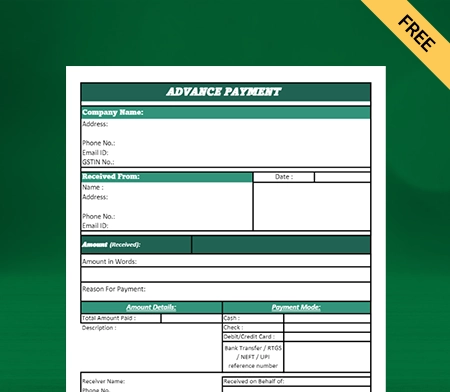

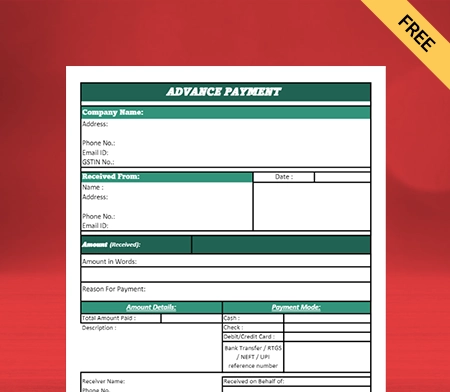

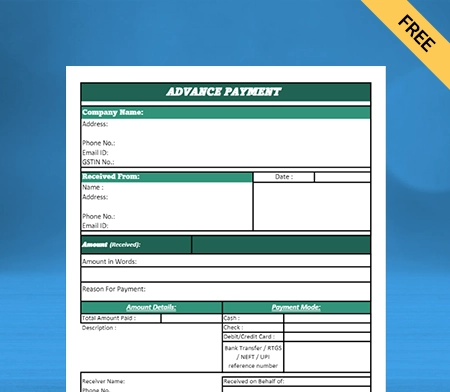

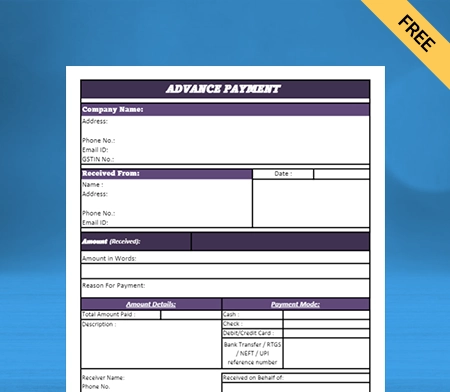

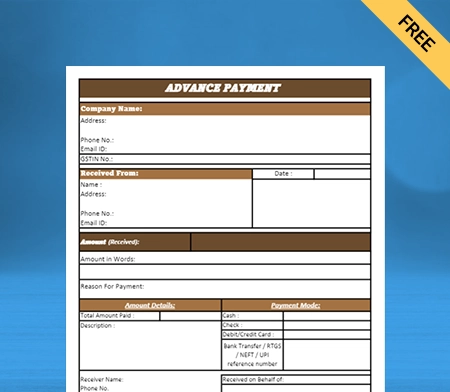

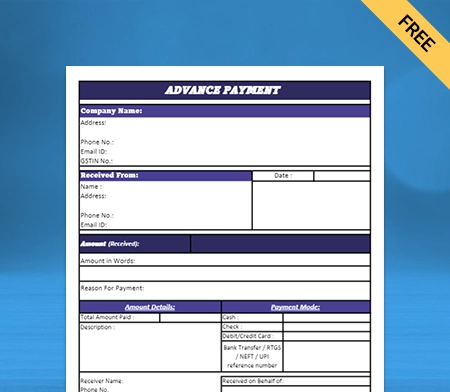

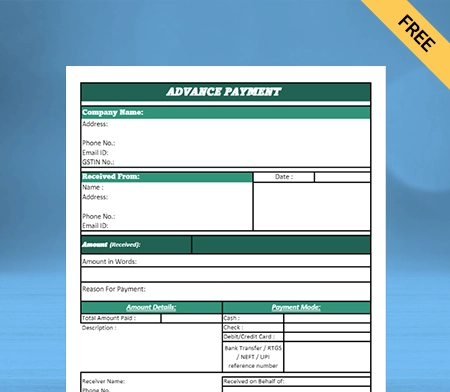

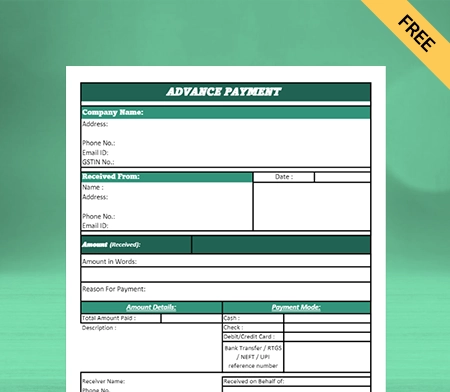

Advance Payment Receipt Format

Use Vyapar’s Advance Payment Receipt Format to record information about funds received by your company. All receipt formats are entirely free. Start your complimentary 7-day trial today!

Advance Payment Receipt Format Vs Vyapar App

Features

Rent Receipt Format

200+ Professional Formats

GST Reports

Auto Calculation

Real-Time Updates

Accounting Integration

Auto Backup

Real-Time Business Insights

Multiple Payment Mode

Free Support and Assistance

Instant Data Sync

Download Advance Payment Format in Excel

Download Advance Payment Format in PDF

Download Advance Payment Format in Word

Download Advance Payment Format in Google Docs

Download Advance Payment Format in Google Sheets

What is an Advance Payment?

The buyer makes an advance payment to the seller before getting goods or services. Sellers request early payments in order to avoid bad debts and cover additional costs. There are several methods for making advance payments. You can make an advance payment using cash, check, bank transfer, or credit card.

A contract or agreement that describes the payment terms, including the amount, the purpose of the payment, and the timetable for the labour or delivery of products or services, usually accompanies advance payments. Before making or accepting an advance payment, it is critical to carefully study the conditions of the agreement.

Types of Advance Payments:

Here are several types of advance payments:

Down Payment: A down payment is a sort of advance payment made when acquiring goods or services. The buyer pays a fraction of the total cost upfront, and the remaining is paid later.

