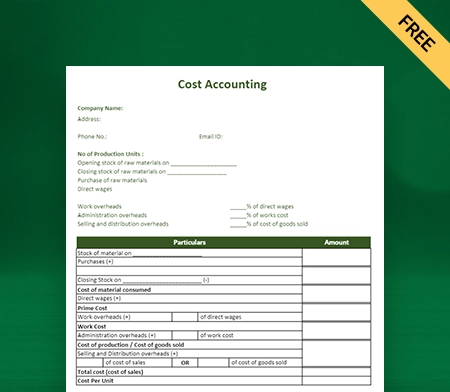

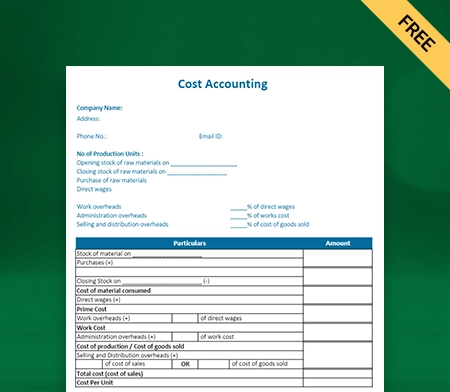

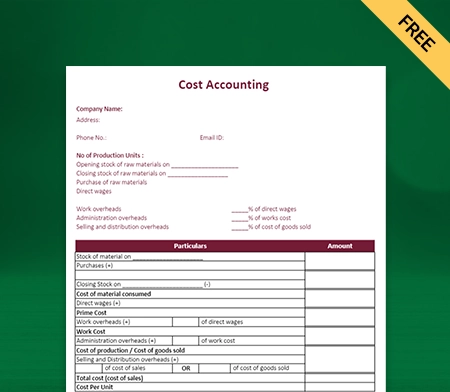

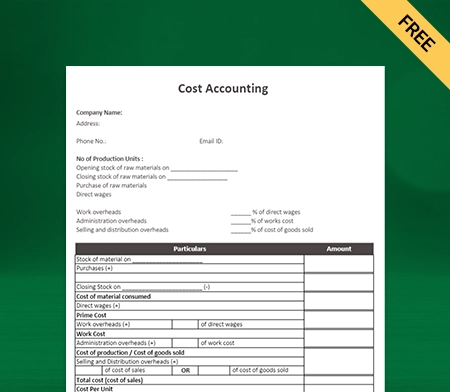

Cost Accounting Format

Vyapar is a comprehensive solution to capture a company’s total cost of production by assessing the variable cost of each step of production and fixed costs such as lease expenses. Get started with the best cost accounting format for free. Try out the trial for 7 days!

Download Cost Accounting Format in Excel

What is Cost Accounting Format?

A cost accounting format is prepared to analyze a firm’s cost structure during an accounting period. The cost accounting format PDF would consist of the cost of production, sales, income generated by a business, and various other factors.

Cost accounting aims to provide an overview of how the company handles its operational analysis of business management. It can efficiently help to report and analyze and let you work positively towards the internal cost controls and their efficiency.

Importance Of Cost Accounting Format

Multiple activities go on in a company, such as the price of a product, cost per unit, variable cost, cost incurred, selling and distribution overheads, etc. Let’s find out the importance of cost accounting in managing the overall cost operations of a company.

1. Calculate the Total Cost Break-Up Effortlessly:

The cost accounting format consists of various factors that make it convenient for an entrepreneur to know their company well. For instance, It is a complete pack of prime cost direct material, estimated cost sheet, factory overhead, works cost, cost sheet format, and each expense it takes to build the product.

Thus, Vyapar makes it easier to calculate the total cost effortlessly so that it becomes easier for an entrepreneur to see where they can push their boundaries and where they need to stop spending.

2. Helps Manage Your Budget:

Cost accounting is an effective way to let your business focus on controlling from cost incurred to the total cost of the product. It effectively works on how a company can manage its budget and meet its fullest potential.

For instance: If the cost accounting format PDF shows that increasing the cost of labour could increase the company’s overall efficiency rather than wasting the cost over incurring extra machinery.

