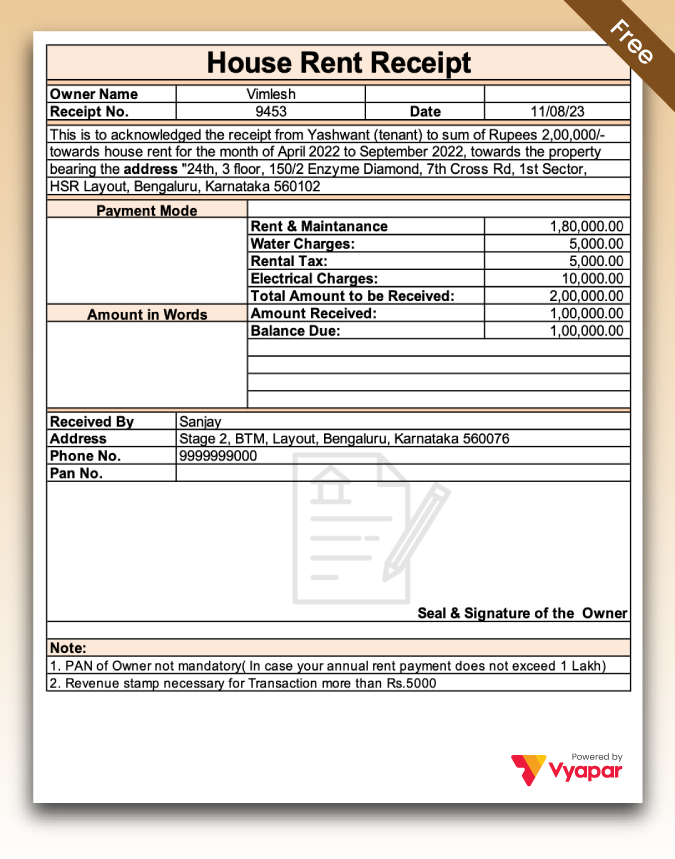

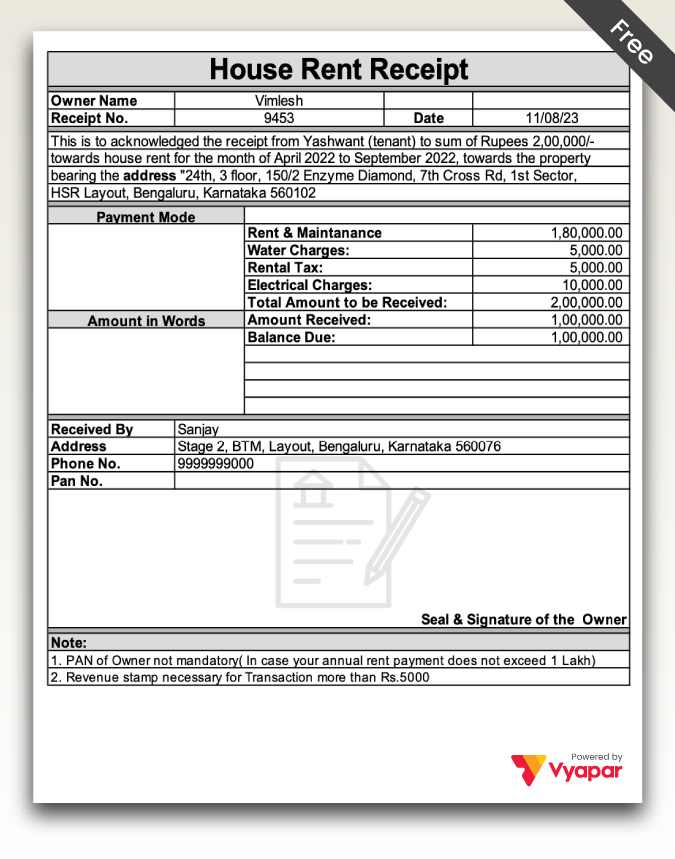

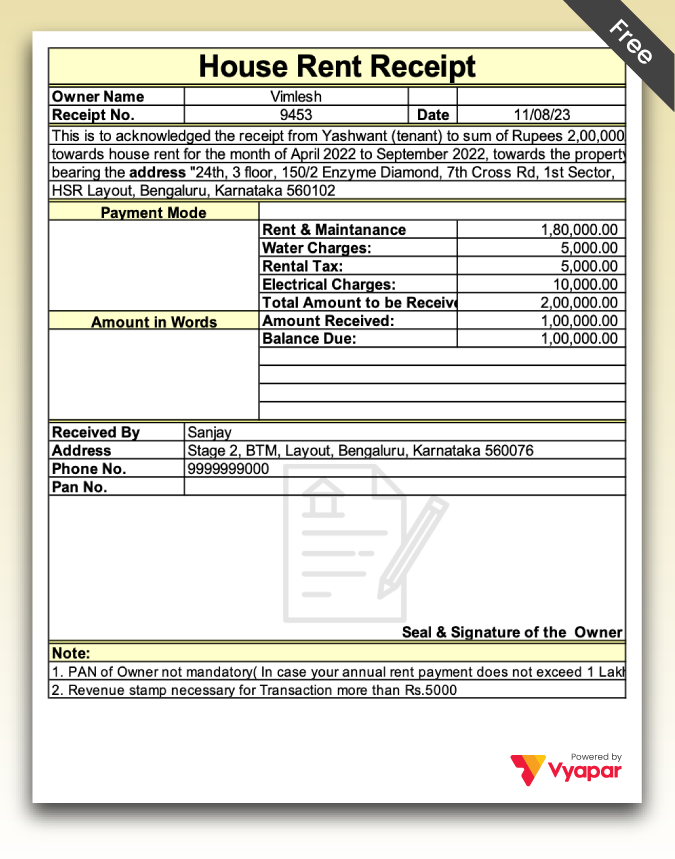

House Rent Receipt Format

Simplify rent management with our free House Rent Receipt Format for tenants, or use the Vyapar App to create rent receipts, track payments, manage outstanding balances, and grow your business – start your FREE 7-day trial today!

Download House Rent Receipt Format in Excel, Word, and PDF

What is a House Rent Receipt Format?

A House Rent Receipt Format as your official document, signed by your landlord, confirming you’ve fulfilled your monthly obligation. But beyond acting as a simple receipt, the House Rent Receipt Format hold a significant tax advantage. Under the Income Tax Act, you can claim exemptions that significantly reduce your taxable income – essentially saving you money!

