NGO Donation Receipt Format

Download the NGO Donation Receipt format for trust. Or use the Vyapar App to create donation receipts, track payment history, and manage outstanding easily!!. Avail 7 days Free Trial Now!

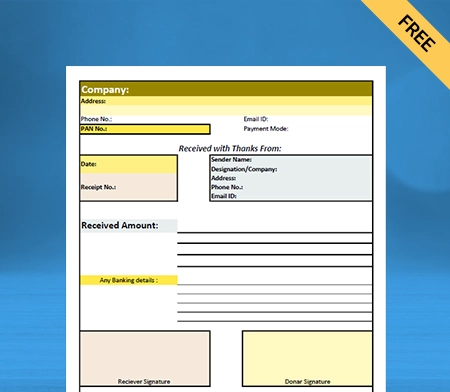

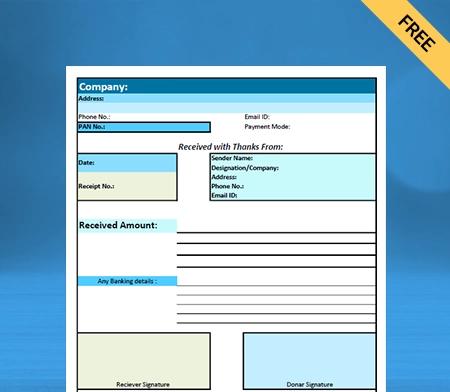

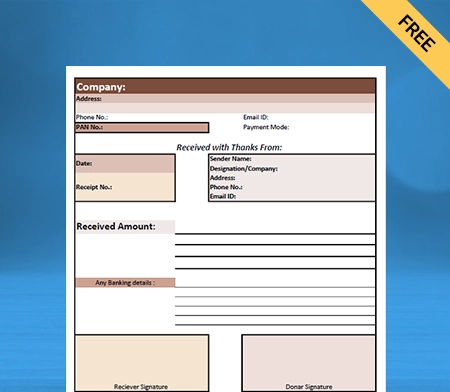

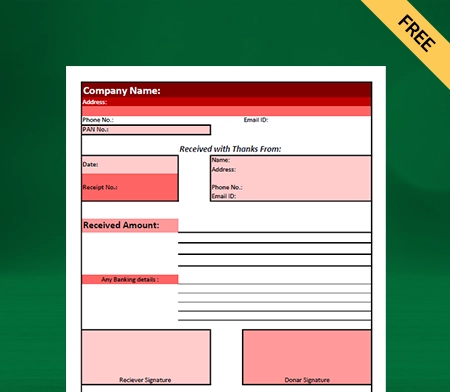

Download Free NGO Donation Receipt Excel, Word, and PDF Formats

Download Free Donation Receipt Format For Charitable Trust

What is the NGO Donation Receipt?

A Non-Government Organisation is a non-profit organisation which works independently from the government. Your organisation may receive donations from donors to carry out your humanitarian assistance.

By mobilising the donations, you can satisfy the essential requirements of needed ones. NGO Donation Receipt is issued after the donation. By providing receipts, NGOs let their donors know they received their donation.

These donation receipts are written as records that tell donors that their gift to an organisation is legitimate as per government rules. Registered non-profit organisations can send “official donation tax receipts” and more informal receipts to donors.

What is a Charitable Donation Receipt?

A written acknowledgement that the non-profit organisation has received a donation is a charitable donation receipt. Donation receipts are also called donation invoices or non-profit receipts. Information about the gift is included in charitable donation receipts (donor name, organisation name, amount, and type). Both monetary and non-monetary contributions are acceptable.

Both donors and religious organisations receive great perks with the donation receipt template. Donors frequently use them when filing taxes because specific charitable contributions can result in income tax savings. Donors can claim a tax deduction by providing a donation receipt as evidence of their contribution.

Donors will value having a copy of their donation receipts during tax season because they contain important information. Making attractive donation receipt templates will save you time and guarantee that you include the essential details about the transaction for the donors. You can automate your accounting procedures with the aid of the Vyapar donation receipt maker app.

What is the Benefit of a Non-Profit Organisation Registering as an NGO?

There are substantial benefits of issuing the NGO Donation Receipt by your organisation as given below:

Helps with a Tax Exemption for Donors: It lets your donors get tax exemption for up to 50% of the donations made to your NGO, and both taxable income and tax payable get reduced. The tax-deductible donation receipt pulls many donors to your NGO.

Without this registration for your NGO in India, your donation receipts would be authorised to be taxed at standard tax rates as per GOI, and the donors won’t be able to avail of the exemptions available.

