SaaS Billing Software

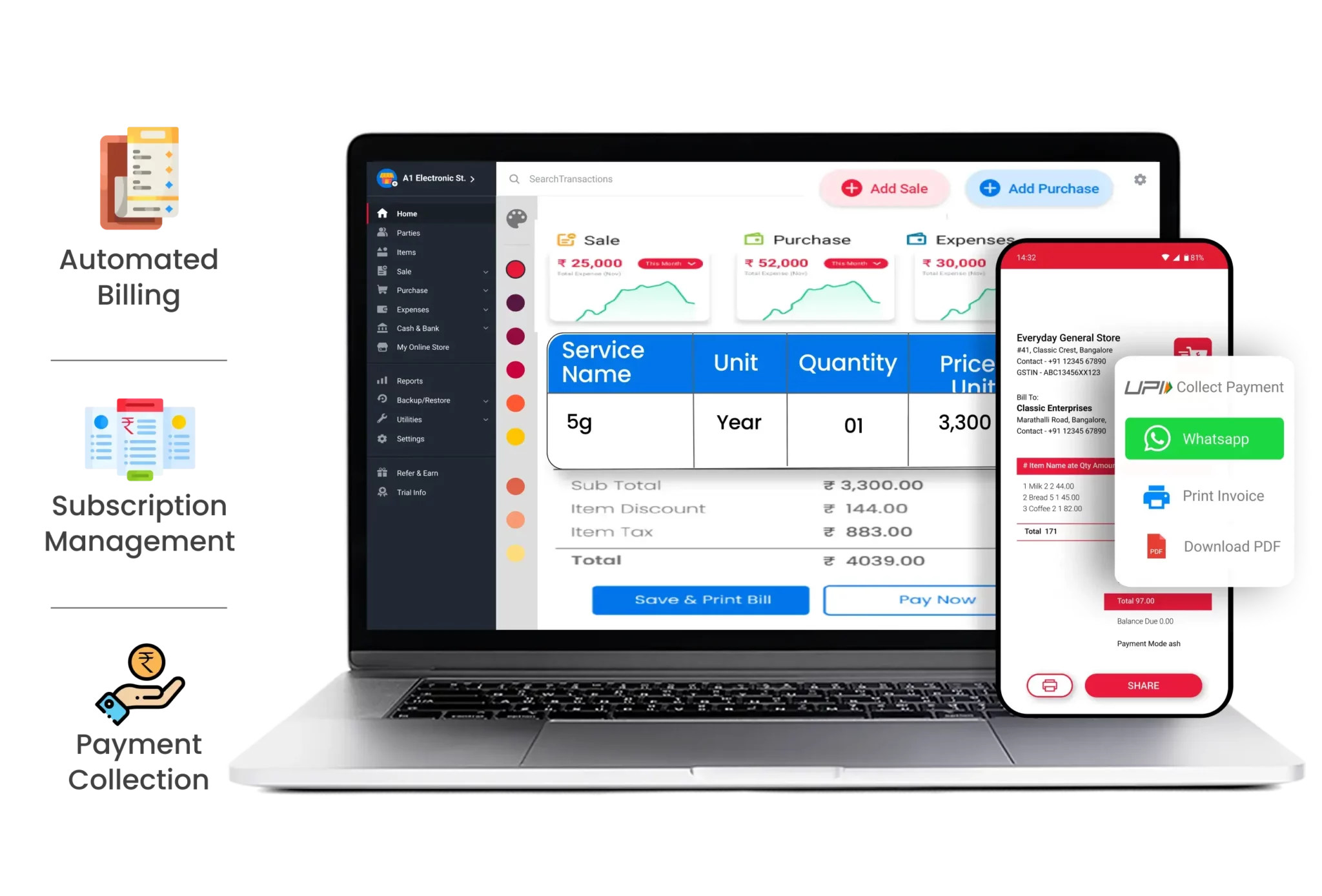

Whether you are looking for a free SaaS billing solution to get started or a scalable SaaS billing platform for growing businesses, Vyapar provides all the tools you need.

