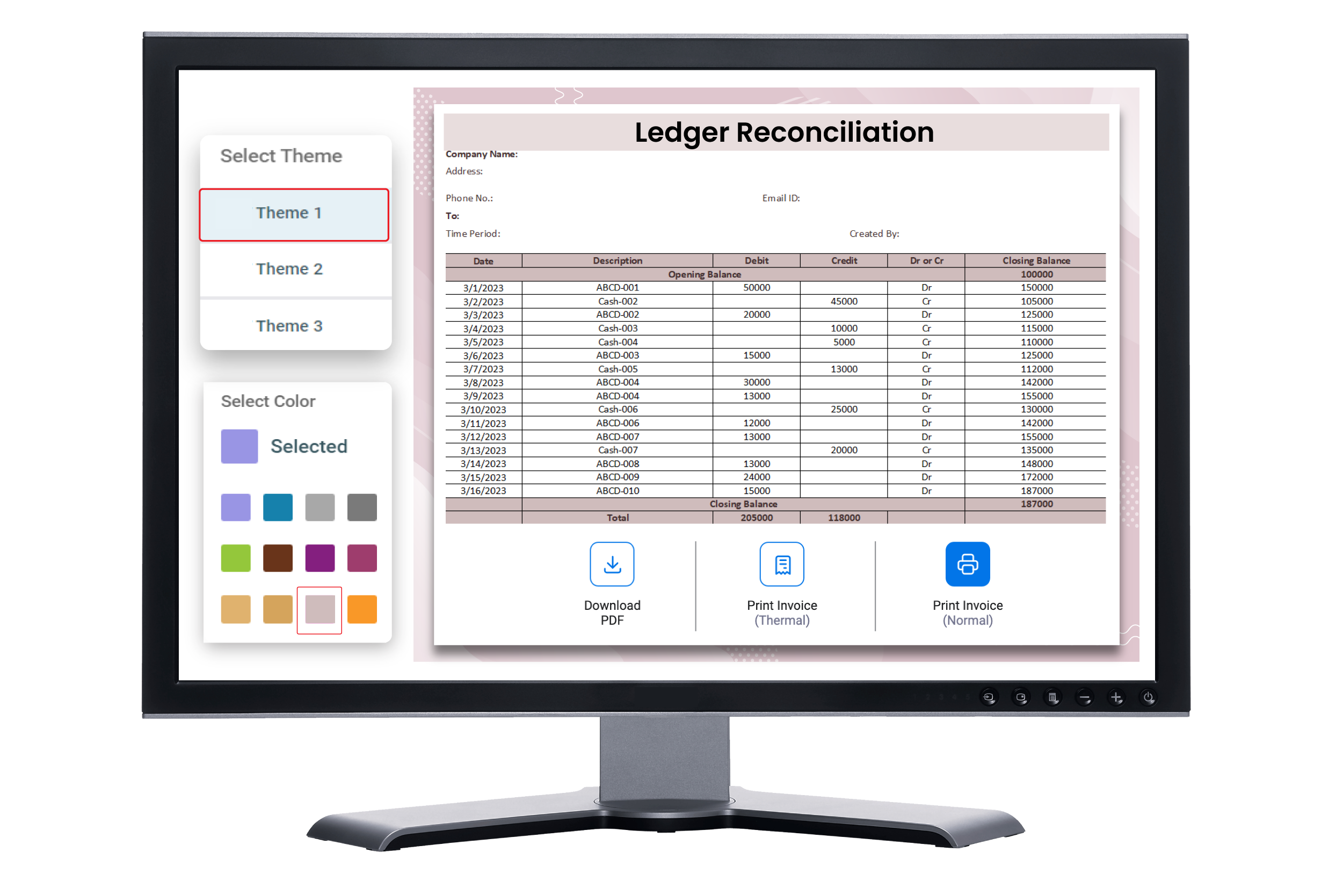

Ledger Reconciliation Format in Excel Download

Use accounting software to create your processional-looking ledger reconciliation format in Excel. Using Vyapar makes the entire process seamless and helps you manage your work with one app.

- ⚡️ Create professional reconciliation with Vyapar in 30 seconds

- ⚡ Share reconciliation automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Download Ledger Reconciliation Format in Excel

Unlock Premium Ledger Formats!

Gain Insights into Cash Flow & Profitability.

Importance Of Ledger Reconciliation in Accounting

Financial Integrity

Proper ledger reconciliation ensures that your accounting records are proper and reliable. It will verify and match with external sources like bank statements.

Error Detection

Ledger reconciliation helps detect errors in case of missed entries.

It immediately reflects the amount missmatch and helps in a smooth transaction process.

Fraud Prevention

Ledger Reconciliation can be a red flag for fraudulent activities. It allows you to investigate and potentially save money.

Informed Decisions

Correct financial data from reconciled ledgers empowers confidence in decision making related to budget setting, strategy planning, investments and more.

Audit Support

Reconciliation ledger format in excel configures strong financial controls and meets accounting standards. It reduces potential issues and makes audits smoother.