Helps Your NGO Build Credibility: Section 12A and 80G Registration rules would make your NGO a good organisation and provide a better platform for your philanthropic work since the Government of India now recognises your NGO. The NGO Donation receipt makes your organization more inclusive and helps you maintain all NGO donation records.

Also, this registration serves as valid proof of your NGO’s existence and purpose, which would bring forward the confidence of everyone associated with it.

Helps Receive Government Support: The Government of India supports funding to registered NGOs that carry out their welfare schemes. If you want government support, then this registration is compulsory.

Not having registration would make your NGO devoid of receiving Government funding. It also opens the door for your non-profit organisation to get foreign donations. Registration helps expand the reach of your NGO, and it helps to build the trust of donors in your organisation.

Advantages of Using NGO Donation Receipt Formats by Vyapar?

Quick Cure for Personal Acknowledgement: It is confusing for the NGO donor to receive a thank-you email after the donation, and a separate receipt by email even increases their headache. The donor’s interaction with your non-profit is about how they feel and how smooth the process is for them, not about your comfort.

It helps in building your organisation’s stature. In this acknowledgement letter, thank the donor of your NGO and highlight the impact of their gift and how their donation will make a difference.

You can easily send an NGO donation receipt via email or WhatsApp by Vyapar, including the donor’s name. Using their first name as a donor reassures them that the data is authentic and accurate.

You should use a person’s real name and make the email address from which you send the NGO donation receipt appear as human and as specific as possible. It is beneficial to religious organisations such as church donations. Donation receipts help keep track of all charitable donations to your religious organisations.

Manage Donation Receipts Seamlessly: It is best practice to know the types of donations and help you to keep track of all your activities, such as your donations coming to your NGO. Besides NGO donation receipts, try to maintain separate recordings of each contribution. The amount of donation to an NGO may not be necessary. It contains non-monetary gifts, such as land or other types of property.

It helps to keep track of pledges, too, since they must be accountable for the year in which the commitment was made, even if the gift doesn’t arrive in the fiscal year.

Whether your organisation stores records physically, digitally, or in both places, it is essential to keep up with them. If you are storing your NGO donation receipts on an advanced cloud-based system, download the records onto a physical hard drive for backup at regular intervals.

An Ultimate Deal on the Annual Summary: The donors to your NGO will also applaud the annual summary. This one receipt is a consolidated record of all the donor’s donations in a single place. It makes it easier for all the donors because they don’t need to keep track of multiple single receipts simultaneously.

This way, donors can organise their records as per their comfort and prepare for accounting and filing tax returns. When you finish processing your year-end donations to the NGO, giving donors any year-end receipts before January 31st of the following year is always best.

Vyapar billing software makes sending automated year-end NGO donation receipts to your donors significantly more straightforward and quicker. Although it may not seem necessary, it is beneficial for donors when they do their taxes.

Why Do NGO Donation Receipts Matter to Donors?

First and foremost, NGO donation receipts let donors know your organisation has received their donations. After all, everyone who donates has one central question: Was it successful? Did the payment go through?

Essentially, your receipt lets your donors know that you received their donation and all is well, and now it is used for the cause for which your organisation works. Furthermore, donors need donation receipts if they want to further claim charitable donations for their tax refunds.

Tax exemption is available on 50% of donation amount up to 10% of adjusted gross annual income. So, any donation above this limit is not exempted from taxes under section 80G of the Income Tax Act in India. Vyapar helps you to create an NGO donation Receipt Format for your charitable organisations.

Why Do NGO Donation Receipts Matter to Non-Profit Organisations?

NGO Donation receipts can reduce income tax as owed by people and businesses, and multinational firms that donate, and because of this, they can encourage donations to charitable organisations.

By providing NGO donation receipts, you let donors know their contribution has been well received and may use them for a better cause. It makes donors feel apprised and acknowledged, increasing their trust and loyalty to your organisation.

Proactively sending donation receipts is key to building long-lasting and trusting relationships between you and your donors. Plus, it’s the perfect opportunity to consider their donation.

You can customise your NGO Donation Receipt as per your requirement by using the Vyapar billing software. It gives your receipt a professional outlook.