Key Vyapar Features of the Best SaaS Billing Software

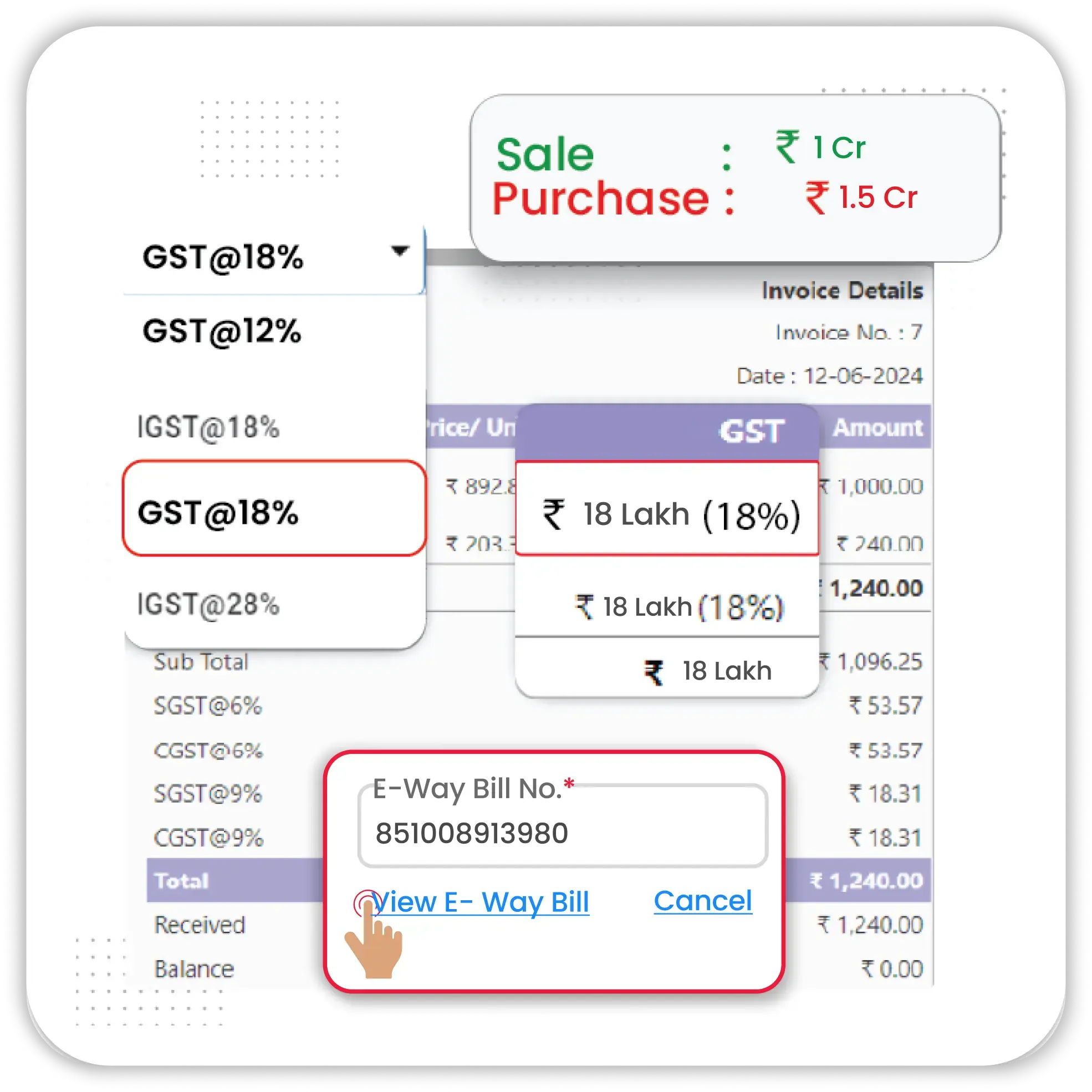

GST and Non-GST Invoicing

A robust SaaS billing system requires accurate invoicing to maintain compliance and transparency. Vyapar helps businesses generate professional invoices with ease.

- Professional Invoice Templates – Choose from customizable invoice templates to match your brand identity in the SaaS invoicing software.

- GST-Compliant Billing – Automatically apply the latest GST rates, ensuring your invoices meet tax compliance in your region.

- Multi-Format Invoice Export – Generate invoices in PDF format, print them directly, or share them via WhatsApp and email.

- Easy Invoice Tracking – Track paid, unpaid, or overdue invoices and send automated payment reminders from within the billing engine.

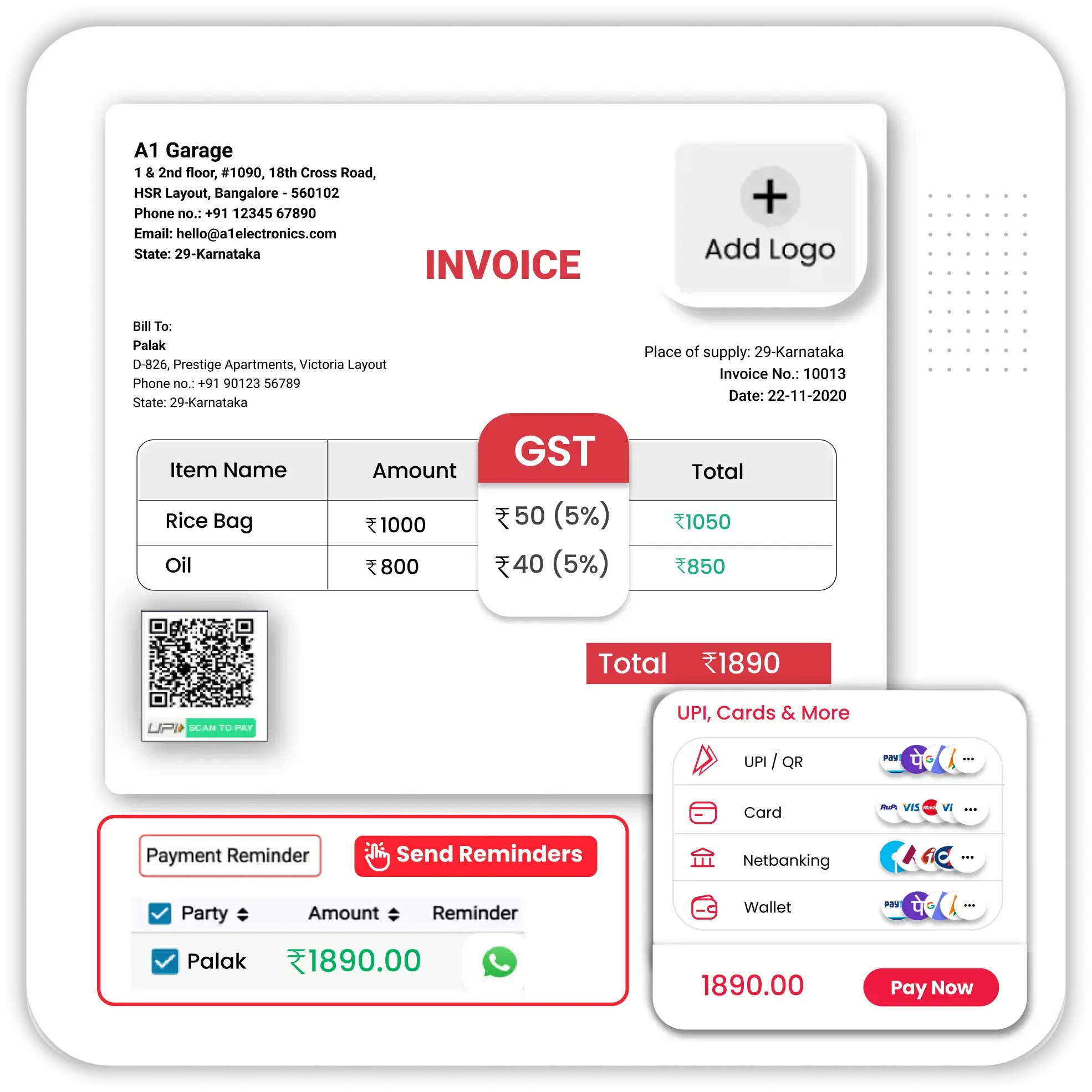

Multiple Payment Options

A flexible SaaS billing platform must support multiple payment methods to enhance customer convenience. Vyapar enables seamless transaction tracking.

- UPI & Digital Payments – Accept payments via UPI, digital wallets, and payment gateways for fast transactions.

- Bank Transfers & Cheques – Record NEFT, RTGS, IMPS, and cheque payments to maintain accurate records.

- Cash & Offline Payments – Keep track of cash transactions within the SaaS billing solutions for better financial management.

- Integrated Payment Tracking – Payments made through UPI, bank transfers, and cash get automatically updated in Vyapar’s billing SaaS software.

Customizable Invoice Templates

The best SaaS billing software should allow businesses to customise invoices to match their branding. Vyapar offers multiple customisation options.

- Add Business Logo & Colours – Create professional invoices by adding your business logo, brand colours, and digital signature using our invoicing tool.

- Custom Fields & Terms – Modify invoices with custom fields, payment terms, and notes for better clarity.

