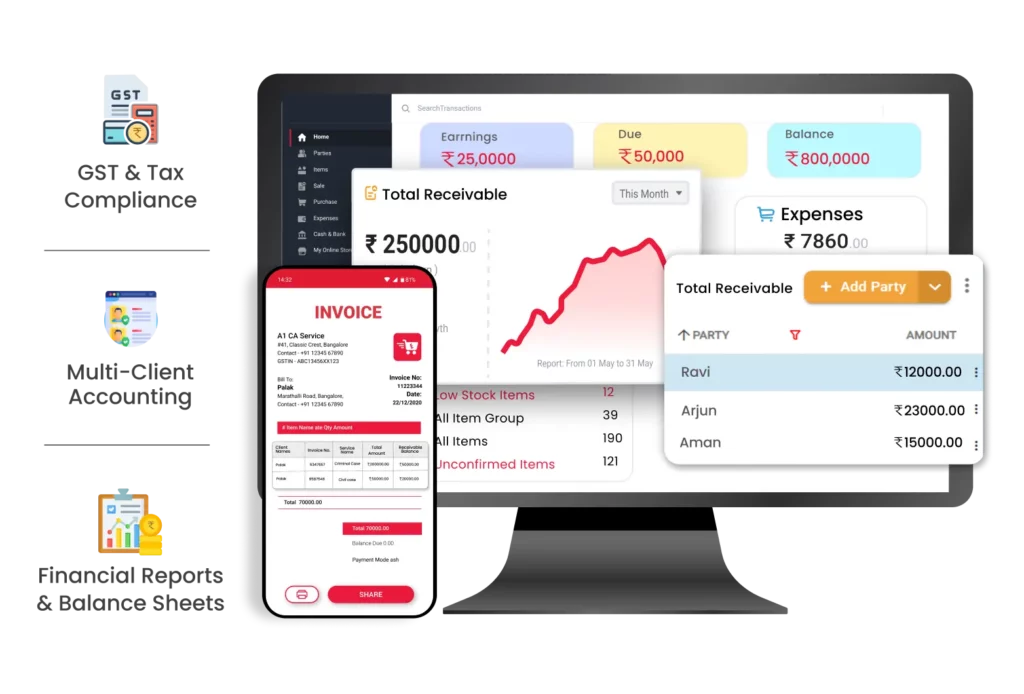

CA Accounting Software

Managing accounting as a Chartered Accountant (CA) can be challenging. Vyapar’s CA Accounting Software simplifies bookkeeping, GST filing, and financial reporting efficiently and accurately. Download Vyapar now to streamline your accounting today!

