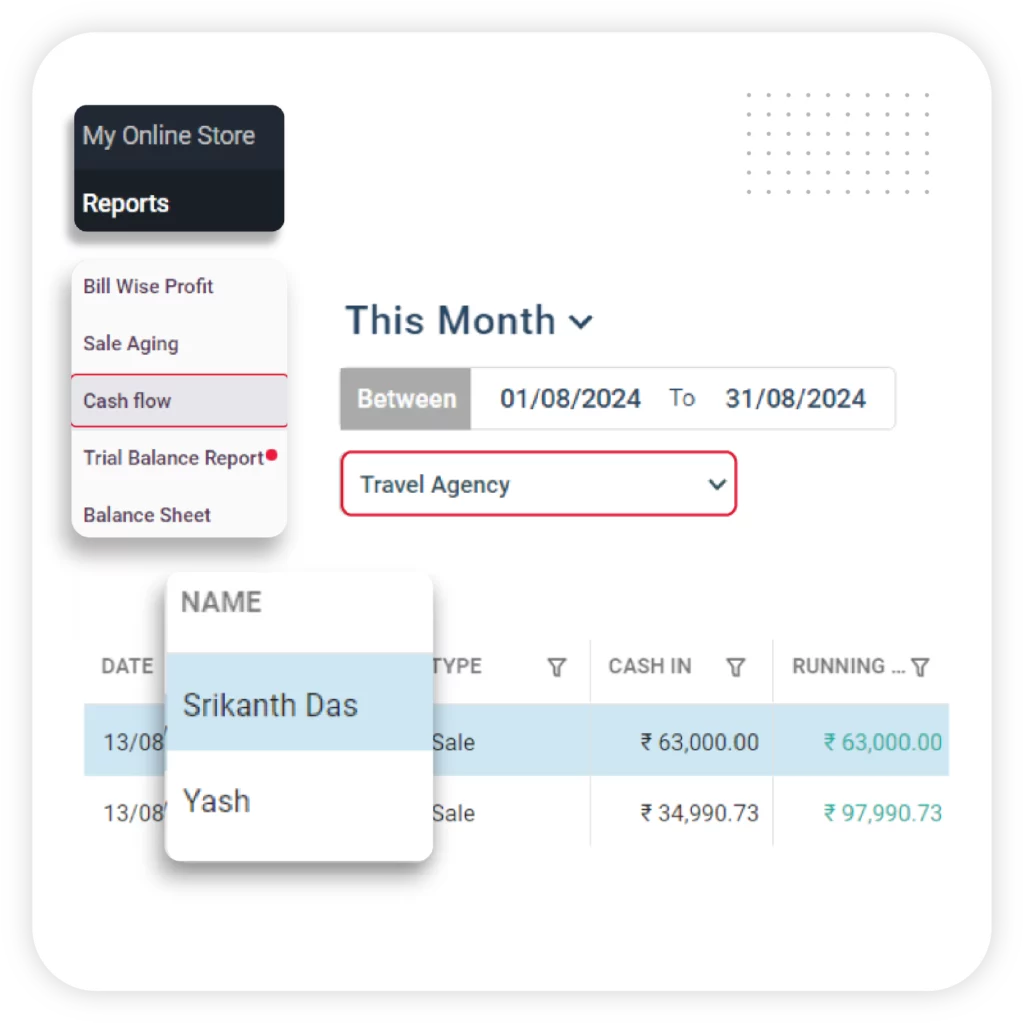

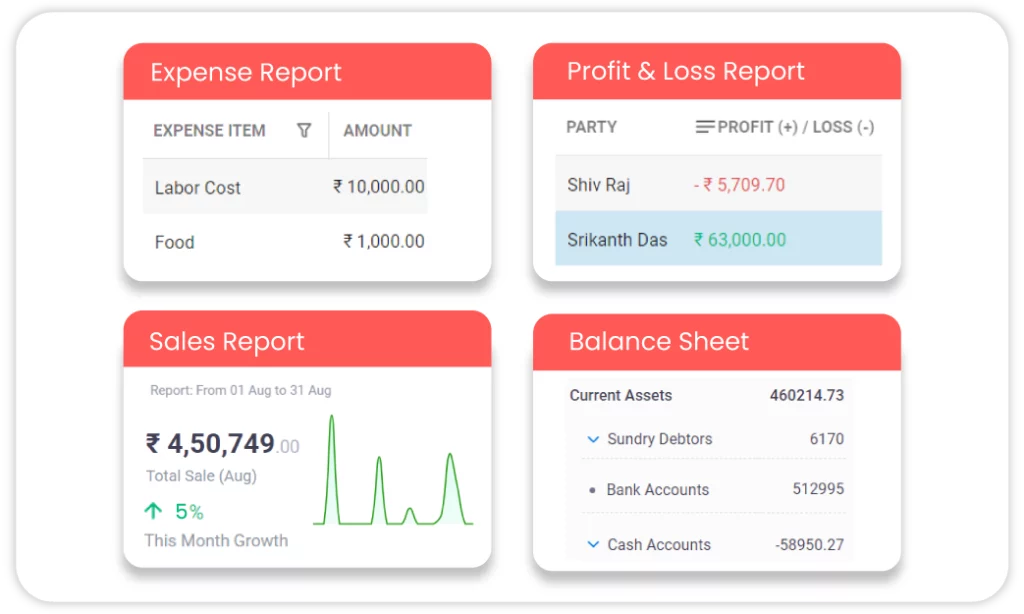

Financial Reports

Generate detailed financial reports, making Vyapar one of the best personal accounting apps for financial planning and decision-making.

- Instant Reports: Create profit and loss statements, balance sheets, and cash flow reports instantly.

- Decision-Making Support: Leverage these reports to make informed financial decisions, a feature crucial in personal accounting programs.

