Money Receipt Format

Use Vyapar’s Money Receipt Formats to record details of the cash received by your business. All formats are free. Try Vyapar with your 7-day free trial now!

Table of contents

- Download Money Receipt Format in Excel

- Download Money Receipt Format in PDF

- Download Money Receipt Format in Word

- Download Money Receipt Format in Google Docs

- Download Money Receipt Format in Google Sheets

- What is the Money Receipt Format?

- What is Included in a Money Receipt Format?

- Importance Of Recording Money Received

- Formats in Which Money Receipt is Recorded in Accounting

- Benefits of Using a Money Receipt Format By the Vyapar App

- Features of the Vyapar App that Help Manage Your Business Efficiently

- Frequently Asked Questions (FAQs’)

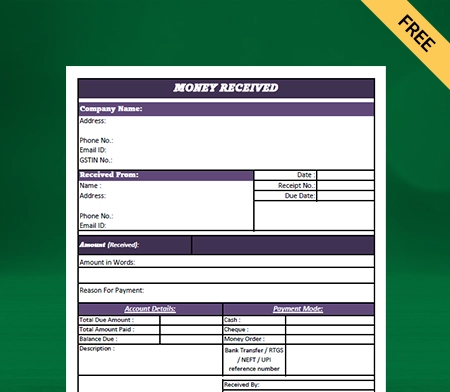

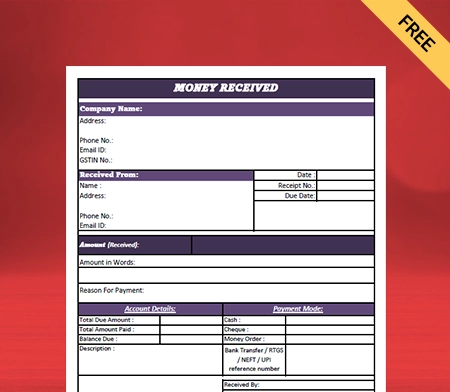

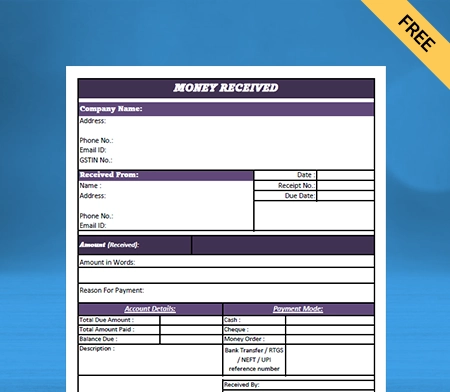

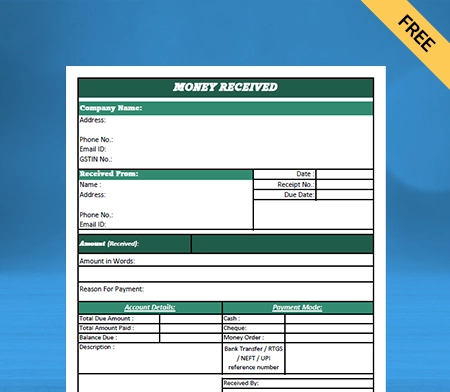

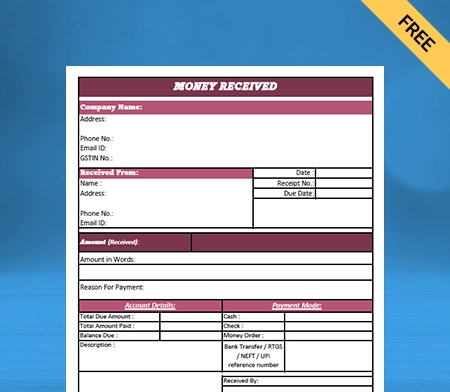

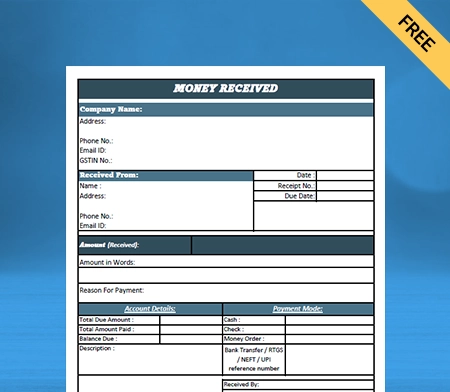

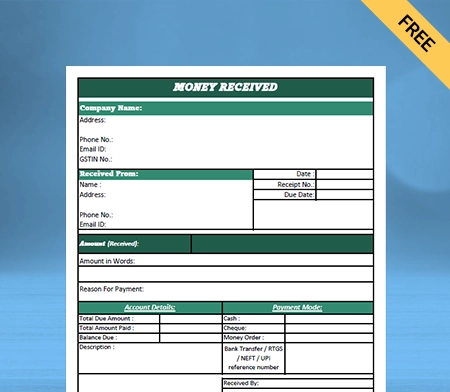

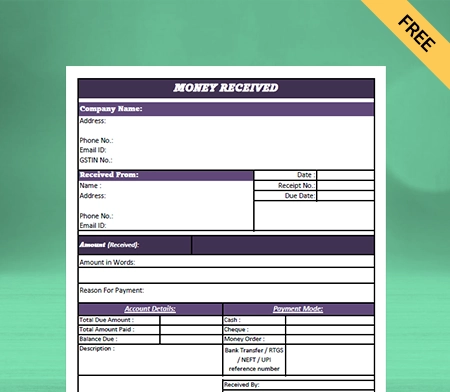

Download Money Receipt Format in Excel

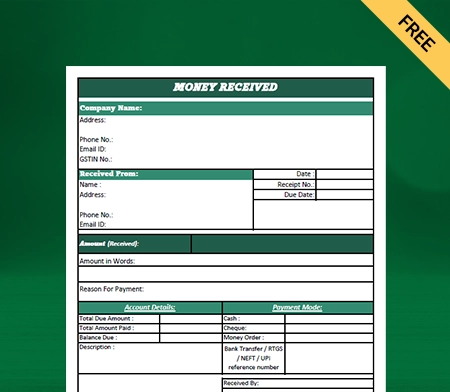

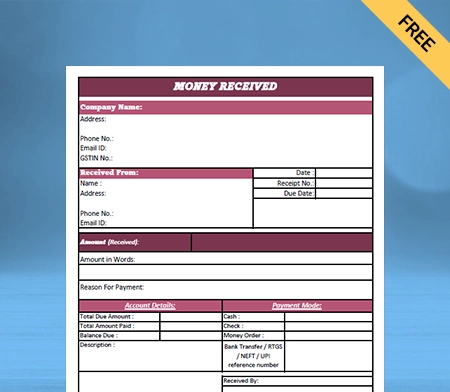

Download Money Receipt Format in PDF

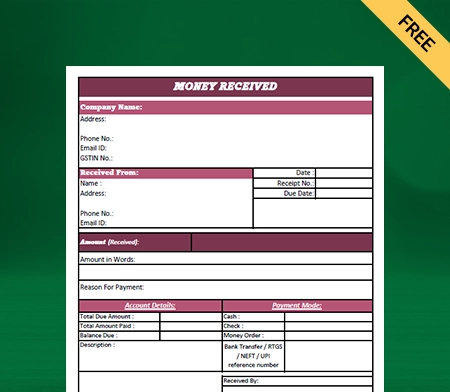

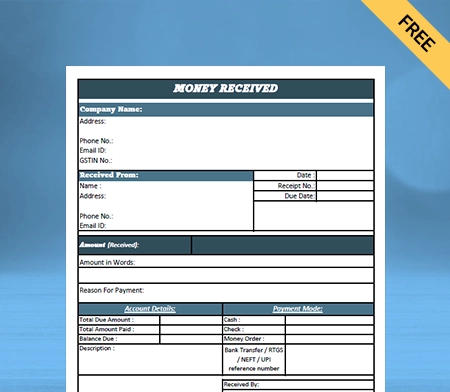

Download Money Receipt Format in Word

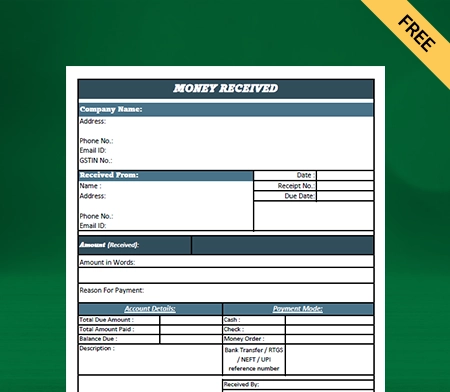

Download Money Receipt Format in Google Docs

Download Money Receipt Format in Google Sheets

What is the Money Receipt Format?

