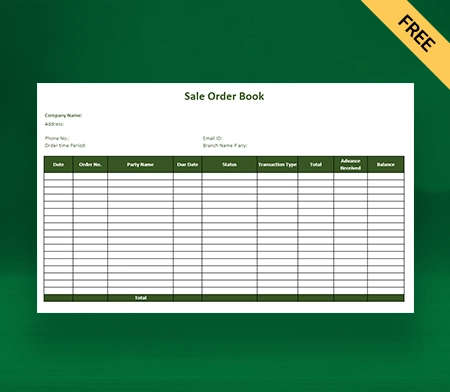

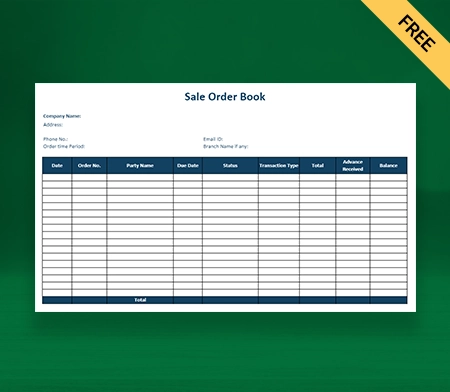

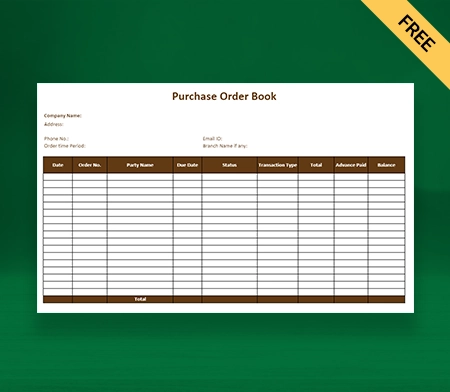

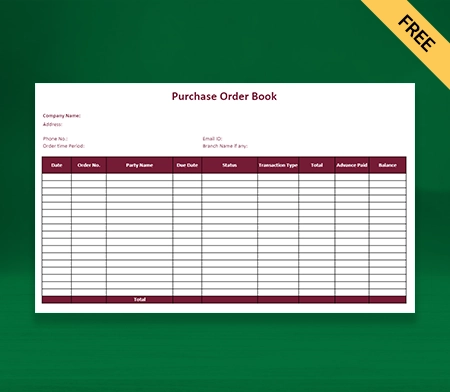

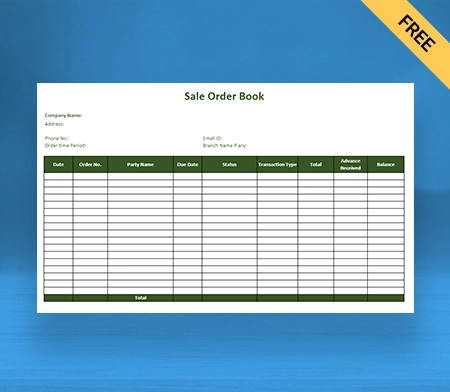

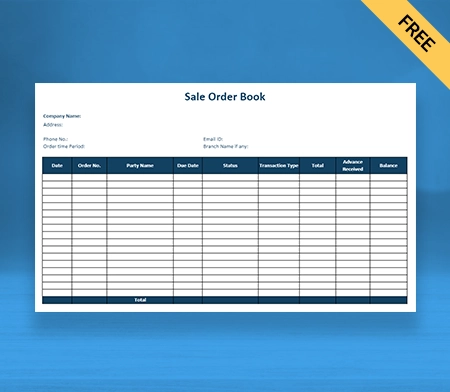

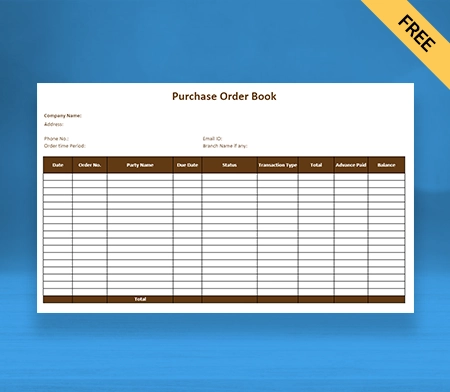

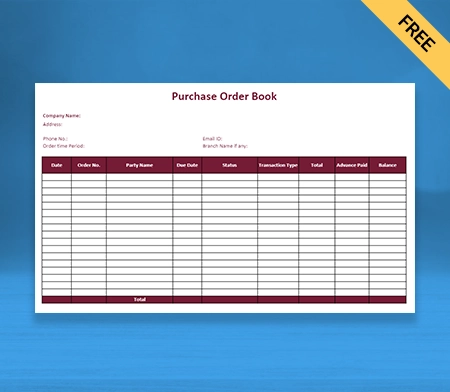

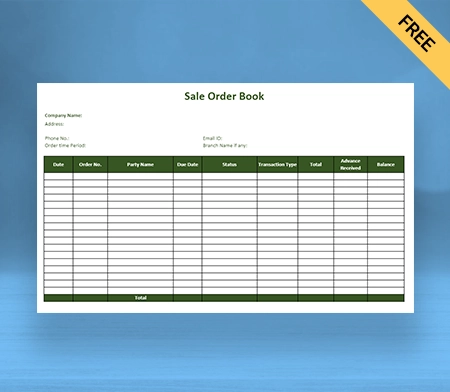

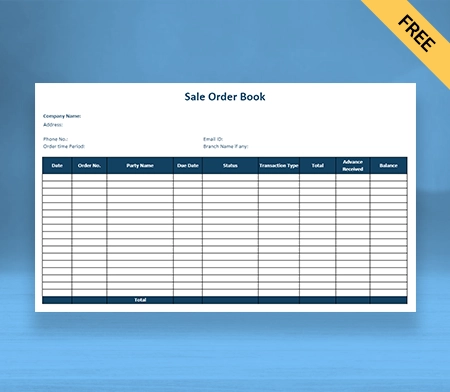

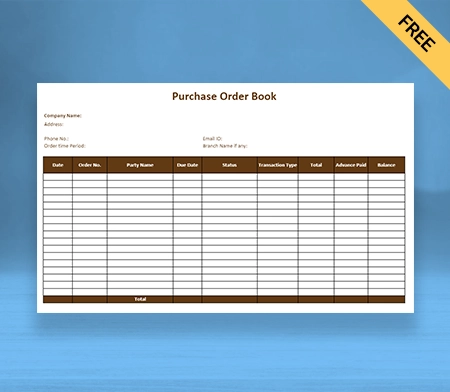

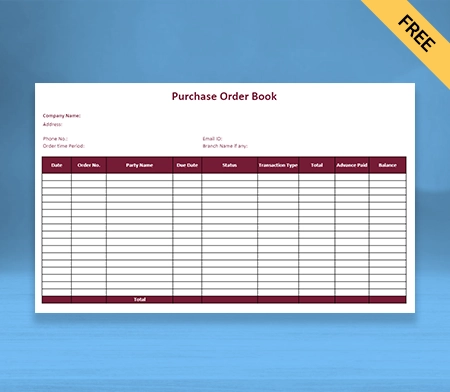

