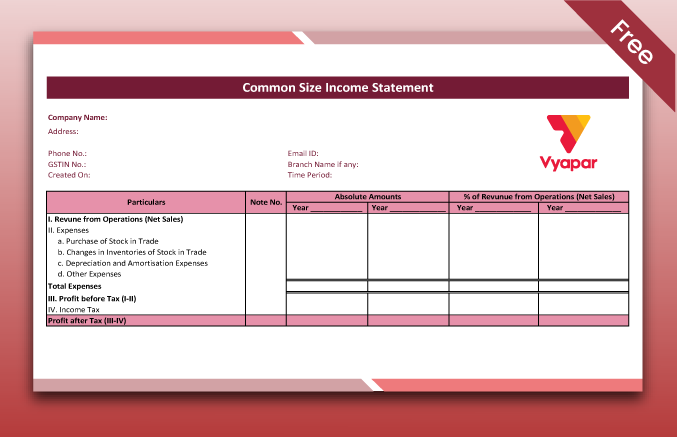

Common Size Income Statement Format

Unlock financial clarity with our Common Size Income Statement format. Download Vyapar for FREE to see expenses as a % of revenue. Try it now!

- ⚡️ Vyapar offers over 50+ templates to create income statements

- ⚡ Export in PDF, Excel & Word

- ⚡️ Personalisation

Download Free Common Size Income Statement Format

Explore the Common Size Income Statement Template, and make customization according to your requirements at zero cost.

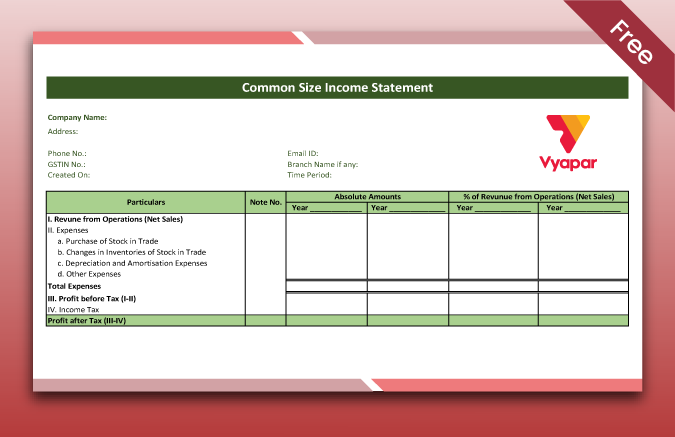

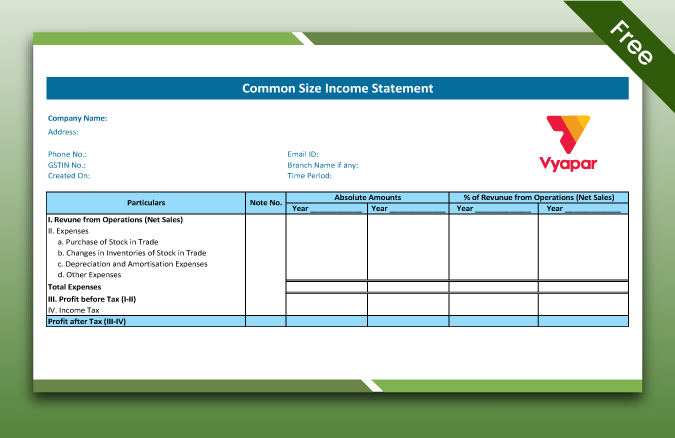

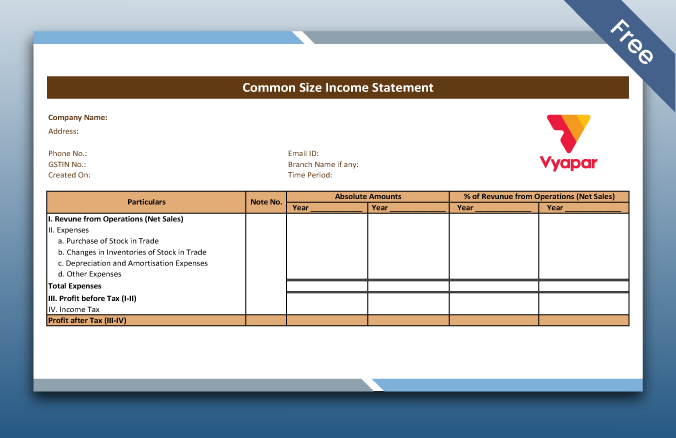

Common Size Income Statement Format in PDF, Excel and Word

Create your first Income Statement with Vyapar App

Objectives of Common Size Income Statement Format

Trend Analysis

The common-size income statement makes trend analysis easier by allowing for the comparison of financial data over different periods. By expressing each line item as a percentage of revenue, it gives an overview of the changing proportions over time.

