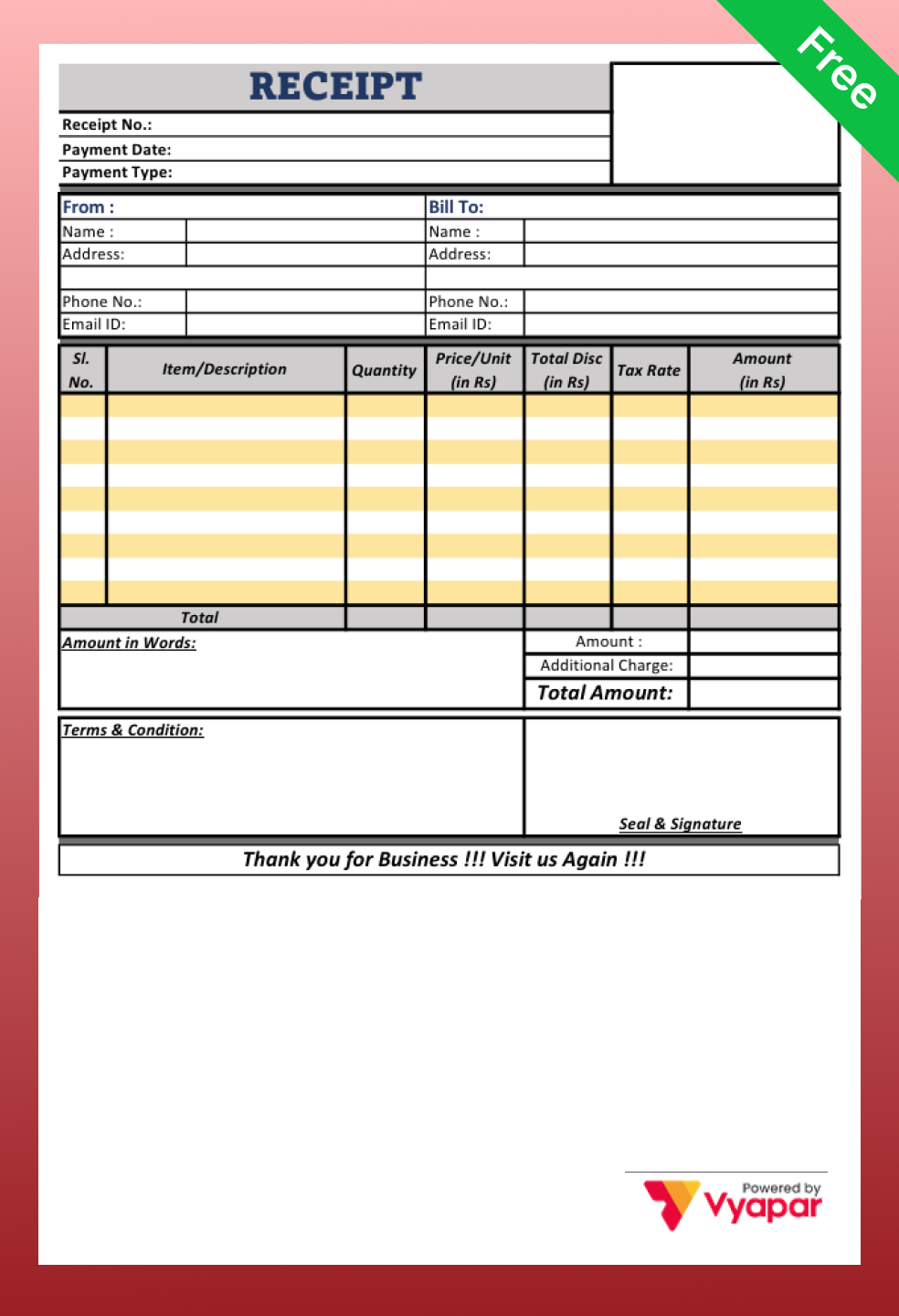

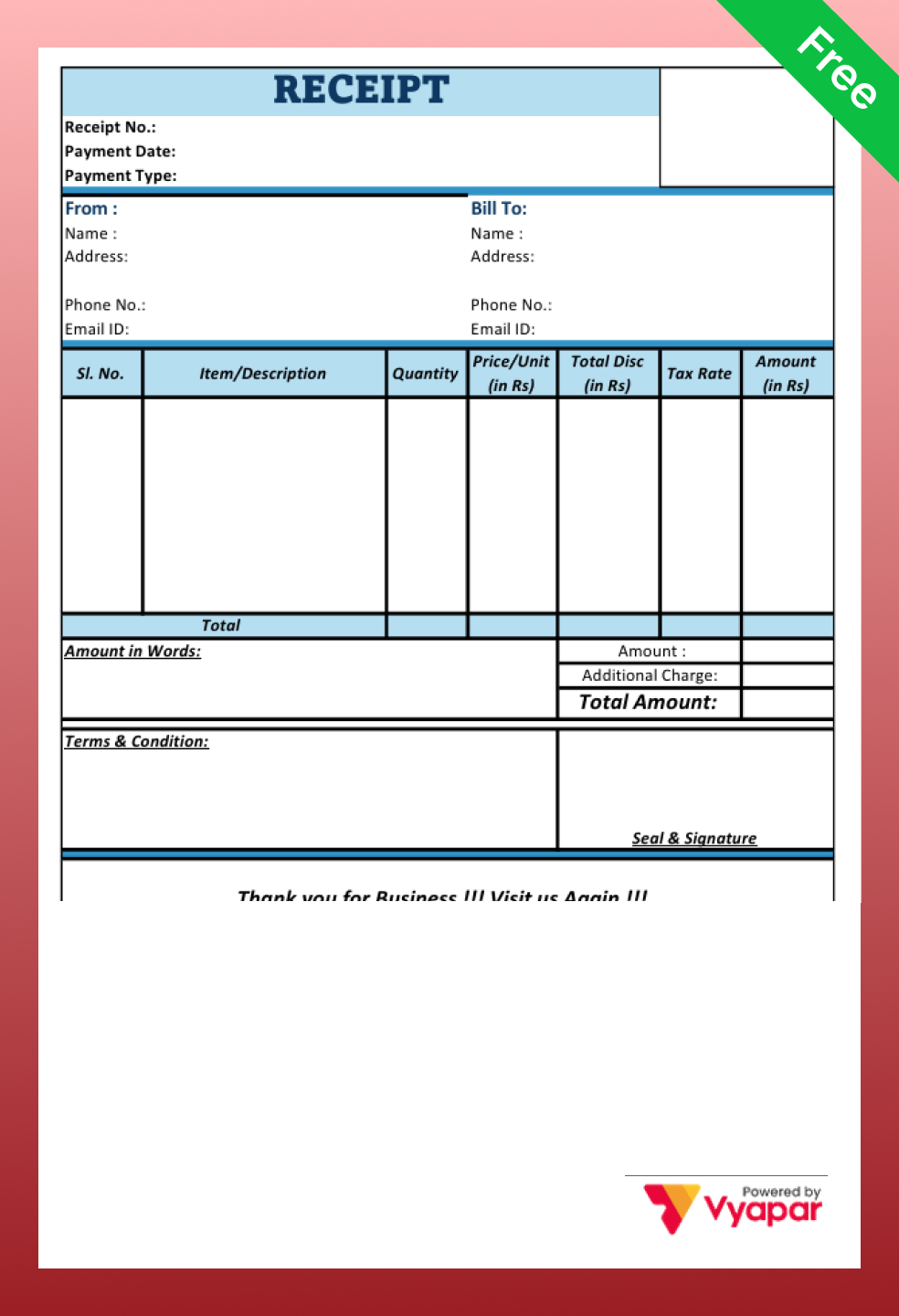

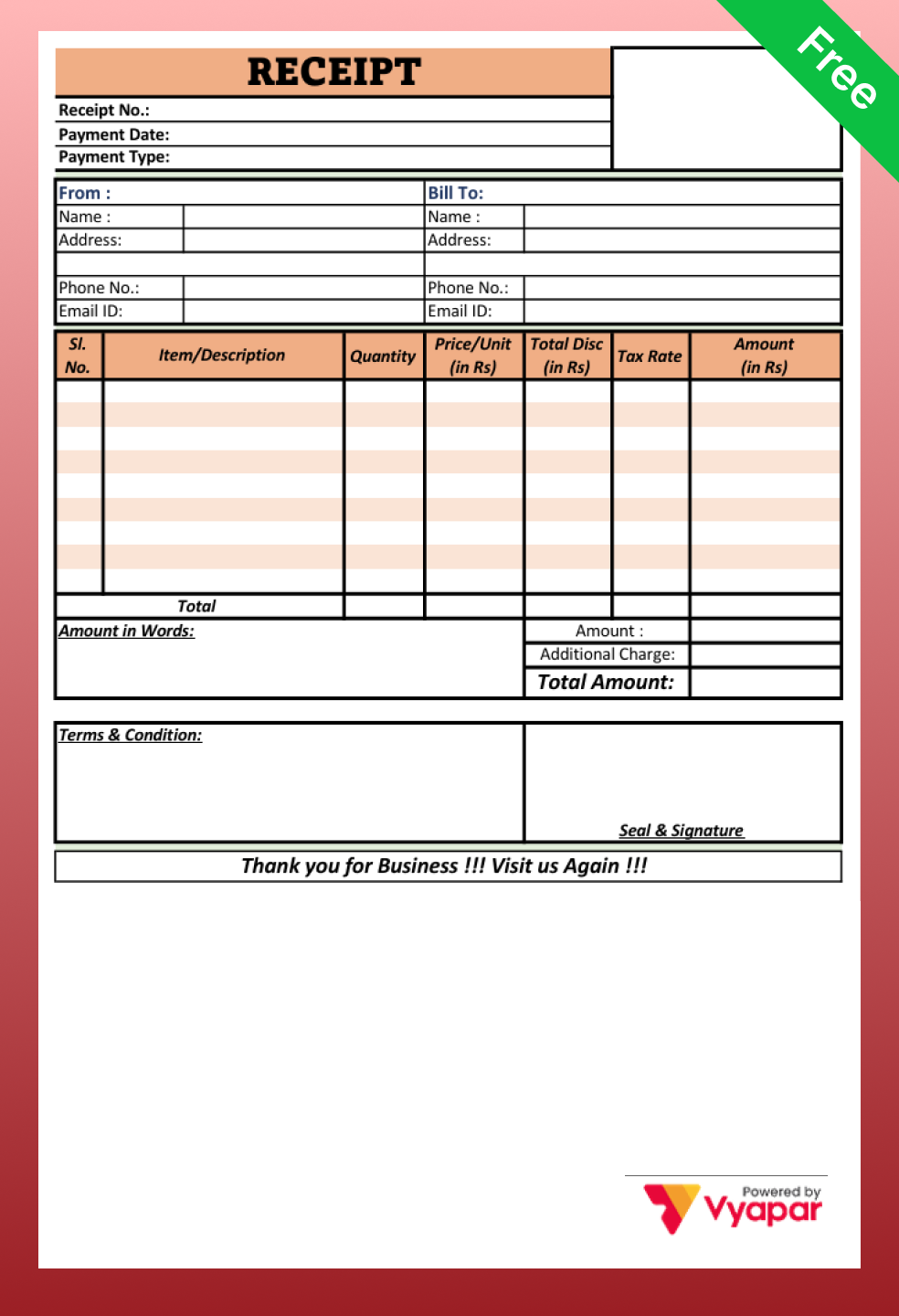