Valuable Features of the Vyapar App to Manage NGOs

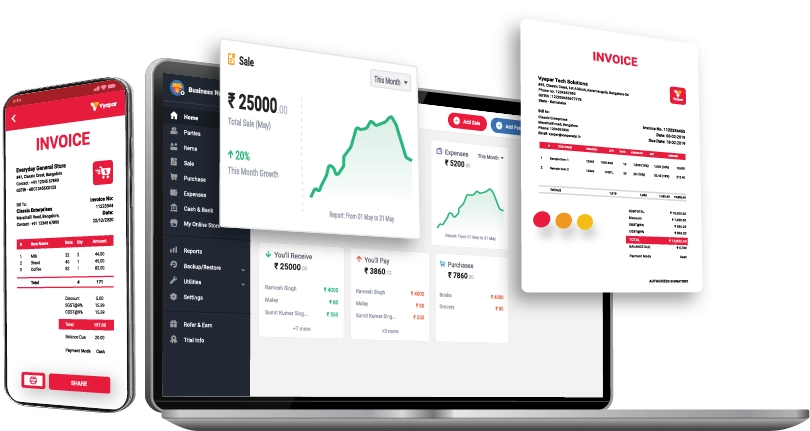

Speed and Accuracy: Speed has become the other name of success, especially in today’s modern online businesses. Your charitable organisation can send an NGO donation receipt to your donors within a few minutes using the donation receipt generator by Vyapar.

Vyapar is geared with all the essential tools and techniques to seamlessly carry out your charitable organisation’s cash donation. You make your NGO cash donation and receipt much quicker and easier. One million small business owners trust Vyapar for their day-to-day activities.

In case you are a member of a more prominent non-profit organisation. You have to frequently send and receive payments to other people to carry out your humanitarian assistance to people. Vyapar adds pace to the essential operation of your organisation.

Modern small and medium business owners use Vyapar to create Invoices, bills, credit/debit notes etc. It automatically comes with all the essential details for your church donation receipt.

Multiple Modes of Payment: By using the professional Vyapar donation receipt maker app, an NGO can seamlessly provide multiple payment methods for transactions in both online and offline methods. You don’t have to pay extra money for these features from your pocket.

Vyapar has online payment substitutes such as IMPS/RTGS, E-Wallet, Net banking, UPI, and credit/debit cards. The donors to your NGO may send their donations online from any place across India. They may not face the friction of coming to your organisation’s door and donating. It digitalises your donation system.

You may also use the alternative cash substitute to receive your donation using the Vyapar billing platform. You may receive your gift by cash and cheque. You may also physically transfer the receipt to your donors, or you may send the donation receipt formats to your donors through online platforms such as WhatsApp and Gmail.

It is essential to revolutionise your payment system, especially in this period. Your donors might find them comfortable with different forms of payment, and you mightn’t annoy them when trust and loyalty building are essential to growing your non-profit organisation.

Online/Offline Software: Vyapar comes with both offline and online receipt generation capacity. You can create NGO donation receipts in both modes, online and offline, by using the Vyapar. Vyapar helps organisations to issue NGO donation receipts to their donors seamlessly.

You need no technical knowledge to use this accounting software. It is easy to use for all age groups of people. Especially older ones frequently face the problem of getting acquainted with ever-evolving technology.

You may run your NGO from remote areas (hilly or forested areas) where you frequently face network issues. So Vyapar is a one-time panacea for your poor network and internet connection. It comes at a very affordable price in comparison to other platforms.

Your charitable organisations may continue their work and can send the NGO donation receipt to your donors in all three formats (PDF, Word and Excel) as per your requirement. You can receive donations through multiple payment methods on a single platform.

Get All Essential Reports: Vyapar donation tracking and management reports are geared toward all essential reports required by NGOs. You can access multiple monthly, quarterly, and annual reports on your PC and Android phones. So you can always be aware of what is happening inside your Business and NGO.

You can easily access the transaction reports such as the sale, purchase, payment, and other income expenses reports using the Vyapar billing software. You can also quickly provide essential notices such as day books, sale ageing reports, etc.

Your organisation may also provide reports to donors so they can organise their records and prepare for accounting and filing for tax returns. It is a win-win situation for you and your donor organisation simultaneously. Using Vyapar, you gear your organisation with all essential reports, which may benefit your organisation’s reach and trust in the long term.

You can also access your device’s GST reports for taxable income and expense transactions. These reports are essential for NGOs’ cash flow management and timely tax compliance.

Cash and Bank Management: Vyapar helps your non-profit organisation seamlessly carry cash to the bank and bank to cash transfer. You may also go ahead with the bank-to-bank transfer. You may keep track of all important transactions as you add income, donation, and expense details.

You may adjust the cash and bank account management per your organisation’s requirements. Vyapar may also help you with cheque management. Your donation by optimising these strategies becomes very quick and easy.

It will guarantee to improve the quality of your organisation and help your charitable organisation build trust and loyalty between your donors. Donations may not be a single-time requirement for your organisation. The more smooth and more effective you may keep your organisation platform. More donors will prefer your NGO to help your cause.

Because these services and features let donors feel potential in your Non-profit organisation, you may also attract many donors to your platform in the future. Vyapar helps you with your loan account management.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

You can use the Vyapar platform to write your NGO donation receipt for your donors. It automatically comes with all the automated basic information such as company name, company address and contact number, date, name of customer or client, amount, reason for payment, receipt number, and receiver character.

You can edit your donation receipt using the Vyapar (PDF, Word and Excel) and add more information to make it more personalised.

You can quickly get the template for NGO donation receipts online. But you may face a problem with the details, as these templates miss some critical information. Secondly, you cannot customise your donation receipt in Excel format.

So you can use the Vyapar app to create the donation receipt for your donors. It is customisable and generated in different formats.

You may still qualify for the charitable donation deduction without receiving the donation receipt. However, there are certain specifications around the donation, which include cash limits and type of donation.

For contributions of cash, cheque, or another monetary gift without considering the amount, you must maintain a set of records of the assistance: your bank record or written communication from the qualified organisation, including the name of the organisation, the amount, and the date of the grant.

A donation receipt format for a charitable trust in India must include the donor and donee’s name, address, contact information, the date, the name of the organisation, the amount, the reason for payment, the receipt number, and the name of the receiver.

A charitable tax receipt is proof of contributions made by a donor. It serves as an acknowledgement to a donor that their donation was well-received. Donation receipts help donors keep track of their finances and file taxes, as donations can reduce income tax liability.

Yes, donations to a charitable trust in India are often tax-deductible under certain conditions, such as being made to eligible trusts registered under Section 80G of the Income Tax Act. Ensure you receive a valid donation receipt with the trust’s registration details for tax benefits. For efficient business management, try Vyapar: simplifying invoicing, accounting, and GST compliance.

Form 10BD is a document used by charitable trusts in India to furnish information about donations received. It is required under Section 80G of the Income Tax Act and is used to provide details of donations eligible for tax deduction. This form helps the trust and the donor to claim tax benefits for the donated amount.

Form 10BE is used by charitable trusts in India to provide details of donations received for scientific research or rural development. It is required under Section 80GGA of the Income Tax Act and helps donors claim tax benefits for contributions made to eligible projects or institutions engaged in scientific research or rural development activities.

In India, the maximum donation to a trust eligible for tax deduction under Section 80G of the Income Tax Act is limited to 10% of the donor’s gross total income. To streamline your business finances and tax compliance, consider using Vyapar: a user-friendly solution for invoicing, accounting, and GST management.

The limit for donation to a trust deduction under Section 80G of the Income Tax Act in India is 10% of the donor’s gross total income. This means that donations exceeding 10% of the gross total income may not be eligible for tax deduction benefits.

The format for an 80G donation receipt typically includes details such as:

1. Name and address of the charitable trust.

2. Registration number and date under Section 80G.

3. Name and address of the donor.

4. Amount donated.

5. Mode of payment (cash, cheque, online transfer, etc.).

6. Date of donation.

7. Statement that the donation is eligible for tax deduction under Section 80G.

8. Signature or seal of the authorized person from the trust.

To invoice a donation, create a professional invoice template with your business details and the donor’s information. Describe the donation, specify the amount, include tax details if applicable, calculate the total, and set payment terms. Review the invoice and send it to the donor.

Donations made to NGOs (Non-Governmental Organizations) registered under Section 80G of the Income Tax Act in India are generally eligible for tax deduction. However, the tax treatment can vary based on the specific regulations and conditions of the donation. It’s advisable to consult with a tax advisor or refer to the Income Tax Act for precise information regarding the taxability of donations to NGOs.

Section 80G of the Income Tax Act in India allows for tax deductions on donations made to eligible NGOs (Non-Governmental Organizations). Donors can claim deductions on their taxable income for donations made to NGOs that are registered under Section 80G and meet the specified criteria set by the Income Tax Department.

GST is usually not applicable on donations to charitable institutions or NGOs in India as they are considered outside the scope of GST. However, if goods or services are received in return for the donation, GST may apply to those goods or services.

An NGO is a term encompassing various independent organizations with diverse objectives, while a charitable trust is a specific legal entity focused on charitable purposes under a trust deed.

A non-profit NGO operates for charitable, social, or humanitarian purposes without seeking to make a profit, while a profit NGO aims to generate income or profits through its activities.