- Customization: Customize reports to focus on specific financial metrics, making this software suitable for both personal and business use.

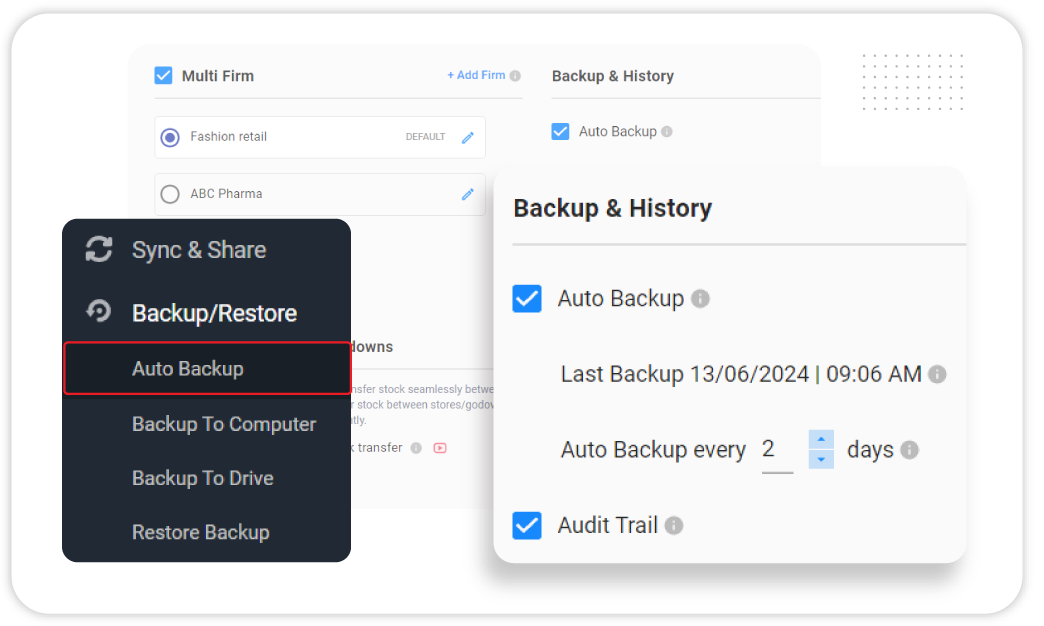

Cloud Backup and Data Security

Vyapar home accounting software ensures that your financial data is backed up in the cloud, providing robust security for your customer data.