Top 4 Key Features of CA Accounting Software

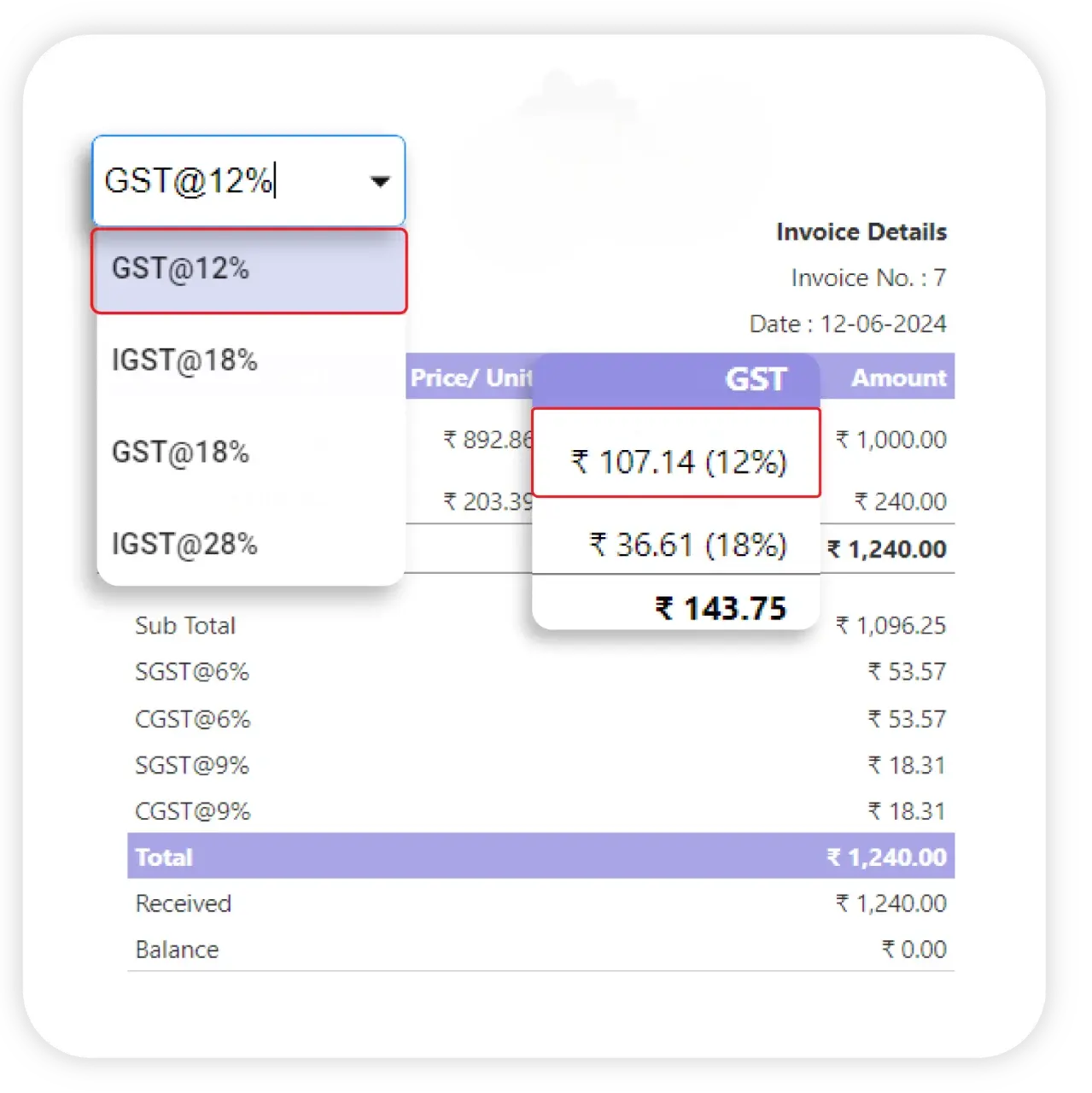

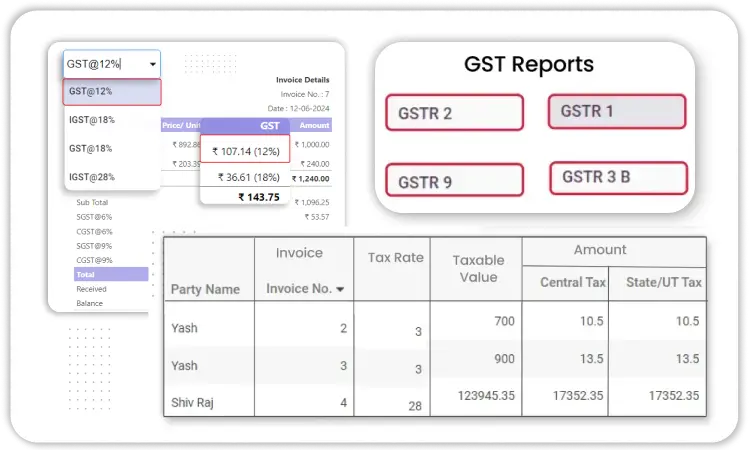

GST & Tax Compliance

Managing GST compliance is crucial for CAs handling multiple clients. Vyapar streamlines tax filing and ensures error-free tax calculations, making it an essential CA accounting software.

- Auto GST Return Filing – Generate GSTR-1, GSTR-3B, and other GST returns automatically.

- ITC Reconciliation – Match Input Tax Credit (ITC) with supplier invoices to avoid mismatches.

- Tax Liability Tracking – Monitor tax liabilities in real time to ensure timely payments.

- GST-Compliant Invoices – Generate GST invoices with auto-calculated tax components.

- TDS & Income Tax Reports – Prepare TDS reports and calculate applicable tax effortlessly.

Multi-Client Accounting

CAs handle multiple businesses, requiring an organized system to separate and manage financial data. Vyapar simplifies multi-client accounting with dedicated business profiles and ledger management, making it one of the most efficient accounting software used by accountants.

- Multiple Business Profiles – Manage multiple clients’ accounts from a single dashboard.

- Client Ledger Management – Maintain customer accounts and vendor transactions effortlessly.

- Automated Bookkeeping – Reduce manual errors with auto-ledger entries and bank reconciliations.

- Native Currency Accounting – Manage transactions seamlessly in your local currency, ensuring accurate financial records and compliance with regional accounting standards.

Financial Reports & Balance Sheets

Vyapar enables CAs to generate detailed financial reports for business analysis, tax compliance, and audit purposes.

- Profit & Loss Statement – Create P&L reports to track revenue and expenses.

- Balance Sheets – Generate balance sheets for a clear financial overview.

- Cash Flow Management – Track cash flow for better financial planning.

- Tax Reports & Audit Support – Generate tax reports for audits and filings.

- Custom Financial Reports – Generate customized financial statements tailored to client needs.

Invoicing & Payment Management

Vyapar offers automated invoicing and payment tracking, helping CAs streamline billing and manage client payments efficiently.

- Customizable Invoices – Generate professional invoices with your CA firm’s branding.

- Payment Reminders – Send automated reminders to clients for outstanding payments.

- Multiple Payment Options – Accept payments via cash, UPI, and bank transfers for enhanced client experience.

- Invoice Tracking – Maintain records of paid, pending, and overdue invoices for better cash flow management.

Advanced Features in Vyapar CA Accounting Software

Customized Invoicing & Billing

E-Way Bill & E-Invoicing Integration

Expense & Income Tracking

Bulk Data Import & Export

Role-Based Permissions

Audit & Compliance Reports

Mobile App for On-the-Go Accounting

Data Backup & Security

TDS & Income Tax Calculation

Multiple Payment Methods

Custom CA Accounting Software – Unlock More Features for Growth!