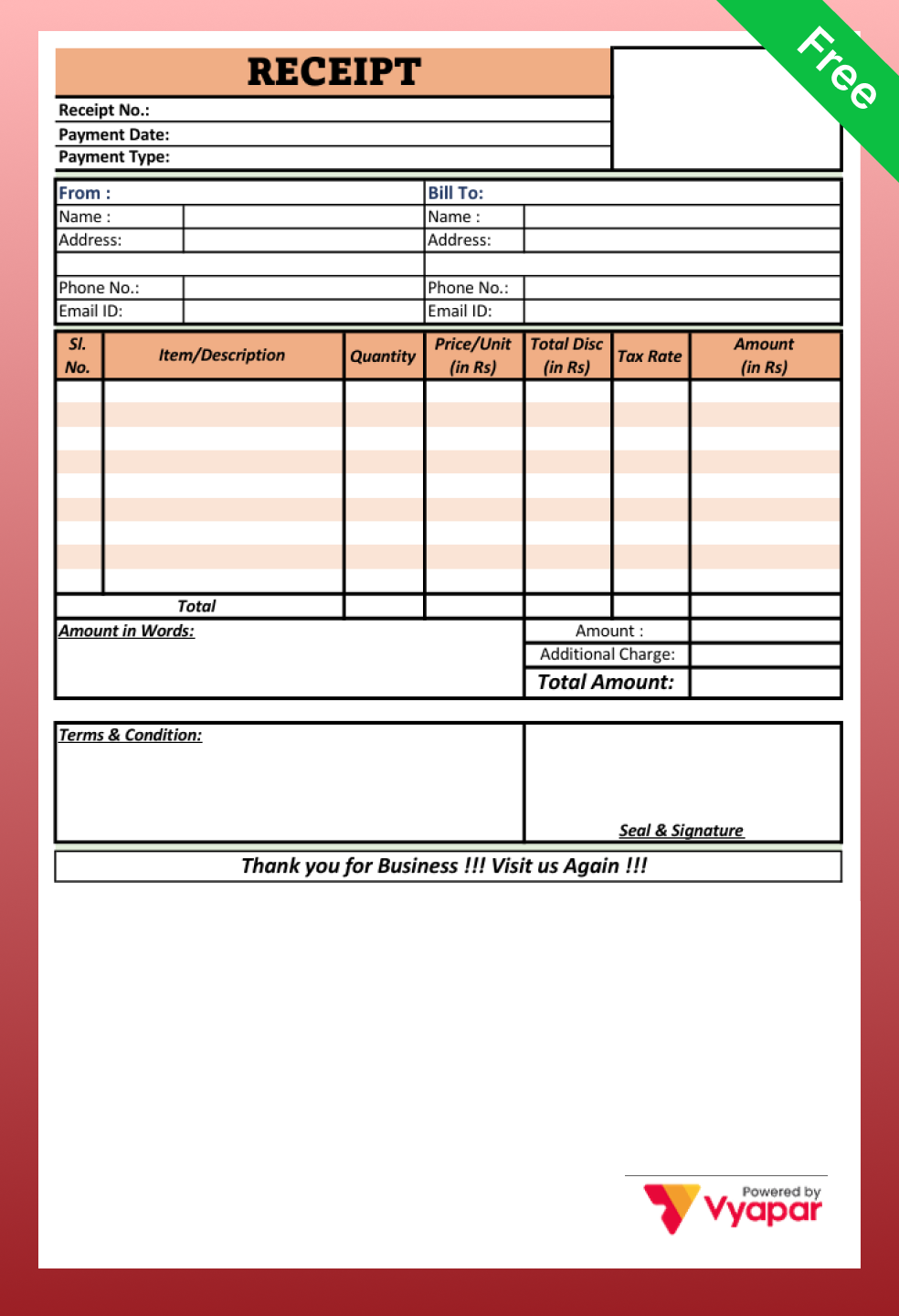

Free Receipt Formats

(Word, Excel & PDF)

Save time with ready-to-use receipt formats.

Easy to customise, print, and share with your

customers.

Create smart receipts in seconds!

