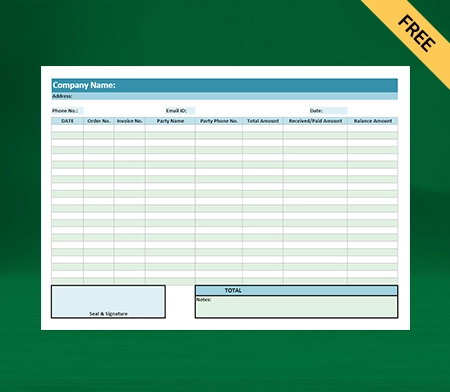

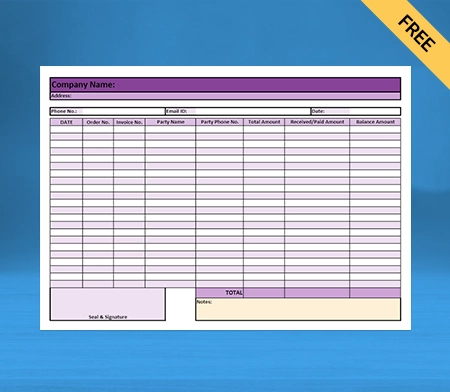

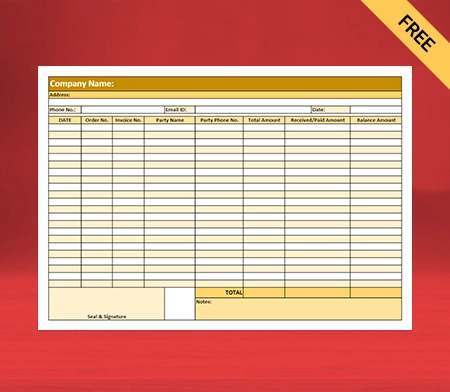

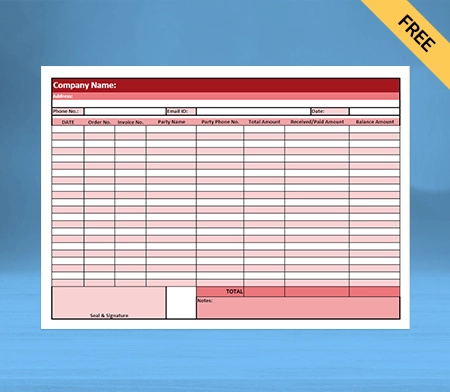

Professional Sales Bill Book Format

Download Sales Report Format to analyze your sales data. Or use the Vyapar App to check your Sale Book, Day Book Purchase Report, P&L Report easily and run your business effortlessly! Avail 7 days Free Trial Now!

- ⚡️ Create professional bills with Vyapar in 30 seconds

- ⚡ Share bills automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of Sales Bill Book Formats

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

What is a Sales Book Format?

Salespeople use the sales book format to keep a record of the sale of goods to their customers. It includes essential details such as the client number, invoice date, and invoice amount.

As a salesperson, you must be very careful and attentive with your documentation for day-to-day sales. You have to spend a lot of time in manual sales bookkeeping to record the sales record of your business. Manual documentation can have human errors and may result in missing essential details.

The credit sale information is recorded at the end of the business day. Based on copies of the company of all the invoices issued to clients on that business day. The information recorded in the credit sales book for the transaction of goods and services to clients gets transferred into the sales ledger.

With Vyapar sales book management software, you can make this process seamless for your employees. Further, it provides you with all the essential features for your business requirements.

What is the Benefit of Using the Sales Book Format?

Using the sales book for your day-to-day business has certain benefits, as given below:

Master Daily Documentation:

Keeping documentation of transactions for your credit sales of goods and services helps your business to thrive with the essential speed. You can save a check on your everyday life in your comfort.

It lets you know how your business is going and where your operation is lacking. So daily documentation helps you to keep a check on your business operation.

Get Paid Quickly:

Sales book documentation helps your business to identify consumers from whom you may expect to get paid for your goods and services. So you can send notifications for your due by using Vyapar sales book management software.

It makes your business operation smooth and helps you get your due payment on time. It is essential for the success of your business.

Promotes Responsibility:

The sales book operation helps your small and medium size business benefit as it promotes responsibility and requirements. It makes your employee aware of their role and responsibilities for their organization.

You can quickly check the day-to-day progress of your employees in your business. It is an essential part of your business to keep everything in order inside your business operation and employees.

Adjustment of Periodic Sales Ledger:

It helps your business in adjusting the sales ledger every month. It helps to keep track of your business activity. You can avoid manual mistakes happening in your business by keeping a check.

You can also use Vyapar’s ledger accounting software, which comes with all the automated details required by your business. It makes your credit sales book operation more mistake-resistant.

Incredibly Easy to Understand:

It enables your business to separate roles and provide chronologically and quickly understood sales data. It aligns your data in simple order so you can quickly grasp it.

Vyapar helps you to get all the essential data and reports that are essential for your business. It offers you all sorts of monthly, quarterly and annual reports, which help boost your business operation.