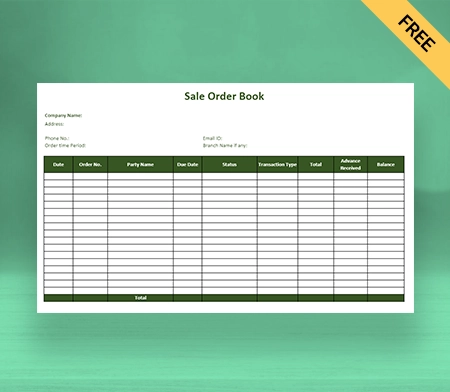

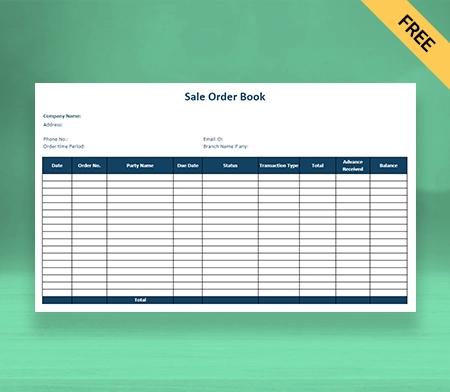

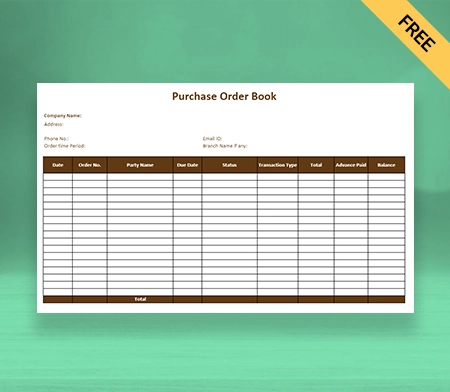

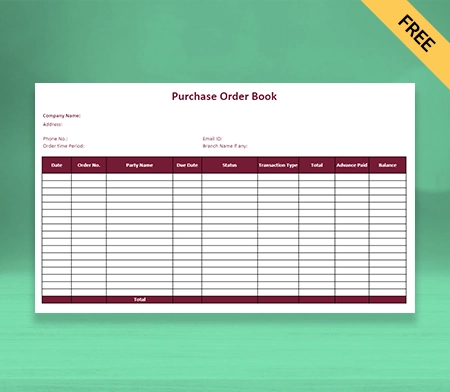

Order Book Format in Excel, PDF

Track your securities and properly organize them in real-time using an Order Book Format. You can access the format for free using the Vyapar accounting app. It’s the best billing software in the market for all your accounting and record maintenance needs. Download the format now!