Trend analysis assists in spotting trends, such as increases or decreases in expenses, and their impact on the organisation’s overall financial performance. It makes your financial statement more accurate and detailed.

Forecasting And Budgeting

The common-size income statement format helps with planning and budgeting by showing how much money comes in and goes out. This format allows you to look at the cost structure in more depth and enables you to find areas that need to be changed.

Businesses can set realistic goals and use their resources well if they know how much each line item costs. This makes making accurate predictions and spending decisions based on facts easier.

Highlighting Financial Ratios

A final objective of using a pest control quotation format is to document the terms and conditions of the pest control service, such as payment methods, liability, and cancellation. By listing down the details, you can protect your rights and ensure a smooth transaction.

Using a pest control quotation template is beneficial as it can improve your conversion rate and revenue. You can use the Vyapar app to send and follow up on your pest control quotes and persuade your clients to accept your offer and hire your service.

What is the Common Size Income Statement Format?

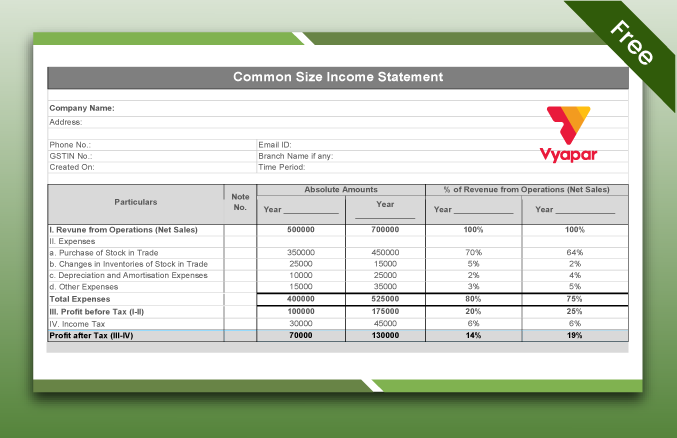

The common size income statement is a type of financial reporting that shows the parts of an income statement as a percentage of net sales or revenue. In this format, each line item, such as the cost of goods sold, running expenses, total assets, and net income, is shown as a percentage of the total revenue.

The common size income statement template makes it easier to compare and analyse the relative proportions of different cost categories. It also helps find areas where a company’s financial performance could be better or cause concern.

How to Create a Common Size Income Statement Format

Creating a common size income statement format shows income and expenses as a percentage of revenue. Here are the following steps to prepare a common size income statement for your business:

- Gather The Financial Statements

- Calculate Total Revenue

- Calculate Percentages

- Create A Table

- Format The Table

Let’s go through each one to understand more.

Gather The Financial Statements

To prepare the common size financial statement, it is essential to gather the appropriate financial statements, notably the income statement, for the desired time to construct a common size financial statement format.

The income statement should include all relevant revenue and expense line items. These statements can be received through the company’s accounting records or financial reporting system. Once you obtain the income statement, you can proceed with the % calculations and common size format described in the prior response.

Calculate Total Revenue

To prepare a common size income statement, calculate the period’s total revenue. The sum of all sales or income the company generates during the specified time period. Generally, it appears at the head of the income statement and offers a clear picture of the company’s total revenue.

Total revenue is determined by aggregating the values of all revenue line items, including sales revenue, service revenue, and any other sources of income reported on the income statement. Once the total revenue has been determined, you can calculate the percentages for each line item on the income statement.

Calculate Percentages

To prepare a Common Size Income Statement, you need to determine the amount for each line item, including the “cost of goods sold” (COGS). Divide the value of each line of the item on the income statement by the overall amount of income and then multiply by 100 to get the percentage.

It is true for all line items, like Cost of Goods Sold, Operating Costs, Interest Costs, and Taxes. By figuring out these percentages, each line item’s addition to the total revenue can be shown in a standard way, which helps with comparisons and where to put your attention.

Create A Table

Create a table that will be used to organise the information. The table should have rows for each line item and a column for the number that goes with it. The line items usually include sales, cost of goods sold (COGS), gross profit, operating expenses, net operating income, interest expense, net income before taxes, taxes, and net income.

Fill in the table with the line items and their percentages, ensuring that the percentages match the calculated numbers. This table style makes it easy to compare and analyse a common size income statement because it is clear and organised.

Format The Table

Set up the table so that it is clear and well-organised. Ensure the table has separate entries for each line item and the percentage that goes with it. Use the right alignment and style to make your writing easier to read. Consider making headlines stand out from the data by bolding or shading them.

