Credit Voucher Format

Download the Credit Voucher Format to boost sales for your business. Or use the Vyapar app for billing and accounting easily and grow your business faster. Avail 7 days Free Trial Now!

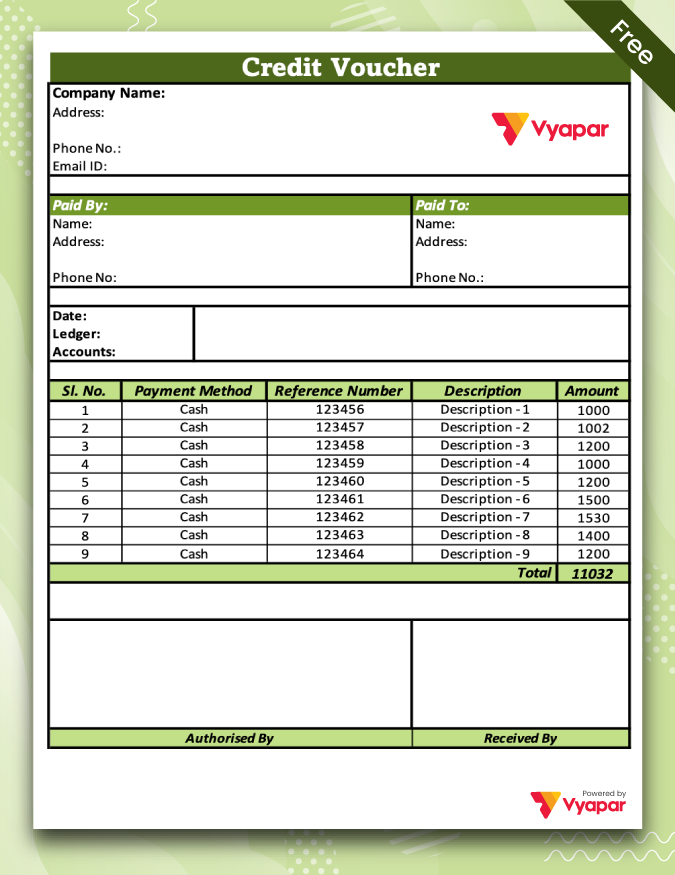

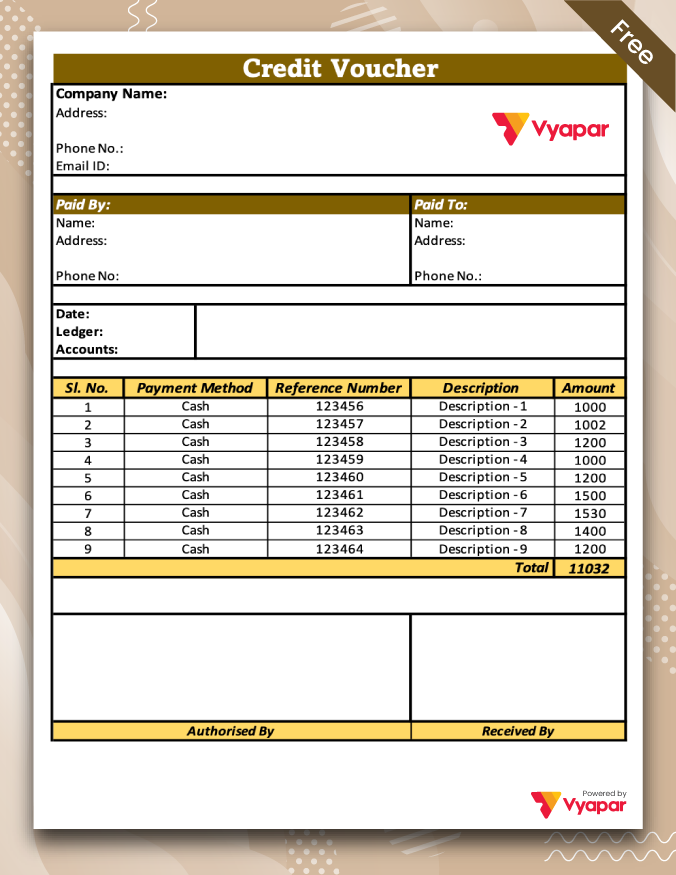

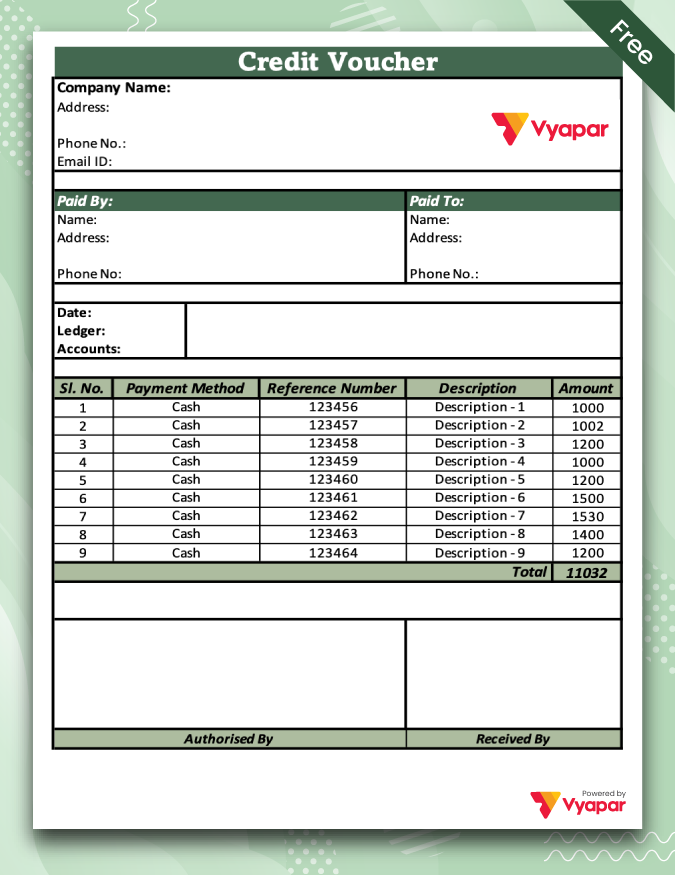

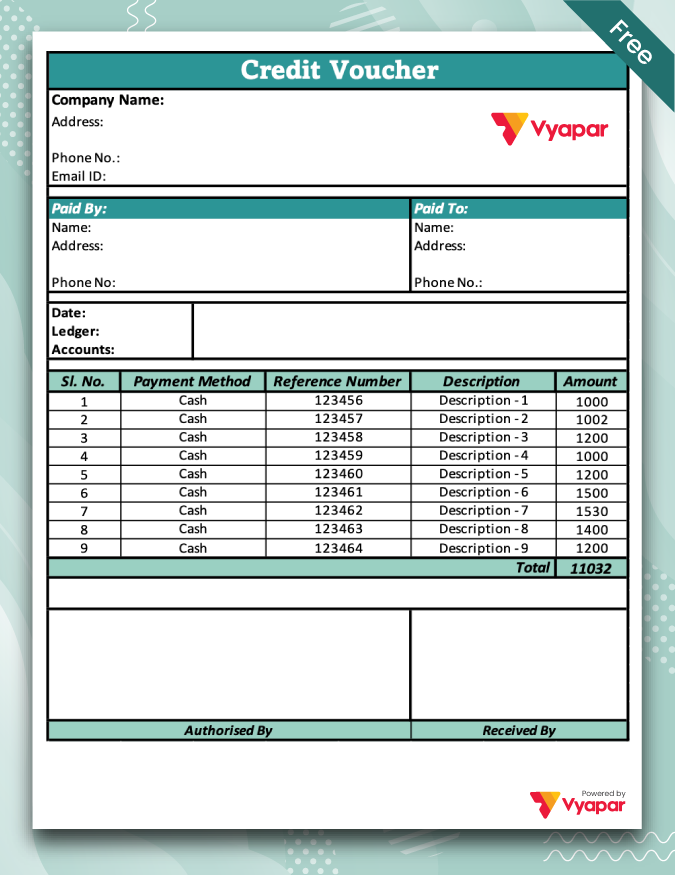

Download Free Credit Voucher Format

Download professional, free credit voucher templates and customize them according to your requirements at zero cost.

What is a Credit Voucher?

When you make a payment, a credit voucher is the paperwork that records the transaction, showing the amount of money involved, whether it’s cash or other forms of payment. So, when someone pays with cash, we prepare these credit vouchers to document the transaction.

There are two main types of credit vouchers:

Bank credit/receipt voucher: This document confirms that money has been received, typically through a bank transaction.

Cash credit/receipt voucher: This document verifies the receipt of payment in the form of a check or demand draft.

These vouchers are crucial for keeping track of cash receipts in a business. They serve as official evidence that money has been received, and they detail which accounts should be credited accordingly. Different types of cash receipts are recorded on these vouchers, depending on the nature of the transaction.

In essence, a credit voucher is a record of payment made, whether it’s in cash or by check. It’s also referred to as a receipt voucher.

Examples of transactions that would require credit vouchers include selling goods for cash, selling fixed assets or investments for cash, or receiving payments from customers for goods sold.

Associated Document with Credit Voucher:

When we receive cash, whether through a check, physical cash, or bank transfer, it’s crucial to maintain proper documentation, just like we do with debit vouchers. This documentation serves as evidence that the cash transaction has taken place.

Moreover, for transactions like capital injections and revenue from construction projects, it’s advisable to include a copy of the contract. Attaching the contract helps ensure transparency and clarity regarding the terms and conditions of these specific transactions.

Advantages of Credit Voucher:

- A credit or receipt voucher serves as the official document confirming that a company has received payment from its clients, banks, or other entities. Some businesses use receipt vouchers to meticulously record specific sales transactions. Despite the perception of a credit voucher system being laborious and time-consuming, it offers numerous benefits.

- In order to maintain a credit voucher system, it’s essential to attach invoices, receipts, and orders, ensuring the accuracy of the documents. These vouchers are assigned unique numbers to prevent errors, ensure proper fund allocation, and maintain accurate records.

- With their ease of access, completion, and validity, credit vouchers streamline bookkeeping processes. Computerized systems automatically generate record entries, further expediting the process.

- During audits, vouchers play a critical role, especially for public companies mandated to undergo scrutiny of their financial statements. Auditors verify that the company has received all goods or services, ensuring that payments are supported by valid vouchers.

- Vouchers also serve as a deterrent against employee misconduct and theft, establishing a clear paper trail that identifies all parties involved in the transaction and their respective roles. This meticulous organization minimizes errors, reducing the need for costly audits and reviews.

- In summary, implementing a credit voucher system not only enhances transparency and accountability but also reduces the necessity for extensive reviews and audits.

Duties of Accountant in Respect of Preparation of Credit Voucher

The voucher stands as the cornerstone of the entire accounting process, demanding utmost care and precision during its creation. It serves as the initial document in the accounting system, and any error at this stage could cascade throughout the entire process, rendering all subsequent details inaccurate.

To ensure accuracy, accountants must adhere to the following steps when creating vouchers:

- Examine the supporting documents meticulously, verifying details such as dates, amounts, and the nature of transactions.

- Obtain appropriate approval from authorized personnel for the supporting documents.

- Determine the type of voucher required for the transaction at hand.

- Possess a comprehensive understanding of accounting principles and regulations.

- Confirm that the total debits and credits recorded on the voucher balance accurate.

- Demonstrate proficiency in assigning debits and credits to the relevant accounting categories.

Following these steps diligently guarantees the integrity and accuracy of the accounting system, starting with the creation of vouchers.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

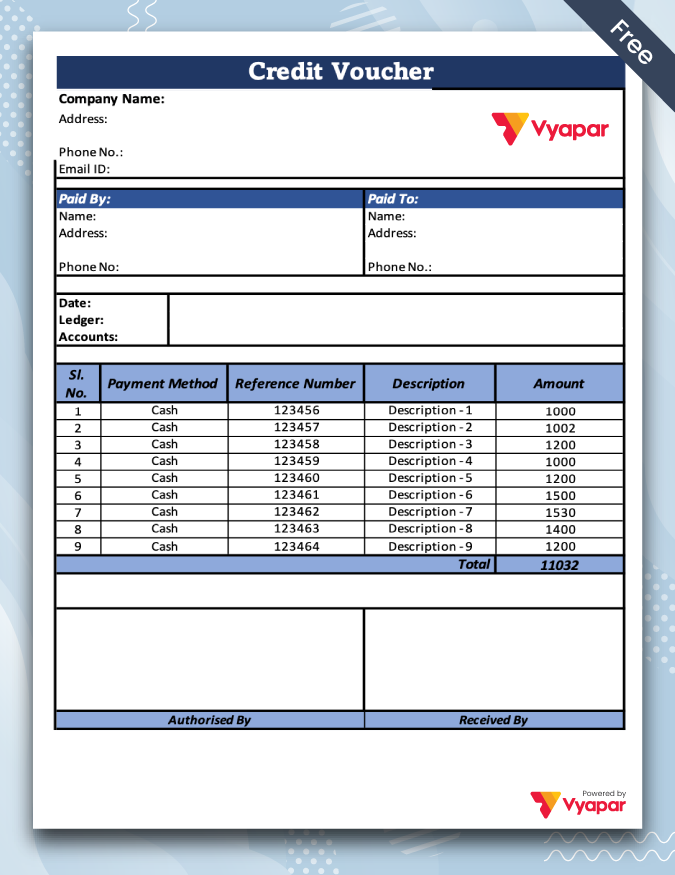

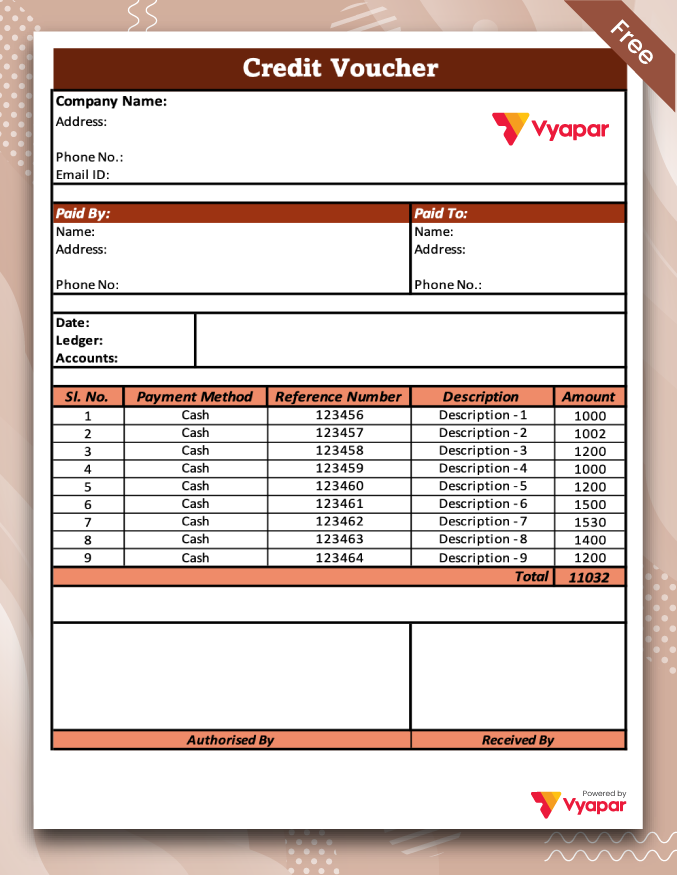

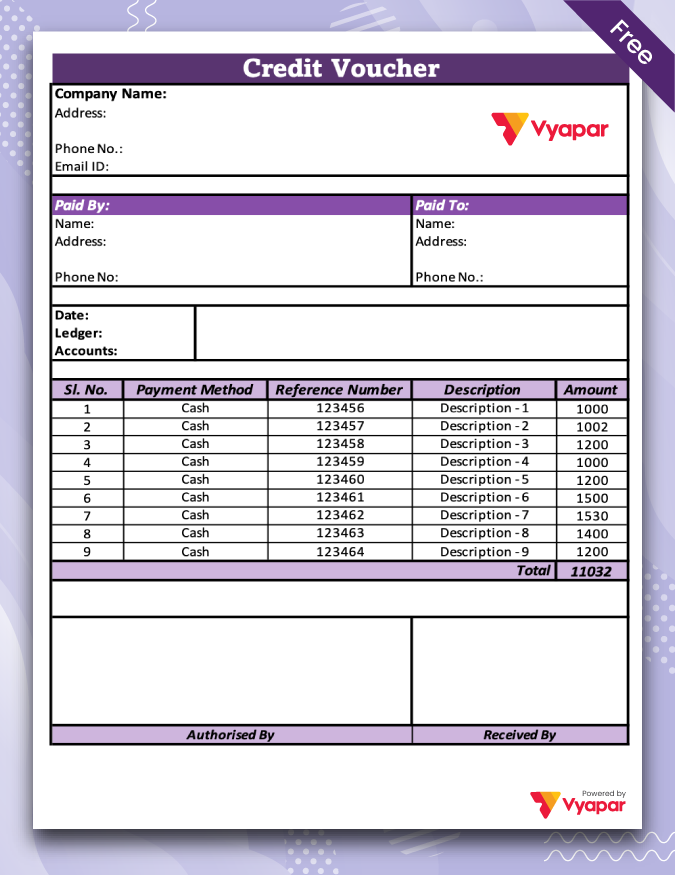

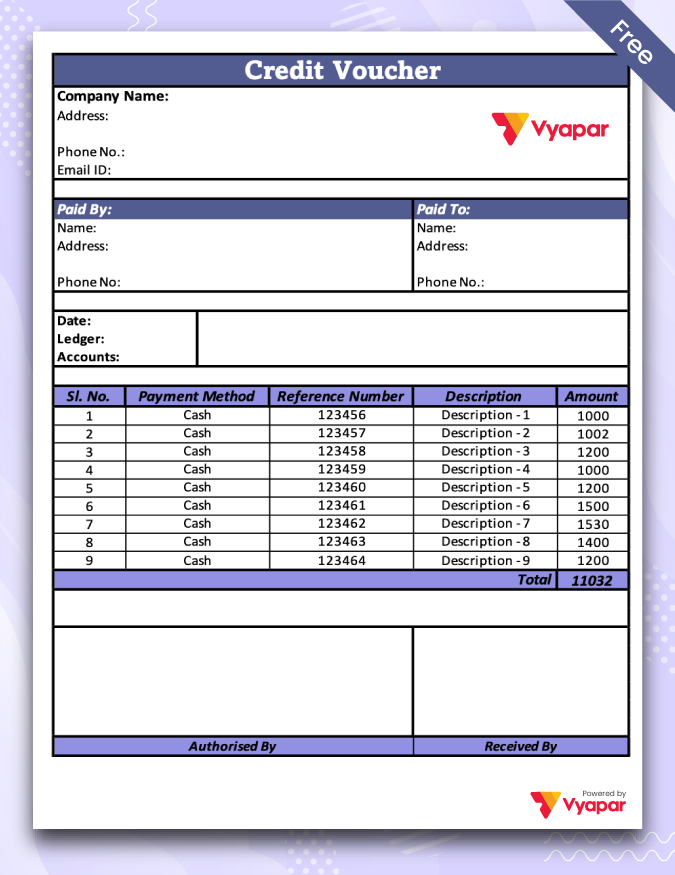

Components of a Credit Voucher

Source documents like challans, counterfoils, checkbooks, receipts, bank deposit slips, bills, cash memos, and other information are used to prepare credit vouchers. The source documents attest to the existence of such transactions and are pertinent to the financial transaction.

A voucher typically contains the following data and information:

- Voucher number

- Date of credit vouchers

- Particulars column- It includes a brief description of the record of the transaction

- Identification Number of the supplier

- The amount payable in words and figures

- Column for total

- The due date for payment

- Name of the account under which liability is created

- Terms and conditions for a discount or other schemes

- Approval stamp and signature of accountant

- Authorised signature of the higher authority

- Receiver’s signature

Difference Between Credit Voucher and Invoice

The company relies on credit vouchers as a crucial tool for maintaining accounting records. When a seller conducts a transaction with a buyer, they provide an invoice along with a written commercial document.

While an invoice is generated at the time of sale, the creation of a voucher occurs only after three documents are reconciled: the purchase order, the invoice, and the receiving report.

Issuing a voucher indicates acceptance of the invoice and signifies the company’s commitment to settling the invoice. Thus, the creation of a voucher is contingent upon the existence of an invoice.

Credit vouchers serve to authenticate transactions recorded in the company’s books, whereas an invoice acts as the foundation for generating vouchers.

Supporting documents for preparation of credit voucher

- The company’s invoice that the supplier receives.

- The supplier’s information, including name, address, and phone number.

- The payment information, such as the total, any discounts, or the deadline for payment.

- The information about the first purchase order the business had placed with the supplier.

- The transactional receipt attests to the fact that the business received the goods or services specified in the invoice.

- The specifics of the ledger accounts involved in that transaction in question.

- The receipt of payment and the authorised signatory of the business attesting to the purchase of goods or services.

- The payment evidence is included in the voucher’s supporting documentation.

Benefits of Using the Vyapar App to Make Credit Vouchers

Experience the Benefits of Lifetime Free Basic Usage: Our business accounting software offers essential features completely free of charge. Android users can access these free services, including the available credit voucher formats, by downloading the app from the Play Store.

Upon signing up and downloading the accounting app from the Play Store, users can enjoy its functionalities without any cost. However, for access to premium features and desktop applications, companies may opt for a subscription model.

Following each transaction, both you and your clients will receive a free SMS containing detailed transaction information, including credit and debit values. This fosters communication and ensures mutual agreement between parties.

Enjoy Flexibility and Time Savings: Businesses require user-friendly automated software to effortlessly generate credit vouchers and promptly deliver them to customers. Similarly, efficient and accurate payment acceptance processes are essential. Vyapar’s automatic payment processing software simplifies these tasks.

The Vyapar credit voucher maker app comes equipped with comprehensive calculation tools, saving countless hours of manual labor. It guarantees that your records remain up-to-date with precise information.

By relieving concerns about accounting tasks, companies can focus on achieving their objectives. Payment processing also demands flexibility, and our Vyapar app ensures swift and seamless transaction processing.

Automatic Data Backup: Safeguard your data’s security by creating local, external, or online Google Drive backups. Vyapar encrypts data for enhanced security, ensuring that data used for creating credit vouchers remains uncompromised.

With Vyapar GST billing software’s “auto-backup” feature, hassle-free backups are provided. When activated, Vyapar automatically creates a backup each day.

Rest assured that your company’s data remains inaccessible to Vyapar team members. Utilize various backup options to tailor backups according to your needs, further enhancing your data’s security.

Diverse Payment Options: Accept all electronic payment methods, simplifying payment processes for current and potential customers. Vyapar’s credit voucher formats enable inclusion of all payment options for customer convenience.

The Vyapar app facilitates sending vouchers to customers via email and WhatsApp. Accepted payment methods encompass cash, credit cards, debit cards, UPI, NEFT, RTGS, QR codes, e-wallets, pay-later options, and more.

Convenience is paramount, and offering customers the flexibility to pay via their preferred method is invaluable. With Vyapar, create professional invoices featuring various payment options effortlessly.

Effortless Business Management: Manage all credit vouchers conveniently from a single platform using the Vyapar app. Keep track of unpaid invoices and send reminders to clients effortlessly.

Tracking all outstanding orders ensures timely delivery, enhancing your company’s reputation. Utilize the Vyapar credit voucher maker app to craft professional sales invoices for clients, elevating your brand image.

The app empowers sellers to manage all accounting requirements efficiently from a unified location. Access essential features via the business dashboard within a single app, enabling effective project management.

Enhance Brand Perception: Build a positive brand image by sending professionally crafted credit vouchers generated using Vyapar’s formats. Provide comprehensive transaction information to foster trust and confidence.

The Vyapar credit voucher format generator app aids in establishing a credible brand presence. Utilize personalized, tax-deductible credit vouchers to differentiate your brand effectively.

Customers trust custom-built quotes as they contain all necessary transaction details. Information may include discounts, taxes, purchase conditions, and product or service descriptions, facilitating seamless transactions.

