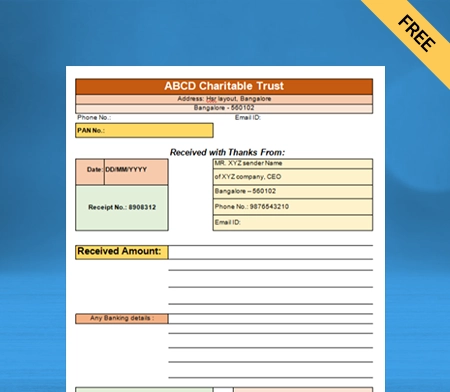

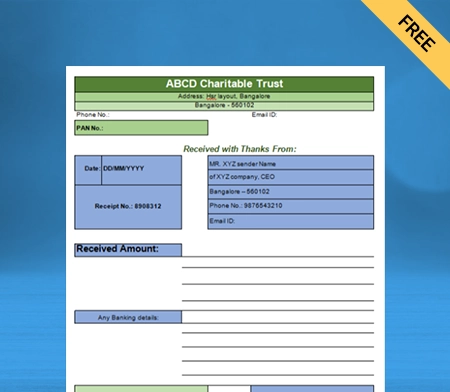

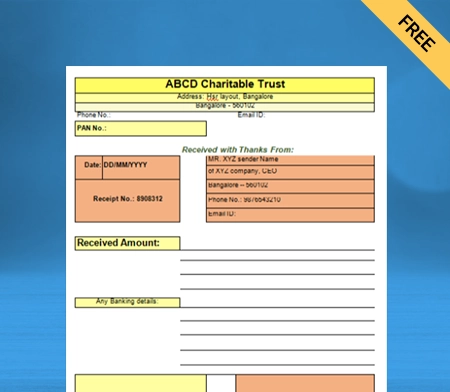

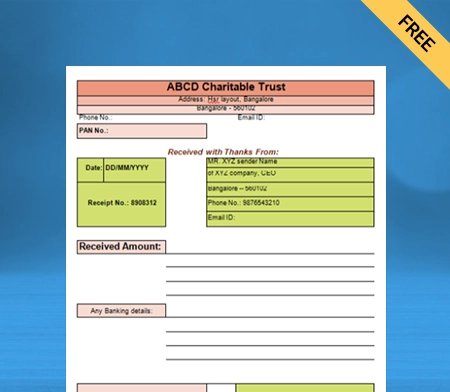

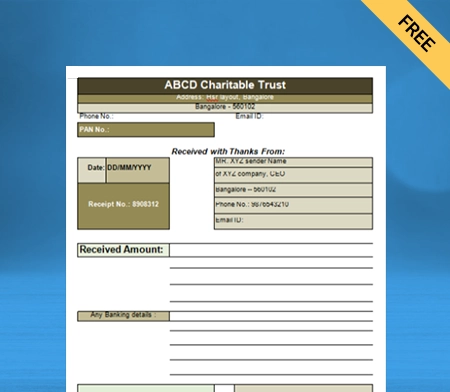

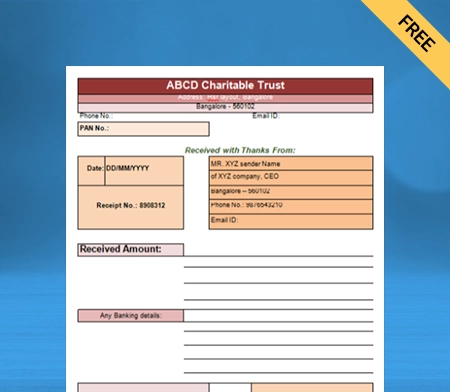

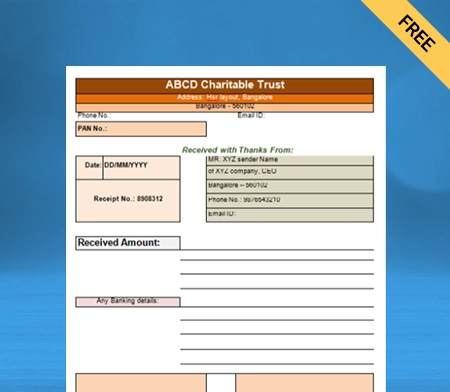

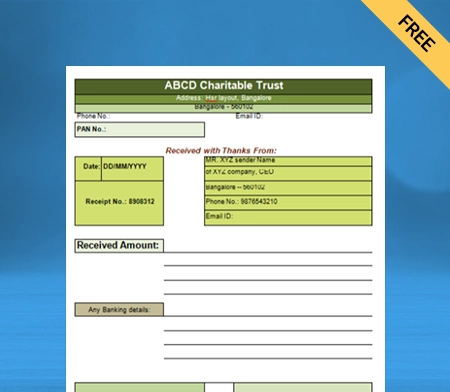

Donation Receipt Format in Word

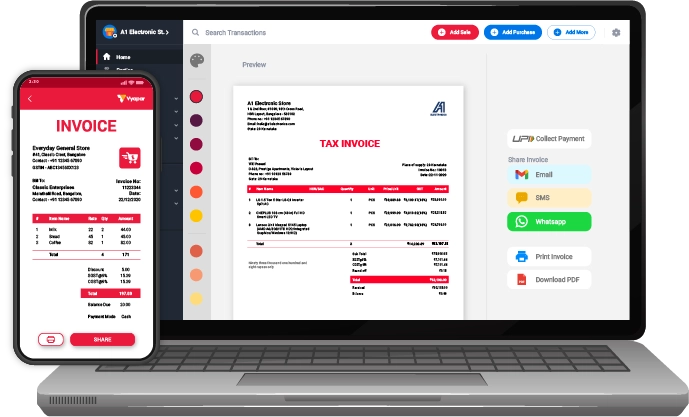

Download Donation Receipt format in Word for trust. Or use Vyapar App to create donation receipt, track payment history, manage outstanding easily and grow your business faster!. Avail 7 days Free Trial Now!

Download Free Donation Receipt Format in Word

What is a Donation Receipt?

A donation receipt is the first topic one must understand before learning about creating a donation receipt format in Word. A donation receipt is an acknowledgement that ensures donors receive their donation.

In other words, it’s a record of a transaction made as a donation to an organisation. A donation receipt is required to avail of charitable benefits on the tax deductible,

A donation receipt is in written form, making it legal and genuine. Many non-profit organisations issued donation receipts by year’s end or the first month of the following year when they received a donation. But this used to be the story a few years back. Today, donation receipts are shared with donors within 48 hours of their donations.

When we talk about a donation receipt, it has some awe-inspiring benefits. Tax reduction is one of the most substantial advantages, but it’s not the only one. Its importance is more significant and higher than you can imagine. Today, we’re going to explore the benefits of donation receipts. But before that, let’s learn what content there is in a donation receipt format.