For percentages, use the same number of decimal places or rounding rules. Add names and labels to the table that make sense. A well-formatted table makes the presentation look better and makes it easier to look for trends and insights in a common size income statement.

Type of Common Size Income Statement

There are two types of common size income statement:

1. Common Size Income Statement:

This common-size income statement uses sales as the initial base for all figures. So, the sales will be used as a base for each line item’s calculation, and each line item will be shown as a portion of the sales.

Uses Of Common Size Income Statement

- Whether profits are going up or down in relation to how much money was made.

- Change the percentage of the goods sold during the accounting time.

- Changes that could have taken place during expenses.

- If there is a rise in the company’s earnings, it should equal the increase in its profits.

- It allows you to compare the pay statements of two or more time periods.

- Recognises changes in the organisation’s financial records, which will help investors decide whether or not to put money into the business.

2. Common Size Balance Sheet:

A Common Size Income statement calculates the balance sheet items as the ratio of each asset to total assets. Each liability is often calculated as the ratio of total liabilities for the liability section.

Common-size balance sheet formats can be used to compare companies that differ in size. The comparison of such numbers for different time periods is not particularly informative because the total values appear to be influenced by various factors.

This method cannot be used to determine standard values for various assets since the trends of the statistics cannot be investigated and may produce inaccurate results.

Features That Make Vyapar Best Choice to Manage Your Business Income

1: Business/Accounting Software

With Vyapar accounting software, prepare your common size income statement, and run a single company or a chain of companies simultaneously. You can easily perform business operations without being listed. Vyapar accounting software gives you an overview of your company’s data on a single or multiple devices simultaneously.

Vyapar is an advanced app that ensures businesses have everything which they require to manage their financial statements. It has an easy-to-use user interface and ensures it provides you with uncomplicated features, which might save you valuable time and resources. You don’t have to pay any subscription fees to use Vyapar.

You can do both GST and non-GST transactions and purchases with Vyapar. The accounting programme enables you to set up and run different business tasks for your courier companies, such as billing, invoicing, and making reports. It also has a business screen that gives a more complete view of the business.

2: Tax And Discounts

Using our advanced feature, you can track the payment status for each invoice. Vyapar also sets invoices’ due dates, ensuring your business has a healthy cash flow. It gives you item-wise or transaction-wise tax and discount options. You can also perform the contra entry into our advanced accounting software.

Vyapar allows you to add or modify the tax group or rate. You can perform efficient discount management on our accounting software. It allows you to accept/make partial and full payments per your business requirement. You can perform loan and cheque management in our accounting tool.

It comes with an easy-to-use user interface, as it automates repetitive business operations into your business. Vyapar offers more than 40+ reports to its users. You can perform a wide range of operations in our accounting tool without paying any additional cost from your own pocket.

3: Online/Offline Accounting Software

When you use our accounting software for your retail business, you won’t have to stop doing business because you don’t have access to the internet or perform your business from the outskirts. Your company can use offline accounting software to accept cash and eWallet payments, which doesn’t require an active internet link. This makes it good for India’s rural areas that don’t have 24/7 internet access.

With our advanced accounting software, you can easily choose the format and prepare your common size income statement and send it to your investors as soon as they ask for it. In rural places, where connection and network problems are common, the online and offline features of the Vyapar app are very important.

Your business can significantly benefit from the app because they no longer have to wait in queue for their bills. It also makes it easier for them to bill since they can record deals as soon as they happen without doing anything else.

4: Add And Manage Multiple Bank Accounts

Retail businesses can easily add and manage both online and offline payments effortlessly. Vyapar is an easy-to-use, free accounting app for Android mobile, Windows PCs and Macbooks. By using the app, you can complete your work more quickly. Whether your money comes from banks or e-wallets, the accounting software makes it easy to enter the information.

Vyapar accounting software lets you send and receive money from different bank accounts. It makes it easy to handle your business cash flow. So, businesses that use the Vyapar accounting software can keep track of all cash coming in and going out. It offers various premium features that give you better control over your business cash flow.

You can view free accounting software from your phone anywhere across India. Vyapar, a financial software for retail companies, enables you to easily collect your business payment and track cheque payments. Using our payment tool, you can perform the bank-to-bank transfer.

5: Composition Party Management

Using Vyapar Software, you can easily manage party E-mail, phone number, registered address, shipping address and GST number Seamlessly. You can perform additional fields to manage the PAN/Registration/DoB etc. It also allows you to add and assign the party of your choice in our advanced accounting software.

You can also perform the party-to-party transfer on Vyapar, and it allows you with payment reminders to the receivables party. On our advanced accounting tool, you can manage the party opening balance and, thereafter, receivables and payable balance.

