Brokerage Bill Format

Easily download Brokerage Bill Format to invoice your customers. Or use Vyapar App to do billing, inventory, accounting easily and grow your business operation faster!

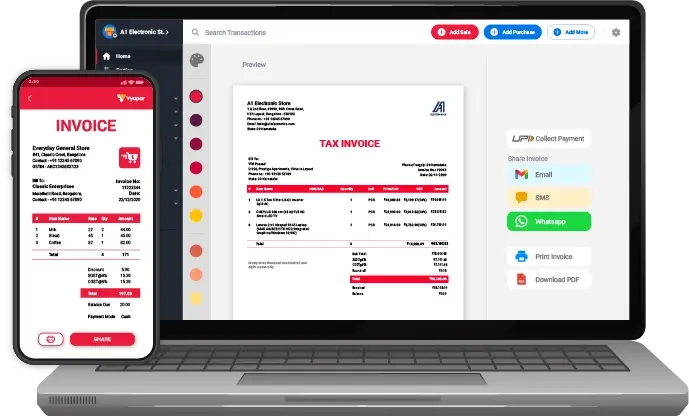

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of Brokerage Invoice Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Free Professional Brokerage Bill Format

Download the professional free Brokerage Bill Format, and make customization according to your requirements at zero cost.

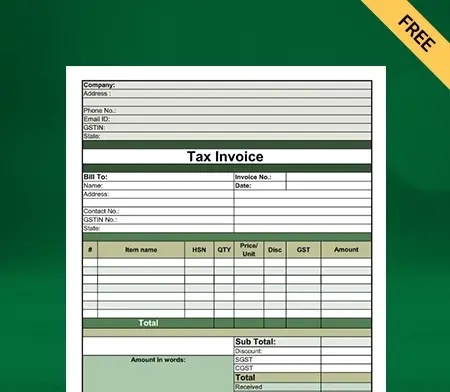

Brokerage Bill Format -1

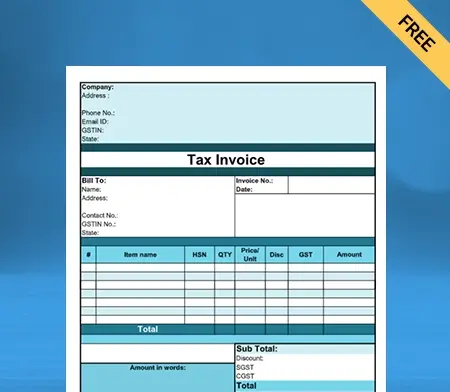

Brokerage Bill Format – 2

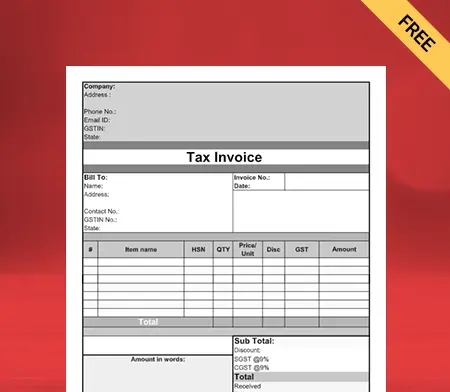

Brokerage Bill Format – 3

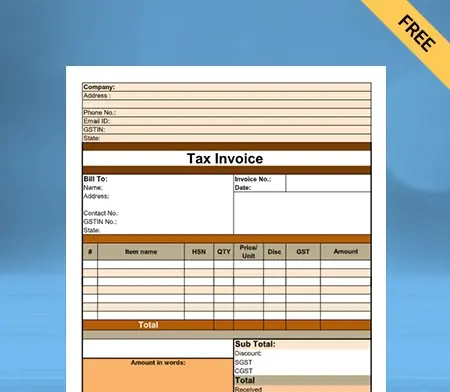

Brokerage Bill Format – 4

What is a Brokerage Bill Format?

A broker is a middleman, an intermediary who arranges a sale between a seller and a buyer. A broker may be an individual or a company. The broker acts per the client’s requests.

