Computerized Accounting Software

Vyapar’s Computerized Accounting Software is your complete accounting solution. Personalize invoices, generate reports, and manage inventory effortlessly—all in one smart app!

Top Tailored Features of Computerized Accounting Software

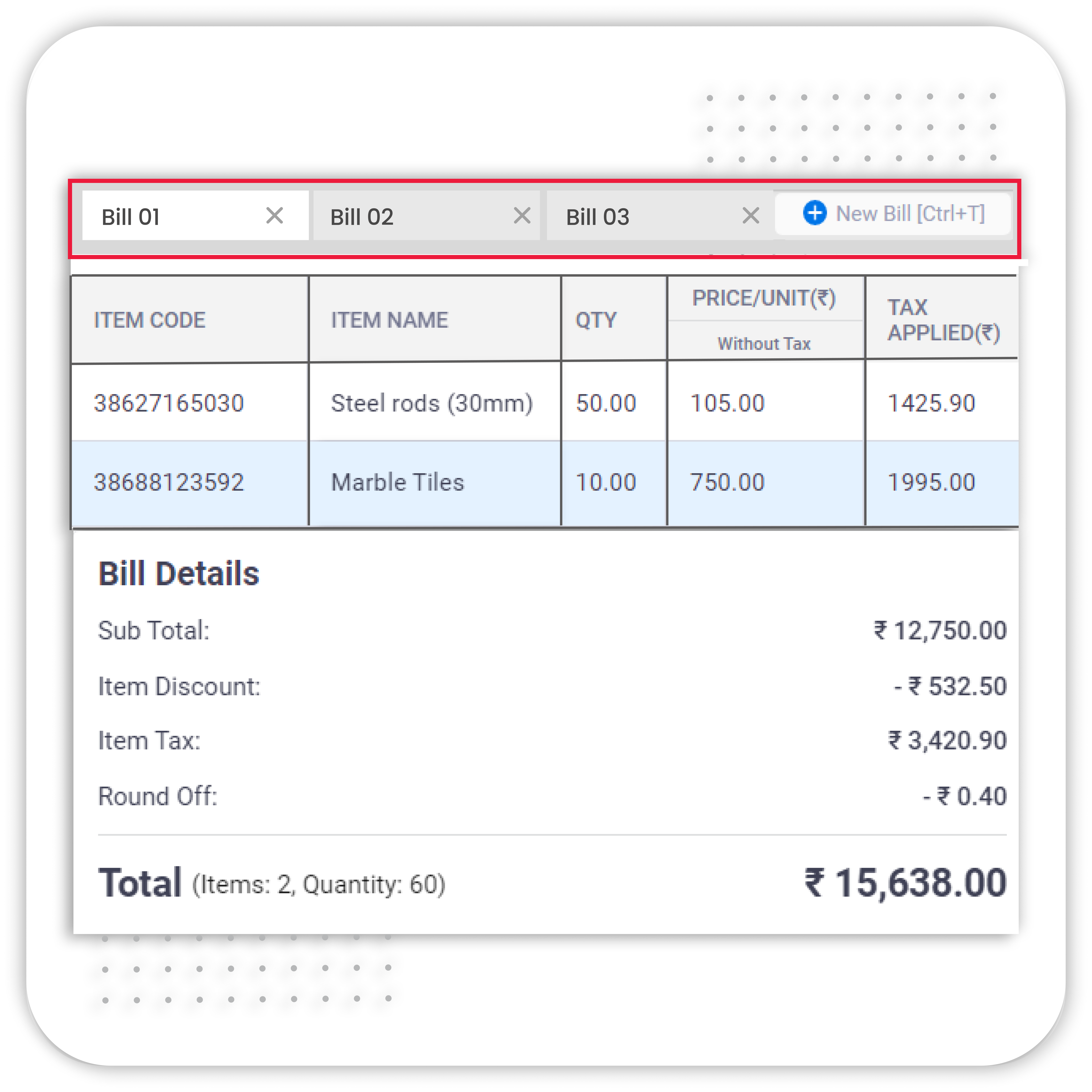

Computerized Invoicing and Billing

Switching to Vyapar’s computerized accounting software streamlines invoicing and billing processes for businesses. Here’s how Vyapar’s software can help:

- Automated Invoicing: Generate professional invoices instantly, reducing manual effort and improving accuracy.

- Expense and Payment Tracking: Track all expenses and payments, enabling better control over cash flow.

- Inventory Management: Monitor stock levels, receive low-stock alerts, and prevent shortages, all within the same platform.

- GST and Tax Compliance: Simplify tax calculations and generate GST-compliant reports, ensuring seamless compliance.

Vyapar’s accounting computer programs software is designed to enhance productivity, reduce errors, and save time, making it a reliable tool for both small and medium businesses to manage finances and grow efficiently.

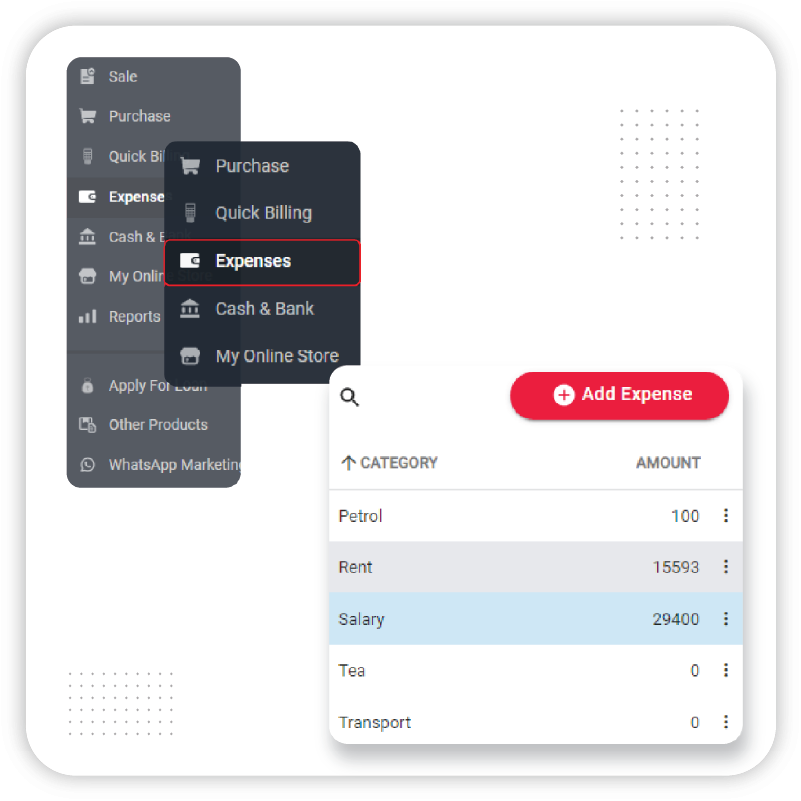

Expense Tracking and Management

Using Vyapar’s computerized accounting system allows businesses to manage expenses more effectively and streamline financial operations. Here’s how Vyapar’s software can help:

- Automated Expense Tracking: Record and categorize expenses in real-time, reducing manual effort and enhancing accuracy.

- Detailed Reporting: Generate comprehensive expense reports to understand spending patterns, helping in budgeting and decision-making.

- Bank Account Integration: Connect bank accounts for automatic transaction tracking, ensuring all expenses are accounted for.

- GST and Tax Management: Easily calculate and manage tax-related expenses, ensuring compliance and accuracy.

With Vyapar’s computerized accounting system, gain the advantages of computerized accounting like reduced errors, time savings, and a clear overview of business expenses, all essential for boosting financial control and profitability.

