Commercial Invoice Format

A shipper must generate commercial invoices when shipping goods to global clients. Vyapar offers professional commercial invoice format for free without much hassle.

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of Commercial Invoice Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Free Professional Commercial Bill Format

Download professional free commercial bill formats, and make customization according to your requirements at zero cost.

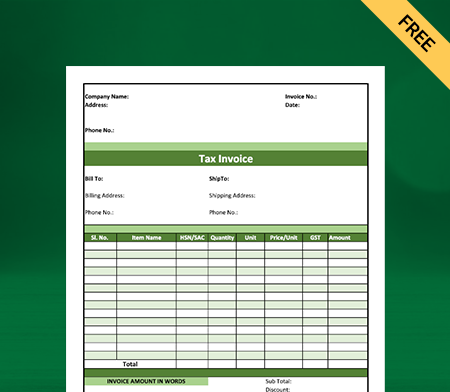

Type 1

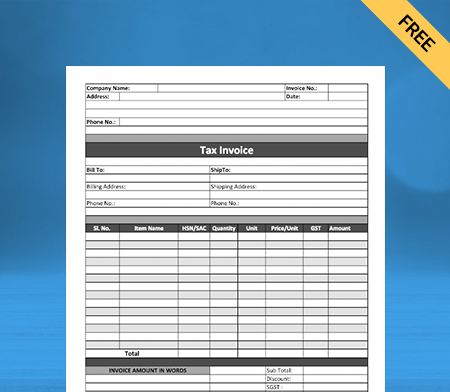

Type 2

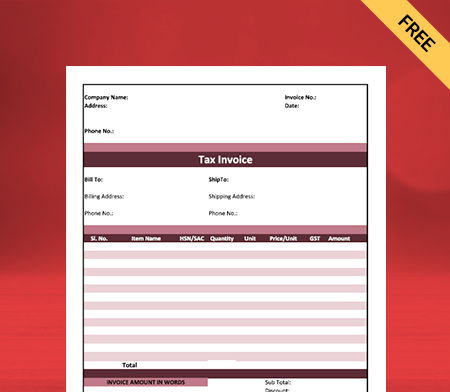

Type 3

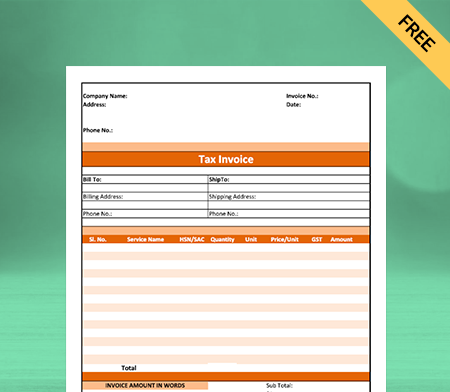

Type 4

Generate Invoice Online

What is a Commercial Invoice?

A commercial invoice is a customs document that an exporter of the goods issues to the receiver. It is legal evidence of the international sale and helps determine duties and taxes payable. A commercial invoice format includes a detailed description of the products sold, their quantities, and the agreed-upon value.

Importance of a Commercial Invoice:

The significance of a commercial invoice is as follows:

- Commercial invoices are required documents in import and export procedures. They help keep records and are integral to the export and import operations paper trail.

- A commercial invoice is evidence of sale as it contains all the transaction details. It includes details of the buyer, seller, and value of goods.

- A commercial invoice is a legal document that documents a sale transaction and hence plays an essential function in guaranteeing payment.

- The description of products in terms of sale, quantity, and price allow the importer to cross-check and verify the contents of the cargo to see if they match the ranges indicated in the commercial invoice.

- The commercial invoice serves as a reminder for overdue payments. It is an effective technique for preserving consumer ties.

- The commercial bill ensures that no one is duped and can be used as proof that the buyer cannot avoid payment.

