Accounting Software for the Service Industry

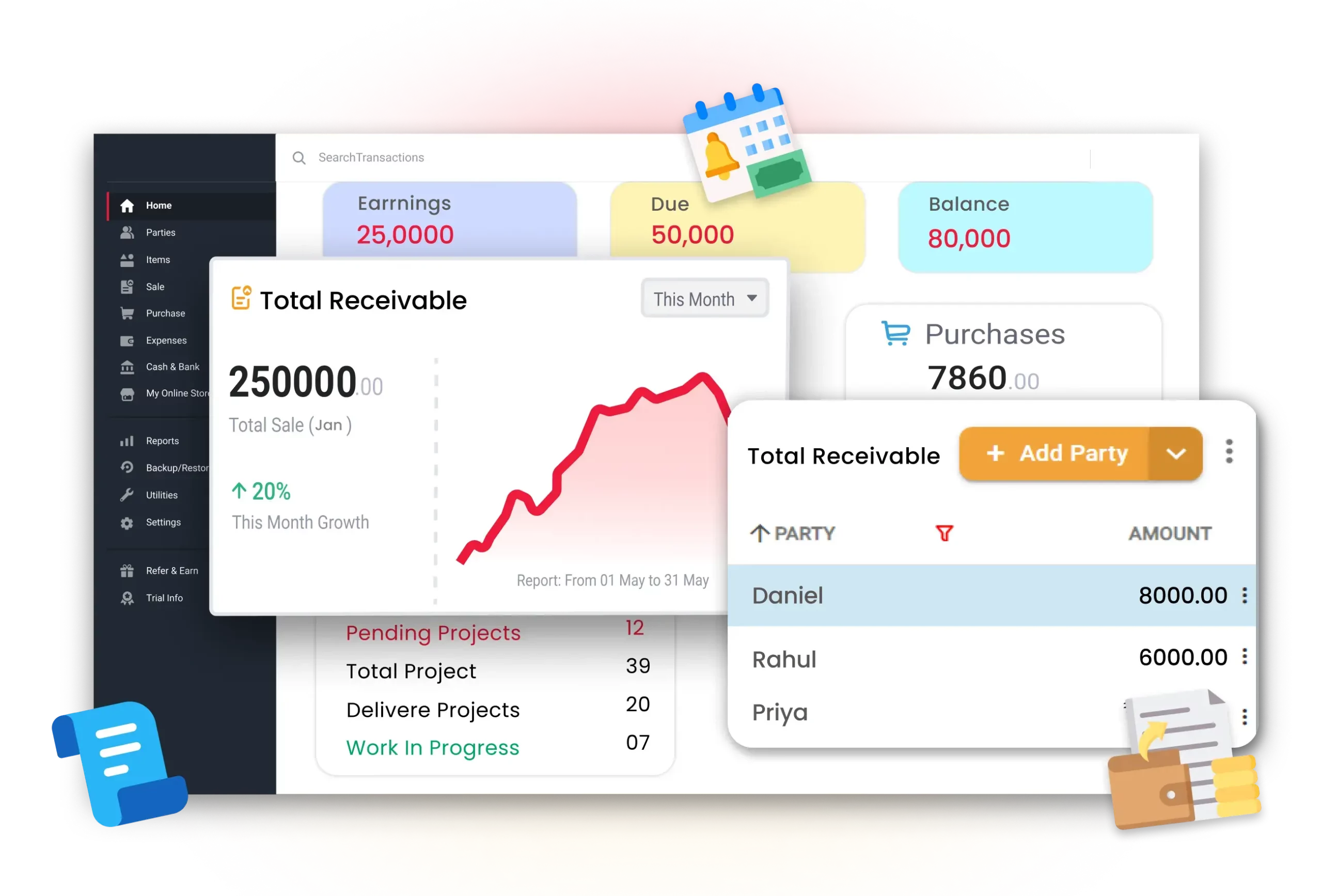

Service businesses deserve stress-free accounting. Vyapar helps you create invoices, track expenses, and view reports, all in one simple app.

Key Features for Service Businesses

Vyapar comes with all the tools a service business needs to stay organised. Here are the key features that make accounting easier than ever.