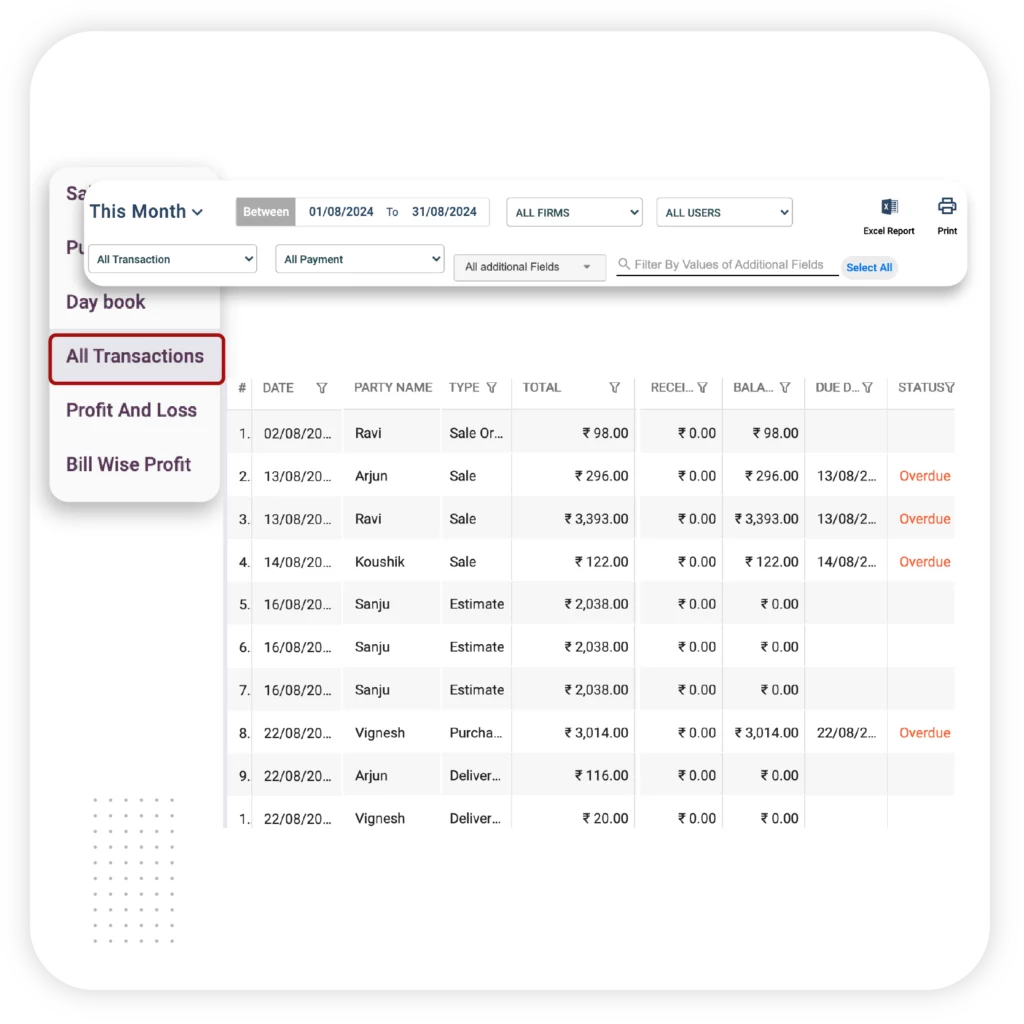

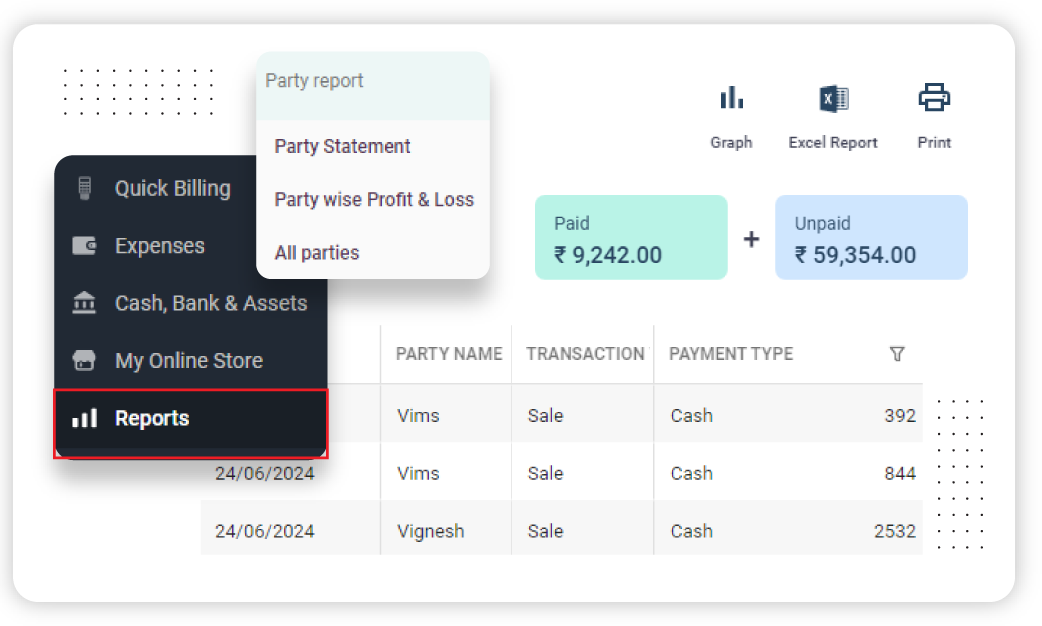

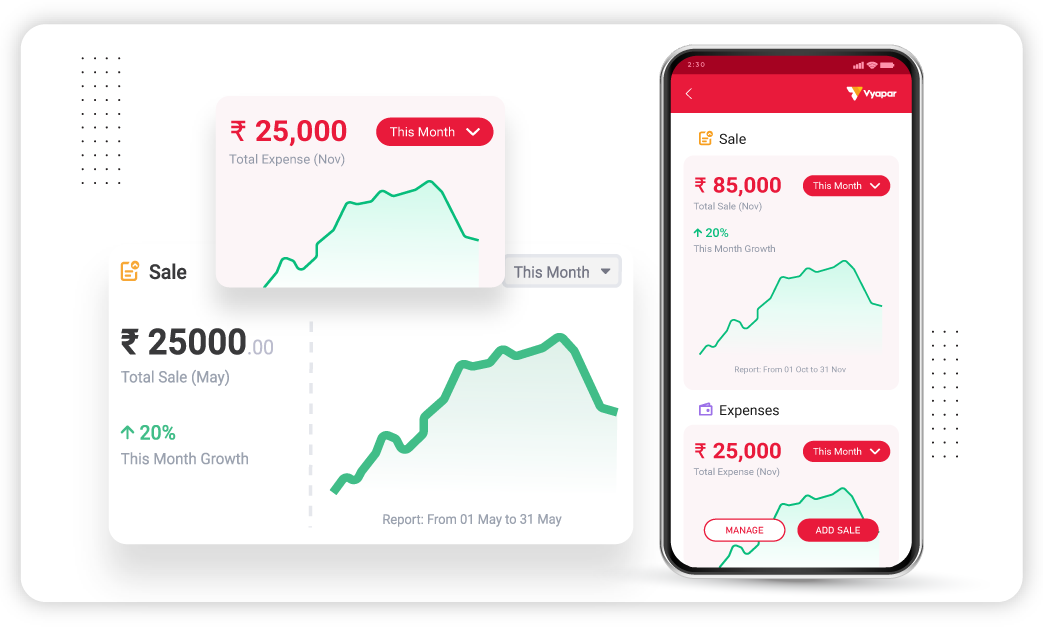

Financial Reporting and Analysis

Vyapar’s computer-based accounting system empowers businesses with detailed financial reporting and insightful analysis, making financial management easier and more efficient. Here’s how Vyapar’s computerized accounting system can help:

- Automated Financial Reports: Generate balance sheets, profit and loss statements, and cash flow reports in just a few clicks, reducing manual work.

- Real-Time Data Insights: Access up-to-date financial data to make informed business decisions and track performance effortlessly.

- Customized Report Generation: Filter and customize reports to focus on specific time frames or departments, allowing for a clearer view of finances.

- GST and Tax Reports: Easily compile GST-compliant reports, simplifying tax filing and ensuring accuracy.

With Vyapar’s computerized system, businesses can gain better control over their finances, reduce errors, and make data-driven decisions for sustainable growth.

GST Compliance

Using computer accounting software like Vyapar helps businesses simplify GST compliance, reducing errors and saving time. Here’s how Vyapar’s computer-based accounting software supports tax management:

- Automated GST Calculations: Calculate GST accurately on every invoice, reducing manual errors and ensuring compliance.

- Comprehensive Tax Reports: Generate GST reports, GSTR-1, GSTR-3B, and other tax-related reports instantly, making filing easier and faster.

- Seamless Filing Process: Upload GST reports directly to the GST portal, streamlining the filing process.

- Input Tax Credit Management: Track input tax credits effectively, optimizing tax savings and maintaining accurate records.

With Vyapar’s computer accounting software free download, businesses can manage GST and tax effortlessly, ensuring compliance while focusing on growth and profitability.