Retainer Payment: A retainer payment is a payment made in advance to a service provider by a client. Service providers include a lawyer or consultant. The retainer payment guarantees that the service provider can work on the client’s project.

Advance Payment For Services: An advance payment for services is paid to a service provider by a customer before the services are provided. This payment type is common in industries such as construction or event planning.

Advance Payment For Goods: An advance payment for goods is a payment made by a buyer to a seller before the goods are delivered. This payment type is common in international trade, where buyers may need to pay for goods upfront to secure a supplier.

Contents of an Advance Payment Receipt Format:

Here are some things that you must include in your Advance Payment Receipt Format:

The Name and Address of Your Company:

You must mention the name of your business. Also, write your address and contact details in the Advance Payment Format.

The Name and Address of the Client:

The name of the client to whom you are requesting the advance payment must also be stated on the advance payment request letter.

A Unique Number:

As a seller, you make many advance sample letters for your customers. It would be best if you numbered the request letters so that you can identify them quickly.

Payment Amount:

The Advance Payment Receipt Format should clearly state the amount of the advance payment that is required. Sellers can request the whole, half, or some part of the payment in advance.

Date of Advance Payment Request Letter:

The Advance Payment Receipt Format should specify the date and timing of the payment, including when the payment is due and any installments or milestones that must be met.

Payment Method:

The Advance Payment Receipt Format should specify the payment method that will be used. You can add modes such as cash, cheque, bank transfer, or credit card.

Clearly Defined Services and Products:

The Advance Payment Receipt Format should clearly specify the goods or services that will be provided, including any relevant details such as quantity, quality, and specifications.