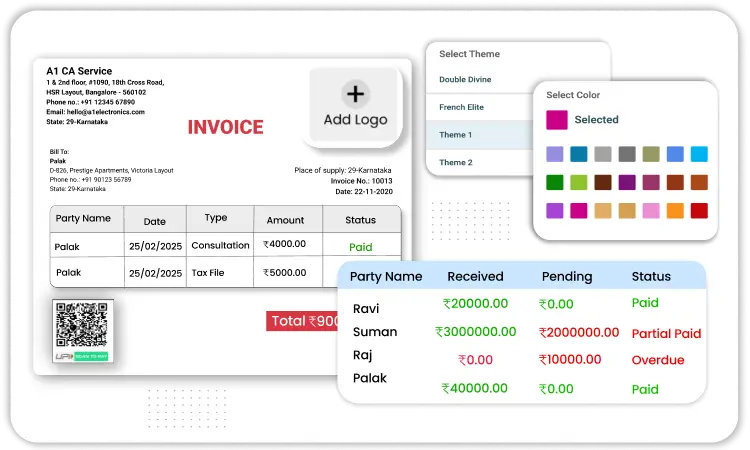

Customized Invoicing & Billing

Vyapar makes invoicing and billing seamless with automated features that help CAs and their clients create, send, and track invoices efficiently.

- Custom Invoice Templates – Design professional invoices with custom branding, logos, and formats tailored for CA firms.

- Automated Invoice Numbering – Maintain sequential invoice numbers automatically, ensuring proper record-keeping and compliance.

- Payment Tracking – Keep records of paid, partially paid, pending, and overdue invoices with real-time updates for better cash flow management.

Vyapar is a CA accounting software that ensures error-free billing and faster payments for accountants and their clients.

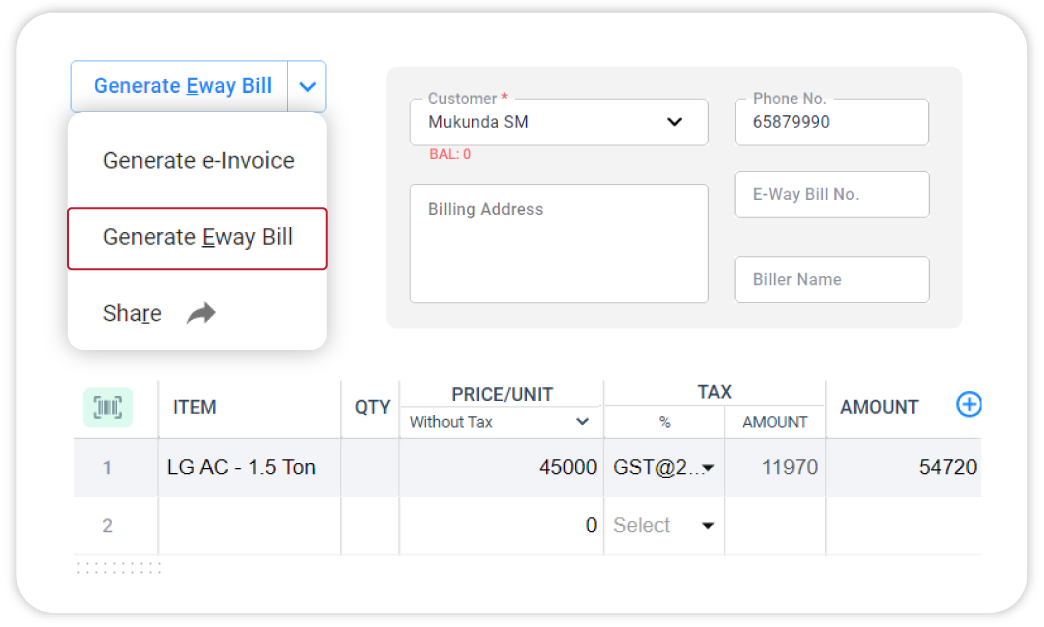

E-Way Bill & E-Invoicing Integration

Vyapar integrates E-Way Bill and E-Invoicing directly with GST portals, eliminating manual errors and making compliance easier.

- One-Click E-Way Bill Generation – Create and print E-Way Bills directly from invoices without needing manual entry on government portals.

- E-Invoice Generation with IRN & QR Code – Generate GST-compliant e-invoices with an Invoice Reference Number (IRN) and QR code, ensuring smooth compliance.

- Auto-Fill Data for GST Filing – Syncs invoice data automatically for error-free GST return filing.

This accounting software used by accountants simplifies E-Way Bill management and e-invoicing, reducing compliance risks.

