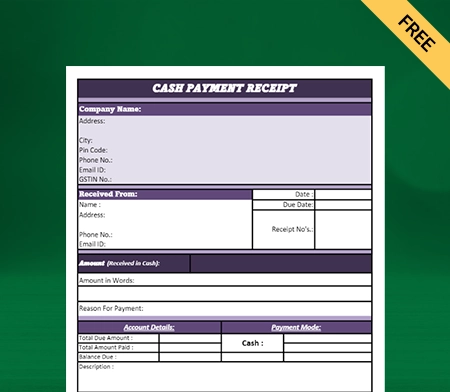

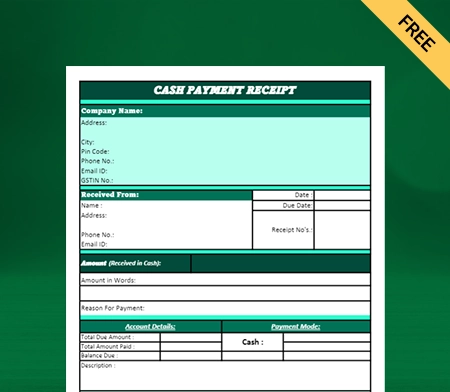

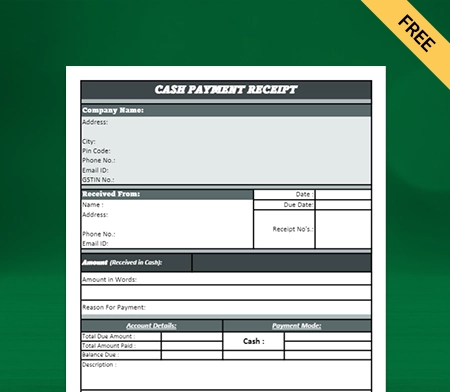

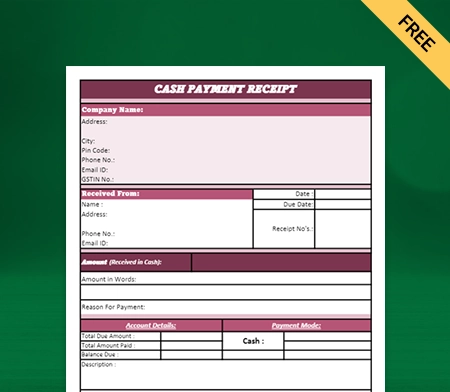

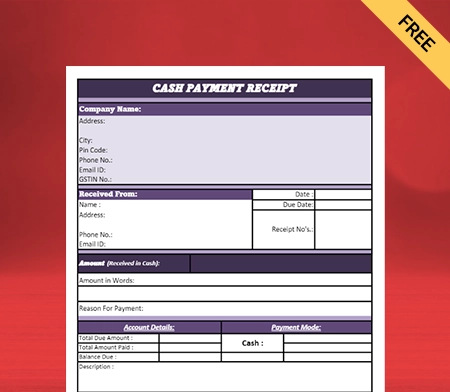

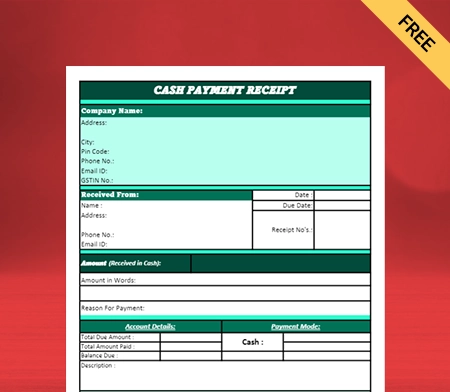

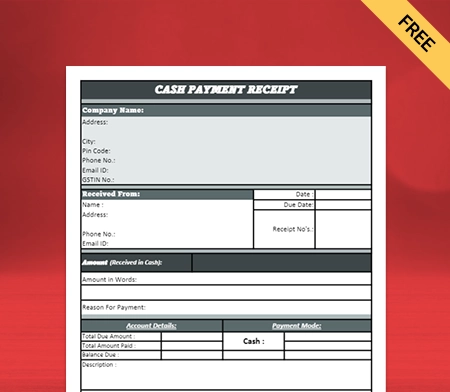

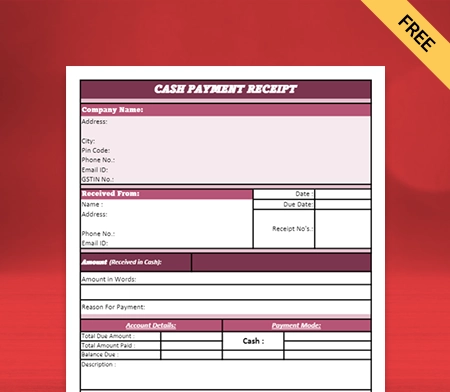

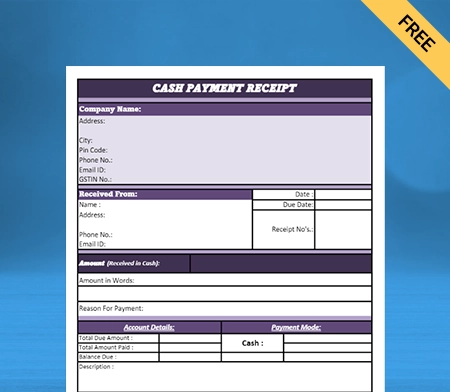

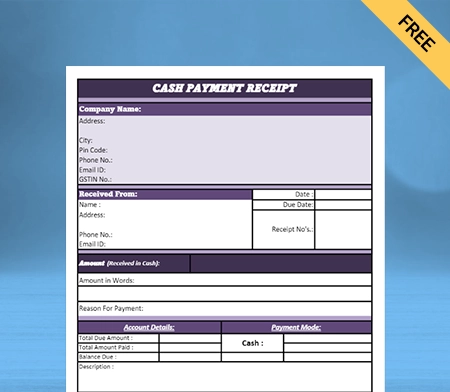

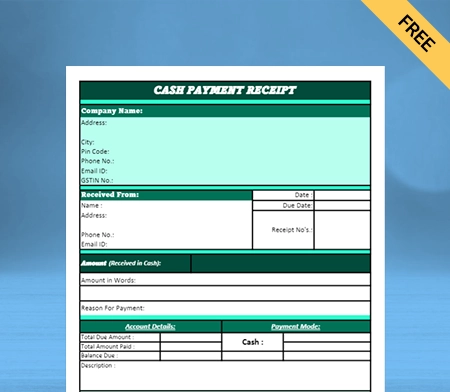

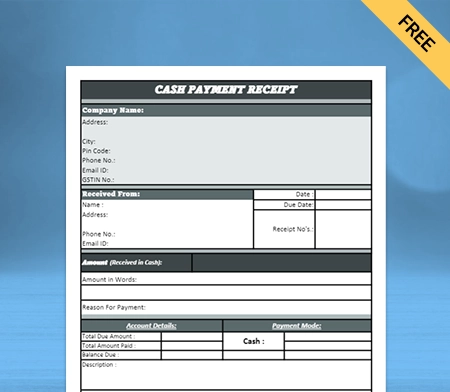

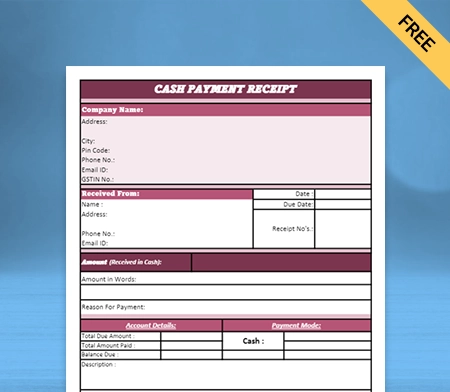

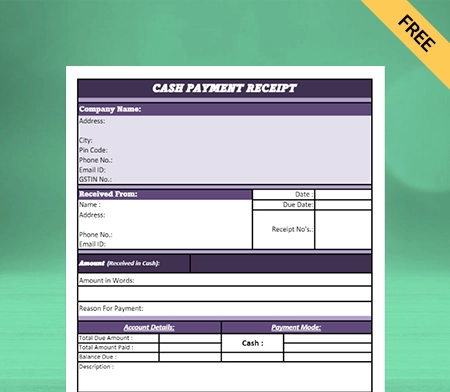

Cash Payment Receipt Format

You can download the software to create the Cash Payment Receipt Format for your business. Or use Vyapar App for all your business requirements like Billing, Accounting, and Inventory Management. Avail of your 7 days Free Trial Now!

Download Cash Payment Receipt Format in Excel

Download Cash Payment Receipt Format in PDF

Download Cash Payment Receipt Format in Word

Download Cash Payment Receipt Format in Google Docs

Download Cash Payment Receipt Format in Google Sheets

What is the Cash Payment Receipt Format?