- ⚡️ Create professional bills with Vyapar in 30 seconds

- ⚡ Share bills automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

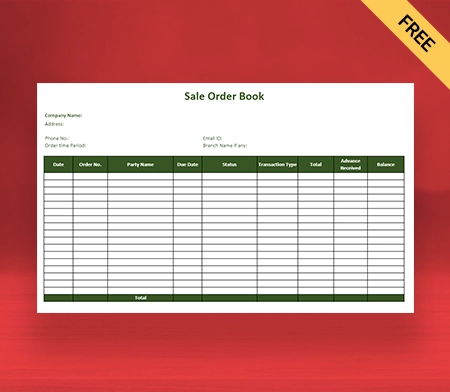

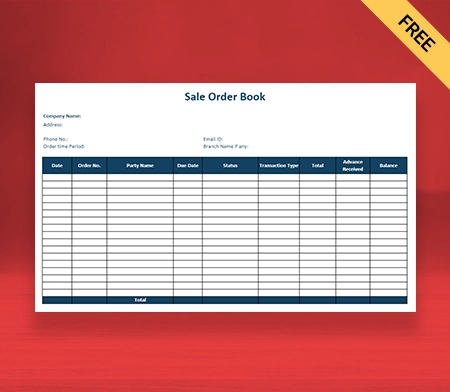

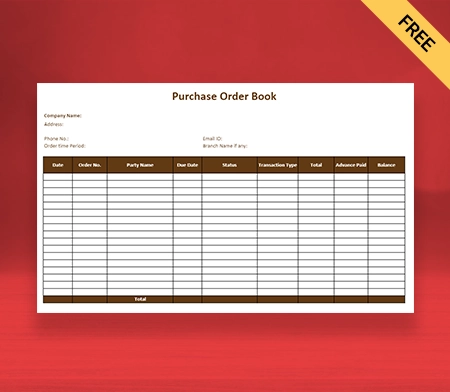

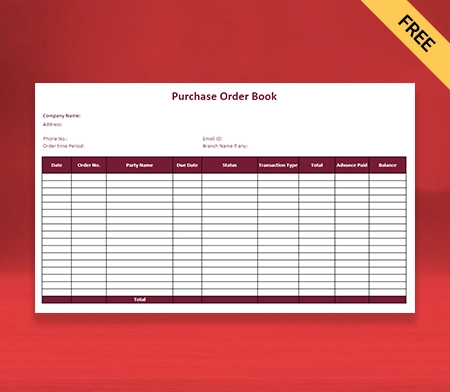

Download Order Book Format in Excel

Download Order Book Format in PDF

Download Order Book Format in Word

Download Order Book Format in Google Docs

Download Order Book Format in Google Sheets

What Exactly is Order Book Format?

