Ledger Format in Tally

Use the Ledger Format in Tally by Vyapar and start recording all your financial transactions in one place. Try the 7-day free trial now!

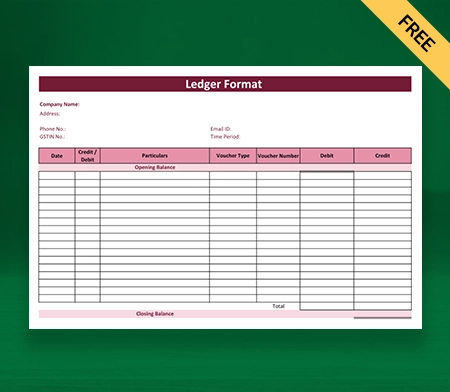

Download Ledger Format In Tally in Excel

What is a Ledger Format in Tally?

The Ledger Format in Tally is a format used to maintain financial statements for different accounts. Tally is a popular accounting software businesses use to manage their financial transactions and maintain books of accounts.

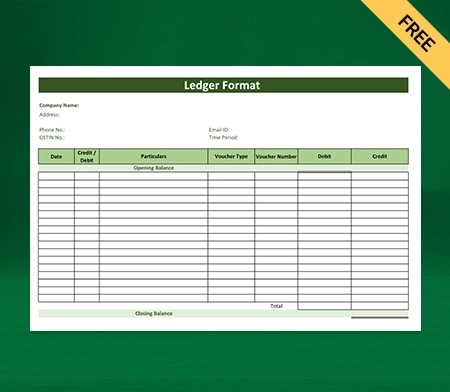

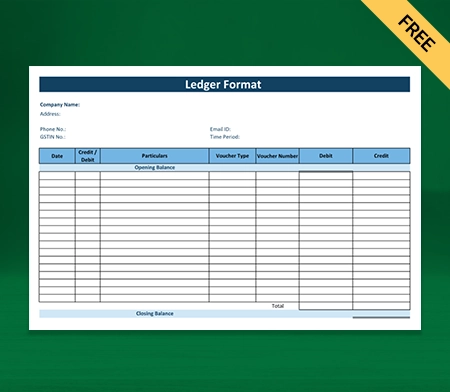

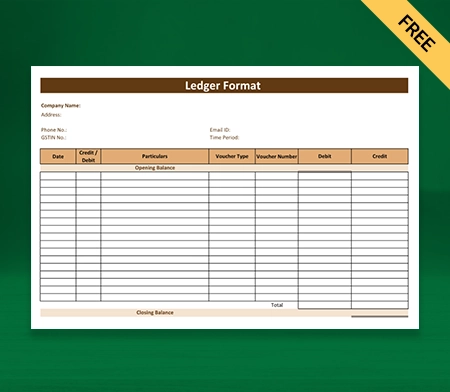

The Ledger account in Tally consists of various components, such as the name of the ledger, opening and closing balances, mailing details, contact details, tax information, bank details, and bill-wise details of transactions. These components help maintain accurate financial records, which are essential for making informed business decisions.

Using the Ledger Format in Tally, businesses can easily create multiple ledgers. They can update and maintain records of different accounts, such as expenses, revenue, fixed assets, liabilities, etc. It also helps track the transactions related to each account and ensures that the financial statements are up-to-date and accurate.

Contents of Ledger Format in Tally

The tally ledger format in Excel consists of various components used to maintain accurate financial records. Some of the contents of the Ledger Format in Tally include:

Name of the Ledger: This is the account’s name that is being created or updated.

Under: This field determines the hierarchy or group to which the balance of the ledger belongs. For example, if the ledger is for rent expenses, it may be grouped under the Expenses category.

Opening Balance: This field indicates the account’s opening balance at the beginning of the financial year.

Address: This field captures the address of the party or entity the ledger represents.

Contact Details: This field captures the contact details of the party or entity that the ledger represents, such as phone number, email address, and website.

Tax Information: This field captures the type of duty tax of the party or entity the ledger represents.

Bank Details: This field captures the bank details of the party or entity that the ledger represents, such as bank account number, branch address, and IFSC code.

Credit Limit: This field indicates the maximum credit limit the party or entity can avail from the ledger.

Bill-Wise Details: This field captures the bill-wise details of the transactions related to the balance of the ledger. It includes details such as the transaction date, amount, type of transaction, and mode of payment.

Closing Balance: This field indicates the account’s closing balance at the end of the financial year.

Maintaining these contents in the Ledger Format in Tally helps keep accurate financial records, which are essential for making informed business decisions.

Types of Ledgers in Tally

In Tally, various predefined ledgers are used to maintain financial statements for different accounts. Some of the types of ledgers in Tally are:

Sales Ledger:

A sales ledger is used to record sales transactions. It is used to maintain records of customer sales, including details such as the customer’s name, address, and contact details.

