Rent Receipt Format PDF

Download the rent receipt format pdf for tenants. Or use the Vyapar app to create rent receipts, track payment history, manage outstanding easily and grow your rent business faster! Begin your 7-day trial with no obligations!

Download Rent Receipt Format PDF

What is a Rent Receipt Format PDF?

A Rent Receipt in PDF format, commonly known as a rent receipt, is a legal document used to record payments made by tenants to their landlords. This document is essential for both parties as it serves as evidence of rent payments, especially in case of disputes.

Landlords are responsible for issuing and retaining a copy of the rent receipt, while tenants should also keep their own records safe. If a rent receipt is not provided, tenants have the right to request one from their property manager or landlord.

The receipt confirms that the landlord has received payment for a specific month’s rent, providing clarity and transparency in the rental agreement.

In case of disagreements or claims of non-payment, the rent receipt becomes invaluable. It should include key details such as the names of the landlord and tenant, the amount paid, and the date of issuance.

Moreover, it’s crucial for the rent receipt to mention any adjustments in rent, such as reductions, to accurately reflect the rental history. This helps tenants to explain any discrepancies and understand the reasons behind such changes.

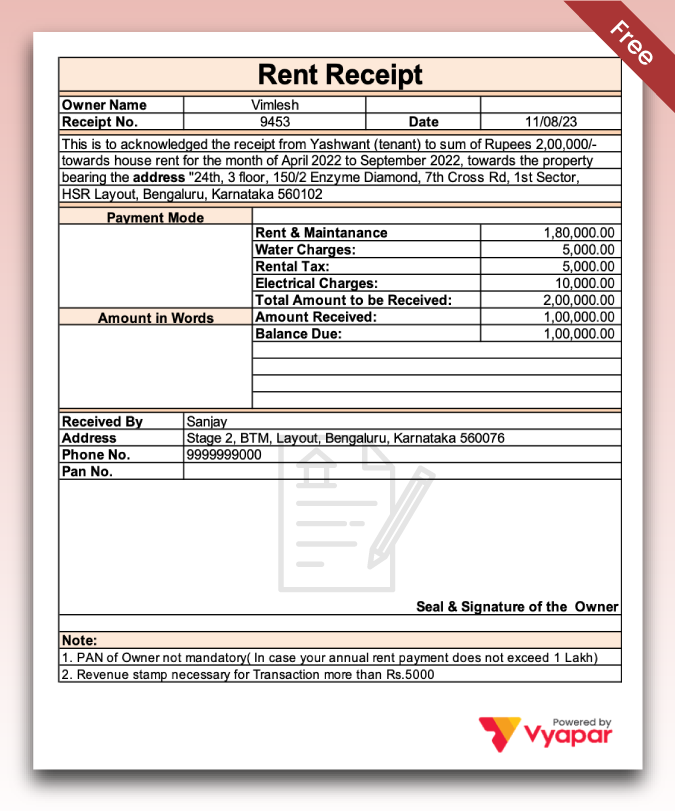

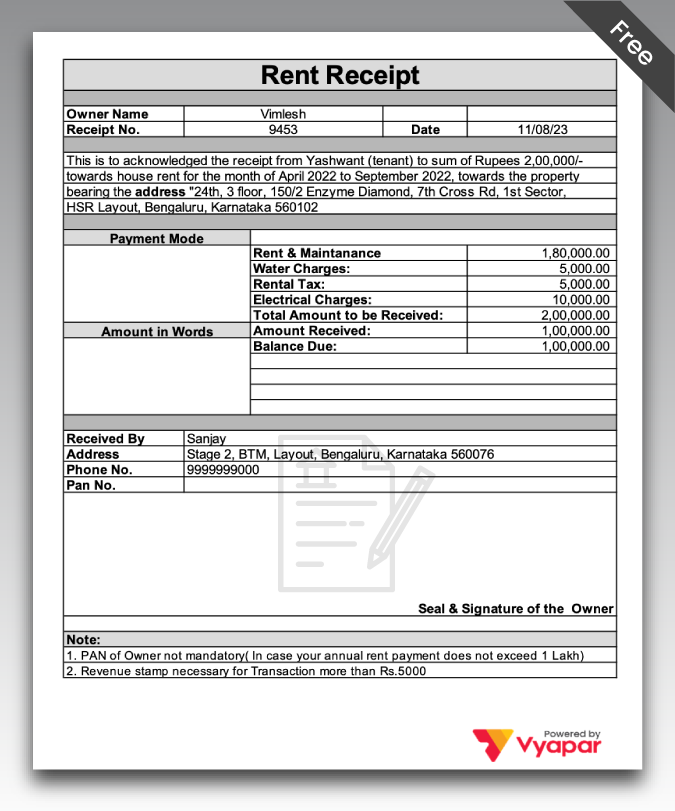

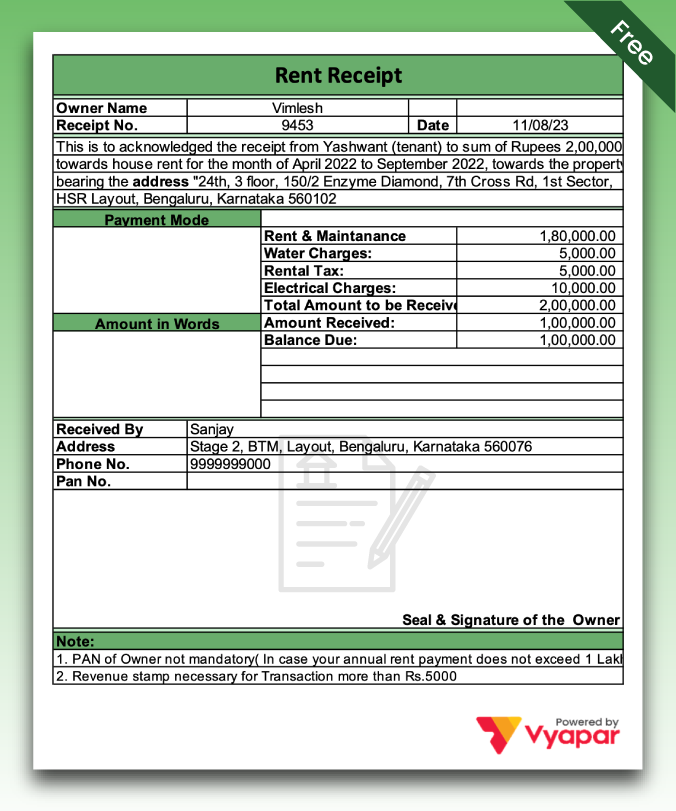

What are the Contents in a PDF Rent Receipt Format?

The rental receipt was made by the landlord, which we have learned. But as a landlord, creating a receipt with no idea what to include could be tricky.

The rent receipt is not subject to an obligation of form or mention. However, when you are creating it, specific data must be included. Here are some important contents your rent receipt format PDF must have:

- The surname, first name, and address of the tenant.

- The surname, first name, and address of the landlord.

- The address of the accommodation.

- The date of sending the rent receipt and the date of paying rent.

- The rental period corresponds to the payment.