Similarly, it helps in various other ways to balance and manage your budget for business operations.

3. Make Managerial Decisions Conveniently:

While making managerial decisions, the most important element is the cost sheet. Everyone knows how important it is to know about the cost that the company spends on its overall activities.

The cost accounting format helps in making these decisions conveniently. It shows the entire costs, including material consumed, variable cost, labour cost, and the overall cost that the company incurred during the specific period.

4. Analyze Your Sales Data:

Creating a cost sheet becomes important when you need to fix the selling price of the product. Here comes the role of managing the cost accounting format PDF so that you can avoid getting tangled while fixing the price of your product.

The cost accounting format not only provides the current cost sheet but also shows you your company’s previous cost sheets and helps you see the variation in sales data.

Thus, the cost sheet is prepared to give you a clear picture to analyze your sales data.

5. Helps In Cost Comparison:

It helps the company compare its present per-cost unit with the previous one. It can compare what leads to a change in the cost of production per unit by simply comparing the cost sheet.

Overall, the Cost accounting format PDF at platforms such as billing software Vyapar saves your entire data (current and previous cost accounting data). This lets you compare the increase and decrease of the costs incurred by your company during the different accounting years.

6. Makes Price Discrimination Convenient:

Do you know how management finds the most appropriate price for its product? Well, first, the company distinguishes between fixed and variable costs, and then the outcome is used by the company to set the best price for their products.

With the help of the cost accounting format, the management could set a price that is neither too high nor too low. For instance: a company can lower the price of production by controlling variable costs during the depression period to fix its prices.

7. Confronting Depression:

Cost control is important during the discouragement period. The selling cost ought to be the most minimal. If thus, the business can make due.

The least selling cost is fixed by diminishing the essential costs, avoiding high costs, choosing a new item, seeking through new deals regions, outlining new deals strategy, making cost cognizance, lessening the wastage, redirecting to a new line of exercises and such. Thus, an association might confront the downturn for compelling work.

How Does Vyapar Help In Managing Cost Accounting Format?

Vyapar Cost Accounting software helps create a professional brand identity with a useful GST billing feature. You can use Vyapar’s cost accounting format software and billing system to manage the invoices for your business. It ensures you provide up-to-the-mark service authorized by the government of India.

Vyapar undoubtedly provides an error-free service to ensure your business’s data management and security. It has a facility of online and offline modes where you can also easily generate the cost accounting format in a few steps.

Benefits Of Using Vyapar To Manage Your Cost Accounting

Accounting Software Vyapar has been a platform of trust for more than one crore people in India. It has become the easiest way to manage various companies’ billing, inventory, and accounting needs. Here are a few reasons why you should choose Vyapar for your company:

1. Time And Cost Saving:

Vyapar soothes the billing process by reducing the time taken on manual invoicing. Our cost accounting software can help you automate tasks like calculating the cost per unit, estimating the cost, managing expenses, etc.

The Invoicing software provides a centralized repository for storing and managing legal documents. With easy access to documents, you can quickly retrieve information. It becomes easy to share files securely.

It streamlines the billing workflow and saves valuable time. This increased efficiency leads to cost savings by reducing the need for additional staff or resources.

2. Accurate And Error-Free Cost Accounting:

Vyapar automates the cost accounting process and is highly known for its accuracy and error-free work. It takes care to add up every cost incurred by the company. From prime cost to final cost, it includes all details. It helps save time and reduce the likelihood of errors.

Vyapar can send automated payment reminders to clients for outstanding utility invoices. This helps businesses maintain a healthy cash flow by reducing payment delays.

3. Transparent And Detailed Work:

Are you looking for simple cost accounting software which ensures that your cost sheet is made with detailed work and transparency? Vyapar is here to help you out.

Vyapar provides transparent and detailed work to its clients to ensure client satisfaction. Over one crore entrepreneurs have been using Vyapar to enjoy the stress-free cost accounting feature.

4. Efficient Time Tracking:

Vyapar introduced a time-tracking feature to ensure orders are fulfilled at the right time. The time tracking feature could track any task to be completed in a given time frame.

Vyapar helps satisfy customers to get their orders done at the right time. Also, you can attach tax invoices with orders and track if payment is due using the app.