What are the Contents of a Donation Receipt?

As a non-profit organisation of business involved in non-profit activities, offering donation receipts to donors is a basic necessity. You have to make sure that the donation receipt has the necessary information.

A dedicated standard format for your donation receipt could be a great idea to ensure nothing integral is left. So here is all the essential content of a donation receipt you should know about:

- The name of the donation maker or donor

- The name of the organisation receiving the donation

- The federal tax ID number and the registration statement of the company

- The date and time when the donation was made

- The amount of money being donated

- The description of the being donated

- A statement indicating if any services or goods were offered to donor insurance for their donation:

- The donation must be reflected in the receipt of the non-profit that didn’t offer any service or good in return.

- The organisation must show a good-faith estimate of the service or goods offered to the donor.

- Name as well as the signature of the authorised representative who accepted the donation – head of department or board member, for example.

- A disclosure statement, only if necessary. It might vary from city to city; therefore, ensure the receipt contains disclosure statements of all the cities to which the donors have contributed.

When you are working on your first donation receipt format in Word, make sure to ensure the above content. All of these pointers are highly important to be included in a donation receipt. Thus, make sure you don’t miss out on any of them. Now, that you are aware of the content of a donation receipt, let’s move on to understanding its importance.

What are Some Popular Types of Donation Receipts?