Terms and Conditions:

The objective of the payment, such as the purchase of goods or services, should be specified in the Advance Payment Format. The format should include the terms and circumstances of the advance payment, including any cancellation or return policies, warranties, or guarantees.

Signatures:

All parties involved in the transaction should sign the Advance Payment Receipt Format to indicate their agreement to the terms and conditions.

Difference Between Advance Payment and Deferred Payment:

Advance and deferred payments are commonly used in business transactions, accounting, and finance. Here is the difference between advance payments and deferred payments:

- Advance payment means the payment made before the delivery of goods or services. In comparison, deferred payment refers to the payment made after the delivery of goods or services.

- Advance payment is made before the delivery of goods or services. Deferred payment is made after the delivery.

- Advance payment reduces the risk for the seller, as the buyer has already paid for the goods or services. Deferred payment increases the risk for the seller, as the buyer may not pay on time or may default on payment.

- The advance payment provides cash flow for the seller, who receives payment before delivering goods or services. Deferred payment, however, may cause cash flow problems for the seller, as they have to wait for payment after providing goods or services.

- Advance payment does not involve interest, as the payment is made before the delivery of goods or services. Deferred revenue may include interest, as the payment is made after the delivery of goods or services.

- Advance payment is recorded as a liability in the books of accounts, while the deferred payment is registered as an asset.

- Advance payment may require a contract or agreement between the buyer and seller, while deferred revenue may require a payment agreement or payment plan.

Advantages of Enabling Advance Payment:

There are several advantages to receiving advance payments in business, including:

Improved Cash Flow:

Advance payments provide businesses with cash injection even before you provide goods or services. This can improve cash flow and provide businesses with the working capital to cover expenses.

Reduced Risk:

As the business has already received payment before providing the goods or services, it reduces the risk of non-payment, late payment, or bad debts.

Better Planning:

Advance payments can help businesses plan more accurately for future projects and expenditures. With advance payment, companies can better understand their cash flow. They can make more informed decisions about their future activities.

Improved Creditworthiness:

Advance payments can improve a business’s creditworthiness and financial stability. It is essential for securing financing or negotiating better payment terms with suppliers.

Faster Sales Cycle:

Receiving advance payments can increase sales by providing immediate cash flow. It reduces the time it takes to close a deal, as customers are more likely to commit to a purchase when they have paid upfront.

Increased Flexibility:

Advance payments can allow businesses to take on new projects or opportunities requiring upfront investment. It helps in the growth and expansion of the company.

Better Customer Relationships:

Receiving advance payments can help build stronger customer relationships. It demonstrates a commitment to delivering goods or services as promised. This can increase customer loyalty and generate repeat business.

Competitive Advantage:

Businesses that offer advanced payment options may have a competitive advantage. They can provide customers with more convenient and flexible payment options. It attracts new customers and retains existing ones.

Importance of an Advance Payment Receipt Format in Business Transactions:

An advance payment letter format is necessary for business transactions for several reasons:

The Advance Payment Receipt Format provides clarity to both parties involved in the transaction. It specifies the terms and conditions of the advance payment, the amount owed, the mode of payment, and the due date.

An Advance Payment Format protects both the buyer and the seller. It ensures that the buyer has paid for the goods or services upfront and provides some protection against non-payment. For the seller, it ensures that they have received payment before delivering the goods or providing the services.

Using an advance payment letter format adds a level of professionalism to the transaction. This clarity helps prevent misunderstandings or disputes arising during or after the transaction.

An Advance Payment Receipt Format provides a transaction record, which can be used for record-keeping and accounting purposes. It can also be used as evidence in case of disputes or legal action.

