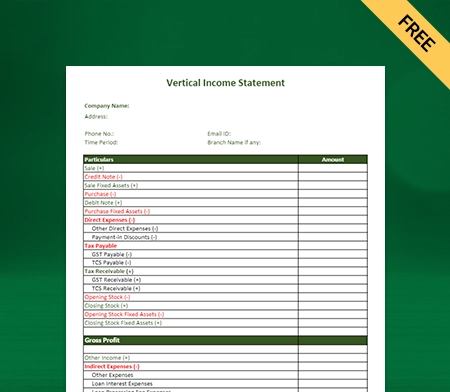

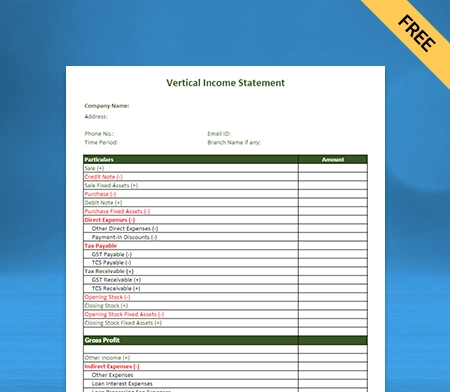

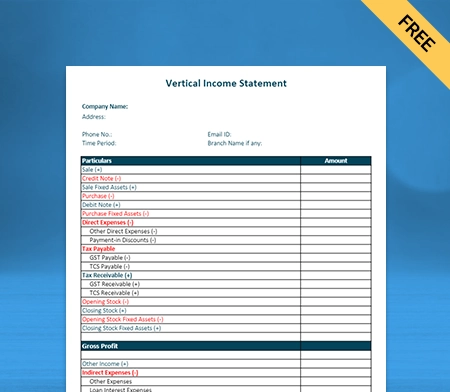

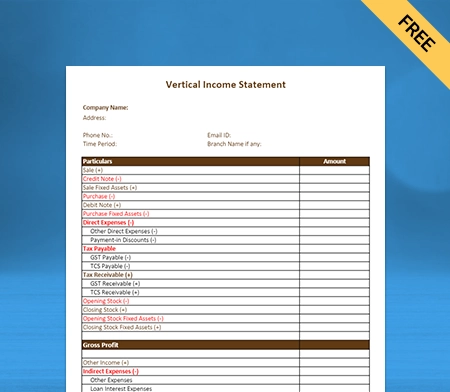

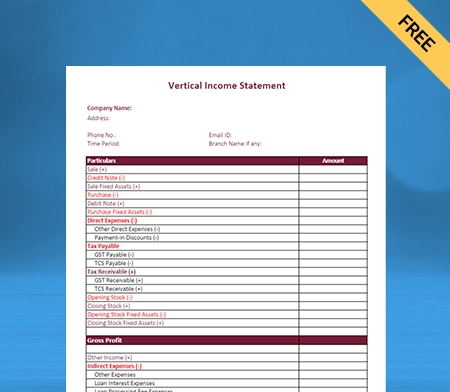

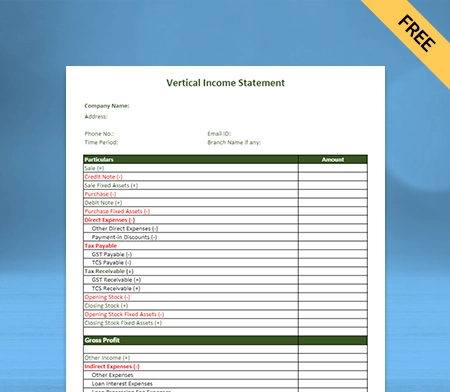

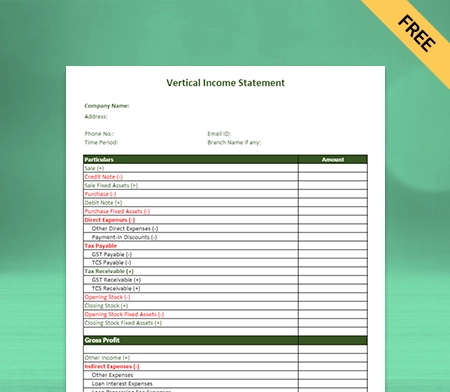

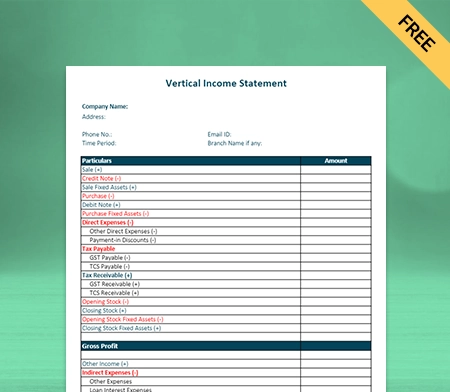

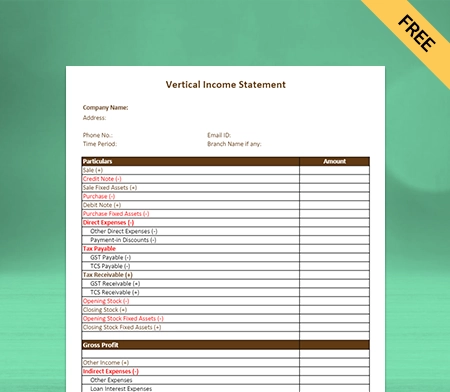

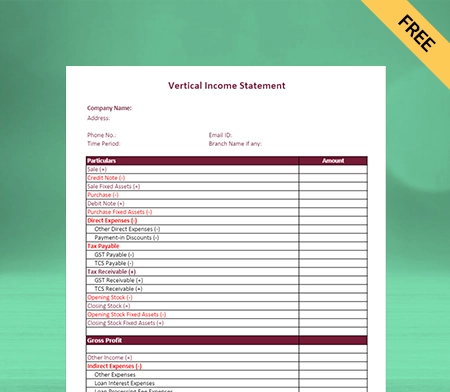

Vertical Income Statement Format

Create a professional and well-detailed vertical income statement format using Vyapar that makes the entire process seamless and helps you manage your work with one app. You can download Vyapar now and access all income statement formats for free.

Download Vertical Income Statement Format in Excel

Download Vertical Income Statement Format in PDF

Download Vertical Income Statement Format in Word

Download Vertical Income Statement Format in Google Docs

Download Vertical Income Statement Format in Google Sheets

What is the Vertical Income Statement Format?

The vertical income statement format is a financial statement that offers a company’s income or revenue details vertically, allowing for a clear and concise representation of income sources and expenses. Revenue is given first in this format, followed by various categories of expenses such as cost of goods sold, operating expenses, and taxes.

The format provides a thorough overview of a company’s financial performance and assists stakeholders in analysing income sources and spending allocation.

Benefits Of Using Vertical Income Statement Format

Here are the following benefits of using the vertical income statement format:

1: Provides Clear Presentation

The vertical income statement format clearly and concisely depicts the company’s income and expenses, making it easier to interpret and analyse. It gives an organised perspective of financial data by grouping revenue and expenses vertically, allowing stakeholders to immediately grasp the important details of a company’s financial performance.