Easy Service Invoicing

Create professional invoices in seconds with your service name, charges, and taxes. Share bills digitally or print them instantly.

Smart Expense Tracking

Manage expenses like travel, tools, or staff salaries. Always know where your money goes and keep costs under control.

Project & Job Costing

Track income and expenses for each project separately. See which services bring the most profit and plan smarter.

Automated Payment Reminders

No more chasing clients. Our invoice reminder software sends quick reminders for pending payments, so you get paid on time without stress.

Smart Service Reminders

Customers get a timely notification when it’s time for their next service, visit, or renewal. This keeps schedules on track and builds stronger customer relationships.

- Customers receive automatic reminders

- Builds trust and loyalty

- Boosts repeat business effortlessly

Success Stories With Vyapar App

It is the easiest of all accounting services, especially for Indian-based users, and includes GST and other aspects of Indian taxation and banking features.

Gaurav S.

I personally find Vyapar super easy to use. It gives a lot of features that help us in maintaining proper books of accounts.

Anshul G.

Vyapar is the very best alternative compared to other accounting software. It is effortless to use. The user interface of this app is straightforward to understand.

Roshan P.

Perfect for all Service Providers

Vyapar is built for every kind of service provider. Whether you run a small shop, work as a freelancer, or manage large projects, this software adapts to your business and keeps your accounts simple.

Who Can Use This Software?

- Salons & Spas

- Repair & Maintenance Services

- Freelancers & Consultants

- Agencies & Contractors

- Other Service Providers

Benefits of Using Vyapar for Service Businesses

How Vyapar Makes Your Day Easier

Morning – Quick Business Check

View sales, cash flow, and pending payments on one clean dashboard.

Afternoon – Smooth Opertions

Create service invoices in seconds and record daily expenses without hassle.

Evening – Clear Reports

Check profits, expenses, and client payments. End the day stress-free.

Frequently Asked Questions (FAQ’s)

What is the best accounting software for service businesses?

The best accounting software for service businesses is one that makes billing, expense tracking, and reporting simple. Vyapar is designed exactly for this — it helps salons, agencies, freelancers, and contractors create invoices, track money, and manage accounts in one place.

Can freelancers and consultants use Vyapar?

Yes! Vyapar is perfect for freelancers and consultants. You can send professional invoices, track payments from different clients, and record daily expenses. This way, all your work is organised, and you never miss a payment.

How does Vyapar help small service shops?

Small service shops like salons, repair centres, and local agencies often struggle with manual records. Vyapar solves this by giving you digital billing, quick expense entries, and automatic reports. It saves time and reduces mistakes, so you can focus on serving your customers.

Does Vyapar work without internet?

Yes, Vyapar works offline and online. Even if the internet is down, you can still create bills, update accounts, and record expenses. Once you are back online, everything syncs automatically.

What reports can I see in Vyapar?

Vyapar gives you reports like Profit & Loss, Cash Flow, and service-wise income. These reports help you see which jobs make the most profit and how money moves in your business. It’s a clear picture of your service performance.

Is my data safe in Vyapar?

Yes, your data is fully secure. Vyapar has backup and protection features so your accounts are safe from fraud or loss. You can manage your business with peace of mind knowing everything is stored securely.

Can I use Vyapar on both mobile and computer?

Yes, Vyapar is available on mobile and desktop. You can manage accounts on the go or from your office computer. All data stays in sync, so you never lose track of your business.

Why do service businesses need accounting software?

Service businesses deal with daily payments, expenses, and customer records. Without proper accounting software, it’s easy to make mistakes or lose track of money. Accounting software helps keep everything organised, reduces errors, and saves time.

What are the common accounting challenges in service businesses?

Some common challenges include late customer payments, missed expense records, and difficulty in knowing real profits. Many service providers also struggle with manual billing. Using accounting software solves these problems by automating records and giving clear reports.

Which type of service businesses benefit the most from accounting software?

Almost every service provider can benefit. Examples include salons, repair shops, freelancers, consultants, contractors, and agencies. These businesses handle regular customer jobs and payments, so having a system that tracks income and expenses makes their work much easier.