Ledger Balance Sheet Format

Stop wasting time with manual ledgers! Vyapar simplifies balance sheets, saving you precious time. Download, analyze & generate reports instantly.

⚡️ Eliminate errors with pre-defined formulas

⚡ Simplify calculations and save time

⚡️ Generate accurate balance sheets in minutes

Highlights of Ledger Balance Sheet Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal and grand total amounts

Consistently formatted

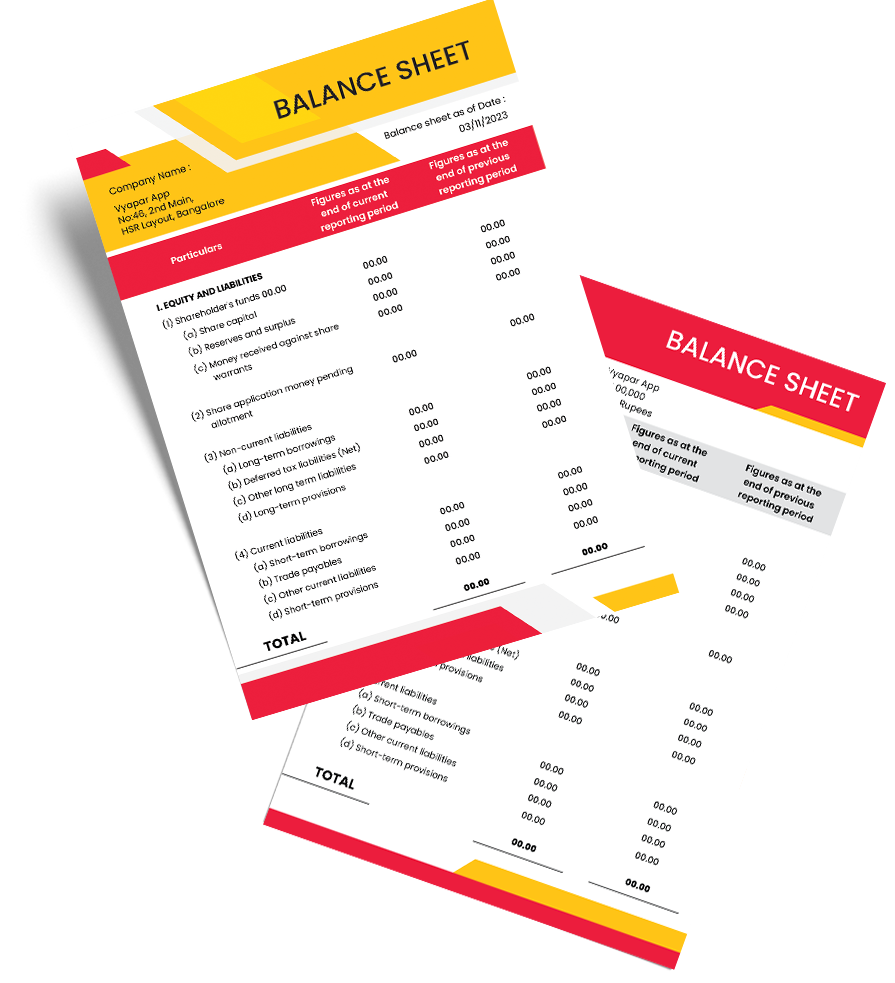

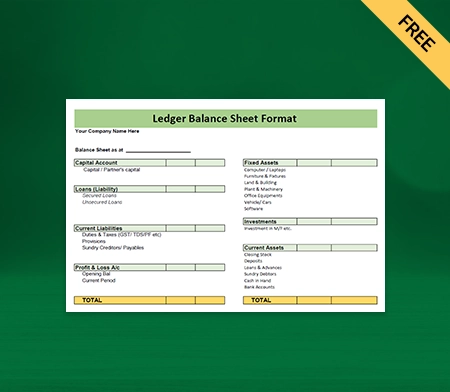

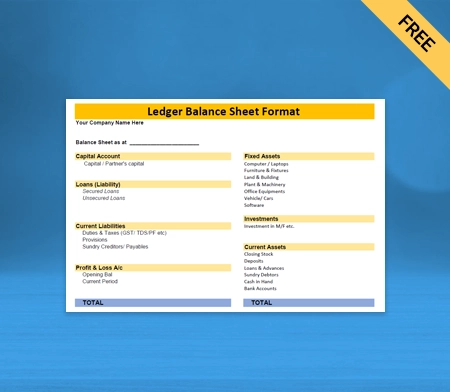

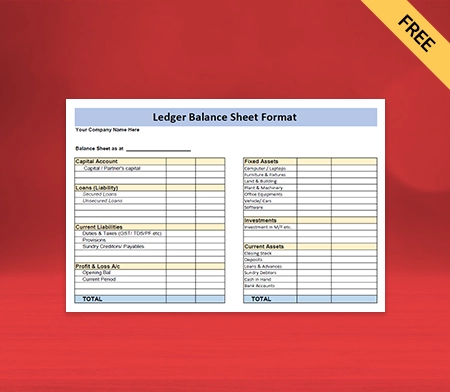

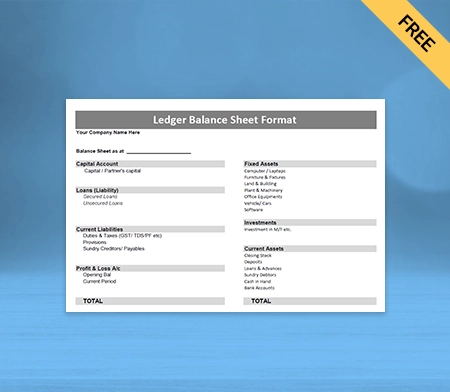

Download Free Ledger Balance Sheet Format

Download free final ledger Balance Sheet Formats, and make customization according to your requirements at zero cost.

Customize Invoice

Type I

Type II

Type III

Type IV

Generate Invoice Online

What is a Ledger Balance?

A ledger is a book of accounts that includes classified and summarized information from journals, such as debits and credits. It is also known as the second book of accounting entries.

Ledger Balance is the balance determined at the end of each working day. Each transaction would be recorded as a debit or credit entries in separate columns in a ledger book. Each account has an opening or carry-forward balance.

There are three primary types of ledger accounts:

- General Ledger.

- Debtors Ledger.

- Creditors Ledger.

What is a General Ledger?

The general ledger gathers data from journals. Once a month, all journals are totalled and posted to General Ledger. The public ledger has a page for each account in the chart of accounts, which you can organize by account category.

Usually, the general ledger has at least seven major categories, including assets, liabilities, owner’s equity, revenue, expenses, gains, and losses.

The general ledger’s main categories can be further sub divided into sub-ledgers. It contains additional details of accounts such as cash, accounts receivable, accounts payable, and so on.

Advantages of General Ledger:

The general ledger provides the following advantages:

- The general ledger shows where the company stands at any given time. For example, a cash ledger will show the cash in hand as of the date, whereas a bank ledger will show the bank balance.