Best Features of Vyapar Computerized Accounting Software

Computerized Inventory Management

TCS management

Multi-User Access with Role Permissions

Payment Reminders

Customizable Invoice Templates

Data Backup & Security

Mobile Access

Vendor & Supplier Management

Barcode Management

Cash Flow Management

Cash & Bank management

Native-Currency Support

Add-On Features of Vyapar Computerized Accounting Software

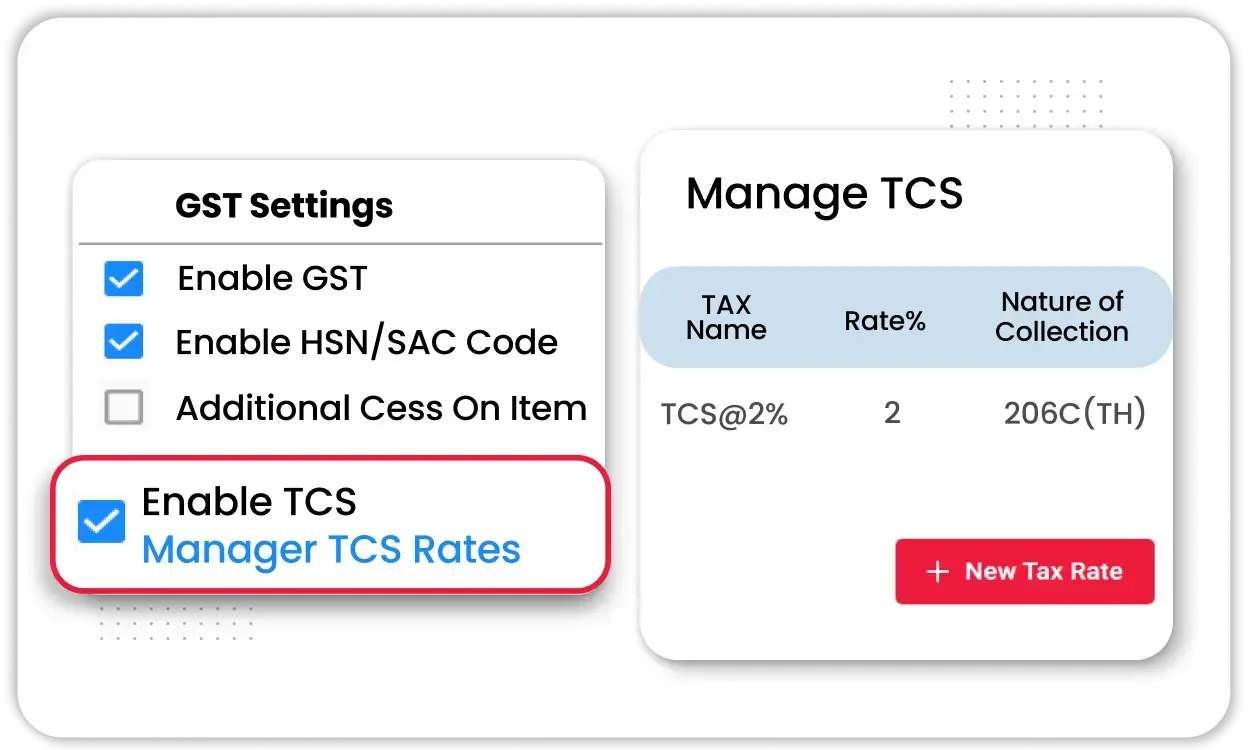

TCS Management

Vyapar’s computerized accounting system makes TCS (Tax Collected at Source) management seamless, helping businesses stay tax-compliant with ease. Here’s how the software simplifies the process:

- Automated TCS Calculations: Calculate TCS accurately on eligible transactions, reducing manual effort and minimizing errors.

- Efficient Record-Keeping: Maintain organized records of TCS collected, ensuring compliance with tax regulations.

- Easy TCS Reporting: Generate TCS reports quickly, simplifying filing processes and improving transparency.

- Real-Time Monitoring: Track TCS amounts in real-time to stay updated and avoid discrepancies.

With Vyapar’s computerized accounting system, businesses can manage TCS seamlessly, focusing on growth without tax worries.

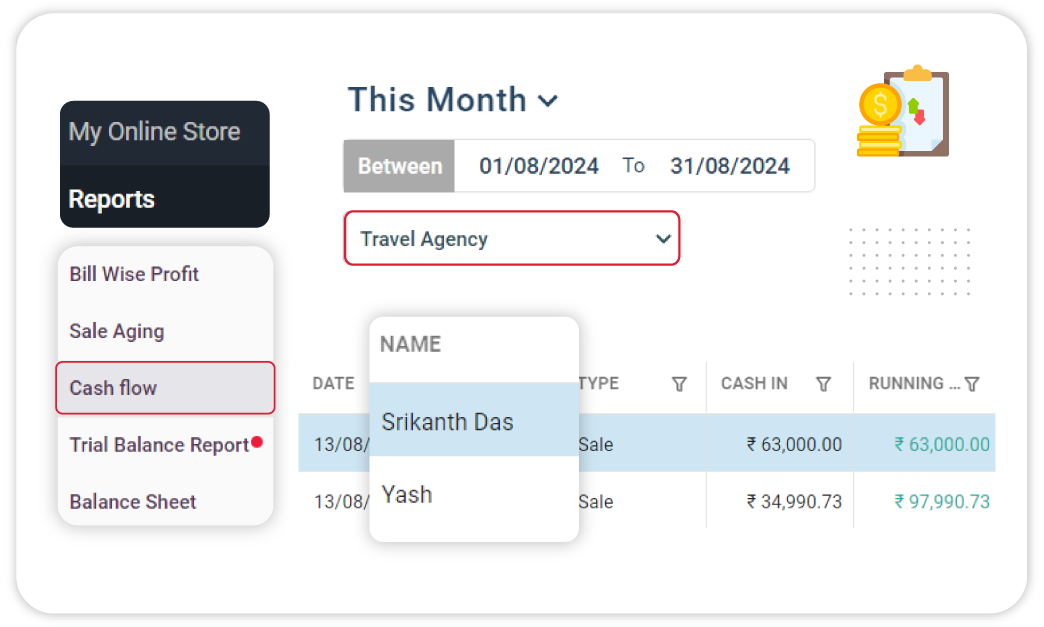

Cash Flow Management

Vyapar’s computerized accounting systems help businesses efficiently manage their cash flow with powerful features. Here’s how Vyapar can assist:

- Track Inflows and Outflows: Easily monitor cash inflows and outflows for better decision-making.

- Manage Payments: Set reminders for upcoming payments and avoid overdue bills.

- Instant Reporting: Generate reports to gain insights into your cash position and ensure smooth operations.

By using Vyapar’s computerized accounting systems, businesses can gain full control over their finances, improve cash flow, and make informed financial decisions

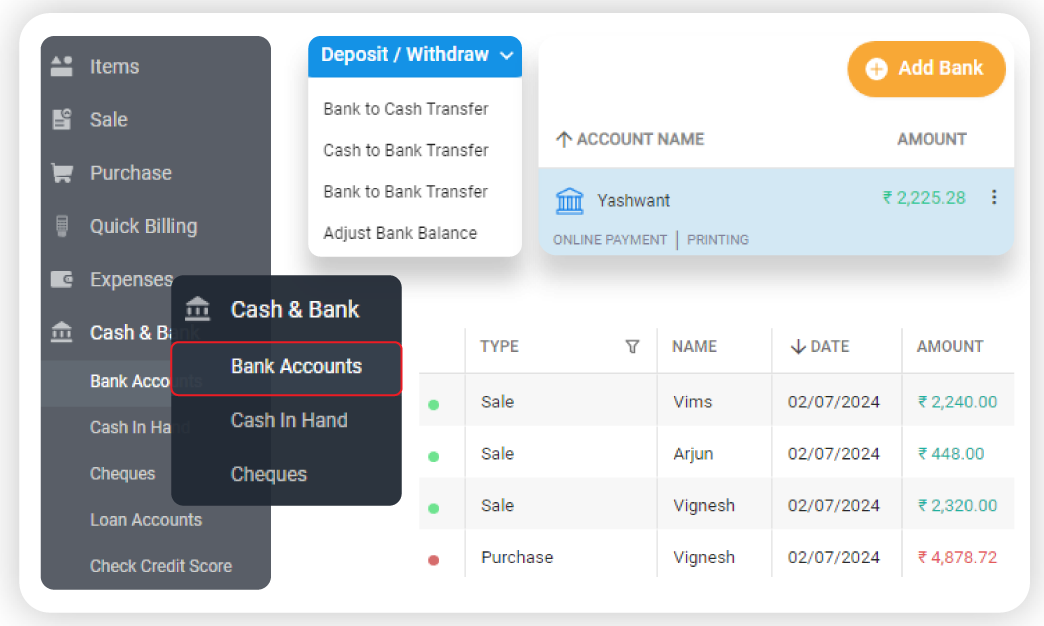

Cash and Bank Management

Vyapar’s computerized accounting software list includes powerful features to streamline cash and bank management for businesses. Here’s how Vyapar helps:

- Track Bank Transactions: Easily record and manage bank deposits, withdrawals, and transfers.

- Cash Flow Monitoring: Maintain a clear overview of cash inflows and outflows to avoid discrepancies.

- Bank Reconciliation: Reconcile your bank statements with ease, ensuring accurate financial records.

With Vyapar’s computerized accounting software, businesses can efficiently manage their cash and bank accounts, reducing errors and improving financial accuracy.