Many beginners who are about to get started with a donation receipt think there’s a singular format for it. But that’s where the twist in the story comes in – there are different formats for different types of donation receipts. Yes, you have read right. There are various types of rent receipts. Some of the most popularly used donation receipts are as follows:

Charity Donation Receipt: It’s a donation receipt a donor received after their gift or donation has been recorded as “accepted” in the books of an NPO. The charity donation receipt could be in the form of an email or physical letter.

Cash Donation Receipt: As the name suggests, a cash donation receipt is offered when donations are made in cash. In case the donation is received in cash, however, the donor’s identity or contact details aren’t available, the donation can be categorized as anonymous.

In-Kind Donation Receipt: An in-kind receipt is a type of receipt issued to donors if they have received goods or services in exchange for their donations. When we talk about this type of donation receipts, they are taxable. However, tax is only charged as long as the services or goods given are greater or equal in value to the donation.

Auction Donation Receipt: During an auction, two types of receipts are issued – receipts for goods purchased and receipts for items donated. In the case of donations, receipts are issued at market price for services and goods exchanged. On the other hand, for items bought at auction, there’s a tax associated with the items, reflected in the donation receipt.

For anyone who’s planning to create a donation receipt for their religious organizations or NPOs, it’s essential to understand the above types. This was just an overview of the popular types of donations.

However, before issuing any donation receipt, make sure to have proper knowledge about it. Understand everything that’s there to learn about your preferred donation receipt. Now it’s time to cover another important topic, i.e., the vital requirements for donation receipts.

What is the Importance of a Donation Receipt?

A donation receipt is a necessary document that records the gift or donation made by a donor to an NPO (Non-profit organization). Every organisation receiving donations must offer a charitable donation receipt to the donor.

Talking about the importance of this receipt, it’s not just beneficial for a donor. In addition to the donor, issuing donation receipts can be advantageous for the organisation in multiple ways. Here’s how:

For Donors:

1. Claims on Tax Returns – receipts for tax-related claims linked with charitable donations and giving come in handy at the end of the financial year.

2. Confirmation – When a donor receives a church donation receipt, it gives them peace of mind and gives them the surety that their donations have reached the right place.

3. Maintenance of Financial Records – Donation recipes make it easy for donors to track their finances and maintain their charity records.

For Non-Profit Organisations:

1. Legally Obligate – According to the IRS, there are certain situations where donation receipt is mandatory. Failure to send one can result in penalties.

2. Tracking Donation History – Sending a donation receipt is an efficient method for keeping track of donation histories within a charitable organisation.

3. Accounting – Donation recipes help manage NPO accounts. They provide organisations with accurate and precise financial records.

We hope you are well aware of the importance of a donation receipt. Let’s move forward with learning about the various types of donation receipts. Here we go!

What are Some Popular Types of Donation Receipts?

Many beginners who are about to get started with a donation receipt think there’s a singular format for it. But that’s where the twist in the story comes in – there are different formats for different types of donation receipts. Yes, you have read right. There are various types of rent receipts. Some of the most popularly used donation receipts are as follows:

Charity Donation Receipt: It’s a donation receipt a donor received after their gift or donation has been recorded as “accepted” in the books of an NPO. The charity donation receipt could be in the form of an email or physical letter.

Cash Donation Receipt: As the name suggests, a cash donation receipt is offered when donations are made in cash. In case the donation is received in cash, however, the donor’s identity or contact details aren’t available, the donation can be categorised as anonymous.

In-Kind Donation Receipt:

An in-kind receipt is a type of receipt issued to donors if they have received goods or services in exchange for their donations. When we talk about this type of donation receipts, they are taxable. However, tax is only charged as long as the services or goods given are greater or equal in value to the donation.

Auction Donation Receipt:

During an auction, two types of receipts are issued – receipts for goods purchased and receipts for items donated. In the case of donations, receipts are issued at market price for services and goods exchanged. On the other hand, for items bought at auction, there’s a tax associated with the items, reflected in the donation receipt.

For anyone who’s planning to create a donation receipt for their religious organisations or NPOs, it’s essential to understand the above types. This was just an overview of the popular types of donations.

However, before issuing any donation receipt, make sure to have proper knowledge about it. Understand everything that’s there to learn about your preferred donation receipt. Now it’s time to cover another important topic, i.e., the vital requirements for donation receipts.