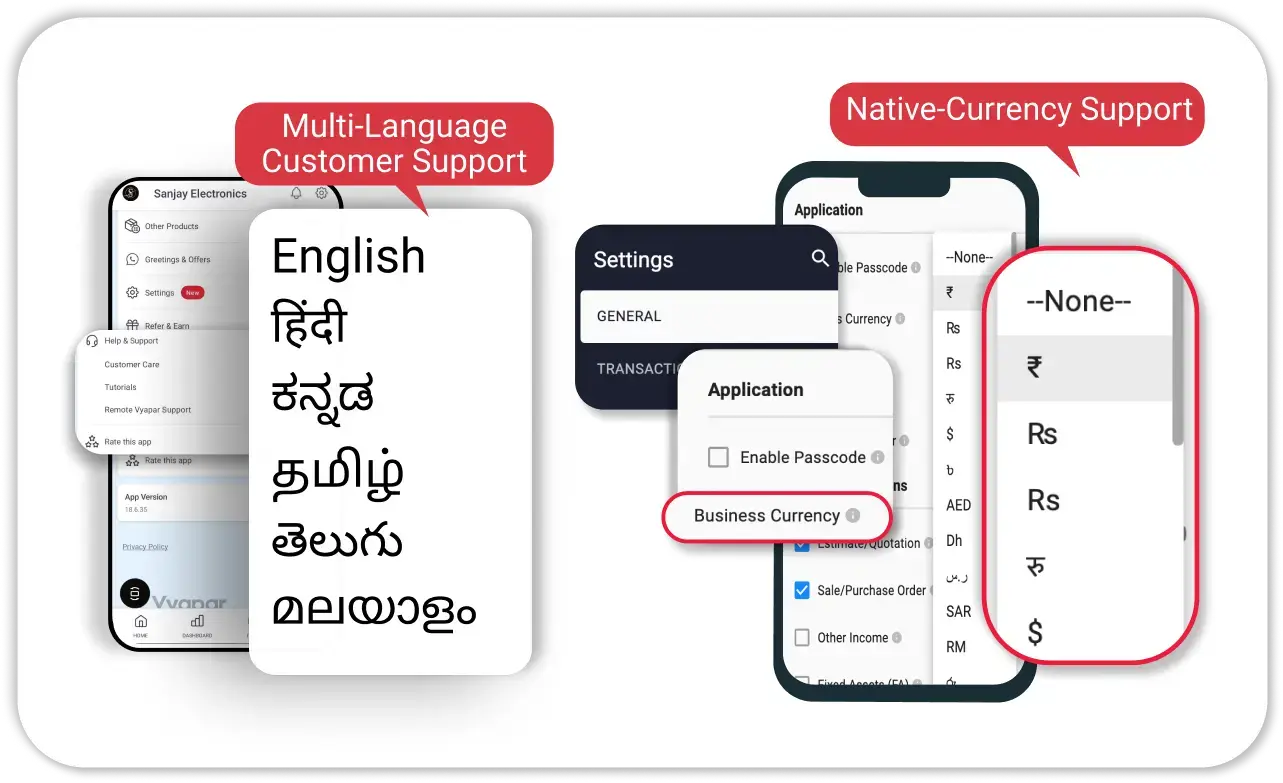

- Multi-Language Support – Generate invoices in multiple languages to cater to international clients.

- Multiple Format Support – Save invoices as PDF files, print them directly, or share via WhatsApp/email.