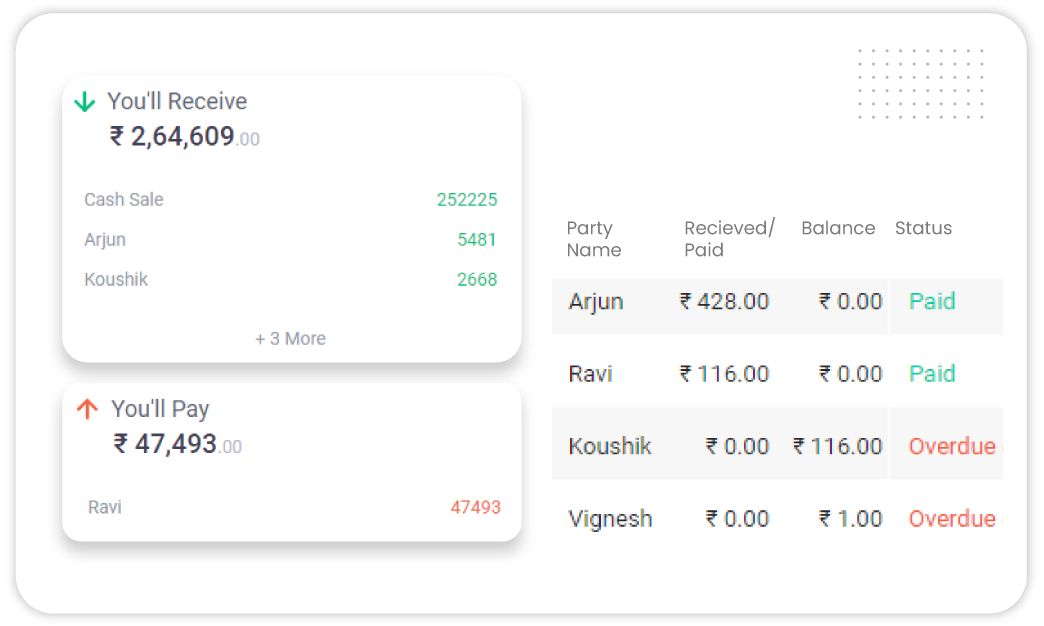

Accounts Payable and Receivable Management

Vyapar’s computerized accounting system offers advantages that streamline accounts payable and receivable management. Here’s how Vyapar helps:

- Track Outstanding Payments: Easily monitor payables and receivables, ensuring timely payments and collections.

- Automated Reminders: Get automatic reminders for due payments, reducing delays and improving cash flow.

- Reports and Insights: Generate detailed reports to track payment status, helping businesses stay organized.

With Vyapar’s computerized accounting software, manage accounts efficiently, reduce manual errors, and improve overall financial management.

Detailed Audit Trail

Vyapar’s computerized accounting software offers a comprehensive audit trail to enhance financial transparency. Here’s how it helps:

- Track Every Transaction: Maintain a clear history of all business transactions, ensuring accountability and accuracy.

- Easily Trace Changes: Review modifications in accounts, such as invoice updates or payment adjustments, with a timestamp and user details.

- Ensure Compliance: Meet regulatory requirements by keeping detailed records of every financial action.

With Vyapar’s types of computerized accounting software, businesses can confidently maintain transparency, reduce errors, and ensure secure audits.

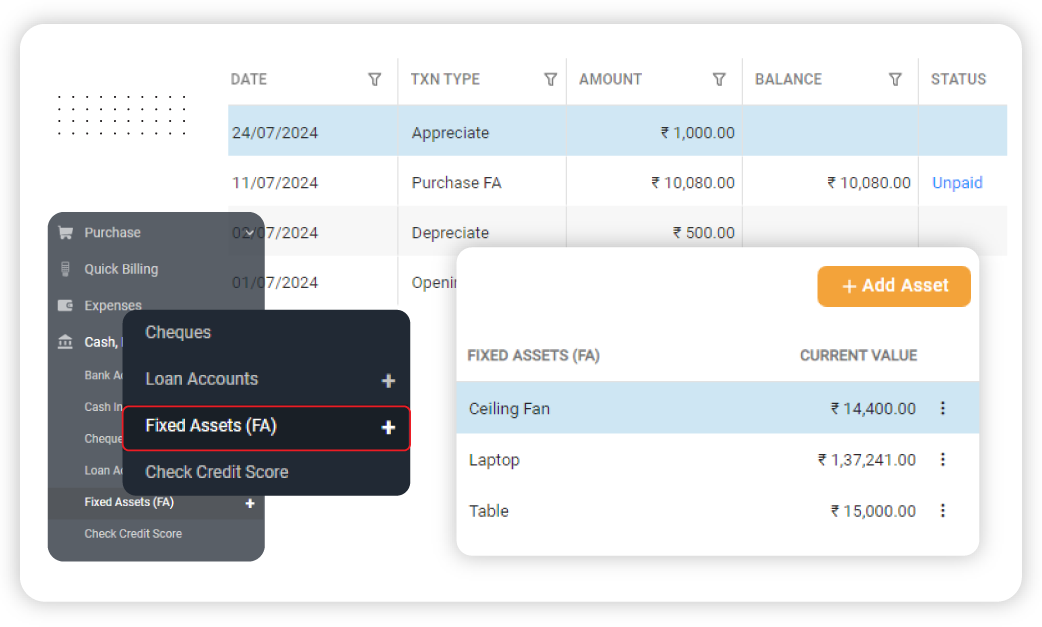

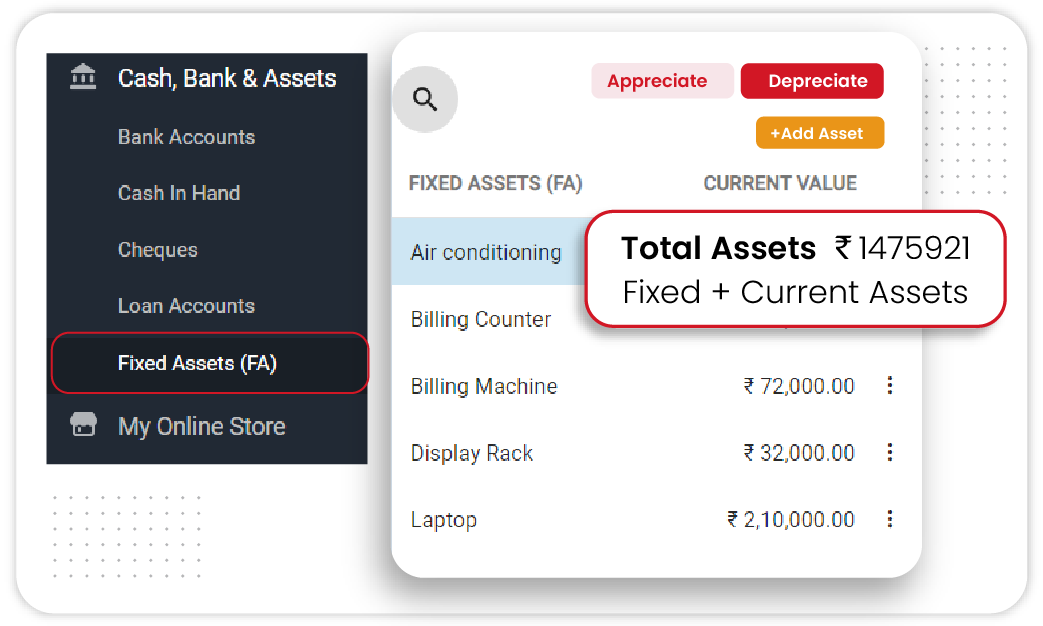

Asset Management and Depreciation Tracking

Vyapar’s computerized accounting system offers a robust solution for managing assets and tracking depreciation. Here’s how it helps:

- Asset Tracking: Easily track physical and intangible assets, their purchase dates, and locations.

- Depreciation Calculation: Automatically calculate asset depreciation over time, ensuring accurate financial reports.

- Real-Time Updates: Stay updated on asset values and their financial impact, reducing manual errors.

With the advantages of computerized accounting systems, Vyapar it assets inventory software helps you manage assets efficiently, streamline calculate depreciation tracking, and maintain accurate records, ensuring better financial control for your business.

Personalized Reports and Custom Fields

Vyapar’s computer accounting programs for small business offer powerful features for personalized reports and custom fields. Here’s how it helps:

- Custom Reports: Tailor financial and sales reports to meet your specific needs, providing deeper insights into your business performance.

- Custom Fields: Add unique fields to invoices, bills, and transactions, helping you track data that matters most.

- Flexible Analytics: Generate reports that reflect your business priorities, improving decision-making and efficiency.

With Vyapar’s computer accounting programs for small business, you can customize your financial insights for better business management.