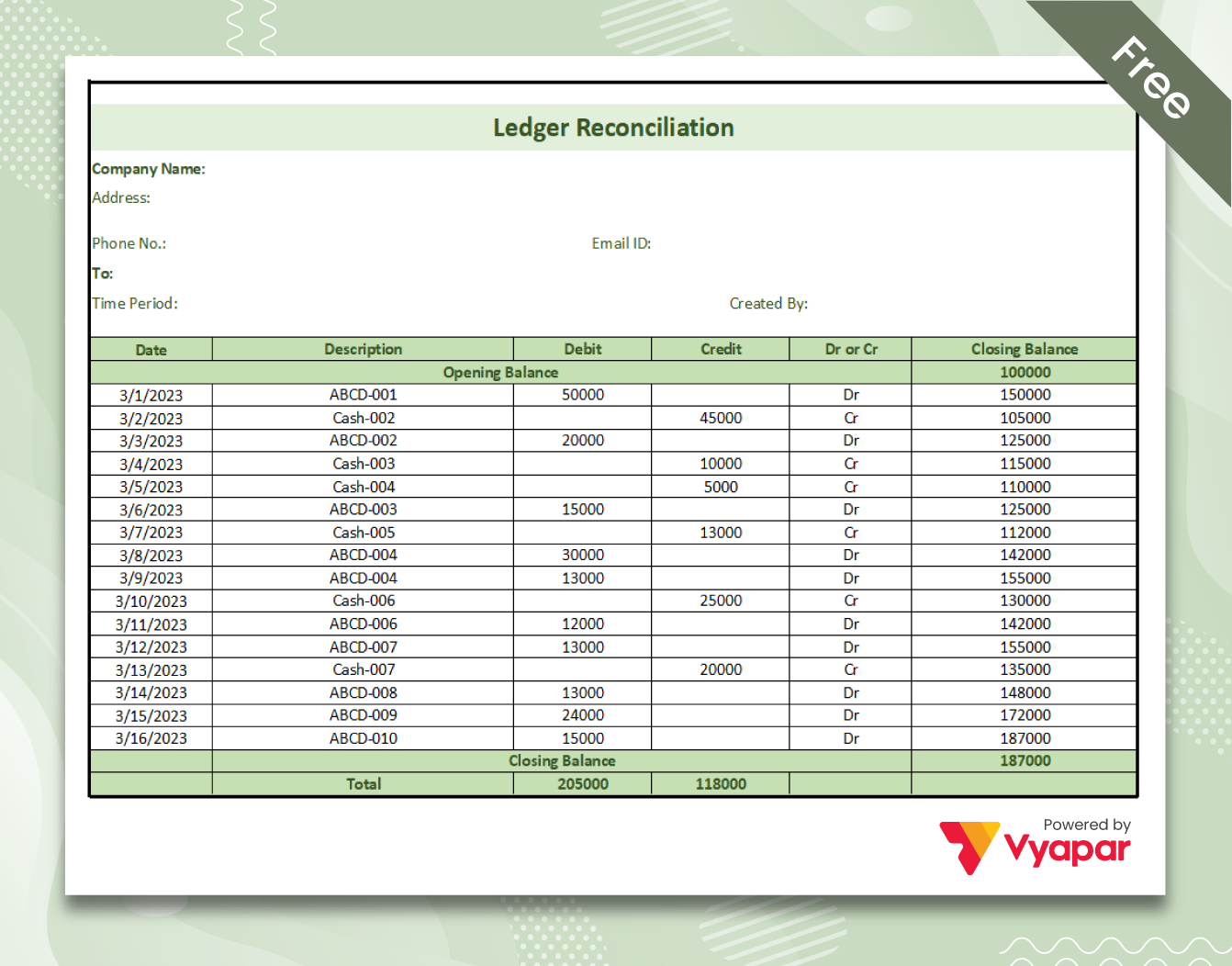

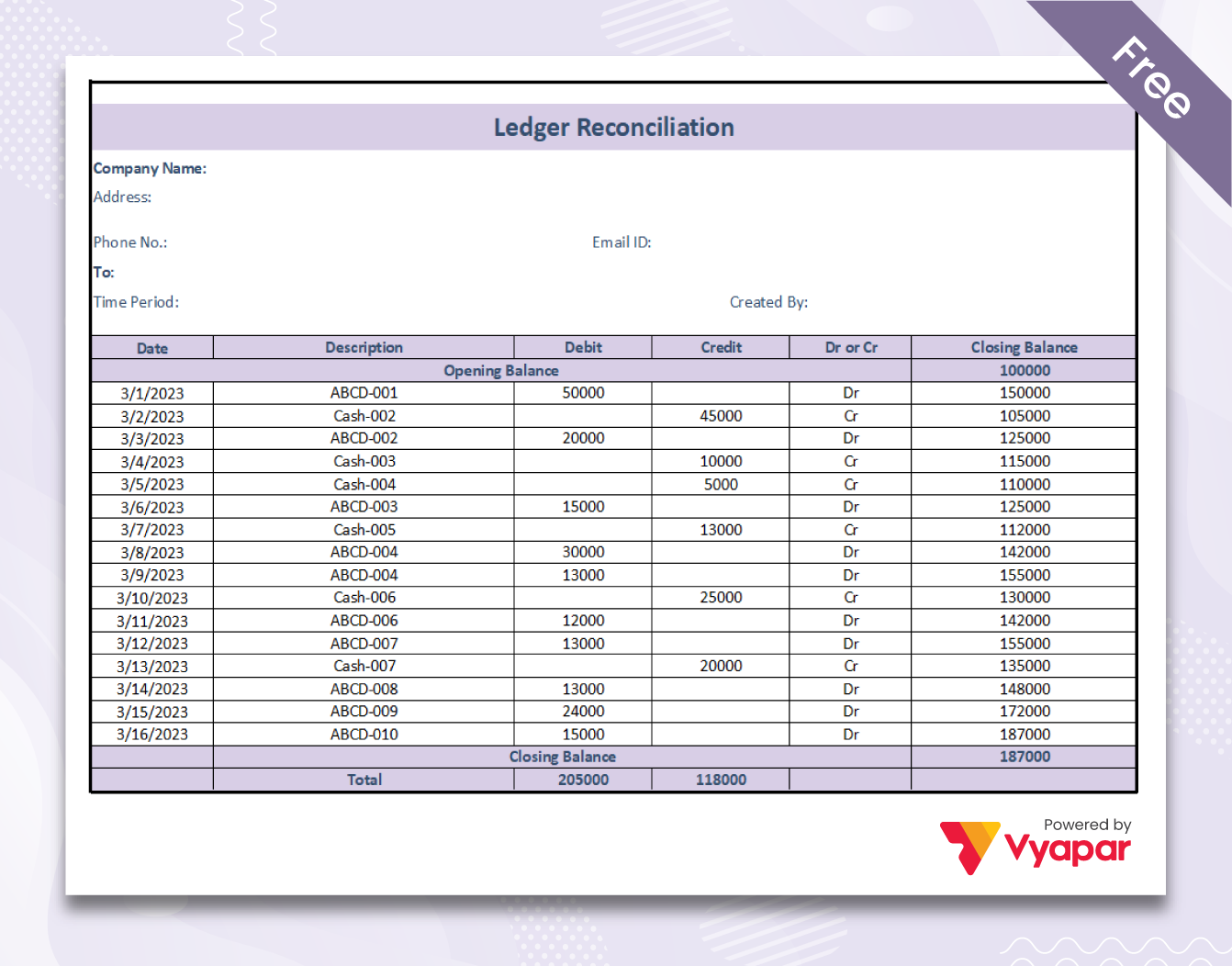

What is the Ledger Reconciliation Format In Excel?