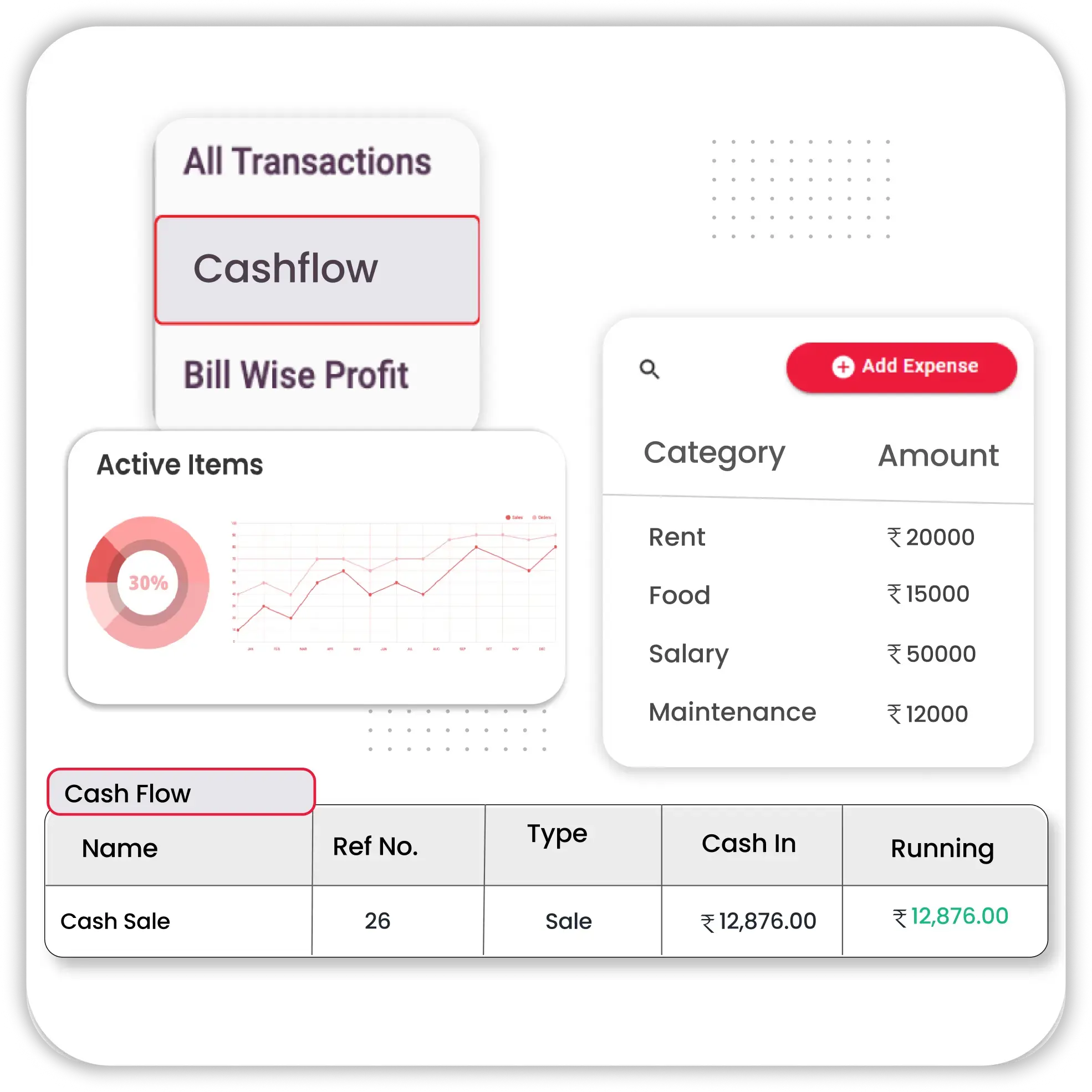

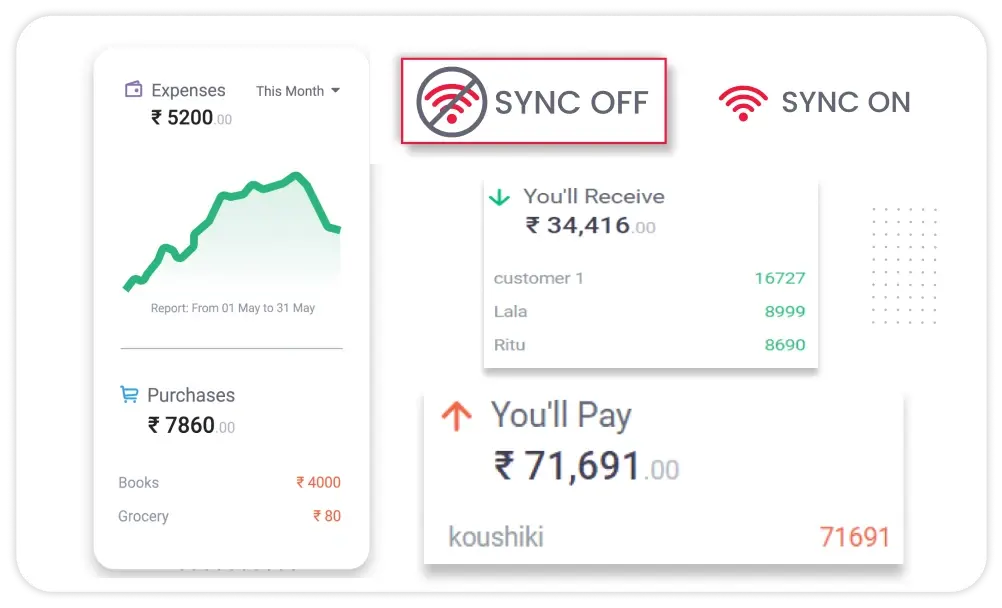

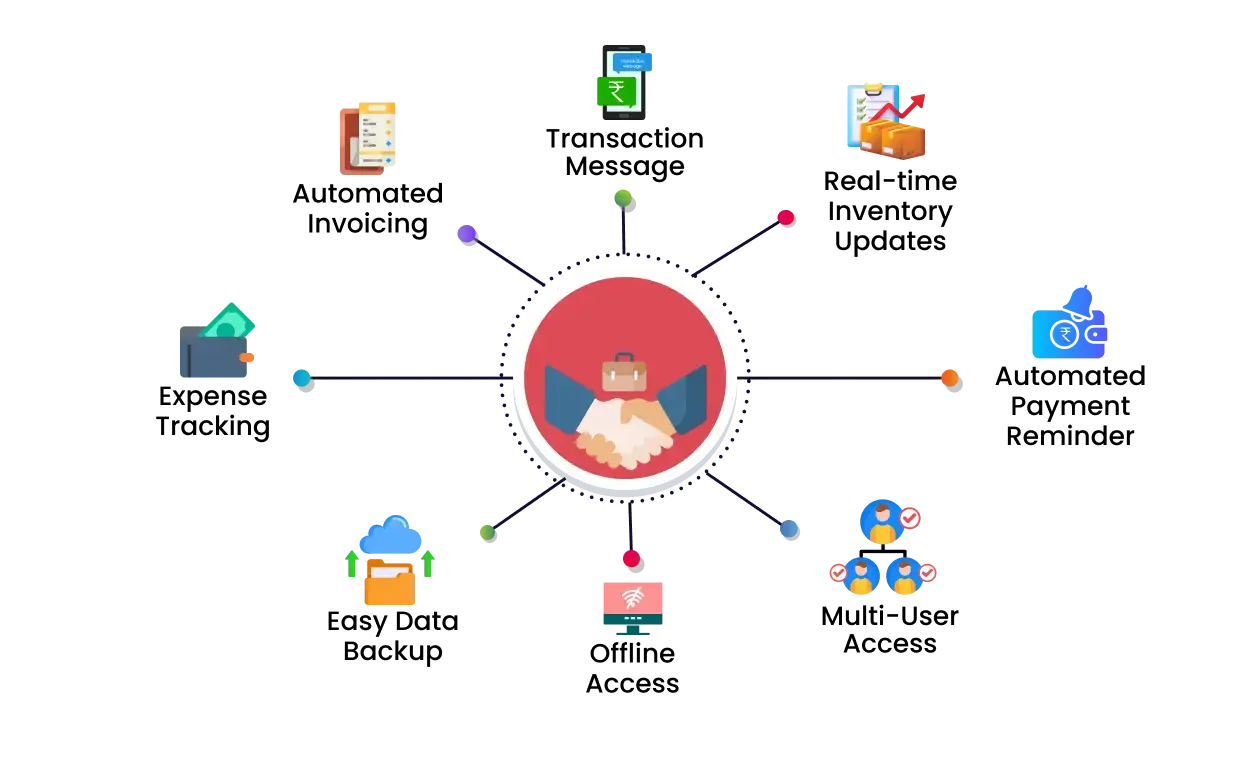

Expense and Cash Flow Management

A powerful SaaS billing system must include financial tracking features to help businesses manage their expenses effectively.

- Expense Categorisation – Record and categorise expenses under salaries, rent, software tools, and utilities.

- Real-Time Cash Flow Reports – Get instant insights on revenue and expenses to maintain financial stability.

- Vendor Payment Tracking – Keep track of supplier payments, due dates, and outstanding balances.

- Profitability Analysis – Analyse business performance with detailed financial reports.