- The amount of the rent excluding charges.

- Discount on rent given to the tenant.

- The number of rental costs.

- The total amount paid.

- The signature of the tenant.

- The signature of the landlord.

- Stap of the agent/landlord, if any.

When working on a rent receipt format PDF, it’s essential to include every detail. It can reduce the potential risk of disputes.

In addition, misunderstandings between the two parties can be eliminated by adequately creating a rent receipt.

Make sure your rent receipt format has all the above details. They are all important from the perspective of the landlord. Thus, there’s no way you could miss out on one of them.

Now that you have understood the content of a rent receipt format PDF let’s move on to its importance. What advantages, as a landlord, do you get by offering a rent receipt to the tenant? Let’s explore!

Importance of Rent Receipts Format PDF for Landlords

It is important for landlords to provide tenants with a rent receipt. You might wonder, “What’s in it for you?” Providing a rent receipt has numerous benefits for landlords.

Primarily, issuing rent receipts contributes to establishing a professional image for the property management company or landlord. Furthermore, receipts facilitate tracking which tenants’ rent has been received and which remains outstanding. This enables timely reminders to tenants who have yet to submit their rent payments.

Additionally, maintaining comprehensive records of all annual rent receipts is highly advisable. In times of disputes, these records serve as invaluable resources. They can swiftly resolve misunderstandings and conflicts, ensuring efficient management of rental properties.

Crucial Things to Note About Rent Receipts

A rent receipt is a legal document if you have mentioned its existence in the rental agreement. Therefore, being a legal document, there are certain things about it a landlord must know. Before you start working on a rent receipt format, here are some considerations to ensure:

- A revenue stamp is required if cash payment against rent is made for an amount more than INR 5,000. In the case of rent payment via cheque, no revenue stamp is required on a rent receipt.