A Cash Payment Receipt Format is used as evidence for cash transactions between a buyer and a seller. It acts as evidence of payment for purchased goods or services the seller issues to the customer.

The format of a Cash Payment Receipt may vary according to the needs of the business or organization that issues the receipt.

What Information Should be Included in a Cash Payment

Receipt Format?

A Cash Payment Receipt typically includes the following information:

Header: It contains the name, logo, address, and contact information of the business that issued the receipt.

Date: The top of the receipt is when the transaction occurred.

Receipt Number: Every receipt must have a special identification number, often printed at the top or bottom of the receipt.

Details About the Buyer: While creating a cash payment receipt, you should ensure that it has a special identification number at the top.

Details About the Seller: It generally includes information such as the client’s name, contact number, and mode of payment.

Payment Details: While selecting the information for your cash payment receipt, it is important to mention the important details like payment method, payment date, total amount, etc.

Description of Goods and Services: The quantity, unit price, and total price of the items or services should be listed, along with a brief explanation of what was acquired.

Total Amount: The bottom of the receipt should prominently display the entire amount paid.

Signature: To validate your cash payment receipt, it is important to include the signature of the individual receiving the payment.

The information given above can make your cash payment receipt more detailed and authentic for your business clients.

Benefits of Using the Cash Payment Receipt

Here are the following benefits of using Cash Payment Receipts for your business:

1. Helps With Record Keeping:

The Cash Payment Receipt Format is tangible proof for the businesses for payment received from their clients. These receipts might be utilized as evidence if there are any disagreements or audits.

Cash Receipt Templates are essential because they show a clear transaction record and help businesses track their financial performance. They also help keep processes transparent and accountable when it comes to money. Using these payment receipts can tremendously help your business to keep account of all your business payments and to keep a better-detailed order of your business payment.

Cash Payment Receipts are a valuable tool for businesses and organizations because they are a physical record of the payment received. They make people feel safe and accountable and help ensure that finances are transparent and follow the law.

2. Provides Accurate Accounting:

Maintaining accurate records of cash transactions is crucial for any business to withhold financial stability and regulatory compliance. Businesses choose the cash payment receipt as it provides valuable insights to businesses, like the total amount paid, payment date, and goods and services traded.

Businesses may readily reconcile their cash receipts with their bank deposits by keeping a thorough record of cash receipts, ensuring that all transactions get appropriately accounted for. This can help to avoid mistakes or disparities that could lead to financial losses or legal problems.

Furthermore, cash flow monitoring is critical for any firm to maintain financial stability and make educated decisions. Cash Payment Receipts can provide vital insight into the business’s cash flow, assisting in identifying trends and areas for development.

3. Helps With Tax Compliance:

Cash Payment Receipts can help businesses comply with tax regulations by providing proof of the revenue received. It can help companies avoid penalties or fines for non-compliance and file accurate tax returns.

Cash Payment Receipts are essential for firms to follow tax rules and prove that they have done business. Businesses must accurately document their financial records and provide a receipt to validate their transaction. The amount paid, the date, and a description of the goods or services provided are all written on these receipts.

Keeping digital receipts can make creating financial statements and tax returns easier, saving businesses time and reducing the chance of mistakes. Receipts are essential for businesses to follow tax laws, keep accurate income records, and avoid fines or penalties.

4. With Better Business Analysis:

Cash Payment Receipts can assist businesses in providing valuable data insights to analyze their sales patterns and make informed decisions in the future, as they can make clever decisions about inventory, pricing, and other business strategies.

By using the cash payment receipt, businesses can get better insights into the ongoing trends as they can quickly figure out which products or services are most popular by quickly analyzing the receipt.

Subsequently, by using the information on Cash Payment Receipts, businesses can learn more about their customers and the market and make better decisions to help them grow and make more money.

How to Find the Best App For Making Cash Payment

Receipt Formats?

While choosing the accounting software to create a Cash Payment Receipt Format, businesses typically consider several factors. These are the following things to go for:

1. Consider the Ease of Use:

By using the software with better ease of use, staff may promptly generate accurate receipts, reducing errors and saving time. The ease of use also enables simple format customization to meet the business’s unique requirements, such as adding the corporate logo and contact information.

It also makes your software more inclusive, meaning it will be simple to understand and use for your staff needing more substantial technical expertise. It can result in higher production and reduced training time for staff.