Advanced Features of Vyapar SaaS Invoicing Software

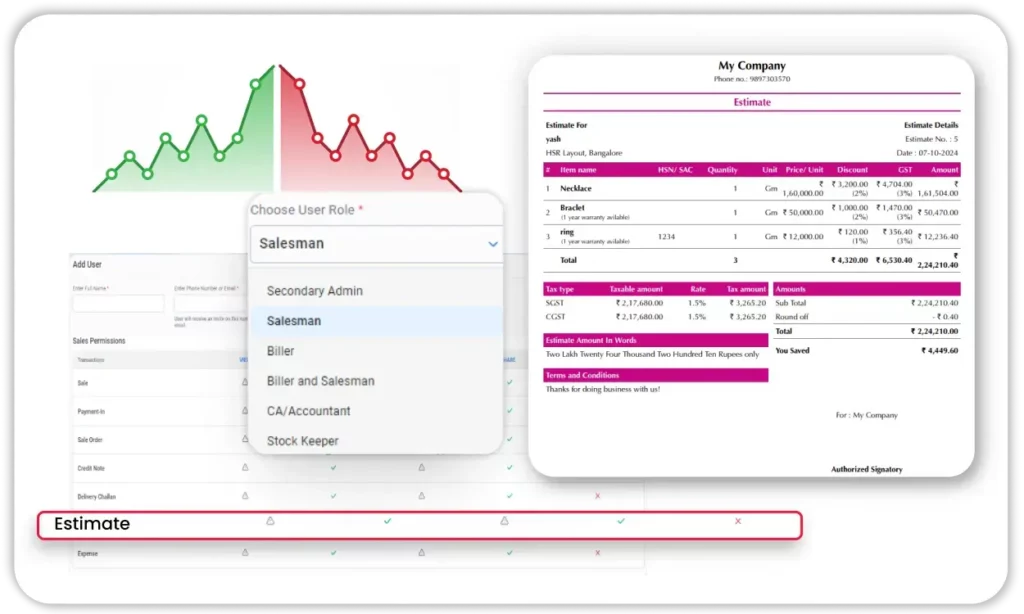

Quotation & Estimate Generation

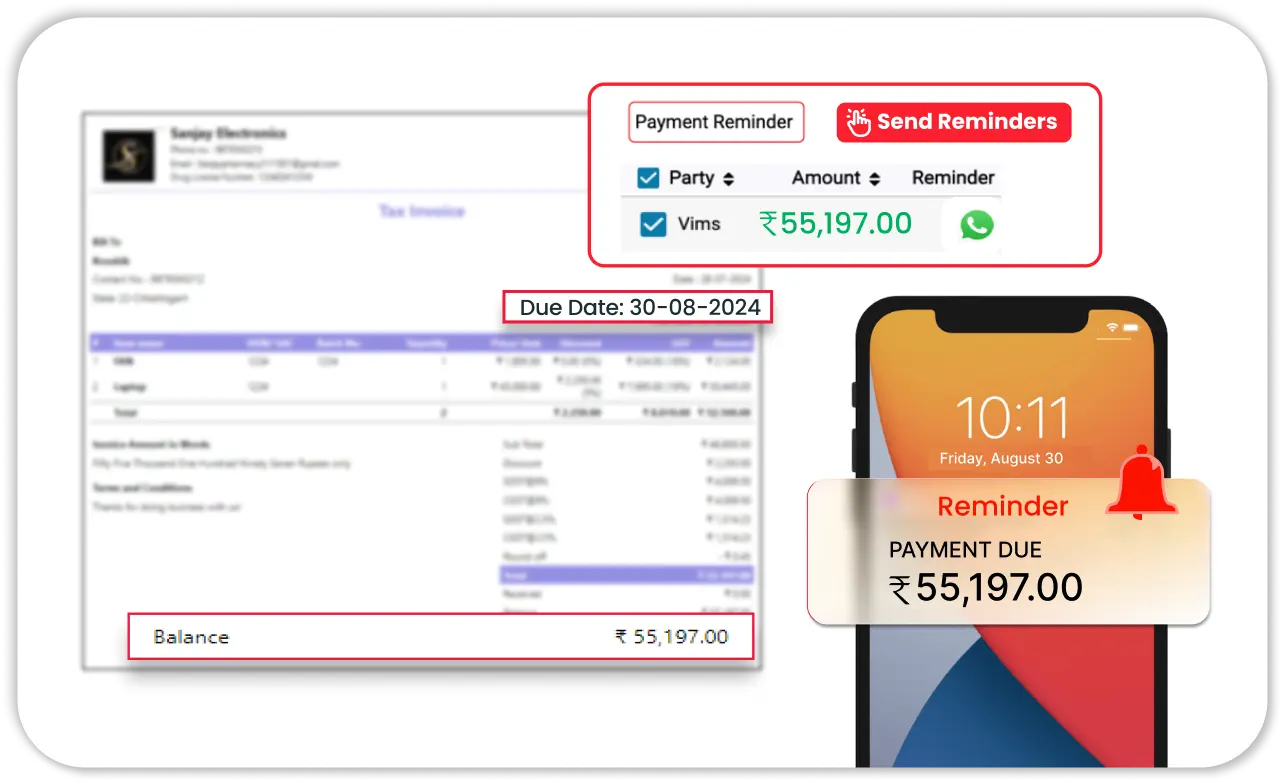

Payment Reminders & Alerts

Multi-Currency Support

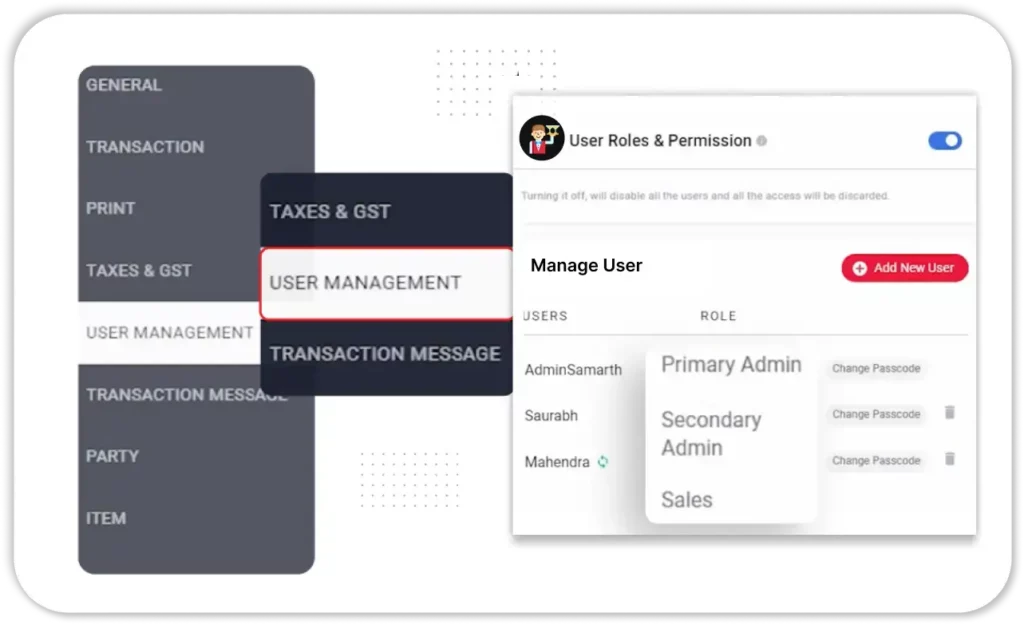

Role-Based User Access

Financial & Tax Reports

Customer & Supplier Management

Inventory & Stock Tracking

Offline & Cloud Backup

Discount & Coupon Management

Prorated Billing Adjustments

Vyapar’s Cutting-Edge SaaS Billing Solutions to Drive Growth

Quotation and Estimate Generation

Vyapar, a leading SaaS invoicing software, simplifies the process of creating and managing professional quotations for potential clients.