To understand what order book format is, we need to first have a basic idea of order books. An order book is a financial tool investors use to record the purchase and sale of securities and investments. Further, it helps investment managers collect payments timely to execute online orders for their clients.

An order book is a physical or electronic book that is used in financial markets. Traders and investors use it to record their recent purchase and sale transaction of securities. You can get the order book format in Excel, and the order book format in pdf for free online.

Now securities could be an asset in any form. For example, it could be stocks, commodities or cryptocurrencies. In an order book, generally, there are two sections that include the details of the buy and sell orders.

The first section of the buy order is also known as the bids. This section presents the price at which an investor or trader has purchased securities. The second section is selling online orders, also known as offers or asks. The selling section represents the prices at which the securities have been sold.

Each side includes the number of securities and assets an investor wants to sell or buy. Simply put, we can say that an order book is a journal of investment transactions. An order book template, on the other hand, is a pre-designed format of the order book.

It’s a basic structure or format that an investor can use to create an order book each month. Besides, it can also be used by trading companies to keep track of their client’s investment records. Now that we know what this format is all about. Let’s look at its contents.

Components Of A Order Book Format

An order book format comprises a variety of elements. Before getting started with the format, it’s important to understand every important component. With that said, here is some key content of the format for the order book:

Bid Orders

The bid orders highlight the prices at which securities are being purchased. If you have purchased shares of some company, at what price did you purchase them? Come under this heading. Moreover, this section also showcases the demand for securities types at different price levels.

Time And Sales Data

To identify the marketing trends, it’s important to first know your trading activity. This section of the order book format records the timings of the purchase and sale of a commodity. You can analyse your trading activities to make future market predictions when you have a record of your trading activities.

Order Type

Being an investor or trader, you don’t just deal in one but multiple types of orders of securities. To know what types of orders you have made in a financial year, this section of the format is used. It indicated the type of order placed by the trader, pre order, limit order or market order, for example.

Ask Orders

Ask orders refer to the prices upon which the trader has sold securities. Trading is all about buying and selling securities. As much as it’s important to record the timing and cost details of the purchase, it’s equally important to have a sale history in hand. This section of the format deals with the sale history of securities.

Order Status

When an order is placed, it is not satisfied in one go when the market is closed. So when an order is placed after a commodity market is closed, it is tracked under this section. The order status section reflects whether an order is open or filled. Moreover, it also records the timings of order placement and fulfillment.

Client DetailsIndependent trading companies mostly use this customisable component in order book format in excel, pdf. In this section, we collect payment details and other vital data about the client. For example, their contact information, name, address and other personal information. The motive for including this section is for identification purposes.

Why is Order Book Format Important For An Investor?

When it comes to the order book format, it’s a basic requirement for every investor and trader. There are so many reasons to get the format for yourself. Some of the key reasons are as follows:

Analyse Order Flow And Trading Activity

An order book format is crucial for investors and traders as it offers valuable insights into order flow. In addition, it also gives a clear understanding of their trading activities for a specific time frame. The format displays the selling and purchase orders.

When both of them are examined, we can easily determine in which direction orders are flowing. Moreover, it also helps observe trading insanity at different price levels. Traders can use this format to understand the market pattern, changes and trends in the order flow.

This understanding further helps us understand the current market dynamics. When you know how marketing dynamics work, you can make more informed decisions. Those decisions will have a high chance of offering profitable returns.

Make Informed Trading Decisions

Every trader or investor’s main objective in purchasing and selling securities is to earn profits and build wealth. One can only earn profits consistently when decision-making is done right. Every decision you make should be informed and based on research and market understanding.