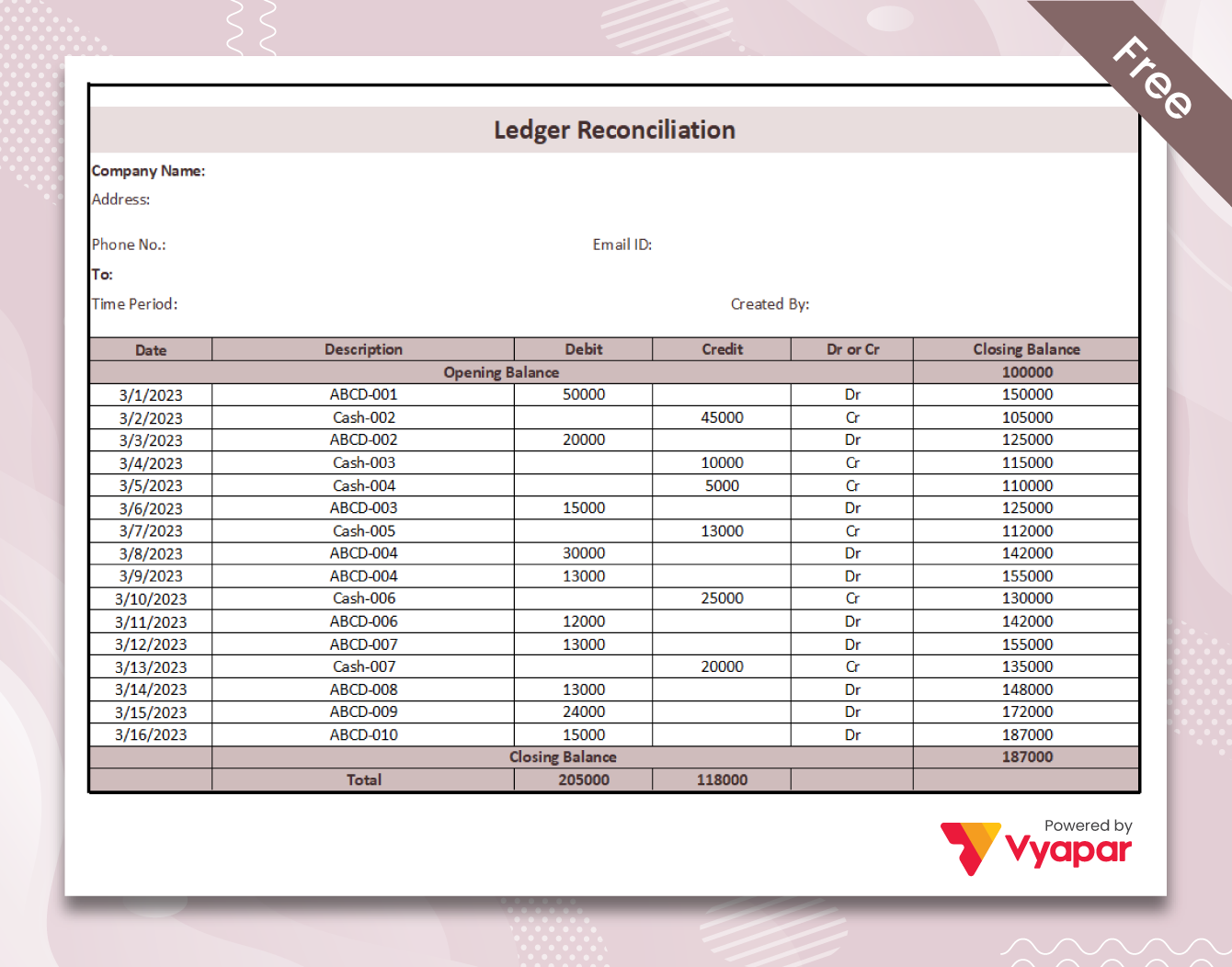

A reconciliation account ledger format in excel is used to compare and match financial data from two or more ledger accounts. It usually has columns for account names, balances at the start, transactions, adjustments, and balances at the end, and an area for analysing differences.

This format ensures accurate financial reporting as financial records are correct and consistent, so users can find differences, fix mistakes, and keep the right account balances. Excel is a popular tool for doing reconciliation party ledger format quickly and well because it has functions for computing and editing.

Benefits Of Using A Ledger Reconciliation Format In Excel

Here are the following advantages of using the ledger reconciliation format in Excel:

Better Documentation

Ledger reconciliation in Excel format can save and print the reconciliation file, which is a helpful feature for keeping records. By saving the reconciliation format in Excel, it becomes a digital record that can be quickly saved, retrieved, and shared for future reference or audits. Since the reconciliation format can be printed, real copies can be kept, which adds an extra layer of backup and accessibility.

This part of reconciliation account ledger format in excel documentation ensures that the standards for keeping records are met, improves accountability, and makes it easier to talk to stakeholders needing access to the reconciled financial data. It is digitally stored and can be accessed when it is required.

Provides Clear Visibility

The party ledger reconciliation format spreadsheet makes it easy to see account balances, activities, and differences. It makes it easier to look at and understand financial data. The tabular layout allows information to be shown in an organised way, with columns and rows for each piece of information. Account balances can be displayed and changed quickly, and transactions can be written down and structured.

Ledger excel format can automatically calculate and show differences by using formulas and conditional formatting. It draws attention to any discrepancies or irregularities. The clear and easy-to-understand layout of ledger excel format spreadsheets increases openness, makes it easier to look at data, and helps people make better decisions during the reconciliation process.

Better Organisation Capability

Accounting Ledger reconciliation format in Excel or account reconciliation ledger makes it easy to organise account information logically, making it easier to keep track of and analyse financial data. With ledger excel format’s ability to make and change columns, rows, and worksheets, users can organise data based on account names, dates, transaction types, or other relevant criteria.

Sorting and filtering features make moving around and finding specific information easy. Ledger reconciliation data analysis tools, like pivot tables and charts, make looking at and understanding financial data easier. It lets users gain insights, spot patterns, and make smart choices based on their well-organised account information.