A simple and clean design can make it simpler for clients to read and comprehend the receipt, enhancing their experience and overall happiness with the firm. It is important to consider ease of use to increase efficiency, eliminate errors, and improve customer experience; businesses create Cash Payment Receipt Format.

2. Software With Better Integration:

Choosing the software to create a Cash Payment Receipt template is essential to consider integration, which is an integral aspect of the software. The integration will help automate the payment process and eliminate the need for mistakes to be made by hand.

Software with the right integration feature makes the generated Cash Payment Receipt easy to read and ensures it accommodates all the vital details. The business should also consider putting its logo and other branding elements on the receipt to help people remember the brand and keep coming back.

Lastly, the business and the customer should be able to find the payment receipt quickly. Companies should consider giving customers paper and digital receipts so they can choose the one they like best. It helps businesses to increase their Professionalism and with more customer satisfaction.

3. Software With High-Class Security:

The security aspect of the software is essential to securing the confidentiality, integrity, and availability of critical information. The software should have encryption and secure data transmission techniques that can be used to protect customer payment information from interception and unwanted access.

Furthermore, it should allow access to just authorized staff by controlling the limited access to payment data and audit trails to monitor and track any changes or access to payment data. Software may also undertake regular security assessments and testing to find and repair vulnerabilities before they get exploited.

Software with better security can help businesses safeguard client payment data and defend their brand and financial stability by implementing these procedures. Data breaches can harm the productivity of your business and can lead to your valuable time.

4. Software With Better Customer Support:

Customer support is an essential part of any software to look for. Since the software that generates Cash Payment Receipts should also handle financial transactions efficiently, it is essential to have a reliable and effective customer support system in place.

You should go for the software with whom you can quickly reach out to the customer support team if you need help with the software or have any queries. They should know everything there is to learn about the software’s features and functions and have the technical know-how to fix any issues.

A robust customer support system ensures that software-related difficulties can be easily solved. It improves the software’s reputation and credibility in the market. So, putting money into software with excellent customer support is essential.

Why Choose Vyapar Software to Create a Cash Payment

Receipt Format?

Here are the following reasons why you should use Vyapar to create your Cash Payment Receipt:

1. Provides Fully Customisable Cash Receipts:

Vyapar is a robust accounting programme for creating customized Cash Payment Receipts for your business, and with Vyapar, generating receipts tailored to your business’s specific requirements.

Vyapar is the best tool, whether you need a simple receipt with basic information or a detailed receipt with itemized products and services. Using our professional see software, you can customize your cash payment receipt per your business requirement.

Vyapar software for Cash Payment Receipt Format allows you to send receipts directly to your customers via email or SMS and create custom receipts. It saves time and simplifies the billing procedure.

You can also add products and services to the receipt and specify each quantity and price. Vyapar is a fantastic tool for businesses creating customized Cash Receipt Templates and streamlining accounting procedures.

2. Create Receipt in Three Useful Formats:

Vyapar cashbook software for Cash Payment Receipt Format is an excellent tool for small business owners to keep track of their money.

You can make Cash Payment Receipts in three different formats with this software: PDF, Word, and Excel, Depending on what your business needs. For example, you can make your receipt in PDF format, which makes the receipts look more professional and can be shared and printed easily.

Further, you can prefer the Word format if you need to make changes or changes to their receipts often. Excel is also a valuable format for businesses that need to keep track of their money and see how it flows in and out.

Overall, using Vyapar software for Cash Payment Receipt in all three formats is a convenient and efficient way for businesses to manage their finances and design the perfect-looking Cash Receipt Templates for your business.

3. Send Payment Reminders to All Customers:

Vyapar software for Cash Payment Receipt Format helps small and medium-sized businesses get paid on time and keep their cash flow steady. Vyapar does it for you by helping you keep track of all payments due in the business dashboard.

You can use the Vyapar app’s reminder feature to remind your customers when they need to pay you back. It will help remind them via WhatsApp and email of how much is still owed and the balance due.

By sending reminders, you can ensure the customer remembers to pay. The Cash Payment Receipt Format by Vyapar offers a wide range of payment options to help your customers pay on time.

It accommodates both online, such as credit cards, debit cards, e-wallets, NEFT, RTGS, and UPI, and offline methods, such as cash and QR codes. You can make the entire process seamless by allowing customers to pay offline and online.

4. Provide Convenience of Multiple Payment Methods:

By offering your clients numerous ways to pay, your clients are more frequently likely to pay for goods and services. It will help you to maintain a healthy cash flow inside your business. Using Vyapar, you can offer UPI, QR, NEFT, IMPS, e-wallets, and credit/debit cards as payment options.