- To claim HRA exemption, a tenant can ask for PAN no. Its landlord chooses to provide it or not. If provided, that copy of PAN must be attached to the rent receipt given to the tenant.

- In case the payment of rent is made through UPI or net banking, a copy of the transaction must be filed in the rent receipt format.

When issuing a rent receipt, ensure the above considerations. It’ll help you avoid any potential legal consequences in the future. Also, if you have a dedicated attorney or legal team, ask for their assistance. They’ll ensure your rent receipt format PDF complies with all the necessary legal clauses.

How Do You Create A Rent Receipt Format Using Vyapar?

If you are new to Vyapar, creating a rent receipt might take a while. To save you time, we have shared steps for recording rent in your accounting books below. The mobile users should follow these steps.

- Download the Vyapar invoicing app on your Android Mobile or Windows devices.

- Once installed, Open The Vyapar app.

- On the Home screen, you will get three lines in the left top corner. Click on it.

- Scroll down, go to the Settings option and click on it.

- Now click on “Items” and select “What do you sell” as “Services” ( As the rental business will be considered as a rental business) and click on the “Close” button on the desktop.(Back button in Mobile)

- Now again, click on “three lines” from the top left corner (in mobile), and then click on Items.

- Then go back to the Service Tab, click on “Items”, and then click on the “Add Service” button.

- Add “Service Name” as “Rent”, “Service code”, and sale price as the rent price; if you are charging any GST, then add the GST rate and then click on the “Save” button.

- If you would like to give “Unit” for your services, like month or days, then go to the Unit bar and click on the “add Units” or “+” icon and add a new unit as a month and use this as your service unit.

- If you want to add your tenant’s GST and PAN numbers to the invoice, go to the left menu.(Top left corner three line in mobile)

- In the Left Menu, click on Settings, then click on “Party” and Enable “Additional Party Details”

- Select the first additional party details Rename it as PAN Number, and click on the “Back button” or “Close Button”

- In the same settings, click on “Taxes and GST” and then the “Enable GST” option. (it will be auto-enabled)

- Now, on the home screen, click “Party” and the “Add Party” button.

- In the “Party name” section, add the “Tenant” name & his Phone number, Email ID, GST Number, and PAN number (It will be available in Additional details)

- Before creating any rent receipt, Go to the Left Menu, scroll down, click on Settings and then click the “Print/Invoice Print” option.

- Scroll down and click on “Change Transaction Names.” Go to the Sale section and remove “Tax Invoice”, rename it as “Rent Receipt”, and then click on the “Save” Button.

- Now, to create a “Rent Receipt”, click on the “+” or “Add Sale” button; select the “Tenant” name from the party section.

- Now, select the “Item” as “Rent” and click on “Save” Button.

To maintain proper accounting, follow the below steps to create a payment receipt:

- There will be an (+) icon. Tap on it.

- Tapping on it will open various billing facilities.

- In the list until you find Payment-In. It’s the sub-section in SALE. Tap on it.

- There will be a total of six sections that you have to fill.

- Enter the name of your tenant in the CUSTOMER NAME section.

- Select the receipt number and choose the current date.

- In the PAYMENT TYPE, you’ll have two options – cash and cheque.

- If your tenant pays the rent in cash, tap on money.

- If your tenant has made the rent in a cheque, tap on the cheque.

- The description section writes – “Rent For The Month.”

- Besides this section, there’s a dedicated section for a photo.

- Tap on it and choose CAMERA.

- Now your camera will open. Click the picture of the cheque and tap the tick.

- The picture will automatically be recorded with this rent entry.

- Now scroll to SAVE and tap on it.

- With this, you have successfully recorded the rent of a tenant.

So, this is how you record your tenants’ rent in your accounts’ books using Vyapar. Make sure you follow the steps in a similar manner as they are provided above. It won’t take much time to create a rent receipt using Vyapar.