The vertical income statement format simplifies the analysis of financial data and allows for informed decision-making based on a thorough grasp of income sources and spending allocation.

2: Comparative Analysis

The vertical income statement format facilitates the comparison of income sources and expenses across multiple periods or between companies, thereby facilitating the analysis of trends and benchmarking. By vertically aligning comparable categories of income and expenses, it is simple to identify patterns, changes, and trends in financial performance over time.

This format simplifies evaluating and comparing the relative significance of various income sources and expense items, thereby facilitating the evaluation of a company’s financial health, efficiency, and performance relative to its counterparts or industry benchmarks.

3: Profitability Analysis

The vertical income statement format enables a thorough examination of profitability ratios, such as gross profit margin. Also, include operating profit margin and net profit margin. By vertically displaying revenue and expenses, it is simpler to calculate these ratios by comparing the corresponding values.

The format clearly shows the relationship between revenue and various expense categories, allowing for a comprehensive profitability evaluation. Based on the profitability ratios derived from the vertical income statement format, stakeholders can evaluate cost management’s efficacy, identify improvement areas, and make informed decisions.

4: Expense Allocation

The vertical income statement format is useful for identifying and comprehending expense allocation across many categories – the cost of goods sold, operating expenses, revenue and taxes. It is easier to monitor and appraise the distribution of expenditures inside an organisation when expenses are presented vertically.

This format delivers cost management insights by showing the relative proportions of expenses in different categories, allowing stakeholders to discover potential cost reductions and increase operational efficiency. The vertical arrangement improves cost analysis and supports strategic expense management decision-making.

5: Completely Investor-Friendly

Providing a comprehensive view of a company’s financial statement, the vertical analysis of income statements is crucial in promoting communication with investors. This format presents income and expenses in a clear and organised manner, allowing investors to rapidly evaluate the company’s financial health and profitability.

The vertical format assists investors in making informed decisions and assessing potential investment opportunities by concisely summarising key financial metrics and trends. It promotes investor confidence and facilitates fruitful engagements between the company and its investors.

6: Efficient Financial Analysis

The vertical income statement format simplifies the financial analysis by categorising income and expenses. This organisational structure makes it simple for analysts to zero in on specific areas of interest, such as revenue sources or expense line items. By presenting data vertically, it is simpler to identify and analyse the factors contributing to a company’s financial performance.

This format provides a distinct framework for dissecting and evaluating the various elements of the income statement, allowing analysts to conduct in-depth analysis, identify trends, and identify areas requiring further investigation or improvement. Financial analysis is more efficient and effective when presented in a vertical format.

7: Improved Decision-Making

The income statement’s straightforward depiction of income and expenses in a vertical style enables stakeholders to make educated decisions. Stakeholders fully grasp a company’s financial performance by organising financial data systematically and easily understandable. They may quickly evaluate income sources, operating expense allocation, profitability ratios, and critical financial KPIs.

With this level of transparency, stakeholders may assess the company’s financial health, identify strengths and weaknesses, and make educated decisions about investments, strategic planning, cost management, and other essential areas of corporate operations.

8: Regulatory Compliance

The vertical income statement format is intended to comply with regulatory standards by abiding by standard accounting principles and reporting requirements. This method of financial statement adheres to established financial information presentation requirements and norms, such as income recognition, expense categorisation, and formatting conventions.

Companies can report their income statements in a uniform manner that fulfils the expectations of regulatory organisations and accounting standards by employing the vertical format. This compliance improves financial reporting transparency, accuracy, and consistency, establishing stakeholder confidence and promoting trust in the company’s financial statements.

Steps To Prepare Vertical Income Statement Format

Here are the following steps to prepare a vertical income statement format:

1: Collect Financial Data

It is essential to obtain the necessary financial data to prepare a vertical income statement. Financial data collection includes obtaining precise revenue figures listed as a percentage, sales revenue, service revenue, and all other sources of income.

For a vertical income statement to be accurate and informative, it is essential to collect exhaustive and precise financial information. It lets stakeholders understand the company’s revenue streams, expense allocation, and financial performance.

2: Organise Revenue Categories

When preparing a vertical income statement, it is essential to identify and list the various revenue sources. These may include product sales, service revenue, consulting fees, subscription income, licensing royalties, advertising revenue, and other revenue streams particular to the organisation.

The vertical income statement provides a comprehensive view of the company’s revenue generation by explicitly designating and categorising these sources. It enables stakeholders to comprehend the revenue composition, evaluate the performance of specific revenue streams, and make informed business strategy and resource allocation decisions.

3: Categorise Cost Of Goods Sold (COGS)

It is essential to accurately prepare a vertical income statement by identifying and allocating the direct costs of producing or delivering goods or services. These expenses are known as the Cost of Goods Sold (COGS). These costs include basic materials, labour, direct production, and shipping.

The vertical income statement provides insight into the direct expenses incurred in generating revenue by accurately identifying and classifying these costs under the appropriate COGS category. It assists in determining the profitability of particular products and services.

4: Calculate Gross Profit

To determine gross profit on a vertical income statement, you should deduct the Cost of Goods Sold (COGS) from total revenue. The COGS represents the expenses incurred in producing or delivering goods or services. When subtracting these expenses from the total revenue, the resulting amount represents the gross profit.

It represents the revenue remaining after direct expenses directly associated with the production or delivery of goods or services have been deducted. Before considering other operating expenses, the gross profit figure provides valuable insight into the profitability of the fundamental operations of the business.

5: Group Operating Expenses

It is essential to categorise operating expenses according to their relevance while preparing vertical income. Common categories include:

- Selling and marketing expenses.

- General and administrative expenses.

- Research and development costs.

- Other categories are pertinent to a particular business.

The vertical income statement provides a comprehensive view of the company’s operational expenses by separating these expenses into distinct categories. This categorisation enables stakeholders to comprehend the summary of expenses and evaluate the financial impact of various business aspects, thereby facilitating expense management, performance evaluation, and decision-making.

6: Calculate Operating Income

Deduct the total operating expenses from the gross profit to calculate the operating or operating profit on a vertical income statement. The operating expenses include:

- Selling and marketing expenses.

- General and administrative expenses.

- Research and development costs.

- Other pertinent operational costs.

The operating income is calculated by deducting these expenses from the gross profit to obtain the operating income. It reflects the profitability of the company’s primary operations before non-operating income and expenses are considered. The operating income illustrates the financial performance directly related to the company’s core business activities and assists in determining its operational efficiency and profitability.

7: Include Non-Operating Income And Expenses

While preparing a vertical income statement, it is essential to account for any non-operating income and non-operating expenses separately. Non-operating income statements include essential details such as interest income, dividend income, or gains from the sale of total assets not directly related to the business’s core operations.

Non-operating expenses encompass interest expenses, losses on the sale of assets, or other expenses unrelated to day-to-day business operations. By segregating non-operating income and expenses, the vertical income statement distinguishes between income derived from core operations and additional income/expenses that may impact overall profitability.

8: Determine Net Income

On a vertical income statement, you add up the operating and non-operating income and remove any non-operating costs to get the net income. Start by adding the working income, which shows how profitable the main business is, to any other income, like interest or dividend income.

Next, take out any costs unrelated to running the business, such as interest costs or losses from selling assets. After considering both operating and non-operating costs and income, it assists businesses in giving an overview of the total revenue generated over a specified period.

Features Of Vyapar That Make It The Best Choice For Your Small Business

1: Business/Accounting Software

The accounting app/software Vyapar makes managing a single business or a network of businesses simple. On Vyapar, you can prepare your vertical account statement format, which is well-detailed and professional-looking. The accounting software by Vyapar allows its Android device users to access business data on multiple devices.

Vyapar is cutting-edge software that gives enterprises the tools to manage their balance sheet. It offers a user-friendly interface and many other essential features to create a professional-looking vertical income statement format. Vyapar provides value for money to its user’s software.

You can use Vyapar for both GST and non-GST transactions and purchases. Using this billing software, you can automate accounting processes such as billing, invoicing, and report generation, maintaining your balance sheet for your business. Using Vyapar, you can be miles ahead of your competitors, who must pay attention to these enhancements.

2: Provides 7-day Free Trial

Vyapar accounting software provides your business with a 7-day free trial. Before committing, this trial period enables individuals and businesses to evaluate the software’s features and capabilities. During the 7-day trial period, users can access Vyapar’s features, including billing, inventory administration, expense tracking, and financial reporting.

It enables users to assess the software’s suitability for accounting requirements. The 7-day duration provides ample time for users to become acquainted with the software’s scalability, integration and many other essential features for the business.

By providing this free trial, Vyapar hopes to enable prospective customers to make an informed decision and verify that the software meets their needs before purchasing. Millions of businesses across India trust inventory management software Vyapar to perform various business operations, and it is value-for-money accounting software.

3: Provide Multiple Payment Options And Get Paid Quickly

Using our advanced software, you can offer numerous payment options for your clients, increasing customer trust in your business, and you will likely get paid more quickly.

You can create a steady cash flow into your business by offering numerous real-time payment options, including online and offline payment options such as cash, cheque UPI, QR, NEFT, IMPS, e-wallets, and credit/debit cards.

Vyapar gives you the choice of payment options that your business clients will most likely prefer, or you can offer them all. If you are operating your business from remote areas, you can have a QR code and cash as one of the payment options, allowing users to send a payment to the UPI id attached. You can also specify your bank account information within the app for clarity.

Your clients can make payments using an online method that allows bank-to-bank transfers (NEFT, RTGS, IMPS). Vyapar offers offline payment options such as cash, cheques and QR codes. Customers should have access to all available payment options. It serves to ensure prompt payment from your customers.

4: Track Your Business Expenses

To maintain a steady cash flow, tracking and recording all expenses in the business is vital for accounting, tax filing and maintaining your balance sheet. Following the general and administrative expenses and creating an accurate report with this accounting software is more manageable.