What Are The Necessary Requirements For A Donation Receipt?

There’s no fixed donation receipt format in Word. You can create your own personalised donation receipt. However, there are certain elements that you have to make sure your donation receipt has.

Depending upon which country your NPO is registered in, here are some critical legal requirements you have to ensure:

For NPOs registered in India and the US:

- Name of the NPO where the donation has been made.

- Name of the person who donated.

- The amount donated.

- Description of non-cash donation.

- Statements reflecting that the organisation has provided no service or goods in exchange.

- Description of the goods and services exchanged for donation, along with their estimated value.

- A statement reflecting that the goods and services provided in exchange for donation is entirely free from intangible religious benefits.

For NPOs registered in Canada:

- Name the NPO where donations have been made, along with the NPO’s address.

- Name along with the address of the donor.

- Amount of the donation made by the donor.

- Description and estimate of the non-cash donations.

- The unique serial number for the donor’s receipt.

- The charity registration number is issued by the CRA or Canada Revenue Agency.

- The location where the donation receipt was issued – state, city, and municipality.

- The date when the donation or gift was received.

- The date when the donation receipt was issued.

- Signature of the individual who’s authorised to issue the donation receipt and accept the donation.

- Website address of the CRA.

How To Create A Donation Receipt Using The Vyapar App?

New to creating donation receipt format with Word? Working on Word might lead to complexities in your way, which can waste a lot of time. Advanced accounting technology like the Vyapar App makes it super convenient.

Here’s how you can create your first donation receipt using the Vyapar app:

- Open the Vyapar App on your smartphone.

- Tap on the three vertical lines on the top left corner of the homepage.

- A slider will appear on your screen, covering half of your screen.

- Please scroll down to find the SALE section and tap on it.

- Multiple options will appear on your screen now.

- There will be a PAYMENT-IN option in the list.

- Click on it and wait for the ALL TRANSACTION page to load.

- Since it’s your first time, your transactions will be empty.

- There will be a TAKE PAYMENT button with a + sign.

- Click on that button, and the PAYMENT-IN page will now open.

- Tap on the RECEIPT NO. and choose the number for your donation receipt.

- Now tap on the DATE section and choose the current date.

- Once you are done picking the correct date, move forward to enter the name of the donor.

- Below the RECEIPT NO. and DATE section, there’s a vast rectangular box.

- Tap on it, type the name of your donor and continue.

- Enter the RECEIVED section with the amount of donation you received.

- The following section is PAYMENT TYPE. If you tap on it, two options will appear on your screen – CASH and CHEQUE.

- Choose whatever medium the donor donated. Let’s suppose it’s cash, so choose that.

- The last section is called DESCRIPTION. Type “Donation” and continue.

- Now click on the SAVE button, and your donation will be recorded in your organisation’s accounting books.

So this is how one can use the Vyapar app to record as many donations as you want in your account books. Make sure you follow the steps as they are given.

Benefits Of Using Donation Receipt Format By Vyapar

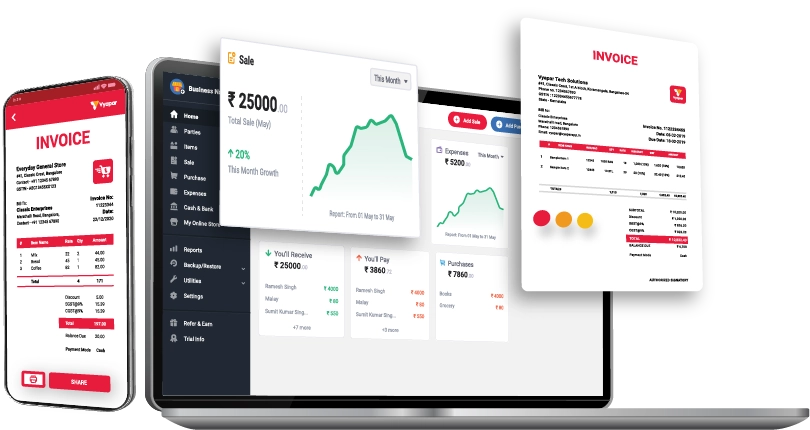

Creating a donation receipt in Word won’t just occupy a reasonable amount of time, but it’s a pretty complex process too. Creating donation receipts is highly convenient and time-efficient using the Vyapar app’s advanced AI interface. Here are some significant benefits of doing so:

Highly Efficient Option:

As a non-profit organisation, you are required to use automated and user-friendly software to manage donations efficiently and in the right way. You can handle all back-end processes conveniently using the Vyapar app’s automated processing facility. It’s a more efficient option than Word.

Flexible Operation:

The Vyapar app is internet-based accounting software which works with the cloud. You can access and manage your books of accounts whenever and from wherever you want. As soon as you have the internet and your accounts connected with this app, your books will be maintained in real-time via AI technology.

Time-efficient Option:

Everyone knows for a fact that time is the most valuable asset for any organisation. On the other hand, creating a donation receipt on Word is time-consuming. You can use the Vyapar apps’ ready-to-use donation receipt template to record received donations. It’s not just time-saving but saves a lot of human effort.

Advanced Security:

Donation receipts are vital and sensitive records. They are meant to be kept safe and secure from breaches. The Vyapar app offers advanced security features such as lock-in passwords. You can lock your app using a strong password, ensuring the only person to access those records is you.

Frequent Backups:

The Vyapar app works in collaboration with the cloud. Every record you create on our app is directly stored in your cloud account. Therefore, even if you somehow lost the app, you can always get it right there. Plus, frequent backups are performed from time to time. Therefore, you can start from exactly where you left off.

Extensive Library Of Invoice Themes

Another tremendous advantage of using the Vyapar app is multiple invoice themes. Users can choose from an extensive library of themes for their donation receipts. You can make your receipts look attractive and informative with the correct number details. Moreover, managing discounts and taxes on donations is also convenient with our app.

Other Important Benefits Of Using Vyapar App For Accounting

The above are some of the critical advantages of using the Vyapar app to create donation receipts. Other than that, there are various other benefits for why NPOs are starting to adopt this technology. Here are some of the other vital advantages of using our app:

Bank And Cash Management: Working with a CA and a team of accounts to manage your accounts could be overwhelming. Small businesses, especially, can’t make such a considerable expense in the starting stage. For them, softwares like Vyapar can be highly beneficial. Thanks to our AI-powered tool, you can manage your cash and bank transactions in real time.

Wide Range Of Reports: With the Vyapar app, users can record and create a wide range of reports. The reports in the Vyapar app can help you with – Transaction reports, Dale ageing reports, balance sheets, profit and loss, and so much more. Since everything will be done digitally, you don’t have to worry about managing reports and preserving them in physical form.

Multiple Utility Options: Just like a variety of reports, the Vyapar app offers you multiple utility options. You can perform financial year management, generate barcodes, export and import items, export tally and perform a wide range of crucial accounting functions. All that for absolutely free. However, for real-time accounting management, buying a premium is ideal.

Record Various Transactions: One of the reasons why more than one crore businesses maintain their accounts with Vyapar is its ability to record various transactions. From the sale, purchase, expense, and other incomes; to delivery challan, payment in/out, and Eway bills – you can record as many transactions as you want. Everything will be stored in the app’s storage, allowing you to access data anytime.

Bank-Wise Payment: Managing payments using the Vyapar app has become highly convenient for businesses. Users can track payment status for multiple invoices individually. In addition, you can also set a due date for them, keeping you in the loop with your cash flow. Moreover, you also have the facility to accept total payments as well as partial payments.

Invoice And Printing: Whenever your customers ask for a physical print of an invoice, you can use the Vyapar app to print on. Our software is compatible with regular and thermal printing options. In other words, it supports laser printers with A4 and A5 paper size compatibility. These are the most common printer options; thus, you won’t have to worry about printing at all.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

You can use the pre-designed donation receipt format in Word from the Vyapar app. Moreover, for real-time accounting management, we recommend you use our automated software.

According to the Income Tax Act, individuals with donation receipts who have made donations are exempt from tax by 50%. Since 80G is the section of ITA with this provision, this receipt is called an 80G donation receipt for tax purposes.

A donation receipt is a record of a transaction made as a donation to an NPO. It reflects the details of the donation made by the donor.