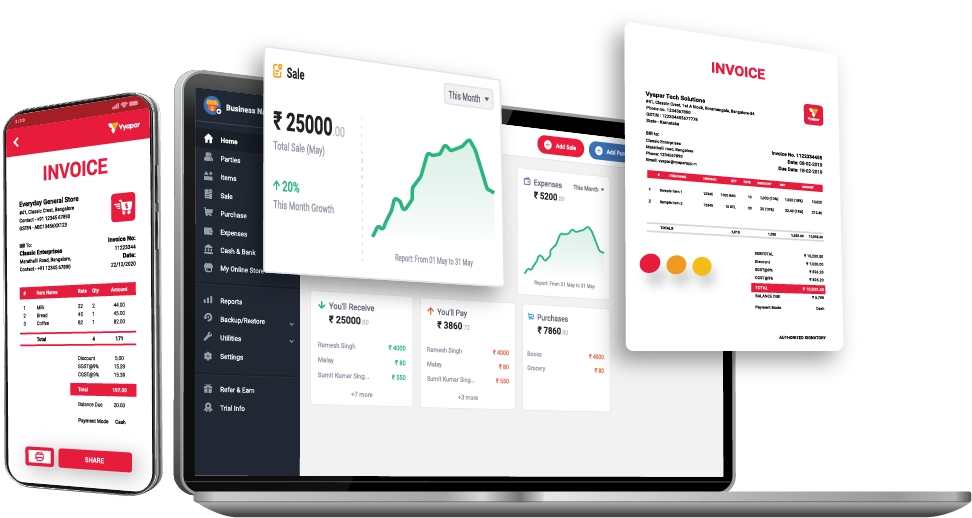

Why is the Vyapar App a Better Alternative To Rent Receipt Format PDF?

Before utilizing the Vyapar rent receipt format in PDF, it’s essential to grasp the benefits it offers. Understanding the advantages of creating a rent receipt using the Vyapar app is crucial. Here are some key benefits you should be aware of:

- Simplified Data Entries: Manual bookkeeping can be time-consuming and challenging, especially for beginners. Vyapar’s rent receipt format streamlines accounting processes, allowing landlords to create receipts within minutes and easily make necessary edits.

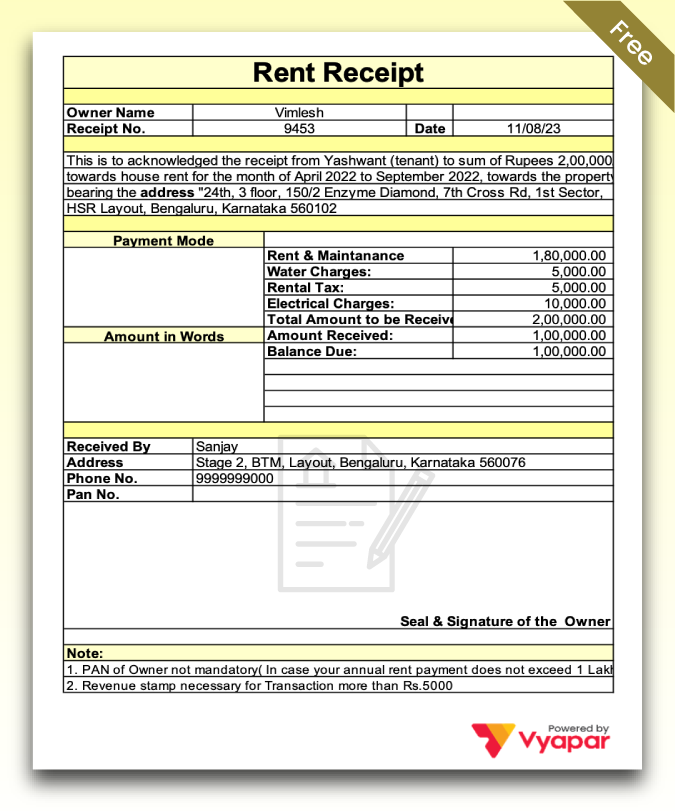

- Multiple Rent Receipt Themes: Vyapar rental property accounting software provides a variety of professional themes, enhancing landlords’ branding identity. With 12 conventional themes and two thermal invoice themes, landlords can choose themes that suit their preferences and customize them as needed.

- Cost-Efficient Solution: Vyapar eliminates unnecessary accounting expenses, offering a cost-efficient solution for landlords. Managing accounts and administrative tasks becomes convenient and time-saving with the Vyapar app.

- Create Reports: Making informed decisions is crucial for growth in property renting businesses. Vyapar enables landlords to generate over 37 types of reports, including balance sheets and profit and loss reports, within seconds.

- Discounts and Taxes: Vyapar facilitates the inclusion of discounts and taxes in rent receipts, ensuring accuracy in financial transactions. The app’s automation feature simplifies accounting processes, while customizable PDF rent receipt templates allow for easy edits.