A Money Receipt Format is a document or template used to record the receipt of money or payment from a customer or client. This document is a payment record and can be used for accounting and tracking purposes.

What is Included in a Money Receipt Format?

Date: You must mention the date on which the money was received in the Money Receipt Format.

Description: A brief transaction description, such as the customer’s name or the payment’s purpose.

Account Debited: The account debited when the money is received is also included. It could be a cash or an accounts receivable account.

Account Credited: The account that is credited when the money is received. It could be a sales account, a revenue account, or an accounts payable account.

Amount: You must include the amount of money that was received in the format.

Additional information that may be included in a Money Receipt Format includes:

- The name of the payer.

- The method of payment (e.g. cash, check, credit card).

- We charged any applicable taxes or fees.

Importance Of Recording Money Received

Recording money received ensures that a business or individual records their financial transactions accurately. Using it is essential for financial reporting purposes, as it allows for the preparation of accurate financial statements. Accurate financial statements are essential for making informed business decisions, securing financing, and complying with tax and other legal requirements.

Recording money received allows a business or individual to track their cash flow. It can help them manage their finances more effectively by identifying trends and patterns in their income and expenses.

If a business extends credit to its customers, keeping track of payments received and outstanding balances is crucial. Properly recording money received formats can help a business manage its accounts receivable more effectively, ensuring customers pay their bills on time and minimizing the risk of bad debt.

Properly recording money receipts is essential for tax compliance purposes. You must report all income, including money received, on your tax returns. Failure to report all income can result in penalties and other consequences.

In some industries, such as banking and finance, strict regulations govern the recording of financial transactions. Properly recording money receipts is essential for complying with these regulations and avoiding legal penalties.

Formats in Which Money Receipt is Recorded in Accounting

There are several formats for recording money receipt. Here are some examples:

Cash Receipts Journal:

A cash receipt journal is an accounting diary in which a business records all cash receipts (cash received in cash, checks, or other payment methods). All incoming cash transactions are tracked in the journal. It has columns for the date, the debited or credited account, the description, and the amount received.

When a business receives cash for the sale of goods or services, the transaction is recorded in the cash receipt journal, along with the relevant accounts affected (such as the sales and cash accounts).

Cash receipt journals are essential because they allow businesses to track their cash inflows, manage their cash flow, and accurately record all cash transactions. It becomes easier for businesses to reconcile their bank accounts and prepare financial statements, which provide an overview of their cash inflows and outflows over a given period.

Sales Journal:

A sales journal records all sales transactions made by a business. It records all credit and cash sales made during a specific period, such as a month or a quarter. It helps to simplify the accounting process by recording the money receipt through the sale.

Each transaction recorded in a sales journal includes columns for the date, customer name, invoice number, description, amount billed, and the money received.

The sales journal helps businesses track their sales revenue and record all transactions accurately. It also helps businesses monitor their accounts receivable and the amount of money owed and track their cash flow.

Accounts Receivable Ledger:

The accounts receivable ledger is a valuable tool for recording money receipt. It provides a detailed record of all the money its customers or clients owe to a business. When a business provides goods or services to customers on credit, an accounts receivable entry is made in the ledger.

The accounts receivable ledger allows businesses to keep track of all payments received from customers. It helps to ensure that all money received is recorded accurately and reduces the risk of errors.

The accounts receivable ledger also helps businesses manage credit by allowing them to see how much money is owed to them by customers. This information can be used to make informed decisions about extending credit to new customers. Also, it can help monitor the creditworthiness of existing customers.

Bank Statement:

A bank statement is a document provided by a bank that shows all transactions in a bank account over a certain period. Bank statements help record money receipts because they provide an independent record of all deposits made into the account.

Businesses generally deposit money received into a bank account. The bank statement will display the deposit date, the source of the funds, and the deposit amount. The accountant can ensure an accurate recording of all money received by comparing the bank statement to the business records.

Bank statements serve not only as a record of money received but also as a tool to track expenses and monitor the overall financial health of a business. By analyzing bank statements, business owners and managers can identify areas where costs are rising, track cash flow, and make informed decisions about the business’s financial future.

General Ledger:

A general ledger helps record money received because it is a central repository for all financial transactions. Individual accounts contain a record of all transactions that have been posted, and together they form the general ledger. These transactions include money received, paid out, and other financial activities.