- Automated Cloud Backup: Keeps your data safe in the cloud. It automatically backs up your information to prevent loss.

- Data Encryption: Vyapar uses high-level encryption to keep your sensitive data secure.

- Access from Anywhere: With cloud backup, you can access your data from any device, ensuring smooth workflow and peace of mind.

Alerts and Notifications

Stay updated by receiving real-time alerts and notifications. This feature makes Vyapar one of the best personal accounting apps.

- Payment Reminders: Receive timely alerts for upcoming payments, so you never miss a deadline.

- Low Stock Alerts: Receive notifications when inventory is low. This helps you reorder items for better stock management.

- Proactive Management: Use alerts to manage expenses, track receivables, and stay on top of financial goals.

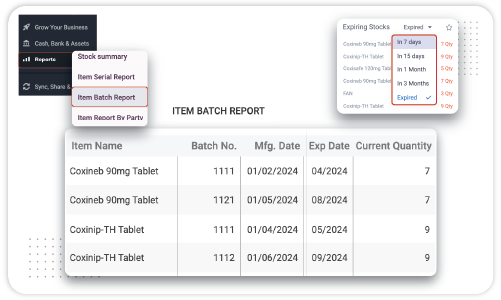

Inventory Management

Vyapar designs its inventory management tools for small businesses, including home-based ones. This makes it great software for personal use.

- Real-Time Inventory Tracking: Keep an eye on stock levels across multiple locations in real-time.

- Low Stock Alerts: Receive notifications when inventory is running low, helping you avoid stockouts in your store.

- Inventory Reporting: Create detailed inventory reports to manage your stock well. This makes Vyapar one of the best solutions for home-based businesses.

Manage Your Personal Finance Easily with Our Easy Accounting Software!

Use Vyapar as a Personal Accounting App for Home-Based Business

Vyapar’s accounting software brings together all systems and applications for managing financial data in one place. Here are the reasons you should go for Vyapar Household Accounting Software for personal use:

Helps Manage Your Cash Flow

The most significant problem small business owners face nowadays is cash flow issues. Using Vyapar’s personal accounting software can be essential in bringing considerable benefits. It helps small business owners understand their cash flows and payment processes better. It also calculates everything for you, reducing finance errors.

Vyapar personal accounting tracks all transactions with seamless scaling and implementation of new products and services.

Skyrockets Your Home Business Efficiency

Vyapar personal household accounting software helps you improve home business efficiency. It can manage accounts receivable, accounts payable, and the general ledger, among other tasks.

Accounting calculations can be complex and time-consuming. This often leads small business owners to buy software. They use this software to make accurate calculations for financial planning.

A personal accounting software app keeps your information intact in one place, making it simple to reference past transactions. It saves your time from laborious paperwork or spreadsheets.

Significantly Reduce Overall Costs

Vyapar personal accounting software speed and efficiency often go hand-in-hand with a tremendous reduction of overall costs. The accounting program enables each member of the accounting team to do more in a given time. Thus, reducing the accounting department’s payroll and administration costs is considerable.

Vyapar personal accounting automates many key calculations for your business. This means you won’t need to hire an outside expert for finance management.

Simplifies Your Tax Filing

Tax accounting can appear particularly intricate for small businesses. In the business realm, monitoring various kinds of taxes can be demanding and requires heightened attention.

Vyapar’s personal accounting systems are exceptionally complete and trustworthy. They help you manage your finances easily. Eventually, they issue every detail required to comply with taxation laws, for example, TDS compliance with Tally.

They also comply with the Indian GST tax rules by formatting invoices automatically. It makes your business process much more efficient and smoothes simultaneously.

Best For Security and Protection

Security is essential for personal accounting and finance management for users. They prevent the unauthorised use of your personal data.

Vyapar encrypts your information so only you can access it. It also keeps your data backups safe from breaches. Therefore, our app does not store your data internally.

Using Vyapar personal accounting helps you create your own security system. You can choose who gets access to sensitive data. It makes your business safer and more reliable.