Purchase Ledger:

This ledger is used to record purchase transactions. It is used to maintain records of supplier purchases, including details such as the supplier’s name, address, and contact details.

Bank Ledger:

A Bank ledger is used to maintain records of bank transactions. It includes details such as deposits, withdrawals, and bank charges.

Cash Ledger:

This ledger is a predefined ledger used to maintain records of cash transactions. It includes details such as cash receipts and payments.

Expense Ledger:

It records expenses incurred by the business. It includes details such as rent, salaries, and utility bills.

Income Ledger:

This ledger records income earned by the business. It includes sales revenue, interest earned, and rent received.

Suspense Ledger:

This ledger records transactions that cannot be immediately classified. It is a temporary holding account until the transaction can be correctly classified.

Capital Ledger:

A Capital Ledger is a type of ledger used in accounting to record the capital contributions made by the owners or partners of a business. This ledger records investments made by business owners or partners.

In summary, there are various types of ledgers in Tally that are used to maintain financial records for different accounts. Each type of ledger serves a specific purpose and helps to maintain accurate financial statements for the business.

Importance of Ledger Format in Tally

In Tally, the ledger format is essential to maintaining accurate and organized accounting records. Here are some of the reasons why the ledger format is essential in Tally:

Accuracy: The ledger format ensures the accuracy of accounting records by providing a standardized format for recording financial transactions. It ensures that all transactions are recorded consistently. It is easier to reconcile accounts and identify errors.

Organisation: The ledger format provides a clear and organised structure for storing financial information. It becomes easier to locate specific information and track the business’s financial status over time.

Compliance: The ledger format is essential to regulatory compliance, as it provides a standardised format for recording financial transactions that meet accounting standards and regulatory requirements.

Reporting: The ledger format is crucial for generating financial reports such as balance sheets, profit and loss accounts, and cash flow statements. These reports provide critical insights into the business’s financial health and help stakeholders make informed decisions.

Auditability: The ledger format provides a clear audit trail of financial transactions, which is essential for internal and external audits. It assures that all financial records can be traced back to their source. It provides transparency and accountability.

In summary, the ledger format is a critical component of Tally accounting software, ensuring accurate, organised, compliant, and auditable financial records.

Difference Between Journal and Ledger

The Ledger and Journal are two essential components of accounting, and both play an important role in maintaining financial records. However, there are some differences between the two. They are:

The primary purpose of the ledger is to maintain a record of all financial transactions related to a specific account. On the contrary, the journal’s main purpose is to record all financial transactions in chronological order before they are posted to the ledger.

The ledger maintains the account balance, which is the difference between the debit and credit entries made in the account. In contrast, the journal records individual transactions as either debit or credit entries.

The ledger is a formal and organised record of all transactions related to a specific account. It is typically presented in a structured format, making it easier to read and analyse. In contrast, the journal is presented in a more free-form format, with individual transactions recorded chronologically.

Ledgers are updated regularly as transactions occur, while the journal updates less frequently. The journal may be updated daily, weekly, or monthly, depending on the business’s accounting procedures.

The ledger provides detailed information about a specific account, including the opening and closing balance, transactions, and outstanding balances. In contrast, the journal provides information about each individual transaction, including the date, amount, and accounts affected.

In short, the Ledger and Journal are both important components of accounting, but they serve different purposes. The ledger records all financial transactions relating to a given account, whereas the journal records individual transactions before they are posted to the ledger.

Advantages of Using a Ledger Format In Tally

Tally’s ledger format ensures that all financial transactions are accurately recorded and updated in real-time. It reduces the chances of errors and helps maintain the integrity of the accounting data.

The ledger format in Tally makes it easy to track and monitor all transactions made in a specific account. It gives users a clear view of all financial activities in a particular account.

Anyone with a basic understanding of accounting can easily understand the ledger format in Tally. The user interface is intuitive and makes navigating the software easy.

Tally ledger format PDF enables easy and accurate financial reporting. You can generate financial statements like balance sheets, profit and loss accounts, cash flow statements, and more.

The ledger format in Tally is designed to save time. Real-time data lets you quickly record transactions, evaluate financial reports, and make informed decisions.

The ledger format in Tally ensures that financial data is stored securely. The software has security safeguards that protect data from unwanted access and alteration.

With Tally’s ledger format in Excel, users can generate detailed audit trails that track every transaction and modification made in the accounting system. This feature simplifies the auditing process, as auditors can quickly identify and verify all transactions in the ledger.

The tally ledger format in Excel enables users to create ledgers in tally prime. Users can plan their finances better and make informed business decisions based on accurate projections.

Tally’s ledger format allows for the customization of reports to suit specific user needs. Users can generate reports based on various parameters, such as account types, date ranges, and previous years.