Indian Laws on Commercial Invoices

An invoice is a mandatory document that CBIC requires to proceed with import or export procedures. Circular No. 01/15-Customs states that a commercial invoice cum packing list would satisfy the criteria for proper import and export procedures, as both documents have similar content. The documents to continue import and export activities are:

- Bill of Lading or Airway bill

- Commercial invoice cum packing list

- Bill of shipping

Create your first invoice with our free invoice Generator

Time Limit for Raising a Commercial Invoice:

A registered taxable person who deals with taxable goods must issue a commercial invoice format. It must contain information regarding the nature of the product, its quantity, value, and tax. Goods moving from one location to another require the invoice to be issued before the removal of goods for collection. Thus, an exporter must give an invoice before the goods are shipped.

What are the Contents of a Commercial Invoice?

Although there is no standard format, the document must include specific details. A commercial invoice format must contain the following information along with the customer declaration:

Information Regarding the Buyer and Seller

Name and address of the buyer and the seller

Tax information and contact details of the buyer and the seller

Information Regarding the Transaction

Date and number of the invoice

Description of the goods like quantity and price

Mode of payment

Import Export Code (IEC) and GSTIN

Country of Origin

Shipping Related Information

Freight charges

Export route

Shipment date

Total weight

Number of packages

Insurance charges

Difference Between Proforma Invoice and Commercial Invoice:

A proforma invoice is provided to give the purchaser information about a product or service he has not yet received from the vendor. A commercial invoice is a legal document that documents the export sale transaction and requests final payment from the buyer.

A proforma invoice template is issued before the purchase order is placed, while a commercial invoice format is issued after goods/services have been delivered and payment is due.

Proforma invoices contain the initial price, quality, quantity, and payment terms but do not require payment. Commercial invoices provide the final agreed-upon data and the final price demand.

There are no entries made for proforma invoices. The buyer and seller must make accounting entries in their books in case of commercial invoices.

A proforma invoice assists the buyer in selecting whether or not to place an order. A commercial invoice notifies the customer of the purchase price.

A proforma invoice estimates the total amount of the transaction. The commercial invoice reflects the full amount owed for the transaction.

The proforma invoice will be valid till the buyer determines whether or not to proceed with the transaction. Once the commercial invoice is issued, the buyer must pay according to the terms specified in the commercial invoice format.

How to Make a Commercial Invoice?

Download a Commercial Invoice Format

The quickest approach to creating a commercial invoice is to use a customisable template from Vyapar. Download the format that suits your business needs and get started.

Enter Seller and Buyer Details

Fill in your company’s information, such as its name, address, phone number, and email address. Include the name and address of the buyer who is purchasing your products. You should also mention the shipping address if it differs from the billing address.

Assign an Invoice Number and Customer Reference Number

Assign a unique invoice number to the commercial invoice format. Additionally, include a customer reference number as well. Customers can use this number to contact your firm with questions or problems or return anything they have purchased from you.

Include the Terms and Conditions of Sale

Specify terms of sale, including information on the obligations, risks, and costs that both the seller and customer assume as part of the sale.

Specify the Payment Terms

Indicate your payment conditions. There will be crucial information concerning the sale terms and conditions that you and the consumer have agreed on. Typically, these details will already be worked out as part of the purchase order for the transaction or as part of the pro forma invoice.

Determine the Currency

Your commercial invoice should include the currency you and the buyer have agreed upon for payment. The currency of settlement is frequently the seller’s currency. Thus if you’re selling things from your business in the United States, your settlement currency will be US dollars.

Include the Shipping Method

Indicate how you will deliver your products to the buyer, such as by air, ocean, or surface transport.

Mention the Product Details

Include the total number of products to be purchased and mailed. Give a detailed description of all products to be shipped. It comprises the container type, the gross weight of each container, the quantity of each article, and the measurement unit. Include the total cost of the cargo and the overall commercial value, which is the total cost of all products covered by the invoice.

Detail Miscellaneous Charges

Record any other fees the customer is expected to pay, such as insurance, export documentation, etc.

Benefits of Using a Commercial Invoice Format by Vyapar:

Less Human Error

An invoicing blunder can cost you a lot of money, especially in the case of international business. It is critical to select the correct software to manage your organization effectively. Your firm can collect data much more quickly using Vyapar.

Automation streamlines the process while eliminating human error. You may concentrate on other tasks and save a lot of time. The user interface for the Vyapar ledger balance sheet formats is straightforward.

Data from suitable programs can be imported and exported. It also sends reminders to collect payments and refund debts, which aids in the avoidance of future problems.

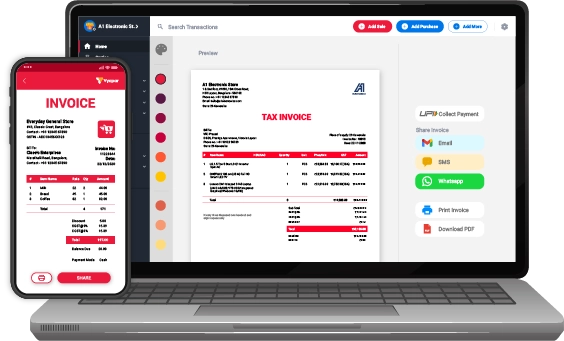

Business Dashboard

Vyapar’s desktop software and mobile app provide a complete business dashboard that displays all the essential data from your everyday business activities in one location.

You can analyze everything quickly, from cash in hand to open cheques, stock value, bank balance, and sales orders. It allows you to manage low stock inventory, purchase orders, delivery challans, expired products, and so on.

It is the best inventory and order management system, billing, and invoicing software. This complete setup will allow you to monitor your company’s financial health and make informed decisions.

Capabilities for Working Offline

You can continue to conduct your import-export firm without an internet connection by utilizing numerous particular invoice generator application features. You can also make commercial invoices for your clients offline via the Vyapar app.

Vyapar’s small business accounting software can create a commercial invoice even when no internet connection is available. This capability has enabled our clients’ businesses not to have to rely on the internet for accounting.

The only time a consumer requires an internet connection or online version of Vyapar is when they want the data to be synchronized across multiple devices.

Invoicing With a Personal Touch

Growing a company’s reputation through its actions is essential to every business. Every interaction counts as a touchpoint for your brand. Bills and invoices are no exception.

By incorporating your company name, logo, and other information, you can alter the theme of the invoices you send to consumers to match your brand.

Using the app’s features, you may create one-of-a-kind commercial invoices. With this technology, you may communicate with your customers as you choose. You’ll respond quickly and give your consumers a better experience.

Business Reports

Business entrepreneurs must make wise decisions. Managing the money required for everyday operations, analyzing data, and evaluating business activity may be difficult. Vyapar can help you with all of these issues.

Vyapar allows you to create 40+ different sorts of reports. Balance sheets, spending or income reports, and GST reports are all feasible to develop. You can keep the company’s cash flow steady and prevent workflow disruptions.

You can look over the reports to see how the company is doing. It allows you to determine which product is popular and stock up on it. You may use the Vyapar app to simplify income tax filing.

The Free Primary Usage for Life

Our business accounting application’s essential features are free of charge. The free services are offered to Android users in perpetuity. Our goal of bringing millions of small business owners into the digital economy includes giving unrestricted access.

You can register free to use the free accounting software and acquire a free copy from the Play Store. On the other hand, a business can use a subscription to access the deluxe functions and desktop programs.

Following each transaction, you and your client will receive a free SMS including crucial transaction information such as credit and debit values. It allows both sides to remain transparent and on the same page.

Other Valuable Features of the Vyapar App:

Multiple Payment Modes:

As an exporter, Vyapar’s many payment options make transactions go much more smoothly. You may produce invoices with several payment choices using the Vyapar invoicing tool. Users can send recurring client payments via bank transfers (NEFT, RTGS, IMPS).

You can generate a QR code for free and include it as one of the payment options inside the invoice to make it easier for your clients to send money to the UPI id associated. Cash, checks, debit cards, and credit cards are also accepted payment methods.

Allowing your customers or clients to utilize the payment method with which they are most comfortable ensures speedier payouts and strengthens your company relationships.

Send Estimate & Quotations:

Using our program, you can effortlessly generate and deliver detailed estimates format and bids to your clients, together with taxes. These can be turned into invoices with a few clicks, saving both parties time and work.

You may create accurate commercial invoices using the software’s provided capabilities. Your invoices and quotes will appear more professional because they are error-free.

The software allows you to print the quotations and send them to clients by email, SMS, or WhatsApp. Because Vyapar automates most processes, creating bills with free templates is easy.

Data Synchronization:

Safety must be prioritized in every organization, especially now that everything is digital. The Vyapar invoicing tool allows you to set up an automatic data backup, allowing you to protect the data in the application.

You can periodically build a local backup for added security. Your Vyapar data can be effortlessly synced and saved in your Google Drive account. It reduces the danger of data loss and keeps your financial details secure.

You can also verify that your data can be evaluated using the accounting capabilities of the Vyapar billing software. You can develop a business strategy after reviewing the company reports.

Compatible with Scanners:

Vyapar is a free inventory management software that helps you to track and manage your item’s stock using barcodes and other vital attributes. Using a barcode scanner, you can access your PC’s product details.

The method eliminates the need to manually enter each item’s name, quantity, and price. During the manual billing procedure, there is a chance of errors; you could omit anything or add the same thing twice. You can reduce those errors by using Vyapar’s barcode feature.

You may access your business dashboard from any location by downloading the Android app. With assistance, you may set up a corporate dashboard on your Windows computer with a connected barcode reader and swiftly create invoices.

Business Administration:

The Vyapar GST billing tool can make it easier to run your business. With Vyapar’s comprehensive dashboard, you can track and analyze your company’s operations in real-time. The straightforward interface of the Vyapar app may help you increase company productivity.

This software can manage your expenses, bookkeeping, and inventory. Because of the format’s simplicity and accessibility, it is easier to keep track of all company transactions. The software eliminates the need to produce invoices for each shipment manually.

On the Vyapar app, you may personalize your company’s features and extra information. The program also allows you to keep track of your inventory and arrange further orders based on your needs.

Optimise Your Inventory Space:

You may quickly set up personalized alerts when your stock falls below a certain level using the inventory management system built into Vyapar. It will remind you to replenish your items, so you don’t run out.

Businesses that sell a wide range of products must effectively manage their inventory. You may keep track of the items in your shop using our GST invoicing software. With Vyapar’s features, you can detect theft in your store.

Using the best billing software is an excellent idea because you can utilize the data to make sales reports and calculate how much inventory is optimal given current trends and previous year’s sales.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

A commercial invoice is a legal document a seller provides to a buyer in an international transaction. The copy serves as both a contract and proof of the sale. It details the number of goods sold, the prices, and the value.

Download a commercial invoice template, fill in the necessary information, including the payment terms, and lay down the shipping documents. Here you have your commercial invoice.

According to GST regulations, a tax invoice must include GST to upload to the GSTR return and show the outbound Supplies.

A commercial invoice is a necessary document for export and import clearance. It is sometimes used for currency exchange. A commercial invoice should be provided whenever items are exported.

The shipper, often the seller (exporter), issues the commercial invoice.

In an international transaction, a commercial invoice is a legal document issued by the seller (exporter) to the buyer (importer). It acts as a contract and proof of sale between the buyer and seller.

A commercial invoice is specifically used for international trade, detailing goods for customs clearance, while a normal invoice is more general and used domestically for invoicing customers and tracking payments.

The primary role of a commercial invoice is to document key details of an international trade deal, like goods, quantity, value, origin, destination, and more. It’s crucial for customs clearance, regulatory compliance, payment processing, duty/tax calculations, and as legal proof of ownership and transaction specifics in global trade.

A commercial invoice is a valid payment request and legal document in international trade, detailing essential information for customs and payment processes.