What Should You Include in Your Sales Book Format?

You should add all the essential data given down below in your sales book:

- Transaction number of sales of goods and services by your clients.

- An account number.

- Name of the customer.

- Invoice number of goods and services.

- Sales amount of purchase.

- Sales tax.

Create your first Sales Bill Book with our free invoice Generator

Why is a Sales Book Important for Your Business?

The sales book is essential for your business as it helps you keep track of your day-to-day credit sales transactions between you and your customers. It plays a very critical role in the success of your small business.

Many small businesses depend on sales from credit to cash regularly. It helps you document all the critical sale transactions in your business daily.

Sales bookkeeping facilitates your request for the due payment, which you must collect from your customers at the end of the month.

What is the Format for a Sales Book?

The sales book includes some vital information. First, in the date column of the sales book, the date of credit sales should be recorded. Particular columns include the actual name of the party purchasing goods or the party to whom goods get sold.

It shows crucial details of transactions on goods regarding quantity, quality, and other descriptions and the rate of trade discount is accepted. In the Ledger Folio (L.F.) column, the page number of the debtor’s accounts in the ledger is recorded for customer reference.

The amount of goods sold is noted in the sales book’s details column. You can lessen trade discounts, packing charges, etc., and get accommodated carefully into the details column.

In the total column, the net amount payable by the retail customer gets noted, and lastly, the total of the amount column is the total credit sales during the period.

Difference Between Sales Book and Sales Accounting

- The sale book refers to a book in which you can record all credit transactions in your business. On the other hand, sale accounting refers to a ledger account in which you can register all the transactions of goods and services in your business, either in cash or credit.

- A Sales book is the primary type of book of records, while sales accounting is a secondary book of accounts based on a journal day business.

- It is maintained to record all the credit business transactions related to the sales of goods; on the other hand, sales accounting is maintained to record all the goods (stock) that take place in your business annually.

- Sales book records only credit business transactions, while credit and cash transactions are recorded in Sales accounting.

- The transferred balance to the business’s financial statement is in the sales book. On the other hand, in sales accounting, the balance is transferred to the business’s financial information. It is transferred to a trading account.

- The sales book does not have the debit column as it is a particular purpose book; meanwhile, sales accounting has both a debit and credit column.

- The sales book is not dependent on any other primary book as the transaction is directly recorded in it from the sales invoice; on the other hand, in sales accounting, it is dependent on the Journal daybook. All the transactions related to the sale of goods are in this ledger.

Benefits of Using the Vyapar App for Managing Sales Book!

Seamless Business Accounting

Vyapar app enables you to manage the single and chain of stores. Businesses are not obligated to register if they want to use the Vyapar. The sales book management app makes it all seamless with the Vyapar dashboard.

You can get data access on single as well as multiple devices. Your data is encrypted with an advanced algorithm; you don’t need to worry about being compromised. Vyapar comes with advanced security features.

Using Vyapar, you can create multiple companies and up to five firms within your company. It is easy to assemble, and you can do this without technical knowledge. Vyapar comes with many brilliant features at a low price.

Vyapar billing app also allows you to create GST and Non-GST transactions for your business. So you can carry on your credit sale of goods using Vyapar’s multiple modes of payment.

Easy to Use for Any Employee:

Vyapar has many features, which are easy to use by people of all age groups to use. You don’t require any technical skills to use such accessible features on your android and Personal computer device.

Older people do not feel comfortable around this ever-evolving technology. While running a business, using these features is necessary as recording your transaction requires a lot of human hours and effort. If older people hesitate to use and keep up with manual sales bookkeeping, your business becomes prone to critical human mistakes.

Avoid mistakes by using the easy-to-use Vyapar sales book formats. Older people and people who are not at ease with modern technology can use the Vyapar features with minimal knowledge.

It is easy to get acclimated with the features and reports of Vyapar. You may thank Vyapar later for making your business platform smooth. So you can easily record the net amount and seamlessly credit the sale of goods and services.

Helpful With Tracking Transactions and Cash Flow:

Vyapar’s professional sales book management platform helps you to carry on actual transactions such as sales and purchases over your devices. It is essential to keep your marketing moving in your sales day book to make your business an overnight success.

It can handle transactions such as expenses, other income, sale/purchase orders, and sale/purchase returns can be easily carried out on Vyapar. You can customize your sales book format by using Vyapar very quickly.

You can prepare the estimate/quotation on your devices and the sales within a short time frame. It builds your business to get customer satisfaction and loyalty, as these are the most critical areas in the success and failure of your business platform.

You can easily prepare credit/debit notes and delivery challan for the transfer of goods. It automatically comes with all the essential details needed in these transactions, making your work much more manageable.

Manage Commodities Like Products and Services

Vyapar assists you with auto stock management. You can instantly check your stock quantity, reserved quantity, and reserved value over your smartphones and Personal computer.

If you don’t feel comfortable around your automatic, you can adjust it manually. Moreover, you can activate and deactivate an item over your platform. It has both single and dual item units.