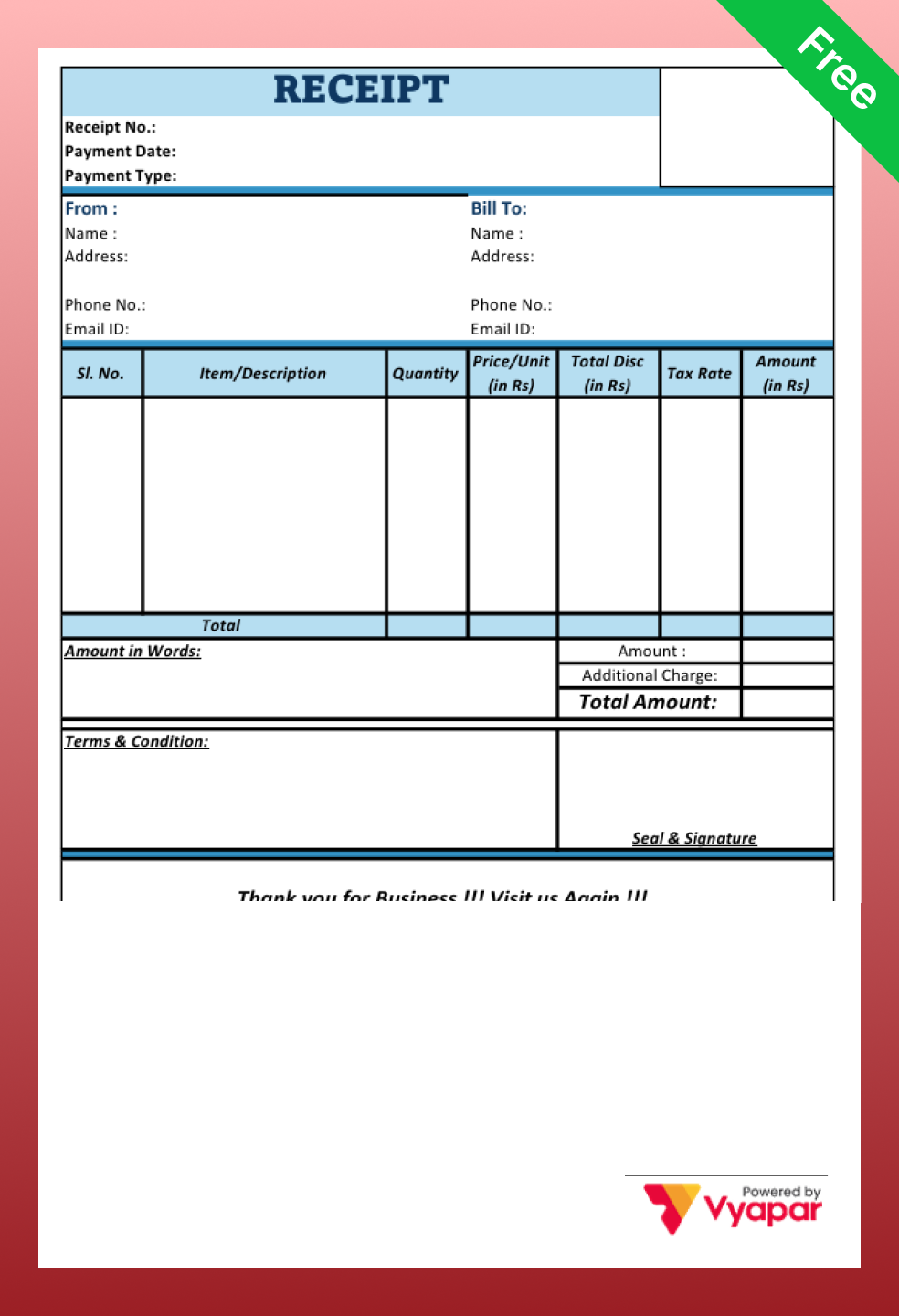

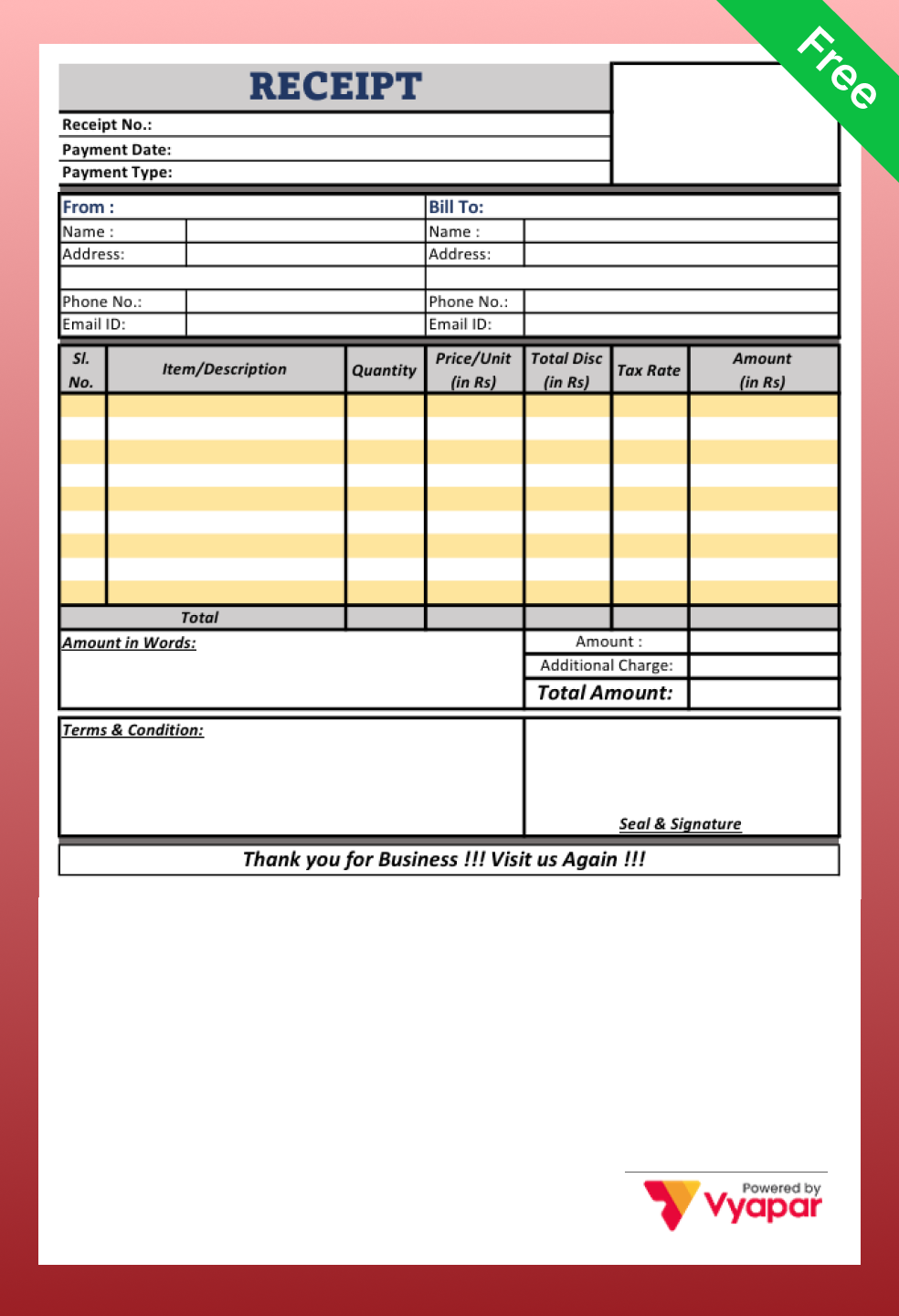

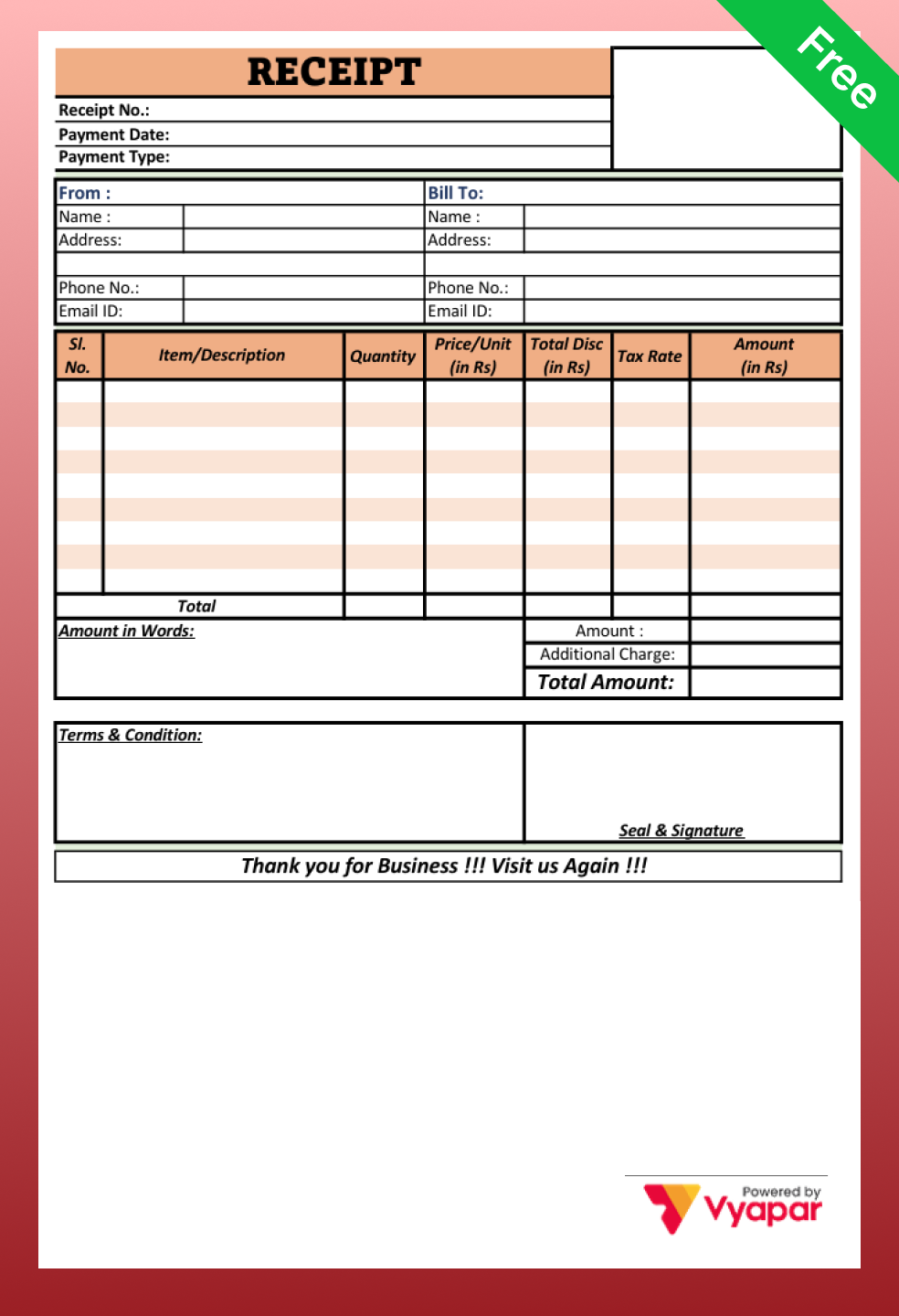

Key Components of a Receipt Format

Receipt Title and Number

Use a clear title and add business details like name, contact information, and GSTIN to look professional.

Customer Details

Mention the customer’s name, contact details, address, and GSTIN, if applicable, to keep records clear and transparent.

Receipt Number and Date

Add a unique receipt number and issue date to help with tracking, audits, and future reference.

Itemised Product/Service Details

List items separately with quantity, rate, HSN or SAC code, and totals to avoid confusion.

Tax Summary (GST)

Show applicable GST types, percentages, and amounts clearly to meet tax rules and compliance needs.

Total Amount and Payment Terms

Include subtotal, discounts, taxes, final amount, payment mode, and due date for smooth payment clarity.

