Joint Venture Account Format

Managing a joint project with partners? A well-structured Joint Venture Account Format helps you track every rupee clearly and avoid reconciliation of Cost and Financial Accounts Format at the time of settlement.

- ⚡️ Record partner contributions easily

- ⚡ Track project expenses and income accurately

- ⚡️ Calculate profit or loss without errors

Choose Your Preferred Joint Venture Account Format File Type

Select the format that best suits your needs. We offer professional, ready-to-use templates in Excel, Word, and PDF for your business needs.

Joint Venture Account Format in Word

Joint Venture Account Format in Excel

Joint Venture Account Format in PDF

Skip Manual Format. Use Vyapar.

What is a Joint Venture Account?

A joint venture account is prepared to:

- Record expenses incurred by each party

- Track sales or income generated from the venture

- Calculate overall profit or loss

- Distribute profit between partners as agreed

It ensures transparency and prevents disputes between venture partners.

Key Elements Included in the Joint Venture Format

Name of the Joint Venture & Co-Venturers

The format begins with the project name and the names of all partners involved. This clearly identifies the joint venture and the participating co-venturers.

Capital Contribution Details

It records the money, goods, or assets contributed by each partner at the beginning of the venture, forming the base for profit sharing.

Expenses (Purchases, Wages, Transport, etc.)

All project-related costs, such as purchases, wages, transport, and other expenses,s are entered to calculate the total investment in the venture.

Sales or Revenue Details

This section includes all income generated from the joint venture, including sales and other earnings, along with any returns.

Profit or Loss Calculation

The format calculates the net result by comparing total expenses with total revenue to determine profit or loss.

Final Settlement Statement

It shows how the final profit or loss is distributed among partners and records any balance payable or receivable for proper closure.