A percentage of the total transaction value or a flat fee is then paid to the broker. It is known as brokerage. Brokers use the brokerage broker bill format to ask for commission payments on the purchase or lease of real estate.

The invoice format should reflect the commission percentage (%) specified in the listing agreement between the agent and client in the invoice. The primary function of a broker is to solve a client’s problem for a fixed payment.

Why Do You Need a Brokerage Bill Format?

As a broker, you offer investors research, investment strategies, and market intelligence. Moreover, you offer clients specialised solutions. A custom brokerage bill format can help you manage your brokerage business seamlessly.

Record and Analyse Transactions:

A bill format for brokers can help record all the transactions in one place. You won’t need to write the same things repeatedly while making an entry.

Your bills will have the same layouts, making it easier for your team to check the details. It reduces the chances of mistakes because your team only needs to handle this data once.

A bill format system helps businesses keep track of their accounts and organise them. Additionally, it becomes easy to track cash flow and recognise the revenue.

Saves Time and Efforts:

You can save time by automating the format of brokerage bills. Entering data, checking calculations, and reviewing reports take less time.

Since all the information is already in the system, information reconciliation happens quickly. Accountants become more productive.

The automatic brokerage receipt templates take less time, so you can generate invoices in a few minutes. Only the required fields need to be updated.

Track Your Cash Flow Anytime:

The online brokerage bill format india makes the entire management process seamless. You can check your firm’s cash flow and payment updates in one place.

With an accessible brokerage bill format, you can manage your brokerage cash flow on the go. It makes accounting in your company quite simple and effective.

Using the brokerage bill format, you can quickly receive updates on your brokerage fees anytime. You can reduce the time needed to manage your business with automation.

Makes Your Task Easy:

If you don’t use bill formats, it’s up to your staff to remember to include all the crucial information. They might make errors.

You can quickly include information in templates, such as payment options, to make it simpler for customers to make payments or share details about other services you provide.

It’s simple to extract data from your files and ledger once the free bill format is set up. Using a template, you can ensure that all invoices contain the most recent information.

Create a Consistent Experience:

You can replicate invoice layouts and update information with the brokerage bill formats. Your invoices and documents look professional.

Moreover, it helps customers. When they receive similar bills, they know where to look for the information.

It allows clients to have a consistent experience. It builds up customer loyalty and makes your life easier.

Get Access to Your Documents 24/7:

You can manage client information with client management software and brokerage specifics in one place, in brokerage bill format. Brokers can use the online format on a computer, tablet, or smartphone.

You can send and manage your invoices anytime, whether at home, travelling, or unable to get to the office.

The brokerage bill format gives your company a more contemporary and streamlined appearance. It gives your clients a great perception of you.

What are Major Specialisations of Brokers?

Various fields have brokers. Let’s look at their main specialisations:

Stock Brokerage:

A stockbroker is a qualified middleman on the stock or commodity markets who buys and sells assets on the client’s behalf at the best prices.

Real Estate Brokerage:

A real estate broker’s role is to find real estate buyers and sellers, such as warehouses, offices, retail, and residential properties. Brokers receive commissions for real estate transactions.

Credit Brokerage:

Credit brokers are experts with the necessary knowledge and connections to financial institutions. They help clients with the acquisition of necessary financing as well as its conversion, repayment, etc.

Forex Brokerage:

A forex broker is a mediator who gives customers access to the foreign exchange market. Individuals can only access the forex market through the intermediary of forex brokers because it is only accessible to a select group of businesses.

Insurance Brokerage:

Insurance brokers prepare policies at a discounted rate. Using this method saves time in filling out insurance contracts. It enables looking for better insurance offers.

Business Brokerage:

An existing business can be bought or sold using the services of a business broker. They typically assist in selling a business, negotiating with buyers, and dealing with business valuations.

What are the Various Types of Brokerages?

Online Brokerage

An online brokerage is a digital investment service provider that interacts with the customer online. The main benefits are speed, accessibility, and low commissions.

They are digital platforms that operate automatically and offer online financial planning services. Using algorithms, they provide financial advice without much human supervision.