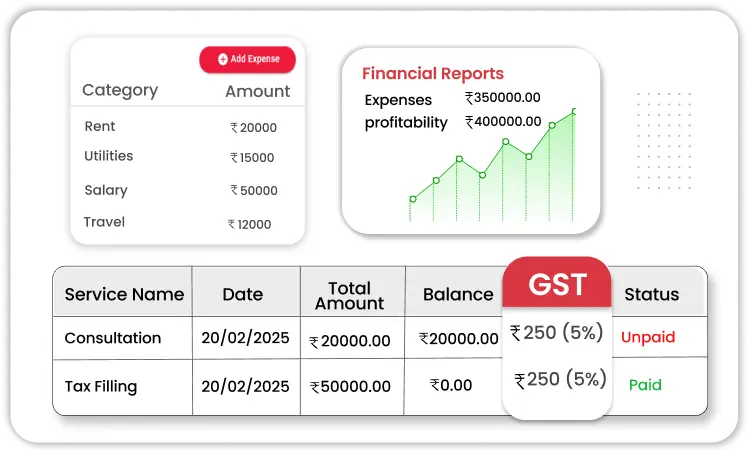

Expense & Income Tracking

Tracking business income and expenses is crucial for accurate financial reporting and tax compliance. Vyapar provides detailed insights into financial transactions.

- Categorized Expense Management – Assign expenses to different categories, such as rent, utilities, salaries, and travel, for clear tracking.

- Automated Income Tracking – Monitor client payments and revenue sources in real-time, ensuring accurate profit calculations.

- GST Input Tax Credit (ITC) Calculation – Track ITC on expenses and maximize tax savings during GST filing.

Vyapar’s CA accounting software automates financial tracking, reducing manual bookkeeping efforts for accountants.

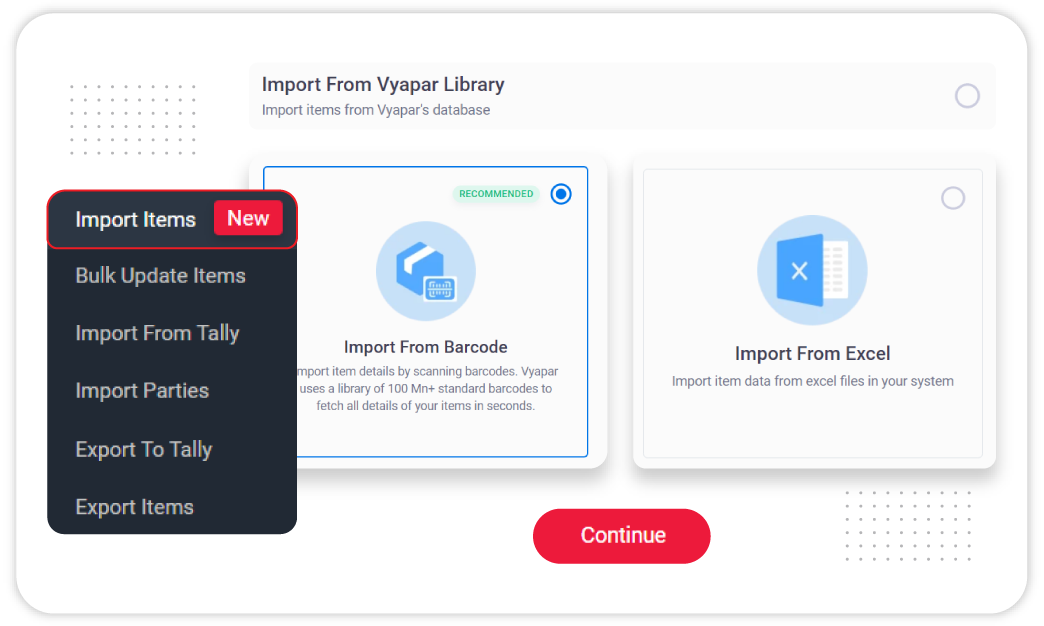

Bulk Data Import & Export

Handling large volumes of financial data is simplified with Vyapar’s bulk import and export capabilities.

- Import Client & Inventory Data – Upload bulk data from Excel files to avoid manual data entry errors.

- Export Reports in Multiple Formats – Download reports in PDF, Excel, and CSV to share with clients or auditors.

- Seamless Integration – Easily transfer data between different top accounting platforms for a smoother workflow.

- Reduces Manual Effort – Automates data entry, saving valuable time for CAs.

Vyapar allows CAs to save time while ensuring accurate financial records.