- Customizable Quotation Templates – Choose from predefined quotation formats and customise by adding your business details, terms, and pricing structure.

- Convert Quotations to Invoices – Easily transform an approved quotation into an invoice with a single click, without manually entering details again.

- Track Quotation Status – Check whether a quotation is pending, approved, or rejected, helping you follow up on potential sales.

- Easy Sharing Options – Send quotations via email, WhatsApp, or print them directly from Vyapar for offline sharing.

Payment Reminders and Alerts

Late payments can impact cash flow. Vyapar’s SaaS billing software automates reminders, ensuring timely payments from customers.

- Automated Due Date Reminders – Set up automatic payment reminders to notify customers before and after their invoice due date.

- Customizable Alert Messages – Personalise reminders with customer name, outstanding amount, due date, and payment instructions for better clarity.

- Multi-Channel Notifications – Send reminders through SMS, email, or WhatsApp directly from Vyapar, ensuring maximum reach.

- Overdue Payment Tracking – Get a clear view of unpaid invoices and follow up efficiently to prevent revenue loss.

Multi-Currency Support

Vyapar supports international transactions, making it easy for SaaS businesses to bill global clients.

- International Transactions – Select a preferred currency while creating invoices to match the client’s location and business needs.

- Multi-Currency Payment Acceptance – Record payments received in different currencies as set based on the business location.

Role-Based User Access

Vyapar provides secure access control, ensuring that only authorised personnel can view and modify financial data.

- Custom User Roles – Assign different levels of access, such as Admin (full control), Accountant (financial access), or Sales Executive (limited access).

- Restricted Data Access – Prevent unauthorised changes to invoices, reports, expenses, and payment records by restricting user permissions.

- Audit Trail Monitoring – Track all modifications and activities made by users, ensuring accountability and transparency.

- Multi-Device Access – Allow team members to access Vyapar from mobile, tablet, or desktop with their assigned roles and permissions.

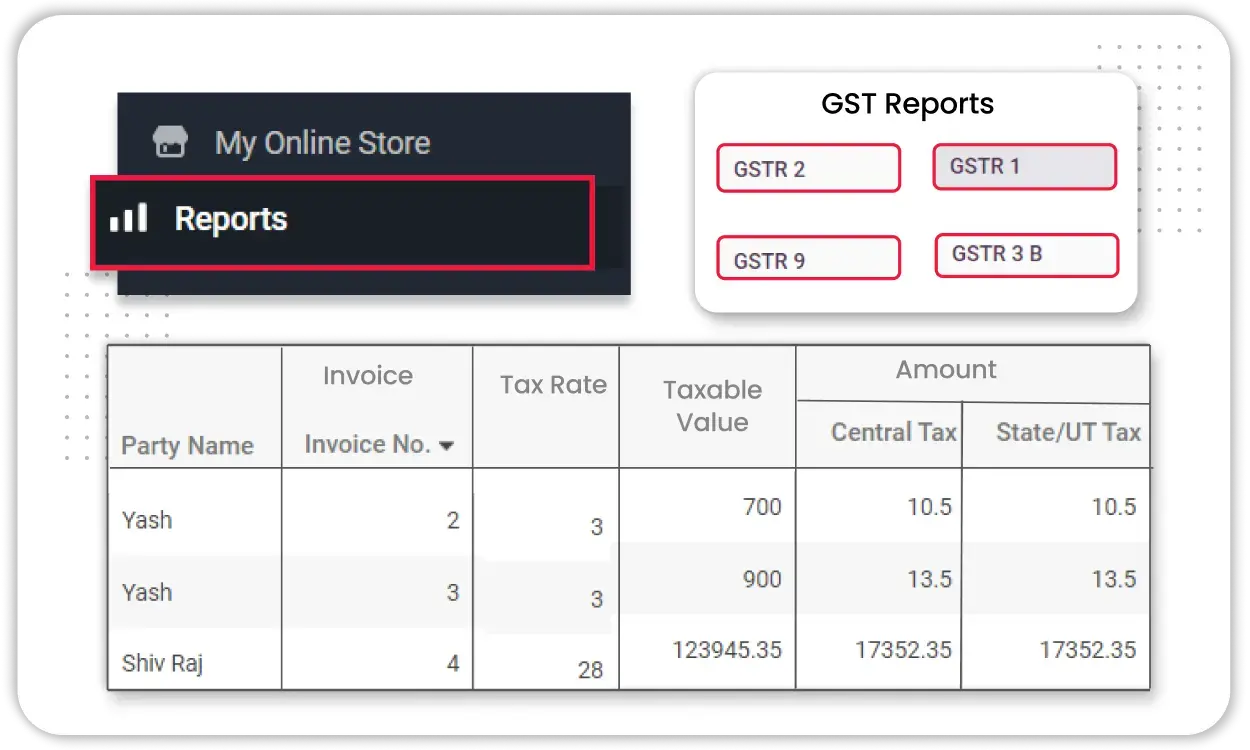

Financial and Tax Reports

Vyapar’s SaaS billing engine generates in-depth financial reports to help businesses analyse revenue and stay tax-compliant.

- Sales & Revenue Reports – Track monthly, quarterly, and yearly revenue to measure business performance.

- Expense Reports – Monitor spending trends by categorising rent, salaries, marketing, utilities, and other expenses.

- GST & Tax Reports – Generate GST-compliant invoices and tax reports for seamless filing.

- Profit & Loss Statement – The SaaS accounting app gives you a real-time overview of your SaaS business’s profitability, helping in better financial planning.