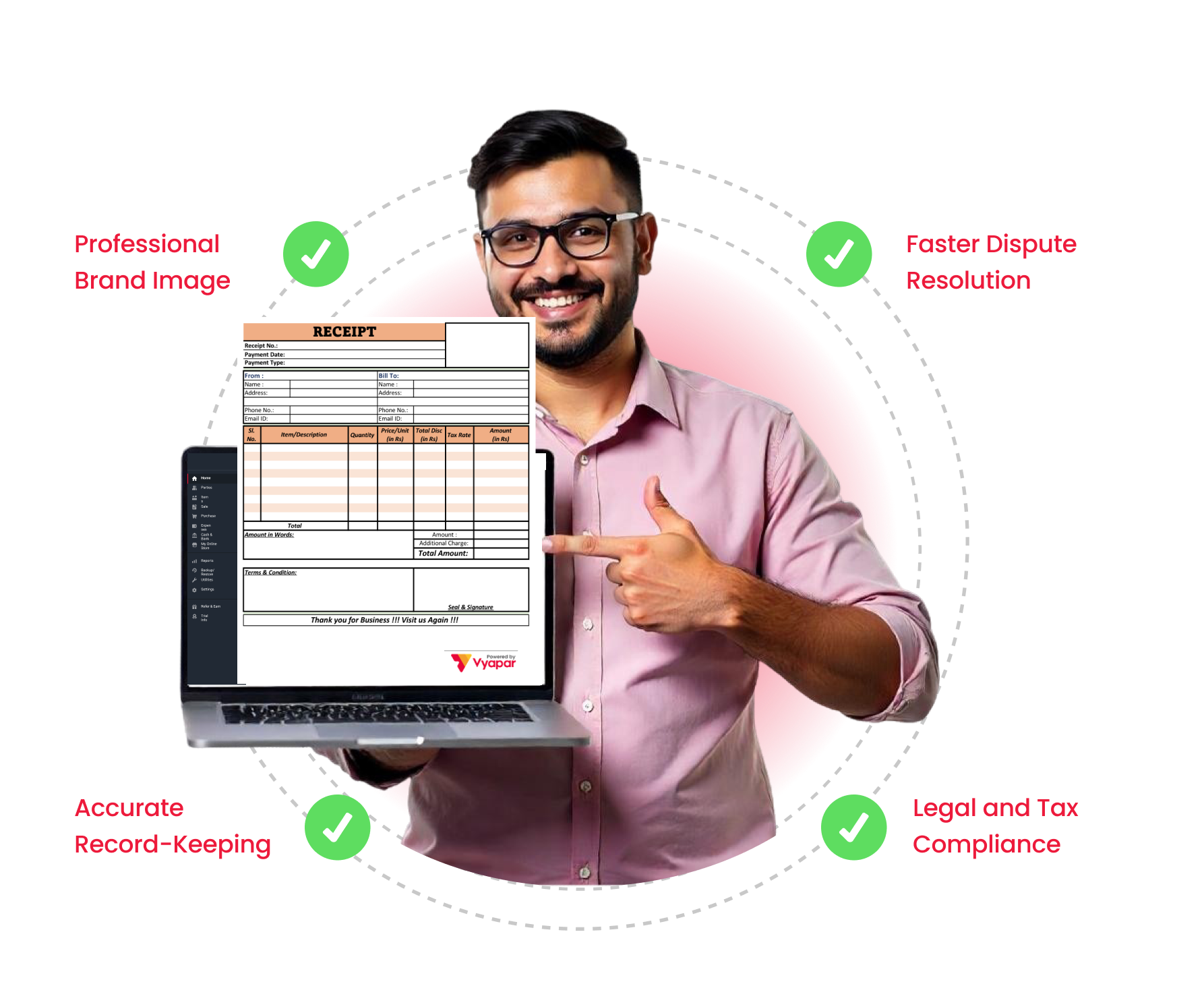

Benefits of Using Receipt Format

Using a proper receipt format offers several practical benefits, including the following.

- Professional Brand Image: A clean and well-designed receipt format helps present your brand as organised and trustworthy.

- Accurate Record-Keeping: A structured receipt format makes it easier to track transactions and keep records clear and error-free.

- Faster Dispute Resolution: Clear receipts with proper details help resolve returns or payment issues quickly and smoothly.

- Legal and Tax Compliance: Proper tax and item details in receipts help meet compliance requirements and avoid audit issues.

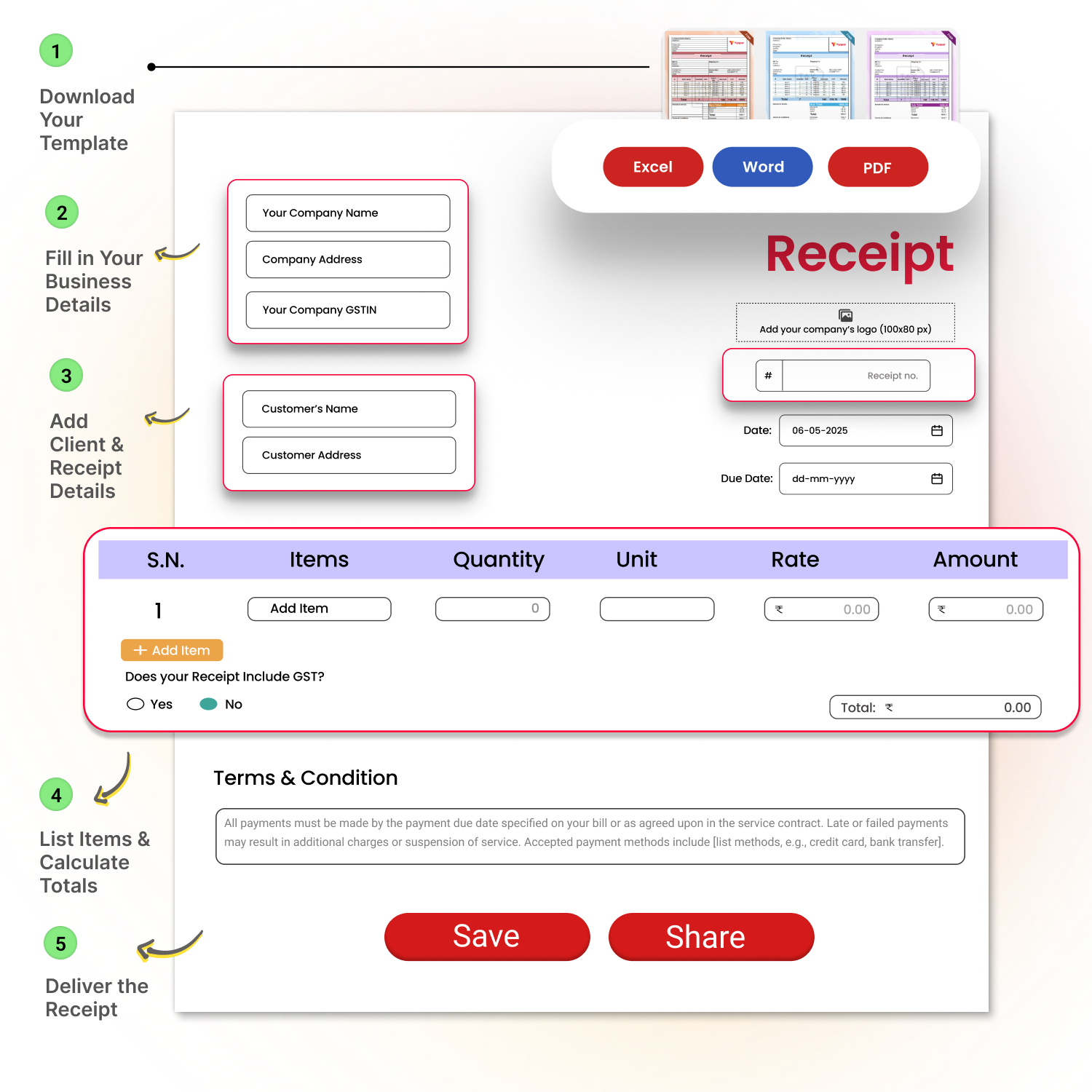

How to Use a Receipt Format

Step 1: Download the Receipt Format

Download a receipt format in Word, Excel, or PDF from Vyapar website.

Step 2: Add Business Details

Open downloaded file and write your shop name, phone number, and address.

Step 3: Add Client Details

Fill in the client name and contact number.

Step 4: Enter Item and Price Details

Add item name, quantity, price, and total amount. Also, add taxes if applicable.

Step 5: Save, Print, or Share the Bill

Save the bill and print it or share it with your client.

Give your receipts a digital upgrade

Upgrade to Smarter Receipt Management With Vyapar

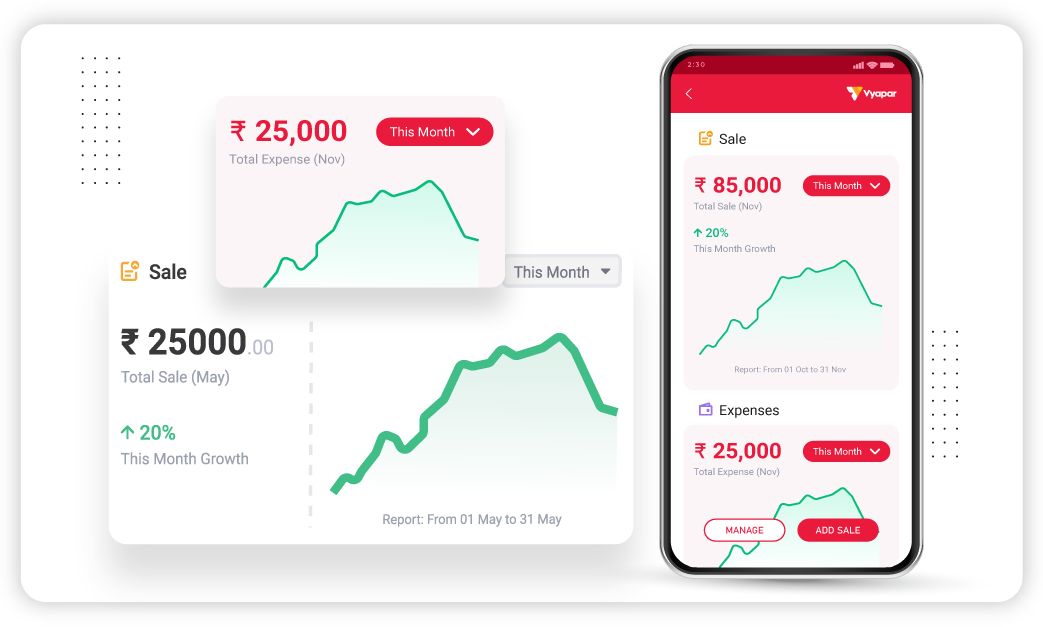

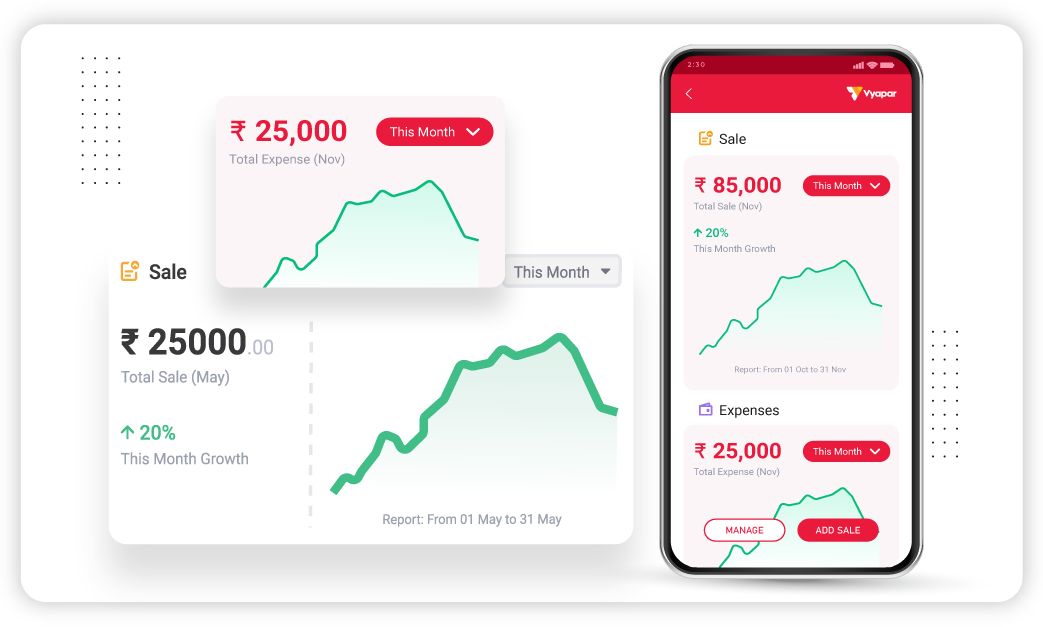

Complete Business Management in One App

- Billing, Inventory, Accounting

- Bank & Cash Flow Tracking

- GST Filing & Reports

.