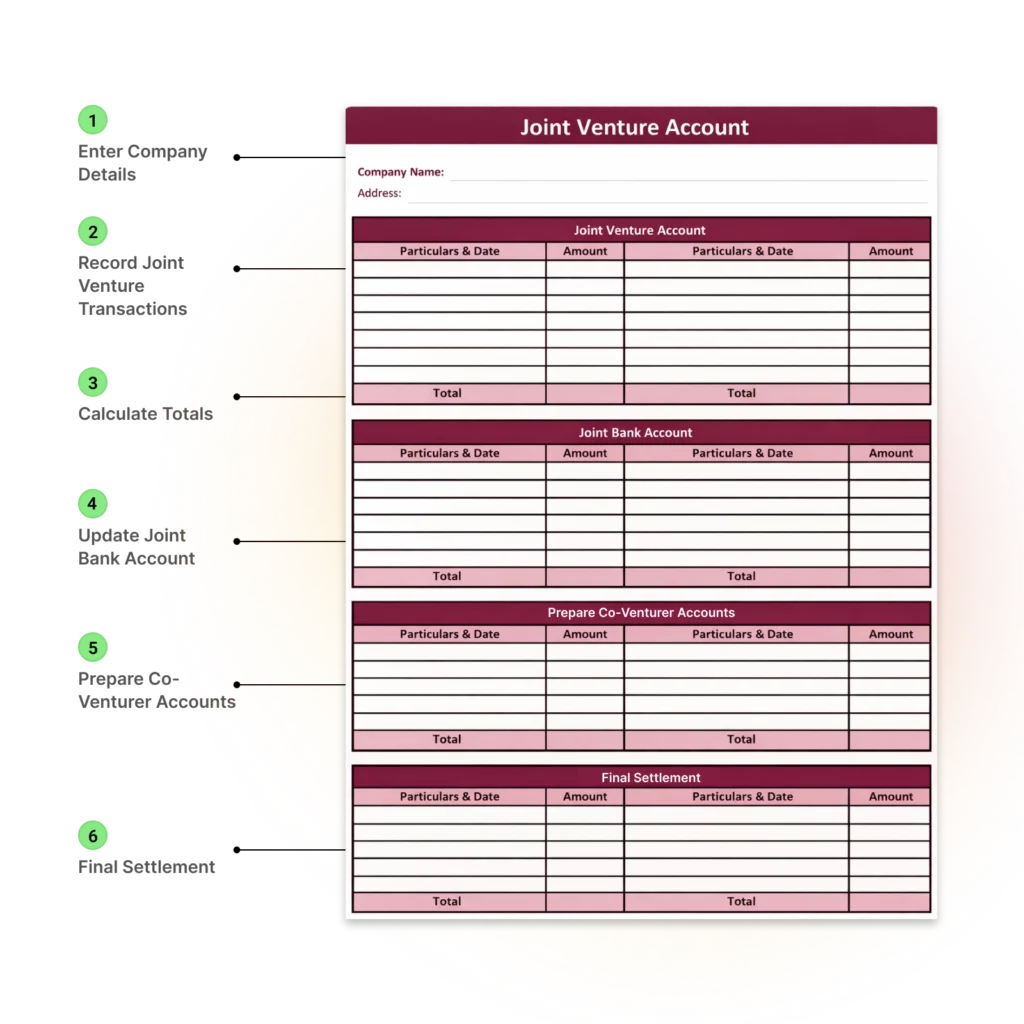

How to Use the Joint Venture Account Format

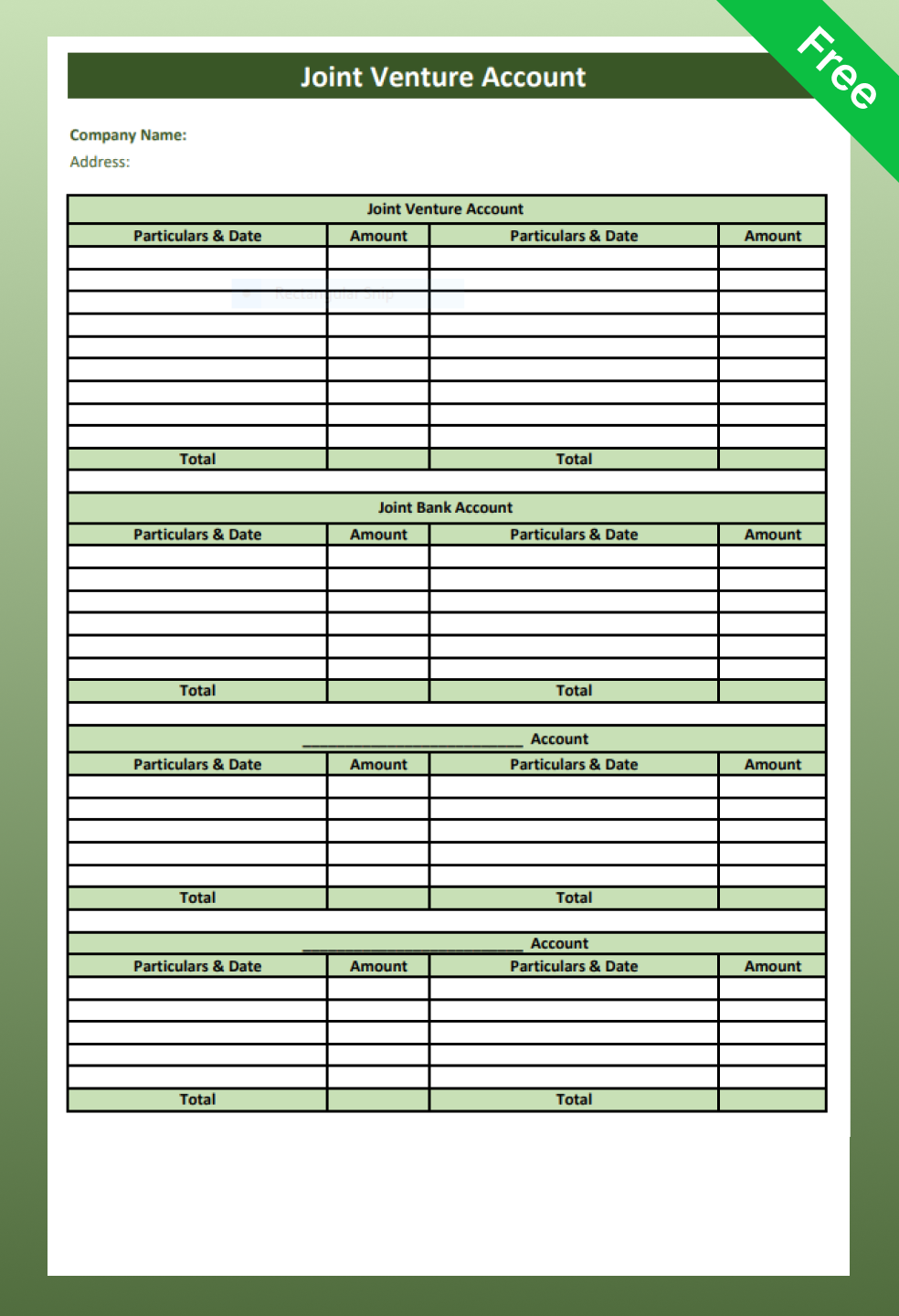

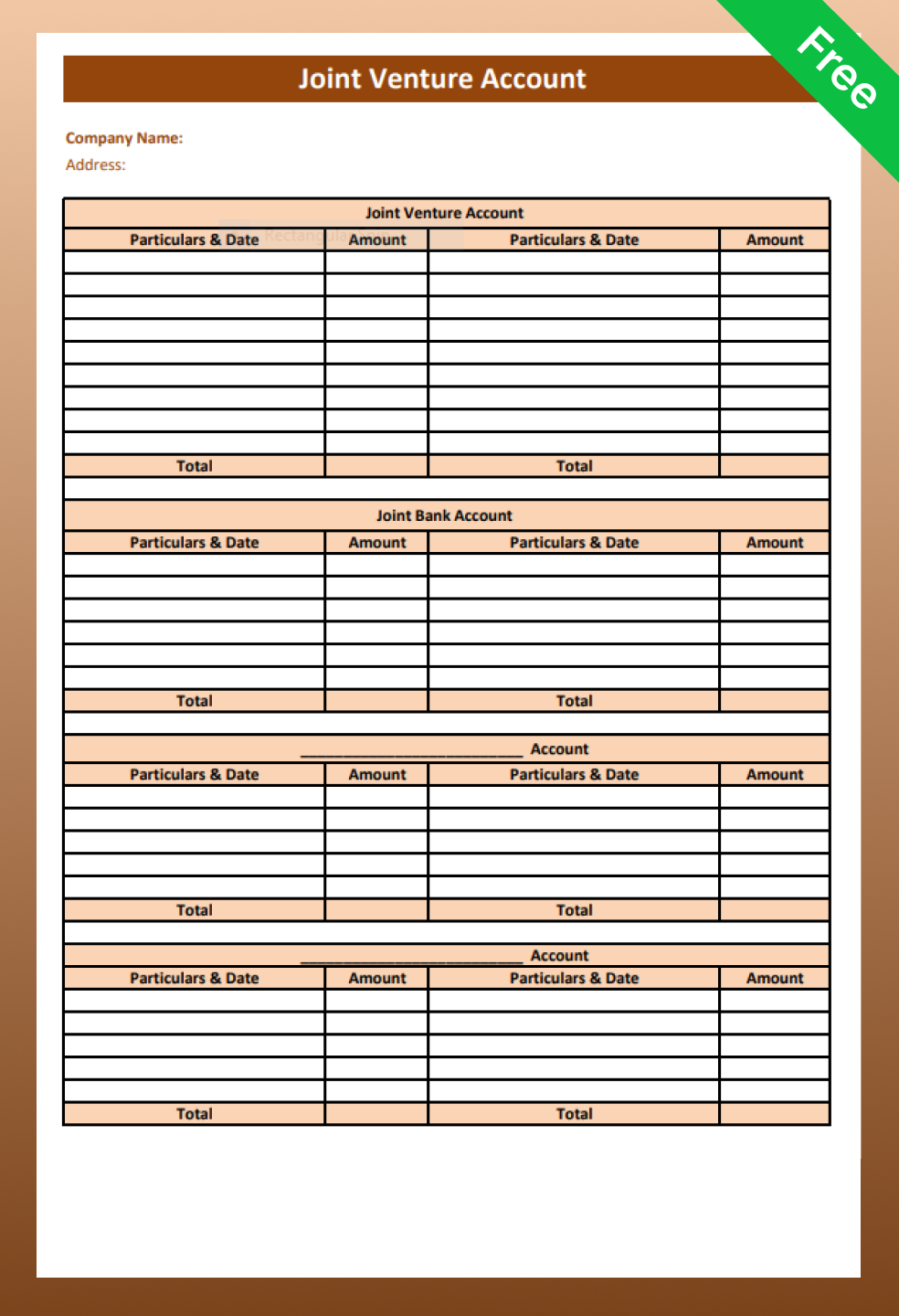

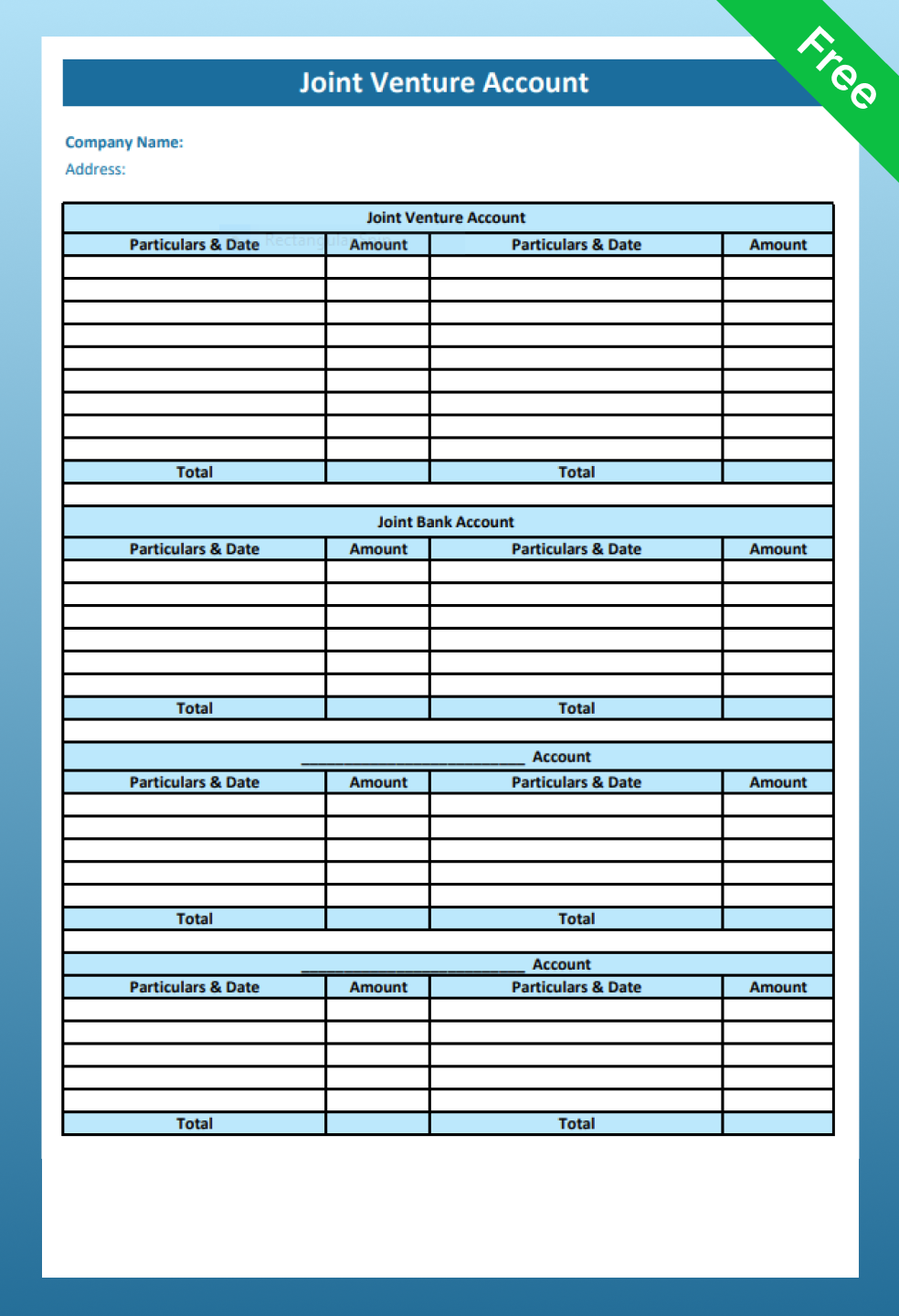

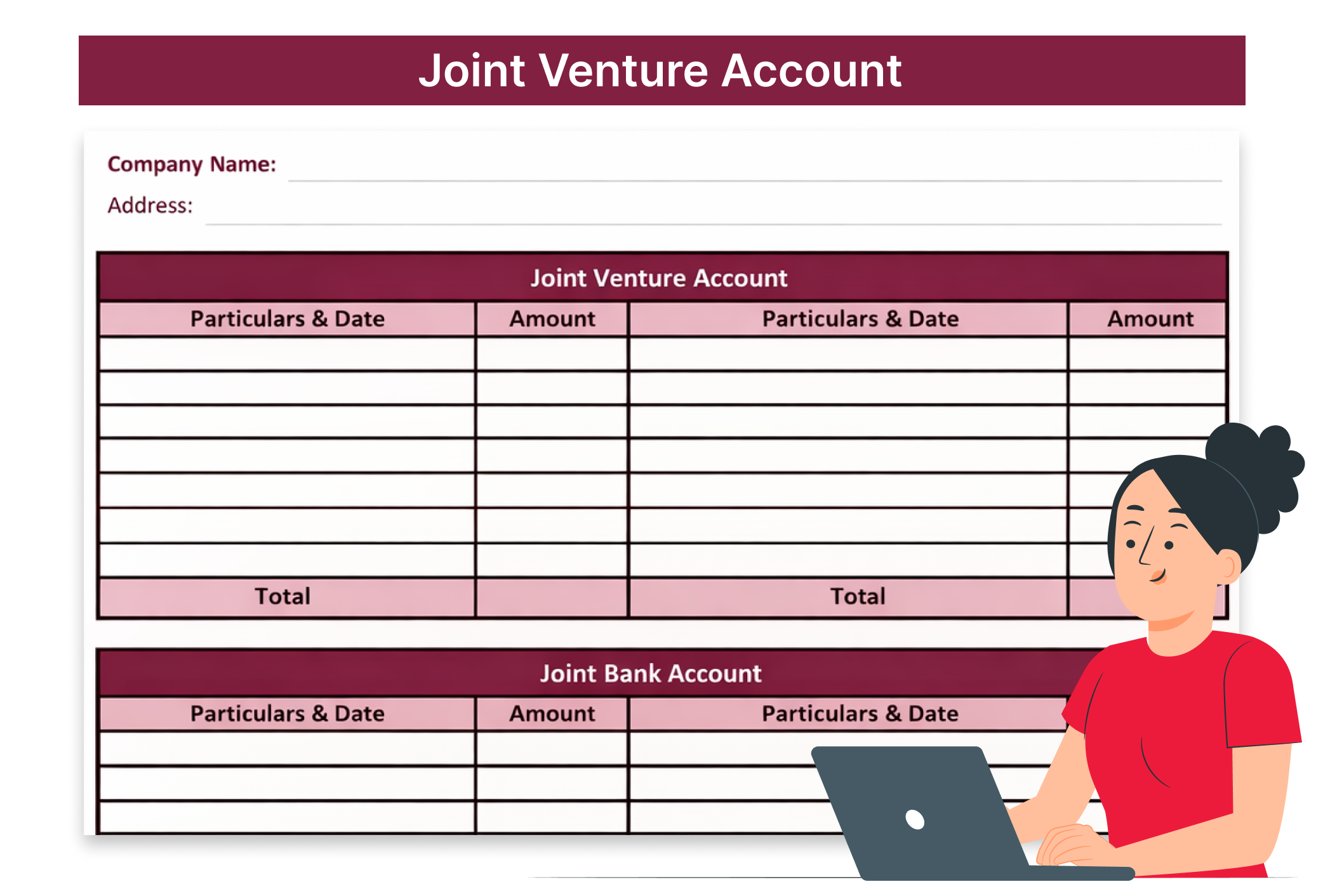

✅ Step 1: Fill Basic Information: Enter the Company Name and Address at the top of the form. This identifies the joint venture and the business involved.

✅ Step 2: Record Transactions in the Joint Venture Account: In the Joint Venture Account, record all expenses and purchases on the debit (left) side. Enter all sales and income on the credit (right) side with dates.

✅ Step 3: Calculate Total Profit/Loss: Add up both sides and calculate the difference to determine profit or loss from the joint venture.

✅ Step 4: Enter Cash Transactions in the Joint Bank Account: In the “Joint Bank Account” section, record all cash received and payments made for the venture, including capital contributions and expense payments.

✅ Step 5: Record Partner Accounts: Use the individual account sections (Co-venturer Accounts) to record each partner’s capital contribution, share of profit/loss, and final settlement amount.