With Vyapar, your dashboard would look more manageable and time-tracking. Yes, you can keep track of time as well as sales, such as sales in your store and production time tracking. The Free billing software helps you save the time required to manage your business.

Using the observations, you can change your business strategy in a timely manner. It ensures that your business operates effectively. All of this using the free invoicing software.

5. Building A Positive Brand Image:

Vyapar is also known for its trusting culture. By using our quotes and estimates, you can easily build a positive brand image, and in the end, you can present a transparent deal for closure with the help of Vyapar.

Here you can use your brand logo, colours, font or any symbol in your invoice, as it will enhance the impact of your brand’s identity. Any buyer would get attracted towards professional custom quotation formats rather than plain text.

The customized quote gets more trust and includes all the information required to make a deal. The data in the quotes also provide service/product descriptions, offers, taxes and also terms of sale.

6. Create GST Reports Effortlessly:

Our top-notch GST billing software enables you to create your GST reports effortlessly. This feature helps automate your bill requirements regardless of the size of the business.

You can easily use free billing software with GST to manage the various accounting requirements of your business. You can easily customize your accounting requirements in a particular customized field.

Vyapar helps you to generate GST invoice formats with just a click with a choice to print or share them with clients. Barcode scanners could also speed up your billing process with shortcut keys that can do wonders in your task.

With the help of this feature, anyone can easily manage due dates in the invoice and track old invoices anytime. Not only this, Vyapar allows you to track any overdue payments quickly.

7. Seamless Business Management:

Vyapar allows you to create useful documents easily with free billing software. Inbuilt features such as quotations, estimates, GST invoices, and cost accounting allow you to manage your business seamlessly.

You can manage and share your data easily through whatsapp, email, sms or printing. Further, you can use Vyapar offers to save time and manage your business efficiently.

Using business accounting software, you can manage your business with higher productivity. The app ensures professionalism for every company to meet their trust.

8. Automatic Data Backup:

Vyapar is a 100% secure app to store your data accurately. Our free accounting app helps you to save your data by creating local, external or online google drive.

GST Invoicing and accounting software could easily recover the data quickly. Additionally, Vyapar in India comes with hassle-free automatic backup, so you dont lose anything.

Over one crore businesses in India have used this free invoicing and accounting software to do the job quickly with added data security. The inscription system helps to provide data with security and privacy to the owner so that their security is enhanced.

Scope Of Cost Accounting Format

Cost accounting, in simple words, keeps track of all the costs incurred by the industry. A cost accountant is a person who takes care of keeping track of all types of costs being done during the accounting period.

There are various scopes of cost accounting format PDF that you should know properly. The crucial scope of cost accounting is discussed below briefly. Any cost accounting department must work according to the scope. Here, you can go through them:

1. Cost Ascertainment:

Cost ascertainment helps in determining the cost being incurred in producing any good. It evaluates or gives you a rough sketch of the future cost before the production starts with the help of past cost adjustments for anticipating future changes.

2. Cost Accounting:

On an important note, cost accounting helps keep track of the money being spent by a company, how much it is earning from it and where the money is being lost. It allows companies to note costs that include a company’s product, service, and any other activity that involves the company.

3. Cost Control:

Cost accounting helps you know about your entire cost spent on production. It includes every minor detail about the cost of making the final product. So cost accounting will provide the cost list and let you analyze where you are spending uselessly and where you need to spend more. Thus it enables “cost control” at various levels of the production process.

Thus Cost accounting format PDF helps in decision-making for any company. Various organizations used to hire experienced cost accountants only who can carefully make the cost sheet.

How To Use Cost Accounting Format PDF?

The cost accounting format could be easily used to keep track of cost-to-cost objects that generally include the company’s products, services and all the activities that involve the company. Cost accounting PDF is helpful because it helps entrepreneurs to analyze where the company is spending its money, how it is earning from it and any loss that the company is going through.

Many companies use cost accounting format PDF to save their cost sheet data. This makes a company capable of comparing its present and previous cost sheets. This helps analyze what changes are good for their company and which are not.