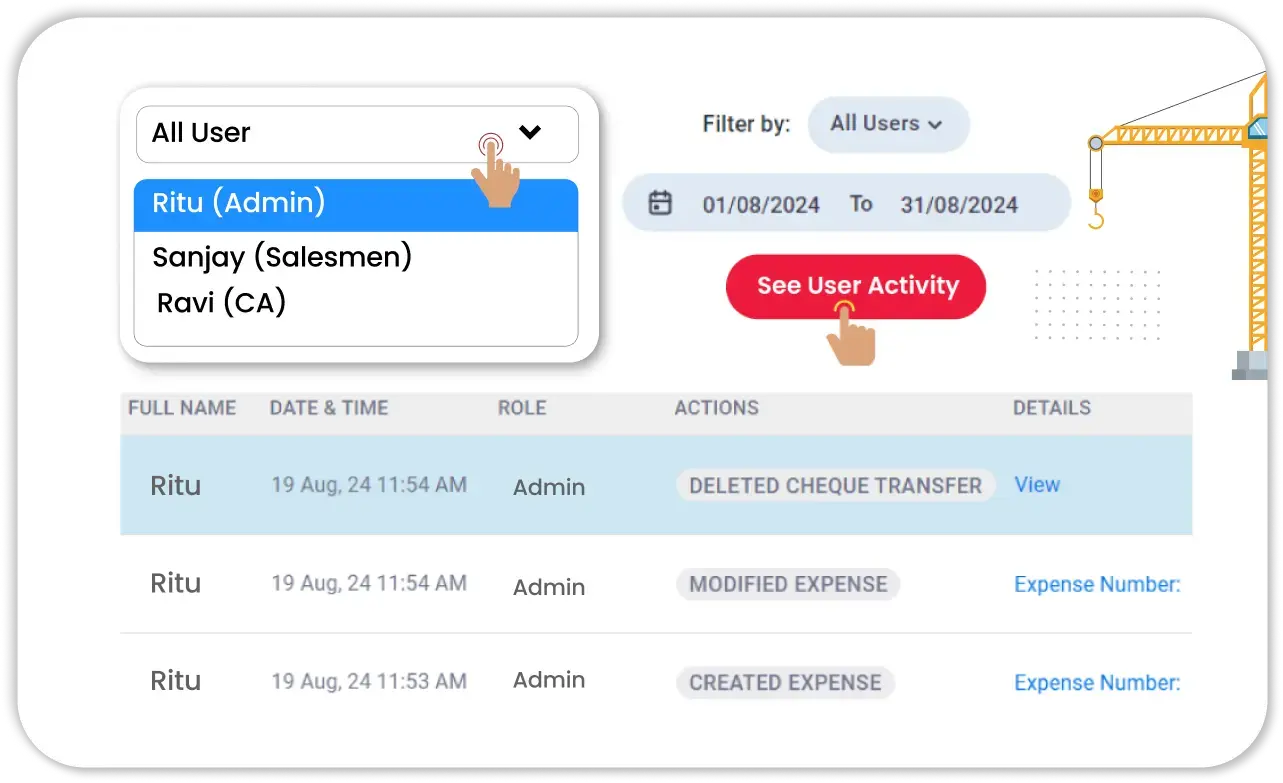

Multi-User Access with Role-Based Permissions

Vyapar offers secure multi-user access, enabling team collaboration while maintaining data privacy.

- Define User Roles & Permissions – Assign access levels for staff, accountants, and clients based on their roles.

- Protect Confidential Data – Restrict sensitive information from unauthorized users to maintain privacy.

- Monitor User Activity – Track modifications made to client financial records, ensuring accountability.

- Ideal for Accounting Teams – Perfect for firms with multiple team members handling different client accounts.

This CA accounting software provides role-based access, ensuring secure team collaboration.

Audit & Compliance Reports

CAs need detailed reports for audits and tax compliance. Vyapar simplifies financial reporting for easy assessments.

- Auto-Generated Audit Reports – Download audit ready financial statements for compliance.

- TDS & Tax Compliance Reports – Ensure businesses meet TDS and income tax requirements.

- GST Summary & Tax Reports – Get clear GST liability breakdowns for accurate tax filing.

- Exportable Reports for Clients & Auditors – Easily share reports with authorities when required.

Vyapar is an accounting software used by accountants to generate tax and compliance reports effortlessly.