✅ Step 6: Finalise and Balance the Accounts: Ensure totals on both debit and credit sides match. After adjusting profit distribution, the accounts should be balanced and ready for reporting.

Types of Joint Venture Account Format

A Joint Venture Account Format helps partners record transactions, monitor performance, and distribute profits accurately. Below are the main types of accounts used in joint venture accounting:

- Joint Venture Control Account: This account records all debits and credits related to the joint venture. It tracks capital contributions, expenses, income, and profit or loss. It provides a complete overview of the venture’s financial position and overall performance.

- Joint Venture Bank Account: A separate bank account is maintained exclusively for joint venture transactions. It records all cash inflows (capital, sales receipts) and outflows (expenses, payments). This ensures transparency and proper cash flow management.

- Joint Venture Receivable & Payable Account: This account tracks outstanding amounts. Receivables include credit sales or amounts due from third parties. Payables include credit purchases or liabilities owed. It helps manage pending payments and maintain accurate financial records.

- Joint Venture Inventory Account: Used to record inventory brought in by partners, additional purchases, and goods sold or consumed. It helps calculate the cost of goods sold (COGS) and closing stock value for accurate profit determination.

- Joint Venture Income & Expense Accounts: These accounts record all income (sales, service income, etc.) and expenses (materials, labour, utilities). They help classify transactions properly and determine the venture’s profitability.

- Joint Venture Profit & Loss Distribution Account: This account shows how profits or losses are shared among partners according to the agreed profit-sharing ratio. It ensures fair distribution and financial transparency between co-venturers.

Difference Between Joint Venture Account and Consignment Account

A Joint Venture Account is created when two or more parties collaborate for a specific business project. They share ownership, control, profits, and losses as per an agreed ratio. The account is closed once the project is completed.

A Consignment Account, on the other hand, involves one party (consignor) sending goods to another (consignee) for sale. The consignor retains ownership of the goods, while the consignee earns a commission. The consignor bears the risk of unsold goods or losses.

In simple terms, a joint venture is a shared partnership for a project, whereas consignment is an owner–agent relationship.

Benefits of Using the Joint Venture Account Format

- Clear Financial Tracking: It records all expenses, revenues, and investments related to the venture, giving a complete view of financial performance.

- Transparent Profit & Loss Sharing: Ensures profits or losses are calculated accurately and distributed as per the agreed profit-sharing ratio.

- Better Cash Flow Management: Tracks cash inflows and outflows separately, helping partners monitor fund utilisation.

- Proper Record of Contributions: Maintains detailed records of each partner’s capital contribution and expenses incurred on behalf of the venture.

- Improved Decision-Making: Provides structured financial data that helps partners evaluate the success of the project.

- Simplifies Accounting & Reporting: Makes it easier to prepare financial statements and close the account once the project is completed.