- Wide Printer Compatibility: Vyapar supports both digital and physical versions of rent receipts, catering to varying tenant preferences. Landlords can share PDF receipts digitally or provide printable versions if tenants require physical copies. The app is compatible with regular and thermal printing sizes, ensuring seamless printing experiences.

Moreover, the Vyapar app also offers a printable rent receipt in case the tenant wants a physical receipt. Our application is compatible with regular and thermal printing sizes. Therefore, the least you have to worry about is your printer not supporting the app because it does.

Some Other Integral Features of Using the Vyapar App

The helpful features of the Vyapar App aren’t limited to rent receipts. Its wide range of features is why it’s the favourite accounting software for many businesses. Following are some vital features of using the Vyapar App:

Data Security and Safety: With the Vyapar rent receipt generator app, your data security is the last thing you need to worry about. Users are provided with the facility to secure their app using a password. Moreover, you can also set passcodes on the transaction levels for deletion and editing.

This way, every time you are about to delete an edit record, you have to enter the password to do so. Further, auto backup is also performed frequently. Besides, you also get the features to perform a backup to Google Drive or manual local backups.

Record Multiple Transactions: The features of Vyapar aren’t limited to just creating rent receipts. You can also record a wide range of transactions in our app. Recording transactions becomes super easy with our app, from sales, purchases, expenses, and other incomes to delivery challan, credit, and debit notes.

Moreover, returns on sales and purchases are the most complicated to adjust in the books of account. The Vyapar app has a dedicated section for each of these, allowing you to manage and maintain your records conveniently.

GST Billing and Invoices: Creating GST-compliant and accurate invoices is essential for every property rent in business. The Vyapar app offers a wide range of features for effective GST billing and accounting. Further, the app makes creating credit and debit notes simple and cost-efficient.

Landlords can create GST bills complying with the GST legislation via this app. Doesn’t matter if your business is medium-sized or small size. The Vyapar rent receipt maker app supports various formats, making the app suitable for all businesses.

Delivery Challan: The “delivery invoice” of the Vyapar app acts as the confirmation for delivery. Users can use our app to help create delivery challans formats and then link those to the desired shipments. Doing this will ensure that every item arrives at its designated destination securely.

Moreover, our accounting software also makes it convenient for businesses to track their shipments. Therefore if something goes wrong, one can use that tracking information to provide necessary instructions to the customer or to support it.

Multiple Payment Options: Accept every digital payment gateway and make it convenient for your new and current tenants to pay their rent using their preferred mode of payment. You can do that using the Vyapar App.

Our app allows users to send the rent receipt to tenants through WhatsApp and email. Further, you can add a QR code in your GST rent receipt format. Adding a QR code makes it easier for tenants to pay their rent. It will, in return, improve your professional image.

Unlimited Basic Usage: All the essential features of the Vyapar app are free. If you are an Android user, you can use the PDF rent receipt formats available on our software without any charges. As useful as the free services of our application are, the premium package is the next level.

In today’s modern era, automation is needed for every business. With our premium package, you can avail proper automation facilities. It will help you manage your accounting process in the most time-efficient manner.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

A rent receipt format PDF is proof of a transaction made against rent. It’s a document containing crucial details about rent being paid. It acts as proof in case of misunderstandings and disputes among landlords and tenants. It’ll show if the rent is paid or not.

When you make a digital or physical copy of a rent receipt, it’s known as a rent receipt copy. It is suggested that every landlord have a dedicated record of rent receipts paid to tenants. This record can be a helpful resource during legal disputes.

You can use the Vyapar app to manually create your rent receipt. Further, you can download it in PDF form using the app itself. For a better accounting experience, you should try the automated accounting services of the Vyapar app. It’s time as well as cost-efficient.

Yes, it’s possible to write rent receipts with your hands. However, that’s the traditional and expired method of creating a rent receipt.

Since accounting technology is pretty good these days, using them would be more time-efficient. With the Vyapar app, you can utilize the pre-existing rent receipt format to save time.

Generally, an employee must submit rent receipts for the last three months to get an HRA exemption. In addition to receipts, you’ll also need the landlord’s PAN if the total rent paid is more than INR 1,00,000.

Attaching the PAN with the rent receipt is necessary in such a case. Once you have submitted rent receipts with PAN, your exception process will start.