Benefits of Using the Advance Payment Receipt Format By Vyapar:

Vyapar is a popular billing and accounting software that offers several benefits to its users. Here are some benefits of using the Advance Payment Receipt Format by Vyapar:

1. Create a Professional Advance Payment Receipt Format:

With Vyapar, you can quickly and easily create a professional-looking Advance Payment Format quickly and easily. Vyapar provides a variety of templates that you can customize to fit your business needs.

Using Vyapar’s formats gives a professional look to your advance payment letters. It creates a good impression on your customers and suppliers, which can benefit your business.

Professional-looking Advance Payment Receipt Formats help in building trust with customers, suppliers, and other stakeholders. Using Vyapar’s professional formats can help businesses to communicate effectively and professionally with their stakeholders.

2. Customisable Templates:

Vyapar allows you to customize the templates of advance request letters to include your business logo, address, and other details. You can also add fields to the template to capture any additional information you need.

Advance Payment Receipt Formats by Vyapar are customizable. It helps to create professional-looking sample letters. You can use your format to portray the identity of your brand accurately. Advance payment letters can help your business stand out from the competition.

The data in the format includes the customer’s name, payment information, a description of the goods or services, and the name of the recipient. In addition to adding or removing rows, you can alter the fields and designs.

3. Consistency Across Documents:

By using the same format across all advance payment letters, you can ensure consistency in your branding and messaging. This can help establish your business as a professional and reliable entity.

The consistent advance payment letter format is easy to review and understand. Each transaction is recorded similarly, decreasing the possibility of errors caused by variances in recording methods.

A standard format like money receipt format helps documenting advance money received guarantees that all information is presented uniformly. It facilitates reading and comprehending financial documents and ensures that critical facts are noticed.

4. Time-Saving:

Using pre-designed invoice formats in Vyapar can save you time and effort in creating invoices, quotations, and other documents. You can quickly fill in the required information and generate the document. It just takes a few clicks.

Vyapar’s formats provide a user-friendly interface for data entry, making it easier and quicker to input information. This saves businesses time that would otherwise be spent inputting information into sample letters.

Vyapar’s formats are designed to automate calculations such as taxes, discounts, and total amounts. This saves businesses time that would otherwise be spent manually calculating these amounts.

5. Error-Free Invoicing:

Vyapar’s formats ensure that all the necessary details are included in your invoices, including your business name, customer details, invoice number, and itemized charges. This can help reduce the risk of errors and disputes with customers.

Advance Payment Formats also ensure that each transaction’s relevant information is captured. It implies there is less chance of forgetting important details, which could lead to mistakes in the future.

An Advance Payment Format can assist you in keeping your records orderly and accessible. It can make reviewing transactions and detecting problems or irregularities easier.

6. Ensures Complete Transparency:

With Vyapar, you can easily organize and track your invoices, payments, and expenses. Using formats, you can quickly sort and filter your data to gain valuable insights into your business performance.

Using an advance payment letter format for recording money received creates a clear audit trail of financial transactions. It makes it easy to spot abnormalities or discrepancies by tracking money flow in and out of an institution.

A method for recording money received can improve the accessibility of financial documents to relevant parties such as auditors or regulatory organizations. It can contribute to open and transparent financial records.

Helpful Features of the Vyapar App For Business Management:

Create Customised Invoices:

Vyapar allows you to create and send professional invoices to your clients easily. You can customize your invoices. You can add your company logo, payment terms, and other details.

Vyapar sends reminders and alerts to businesses and customers for upcoming and overdue payments. This helps companies to stay on top of their accounts receivable and reduces the risk of late payments.

Vyapar’s invoicing feature allows businesses to offer multiple payment options to their customers, including cash, check, bank transfer, and online payments.

Vyapar’s invoicing feature is accessible from mobile devices, allowing businesses to create and send invoices.

Seamless Inventory Management:

You can manage your inventory efficiently with Vyapar. You can add products, track stock levels, and get alerts when items run low.

Vyapar’s inventory management software allows businesses to track their stock levels quickly. Companies can quickly identify when to reorder stock and avoid running out of inventory.

Vyapar’s inventory management feature supports a barcode scanner, making adding and removing items from inventory easy. This saves time and helps to reduce errors that can occur when adding or removing items manually.

Businesses can also manage their sales orders and invoices and track outgoing stock. This helps companies to understand which products are selling well.

Perform Expense Tracking:

Vyapar lets you track your business expenses, including bills, receipts, and payments. You can categorize your expenses and generate expense reports.

Keeping track of your expenses allows you to increase income while lowering costs. You can use the free software to keep track of outstanding funds. It also helps them monitor their materials in the future.

Budgeting is easy with our programme. Companies can reduce costs fast and save a substantial amount of money. You can monitor your GST and non-GST spending with our free billing software.

Vyapar is a smartphone app that is free for small and medium-sized companies. People can manage their finances better. Keeping track of your expenses can also assist you in developing appropriate plans.

Various Business Reports:

Vyapar provides a range of business reports to help you track your sales, expenses, inventory, and profits. You can view your information in graphical and tabular formats. With the Vyapar accounting app, you may create 40+ business reports.

You can quickly assess your company’s success on your dashboard by tracking sales, purchases, cash on hand, stock value, expenses, open checks, and loan amounts.

Generating sales reports, production reports, financial records, and other data is possible. You can access this information from anywhere through live status tracking. You can receive all of your company’s vital information in one place.

Report analysis can provide a comprehensive and accurate picture of your company. It has the potential to improve your company’s operational efficiency. It also enhances your employees’ morale.

Ensure Data Security:

Vyapar uses encryption to protect its users’ data, including their financial and personal information. The Vyapar app encrypts and secures all information transferred between the user’s device and its servers, ensuring that outsiders cannot access it.

The software invites users to select a secure password and gives them the option to implement two-factor authentication in order to increase security. It aids in preventing unauthorized access to the account of the user.

Various security measures, including firewalls, intrusion detection systems, and regular vulnerability assessments, protect the data stored on Vyapar’s servers.

Vyapar app provides an automatic data backup and recovery feature to protect against data loss due to device damage or failure.

Setup Online Store:

With the Vyapar billing and accounting software, you can set up your online business in hours. You can list all the products and services you offer your clients using our mobile application.

It will help you gather a list of all the products and services you offer and promote your online sales. You can accept online orders from consumers who can later pick up their packed goods from your store by sending links to your online store.

By setting up the package for your customers before they arrive using the online shop option, you can cut down on time spent at the checkout counter.

Providing doorstep or store pick-up services increases sales, which aids in your company’s growth. With GST billing software, you can update your online business whenever possible.

Frequently Asked Questions (FAQs’)

An Advance Payment Receipt Format refers to the structure or template used to create a document that outlines the terms and conditions for an advance payment.

The advance payment structure clarifies the transaction for both parties involved. It outlines the advance payment’s terms and conditions, the amount due, the payment method, and the due date.

You can use Vyapar’s features and customize your Advance Payment Receipt Format to suit your needs. You can change the colour, logo, and fonts and add fields to personalize it.

Include the following essential elements in an Advance Payment Receipt Format:

Name of parties involved

Description of goods and services

Payment Amount

Payment Method

Due date of payment

Terms and conditions

Signature

Here’s how you can ensure that your Advance Payment Receipt Format is legally compliant:

It will help if you familiarise yourself with the contract laws and regulations.

Include clear and detailed terms and conditions in the Advance Payment Format.

Check that the payment is proportionate to the value of the goods or services.

Obtain consent and agreement from the parties involved.

Yes, An Advance Payment Receipt Format is suitable for transactions involving both goods and services.

In most cases, businesses become responsible for taxes when they provide goods or services, rather than when they receive payment. However, it may depend on your locality. You may have to pay taxes on the advance payment when it arrives. That’s why you must determine when the tax liability arises in your jurisdiction.