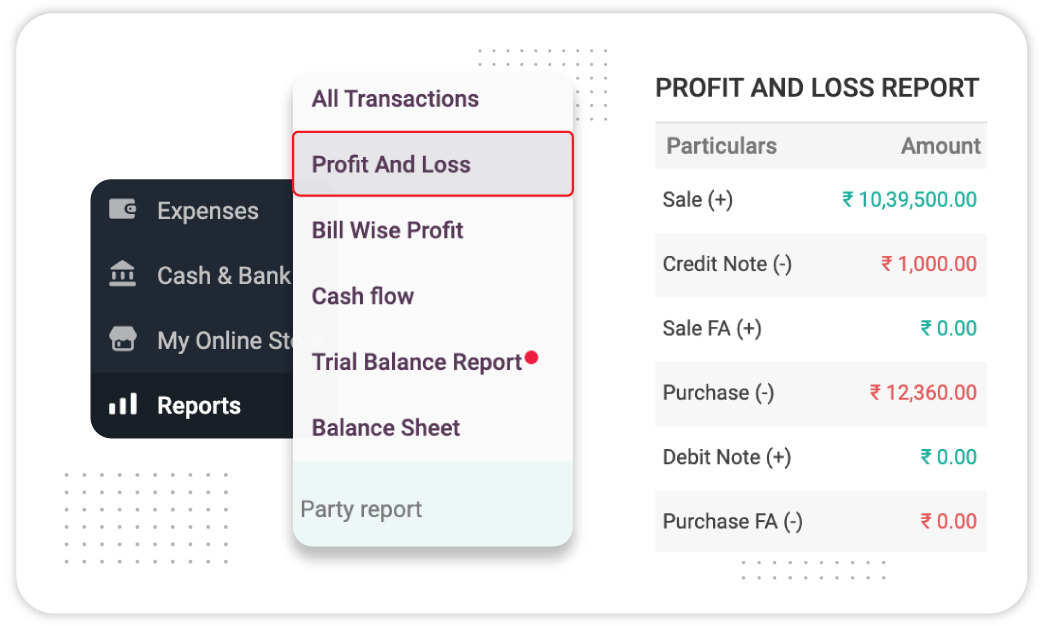

Detailed Profit and Loss Statement

Vyapar’s computerized accounting systems help businesses generate detailed profit and loss statements for clearer financial insights. Here’s how Vyapar’s software can benefit customers:

- Accurate Reporting: Automatically track income, expenses, and profits, providing accurate and up-to-date statements.

- Customizable Categories: Tailor your P&L statement to match your business needs and categories.

- Real-time Data: Access profit and loss data anytime, ensuring you make informed decisions.

With Vyapar’s computerized accounting systems, easily manage your finances, improve transparency, and enhance your business decision-making.

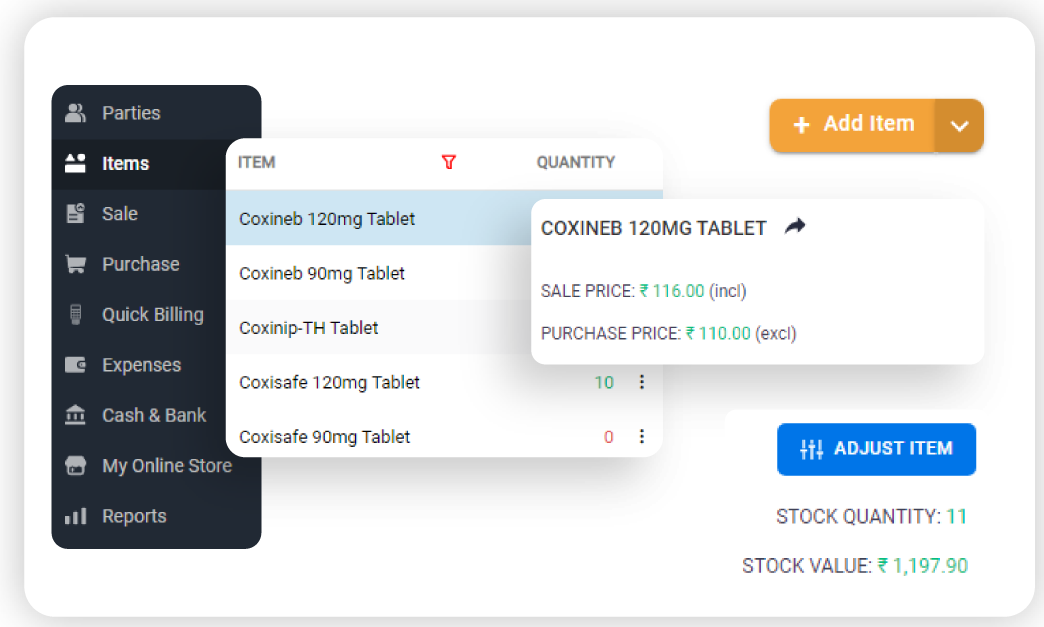

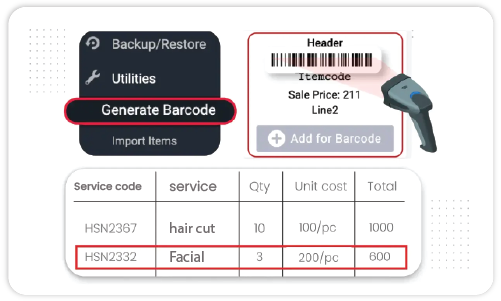

Computerized Inventory Management

Vyapar’s computerized accounting software streamlines inventory management, helping businesses stay organized and efficient. Here’s how Vyapar’s system can assist:

- Inventory Categorization: Organize stock by product type, allowing for easier tracking and faster retrieval.

- Real-Time Stock Monitoring: Receive alerts on low stock levels, preventing shortages and ensuring continuous operations.

- Barcode Integration: Simplify stock entry and management with barcode scanning, reducing manual errors.

- Detailed Inventory Reports: Access insightful reports for better decision-making and improved profitability.

With Vyapar’s types of computerized accounting system, businesses can manage inventory effectively, reduce errors, and focus on growth.

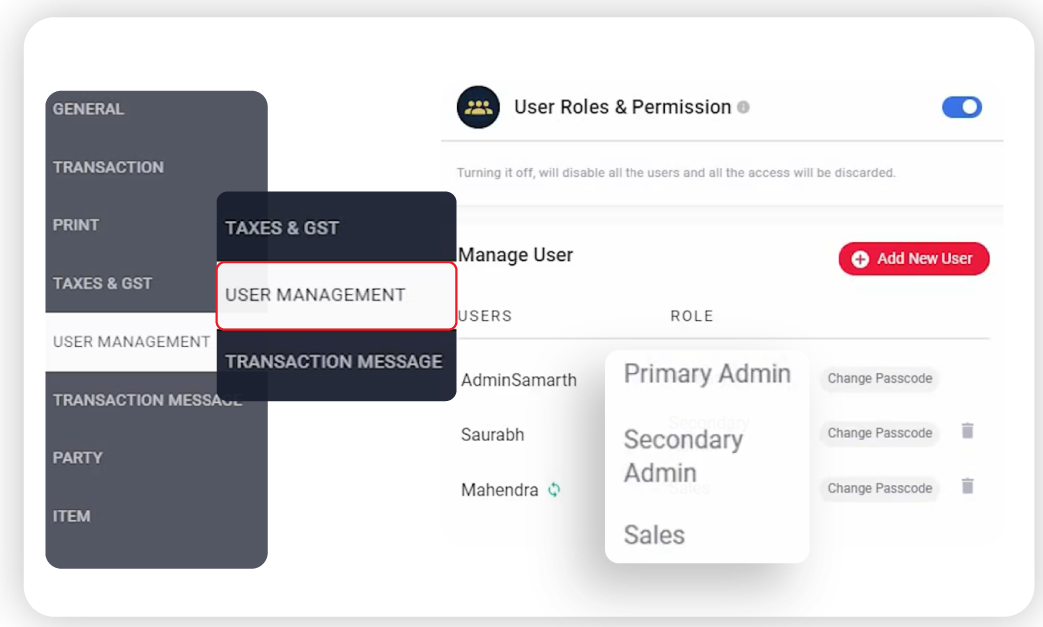

Multi-User Access with Role Permissions

Vyapar’s computer accounting software enables businesses to manage multi-user access with ease, ensuring secure and efficient operations. Here’s how Vyapar’s software helps:

- Role-Based Access: Assign specific roles and permissions to team members, allowing access only to relevant sections.

- Enhanced Security: Protect sensitive financial data by restricting access based on user roles.

- Seamless Collaboration: Facilitate smooth teamwork by enabling multiple users to work simultaneously without compromising data integrity.

With Vyapar’s computerized system, businesses can maintain control over user access, improve security, and foster collaboration, all in one reliable platform.