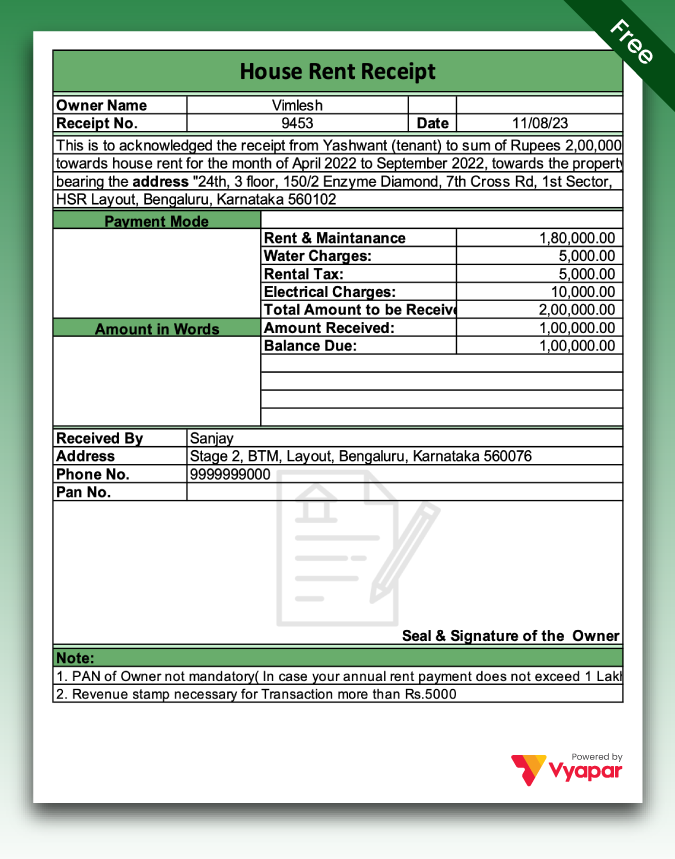

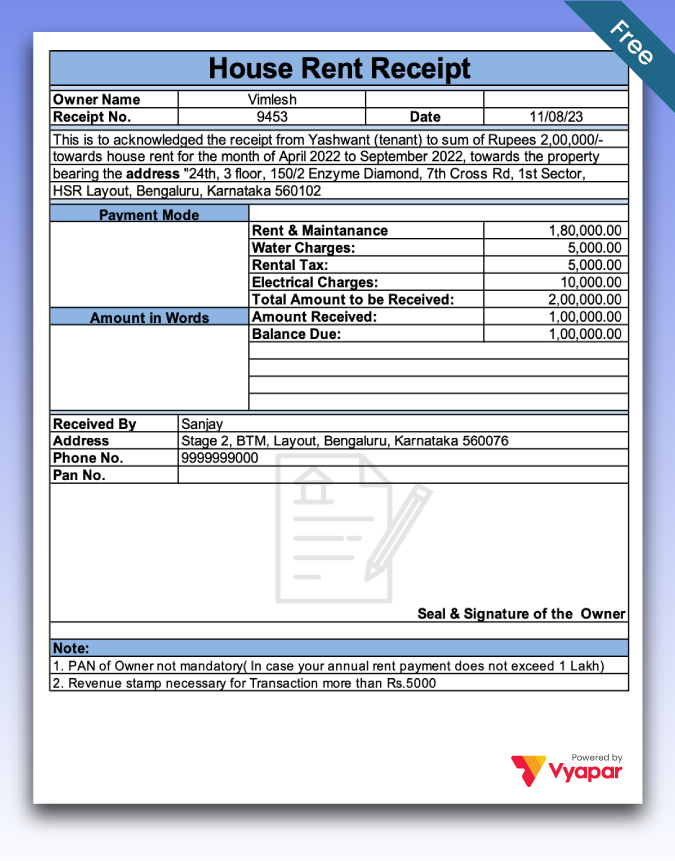

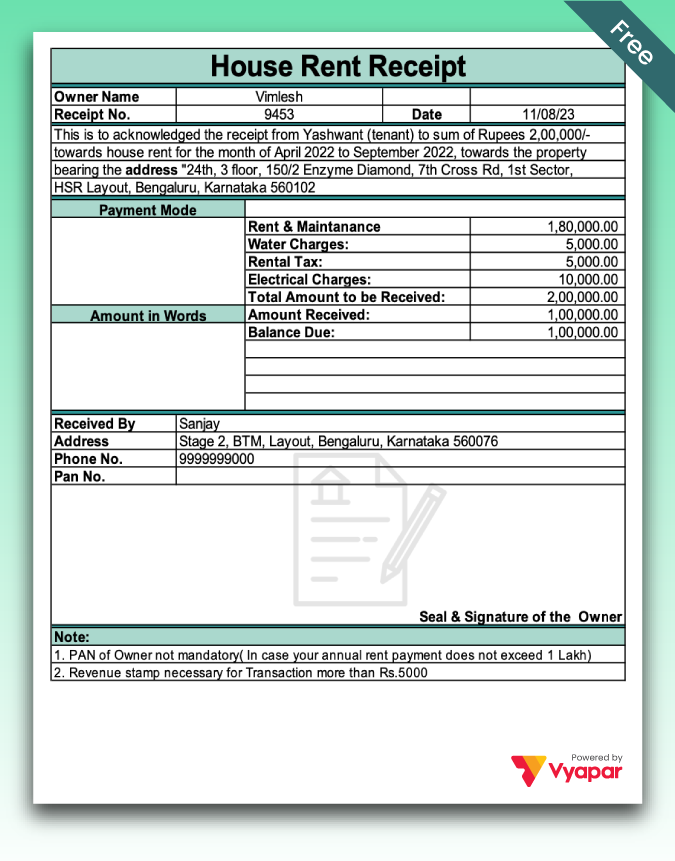

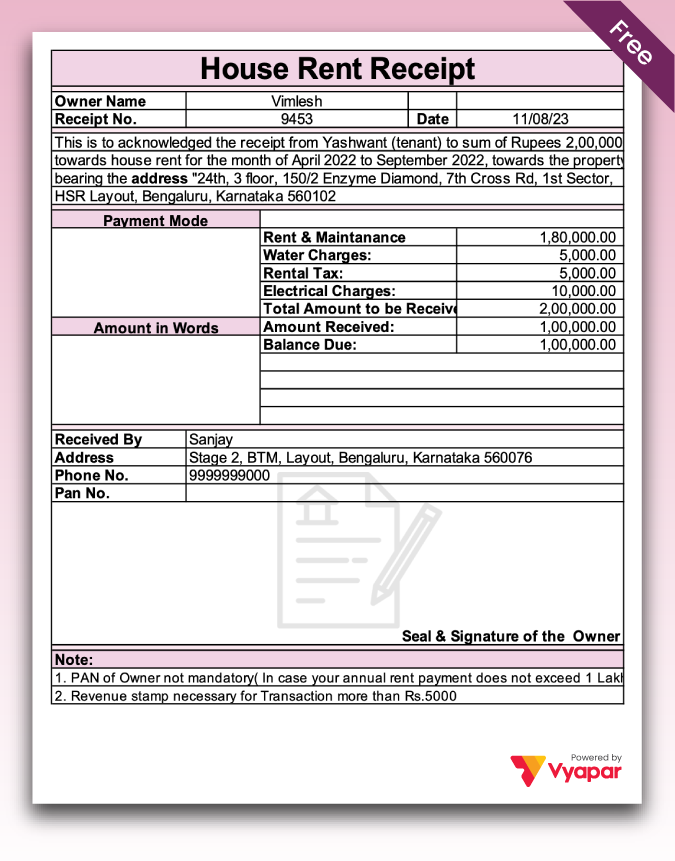

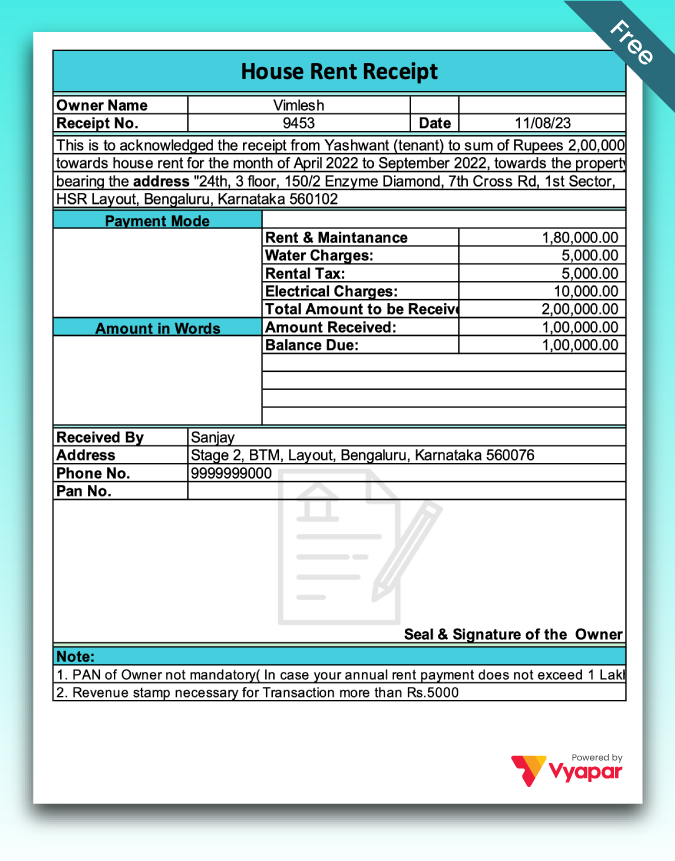

Essential Elements of the House Receipt Format

- Name of the tenant

- Name of the Landlord

- Total Amount of Rent

- Payment Date

- Period of Rent

- Address of the Rented Property

- Landlord’s PAN (if the rent is more than Rs.1,000,000 per year)

- A revenue stamp is required whenever an amount exceeding Rs. 5000 is paid in cash.