The order book format in Pdf, Excel is an excellent financial tool for investors as it helps with improved decision-making. You can understand an asset’s demand and supply levels at various price points using an order book.

Moreover, you can also check the history of specific securities dealing in quantity. With information about past quantity dealings and price points of securities, you can determine potential exit and entry points. It improves your decision-making, as you know, when you purchase, hold and sell.

Gain Insights Into Market Sentiment

The third exclusive reason to invest in an order account format is that it helps investors understand market sentiments. By now, we are clear that an order book contains the buy and sell order history. When we analyse the data from both these sections, we get insights into securities market operations.

We get an idea of the real-time sentiment of our past market participation. For example, if there are more purchase orders and fewer sales orders. This means that there’s a positive sentiment.

Conversely, there is more sell order and fewer purchase order, which reflects negative market sentiments. This information can help you understand the market stability and align your strategies accordingly. With better strategies, the chances of making profits are always considered high.

Monitor Order Status And Execution

An order book format allows investors to monitor the execution and status of their orders. Order here refers to the purchase or sale of securities. When investors place sell or purchase orders in the commodity market, the order book allows them to track those orders.

The tracking can be done in real-time to ensure timely strategic planning. Moreover, with this format, you can see if your orders are completed, partially filled or still open. This information about the order status is important for adjusting and managing trading positions.

Since traders can monitor their order execution in real-time, it helps ensure that trades are executed correctly. By closely monitoring the order execution, you can manage your market positions actively.

Identify Support And Resistance Levels

A good reason why you should be using an order book format in excel, pdf is because of its advanced support capabilities. It helps traders identify resistance and support levels. When we talk about support levels, it refers to price levels at which the buy order accumulates.

The accumulation of price levels indicates the buying interest and potential floor for the price of the assets. On the other hand, resistance levels are also price levels but with a concentration on selling orders. The resistance levels suggest the selling pressure and potential ceiling for the price of an asset.

By analysing these levels, through order books, informed decisions can be made. The decisions are about when to enter or exit the market.

Understand Market Depth And Liquidity

An order book format gives insights into the market liquidity and its depth. Market depth refers to the availability of selling and purchase orders at different prices. By evaluating the order book, traders can assess the market depth by observing the size and quantity of orders.

The information that is extracted from the analyses is further used for determining the overall market liquidity. Understanding the liquidy helps decide whether to purchase or sell an asset.

When the liquid levels are high, it means the market is active. Therefore, there will be better price stability and tighter selling spreads. When you have a good idea about market liquidity and depth, adjusting trading strategies immediately becomes easy.

Explore Order Book Imbalances

With an order book format in Pdf, Excel traders can easily understand the imbalances in their order book. An order book imbalance happens when there’s a disparity between the selling and price orders. For example, there are many buy orders, but the sell orders are low at a price level.

So we can easily see a potential imbalance towards the seller as buying orders are more. A good thing about order book imbalance is that it provides insights into market trends and price shifts.

Traders can easily interpret those imbalances as signals, reflecting changes in market dynamics. When you are aware of this market change, you can make informed decisions towards capitalisation. Those decisions will be based on facts and help you manage risk effectively.

Determine the Effectiveness Of Trading Strategies

For every trader, it’s important to evaluate the effectiveness of their trading strategies from time to time. That’s when an order book format in Excel, pdf comes to help investors out. Compare your strategies with your order book.

Doing this will help you evaluate how well they align with the prevailing market conditions. Using this comparison, you can also understand whether your strategies are generating desired results. That evaluation will be based on the demand dynamics and supply reflected in your order book.

By evaluating your trading strategies’ effectiveness, the right adjustments can be made. You can refine your approach and enhance the overall performance of your trading and investing activities. That’s exactly what every investor aims to do in the long run.

How To Access Order Book Format In Vyapar?

Invoicing Software Vyapar is India’s best order book form builder and the best accounting software. It offers an exceptionally designed order book format that’s highly customisable. If you use Vyapar for the first time, you might feel overwhelmed finding this format. Let’s guide you the right way:

- Open the Vyapar app on your smartphone.