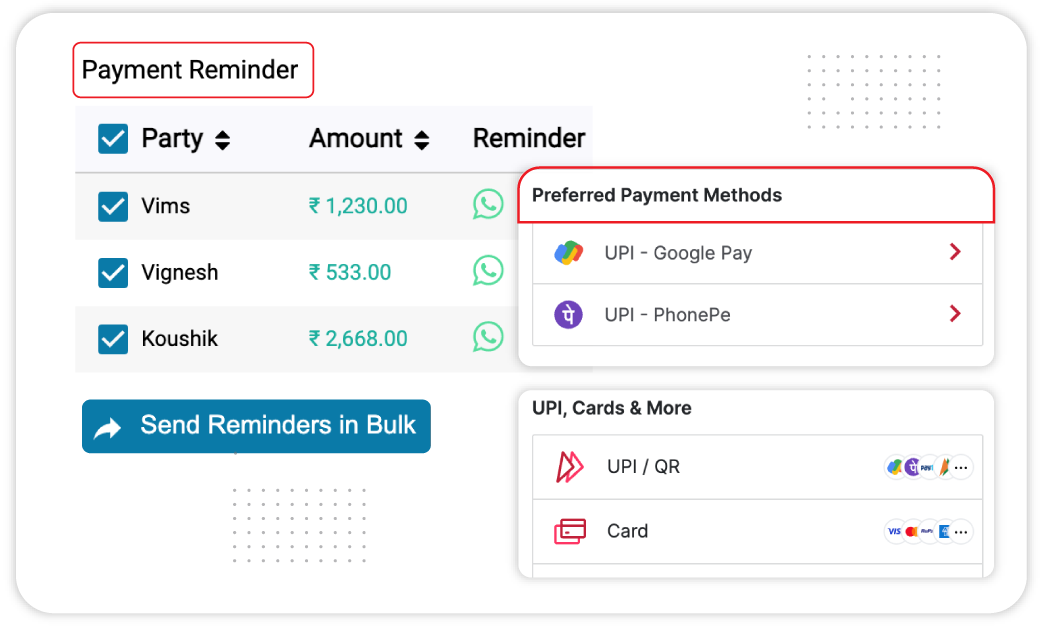

Payment Reminders

Vyapar’s computerized accounting systems help businesses stay on top of their payment collections with automated reminders. Here’s how Vyapar’s software simplifies payment management:

- Automated Payment Alerts: Set up reminders for upcoming payments, ensuring timely collections and reducing overdue invoices.

- Customizable Reminder Settings: Customize reminder frequency and message templates to match your business needs.

- Seamless Integration: Sync payment reminders with your invoicing system, streamlining the process and preventing missed payments.

With Vyapar’s computerized accounting software, businesses can efficiently manage cash flow, improve payment recovery, and focus on growth.

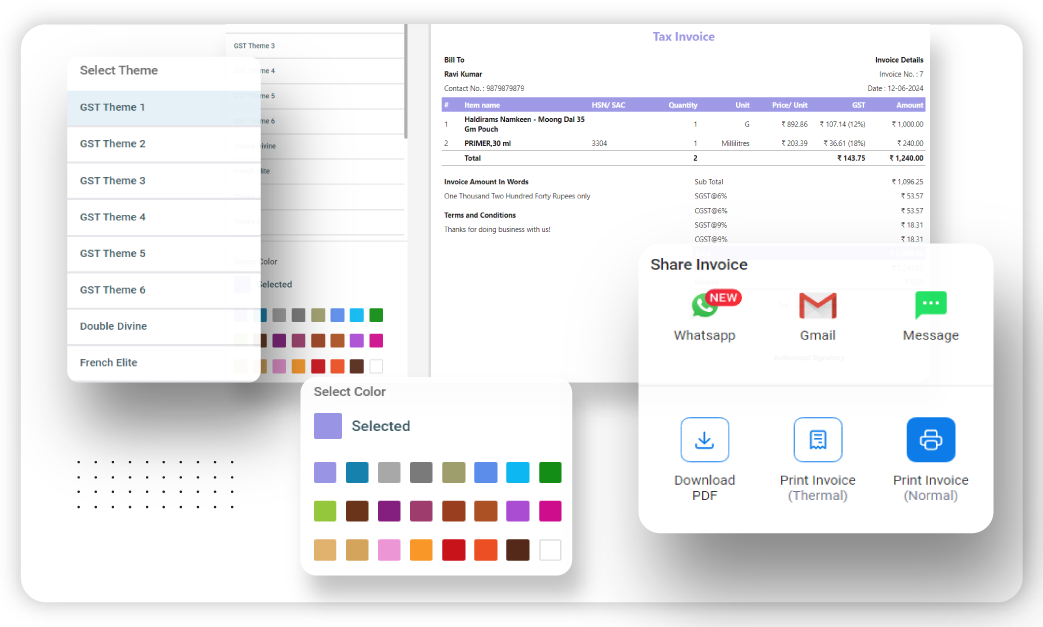

Customizable Invoice Templates

Vyapar’s types of computerized accounting software provide businesses with customizable invoice templates to streamline their billing process. Here’s how Vyapar helps:

- Personalized Invoice Designs: Customize invoices with your company logo, brand colors, and preferred layout for a professional touch.

- Flexible Template Options: Choose from a variety of pre-designed templates or create your own to suit your business needs.

- Easy Editing: Quickly adjust the details, such as payment terms or product descriptions, ensuring accurate and efficient invoicing.

With Vyapar’s computerized accounting software, businesses can enhance branding, save time, and improve invoice accuracy.

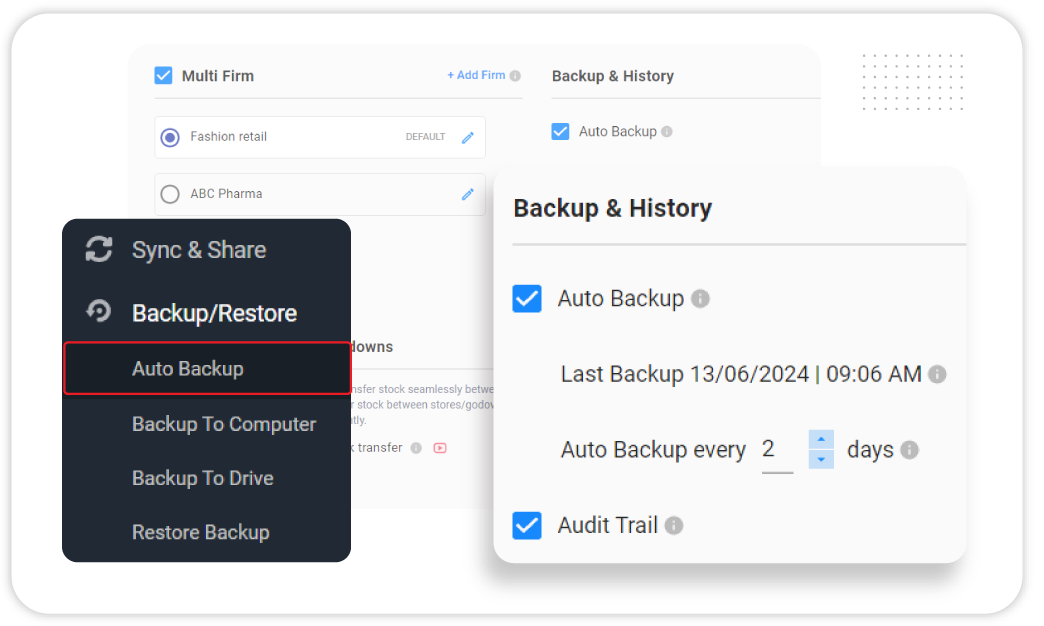

Data Backup and Security

Vyapar’s computerized accounting software free download ensures your business data remains secure and backed up, protecting you from data loss. Here’s how Vyapar helps:

- Automatic Backups: Secure your data with automatic cloud backups, ensuring it’s safe and accessible at any time.

- Data Encryption: Vyapar uses advanced encryption techniques to keep sensitive financial data protected from unauthorized access.

- Seamless Recovery: Restore your data with ease in case of any system failures, ensuring business continuity.

With Vyapar’s computerized accounting software, you can confidently manage your financial data with top-notch security and reliability.

Mobile Access

Vyapar’s accounting computer programs software gives you the flexibility to manage your finances on the go. Here’s how Vyapar helps:

- Remote Access: Access your financial data anytime, anywhere, using the Vyapar mobile app, making it easy to stay connected with your business.

- Real-Time Updates: Track transactions, generate invoices, and view reports in real-time, even while on the move.

- Convenience: Manage accounts, expenses, and sales directly from your mobile device, improving productivity and decision-making.

With Vyapar’s mobile access feature, streamline your accounting tasks and manage your business with ease, anytime, anywhere.