When money is received, the general ledger records the transaction. The entry for the transaction will contain the date of the transaction. It will also include the source of the money receipt, the amount received, and the account to which the funds should be credited. This information is essential because it helps track the money flow into the business.

The general ledger is also helpful in analyzing financial performance over time. By looking at the entries in the general ledger, business owners and managers can see trends in revenue and expenses, identify areas where costs may be rising, and develop strategies to improve profitability.

Benefits of Using a Money Receipt Format By the Vyapar App

1. Customised Money Receipt Formats:

Cash Receipt Templates by Vyapar can be completely customized. It aids in the creation of professional-looking cash receipts. You can utilize your format to accurately reflect your brand’s identity.

If everything on the bill is in the correct position, your customer will comprehend the cost and explanation of your charges. Customized Cash Receipt Templates can help your company stand out from the crowd.

The Cash Receipt Templates include all the information. It contains the customer’s name, payment details, a description of the goods or services, and the receiver’s name. You can change the fields and designs and add or delete rows.

2. Use Money Receipt Formats Without the Internet:

You can download the Money Receipt Format by Vyapar and use it anytime you want without the internet. You can keep track of your Cash Receipt Formats both electronically and physically. You can manually fill out the format after printing a digital copy, which takes a few minutes.

The user can download the Money Receipt Format for subsequent use. The entire operation is free of charge. Customization makes you appear more professional, increasing the value of your brand.

The Money Receipt Format can be customized to match your needs. Other options exist for printing the tailored format and manually entering the data. The Money Receipt Format works with all standard bill sizes and regular and thermal printers.

3. Improves Efficiency in the System:

Vyapar’s Money Receipt Formats save time and effort by providing staff with a clear template for recording the money received. It saves employees and managers time writing and analyzing reports, allowing them to focus on other essential responsibilities.

Vyapar Cash Receipt Templates have certain automatic functions that save time and reduce error risk. Automation can categorize spending and generate reports automatically, saving staff the time and effort to track and report the money received manually.

A Money Receipt Format helps increase responsibility by informing staff about sales and income. When clear restrictions exist, employees are less likely to overspend or report incorrect charges.

4. Maintains Consistency in Work:

Using a standardized Money Receipt Format creates a consistent system that anyone can quickly follow, reducing the chance of errors due to differences in recording methods. This ensures that each transaction is recorded similarly, making it easier for you and others to review the information.

Businesses can ensure uniform presentation of all information and prevent important details from being overlooked by using a consistent format for recording money received, making it easier to read and understand financial records.

A standard format for recording money received can help ensure that all relevant information is captured accurately. It reduces the risk of mistakes, such as missing or incorrect amounts, and makes it easier to reconcile accounts.

5. Reduce Errors And Eliminate Issues:

Professional Cash Receipt Templates in Excel, Cash Receipt Templates Pdf, and Cash Receipt Format In Word also ensure that all necessary information is captured for each transaction. It means there is less chance of omitting essential details that could lead to errors in the future.

A format can include prompts for crucial information such as the date, amount received, source, and other relevant details. Following these prompts can reduce the likelihood of entering incorrect or incomplete information.

A format can help you keep your records organized and easily accessible. It can make it easier to review transactions and detect errors or discrepancies.

6. Maintains Complete Transparency:

A format for recording money received can include all necessary fields and information, such as the transaction date, the amount received, and the payment source. Using this documentation ensures accurate and transparent capture of all details.

Using a format for recording money received creates a clear audit trail of financial transactions. It helps to track the flow of money that comes in and goes out of business, which makes it easier to identify any irregularities or discrepancies.

A format for recording money received can make financial records more accessible to relevant parties, such as auditors or regulatory bodies. It can help to ensure that financial records are open and transparent.

Features of the Vyapar App that Help Manage Your Business Efficiently

Management of Cash Flows:

With Vyapar, you can keep track of your money receivables and payables. The cash inflow in your firm ensures you have enough cash to continue the business operations.

The dashboard can assist you in confirming that you can easily support current costs. You may send free payment reminders to your customers using our Cash Receipt Templates. It will help to ensure that your customers pay on time.

Businesses can use the money-received data stored in a database to record transactions. It helps in payment tracking. Companies widely use cash flow management in billing, accounting, and other tasks.