- On the top right corner, click on the MENU Icon.

- You will notice various options such as ITEMS, BUSINESS DASHBOARD, REPORTS, ETC.

- Tap on REPORTS, and a new page will open on your screen.

- Now you can manually scroll and find the ORDER BOOK.

- Or tap on the search icon, type “ORDER BOOK”, and search.

- The order book format will appear on the search result.

- Tap on it, and you will get a performance of the order book, in which you can fill in the details.

- When you are done filling in the required details (contact details, for example), click on SAVE, and you are done.

- Your record is saved and can be shared with anyone through various means, such as Gmail.

So this is how you can access and use an order book format in excel, pdf in the Vyapar accounting app. Apart from this format, the app offers a variety of other formats too. For example, Cash flow format, balance sheet format, stock summary report, and so much more.

All these formats are available for free within the app. You don’t have to pay anything extra to access these formats. And the best part, all the forms and reports are completely customisable. You can make changes to them according to your brand requirements.

Underrated Advantages Of Using An Order Book Format

An order book format is a financial tool with enormous advantages. Whether you are an investor or trader, it’s going to help you a lot. Order books are helpful for investment managers as it helps them collect payments too. Here are some of the ways it can help you:

Effective Risk Management

For effective risk management, traders are highly recommended to use an order book format. An order book gives a detailed perspective of purchase and sales orders that you have made. When we say detailed, it means there’s also the presence of order prices.

By analysing the trade history on the basis of prices, the right buying and selling positions can be evaluated. Moreover, the format also allows you to identify potential price movements. In addition, you can also assess market liquidity.

Having an idea about these two will help you make informed decisions towards an order’s risk exposure. You can easily identify the impact of a price position on your trade order. Understanding that impact will help you adjust your risk management strategies better.

Spot Hidden Liquidity And Order Imbalances

A very underrated advantage of an order book format is its ability to detect hidden liquid. Not just that, but its capability to identify order imbalances is also highly unappreciated. Ask prices and top bids are often visible on a trading platform.

But what makes an order book different is that it provides a comprehensive view of sell or purchase orders. It also includes those orders that are not visible immediately after placement. By analysing a trading book, you can identify hidden pockets of liquidity.

These hidden orders can impact the market dynamics. Thus, the insights that you extract after their analysis will help you detect potential price movements. Besides hidden liquidy, the format also allows you to identify order imbalances. The imbalances are signals for potential market trends.

Improved Timing For Trade Execution

An order book format is an excellent tool for investors to improve the timings for trade execution. You can use it to gain insights into the quantity of your purchase and sale orders. And that too at different price levels.

Doing this helps identify optimal exit and entry points for the trades. For example, you notice a large concentration of purchase orders at a certain price level. So this means there’s a support level, and the prices will likely rebound.

With the knowledge of entry and exit points, you can time your trades strategically. This will allow you to take advantage of market conditions. And thus, improve the overall profitability of your trades.

Gauge Market Depth And Price Impact

An order book format is a valuable tool; we have successfully learned that so far. But many traders are still unaware of some exclusive benefits of this tool. One such benefit is its potential to identify price impact and market depth.

Using an order book, you can track ordered quantities at prices visually. The tracking of buy and sell orders helps understand the market depth. Moreover, it also offers an advanced capability to evaluate the price impact of executing huge trades.

Every trader aims to make informed decisions about trade sizes and order placement. If you have the same aim, understanding price impact and market depth is important. An order account does not just help with that. In addition, it also helps identify potential slippage associated with your trades.

Enhanced Understanding Of Market

Before starting the trading journey, the first thing one does is learn about the market. But understanding the market isn’t a one-time job. Since the market is ever-evolving, you would need to keep up your learning with time.

With an order book format, traders can gain a deeper and better understanding of the market. You can use it to observe the order flow and identify market trends and patterns. In addition, you can also figure out the sequence of future purchase and sale orders.

It doesn’t end here. The order book also provides valuable information about the distribution of liquidity. This information can be used to spot areas of resistance and support. When you are aware of resistance and support, interpreting market sentiment becomes easier than ever.