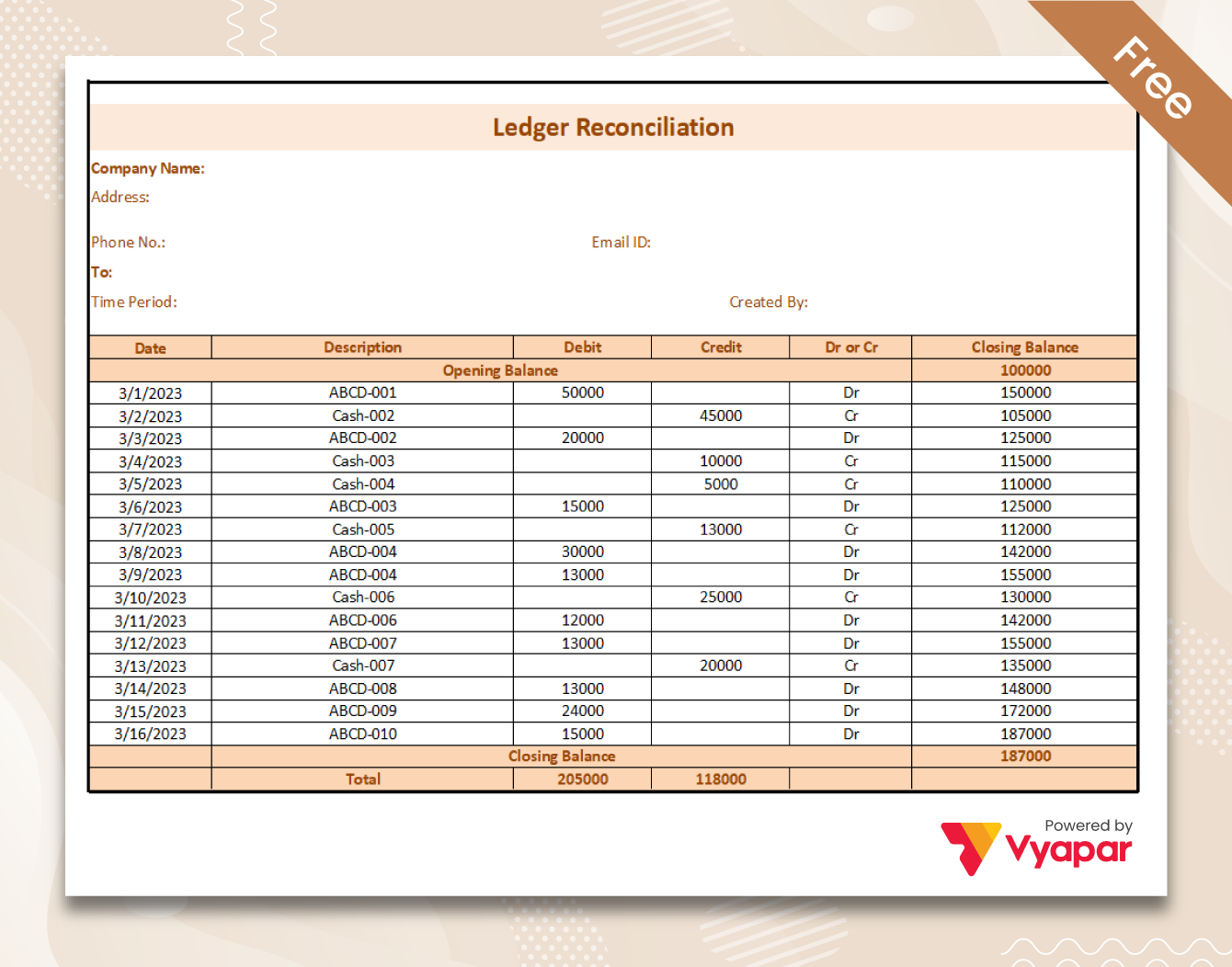

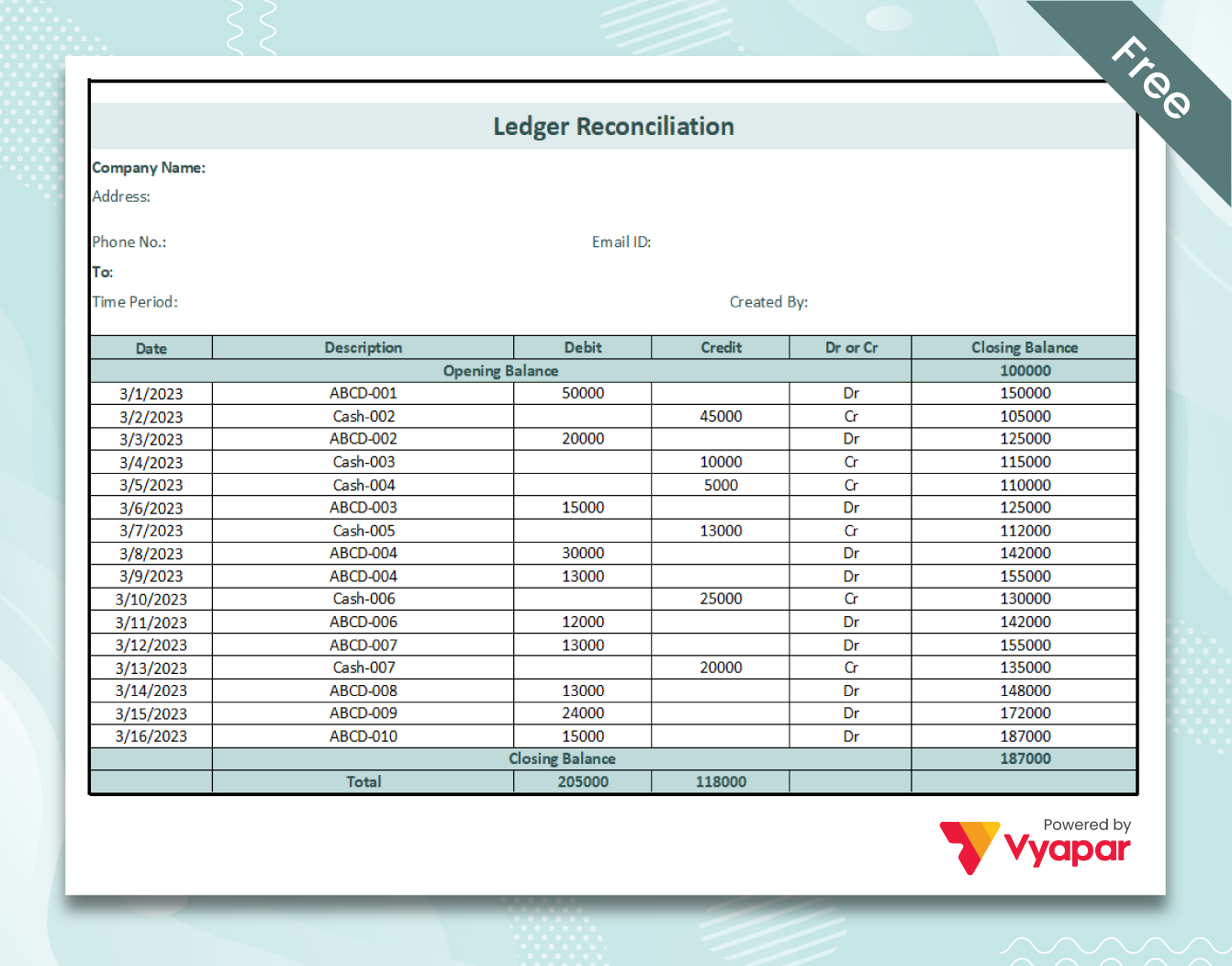

Customisable Formats

Reconciliation Accounting ledger excel sheet allows you to quickly change and update the reconciliation format to meet changing needs. It has easy-to-use interface and editing tools, and users can change column layouts, formulas, or styles to suit their business needs. You can add or remove columns, add new numbers, or change formulas without problems.

It makes it possible to change the reconciliation style as business processes change or new reporting needs arise. Ledger excel format is easy to use, so users can easily update and change the style to ensure it stays useful and meets the changing needs of the reconciliation process.

Maintain Audit Trail

Ledger excel format keeps an audit trail, a helpful tool for transparency and responsibility. The billing software keeps track of the formulas and changes made to the reconciliation code and holds a record of them. Every change in ledger reconciliation is recorded, along with the date and person who made it.

This audit trail shows a clear history of changes, making the balancing process transparent and making it easy to spot any mistakes or differences. It supports accuracy, safety, and good financial management by letting users track and review changes.

Better Data Analysis

The data analysis features in ledger excel format, such as pivot tables and charts, enable users to draw meaningful conclusions and spot trends from reconciled data. By condensing expansive datasets, using filters, and cross-tabulating data, pivot tables make it possible to conduct dynamic and interactive analysis.

It makes finding patterns, contrasts, and correlations in the merged data easier. Excel’s charting features also offer visual representations that simplify comprehending and effectively explaining trends and patterns. By utilising these capabilities, users may dig deeper into the reconciled data, find insightful information, and make data-driven choices that promote corporate expansion and improvement.

High-Level Accuracy

Computational capabilities are essential for ensuring accurate calculations and minimising human error when you reconcile your ledger. Ledger excel format performs consistent and precise calculations using formulas, functions, and built-in mathematical operations. It reduces the possibility of manual calculation errors and increases the precision of reconciling account balances, transactions, and adjustments.