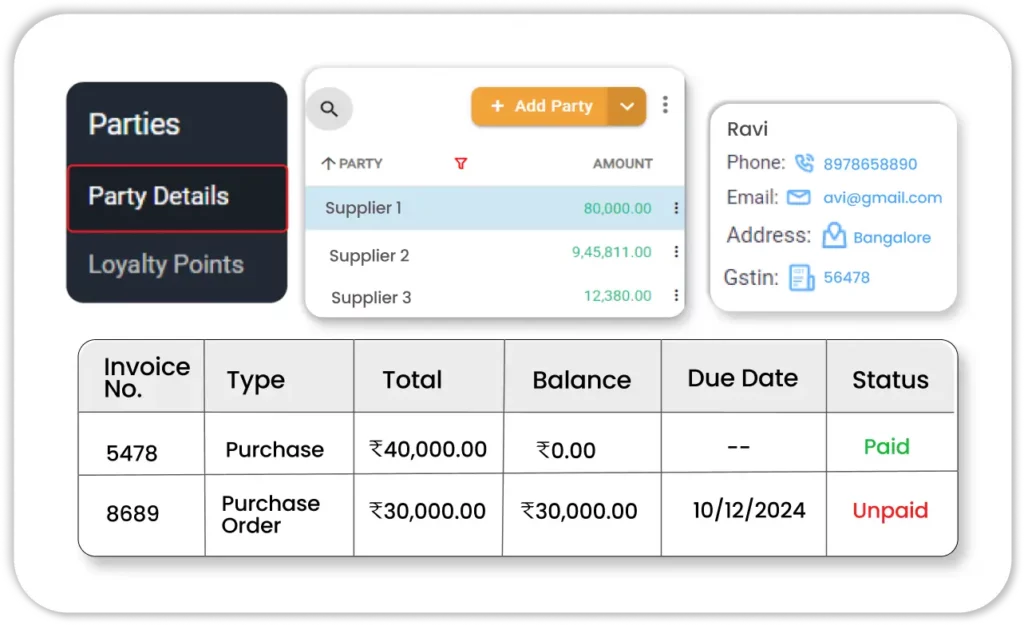

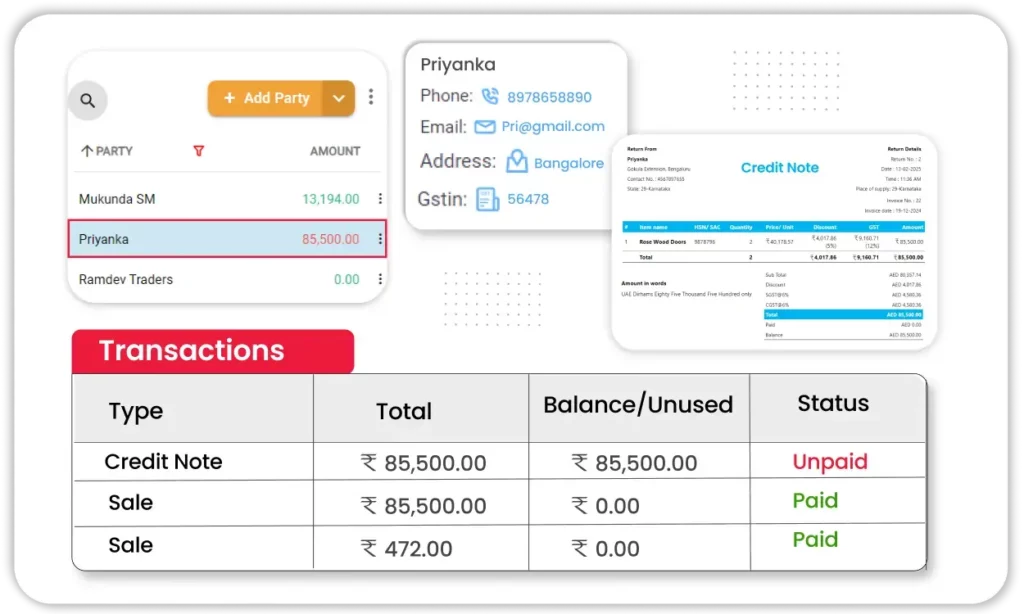

Customer and Supplier Management

Vyapar helps businesses keep track of customer interactions and supplier payments for smooth operations.

- Customer Contact Management – Store and manage customer details, transaction history, and outstanding balances in one place.

- Supplier Payment Tracking – Keep track of pending supplier invoices, due dates, and completed payments.

- Credit Limit Management – Set credit limits for customers and track outstanding dues to manage credit risks effectively.

- Loyalty & Discounts – Offer and manage discounts, special offers, and loyalty benefits, and share them via WhatsApp directly from Vyapar.

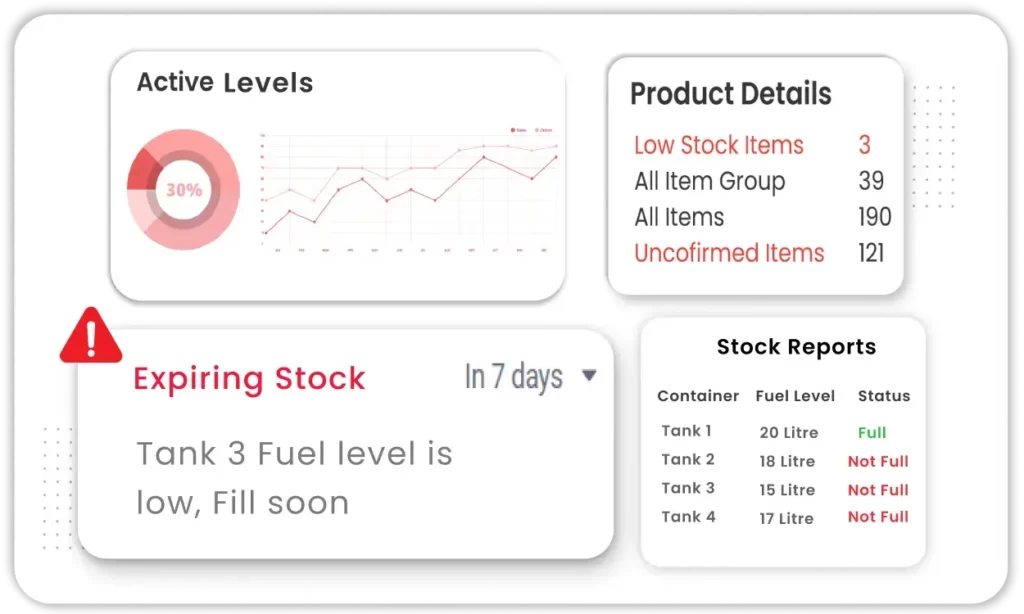

Inventory and Stock Tracking

For SaaS businesses managing software licenses or digital products, Vyapar provides efficient tracking tools.

- Stock Alerts & Notifications – Receive automatic alerts when license availability or stock levels drop below a set threshold.

- Easy Purchase Order Creation – Generate professional purchase orders (POs) with supplier details, item descriptions, quantity, and pricing in just a few clicks.

- Batch & Expiry Tracking – Monitor different software versions, update cycles, and expiration dates to avoid disruptions.

Offline and Cloud Backup

Vyapar ensures data security and uninterrupted access by offering offline functionality and secure cloud backups.

- Automatic Cloud Backup – Business data, including invoices, reports, and transactions, is automatically stored securely in the cloud.

- Offline Mode Functionality – Work without an internet connection and sync data automatically once online.

- Multi-Device Syncing – Access and update data in real-time across multiple devices for a seamless experience.