How to Use Ledger Format in Tally?

- Open Tally and go to the Gateway of Tally.

- Click on the Accounts Info option and select Ledgers.

- Choose the ledger for which you want to create a format and press Enter.

- Press the Alt+F12 function key or click on the button ‘Set Alter Ledger’ located at the bottom of the ledger creation screen.

- A new screen will appear, where you need to select the option ‘Format’ from the left-hand side menu.

- In the ‘Format’ screen, you will see different sections to modify the format of the ledger. Here, you can add, delete or modify fields as per your requirement.

- You can also customise the appearance of the ledger by choosing from various options for font style, size, and colour.

- Once you’ve made all of the necessary changes, click the ‘Yes’ button to save the changes.

- You can assign the newly created format to any other ledger by selecting it from the ‘Format’ field in the Ledger Creation screen.

By using the Ledger Format feature in Tally, you can customise the appearance of your predefined ledgers, making it easier to read and understand your financial data.

How to Export Data From Vyapar to the Tally?

Small businesses can use the Vyapar ledger format in Tally to make entries and then export the data to Tally. Vyapar is compatible with tally software. Here’s how you can export data from Vyapar to tally software.

Open Vyapar and log in to your account.

- Navigate to the utility section in the left menu.

- In the drop-down menu, there is an option to “Export to Tally.” Click on it.

- All of your transactions will be listed.

- Set the period for which you want to export data to Tally.

- You can export sale transactions, credit notes, purchases, and debit notes from Vyapar.

- Using the filter icon, you may also filter the invoice number, party name, transaction type, and payment type. On the upper right side, there is an option to “Export to Tally.” Click on that.

- Your system will generate a folder in your documents called “Tally Export” as a result.

- There are two data files in the part (master.xml and voucher.xml).

Now open the Tally on your desktop.

- You can import data from an existing firm by selecting “Import Data” from the Gateway of Tally menu.

- Click “Cmp Info” from the right menu to import data into a new company.

- Choose “Create Company” and fill out all of the required information.

- After you’ve created a new company and entered your GST information, click Import data.

- Import the ‘Masters’ data first, then the ‘Vouchers’ data.

- The software will prompt you for the file location to import the data.

- To enter the file path, navigate to your documents, click on the path, and then enter masters.xml.

- Now, using Ctrl+Alt+V, copy that path and paste it into the Tally.

Benefits of Using Vyapar’s Ledger Format in Tally

1. Accurate and Detailed Records:

Using a ledger format allows you to keep a comprehensive record of all your financial transactions. You can track every transaction in detail, including the date, the amount, the party involved, and the type of transaction.

The tally ledger format in Excel eliminates human errors while calculating or inputting data. You can rapidly categorize transactions and keep track of cash flow.

The ledger format makes it easy to track and monitor your financial information. You can quickly access and use the information you need to make informed decisions.

2. Easy to Detect Errors:

The ledger format makes it easy to detect errors in your financial records. If there is any mistake or error, you can quickly identify it and correct it.

When using a tally ledger format PDF, the entry structure requires specific information to be entered in specific fields.

It reduces errors that could occur due to missing or incorrect information. Additionally, using free billing software can help detect errors such as duplicate entries or inconsistent data.

3. Complete Transparency:

You can effortlessly organise and track your invoices, payments, and expenses using the tally ledger format in Excel by Vyapar. You may rapidly sort and filter your data using formats to acquire valuable insights into your business’s performance.

When money is received, an advance payment letter type creates a clear audit trail of financial transactions. By watching money flow in and out of an organisation, it is simple to detect irregularities.

A mechanism for recording every transaction can make financial papers more accessible to relevant parties such as auditors or regulatory entities. It helps make financial records more open and transparent.

4. It Saves Time and Money.

Making ledgers by hand takes time, increasing the potential for calculation errors and mistakes. You can avoid this problem using Vyapar’s Ledger Format In Tally, which automatically performs all computations.

Time is money in any business, and using the best tally ledger format PDF will help you save a lot of it. You don’t need many employees to develop professional bill book formats, rather you can just use the Vyapar ledger format generator and create bills in no time..

The inventory management software updates the records automatically, cutting operating costs by eliminating overdue bookkeeping. Because all data is saved digitally in your device and backup location, it also saves money on printing and distribution.

5. Data Organisation Made Simple:

Using a Ledger Format In Tally can assist in organising financial information clearly and understandably. It lets stakeholders easily detect critical financial data such as cash inflows and outflows.

Vyapar allows you to customise Ledger Format In Tally per your business needs. You can also add fields to the template to gather additional information.

It helps in the building of a Ledger Format In Tally. You can utilise it to represent your company’s identity accurately. tally ledger format in excel can help your business stand out from the competition.