- Payment methods (cash, credit card, money order, check, etc.)

- Signature of Landlord or Manager

Why Do You Need a House Rent Receipt?

Controlling your monthly rental costs can sometimes feel just like riding an unstable high-wire. However, one key element that helps ensure smooth sailing is the landlord’s rental agreement. Your lease agreement, which is being affixed by the landlord, shows that your rent has been duly paid every month. The agreement comes with multiple advantages.

Beyond just a payment record, here’s why House Rent Receipt Format are essential: Beyond just a payment record, here’s why house rent receipts are essential:

- Tax Savings & Exemptions: The Tax Income Act provides you with an effect of reducing your taxable income by deducting HRA (House Rent Allowance) exemptions with the House Rent Receipt Format. So, spending less cash is literally putting more coins in your pocket!

- Legal Protection: A house rent receipt is such a weapon that it can come in handy if any tenancy dispute with a landlord arises. It serves as proof of genuine, on-time payments, especially when you have bills in significant amounts. You no longer have to verify through your bank statements and pay additional charges.

Through Vyapar, the procedure of generating rent receipts becomes very convenient because you can do this task online. House rent receipt pdf or any other preferred format targeting ease of usage and record keeping.

Here’s a quick breakdown of how rent receipts benefit you:

HRA Tax Exemptions:

- Claim exemptions under Section 10(13A) of the IT Act for salaried individuals.

- The exemption amount is determined by the lowest of:

- Actual HRA received from your employer.

- 50% of your salary if residing in a metro city.

- 40% of your salary for other cities.

- Actual rent paid minus 10% of your basic salary and dearness allowance.

Employees receiving HRA exceeding Rs. 3,000 per month must submit rent receipts to their employers for claiming HRA.

Self-employed individuals: Can benefit from tax exemptions under Section 80GG, further enhancing their tax savings.

As long as you keep accurate and accessible rent receipts, you have all the attributes that can help you look after the rent and due tax payments and act as a shield against the occurrence of any unexpected scenarios.

Streamline your rental activities now through Vyapar’s House Rent Receipt Format developing online tool.

How does the House Rent Allowance (HRA) work?

Discounting your HRA, as you may be eligible for the House Rent Allowance (HRA), which is a part of your salary meant to ease your rent burden. Providently, one of the advantages of this allowance is that it brings you tax advantages. Let’s break it down.

HRA and Tax Exemptions:

- HRA Exemption Eligibility: The exemption only applies to people who have rented habitation.

- Tax Savings Advantage: While HRA is an emolument component, it is, to a small extent, taxed thanks to Section 10(13A) and Rule 2A of the Income Tax Act.

- Reduced Taxable Income: To figure out taxes, HRA exemption is deducted from income and, subsequently, saving on the tax bill is possible.

Important Points:

- Living in Self-Owned Property: If you neither live in a rented house nor on the landlords, the full HRA you get from your employer becomes taxed.

- Landlord’s Role: With the assistance of Vyapar’s house rent receipts, landlords can be assured that all important components are present which make the task of obtaining tax deductions at the time of filing tax juridical hassle-free for tenants.

- Tax Exemptions for Rent Expenses – Beyond HRA:Tax Exemptions for Rent Expenses – Beyond HRA:

- Section 80GG: This is the part that can be used for people who work on salary and those who are self-employed too. They are only allowed to deduct the rent when it surpasses 10% of their earning or salary.

- HRA Exemption or Section 80GG Deduction Calculation:HRA Exemption or Section 80GG Deduction Calculation:

- Rent Paid: Not every cent exceeding the limits from 10% to 25% of your wages or revenue is not eligible for exemption or deduction.

- Alternatives: This exemption/deduction is capped at a certain point, being either:

- Rs 5,000 per month

- Not more than 25% of your adjusted income after capital gains and deductions that you enjoy every year (originally referred as gross income) under special sections described here.