Ready to Manage Joint Venture Accounts Like a Pro?

Run Your Joint Venture Business with

Complete Control in One App

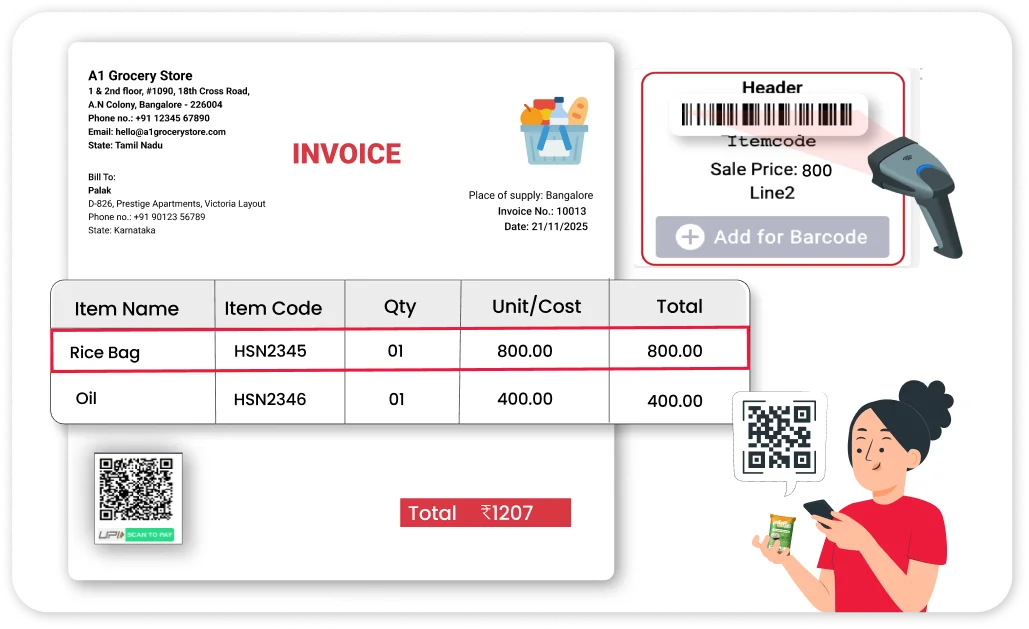

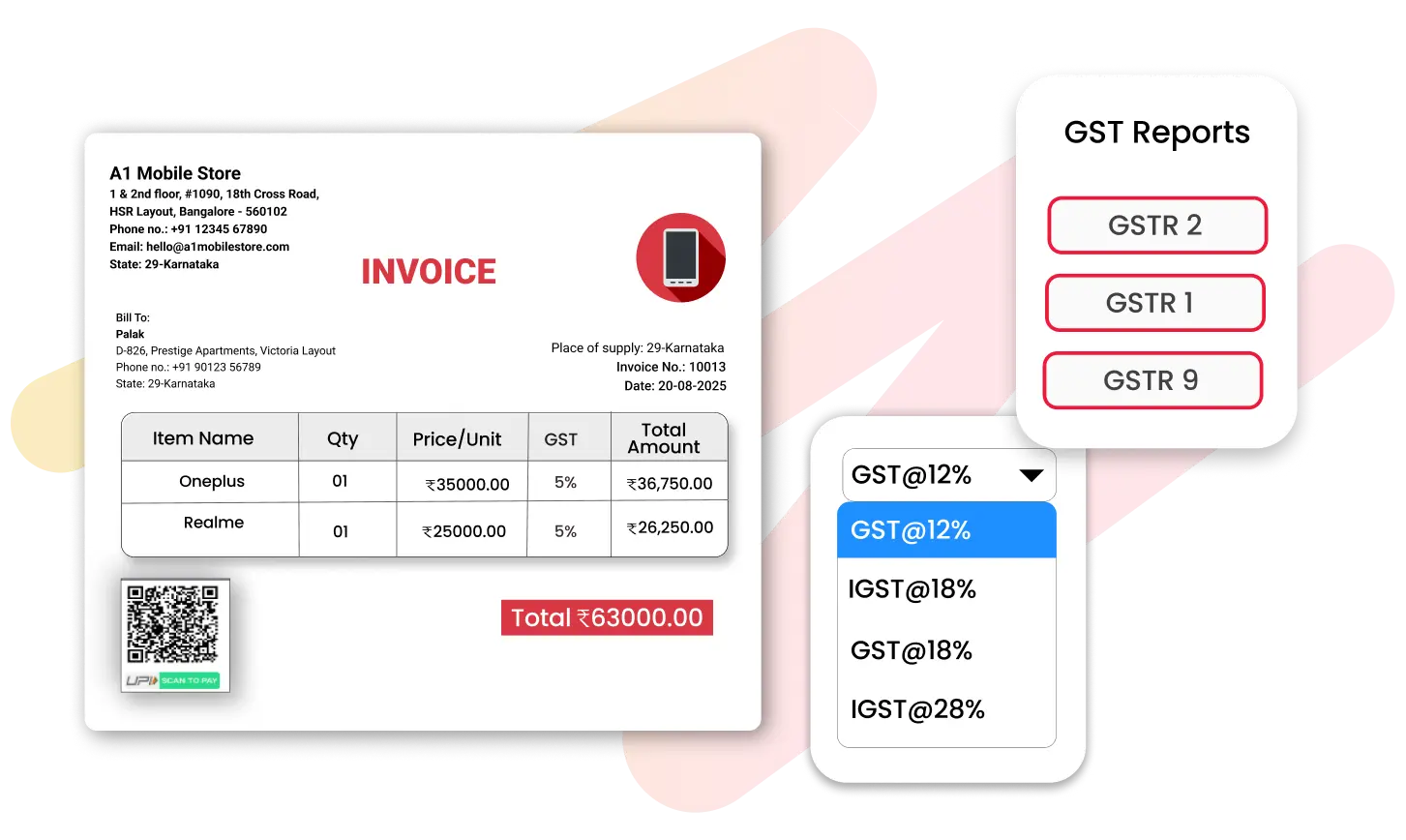

Smart Billing and Invoicing

Smart Billing and Invoicing

Create GST invoices, quotations, and estimates in seconds. Share bills via