Vyapar Cash Receipt Templates help avoid accounting errors. This free billing software helps you manage your business’s financial flow. This all-in-one program allows you to manage cash transactions.

Data Security And Protection:

Data security is quickly becoming a primary priority for all business owners. You can use the Vyapar app to set up automatic data backups and protect your app data. You can also add a double layer of security by creating a local backup.

It would aid in the security of data stored in a private area, such as a pen drive or hard drive. You may preserve your company’s security using the free billing system software to set up automatic backups or regularly execute secure ones.

The accounting features of the Vyapar billing software ensure that you may examine your sales data whenever necessary and establish a business strategy after reviewing the Vyapar app’s business reports.

You may set up an automatic data backup in the Vyapar cash receipt maker app, assuring the protection of the data in the app. You may also use your sales data to build reports and study sales data for future growth.

Create Your Online Store:

You may set up your online business in hours with the Vyapar billing and accounting software. Using our mobile application, you may list all the goods and services you provide your customers.

It will assist you in presenting a catalogue of all the goods and services you provide and increase your online sales. When you send links to your online store, you can take online orders from customers who can later pick up their packed goods from your store.

Using the online shop option, you can save time at the checkout counter by preparing the package for your clients before they arrive. It can reduce wait times and improve your customers’ experiences.

By increasing sales, providing doorstep or pick-up services from your store helps your business develop. You can update your online store anytime by using GST billing software.

Simple Bank Account Management:

You can send and receive money using bank accounts and conduct bank-to-bank transfers for simple cash flow management. Vyapar invoicing software is the best since it can handle all cash-ins and cash-outs.

To use the bank accounts feature, you must link a business account to the Vyapar Accounting Software. It enables you to make deposits and withdrawals from your bank account. The Vyapar app simplifies the management of liability, O.D., and credit card accounts.

Online and physical enterprises may initiate, manage, and track payments efficiently. You may rapidly enter data into the free Management Software whether your revenue comes from banks or e-wallets.

Using Vyapar’s free accounting software, you can change the number of cheque payments manually. The Vyapar App supports open checks, allowing users to deposit or withdraw funds and cancel them quickly.

Reports Can Be Created in Minutes:

Business reports are an essential source of information. They keep everyone informed about current and completed events. You can build 40+ business reports with the Vyapar app. Vyapar invoicing and administration software is available in a variety of formats.

You can quickly examine your firm’s performance on your dashboard by tracking sales, purchases, cash on hand, stock value, expenses, open checks, and loan amounts.

Generating sales reports, production reports, financial records, and other information are possible. Through live status tracking, you can obtain this information from any location. You can get all the essential information about your company in one spot.

Report analysis can provide a complete and accurate view of your business. It can increase your company’s operating efficiency. It also boosts your employees’ productivity.

Keep Expenses Tracked:

Keeping track of and recording all expenses incurred throughout the delivery of commodities is crucial for accurate accounting and tax preparation. Vyapar makes it easier to generate precise reports and track costs.

Keeping track of your spending allows you to increase revenue while minimizing costs. You may keep track of outstanding money by using the free programme. It also aids in the future tracking of their materials.

With our free program, budgeting is a breeze. Companies can quickly reduce costs and save a considerable amount of money. With our free billing software, you can track your GST and non-GST spending.Vyapar is a free accounting app for small and medium-sized businesses. People can better manage their money with our software. Keeping track of your costs can also help you develop suitable alternatives. As a result, corporate profits will rise.

Frequently Asked Questions (FAQs’)

A Money Receipt Format is a document or template used to record the receipt of money or payment from a customer or client.

A Money Receipt Format may include the following information:

Date of transaction

Name of payer

Payer’s contact information

Amount received

Payment method (e.g. cash, check, credit card)

Invoice or account number

Description of goods or services

Discounts or fees

Tax information (if applicable)

The Money Receipt Format is essential to managing finances for businesses and individuals. It enables accurate financial reporting, effective cash flow management, and compliance with tax and legal requirements.

Any business or individual receiving payment for goods or services can use a Money Receipt Format.

Some common formats for recording money received are:

Cash Receipt Journal

Sales Journal

Accounts Receivable Ledger

Bank Statement

General Ledger

You can use a Money Receipt Format for tax purposes. Maintaining accurate records of money received is often necessary to properly report income for tax purposes.

Related Posts:

1. Sales Report Format in Excel