You can create multiple Companies and up to five firms within a company. It enables you to create GST as well as Non-GST transactions. You can have your business overview using our accounting software’s business dashboard. You can access your party data on single as well as multiple devices.

6: Provides You With A 7-day Free Trial

Vyapar accounting software allows your business to have a 7-day free trial. You can easily familiarize yourself with its tools and features, enabling you to excel in your business. You may explore its features and functionalities without paying a penny.

During the trial period, users can create and manage invoices, track costs, generate reports, and use other software functions. Users can thoroughly go through Vyapar features before finally committing to a paid subscription. Users can examine the software’s fit for their company’s needs and make an informed decision during the trial.

One crore small business owners use Vyapar to perform their day-to-day operations as it is cost-efficient and easy to use. It aims to provide small businesses with every possible tool and feature, allowing their companies to grow with leaps and bounds.

Benefits of Using The Common Size Financial Statement Format

Here are the following benefits of using the easy format of common size financial statement:

1: Helps In Comparing Companies

The common size income statement template makes it possible to compare the financial success of companies of different sizes and industries meaningfully.

By expressing financial numbers as a percentage of income, the bias of absolute rupee amounts is taken out of the picture. It allows users to focus on the relative sizes of line items and to find trends or patterns that might need to be more obvious when comparing raw numbers.

Using the professional format gives companies a standard way to be judged and compared, which makes it easier to make good choices and compare how well different entities are doing.

2: Identifying Areas of Improvement

The Common size income statement assists businesses in determining the area that requires more attention to perform better financially. It emphasises the relative value of the various sections of the income statement by expressing each line item as a percentage of revenue.

If certain expense categories are disproportionately high, it indicates potential areas for cost reduction or process improvement. Costs can be lowered, or activities that generate money can be streamlined.

It is much simpler to discover areas with the potential for improvement and to take measures focused on improving overall financial performance if one analyses the percentage breakdown of various expense categories.

3: Assists in Benchmarking

The common size format makes it possible to compare a company’s financial performance to its peers or competitors in the same field. Putting each line item as a percentage of a common base, like income, gives a standard way to compare them.

The format needs to be simpler to help compare the businesses in terms of net revenue, expenses and other financial measures effortlessly.

By comparing the percentage breakdown of different line items, like profit margins or cost ratios, businesses can compare their performance to their industry averages. It helps them analyse where they may be doing better or worse than their peers.

4: Offers Investors Insight

The format of common size income statement benefits investors as it helps them understand how a company is doing financially. It gives a standard view of the company’s finances by showing each line item as a percentage of a common base, like income.

A professional income statement format provides investors with essential information about the company’s overall performance in the given period, enabling them to make better investment choices.

It gives investors vital information about the company’s overall financial performance, which helps them make better investment choices.

5: Identifying Cost Drivers

The common size income statement template is beneficial in identifying the major cost drivers within an organisation’s operation. By mentioning the company’s expenses as a percentage of revenue, it calls attention to areas where costs may be rising or falling disproportionately.

Using the professional format enables the companies to provide a focused analysis of cost structures and helps identify key drivers impacting profitability.

By allowing the relative importance of different expense categories, companies can allocate resources efficiently in other important areas. It can help make intelligent decisions regarding cost management. Further, it ensures the timely implementation of strategies to improve profitability and operational efficiency.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

The common size income statement format presents all income statement data, such as a percentage of total sales or income, as a financial statement for the company. It makes it easy to compare the relative value of different expenses and shows how well the company is doing financially.

The common size income statement determines how the different types of expenses and income are related. It helps to find upcoming and ongoing trends, compare performance over different periods, and compare to standards in the business.

To calculate the common size income statement, divide each line item by the total revenue or sales and multiply the result by 100. It facilitates comparison and analysis of the various components of the income statement by expressing each line item as a percentage of total revenue.

Using a common size income statement template has benefits such as allowing for easier comparison between companies or periods, emphasising trends in spending categories, identifying areas for improvement, and benchmarking against industry standards. It aids in analysing the proportional relationship between expenses and revenue, revealing cost structure and facilitating performance evaluation and decision-making.

The format of common size income statement accommodates the sections for sales or revenue, cost of goods sold, gross profit, operating expenses (like selling, general, and managerial expenses), operating income, non-operating income or expenses, taxes, net income, and earnings per share.

You can prepare the common-size income statement using the Vyapar advanced software as frequently as needed for analysis, such as quarterly or annually. The frequency of preparation is determined by the company’s reporting requirements, the availability of financial data, and the purpose of the analysis being conducted. There is no mandatory frequency for it.