Customers widely prefer business platforms that provide them convenience with the choice of how to pay for their business goods and services. By allowing your clients their preferred payment mode, businesses can earn great support from their clients.

With the Vyapar software for Cash Payment Receipt Format, you can make excellent receipts with more than one way to pay. You can choose the payment options your customers will likely choose, or you can give them all to pay for your goods and services.

As one way to pay, you can include a QR code on the invoice that your customers can use to send a payment to the UPI ID on the invoice. Vyapar software also allows you the option to add a bank account.

5. Makes Billing and Invoicing Process Seamless:

Our Vyapar invoicing software is all in one. It does everything and is an excellent addition to your business because it also helps you automate your billing needs and create a professional-looking Cash Payment Receipt.

It works well to help small and medium-sized businesses save more time on accounting. Using our free billing software with GST, business owners can file GST tax returns, manage their inventory, send out invoices, and send out bills.

Businesses can change the fields in our free accounting app to meet their needs and create a steady cash flow. You can use the Vyapar app to make GST invoices for your clients in less than a minute, which you can print or send to your clients.

It already comes with all the essential details required for billing, and bills are in the GST invoice format, and you can make them with our GST billing software.

6. Setup Automatic Data Backup For Safety:

Vyapar software to generate a Cash Payment Receipt Format is 100% safe, and you can quickly and accurately store your data. With our free app, you can back up your Google Drive data locally, remotely, or online to keep it safe.

This Vyapar Software for Cash Payment Receipt Format makes it easy to regain lost data quickly. The “auto-backup” feature of Vyapar software to create a Cash Payment Receipt Format in India makes it easy to back up your files.

All your business data gets encrypted with extra security, and the Vyapar app is the most advanced free software for creating Cash Receipt Templates.

When this mode is turned on in the Vyapar software, a backup is made automatically daily. Keeping the data backup will keep your Valuable data intact.

7. Add, Manage, and Track Multiple Bank Accounts:

The Cash Payment Receipt Format by Vyapar is entirely secure, and you can quickly and accurately store data. Using our free app to create your professional-looking Cash Receipt Template.

You can securely back up your Google Drive data locally, remotely, or online. Vyapar Software makes it simple and quick to recover lost business data.

The data is encrypted for added security, and the Vyapar application is the most advanced free Cash Payment Receipt-generating software available. The “auto-backup” feature of the Vyapar software for Cash Payment Receipt Format in India simplifies file backup.

A daily backup is performed automatically when this mode is enabled in the Vyapar app. Using Vyapar inventory management software helps your business to keep your data intact and removes the chances of any possible data breach and theft.

8. Builds a Positive Brand Image Among Customers:

While performing your business, providing your clients with a professional-looking Cash Payment Receipt significantly enhances the brand’s image. In addition, you can build trust by giving full disclosure about the transaction.

The Vyapar software to generate a professional-looking Cash Payment Receipt Format helps you establish a professional brand. An expertly crafted, personalized Cash Receipt Template can set you apart from the competition and demonstrate your expertise as a seller.

Vyapar allows you to include our company’s logo, style, font, and brand colours on your invoices, as doing so will assist you in presenting your brand’s identity in the best possible light. A buyer will likely feel more comfortable purchasing from a seller using professional custom quotation formats rather than plain text.

Frequently Asked Questions (FAQs’)

The Cash Payment Receipt Format is a digital document of cash transactions between the business and clients. It has important information like the transaction date, the amount paid, the name of the payee, and any other information needed for keeping records or accounts.

Yes, a date on a Cash Payment Receipt Format is required because it showed when the transaction occurred. Additionally, the date facilitates the tracking and organization of financial records and streamlines accounting procedures.

You can certainly use the handwritten Cash Payment Receipt for official purposes. But it may be the subject of constant human errors, which might hurt your business. So that’s why you can use the Vyapar software to create your professional-looking, error-free Cash Receipt Template.

For tax purposes, you should keep your Cash Payment Receipt in a separate folder or envelope labeled “Cash Receipts”. Or you can use Vyapar, which includes the date and purpose on each receipt. It is also advisable to categorize them by expense type (such as rent, utilities, and supplies) for easier tax preparation.

Yes, Cash Payment Receipts are legally required in India. Some examples of such criteria for receipts include the date, price, and description of the products or services purchased, as well as the seller’s or supplier’s name and contact information.