Discount Brokerage

A stockbroker who executes buy and sell orders with a lower commission is known as a discount broker. Discount brokers concentrate on the fundamentals, while full-service brokers offer a wide range of services.

Discount brokers fulfil their clients’ buy and sell orders but do not provide any additional services. For seasoned investors looking to cut costs, they may be appropriate.

Full-Service Brokerage

A full-service brokerage offers clients various expert services, including tax advice, investment advisory, equity research, etc. Full-service brokers usually have offices in major cities where clients can visit.

Investors with different interests and varying levels of expertise can receive specialised support from these brokers through specially designed brokerage plans and services.

Why Use Vyapar’s Brokerage Bill Format?

The broker market is highly competitive. Businesses need to attain and retain clients. Brokerage Bill Format by Vyapar helps you make bills faster and manage your business seamlessly. Here’s how:

Keep Your Data Secure:

You can configure an automatic backup of data in Free Brokerage Bill Format by Vyapar, ensuring the security of the data saved in the application.

Occasionally, you should make a local backup for your security. The Vyapar bill format would also help protect your data on a hard drive or another storage device.

You can use Vyapar’s brokerage bill format to ensure your company’s security by setting up automatic backups or performing secure backups on schedule.

No Extra Costs:

With the Vyapar brokerage bill format generator, you can access all essential features for free. Android mobile users have lifetime access to the free features.

Users can sign up to use the accounting app for free after downloading the app for free from the Play Store. However, a broker can use a subscription to access the premium features and desktop programmes.

Having professional billing software allows brokers to scale their business operations. They can build their business professionally and seamlessly create custom invoices.

Collect Payments via Different Modes:

The brokerage bill format by Vyapar allows you to provide payment mode choices to your clients. You can collect brokerage through UPI, QR, NEFT, IMPS, e-wallet, and credit/debit cards.

Using the Vyapar brokerage bill format, you can create invoices that include multiple payment options. You are likely to retain your clients if you provide payment options.

Additionally, you can include information about your bank account in the bill. Customers will choose you over competitors who do not offer a variety of choices.

Automation Reduces Errors:

One of the most significant advantages of online brokerage bills is its automation. An online bill format can help you avoid processing incorrect billing amounts or sending a bill to the wrong client.

You can remind your clients to make payments by sending them follow-up emails using the brokerage bill format generator. You can concentrate on expanding your business because it saves you time.

The brokerage bill format automatically calculates the amount due. Taxes are added, and it makes sure the correct client is billed. It only takes a minute to correct and resend if you make a mistake.

Features that Make Vyapar Best For Creating Brokerage Bills:

Share Professional Brokerage Quotations

You can quickly create brokerage quotations by using the Vyapar brokerage bill format. Thanks to the software’s fantastic features and customizable quotation formats, you can send quotes and estimates to clients whenever you want..

Brokers can send bills for brokerage services via WhatsApp, email, SMS, or printing. The bill creator software from Vyapar offers a professional appearance along with real-time quotes and estimates.

Most processes are automated with the help of the Vyapar brokerage bill generator. It eliminates errors in the quotes and estimates. Brokers can also establish a due date for effortless tracking of invoices.

Additionally, you can change your quotes and estimates into brokerage invoices at any time. The brokerage bill format software from Vyapar makes estimates and quotes simpler.

Manage Your Brokerage Bank Accounts Seamlessly:

Brokers can easily track both online and offline brokerage payments in their bank through Vyapar. Regardless of whether your brokerage comes from banks or e-wallets, you can add the information to the broker management app.

You can control bank account data to manage your cash flow. Agents can use the Vyapar brokerage bill format app to handle all cash-ins and cash-outs.

You must first link your brokerage account with your bank to Brokerage Bill Generator Software to use the app’s bank accounts feature. You can quickly withdraw or deposit cash from your bank accounts.

The Vyapar App supports open checks, which let users deposit or withdraw money. The Vyapar bill format and the numerous payment options make it simple to track cheque payments.

Create Your Brokerage Bills Professionally:

Your business’s reputation and identity are established when you send customised brokerage bills to your customers. Using our brokerage bill format, you can quickly enhance the visual appeal of your brokerage invoice.