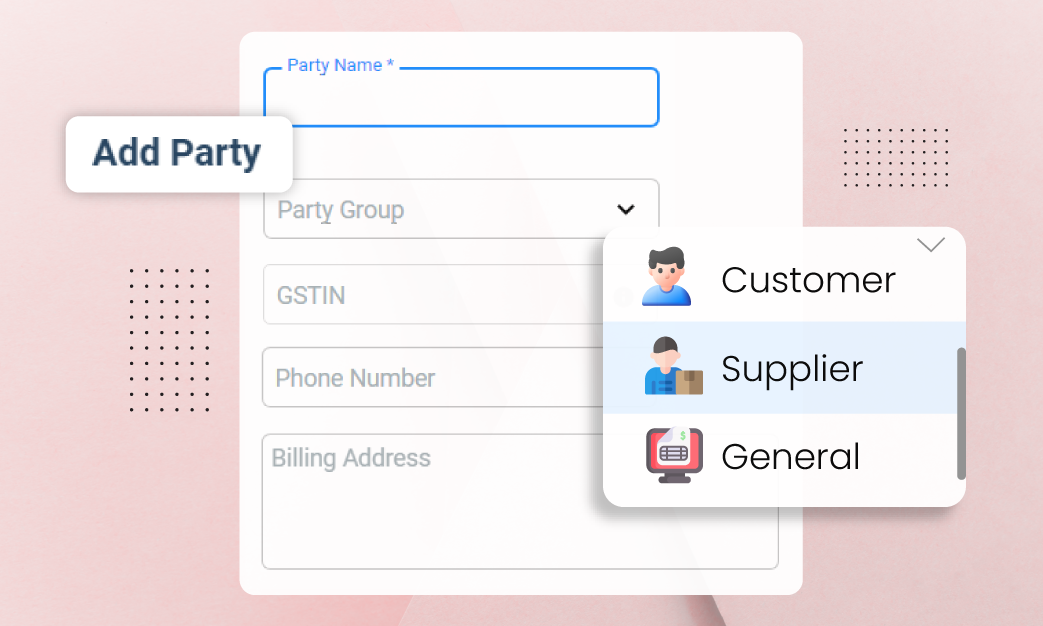

Vendor and Supplier Management

Vyapar’s computerized accounting software offers key benefits for managing your vendors and suppliers. Here’s how it helps:

- Centralized Data: Store vendor and supplier information in one place for easy access and management.

- Transaction Tracking: Keep track of purchase orders, payments, and outstanding invoices with ease.

- Improved Communication: Streamline interactions and maintain clear records for efficient collaboration.

The advantages of a computerized accounting system in vendor and supplier management include better organization, faster processing, and enhanced decision-making, helping businesses grow and reduce errors.

Barcode Management

Vyapar’s computerized accounting system software simplifies inventory management with integrated barcode and QR code scanning. Here’s how it benefits your business:

- Quick Stock Management: Easily scan products for faster stock entries and updates.

- Accurate Tracking: Ensure precise product tracking and reduce manual errors.

- Efficient Billing: Speed up the checkout process and minimize delays with quick scanning.

By using Vyapar’s barcode and QR code scanning features, businesses can improve efficiency, reduce errors, and streamline their operations, leading to faster growth and smoother transactions.

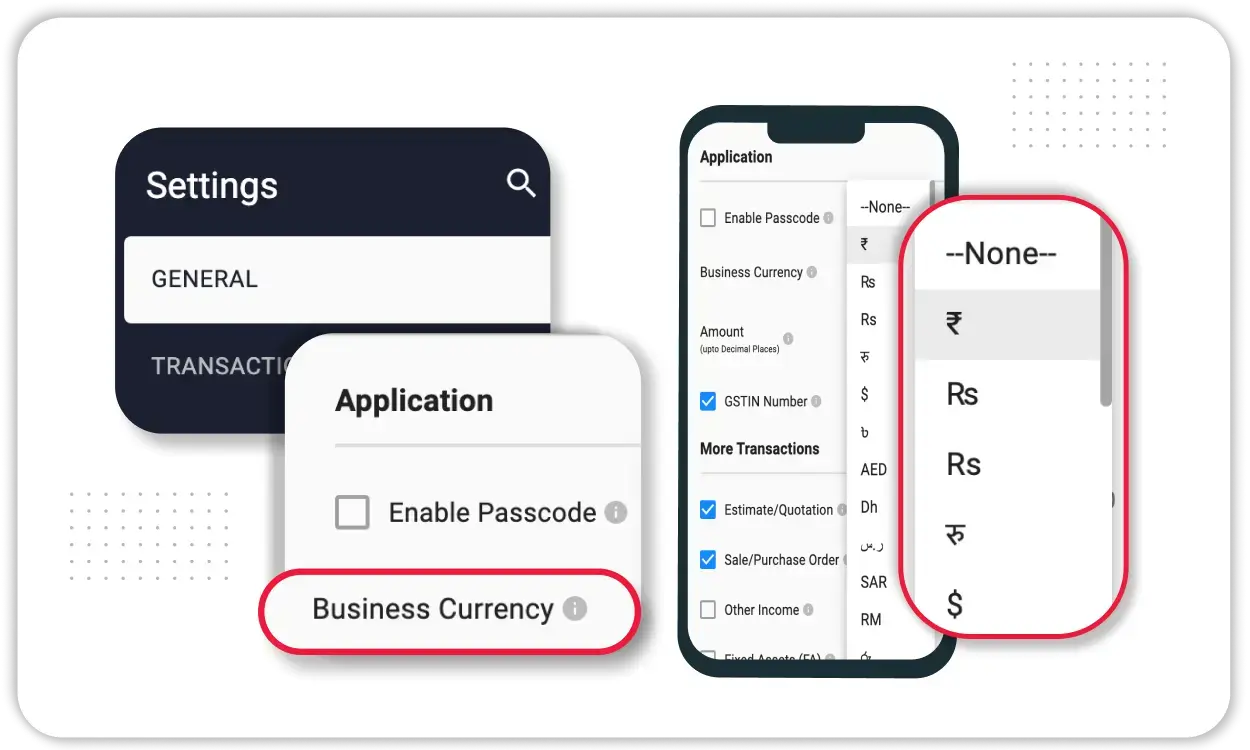

Native-Currency Support

Vyapar’s computerized accounting software makes managing finances easier with native-currency support. Here’s how it helps:

- Multiple Currency Management: Businesses can handle transactions in their local currency, making accounting seamless and accurate.

- Real-Time Exchange Rate Updates: Stay updated on exchange rates for international transactions.

- Simplified Invoicing: Generate invoices in the desired currency, enhancing customer experience and reducing errors.

With Vyapar’s computerized accounting software, businesses can confidently manage finances, regardless of location, ensuring smooth operations and financial accuracy.

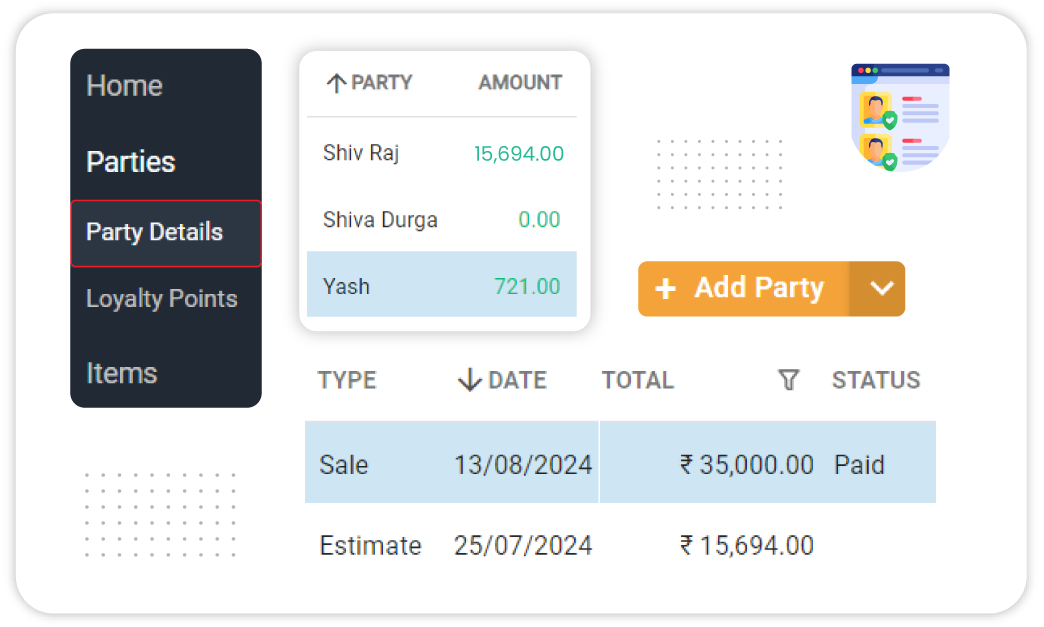

Client and Customer Management

Vyapar’s computerized accounting systems help businesses manage their clients and customers with ease. Here’s how it works:

- Customer Database: Keep detailed records of customer information, including contact details, purchase history, and payment terms.

- Payment Tracking: Track payments and outstanding invoices, ensuring timely follow-ups and reducing late payments.

- Easy Communication: Send customized reminders and invoices directly to clients, improving client relationships and enhancing customer service.

With Vyapar’s computerized accounting systems, businesses can streamline customer management, reduce errors, and foster stronger client relationships.

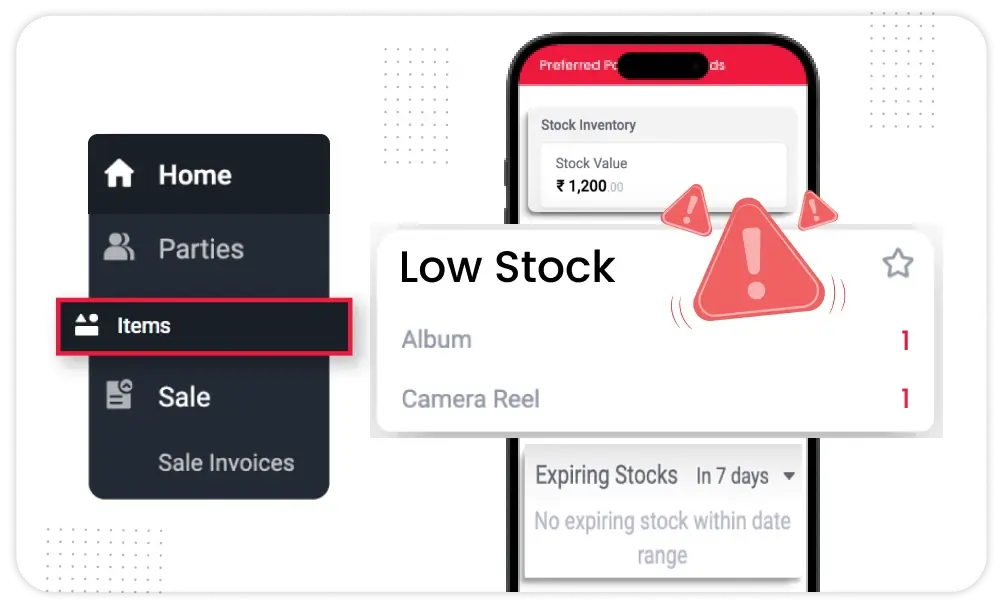

Inventory Alerts

Vyapar’s computerized accounting system enhances inventory management by offering real-time alerts. Here’s how it helps:

- Low Stock Alerts: Get notified when stock levels are low, ensuring you never run out of popular items.

- Expiry and Reorder Alerts: Set alerts for expiring products and reorder points, preventing wastage and stockouts.

- Seamless Integration: Easily track inventory across multiple locations for better control.

With Vyapar’s computerized accounting systems, you can streamline inventory management, reduce errors, and improve stock control, allowing your business to operate efficiently.

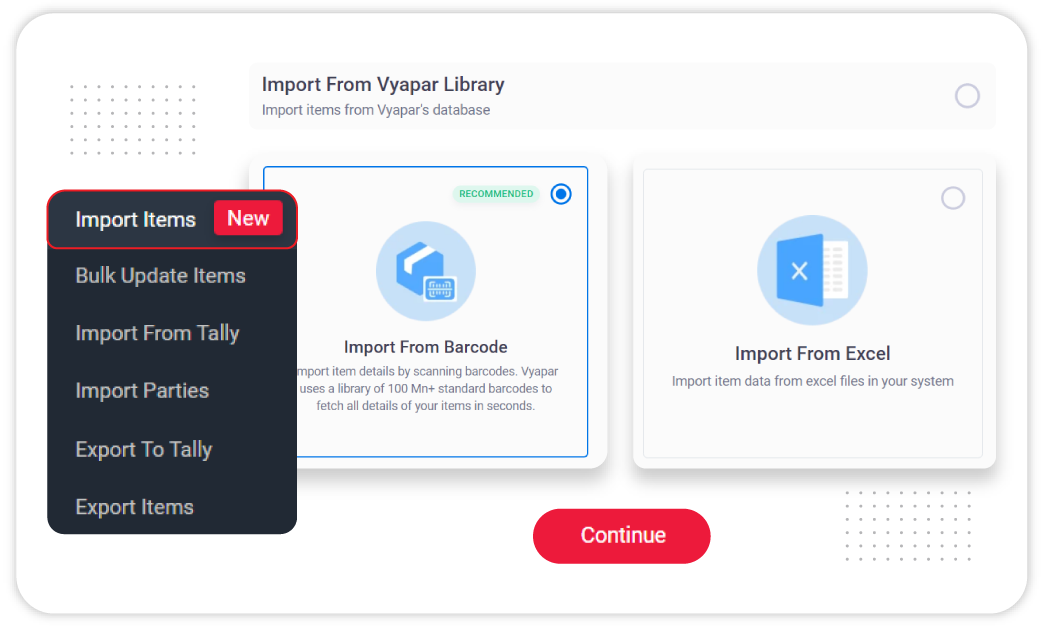

Import and Export Data

Vyapar’s computerized accounting software makes importing and exporting data seamless, offering key advantages of computerized accounting systems. Here’s how it helps:

- Data Import: Easily import financial data from various formats, saving time on manual entry.

- Data Export: Export reports, invoices, and financial records for analysis or sharing with stakeholders.

- Customizable Integration: Import and export data with flexibility, making it easier to integrate with other systems.

With Vyapar’s computerized accounting software, you can simplify data management, reduce errors, and improve overall efficiency.

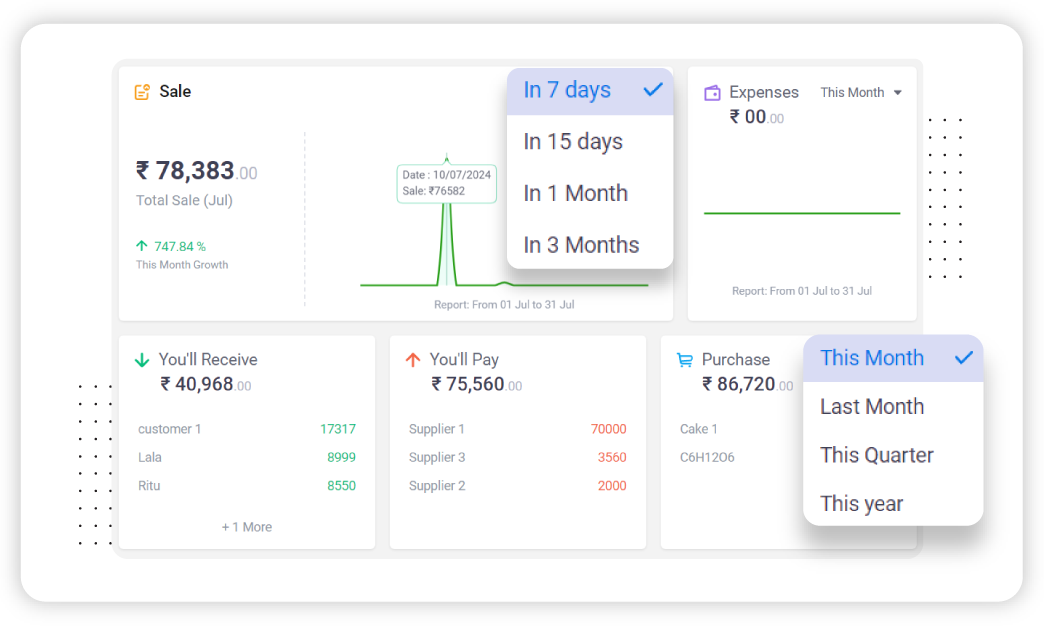

Customizable Dashboard

Vyapar’s computerized accounting software offers a customizable dashboard, providing key advantages of computerized accounting systems. Here’s how it benefits customers:

- Personalized View: Customize your dashboard to display essential data, such as sales, expenses, and cash flow, at a glance.

- Quick Access: Access frequently used features, reports, and metrics with ease.

- Data Insights: View real-time data for informed decision-making.

With Vyapar’s computerized accounting software, you can tailor your dashboard for better visibility, streamline operations, and improve efficiency in managing your business finances.

Frequently Asked Questions (FAQs’)

Computerized accounting software assists bookkeepers and accountants in recording and reporting a firm’s financial transactions.

There are three types of Computerized accounting software:

1. Ready-to-use Computerized accounting software

2. Customised Computerized accounting software

3. Tailored Computerized accounting software

Computerized accounting software makes online data entry and storage for accounting purposes. Additionally, purchase and sale invoices can be generated and printed.

A Computerized accounting system reduces the errors of manual work and maintains accuracy. It saves time by quickly processing the data.

Automated systems help businesses manage their clients, bank accounts, and billing requirements. It can also generate reports which help in growth.

An automated system can be costly with the installation and training charges. All the data is stored in a computer, so you could lose important documents if there is a virus attack on the software.

Accounting for computer software costs involves tracking and categorizing expenses related to software development, purchase, or maintenance to ensure accurate financial reporting. Vyapar’s Computerized Accounting Software helps businesses manage these costs efficiently within their accounting system.

Yes, Vyapar’s Computerized Accounting Software allows you to categorize and track expenses related to software, helping you manage your software costs and keeping your financial records up-to-date.

Vyapar provides flexibility in categorizing software costs. Development costs that qualify can be recorded as assets, while other expenditures can be treated as expenses, following standard accounting practices.