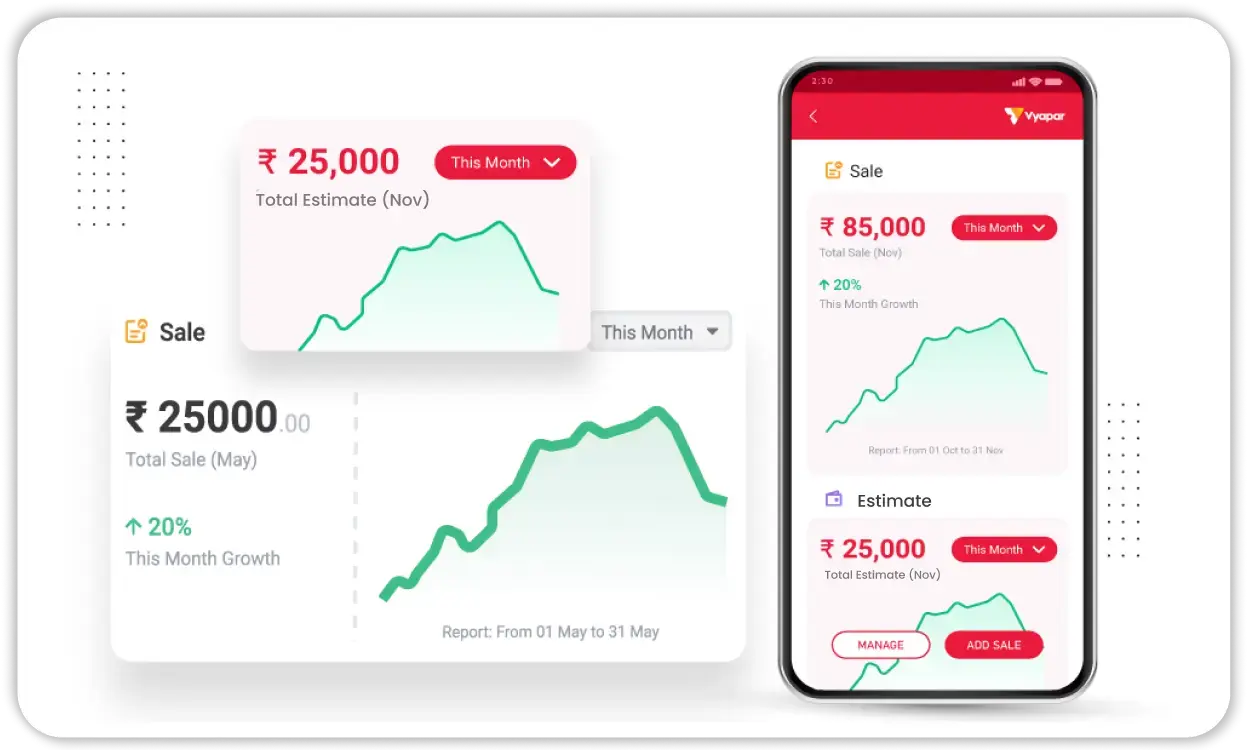

Mobile App for On-the-Go Accounting

Vyapar’s mobile app allows CAs to manage financial data remotely with ease.

- Access Client Accounts Anytime – Work from anywhere using a mobile-friendly dashboard.

- Create & Send Invoices on Mobile – Issue invoices instantly without needing a desktop.

- Expense Recording on the Go – Log business expenses as they happen for real-time accuracy.

- View Financial Reports in Real-Time – Stay updated with financial data even while traveling.

Vyapar is a CA accounting software with full mobile access, making accounting more flexible.

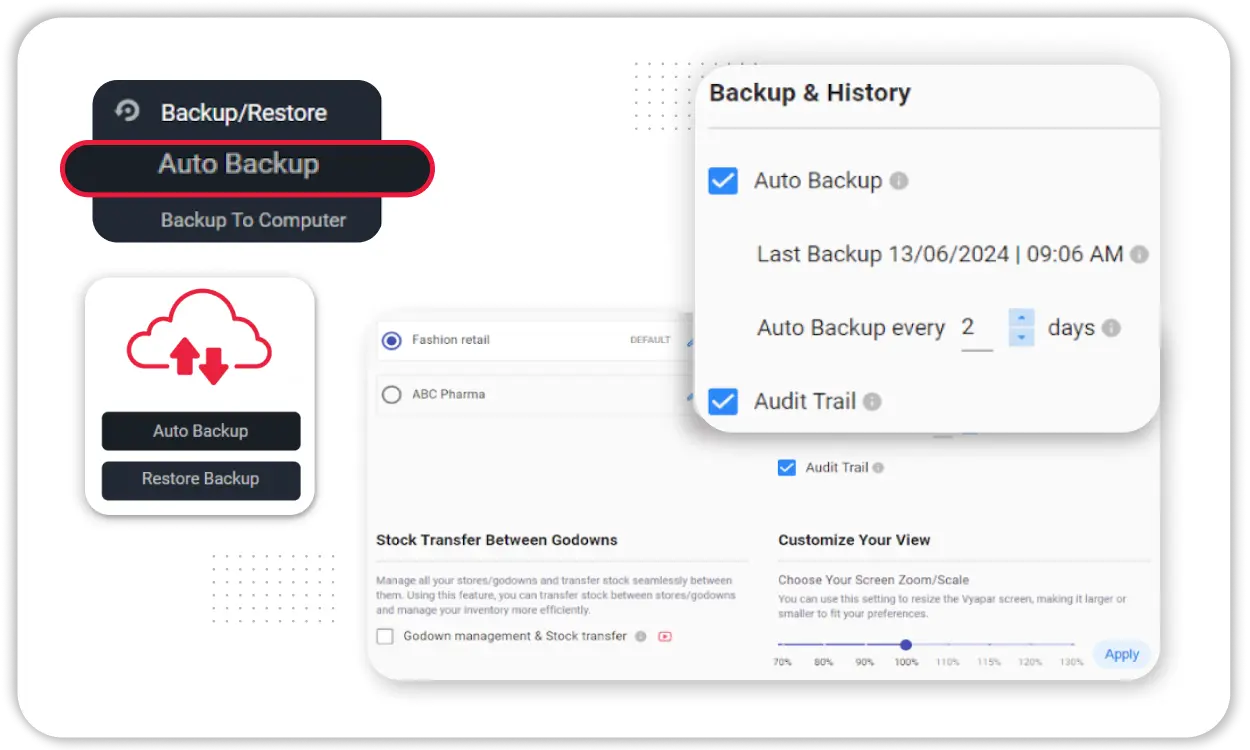

Data Backup & Security

Vyapar ensures data security through cloud backups and encryption, safeguarding financial information.

- Automatic Cloud Backup – Prevent data loss with secure cloud storage.

- End-to-End Encryption – Protect client financial records from cyber threats.

- Offline Access & Syncing – Work offline and sync data once connected.

- Multi-Device Access – Access financial records from desktop and mobile devices.

Vyapar is a trusted accounting software used by accountants, ensuring data privacy and protection.

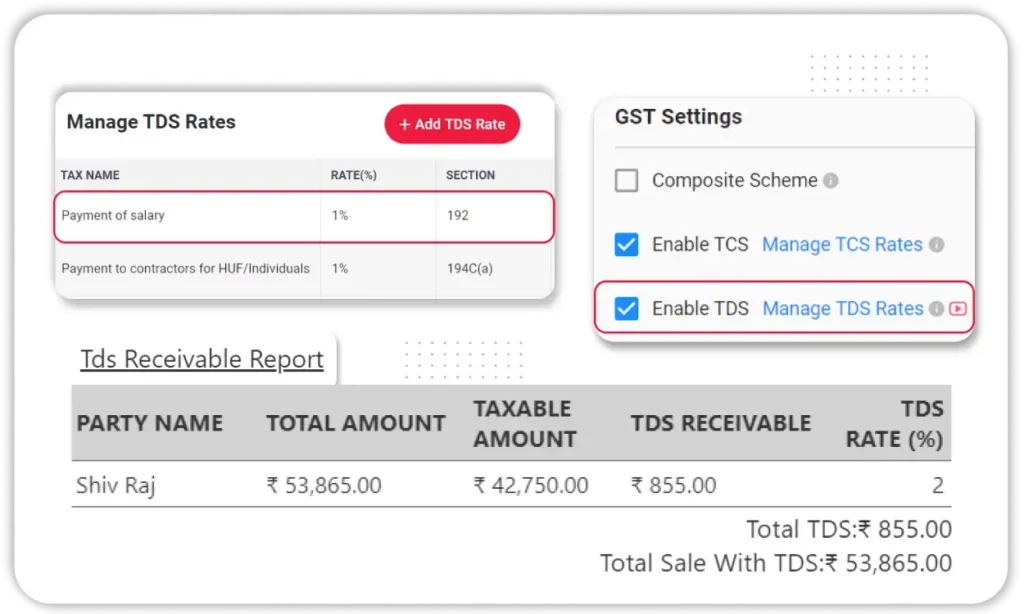

TDS & Income Tax Calculation

Vyapar simplifies TDS and income tax calculations for better tax planning.

- Auto TDS Deduction – Calculate TDS on invoices and generate TDS certificates.

- Income Tax Estimation – Estimate taxable income for businesses and individuals.

- Tax Report Generation – Download tax reports for compliance and filing purposes.

- Eliminate Manual Errors – Automate tax calculations to prevent discrepancies.

Vyapar’s CA accounting software simplifies TDS and tax compliance.

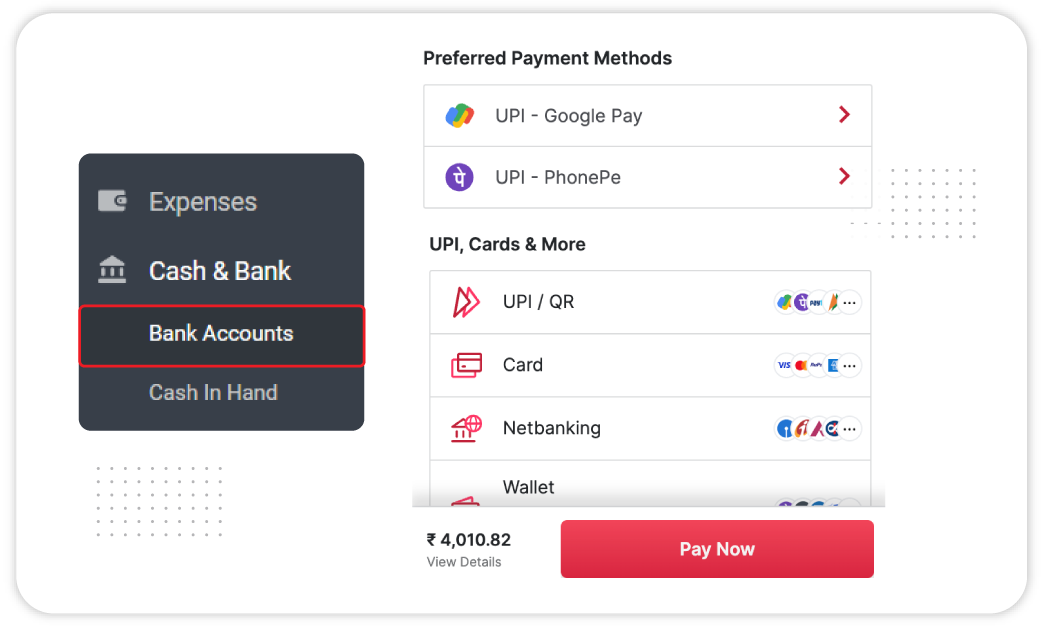

Multiple Payment Methods

Vyapar offers seamless integration with various payment methods to ensure easy and efficient transactions.