Options for simple customisation are available. You can easily prepare the client’s bill. Two thermal printer templates are available in our Vyapar brokerage bill maker software.

Additionally, it has twelve invoice designs for standard printers. Choose the invoice templates for a brokerage that best meets your needs. Using brokerage custom bill formats, you can produce a more detailed invoice.

You can add extra details, such as your client’s requirements, messages tailored to each customer, and other services. As a result, you build a stronger relationship with your clients.

Generate Bills Without Internet:

Brokers don’t need an internet connection to use the Vyapar brokerage bill generator app. You can use it offline.

You can continue operating your business even with iffy internet connectivity thanks to Vyapar’s brokerage bill format.

When you connect Vyapar to the internet, it instantly validates your transactions and updates your database. Remote locations can benefit from Vyapar’s offline and online features.

Without an internet connection, your business can continue to run using these features. It is also easier to manage all the details in the future using a standard brokerage billing format.

Get Detailed Reports:

Brokers need to choose carefully. It can take time to balance your operational and financial obligations at a time. The Vyapar brokerage management app is the answer to each of these issues.

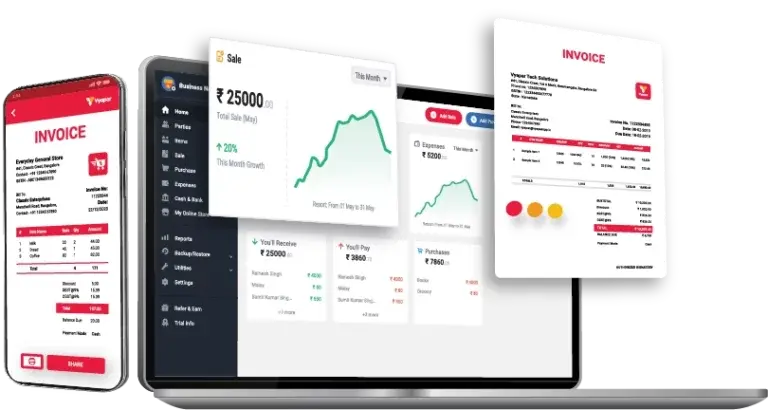

Using the Vyapar brokerage bill formats, you can generate more than 40+ reports. Balance sheets, total expense or revenue reports, and GST brokerage reports are options.

You can assess the company’s financial situation by looking over the brokerage reports. You can modify the cost of your broker services to reflect the state of the market.

The app could make filing taxes easier. You can keep the cash flow going while avoiding workflow disruptions.

Track Receivables and Payables:

Users can effortlessly track business cash flow and retain all the transaction details with the help of a professional, free brokerage bill format.

Through Vyapar free bill formats, you can keep track of the money you receive and the money you owe. You can also set payment reminders to ensure that these clients pay their debts on time.

Additionally, you can save time by sending payment reminders to all of your customers at once using the bulk payment reminder feature. Vyapar’s automated brokerage bill format makes calculations automatically.

You can prevent errors and create a business plan using Vyapar’s brokerage bill format maker. Using the brokerage bill format generator, you can keep track of payables and receivables by the party.

Frequently Asked Questions (FAQs’)

A broker is a middleman who facilitates transactions between traders, sellers, and buyers. Several industries have brokers, including insurance, real estate, finance, and trade.

All taxable value of supplies made by a broker is subject to GST in India. 18% GST applies to total brokerage charges.

A reverse charge mechanism applies to services provided by a broker or commission agent to the following individuals:

1. Bank

2. Financial institution

Add the name of your broker business, address & contact information.

1. Enter the date and bill number.

2. Describe your broker services in detail.

3. Add the total amount inclusive of taxes.

4. Download or print the invoice.

You can invest in securities, such as stocks, mutual funds, and exchange-traded funds. You can use potential long-term growth to your advantage and save money for retirement.

The fee that brokers collect from buyers is the brokerage fee. The brokerage bill format fee is calculated as a predefined percentage of the total turnover.