- It helps in bank reconciliation because all bank account transactions are in a single place.

- Since ledgers are classified at the time of creation, an organization can view all its debtor’s ledgers in one go.

- It helps auditors understand business transactions. A detailed assessment of ledgers can provide auditors with a comprehensive understanding of the business.

- It provides accurate records of financial transactions and helps compile trial balances.

- You can easily file tax returns as all expenses and income are in one place.

- Users can spot any unusual activity easily and stop fraud.

What is the purpose of Ledger in Accounting?

The following are the primary objectives of ledger accounts:

The ledger is a permanent record book that contains several accounts for various subjects. The primary purpose of a ledger is to provide classified financial information.

The basic double-entry principle states that debit always equals credit and vice versa. Accountants can prepare ledger accounts using the double-entry system. So, you can find fault if a trial balance doesn’t check the arithmetic accuracy.

The ledger is a book of accounts that records all of the company’s financial transactions. It keeps track of all expenses, losses, income, and gains.

Thus, it helps prepare the business’s profit and loss statement. A user can determine the profit earned or loss suffered during a given accounting period.

The ledger also contains the accounts for the business’s financial transactions involving capital, liabilities, and assets.

You can create a balance sheet format to show the business’s financial position at a specific time. You can also use the balances of these accounts and prepare the profit and loss statement.

How to write a Ledger?

Accounting ledgers are generally created by businesses that use a double-entry bookkeeping system to record transactions. Every transaction has two columns and affects at least two accounts.

Ledgers separate financial data from journals into distinct accounts such as receivables, cash, and sales accounts. It gives you access to the specifics of your transactions.

Here are some simple steps to create a ledger:

- Make a ledger for each account. A cash ledger, for example, will include your company’s all-cash transactions. Create a general ledger account for unusual or unplanned expenses.

- Write the Journal’s number, date, and description by making columns on the left side of the page.

- Create credit, debit, and balance sections on your left. Debit refers to money received, whereas credit means what you pay. The difference between credit and debit is the balance.

- Enter the data and amount of journal entries into the related accounts. Write the transactions as they occur. If you make an entry in your Journal, add it to the ledger right away.

- To create a comprehensive ledger, you can combine these cash accounts. Account numbers are listed on the front page of the ledger in an accounting chart.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Difference between General Ledger and Trial Balance:

General ledger and trial balance refer to a company’s expenses and income. But the boat differs in several ways, which include:

- A Ledger is an account-by-account summary of business transactions recorded in the Journal. A Trial Balance is a statement prepared at the end of a fiscal year showing all ledger accounts’ debit or credit balances.

- The general ledger is detailed and includes transactions in all individual cash accounts, such as assets and equity. On the contrary, the trial balance is short and contains just the total of each category.

- General Ledger serves as a database for all the business’s financial activities. A trial balance is not a repository for all the data but a report.

- You can get the most specific details about any transaction with the help of a general ledger. A trial balance summarizes all the figures from the general ledger to help you determine if your accounts are in balance.

- A general ledger is the primary source of information, and accountants and auditors use it to trace balances. Investors may use trial balances to decide whether to buy shares in a company in their year-end reports, and auditors request a copy of their year-end statements.

- You can prepare a general ledger at any time of the year. The trial balance includes the total of accounts for a specific reporting period.

- All Ledger accounts are prepared in the ‘T format,’ with debit transactions appearing on the left column and credit transactions on the right. You can make trial balances in a columnar format, with separate columns for posting ledger account debit and credit balances.

- Some follow the calendar year and others prepare the ledger per the financial year. Accountants mostly prepare trial balances at the end of the year, but one can prepare them monthly, quarterly, or half-yearly.

- The general ledger could be more than 100 pages because it includes detailed information. As the trial balance consists of account totals, it is only a few pages long.

- Accountants organize general ledger entries or postings by account class. Depending on the transaction, you must place it in the correct column so that the numbers match and the account balances. Since you’re only using totals, the trial balance lacks these classifications. The only thing to double-check is that you’ve matched the correct number with the proper heading.

The general ledger influences the trial balance. Accountants use a ledger as the base to write total amounts in the trial balance.

Additional Benefits of using Ledger Balance Sheet Format by Vyapar:

Lifetime free basic usage

You can easily create custom invoices using our free GST accounting and billing software. You can also manage your dashboard and track inventory items. Vyapar app works well on your mobile phone, laptop, or desktop computer. You can use it in any operating system, and the app’s the free mobile version. The free app gives you access to many other valuable features. Users have a 7-days free trial on the desktop version but have to pay for later use.

Eliminate Human Error

An error can cause a significant loss. Thus, it is essential to choose the right software to avoid mistakes. With Vyapar, your company can process data much faster, saving time.

Automation speeds the process while eliminating human error. You can easily export and import data from other compatible softwares.

Vyapar ledger balance sheet formats have a user interface that is simple to use. It also sends reminders to collect payments and repay debts, which helps reduce future disputes.

Create customized bills

Vyapar allows you to create invoices format in minutes. The app will let you personalize your bills while making you appear professional. You can save time by auto-filling repetitive debit entries with the app.

Using professional bill book formats you can make your bill book unique for your mobile shop. The invoice can include your company’s logo, email address, phone number, payment methods, customized themes, address, and name.

You can contact your customers however you want using this tool. You will be able to provide a better experience to your customers and respond faster.

Offline Access

The Vyapar software does not require any special accounting knowledge. The Vyapar ledger accounting software is suitable for all small and medium-sized businesses.

Most accounting software requires internet access, making it challenging to use in remote areas. You don’t need internet access or connectivity to use the Vyapar App.

It is an offline application that you can use anywhere. Furthermore, the offline feature protects your data by keeping it accessible only to the user.

Saves Time

The manual process of recording transactions can take a lot of time, increasing the likelihood of calculation errors and mistakes. You might need to hire many accountants to manage your accounts.

You can avoid this problem by opting for the Vyapar app. The app performs calculations automatically and accurately, and the Vyapar app records all your transaction data and generates reports.

You can quickly go over the income statements and analyze your company. Anyone on your team can manage the software, so you don’t need to hire additional personnel for the job.

Other valuable features of the Vyapar App:

Business Reports

Business owners are required to make informed decisions. It can be challenging to manage all the daily operations finances simultaneously. Vyapar is the solution to all these problems.

Vyapar helps you create 40+ various reports. GST report, sales or purchase report, expense or revenue report, and balance sheets are some reports that you can generate.

You can analyze the reports and evaluate the business’s position. This way, you can identify the product in demand and keep that in stock.

The Ledger balance sheet format can help you file taxes seamlessly. You can maintain the business’s cash flow and avoid workflow interruptions.

Data Safety and Security

The Vyapar app handles data and ensures its security through three factors, and they are password protection, data encryption, and continuous backup.

The encryption system only allows the owner to access the data. Vyapar will not save or share authentication data from users for future use.

The Vyapar App allows you to back up the data in your Google Drive by enabling Auto Backup. You can create data backups based on your needs to help ensure your data’s security.

The software is bound to protect user privacy, so no one, not even Vyapar, can access the user’s data. For safety, we recommend regularly changing passwords and keeping backups offline.

Inventory Control

The Vyapar app has several unique inventory management features. You can use the app to track your company’s sales. This way, you can make the optimum use of your inventory space.

Business reports can help you measure the efficiency of your management. You can save space by removing items that do not sell.

Vyapar inventory management makes creating sales or purchase orders format easier by assigning a due date for easy tracking. You can ensure that inventory items are always available by enabling auto stock adjustment.

It boosts employee productivity and ensures that you fulfill orders timely. Vyapar helps you keep sufficient reserved stock on hand to complete the order.

Send Payment Reminders

Ensure timely payments and maintain your business’s cash flow with the Vyapar app’s reminder feature. The app reminds you when there is a pending payment.

You can send repayment alerts to your customers directly from Vyapar using Whatsapp or email, and it will remind them about their outstanding dues.

Additionally, Vyapar supports a variety of payment modes. It includes cash, credit cards, debit cards, e-wallets, NEFT, RTGS, and UPI.

It gives your customer the convenience of choosing a suitable payment option. The app’s features collectively work to ensure that your business runs smoothly.

Business Performance Dashboard

Our app can easily track sales, purchases, cash in hand, stock, expenses, and loan amounts. Vyapar’s effective dashboard lets you access your data through live status tracking.

The app contains all the features to meet your business requirements. You can set up due dates for tracking orders. Thus, a user can avoid delivery delays and ensure customer satisfaction.

Vyapar’s dashboard is user-friendly and seamless to use. You can view your business status and know about the financial position of your entity via the dashboard.

You can add company details by clicking on the left corner of the app. You can also print those details in the customized invoices with the correct settings.

Record Expenses

A company’s expenses help in determining its growth. By evaluating costs, you can better manage your company. The app has a separate section for handling expenditures.

You can identify areas where you are spending more and find ways to cut unnecessary costs. Recording expenses is also essential for accounting and tax filing.

Our app is ideal for expanding businesses. It helps in the management of their finances. The company can save time and money by recording its expenses with Vyapar.

It also contributes to cost savings. Furthermore, keeping track of costs will help develop better strategies and boost the entity’s profits.

Frequently Asked Questions (FAQs’)

A ledger balance sheet includes accounts for liabilities, assets, equity, debts, and so on. It contains all of the information required to prepare financial statements.

Determine the balance of each ledger account. The trial balance can then be created by categorizing each closing balance from the general ledger accounts as a debit or a credit balance. Using the trial balance, create a balance sheet format.

A ledger records transactions for each account as they occur. The business prepares a balance sheet at the end of each financial year.

The five categories of General Ledger are assets, liabilities, owner’s equity, revenue, and expenses.

Ledger balances represent transactions that have not yet been processed. In contrast, available balances represent unprocessed transactions.

No, a ledger is not a balance sheet. While a ledger contains detailed account information, a balance sheet is a summary of a company’s financial position, including assets, liabilities, and equity, at a specific point in time.

The format of a ledger sheet typically includes the following columns:

1. Date: The date of the transaction.

2. Description: A brief description of the transaction or account activity.

3. Debit: The amount debited or increased in the account.

4. Credit: The amount credited or decreased in the account.

5. Balance: The running balance of the account after each transaction.

The ledger sheet organizes transactions chronologically and tracks the debit and credit amounts for each account, allowing for easy monitoring and reconciliation of account balances.