- Diverse Payment Options – Accept payments via credit/debit cards, UPI, net banking, and digital wallets.

- Customizable Payment Gateways – Integrate with popular payment gateways to suit your business needs.

- Increased Flexibility – Provide customers with options like Cash on Delivery (COD) or bank transfers.

- Enhanced Customer Experience – Offer your customers a convenient, secure, and hassle-free payment experience.

Vyapar’s payment solution streamlines the payment process, helping businesses focus on growth while ensuring fast and secure transactions.

Vyapar Accounting Software – Fast, Accurate Billing & Accounting On the Go!

How CA Accounting Software & Apps Like Vyapar Empower Your Business

Vyapar’s CA Accounting Software simplifies financial management, ensures tax compliance, and enhances efficiency for Chartered Accountants (CAs). It automates bookkeeping, invoicing, and tax filing while providing secure data management and multi-business support. Below are the key benefits explained in detail:

Saves Time: Automate Bookkeeping and GST Filing

Vyapar automates bookkeeping and GST filing, reducing manual effort and saving valuable time.

- Auto-Ledger Entries – Transactions are automatically recorded in ledgers, eliminating the need for manual entry.

- GST Auto-Calculation – The system calculates GST for invoices, purchases, and returns, ensuring accuracy.

- One-Click GST Filing – Generate GSTR-1, GSTR-3B, and other returns directly from the software.

Reduces Errors: AI-Powered Calculations Ensure Accuracy

Vyapar’s AI-driven calculations help prevent accounting errors, ensuring accurate financial records.

- Auto Tax Computation – Avoid errors in GST and TDS deductions.

- Invoice Validation – Ensures invoice details are correct before sending to clients or tax authorities.

- Real-Time Data Sync – Transactions are updated instantly, reducing reconciliation errors.

Client-Friendly: Offer Detailed Reports for Client Understanding

Vyapar provides clear and easy-to-understand reports, making it simpler for CAs to explain financials to clients.

- Visual Dashboards – Clients can view sales trends, cash flow, and tax liabilities easily.

- Export & Share Reports – Download reports in PDF, Excel, or CSV format for presentations and filing.

Cost-Effective: No Hidden Charges, Pay Only for What You Use

Vyapar is an affordable accounting software with transparent pricing.

- No Extra Fees – No hidden costs for basic accounting, invoicing, and tax features.

- Custom Pricing Plans – Choose plans based on business needs without unnecessary expenses.

- Free Trial Available – Test the software before committing to a paid plan.

Mobile Access: Manage Accounts from Anywhere

Vyapar’s mobile app allows CAs to access accounting features remotely.

- Cloud Syncing – Access data from both mobile and desktop devices in real time.

- Invoice & Expense Tracking on Mobile – Generate invoices and record expenses from anywhere.

- Multi-Device Accessibility – Work seamlessly across smartphones, tablets, and desktops.

Multi-Business Support: Handle Multiple Businesses with 1 Login

Vyapar helps CAs manage multiple businesses or clients within the same account.

- Separate Financial Books for Each Business – Maintain individual ledgers, invoices, and GST filings.

- One-Click Business Switching – Easily switch between businesses without logging out.

- Consolidated Business Reports – Generate combined or individual reports for each business.

Custom Invoices: Professional Invoicing for Clients

Vyapar provides customizable invoice templates to match CA firm branding.

- Personalized Invoice Designs – Add company logos, custom fields, and color themes.

- Automated Invoice Numbering – Maintain proper invoice sequences without manual tracking.

User-Friendly: Easy-to-Use Interface for Seamless Accounting

Vyapar is designed with a simple and intuitive interface, making accounting tasks effortless.

- Minimal Learning Curve – Even users with no prior accounting knowledge can operate the software.

- Quick Setup & Navigation – Easily configure business details, GST settings, and reports.

- One-Tap Reports & Invoices – Generate reports and invoices in just a few clicks.

Vyapar’s Growing Community

Take Your Business to the Next Level with Vyapar App! Try Free!

Frequently Asked Questions (FAQs’)

CA Accounting Software helps Chartered Accountants (CAs) manage bookkeeping, taxation, invoicing, and financial reporting for multiple clients. Vyapar’s software ensures 100% GST and income tax compliance.

Vyapar automates GST & income tax calculations, tracks Input Tax Credit (ITC), and generates audit-ready tax reports, reducing manual effort and ensuring compliance.

CAs prefer Vyapar, Tally, and QuickBooks, but Vyapar stands out for its ease of use, automation, and affordability.

It is a call logging system by Panasonic for tracking telephone expenses, not a financial accounting tool like Vyapar.

CA Max is a tax and bookkeeping software, but Vyapar provides a better user-friendly solution with multi-business support.

Yes, Vyapar is a CA-friendly accounting software with multi-client management, invoicing, GST filing, and tax reports.

Yes, Vyapar is simpler, more affordable, and GST-compliant, making it a top choice for CAs over complex tools like Tally.

Yes, Vyapar’s mobile app allows real-time access to accounts, invoices, and reports from anywhere.

Yes, Vyapar provides end-to-end encryption, cloud backups, and offline access to keep client data safe.