Accurate Market Supply And Demand Visualisation

An order book format in excel, pdf provides traders with accurate visualisation of demand and supply in the market. You can use the order book to understand the price placement of your buy and sell orders. This understanding will allow you to assess the market’s demand dynamics and current supply.

Let’s suppose you are checking a client’s order book and notice a significant concentration of buying orders. This means that the trader has noticed the higher demand for that securities. This is the reason why more buy orders are placed through the client account.

Similarly, let’s suppose the quantity of sell orders is higher than buy orders. This indicates that there’s a greater supply rate. By visualising the demand and supply levels, you can identify areas of significant selling or buying interest.

Uncovering Market Manipulation

Another excellent advantage of an order book format in excel, pdf is it helps in identifying potential market manipulation. To identify the market manipulation, start by carefully examining your order book. When you do so, you will notice abnormal or unusual patterns.

Those patterns are signs of manipulative activities. For example, traders place large orders at a specific price level to create an artificial imbalance in demand and supply.

If you notice such an imbalance, it’s a sign of an attempt to manipulate the market. Knowing how to identify potential manipulation attempts helps in making informed decisions. You can make effective decisions to protect your positions or avoid getting caught in any manipulative scheme.

Enhanced Order Execution Strategies

Having an order book comes with the advantage of improved order execution strategies. Since the market is constantly evolving, you need to evolve your strategies as well. That is when this format comes into play, allowing you to study your techniques better.

With an order book, you can gain insights into the order flow dynamics. You can use the insights to optimize your order execution. You will know what’s the favourable time of order placement and ideal price levels.

For any trader, constant improvement in strategies is the biggest challenge. This format comes to rescue you by allowing you to keep up with market trends. When you know what’s happening in the market, improving your work tactics isn’t tough.

Frequently Asked Questions (FAQs’)

A format for an order book is a pre-designed format for an order book. The order format offers a detailed description of all the buy and sell orders placed by a trader or investor. In simple words, it’s a record of all your orders (both offline and online orders) for a specific month or time frame.

You can either hire an accountant or someone expert in creating an order book template. That will cost you a lot. Or you can simply download the Vyapar app for free online and access the order form template. The second option is better so we recommend you do that.

Yes, there’s a free way of using a format for an order book. It’s by downloading an accounting app such as Vyapar. Vyapar has an inbuilt order book template that’s free to use. The best part is that you can customize the form according to your business theme.

In an order book template by Vyapar, it’s possible to include as many investments as possible. Whether it’s about 2 or 200 investors, you can stretch the format as much as you want. This will allow you to include a designed number of investments.

An order book format includes a variety of details such as buy orders, sell orders, etc. To have a detailed overview of each heading or section of this format, scroll up. We have talked about the components of this format in detail.

A format for an order book is an excellent tool for traders and investors to track their orders. Since most transactions are conducted through online orders, you can automate the process to ensure accurate order book details.

So if you are someone who wants to keep themselves updated about their order placement, this format is what you need. Download Inventory Management Software Vyapar and access the free order form samples!

Yes, there’s an excellent accounting app called Vyapar that is free to use. Moreover, Vyapar offers a premium order book template that you can access without any cost. So what are you waiting for now? Download the app and book order form templates now!

You will be surprised to know that Vyapar provides the most affordable option for order book templates. In fact, it’s a ZERO-cost option to access the format. You don’t have to pay anything to use the online order forms. It’s free to use and comes with a variety of benefits, such as easy customisation.

Yes, Vyapar provides the best order form templates. It’s an exclusive accounting software that comes with a variety of features and facilities. You can use it to create sales reports, track expenses, create delivery challan, and so much more. Download the app and get yourself a personal accounting buddy now!

Do you deal with clients in multiple currencies? No worries, Vyapar comes with an advanced capability to support a large number of currencies. Whether it’s Dollar or Euro, whatever the currency is, you can easily find it on the Vyapar app. Simply go to the SETTINGS and pick your desired currency option.

Related Posts: