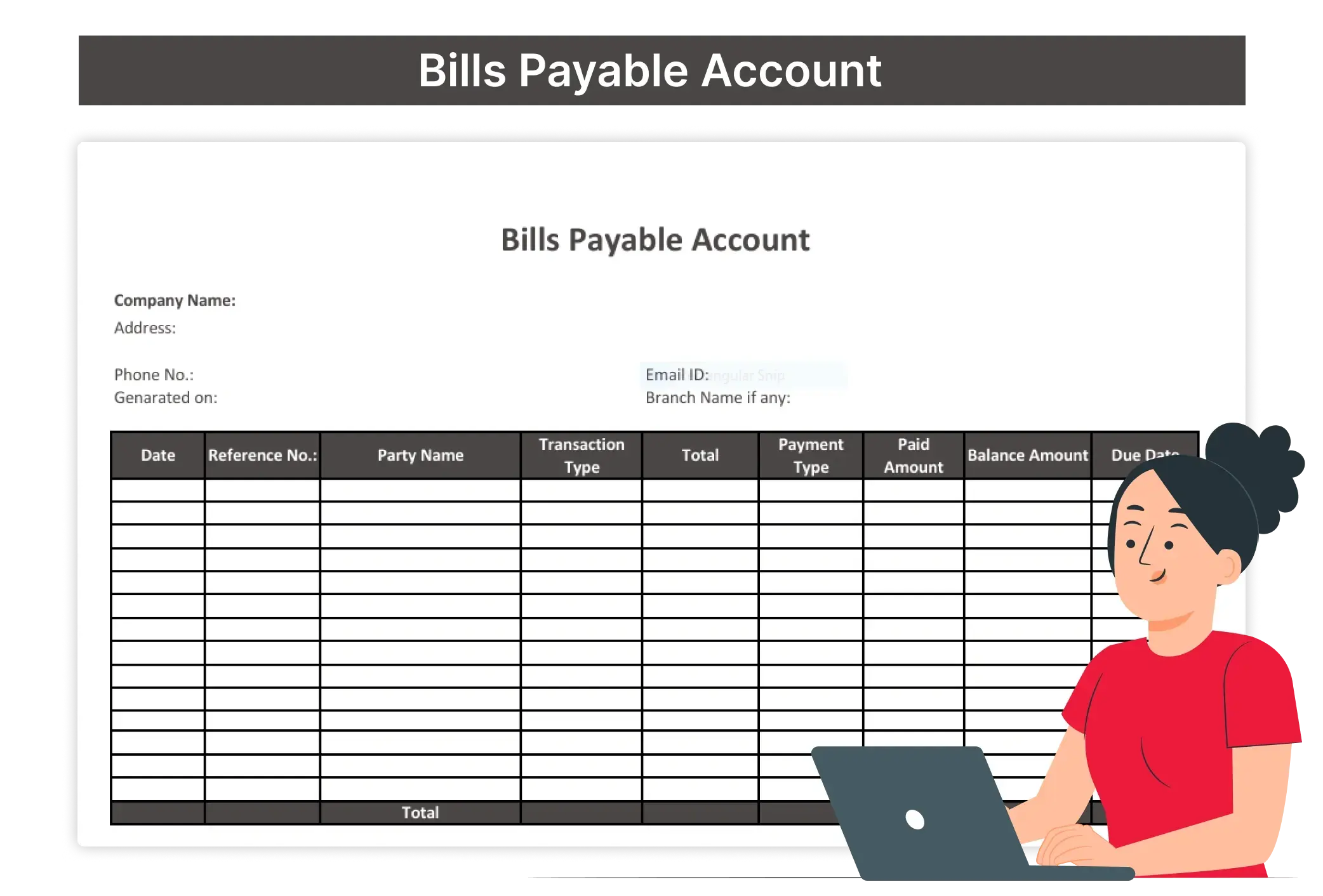

Bills Payable Account Format

Maintain financial clarity with a structured Bills Payable Account Format that ensures accurate recording of every bill payable and better control over outstanding payments.

- ⚡️ Organised bills payable ledger structure

- ⚡ Clear entry format with example

- ⚡️ Better control over due payments

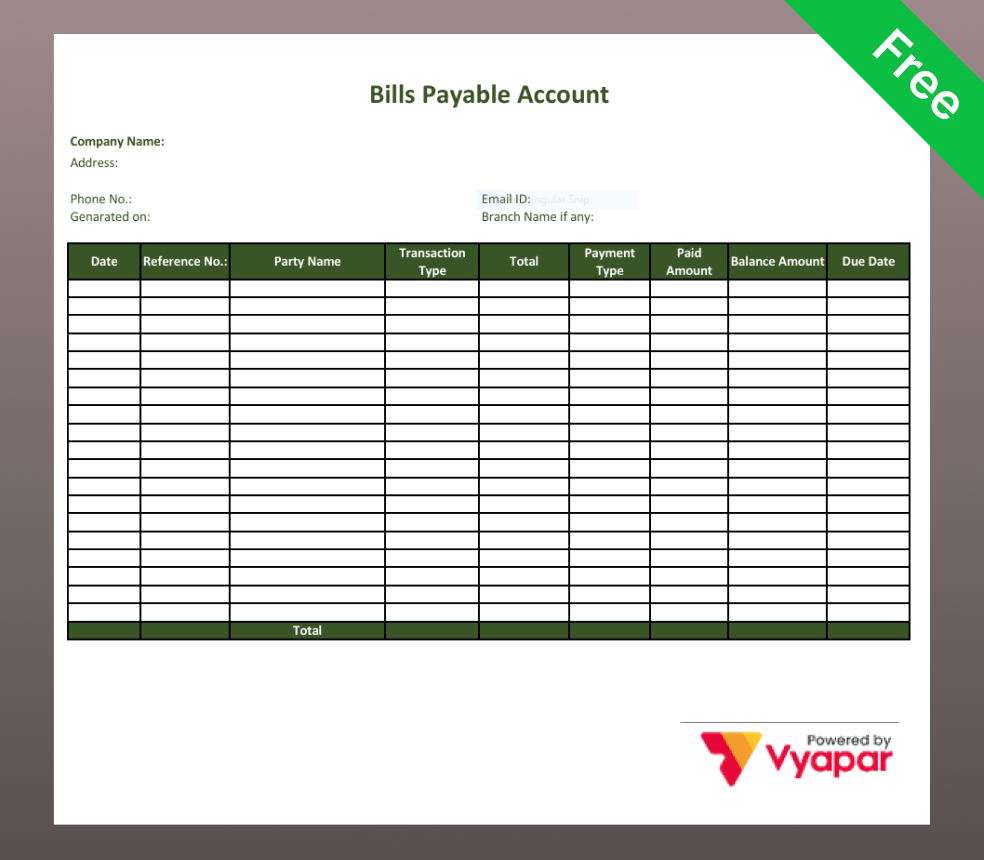

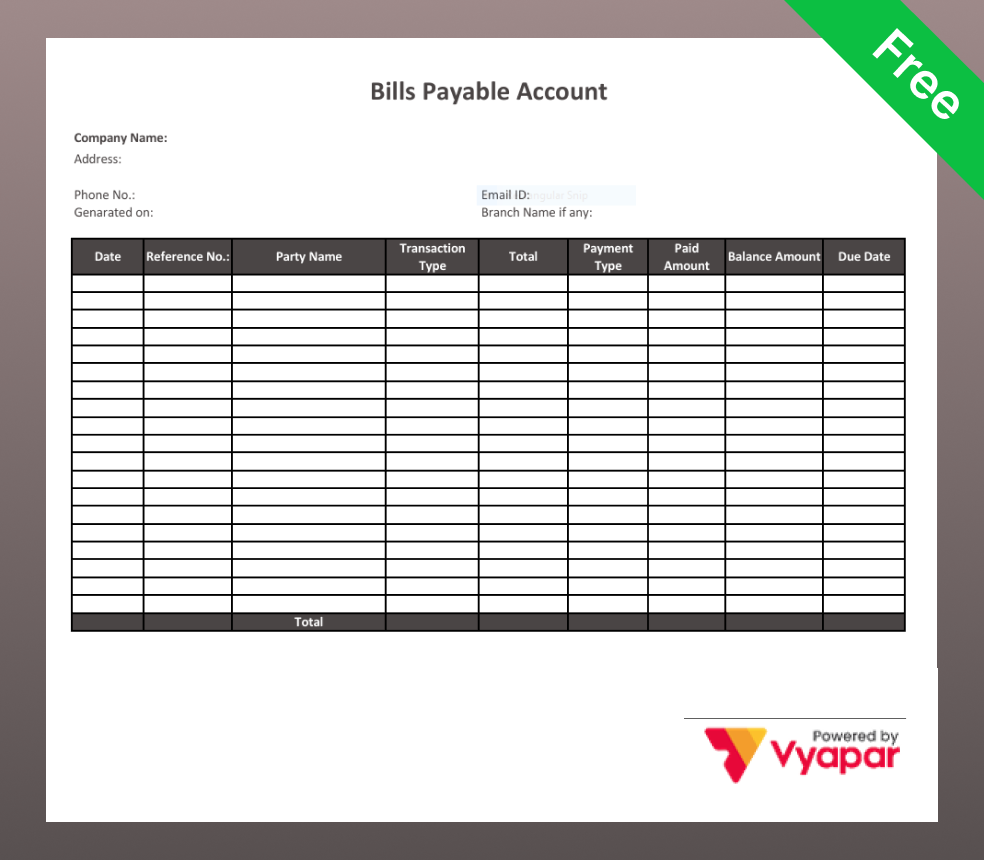

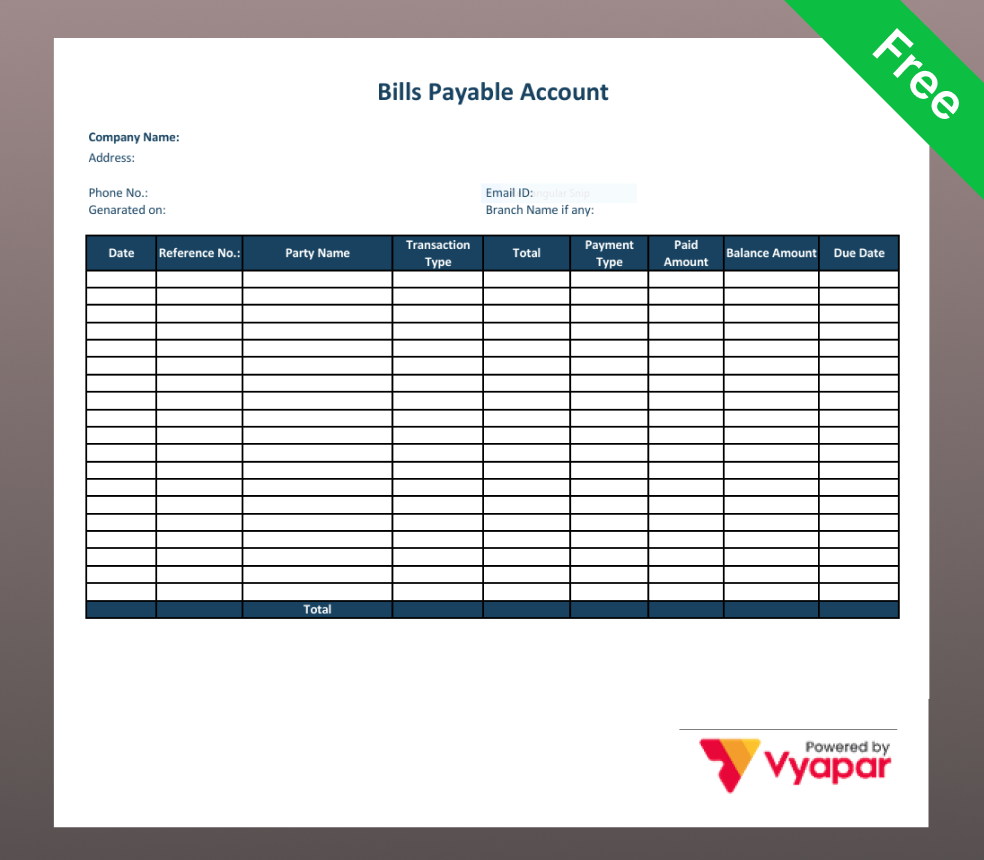

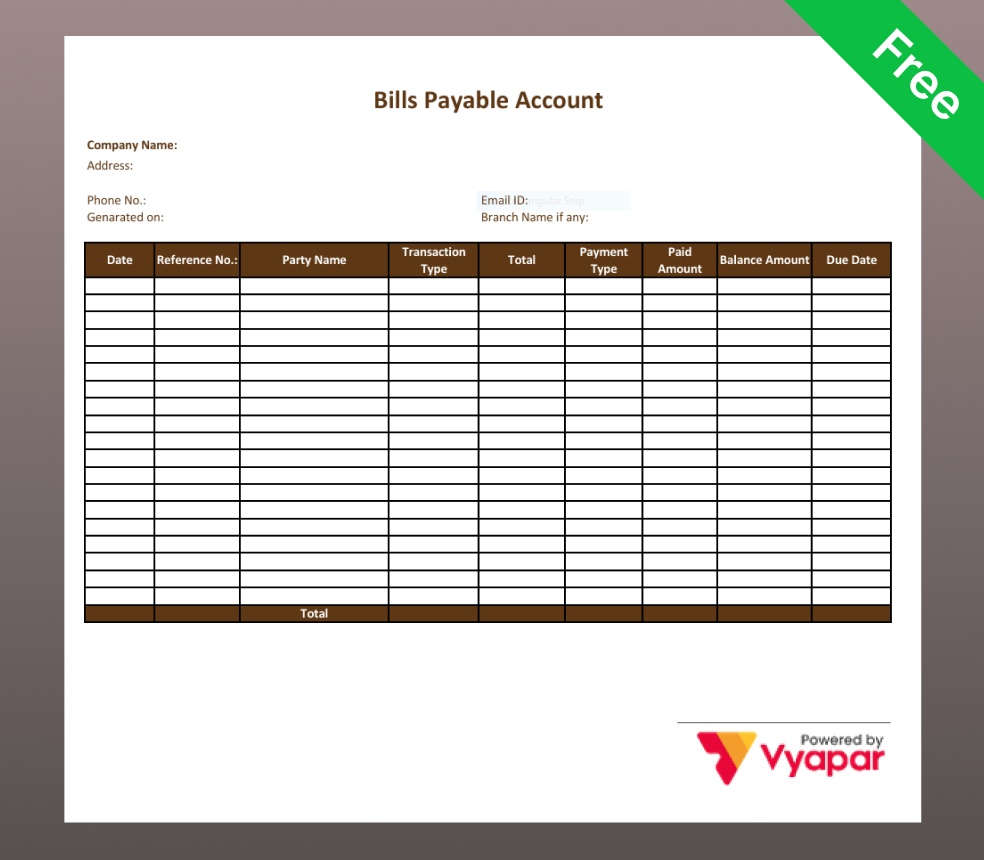

Download Bills Payable Account Formats

Download Bills Payable Account Formats in Excel, Word, or PDF based on your business requirements.

Bills Payable Account Formats in Word

Word format works well for manual documentation.

Bills Payable Account Formats in Excel

Excel format is ideal for calculations and automatic balance tracking.

Bills Payable Account Formats in PDF

PDF format is suitable for printing and record-keeping.

Downloaded the Template? Now Make It Automatic.

Details Required in the Bills Payable Account Format

To properly track your pending payments, make sure the following details are filled correctly:

- Company Information: Enter the company name, address, contact details, branch name (if any), generated date, and reference number to identify the report clearly.

- Date and Transaction Type: Record the transaction date and specify the type (such as purchase or payment) to maintain a clear record of bill activity.

- Party Name and Reference Number: Mention the supplier name and bill or invoice reference number to track each payable accurately.

- Total Bill Amount and Due Date: Enter the total payable amount and clearly mention the due date to avoid late payments.

- Payment Type and Paid Amount: Record how the payment was made (cash, bank, UPI, cheque, etc.) and the amount paid to track full or partial settlements.

- Balance Amount: Check the remaining balance amount to know how much is still pending and manage outstanding liabilities effectively.

Who Can Use This Bill’s Payable Format?

This bill’s payable format is suitable for any business that purchases goods or services on credit and needs systematic liability tracking.

Small shop owners

Manage daily supplier dues efficiently.

Wholesalers

Track bulk purchase payments and vendor commitments.

Retail businesses

Monitor inventory-related outstanding bills.

Accountants

Maintain structured payable records for clients.

Service providers

Organise vendor payments and due schedules.

Businesses handling credit purchases

Track short-term liabilities accurately.

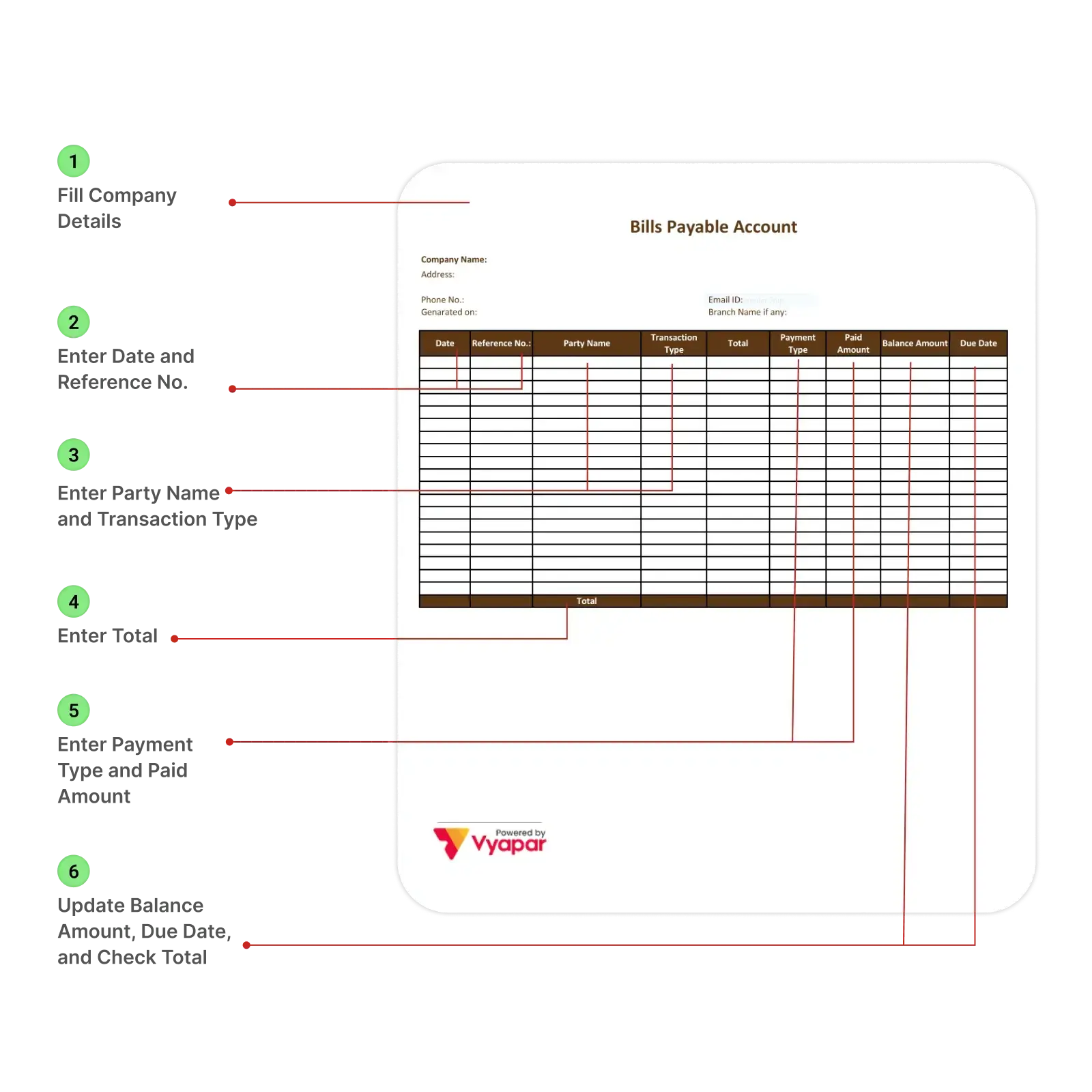

How to Use a Bills Payable Account Format

Step 1: Fill Company Details: Enter the Company Name, Address, Phone No., Email ID, Generated on, and Branch Name, if any, at the top of the sheet.

Step 2: Enter Date and Reference No: Fill in the Date and Reference No. for each transaction. This helps track when the bill was created and links it to the correct invoice.

Step 3: Enter Party Name and Transaction Type: Record the Party Name and select the appropriate Transaction Type. This ensures you know which supplier the bill belongs to and what kind of transaction it is.

Step 4: Enter Total: Enter the full bill amount in the Total column. This shows the total amount payable for that entry.

Step 5: Enter Payment Type and Paid Amount: When payment is made, update the Payment Type and the Paid Amount. This helps track whether the bill is fully paid or partially settled.

Step 6: Update Balance Amount, Due Date, and Check Total: Maintain the Balance Amount and mention the Due Date to monitor pending payments. Review the bottom Total row to verify overall payable amounts.

Accounts Payable vs Bills Payable

| Feature | Bills Payable | Accounts Payable |

|---|---|---|

| Meaning | Written promise to pay later | Money owed to suppliers |

| Documentation | Promissory note / Bill of exchange | Invoice / Purchase bill |

| Formal Agreement | Yes | No |

| Payment Period | Usually longer | Usually short-term |

| Transferable | Yes | No |

| Interest | Often charged | Usually not charged |

Key Benefits of Using Bills Payable Account Format

- Tracks Outstanding Supplier Payments Clearly: All pending bills and supplier details are listed properly. You can quickly see the total amount due.

- Prevents Late Payment Penalties: Due dates are clearly mentioned. This helps avoid late fees and maintain good supplier relationships.

- Maintains Structured Financial Records: All payment records stay organised and easy to check. This makes accounting and audits simple.

- Improves Cash Flow Planning: Upcoming payments are visible in advance. This helps manage money better and avoid cash shortages.

Ready to Manage Bills Like a Pro?

Switch to Automated Bills Payable Management

with Vyapar App

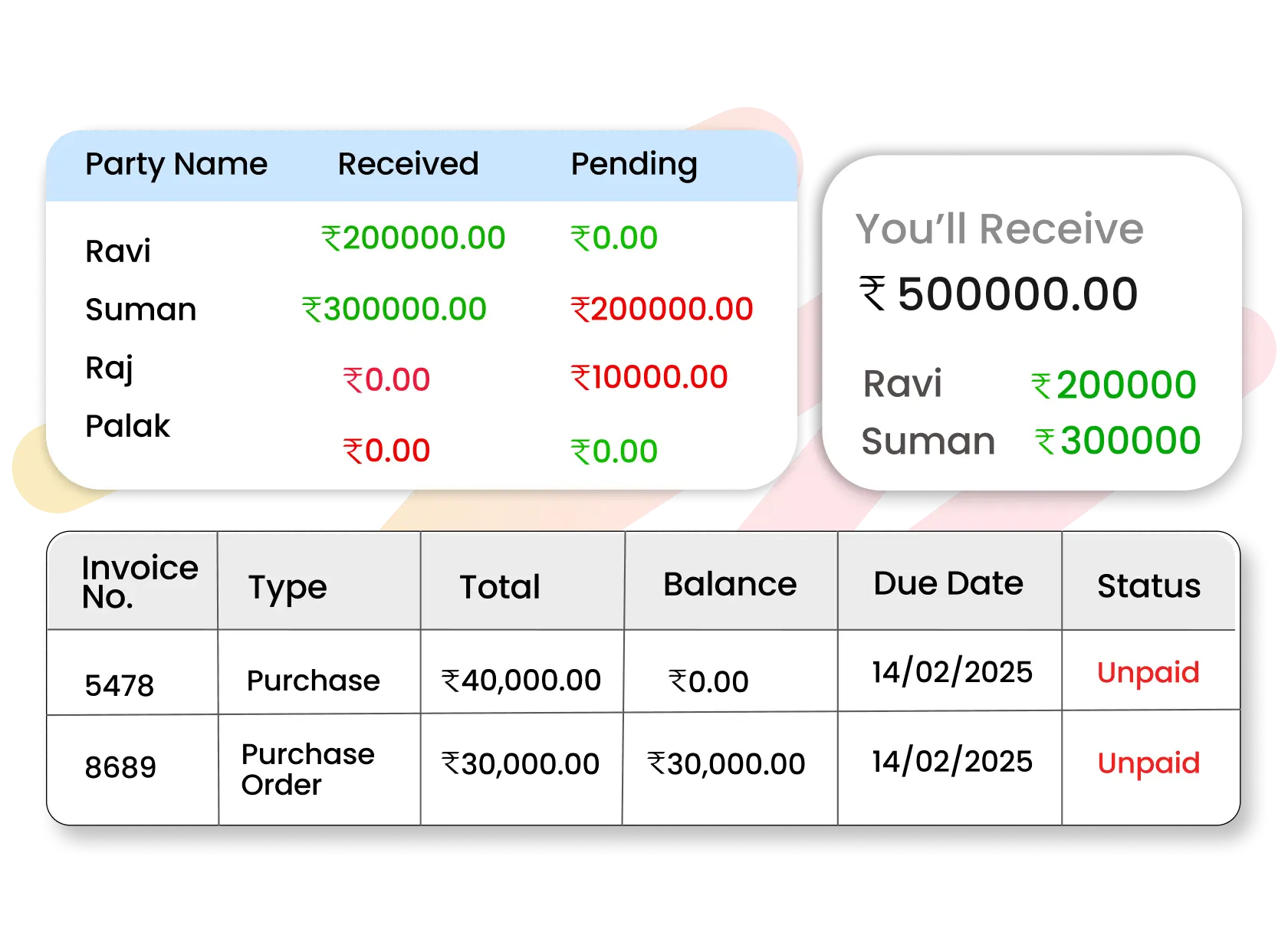

Auto-calculate Supplier Outstanding Balances

Auto-calculate Supplier Outstanding Balances

Outstanding amounts update automatically when a bill is added or a payment is recorded. No manual calculations are required. This reduces mistakes and keeps payable data accurate in real time.

Maintain Supplier-wise Ledger Instantly

Maintain Supplier-wise Ledger Instantly

Complete transaction history for each supplier is available in one place. You can quickly check total purchases, payments made, and pending amounts. This improves clarity and simplifies reconciliation.