WhatsApp or email and set payment reminders to ensure faster collections and better cash flow.

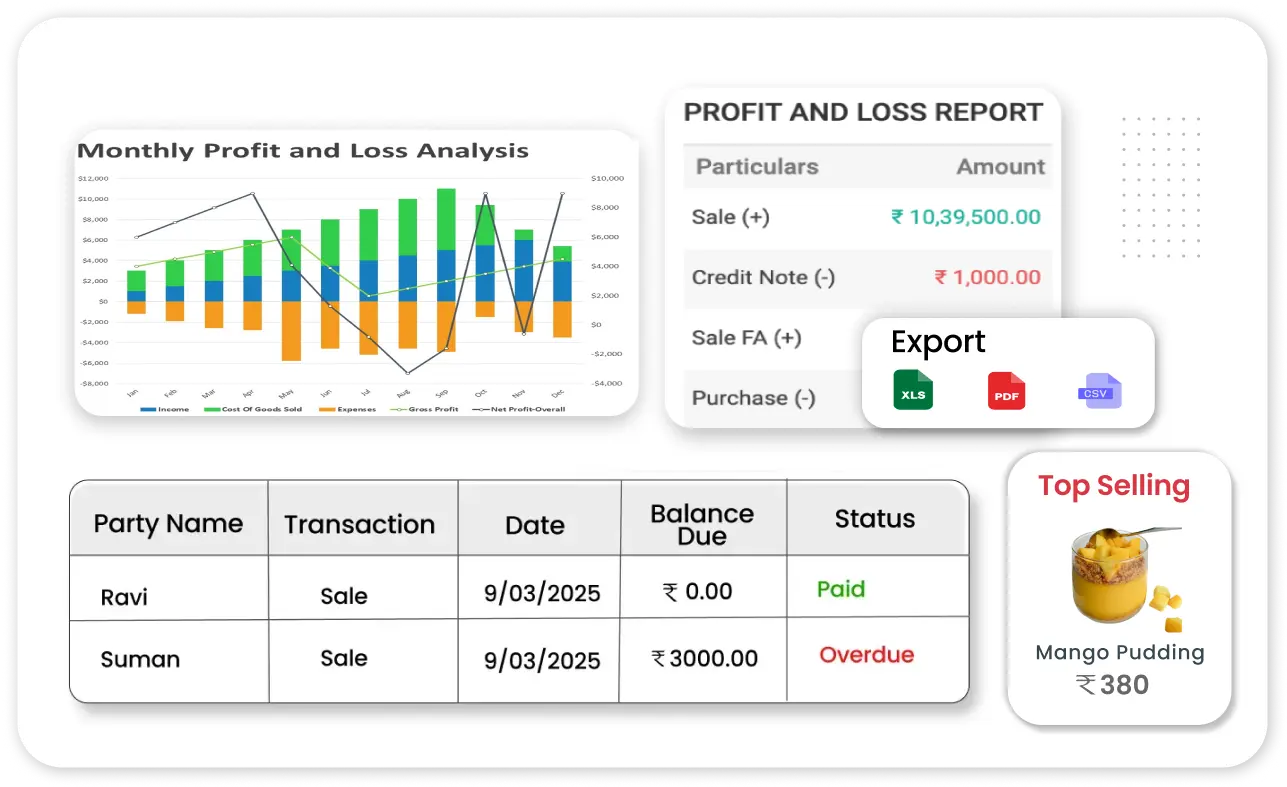

Real-Time Business Dashboard

Real-Time Business Dashboard

Get instant insights into cash flow, sales, expenses, stock levels, and outstanding payments, all in one place. Make informed decisions quickly.