You can easily add new items as per your choice. It can be added and assigned item-category-wise. You don’t have to pay any additional cost from your pocket. Vyapar free inventory management software gives you all these features for free.

You can do barcode scanning and barcode management for inventory. You can also create and manage online stores to expand your business and customer reach. Customers can quickly get acquainted with goods and services from their devices and easily order from your added benefits at the Vyapar store.

Collect Payments Seamlessly With Multi-Payment System:

Vyapar gears your small business with different transaction modes between you and your clients. It will make your transaction smoother and help to build the pillars of customer loyalty and trust in your business.

You can use offline substitutes such as cash and cheque of Vyapar for sales of goods and services. It helps you avoid friction over the payment method with clients as you get all important modes of payment on the Vyapar digital platform.

You can also use online substitutes such as net banking, IMPS/RTGS/E-Wallet, etc., as it becomes necessary to gear your business with evolving payment methods. As modern-day settlement keeps on growing and many clients themselves evolve with it.

On Vyapar sales book management software, you can send complimentary transaction messages. Can print Quick Response code and receive UPI payment from your clients seamlessly. Vyapar also allows you to customize your sales book as per your requirement.

Use the Vyapar App for Several Utilities:

Vyapar helps you manage financial year accounting between you and your customers throughout the year. Exporting data to tally from Vyapar is very simple.

You can easily share or import the inventory data of all your items very smoothly. It also gears you with the information of party import in your device.

You can track the real-time sales data of goods or items from any location with the help of the sync feature that is embedded in vyapar. Features like barcode generation for Quick billing is a completely free feature, for which you don’t have to pay any additional cost.

One million small business owners trust the Vyapar app. You can revolutionize your sales book management requirements using the free Vyapar sales book formats.

Record Sales Anytime Online and Offline:

Business owners belong to remote areas such as mountainous terrain, deserts, and densely forested regions. They frequently face the problem of poor internet and network connection as it affects the efficiency of your business platform.

Vyapar is a one-time remedy for your poor network and internet that disrupt your business activities. Using Vyapar, make your business more advanced and lucrative for your clients.

You can operate your business activities across India. You can customize and share your invoices, bills and credit sales with your customers on digital platforms such as Whatsapp and Gmail.

It allows you to cash to the bank and the bank to transfer seamlessly. Vyapar sales book management software is highly trusted amongst various business platforms and enables multiple invoice themes. You can choose and customize your bills and invoices as per your requirement.

Get All Crucial Reports for Business Growth:

Vyapar sales book report management system allows you all essential reports (monthly, quarterly and annual) in your business. It seamlessly provides you with transaction reports such as sales, purchases, payments, other income, and expense reports.

It allows you to have all essential GST reports(GSTR1, GSTR2, GSTR3, GSTR4, and GSTR5). Vyapar sales book management software lets you with party outstanding and party report groups seamlessly.

It allows you to tax, discount, discount/item report etc. You can also check your bank statement report after the sales of goods and services with your clients. Moreover, it gives you custom reports for all transactions in your business.

Vyapar makes your business operation quicker and smoother. It allows you to receive your payment for sales of goods and services with multiple modes of payment.

Frequently Asked Questions (FAQs’)

Salespeople use the Sales Book Format to check every credit sale to their customers. It includes essential details such as the client number, invoice date, and invoice amount.

You can use Vyapar, which comes automatically with all details required in your sales book record for the transaction of goods.

You can use sales book formats that come with all the essential details required to create and adjust the information needed in your sales book. You can prepare your sales record digitally, store it in Vyapar and use its requirements in future.

While creating your sales record using Vyapar, you have no technical skills, as it automatically comes with all essential details for a sales book. You can easily record the information on the day-to-day operations of your business in Vyapar.

The other name for the sales book is a journal. The salesperson uses a sales journal to maintain a record of the information on sales of goods and services to the customers.

The salesperson prepares a sales book to keep a check and record the details related to the sales of goods and services. You can record the sales book information digitally on Vyapar. It comes at very affordable prices, and 1 million small business owners trust Vyapar.

The sales book records all credit transactions in your business; on the other hand, sale accounting refers to a ledger account in which you can register all the transactions of goods and services that take place in your business, either in cash or credit.

To create a sales bill:

* Use Vyapar or similar software for professional templates.

* Enter business and customer details.

* Describe items sold, quantities, and prices.

* Calculate total amount due, including taxes.

* Specify payment terms and method.

* Review and print or send the bill to the customer.

To print a sales bill:

1. Open the sales bill document in your invoicing or billing software, such as Vyapar.

2. Ensure all details, including customer information, items sold, prices, and total amount due, are accurate.

3. Connect your printer to your computer or device.

4. Click on the “Print” or “Print Preview” option in your software.

5. Select your printer and adjust settings like paper size, orientation, and number of copies.

6. Click “Print” to generate a physical copy of the sales bill.

7. Review the printed bill for correctness and provide it to the customer.