Cost accounting format PDF is required for companies selling goods and services. It doesn’t matter the size of the company or how strong its investment is; Cost accounting is the need of all.

Using the best Cost accounting format by Vyapar helps you to create a transparent and detailed cost sheet. You can see all the detailed work and choose different themes for different costs.

Frequently Asked Questions (FAQs’)

The cost accounting format consists of the cost that the business incurs from the initial production stage to the closing stock of finished goods. Companies can conveniently analyze the best price for their products and services using this format.

It also lets you quickly compare your present cost sheet with the previous ones. This would further help you decide whether the cost per unit could be increased or decreased.

The sheet contains the following:

1. Cost per unit of a product

2. Total cost

3. Selling price

4. The price of a product

5. Variable cost

6. Cost incurred

7. Estimated costs

8. Selling and distribution overheads

9. Management for cost control

10. Summary of the total cost of production and various other components

Various other things are included in the cost sheet, but the crucial components are mentioned above.

Cost sheets are highly important in the following ways:

It helps settle the final cost for your business’s product. It calculates the cost per unit and the total cost of a product.

Using the cost accounting format, you can easily see how various costs, such as fixed and variable costs, lead towards the final cost.

They make it easy for you to calculate your product’s or service’s selling price, including the material and resources used during the production period.

When it comes to changing the price of your product, a comparison is required between the previous cost sheet and the present one. To look into the cost sheet in-depth, compare and find the new price of the product.

Now, after getting every detail in the cost sheet, you can find where you are spending uselessly and where you need to spend more. Thus the cost sheet is important for cost control.

Let us learn about the key components of cost accounting:

1. Prime Cost:

This is also known as basic or first cost; here, you must mention all the expenses involved in the production process.

This includes the cost of labor, the purchased product, the packing cost, and every little cost the company bears while producing a good.

The formula for calculating premium costs is as follows:

Prime Costs = Direct Labour + Direct Raw Material+Direct Expenses.

2. Work Cost:

You can easily get work costs by summing up premium costs and overheads. Overhead costs, such as factory costs, electricity bills, and maintenance costs, are necessary to complete the process, even though they do not directly contribute to the product building.

3. Cost of Production:

This includes all expenses directly related to business operations, thus adding work costs and overhead administration costs and subtracting its remainder from the Opening and Closing Stock of Finished Goods.

4. Cost of Sales:

Also known as total cost, contains all the expenses involved in production and other costs involved in distribution and selling. The cost of sales would let you understand how much you have spent on a product, including the resources used for production.

Below, we list the top 5 commonly used accounting methods.

1. Job Costing: various firms go on to have job work and thus use a costing method.

2. Batch Costing: We use this method when we pre-produce goods without prior demand.

3. Process Costing: This includes the continuously produced goods. We use process costing to determine the cost per production unit for producing these goods in high quantities.

4. Operating Cost: It calculates the cost of service provided to the customers. Service sector companies highly use this method.

5. Contrast Costing: It allows you to track the cost of a specific contract with a specific dealer or customer through contract-based cost calculation.

Creating a cost accounting format is relatively easy. Here are a few steps by which you can easily make your own cost accounting format PDF:

Step1: Calculate Prime Cost

Prime Cost = Direct Material Consumed + Direct Labour + Direct Expenses

(Direct Material= Material Purchased + Opening stock of raw material-Closing stock of raw material.)

Step 2: Calculate The Work Cost

Works cost = Prime Cost + Factory Overheads (Indirect Material + Indirect Labour + Indirect Expenses)+opening Work in progress-Closing work in progress.

Step 3: Calculate Cost Of Production

Cost of Production = Works Cost + Office and Administration overheads + Opening finished goods-Closing finished goods

Step 4: Calculate Total Cost

Total cost = Cost of Production + Selling and Distribution Overheads

Step 5: Finally, Find Profit By

Profit= Sales – Total Cost

Remember, if you want to get all these steps done quickly and correctly, experience the services offered by Vyapar to push the limits of your business to the next level.

Vyapar will provide you with cost accounting services, and you can also experience GST billing software services, a free online logo maker, a free invoice generator and a free online quotation maker.

You can enjoy all these services with just a click without hurting your wallets, only with Vyapar.