Helpful Features of the Vyapar App for Small Businesses

Bank Accounts:

Online and offline payments can be added, managed, and tracked quickly for businesses. You can send and receive money and conduct bank-to-bank transfers using bank accounts.

A business account must be added to your bank using Vyapar before you can use bank accounts in the app. Managing credit cards, OD, and loan accounts is simple using the Vyapar app.

It is the best method for easily maintaining a complete bank account book. Additionally, it enables effortless withdrawals and deposits into bank accounts.

From their mobile device, users can access the free credit voucher format wherever there is internet connectivity. You can manage cheque payments and manually adjust the amount with the aid of Vyapar.

Track Orders:

Creating sales or purchase order formats is simple with our credit voucher generator. Setting up a due date for tracking orders is also easy.

With the assistance of this GST Accounting and Billing Software, we get an automatic stock adjustment. It ensures the availability of inventory items.

The ability to track orders is crucial for completing them on time. Tracking stops unnecessary losses, and you may be able to use the time you would have spent searching for other routine tasks.

Our credit voucher maker app makes it easier to improve your purchase/sale order. The Vyapar app offers several options, including Excel, Word, and PDF.

GST Invoicing / Billing:

Using free billing software with GST, business owners could efficiently complete various tasks, such as filing GST returns and managing inventory, invoicing, and billing.

Our free accounting app allows businesses to customise the fields to meet their specific requirements. Using the app, you can quickly create GST invoices for your customers, print them, and share them.

For bills you can create using our GST Software for billing, it is typically advised to use the GST invoice format. You can speed up the billing process with the aid of the barcode scanner.

The free GST mobile app creates multiple parties to manage every client effectively. The Vyapar app allows any business to identify any past-due payments quickly.

Online store:

Set up your online store using the Vyapar GST billing software within a few hours. You can list every product or service you provide to customers in online directories.

With Vyapar, you can present a catalogue of all the products and services you provide, increasing your online sales. Using the features of an online store is free.

The link you provide to your customers enables them to place orders with you online and pick up their purchases from your physical store.

Offering doorstep or pick-up services from your company using your credit voucher generator is the best way to help everyone in your neighbourhood.

Plan your inventory space:

Inventory management is essential for companies that sell a wide range of goods. In these situations, our free credit voucher maker app is helpful. You can keep track of the merchandise that is on hand in your store using the inventory management features in the credit voucher maker app.

With our credit voucher generator, you can set up low inventory alerts to place advance orders and watch for theft. Routine inspections can also help find inventory mismatches.

A professional tool can help you manage the items in your warehouse perfectly. Removing the items you no longer need can help you organize your space and save space.

Using the best credit voucher generator, you can create sales reports and comprehend how much inventory is ideal based on last year’s sales and current trends.

Receivables and Payables:

With the help of the credit voucher generator app, users can seamlessly maintain all transaction details and keep track of the company’s cash flow. Your method for safeguarding the specifics of your transactions has improved.

The credit voucher maker app’s dashboard section allows you to keep track of the party’s receivables and payables. You can also easily check who neglected to pay you back.

You can set payment reminders to ensure that these customers pay their debts on time. Any party can get free email, SMS, and WhatsApp payment reminders.

Additionally, you can save time by using the bulk payment reminder feature to send payment reminders to all of your customers at once. The automatic credit voucher generator performs calculations.

Frequently Asked Questions (FAQs’)

Credit vouchers serve as the official record of cash receipts. These vouchers are made to track different types of business-related cash receipts. Credit voucher examples: Cash received from debtors; sale of goods for cash; sale of investments or fixed assets for cash, etc.

The cash voucher form should have spaces for the name of the cash recipient, their initials, the sum of money sent, the date, the reason for the transfer, and the account code to which you should charge the money.

Select a template that suits your needs. Customise and fill in all the necessary details. Use your brand’s name and mention details about goods and services. Save the format for future reference.

A credit voucher serves as proof of a cash or cheque payment. Credit vouchers are made if someone gives us cash.

A credit voucher includes the amount of money used to purchase it at the time of purchase. It cannot be traded for cash and has no cash redemption value.