- Lowest Value Applies: Whichever amount turns out to be the lowest among the three calculations above becomes exempt from taxes.

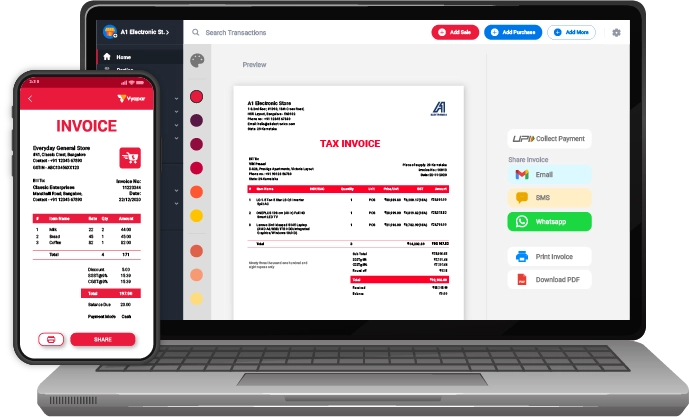

Why is the Vyapar App the Better Option to the House Rent Receipt Format? It is Exposing.

- Easy Management: An inventory management app Vyapar, namely, a free one, helps you to handle all your leasing affairs in one location. That being it, it is used for tracking the outstanding invoices and sending Reminders to tenants.

- Vyapar rent bill application provides an opportunity for individuals to brand themselves & issue rent bills to their tenants on a personalized basis. Keep all your customers’ data in one place, and thus, you’ll generate invoices hassle-free, monthly.

- Using pen and paper made by a professional house rent receipt maker app will give a landlord the trust from their tenants. Besides this, the software gives you a way to organize your tenants in an organized manner in one place via the business dashboard where you can access every necessary function.

- Flexible and Saves Time: Its simple to create professional rent receipt using Vyapar rental property accounting software, any person without high-tech accounting knowledge can prepare it. Owing to the simple structure, all the ways to apply the free rent receipt templates are at your service. Data that is private and business-related is coming and going immediately, between laptops to computers.

- Traditionally, manual bookkeeping has been either time-consuming or marred with errors. Automation rectifies the problem and ensures no errors arise in the latter steps. You are able to concentrate on other things at the same time while having a substantial reduction of the time you spend on other activities. It will prepare the reports exactly as you need,despite all the details that may have varying sizes and irregular shapes.

- The digitized house rent receipt generator provided by Vyapar automatically logs the entry details of your transactions. In just a few minutes you can scroll up and down to reviewing your business reports and doing analysis. It also reminds us to get money and expend repayment consequently which helps to evade any problems in future.

- Various Payment Options: Set up very digital payments and make the payments of current and prospective residents really easy. Give priority to online payments and choose the favorite payment method of the residents. This is another great way in which you can send rent receipts of the house to your customers on email and WhatsApp via using this app.

It is quite simple nowadays, as a single QR code can be made that will accept all the modes of payment. There are variations of cash, credit card, debit card, UPI, NEFT, RTGS, E-wallets, QR codes, pay later booking for others.

Convenience is key nowadays, and companies like yours are doing all they can to provide the payment means that suit their customers most. Creating invoices through the Vyapar app would be very easy, and invoices created will be of high quality with multiple payment options.

Life-Long Free Basic Usage: Android users will enjoy the facts that they can have the premium services indefinitely at no charge. Open access is among the objectives we want to be attained giving millions of small entrepreneurs a chance to make full use of the digital economy.

Register and download the accounting software from Play Store. It is free for the first trial. However, business users are intended to appreciate subscriptions for their utilization of premium functions and solutions.

Upon performing every trade, your client and you will be automatedly delivered an SMS to zero in on the credit and debit value of each transaction. This results in maintaining the Internet of Things, along with maintaining transparency.