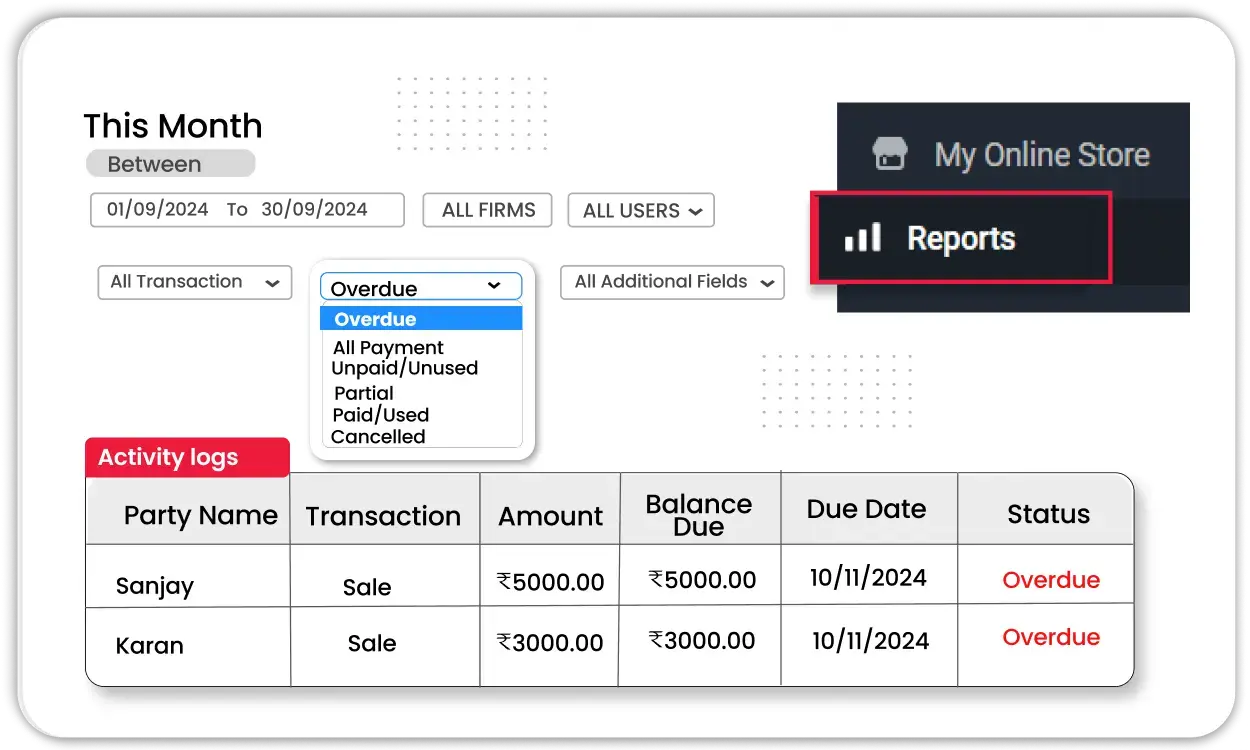

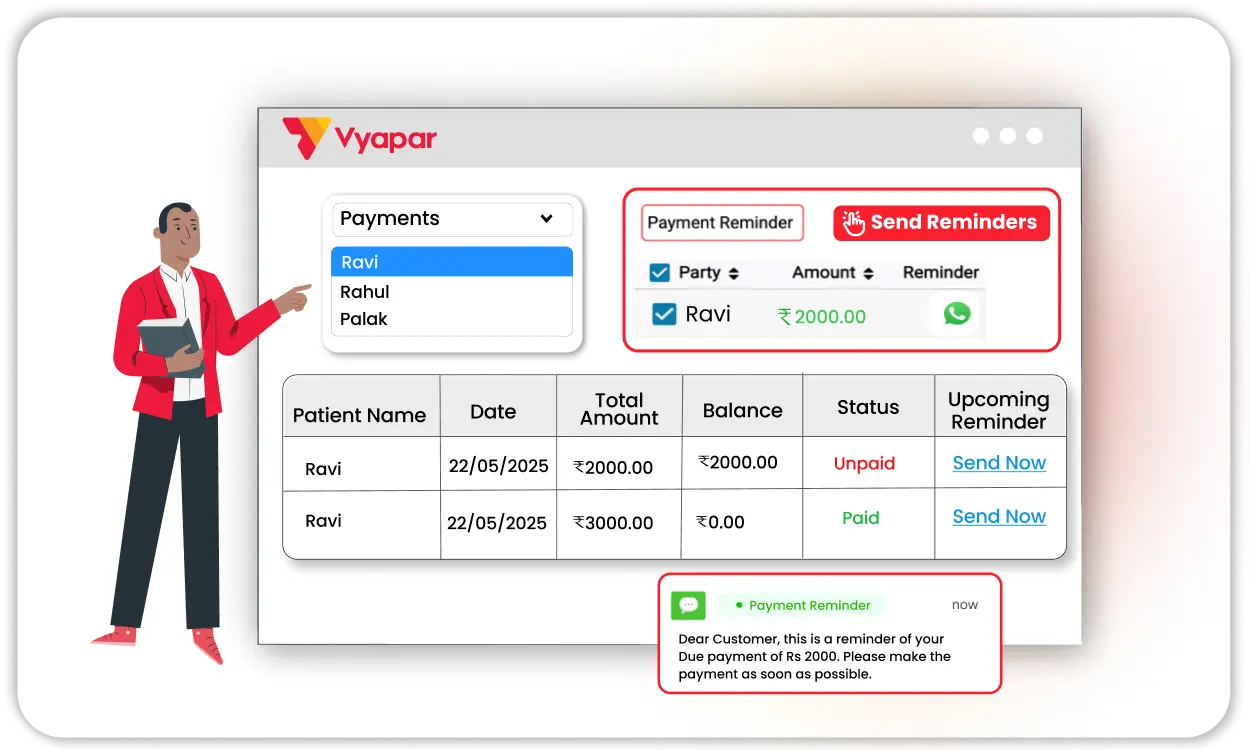

Set Due Date Reminders

Set Due Date Reminders

Automatic reminders are generated for upcoming and overdue payments. This helps avoid late fees and interest charges. Timely alerts also improve vendor relationships.

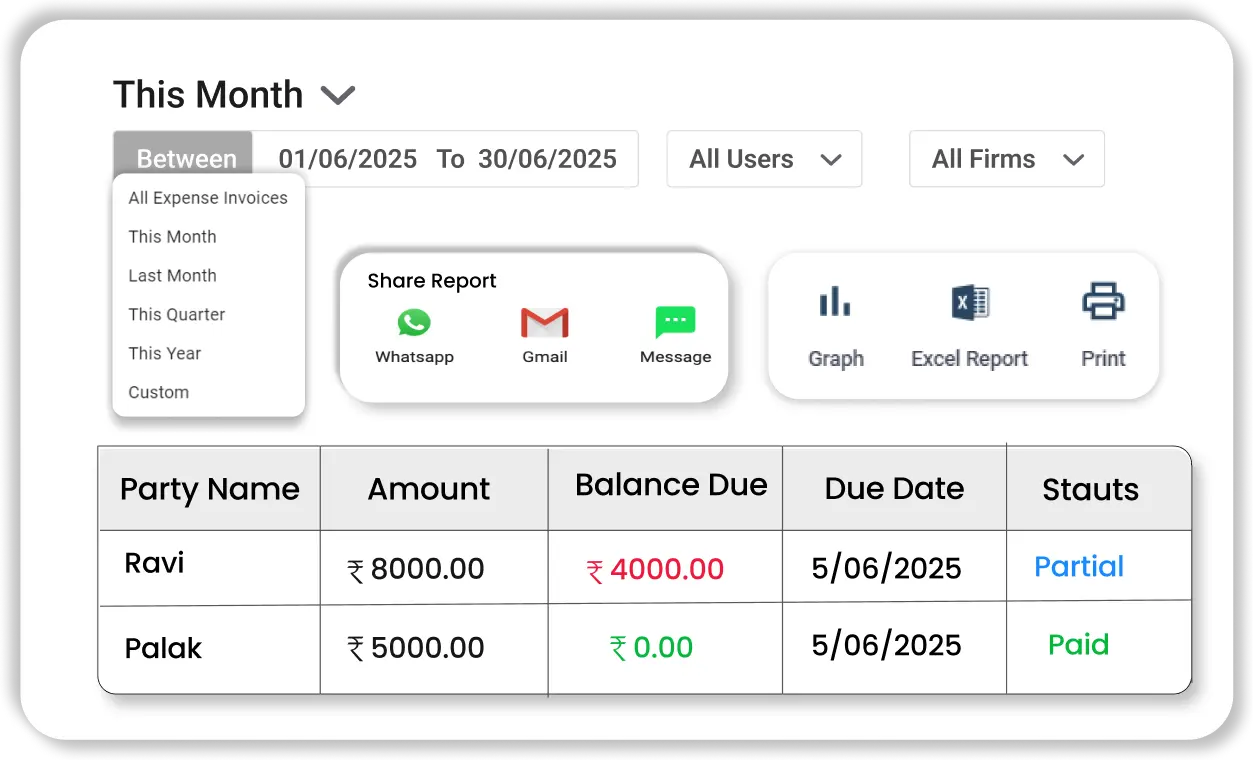

Generate Payable Reports in Excel or PDF

Generate Payable Reports in Excel or PDF

Structured bills payable reports can be exported easily. These reports are useful for audits, financial reviews, and internal analysis. Data remains professional and ready for sharing.

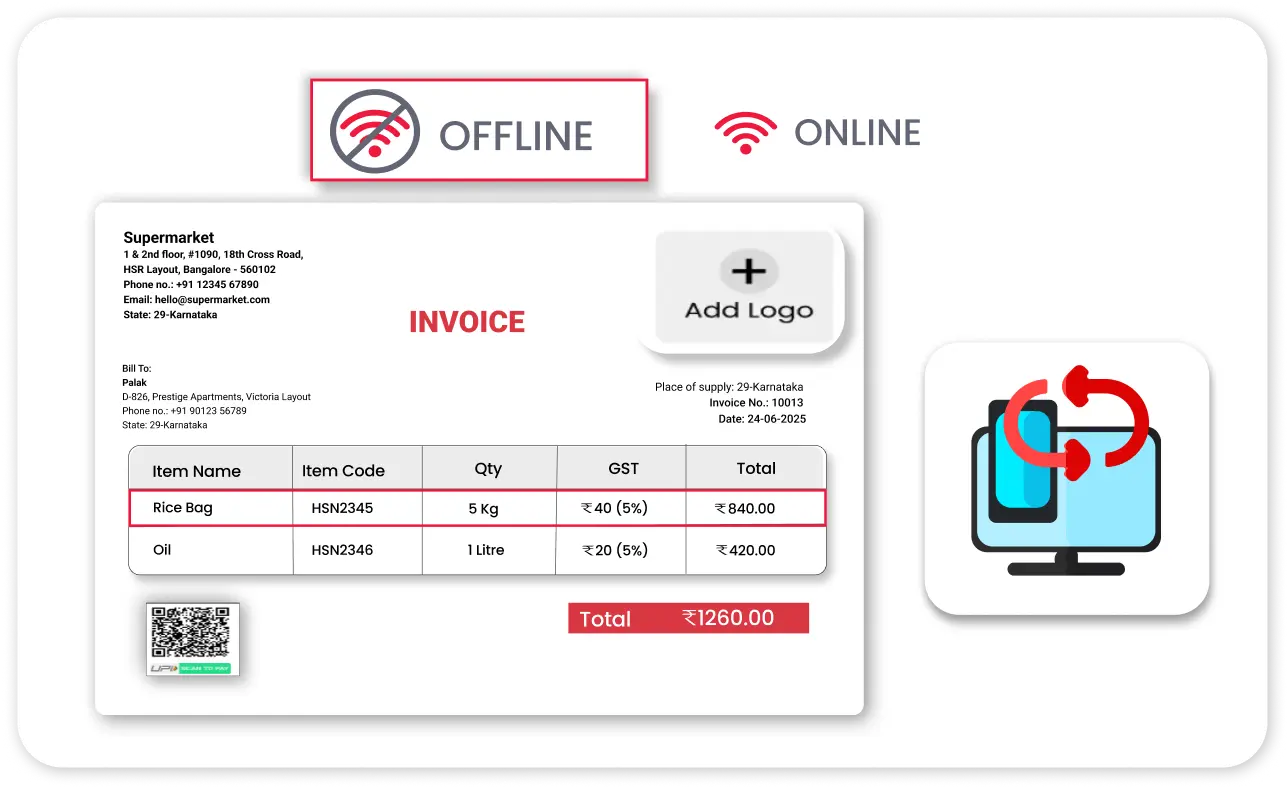

Access Data Offline and Sync Securely

Access Data Offline and Sync Securely

Work can continue even without internet access. Data syncs securely once the connection is restored. Business information stays protected and uninterrupted.

Get a Free Demo

Frequently Asked Questions (FAQ’s)

A bills payable account format is a structured accounting template used to record written payment commitments made by a business. It includes bill number, supplier details, due date, debit and credit entries, and outstanding balance.

A bills payable ledger format is a table used to track accepted bills and related payments chronologically. It shows the remaining payable balance after each transaction.

Create columns for date, description, debit, credit, due date, and balance. Record the bill when accepted and update the ledger when payment is made.

When a bill is accepted, debit the supplier or purchase account and credit the bills payable account. When payment is made, debit the bills payable account and credit cash or bank.

Yes, bills payable are classified under current liabilities because it represents short-term financial obligations payable within an accounting period.

Bills payable arise from formal written commitments such as promissory notes, while accounts payable relate to routine supplier invoices without a written loan agreement.

Did not find what you were looking for?