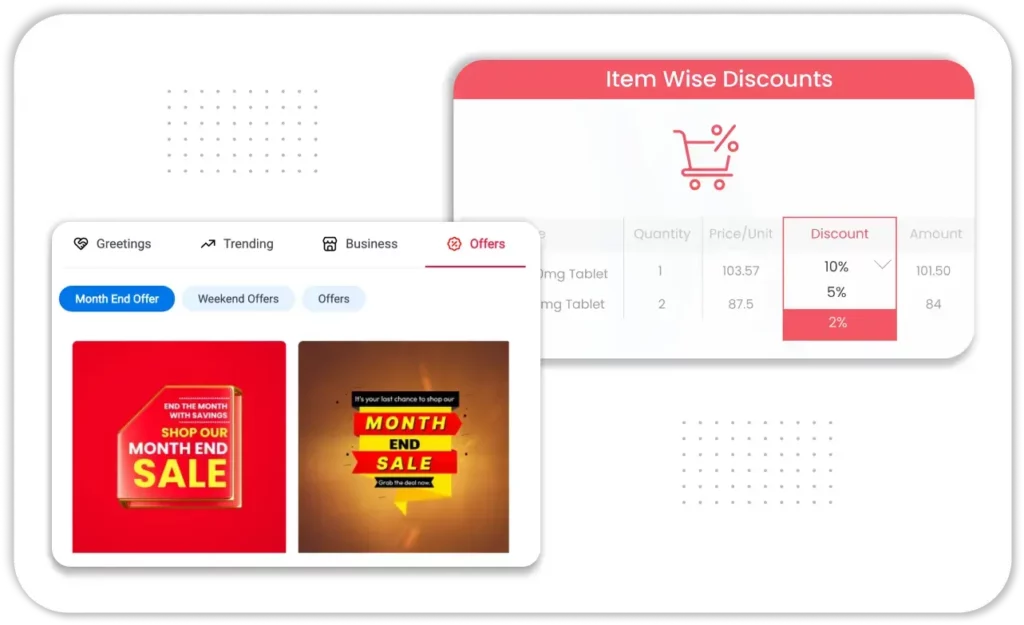

Discount and Coupon Management

Vyapar makes it easy to offer, track, and apply discounts and promotions for customer retention.

- Custom Discount Rules – Set flat or percentage-based discounts on specific invoices, products, or services.

- Limited-Time Promotions – Create and manage seasonal or time-bound discounts with automated start and end dates.

- Coupon Code Generation – Generate unique discount codes for marketing campaigns and promotional offers.

Prorated Billing Adjustments

Vyapar automates prorated billing, ensuring accurate charges for subscription changes.

- Automatic Proration Calculation – Adjust customer invoices when they upgrade or downgrade their plan mid-cycle.

- Refund & Credit Adjustments – Easily process partial refunds or credit notes for cancellations and mid-cycle plan changes.

Vyapar: The Only SaaS Billing Software You Need! Try Today!

Why Vyapar is the Best SaaS Billing Software?

Vyapar is more than just a SaaS billing platform—it’s a complete business management solution designed for ease, affordability, and efficiency. Unlike complex alternatives, Vyapar offers a simple setup, offline functionality, and cost-effective pricing, making it ideal for businesses of all sizes. It ensures seamless invoicing, expense tracking, and tax compliance without high recurring costs.

What sets Vyapar apart is its localised GST support, real-time assistance, and multi-currency invoicing, catering specifically to Indian businesses. With inventory tracking, payment management, and financial reports, Vyapar goes beyond billing, helping businesses streamline operations effortlessly. Try it free and experience the best SaaS billing software today! 🚀

Benefits of Vyapar SaaS Invoicing Software

Seamless Mobile & Desktop Access

Manage invoicing, payments, and reports anytime, anywhere with Vyapar’s mobile and desktop compatibility.

Scalable for Growth

Easily adapts to growing business needs with multi-device access and role-based permissions.

No Internet Dependency

Works offline, enabling businesses to generate invoices and track transactions even when an active Internet connection is unavailable.

Multi-Business Management

Vyapar enables handling multiple businesses under one account, streamlining operations effortlessly.

Reliable Customer Support

Quickly resolve queries with dedicated support via chat, call, and email.

Custom Business Branding

Allows personalised invoices with logos, colours, and signatures to enhance brand identity and professionalism.

Vyapar’s Growing Community

Take Your Big Business to the Next Level with Vyapar App! Try Free!

Frequently Asked Questions (FAQ’s)

SaaS invoicing is the process of generating and managing invoices using Software-as-a-Service (SaaS) platforms. It is also known as Subscription-based billing. SaaS billing models help save time and costs. It reduces manual efforts by automating invoices. Your company can collect revenue via a recurring billing system with SaaS billing software.

Our SaaS invoicing system offers customisation options. Your invoices can be made unique by including your company logo, choosing colours, and changing the layout. You can also customise the invoice details to reflect your brand identity by adding custom fields.

Yes. Vyapar SaaS invoicing software includes tools for tracking payments and monitoring past-due invoices. You can quickly view each invoice’s payment status, set up automated reminders for late payments, and generate reports to assess payment trends and outstanding balances.

Businesses can adopt several types of Software as a Service (SaaS) invoicing subscription models. Here are some common types of SaaS invoicing subscription models:

1. Flat-Rate Pricing: Customers pay a fixed monthly subscription or annual fee for using the SaaS invoicing software.

2. Tiered Pricing: Businesses use to provide clients with various products or services at various price points and customers can choose the package that best suits their needs.

3. Usage-Based Pricing: In this model, customers are billed accordingly by the number of invoices generated, transactions processed, or other SaaS metrics.

4. Per-User Pricing: In this model, customers are charged based on the number of users accessing the SaaS invoicing software.

5. Value-Based Pricing: The cost of the SaaS invoicing software is determined based on the value it delivers to the customer’s business.

6. Freemium Model: Initially, a basic version of the software for free will be provided later on it will be charged for additional features, higher usage limits, or premium support.

7. Custom Pricing: SaaS invoicing providers offer custom pricing models tailored to the specific needs of large enterprises or businesses with unique requirements.

Vyapar offers a free trial with essential features. For advanced capabilities like GST reports, multi-currency invoicing, and expense tracking, you can upgrade to a paid plan.

Yes! Vyapar allows you to create invoices, record payments, and manage expenses without an internet connection, syncing data once you’re online.

Yes! Vyapar allows you to set different currencies, invoice international clients, and track payments with ease.

Vyapar ensures top-notch security for your business data by implementing multiple layers of protection, including cloud backups, offline access, encryption, and role-based user controls. Your financial information, invoices, and transaction records are stored securely to prevent unauthorised access, data loss, or breaches.