Our free accounting is an efficient option for recording expenses. Businesses can easily optimise their vertical analysis of income statements to save more money. With our free GST software, you record both GST and non-GST expenses and quickly analyse the yearly profit margin with a common size income statement analysis.

Further, Vyapar solutions have various benefits over competitors, offering numerous essential features to their users. This free accounting software is an efficient option for quickly recording outstanding expenses and performing various other operations.

Our free mobile and Windows app is suitable for growing businesses with leaps and bounds. It helps keep their finances in check on unwanted expenditures. Using this GST software, the company can optimise the expenditure by recording your business’s expenses, net income, and base figures.

5: Tax And Discounts

Vyapar accounting software ensures that firms may calculate and deal with their financial commitments accurately. Users can implement tax and discount on an item and transactions-wise with Vyapar, providing additional pricing flexibility and control.

It enables users to determine whether item prices include or exclude taxation, allowing it to accommodate different pricing structures and tax legislation. This tool assures accurate tax estimates and simplifies corporate compliance.

Users can easily add or change tax groupings and tax rates. This feature of Vyapar is particularly beneficial for businesses that operate in various tax countries or are subject to shifting tax legislation.

Users can modify tax parameters to their individual needs. Users can apply discounts to individual items or transactions, track discount history, and generate analytical reports. Vyapar invoicing software helps firms manage promotional programs, negotiate pricing with clients, and track the effectiveness of reductions.

6: Free Lifetime Basic Usage

Using our free accounting software, You can seamlessly create essential statements and balance sheets. Further, using Vyapar, you can manage your dashboard and track inventory items effortlessly. By using free access to Android users, you can use many other useful features to perform your day-to-day operations.

Vyapar aims to assist its users in creating an efficient and professional business platform for its users. Keeping that in mind, it offers all essential features of a business accounting software accessible for free to its users.

Lifetime free access to Android devices makes our accounting tool the best fit for SMEs. You can perform your business operations from anywhere across India with our online/offline accounting software.

Having professional tools allows SMEs to scale their business operations and meet the rising demand of their clients. Users can build their business professionally without making a dent in the balance sheets and customise it in different formats as per their preference. Further, it also offers you to choose from a premium package on Windows to reduce costs and make your business more accurate.

Frequently Asked Questions (FAQs’)

A vertical income statement format is a method of financial reporting that displays income statement information in a vertical or columnar layout. It presents revenue, expenses, and net income as discrete line items.

It enables a straightforward comparison of each component as a percentage of total revenue. Further, the vertical income statement format allows users to analyse the relative proportions and trends of the various items on the income statement.

A vertical income statement displays financial data in columnar format, with each item as a percentage of total revenue. In contrast, a horizontal income statement presents financial information in a horizontal format, displaying line items for various periods side by side.

In contrast to the vertical format, which emphasises the proportion of each item, the horizontal format compares the absolute amounts of income and expenditures across various periods.

The vertical income statement format is advantageous for financial analysis because it provides a clear view of the relative proportions and trends of the items on the income statement. It facilitates the comparison of expenses, revenue, and net income as percentages of total revenue, thereby facilitating the identification of cost structures, profitability ratios, and potential enhancement or optimisation opportunities.

The information is laid out in columns in a vertical income statement format. Each line item, like income, costs, and net income, is shown on its row. The amounts for each item are generally shown as the percentage of the total income. This makes it possible to compare the essential things in your balance sheet.

There are many benefits to using a vertical income statement format, such as clear presentation of financial data, easy comparison of line items as a percentage of total revenue, identification of cost structures, analysis of trends, and the ability to benchmark against industry or competitor data for better financial analysis and decision-making.

Focus on the percentages when interpreting data presented in a vertical income statement. The greater the percentage, the greater the proportion of revenue or expenses. Examine trends by comparing percentages across multiple time intervals.

Consider any substantial alterations or outliers. Pay close attention to cost structures, profitability ratios, and improvement or optimisation opportunities. Compare the results to benchmarks in the industry for additional insight.

You can use Vyapar software, which is free for Android users and offers numerous tools that help you create a professional vertical income statement format for your business. Millions of users trust Vyapar because it offers advanced tools and features to their users.

After paying a small subscription fee, you can prepare a fully customised professional vertical income statement format on your Windows PCs or MacBook devices.

Related Posts: