Consultancy Invoice Format

You can easily access and create consultancy Invoice format through the Vyapar application. This application helps you develop consultancy invoices for your clients to view the services provided by you.

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of Consultancy Invoice Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Free Professional Consultancy Invoice Format

Download professional free consultancy bill formats, and make customization according to your requirements at zero cost.

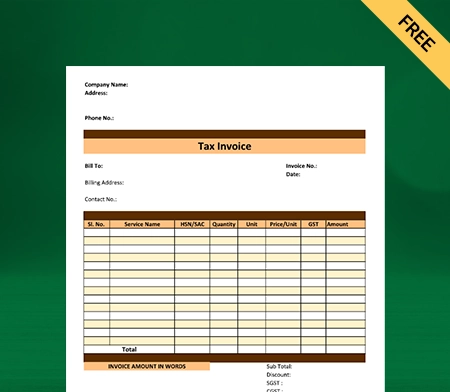

Type 1

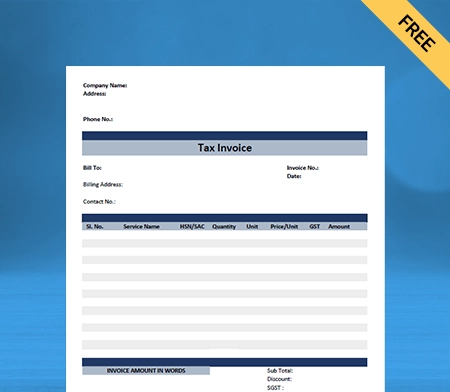

Type 2

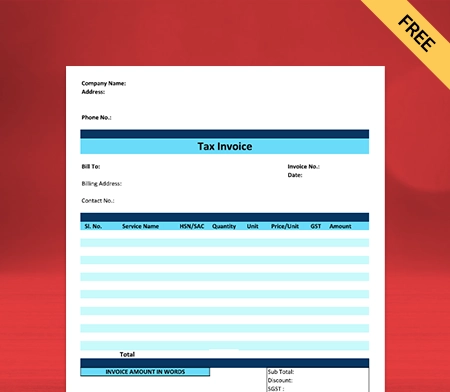

Type 3

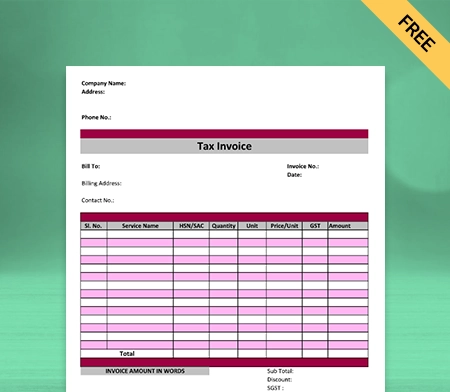

Type 4

Generate Invoice Online

What is a Consultancy Invoice?

A consultancy invoice is a document sent to the consumer by the service provider as a request for payment. This document contains a record of all the goods, services, or products provided to the client. Another feature of this document is that it also presents the project’s overall cost before the client. All this information is provided in the form of a list.

A consultancy invoice is a very expressive document that lists everything in a detailed format. A typical consultancy invoice will present a breakdown of all the variables, ending with a total amount for everything.

This document is sent to the client after the completion of the project as an indication that the work is done. It also serves as a reminder that the work has been completed and the client needs to pay their dues.

Types of businesses using consultancy invoice format

Several types of businesses in the industry use consultancy invoice format for their services. These are as follows:

- Health-care companies

- Technological companies

- Retails service companies

- Food Industry

- Any form of business that has just set foot in the market and is looking forward to gaining expertise.

- Other existing firms and companies intend to change the process of sales, products, services, etc.

Why Do Businesses Need a Consultancy Invoice Format For Themselves?

Businesses, big or small, freelancers, consulting agencies, etc., must use a consultancy invoice format. It helps their client to have the ability to know about the services, their charges, and other details. Besides these, a professional invoice format is necessary because :

Helps in filing taxes:

A clear record of the goods and services you have provided within a financial year can always come in handy. A professional consultancy invoice helps you maintain such records so that you don’t have to panic at the end of the financial year. You can sit back and easily rest while filing the taxes without the thought of losing any data.

Record of services:

This document also helps you keep a record of the goods and services you provide. So, now you won’t have to rely on your memory to provide a record of what you have to offer to your clients. You will always have a consultancy invoice ready for the record.