Build Customer Relationships

Vyapar personal accounting software helps with billing and invoicing. This prevents delays and miscommunication. It also makes small home businesses look more professional and credible.

Vyapar lets your customers pay using their favorite payment method. It also helps you give them invoices or bill receipts. It helps you to build a more customer-oriented business platform and makes your business a money machine.

All these help your home business build a strong client relationship and make the small business viable in the long run.

Effortless Expense Tracking

Vyapar’s home accounting software programs connect directly to your bank accounts and credit cards, automatically downloading transactions. This eliminates manual data entry and captures all your spending. You can also scan receipts with your phone’s camera and the software will categorize them, saving time and reducing the risk of errors.

Smarter Budgeting

The personal accounting app for home empowers you to create realistic budgets based on your income. You can track your spending in different categories, such as groceries, entertainment, or bills.

This helps you see how close you are to your budget goals. This helps decide if you risk overspending in a particular category. This real-time feedback keeps you accountable and helps you stay on track.

Powerful Insights and Trend Analysis

The home expense accounting software doesn’t just record numbers, it helps you understand them. It categorizes expenses, generates reports and charts, and identifies spending patterns. This can reveal areas where you might be unknowingly overspending. Knowing your expenses, you can decide where to cut back and free up resources for your savings goals.

Vyapar’s Growing Community

Take Your Home Business to the Next Level with Vyapar! Try Free!

Frequently Asked Questions (FAQs’)

Personal accounting software is used primarily by individuals or businesses owned by one person. It assists your business mainly with accounts payable-type accounting transactions, managing budgets, and simple account reconciliation.

Personal accounting management software helps your business with tax preparation. This software assists small businesses in filing tax returns in a format suitable to the Internal Revenue Service.

You can use the Vyapar personal accounting software to keep your business operations aligned and orderly. Vyapar is all in one app. You will be amazed to see its range of features at such affordable prices.

Vyapar personal accounting software is trusted by one crore business owners, with a 4.7/5 rating on the Google Play Store. It makes your financial management much more efficient for you and your customers.

Vyapar personal accounting software comes completely Free on the Play Store for your business, and you can discover its many features free of cost. Using Vyapar, you can manage your personal finances in Excel using a professional accounting format.

You can use Vyapar personal accounting software to keep track of your small business’s day-to-day income and expenses in your industry. Vyapar lets your business platform have the lion’s share among your competitors through its efficient and unique features that you will come across no order business platform.

Yes, these tools are designed with user-friendliness in mind, making them simple enough for anyone, even without accounting experience.

Most software offers cloud backup and uses encryption to ensure that your data remains secure.

Yes, many tools come with tax compliance features that help you calculate taxes and generate the necessary reports.

Yes, Vyapar’s personal accounting software is available on both Android and iOS platforms. You can download it from the Google Play Store for Android devices and from the Apple App Store for iOS devices. This ensures that users can access and manage their finances on the go, no matter which mobile device they use.

Yes, Vyapar allows cross-platform synchronization. You can sync your data between Android and iOS devices using cloud backup. This feature ensures that you can seamlessly manage your personal finances across multiple devices without worrying about data loss.

Vyapar offers a free version with basic features on both Android and iOS. However, for more advanced features, such as multi-user access, cloud storage, and custom reports, you may need to subscribe to a premium plan available on both platforms.

Yes, Vyapar’s personal accounting software allows you to create, customize, and print invoices directly from both the Android and iOS apps. You can also share invoices via WhatsApp, email, or other messaging platforms with just a few taps.

Yes, Vyapar’s personal accounting app is ideal for home-based businesses. It offers essential features to streamline your operations:

Invoicing: Create professional, customizable invoices with your brand details.

Inventory Management: Track stock levels, set alerts, and manage products.

Expense Tracking: Record and categorize expenses for better budgeting.

GST Compliance: Generate GST-compliant invoices and reports for easy tax filing.

Payment Reminders: Send automated reminders to ensure timely payments.

Yes, Vyapar is the best home accounting app for iPad, which is super compatible with iPad devices. The app is available for download on the App Store and you can use it for free.