6. Document Consistency:

By adopting the same structure for all statements, you can ensure consistency in your ledger format in Tally. It positions your firm as competent and trustworthy.

The consistent tally ledger format in Excel Format is straightforward to read and understand. Each transaction is recorded similarly, reducing the possibility of errors due to variances in recording methods.

A standardised approach for reporting funding sources and applications guarantees that all information is presented consistently. It makes financial documentation easy to read and comprehend.

Valuable Features of the Vyapar App

Quickly Generate Estimates:

You can rapidly generate estimates for customers using the Vyapar app. The majority of the process is automated, resulting in error-free quotes.

Vyapar’s tally bill types offer professionalism to your estimates while simplifying management. Customers can immediately understand them, which helps with client retention.

The built-in feature of the programme allows you to send quotations at any time. There is no need to generate invoices right away. Once the transaction is completed, you can convert those estimates to sale invoices.

Vyapar offers the possibility of obtaining a quick tally ledger format PDF. You may generate them from anywhere and improve the efficiency of your organisation. You can also keep track of bills by assigning a due date to each one.

Inventory Management:

Vyapar’s stock inventory app aids in performance enhancement. You may track your company’s sales using the Vyapar app’s capabilities, such as business reports.

By using inventory tracking features, businesses can maximize the utilization of inventory space. Using the analysis, you can eliminate items that don’t sell frequently and save space.

Vyapar uses the batch number, expiration date, manufacturing date, slot number, and other information for tracking. Having the necessary stock on hand for sale when needed is beneficial. It also helps to keep a record to ensure no theft goes unreported.

With Vyapar’s free billing software, you can see the current status of your inventory. You can also set up alerts to inform your suppliers of new orders.

Data Security and Safety:

Vyapar protects user privacy by encrypting and securely storing data. Vyapar ensures that Google’s authentication information remains confidential and inaccessible to the public or any other party.

The accounting app will only use your information for backups, updates, and login security. The backup and updates will let you pick up where you left off in the case of a server malfunction.

You can set up an automatic data backup using Vyapar, which protects the safety of the data stored in the application. By making a local backup, you can increase security even further.

It would help to keep secure data on a hard disc or pen drive in a private location. You can maintain your company’s security by using the billing software Vyapar app to set up automatic backups or conduct secure backups regularly.

Monitor Expenses:

Keeping track of and recording all expenditures made throughout the delivery of the items is essential for properly preparing your accounting and taxes.

With Vyapar, creating accurate reports and keeping tabs on spending is simpler. Additionally, keeping track of your expenses will make it simpler to develop practical solutions. It will increase business profitability.

Raising revenue and saving expenditures is feasible by keeping track of spending. Using the free software, you can easily keep track of unpaid obligations. Additionally, it helps them track their material in the future.

Budgeting is easy with the help of our free software. Businesses may rapidly reduce expenses and save a sizable sum of money. Using our free billing software, you can keep track of GST and non-GST expenses.

Manage the Cash Flow of Your Business:

Organisations can manage bills using Vyapar’s billing and accounting software for ledgers. It improves the efficiency of tracking and collecting payments.

You may monitor your current payables and receivables with Vyapar. Your company’s cash flow ensures you have enough cash to keep your operation going.

The dashboard will indicate and prompt you to pay regular bills without missing an EMI payment. Knowing your financial flow may help you make decisions more swiftly.

It will make sure that operations are efficient and help in debt reduction. Billing and accounting are crucial tasks that depend on adequate cash flow management.

Financial Reports:

You may track your sales, spending, inventory, and profits with the help of various business reports offered by Vyapar. Your information is available in both graphical and tabular representations. You can generate more than 40+ business reports using the Vyapar app.

You can rapidly measure your company’s progress on your dashboard by monitoring sales, purchases, cash on hand, stock value, expenses, open checks, and loan amounts.

Creating financial records, sales reports, production reports, and other data types is possible. Through live status tracking, you can access this information from anywhere. You can access all the crucial information about your business in one location.

The study of tally ledger format PDF can give you a complete and accurate view of your business. It might increase the effectiveness of operations at your business. It also improves your employees’ morale.

Frequently Asked Questions (FAQs’)

The Ledger Format in Tally is a standardised format that helps maintain accurate financial records for different accounts in Tally.

You can customise the leader format in Tally according to your business needs. You can customise various options such as columns to display, column headings, font size, and alignment. You can also add or remove columns as per your requirements.

Yes. It is necessary to maintain a ledger format in Tally. You cannot record and maintain financial transactions without the ledger format in Tally.

You can export ledger format data in Tally. However, the import option is not available in Vyapar yet.

Follow these steps to create a ledger format in Tally:

1. Log in to the Gateway of Tally

2. Click on Accounts info and then Ledgers

3. Now, you can create single ledgers.