Keep track of your client accounts:

Another great feature of this document is that you can easily keep a record of transactions and other details between your clients and your company. This way, you won’t risk mixing up the records of one client with another. So, an easy and convincing way of being in control of your client accounts.

Knowledge of payment dates:

You can avert many issues by keeping a record of all the other details related to your business. Such as losing track of due dates. It might help avoid problems between your client and your business because the payments are overdue.So, a consultancy invoice format helps you maintain a record so that all the payments from your client are up to date. In the future, you can also get reminded to take follow up on the payments that are due in the future or are late.

Monitor your growth:

Maintaining a record also helps you track your business’s growth chart. Through this process, you can monitor and see the areas that have allowed you to yield profits and the areas that need to be worked upon.This document will also provide a clear description of what services you offer are in demand and the ones that are less in demand. You can likewise make improvements in your business and grow in a better way.

Keeping records without any external help:

Using professional consultancy invoice format features helps you maintain an in-house record of your business. It means that you don’t have to rely on external help to do the work for you. Further, you will have less risk of losing your data to other external parties.

Being Organized:

By keeping records, you ensure that :

- Firstly, you gain the trust of your clients by showing your company’s organizational skills. It paves the way for a trust-based relationship between the service provider and client.

- Secondly, you can also show the taxation authorities that there are no hidden records. Being organized is the key to staying clear of any problem.

Create your first invoice with our free invoice Generator

The Different Types of Consultancy Invoices

There are several consultancy invoice formats available for businesses to choose from. They can easily select the one that suits them the most.

Standard Invoice: This document carries a simple bill for all the services that the business has provided to the client.

Timesheet invoice: Many businesses charge their clients on an hourly basis. So, a timesheet invoice is a document that helps in tracking the billable hours in every project. This document contains the details of the number of hours to complete the work and the pay decider per hour.

Expense report: Sometimes, some expenses have occurred without warning. These expenses were not decided before, but these came up on-site for variable reasons. This document serves the purpose of presenting such expenses.

Recurring invoice: Recurring consultancy invoice is used for clients who are always served with the same products or services. Doing the same work ensures that each billing cycle is repeated for them.

Interim invoice: In some cases, the consultant needs to work on a long-term project in a stepwise manner. After the completion of each step, an interim invoice is sent for receiving the payment.

Final invoice: This document is submitted at the end of the project with the total due amount.

What Details Need To Be Included In a Consultancy Invoice Format?

The consulting business needs to take note of all the details that are being included in the document. The details need to be put as per the client’s requirement so that the amount quoted you cannot be questioned by them.

Here are some points to ensure that your consultancy invoice format provides your client with the professional invoice you aim to get.

The details to be included in a consultancy invoice format are:

Business contact information:

This section contains all the details about the consultancy business, like the business’s name, phone number, logo, link to their website, and other essential information. These details are vital as they help in identifying the professional consultant. Using a standard form of a header can ensure that it can be reused for your future consultancy invoices.

Client contact information:

Including the client’s contact information is as essential as the consultancy business information. Their details should also be included in the invoice, including their name and phone number.

Date of invoice and due date:

Both parties need to date the invoice. It is a crucial step to avoid any form of confusion regarding the creation of an invoice. Similarly, the due date should also be presented clearly. Both dates are the only ways to keep track of paid and unpaid amounts by the client.

Put numbers for your invoices:

An invoice number is significant as it is the first thing one will search for to find out the record of a specific client. It is also used for reference purposes. An invoice number is unique for every new invoice. It helps in distinguishing between the different consultancy invoices developed for various clients.

Description of goods/items or services:

You need to include an in detail description of the goods/items or services you provide to the client. It should be done separately for each item or service delivered. To give the details, you must mention the service or thing provided, with the amount charged for the item and other information describing the item in the consultancy invoice format.

The number of hours put in for the service:

As mentioned before, a professional consultancy invoice also contains the billable hours’ details. That is the number of hours put in by the business in the project.

Most consultancy businesses charge based on the hours they took to complete the project. Hence, it becomes essential for this detail to be communicated to the client through an invoice.

The breakdown of the billable hours can be presented by mentioning the different activities done and the milestones achieved during the completion of the project with the time put in.

State the prices:

The consultancy business needs to provide a clear picture of the calculation done. So, you should mention the current rate that your company charges for the project. Then you must multiply the charge per item with the billable hours to present a total amount that needs to be paid by the client. It is the total amount the client is expected to pay to complete the project.