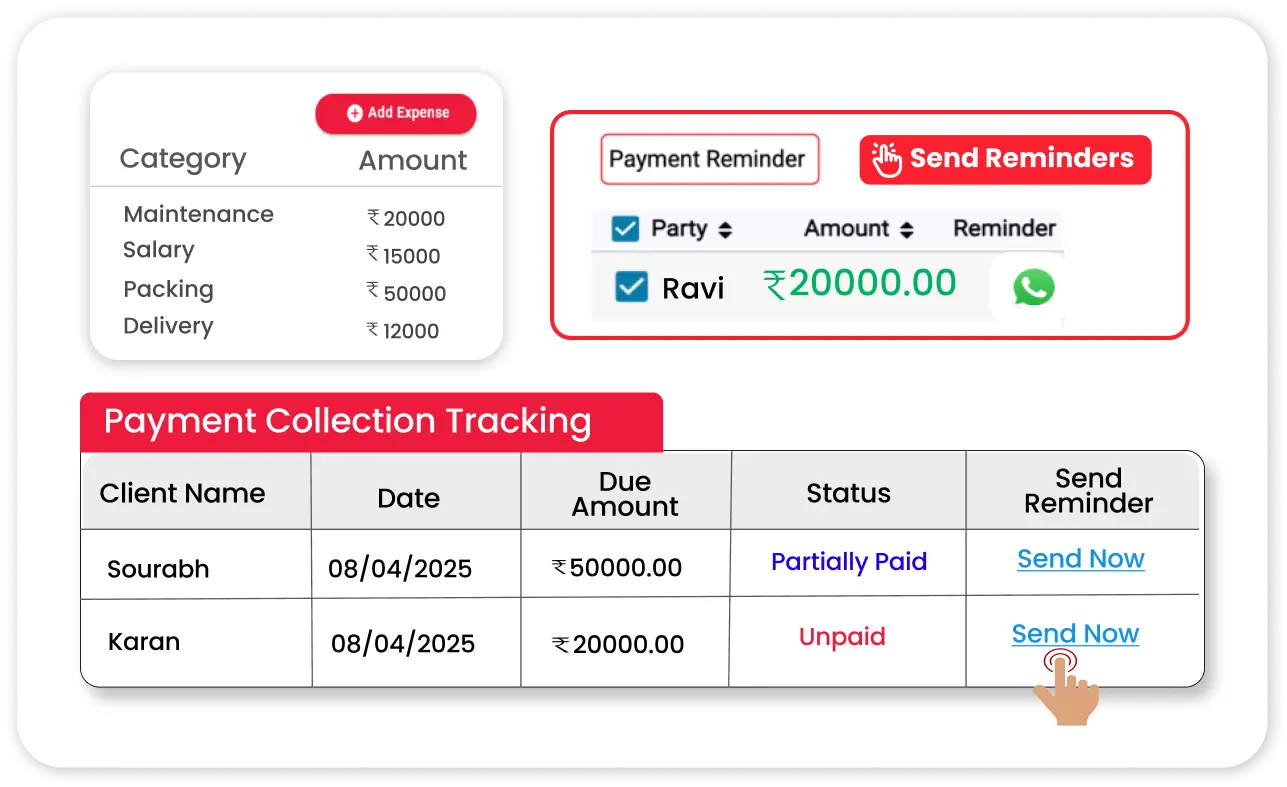

Expense Tracking and Profit Reports

Expense Tracking and Profit Reports

Monitor expenses and generate Profit & Loss reports instantly. Understand your margins and improve overall profitability.

Detailed Business Reports

Detailed Business Reports

Generate Balance Sheet, sales reports, stock summaries, and party ledgers to analyse performance and plan growth.

GST and Tax Compliance

GST and Tax Compliance

Automatically calculate GST, apply tax rates, and generate tax reports to stay compliant and avoid errors.

Get a Free Demo

Frequently Asked Questions (FAQ’s)

A joint venture account is a special accounting record used to track expenses, revenue, and profit or loss of a joint project between partners.

The purpose of a joint venture account is to calculate the total profit or loss of the project and ensure fair distribution between co-venturers with proper financial records.

Profit in a joint venture account is shared between partners according to the agreed profit-sharing ratio mentioned in the joint venture agreement.

The joint venture account format differs from other financial statements in that it emphasises a joint venture’s financial activities and outcomes. It focuses on contributions, expenses, revenues, and profit/loss distributions related to the joint venture. In contrast, other financial statements provide a more comprehensive view of a company’s financial position and performance.

Joint ventures are usually recorded using either the separate set of books method or the memorandum joint venture method, depending on how partners manage accounting records.

Joint venture transactions are recorded by debiting expenses and crediting sales in a joint venture account, then transferring the final profit or loss to partners’ accounts.

Did not find what you were looking for?