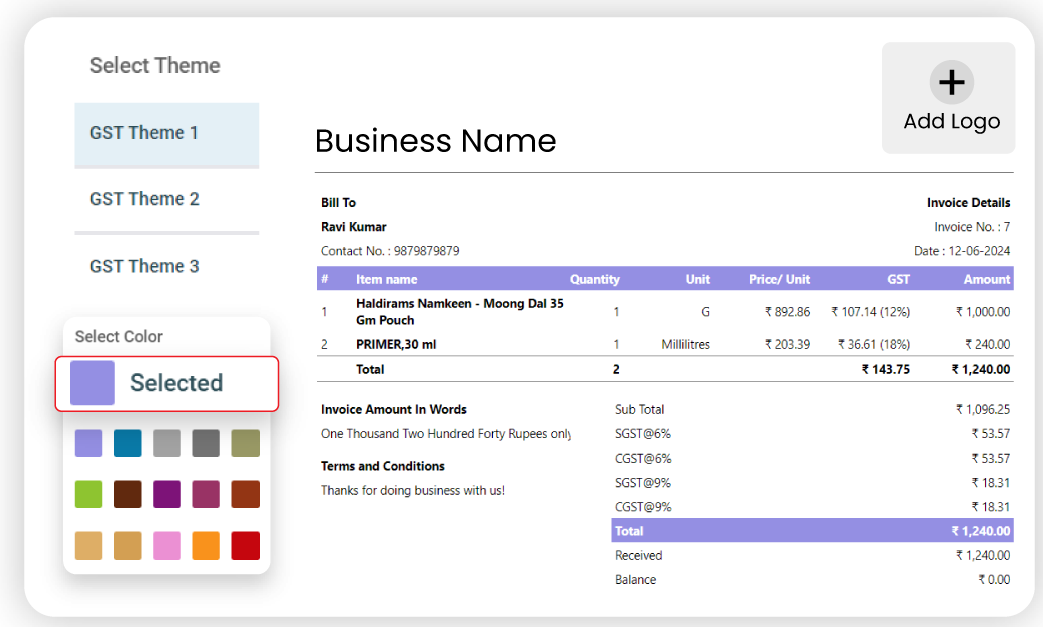

Receipt Customisation & Branding

- Add Logo and Colours

- Custom Invoice Fields

- Multiple Invoice Themes

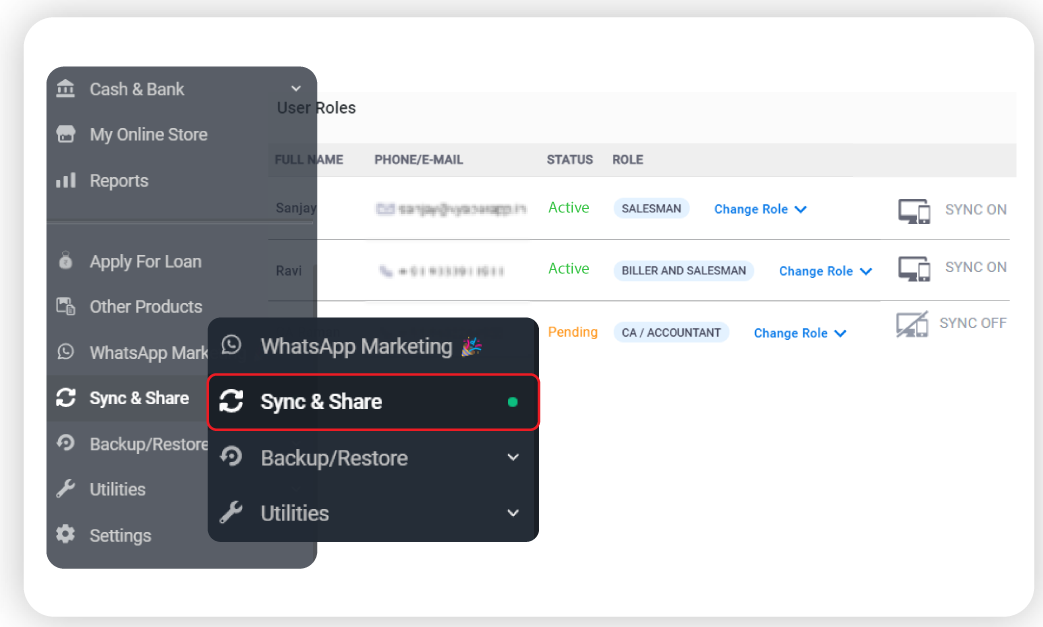

Integration and Synchronization

- Multi-Device Sync

- Auto Cloud Backup

- WhatsApp & Printer Integration

Mobile-Friendly & On-the-Go Billing

- Bill On-the-Go

- Track Inventory & Sales

- Full App Experience

Frequently Asked Questions (FAQ’s)

What is a receipt format?

Which details should be included in a receipt format?

Can I edit receipt formats in Word, Excel, or PDF?

Are receipt templates free to use and customise?

What is the difference between a receipt and an invoice?