Details of discounts if applicable:

It is common for many consultancy businesses to provide discounts for their new clients, frequent clients, or extensive projects. So, you can mention the discount in the invoice with details of the reason for presenting a discount.

Applicable taxes:

The amount to applicable tax charges like VAT, GST, or any sales tax should be mentioned before listing the total amount in the invoice. If more than one form of taxation is available, then it should be mentioned in one separate section for the client to notice.

Terms and conditions for payment:

To avoid any form of confusion, the terms and conditions for the payment should be mentioned by the consultancy business in the invoice. It should be mentioned if the payment must be made as a lump sum or through any other plan.

Mentioning the due dates is also one good step that the business should take. Also, the preferred mode of payment by the company should be mentioned in the document.

A description of the policies and rights:

There are always policies regarding privacy and rights with a company that needs to be mentioned in the document. Sometimes, a consultancy invoice might contain some information worth protecting from other parties, which should be mentioned in the document. By issuing such guidelines, the business ensures that the information provided stays safe between the two parties.

Stating the final or total amount:

The monetary unit for the transaction should be taken care of and explicitly mentioned in the document. The subtotal amount should be mentioned at the bottom of the list present in the document.The business should ensure that the final amount is the one which is the final figure after the calculation of all taxes and discounts. This amount should then be presented in bold and a different font.

A thankyou note:

We suggest that you add a thank you note to your invoice. This simple step provides the transaction with a personal touch. Showing gratitude to the client for choosing your services indicates that you would like to maintain an excellent professional relationship with them.

The Benefits Of Using Vyapar Invoicing Software For Your Consultancy Services

There are a lot of unsaid benefits that you receive by using the Vyapar application for developing your consultancy invoices.

These are as follows:

Making custom invoices:

By using the Vyapar invoicing software for consultants for developing your consultancy invoices, you can easily adjust the details of an invoice according to your needs. You can change every minute detail to make it perfect for presenting it before your client.

This way, you can ensure that your invoices look professional while providing the details they ought to provide. It is a small step, but it will signify consistent efforts and loyalty toward your consumers.

Saves time for your business:

Using custom templates that can be saved, you can easily create new invoice formats within seconds. This way, the invoice can be developed and shared within the same day without missing any details.

Easier to check every detail:

It is easier to check details in your invoices if the layouts are simple and saved beforehand. So, by having the same format for the invoices, you won’t lose any data, and the chances of any mistakes will be reduced to a great extent.

Reduced efforts:

When you have invoicing software, you won’t have to find experts to handle your invoices. One can quickly learn the working of the Vyapar app within a single go, and the path ahead becomes as smooth as butter.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

A consultant invoice is a document that indicates the charges that need to be paid by the consumer. It contains the details of all the costs incurred by the business providing the services for the client’s project. It is sent to clients, and payment is requested. Consultancy businesses usually use consultancy invoice applications like Vyapar for developing a professional invoice.

The consultancy invoice format is used to create a consultancy invoice template. Once the template is finalized, the person using the format has to just fill in the details inside the blank areas. These templates are customizable. The consultancy invoice format contains elements like the contact information of the business and the client, their logo, address, item description, etc.

Here are some tips for raising an invoice as a consultant:

Keep track of your hours:

Some businesses work on a project on an hourly basis. So, it is essential to mention this in the invoice document for clarity between both parties. Later, the business can be paid according to the billable hours for the project.

Include a header:

It is something that must appear on the top of every one of your invoices. The details in a header include your company’s name and other important information like contact details, logo, etc.

Client’s contact information:

Adding your client contact information is critical to cross-check that the invoice is created for the correct client. It turns out to be helpful in tracking the invoice and payment.

Invoice date:

An invoice date helps in keeping a record of issuing an invoice.

Numbering your invoices:

Numbering your invoice helps in differentiating between your other invoices. It also helps in keeping a separate record of all your invoices.

List of services and terms and conditions:

You need to list your services with the amount charged for them. You also need to mention the terms and conditions of the transaction, if any.

Total amount:

The bottom of the document contains the total amount, including all taxes and discounts. It should be mentioned in bold font.

You can easily make a consulting invoice by first tracking the number of hours put in for the project and then mentioning details like the header, client’s details, invoice date, invoice number, etc. in the document, or you can choose to use the Vyapar application for the creation of your consultancy invoice in a quick easy and professional manner.