In addition, the ledger reconciliation format in Excel formula auditing tools enables users to trace and debug formulas, identifying and resolving any potential errors. Excel’s computational capacity provides a dependable and effective platform for conducting complex calculations, enhancing the precision and integrity of ledger reconciliations.

Greater Flexibility

Ledger reconciliation in Excel format is user-friendly for modifying and revising the reconciliation format to accommodate changing business requirements or scenarios. Excel’s adaptability enables users to add or remove columns, modify formulas, and incorporate new data fields as necessary.

Users can quickly modify the layout, formatting, or calculations with its user-friendly interface to meet their evolving requirements. This flexibility enables businesses to remain agile, ensuring the reconciliation format remains current, pertinent, and tailored to the organisation’s specific financial processes and reporting standards.

Steps To Choose The Suitable Software For Ledger Reconciliation Process

Here are the following steps to choose the professional inventory management software to perform the ledger reconciliation in your business:

Step 1: Research Available Options

Explore the different options on the market to do a thorough study on software solutions for ledger reconciliation. Look for tools and features, and functions that meet your business needs, like automatic matching algorithms, the ability to import and export data, integration with your bank, and data validation. Read user reviews and ratings to gauge customer happiness and reliability.

Think about different pricing methods, such as up-front costs, licensing fees, and ongoing costs for maintenance. By doing a lot of study on these things, you can reduce your options and choose the ledger accounting software that best fits your organisation’s needs, budget, and long-term goals.

Step 2: Assess The Compatibility

While deciding on a ledger reconciliation software, consider how well it will work with your current systems and infrastructure. Check to see if the software can easily connect to your financial system to make it easier to share data. Check the compatibility of file formats to ensure that reconciliation data can be easily imported and exported between systems.

Consider scalability to ensure the software can keep up with the growth of your company and the increase in the number of reconciliations. Consider things like system needs, database compatibility, and network infrastructure to ensure the software is easy to set up and works well with your other systems.

Step 3: Consider User-Friendliness

When evaluating software for financial reconciliation, it’s important to look at how easy it is to use. The software should have simple features and be easy for employees to use and navigate. Look for things like easy-to-use menus, clear labels, and processes that make sense.

Think about whether the software has panels or shortcuts that can be changed to make user interactions easier. A well-designed user interface makes it easier for your team to get used to the software quickly, reconcile quickly, and make fewer mistakes or cause less confusion during the reconciliation process.

Step 4: Review Security Measures

Due to the sensitive nature of financial data, it is essential to prioritise strong security measures when choosing free invoicing software for ledger reconciliation format in Excel. Make sure the software you choose uses encryption technology to safeguard data while it is being transmitted and stored. Look for features guaranteeing only authorised users can access and modify data, such as user access restrictions.

Disaster recovery plans and routine data backups should be in place to avoid data loss. You may protect the confidentiality and integrity of your financial data by prioritising these security measures, preserving regulatory compliance, and reducing the possibility of unauthorised access or data breaches.

Step 5: Trial And Feedback

Before choosing a programme for ledger reconciliation, try it out or give it a demo using a small part of your reconciliation process. Also, get feedback from your colleagues and friends who might use the software or from people in the same business who have used it.

Their ideas can give you valuable insight into various aspects of the software. By getting feedback and running a test, you can select the ledger reconciliation software that suits your business. You may also visit online websites which make comparisons between different software.

Why Vyapar App is The Best Alternative For Your Financial Management?

Gain Control Over Your Finances

Simplify Reconciliation Processes

Boost Efficiency and Save Time

Make Data-Driven Decisions

Mobile Access & Convenience

Cost-Effectiveness

Ensure Peace of Mind

Data Security

Top Features Of Vyapar To Enhance Your Financial Health

1: Business/Accounting Software

With Vyapar accounting software for the ledger reconciliation process in Excel format, you can run a single company or a network of companies simultaneously. You can still run your business whether you are listed or not. Vyapar allows you to view your company’s data on single or multiple devices at the same time using our business dashboard.

Vyapar is a smart accounting app that ensures your business has everything it needs to become successful and profitable. It has an easy-to-use interface and can be easily used by your employees without having any complex features. It allows your company to have up to five chains or businesses.

By using the Vyapar software, you can make both GST and non-GST purchases. The accounting program allows you to set up and run different business tasks for your courier companies, such as billing, invoicing, and making reports. It also has a business screen that gives a more complete view of the business.

2: Cash And Bank Management

Vyapar is an all-in-one software for managing cash and banks for your business. With Vyapar, it’s easy to handle both cash-to-bank and bank-to-cash payments, so you can move money quickly between your cash register and bank accounts. Also, Vyapar makes transferring money between accounts easier by letting your client send money from one bank account to another.

Also, Inventory Management Software Vyapar allows you to change your cash and bank amounts, making it easier to track your finances and ensure everything is in order. Vyapar streamlines cheque management by facilitating the recording and tracking of cheque transactions. The system lets you easily handle deposits and withdrawals and check the clearing status.

Also, the platform makes it easier to handle loan accounts by giving you tools to keep track of loan information, keep an eye on payments, and make loan statements for better financial tracking. Vyapar offers businesses all the tools they need to manage their cash and bank accounts, including an easy-to-use layout and a number of features that improve financial operations.

3: Delivery Challan Format For Consignments

By using Vyapar “Delivery Challan”, you can get confirmation of the arrival of goods and services. This free accounting android app lets you make delivery challans and link them to your shipment. You can use the delivery challan format to ensure your goods get to customers safely.

The Vyapar app automatically makes a daily backup when you turn on this mode. Our free accounting software makes it easy to keep track of consignor and consignee information. This process helps the business run well and helps customers get their packages safely.

The delivery challan format turned into bills, which is a good idea because it helps adjust auto stock. With the accounting tools, you can track all the delivery acknowledgements. It is easier to run a business with our software which allows you to achieve your productivity goals.

4: Keep Your Data Safe With Multiple Backup

Vyapar accounting software is 100% safe for the ledger reconciliation process, and you can easily and correctly store your ledger reconciliation data. Vyapar software for ledger reconciliation format in Excel, you can back up your Google Drive info locally, remotely, or online to keep it safe. The Accounting Software makes it easy to get back lost data fast.

We encrypt your valuable ledger reconciliation data for extra security, and the Vyapar app offers the most advanced free software for reconciliation and accounts. The “auto-backup” option of Vyapar software in India makes it easy to back up your files. When you turn on this mode in the Vyapar app, it automatically makes a backup daily. Vyapar software for reconciliation customer ledger format in Excel makes it easier to back up all of your info, so you don’t lose anything.

Most small and medium companies in India have used our free accounting software to keep track of their finances and to prepare ledger reconciliation format in Excel because it makes the job go faster and keeps data more secure. The app has a method for encrypting your business ledger reconciliation data so that only the owner can see it. It makes security even better.

5: Keep Track Of Your Expenses

It is important for ledger reconciliation and tax filing that all businesses keep track of and write down the incurred expenses. With the accounting program, it is easier to keep track of money spent and make a correct report. Keeping track of costs is easy with the Vyapar app. With our free tools, you can effortlessly track GST and non-GST costs.

Also, Vyapar’s accounting options have a number of advantages over those of competitors who need to focus on such essential areas. It cuts down the cost and makes as much money as possible for your business platform. The free accounting program is a good way to quickly keep track of expenses that are still due. It also helps keep track of them in the future.

The Vyapar app is good for businesses that are in the beginning. It helps them keep their money in order. By using GST software to track the costs, the company can find the best way to spend the money. Keeping track of business expenses will also help you make better plans. The business will make more money as a result.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

In Excel, a ledger reconciliation format is a structured template used to compare and match up financial data from different ledger accounts. It usually has columns for account names, starting balances, transactions, adjustments, closing balances, and an analysis of their differences.

You can use Vyapar accounting software to create a professional-looking ledger reconciliation in Excel format. It already comes with all the essential details required in your ledger reconciliation format. You don’t have to pay any subscription fees to use our professional software from your Android devices. You can access our app from tablets, MacBooks, PCs and Android phones.

Formulas in Excel format enable doing calculations and speeding up processes during ledger reconciliation. They ensure accurate analysis of financial data. You can use formulas like SUM, IF, VLOOKUP, and SUMIF to determine closing balances, make changes, compare data, and find differences. Excel formulas speed up the accounting process and ensure that financial data is calculated and analyzed correctly.

You can enable the track changes function in Excel to track changes and keep an audit trail in a ledger reconciliation style. This feature tracks changes made to the spreadsheet. You can also utilise cell comments or special columns to document changes, explanations, or user annotations. It contributes to transparency, accountability, and a clear record of modifications made during the reconciliation process.

Here are some recommended practices for using an Excel format for ledger reconciliation: Use proper formatting and data validation rules to ensure consistency, document manual adjustments or calculations, reconcile accounts regularly, conduct exhaustive reviews to identify discrepancies, and use formulas and functions to automate calculations and ensure accuracy.

Vyapar accounting software is the best option to create and customise your ledger reconciliation in Excel format. More than one crore business owners across India trust it to meet their accounting needs and prepare the ledger reconciliation format. Vyapar is easy-to-use and helps small business when it grows.

Ledger reconciliation is a process which is involved in double-checking all the finances. This process helps to ensure the data accuracy by highlighting errors which can occur due to typos or any transactions unrecorded. It also identifies discrepancies which require further investigation, like bank charges or outstanding checks. Regular ledger reconciliation helps maintain clear financial records, streamlines year-end-processes and prevents any kind of fraud.

General ledger reconciliation helps to verify the reliability of the account balances. Let’s say if your bank statement shows a balance of $1200, whereas your balances in the general ledger show a balance of $1300. Reconciliation will help in finding the actual reason for the $100 difference. It can be an outstanding deposit that you made but its not updated in bank yet, or a check you wrote that hasn’t been cleared yet. By investigating these discrepancies and making the adjustments, you can ensure your financial records are correctly reflected

To reconcile a ledger format in Excel, you can follow these steps:

1. Organize ledger and bank statement data in separate Excel tabs.

2. Copy ledger transactions into one tab and bank statement transactions into another.

3. Ensure consistent column headers for date, description, amount, and transaction type.

4. Match corresponding transactions between the ledger and bank statement tabs to reconcile them.

Reconciliation ledger format in excel is a process to double-check financial records and match it with your bank account.

Here’s the gist on the process:

* Check your checkbook and bank statement.

* Compare the ending balances with the last amount in each.

* If there is any difference then investigation is required. Maybe a check is written but not cashed yet.

* Once you find the reason, adjust your records to match the bank.

* Do this regularly, like once a month, to keep your finances tidy!

GL and SL reconciliation, also known as general ledger to sub-ledger reconciliation, is a process businesses use to ensure their financial records are accurate. Here’s a breakdown:

General Ledger (GL): This is the main cabinet, holding summaries of all your financial transactions. It’s like a big picture overview of your money coming in (credits) and going out (debits).

Sub-Ledgers (SLs): These are smaller drawers within the cabinet, each dedicated to a specific type of transaction. For example, you might have a drawer for accounts receivable (money owed to you by customers), another for accounts payable (money you owe to vendors), and another for inventory.

Ledger reconciliation involves ensuring that the balances in the general ledger are accurate and consistent with the subsidiary ledgers or other supporting documents. The formula for ledger reconciliation can be generalized as follows:

Adjusted General Ledger Balance

=

Adjusted Subsidiary Ledger Balance

Adjusted General Ledger Balance=Adjusted Subsidiary Ledger Balance

Where:

Adjusted General Ledger Balance: This is the balance in the general ledger account after considering all reconciling items.

Adjusted Subsidiary Ledger Balance: This is the balance in the subsidiary ledger account after considering all reconciling items.

Bank Reconciliation: Ensures that a company’s financial records (cash account) match the bank statement.

Ledger Reconciliation: Ensures that the balances in the general ledger are accurate and consistent with the subsidiary ledgers or supporting documentation.