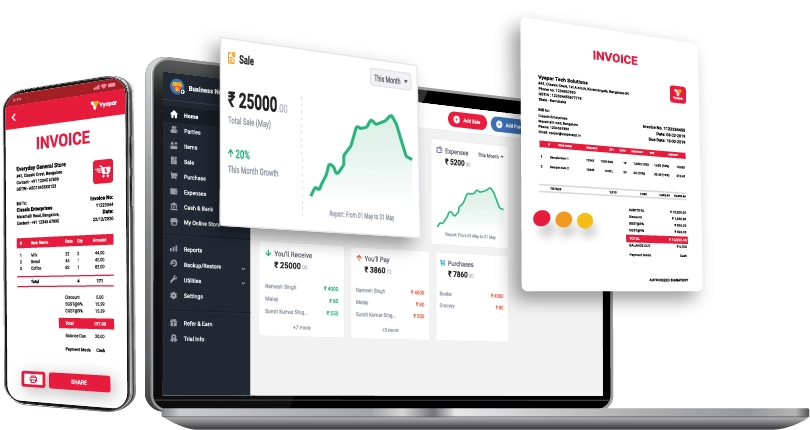

Create Reports: This detail gives the landlords an opportunity to convert the reports into either PDF or Excel. The program users are able to control of these transactions and to at the moment generate the reports using the Vyapar software to get house rent receipts.

The totally free GSTi&c.squared Software that allows viewing and analyzing house rent data in real time. Sales and expense reconcile, that also used to make graphical reports to track them with the help of the app.

This free business financial software will be able to correct financial accounts, enterprise details, etc; it is a wholly efficient way of getting to know the business profit very fast.

Customizable Formats: The voms for rent from vyapar are fully customizable. Logo of your company, font, color for style and the all-important brand identity can be included on your receipts to present a perfect identity of your brand.

Some Useful Features of the Vyapar App

- Offline & Online Billing: Carry on sending invoices with laggy internet oh! Vyapar features both offline and online functions where the offline tab provides you with the option to create and store invoices that can be updated to the online version when you reconnect.

- Simplified Bank Management: Find all your income streams, in the accounts, e-wallets etc. With Vyapar flexible cash flow is assured thanks to absence of any issues with transfer visibility and deposit/withdrawal mechanics while interacting via the app. (Note: To access this feature, grant permission for your Instagram account to be linked with your business account (contains your connected business account).

- Effortless Quotation & Estimate Creation: Professional quotes and estimates allow for easy generation. Vyapar eradicates errors, and invoices can be produced in no time.

- Seamless House Rent Collection: Spare time for tenants, who can receive just in time quotes. Vyapar helps in generating bills automatically and moreover, managing the collection of rent process happens to be an ease.

- Enhanced Security: Data security takes the leading part in this. Along with the auto/local adoption of the data backups that ensures security of the data to the maximum.

- Actionable Business Insights: Evaluate your sales data and create reports to decide which choice is appropriate for your business. Through Vyapar, you can learn about how your property income works to achieve the planned goals for the future.

- Professional Branding: Complement your invoicing with a special design including customizable invoice designs. Please feel free to offer suggestions or make edits as you see fit. Vyapar gives different choices of high-end invoice computerization to outmatch your tenants.

- Flexible Printing: Pick how you want to print your invoice, whether it is regular (laser) or thermal printers. Vyapar, as easy as the name is, comes with various different sizes of document support and also you can set custom formats. Just connect your printer via cable or Bluetooth and you are ready to start using it.

- Multiple Sharing Options: Send out digital invoices emails, SMS, or WhatsApp. Alongside this, Vyapar permits you to prepare and print invoices in the preferred formats including MS Word, Excel and PDF for email or printing.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

A rent receipt is a valid document stating that a tenant has made the payment for his/her monthly rent to a landlord. It is usually caused after you return the rent to the landlord.

There is no predetermined mandate; however, most of them encompass details such as burst name, landlord name, rent paid, and payday.

A house rent receipt should include: A house rent receipt should include:

* Tenant Name

* Landlord Name

* Payment Amount

* Payment Date

* Rental Term (optional)

* Reside at; (Address and details of Rented Property)

* Landlord or Manager Signature

However, it is pertinent to realize that the only chance a taxpayer will have is to pay cash in excess of Rs. The duck stamp purchasers of 5,000 are requesting to have them printed on their sales receipts. If the rent is transferred by cheque, then cash need not be used to buy stamps.